U.S. Dry Product Stocks Update – Nov ’16

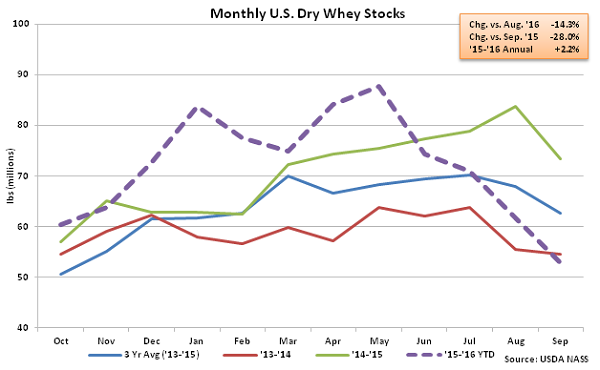

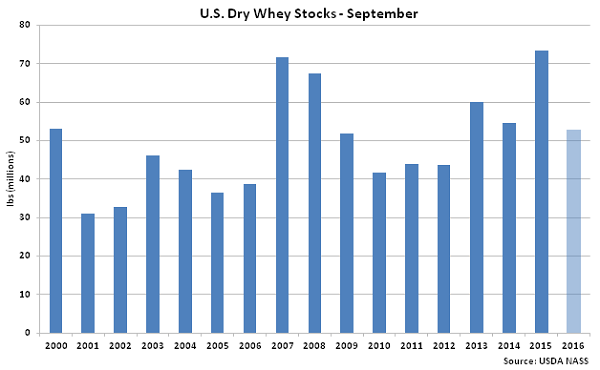

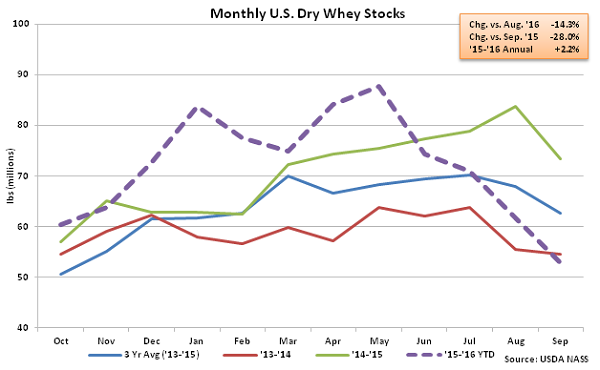

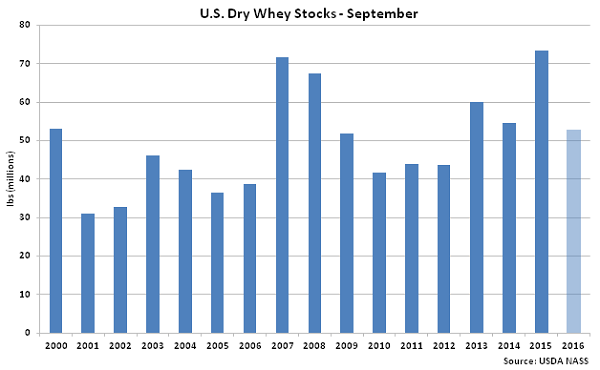

Dry Whey – Stocks Decline to a Three and a Half Year Low, Finish Down 28.0% YOY

Sep ’16 month-end dry whey stocks of 52.9 million pounds declined on a YOY basis for the fourth consecutive month, finishing 28.0% below the record seasonal high experienced during Sep ’15. Dry whey stocks reached a three and a half year low, driven lower by production declines and strong export demand. The YOY decline in dry whey stocks was the largest experienced in over six and a half years on a percentage basis. Dry whey stocks declined by 8.8 million pounds, or 14.3%, from the previous month which was significantly more than the three year average August – September seasonal decline in dry whey stocks of 1.8 million pounds, or 2.6%. Sep ’16 NFDM stocks finished 15.7% below three year average figures for the month of September.

Sep ’16 month-end dry whey stocks of 52.9 million pounds declined on a YOY basis for the fourth consecutive month, finishing 28.0% below the record seasonal high experienced during Sep ’15. Dry whey stocks reached a three and a half year low, driven lower by production declines and strong export demand. The YOY decline in dry whey stocks was the largest experienced in over six and a half years on a percentage basis. Dry whey stocks declined by 8.8 million pounds, or 14.3%, from the previous month which was significantly more than the three year average August – September seasonal decline in dry whey stocks of 1.8 million pounds, or 2.6%. Sep ’16 NFDM stocks finished 15.7% below three year average figures for the month of September.

Nonfat Dry Milk – Stocks Finish at the Largest September Stocks Level on Record

Nonfat Dry Milk – Stocks Finish at the Largest September Stocks Level on Record

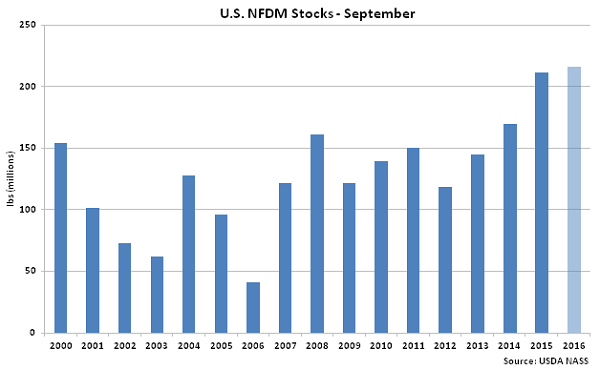

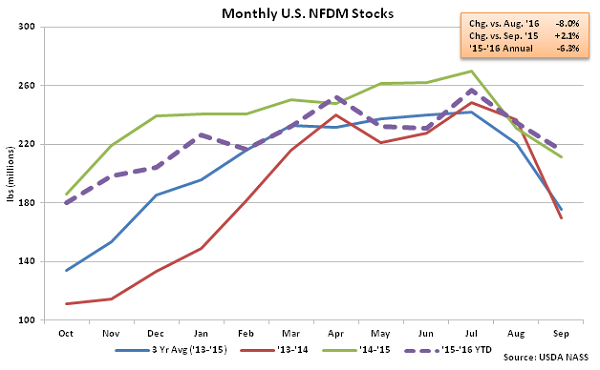

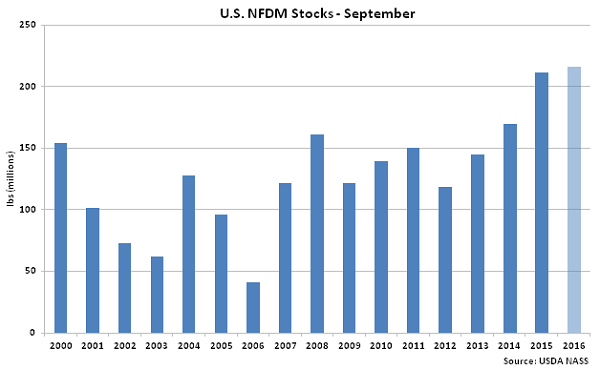

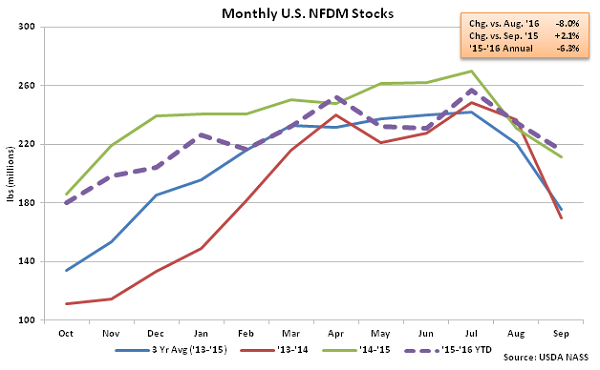

Sep ’16 month-end nonfat dry milk (NFDM) stocks of 216.1 million pounds increased 2.1% YOY, finishing at the highest September figure on record. NFDM stocks finished higher on a YOY basis for the first time in four months, driven higher by increased production volumes. NFDM production increased on a YOY basis for the first time in 12 months during Sep ’16, finishing up 4.7%. Sep ’16 month-end NFDM stocks declined MOM by 18.7 million pounds, or 8.0%, however the decline was smaller than with the three year average August – September seasonal decline in NFDM stocks of 23.1 million pounds, or 13.7%. Sep ’16 NFDM stocks finished 48.9% above three year average figures for the month of September.

Sep ’16 month-end nonfat dry milk (NFDM) stocks of 216.1 million pounds increased 2.1% YOY, finishing at the highest September figure on record. NFDM stocks finished higher on a YOY basis for the first time in four months, driven higher by increased production volumes. NFDM production increased on a YOY basis for the first time in 12 months during Sep ’16, finishing up 4.7%. Sep ’16 month-end NFDM stocks declined MOM by 18.7 million pounds, or 8.0%, however the decline was smaller than with the three year average August – September seasonal decline in NFDM stocks of 23.1 million pounds, or 13.7%. Sep ’16 NFDM stocks finished 48.9% above three year average figures for the month of September.

Sep ’16 month-end dry whey stocks of 52.9 million pounds declined on a YOY basis for the fourth consecutive month, finishing 28.0% below the record seasonal high experienced during Sep ’15. Dry whey stocks reached a three and a half year low, driven lower by production declines and strong export demand. The YOY decline in dry whey stocks was the largest experienced in over six and a half years on a percentage basis. Dry whey stocks declined by 8.8 million pounds, or 14.3%, from the previous month which was significantly more than the three year average August – September seasonal decline in dry whey stocks of 1.8 million pounds, or 2.6%. Sep ’16 NFDM stocks finished 15.7% below three year average figures for the month of September.

Sep ’16 month-end dry whey stocks of 52.9 million pounds declined on a YOY basis for the fourth consecutive month, finishing 28.0% below the record seasonal high experienced during Sep ’15. Dry whey stocks reached a three and a half year low, driven lower by production declines and strong export demand. The YOY decline in dry whey stocks was the largest experienced in over six and a half years on a percentage basis. Dry whey stocks declined by 8.8 million pounds, or 14.3%, from the previous month which was significantly more than the three year average August – September seasonal decline in dry whey stocks of 1.8 million pounds, or 2.6%. Sep ’16 NFDM stocks finished 15.7% below three year average figures for the month of September.

Nonfat Dry Milk – Stocks Finish at the Largest September Stocks Level on Record

Nonfat Dry Milk – Stocks Finish at the Largest September Stocks Level on Record

Sep ’16 month-end nonfat dry milk (NFDM) stocks of 216.1 million pounds increased 2.1% YOY, finishing at the highest September figure on record. NFDM stocks finished higher on a YOY basis for the first time in four months, driven higher by increased production volumes. NFDM production increased on a YOY basis for the first time in 12 months during Sep ’16, finishing up 4.7%. Sep ’16 month-end NFDM stocks declined MOM by 18.7 million pounds, or 8.0%, however the decline was smaller than with the three year average August – September seasonal decline in NFDM stocks of 23.1 million pounds, or 13.7%. Sep ’16 NFDM stocks finished 48.9% above three year average figures for the month of September.

Sep ’16 month-end nonfat dry milk (NFDM) stocks of 216.1 million pounds increased 2.1% YOY, finishing at the highest September figure on record. NFDM stocks finished higher on a YOY basis for the first time in four months, driven higher by increased production volumes. NFDM production increased on a YOY basis for the first time in 12 months during Sep ’16, finishing up 4.7%. Sep ’16 month-end NFDM stocks declined MOM by 18.7 million pounds, or 8.0%, however the decline was smaller than with the three year average August – September seasonal decline in NFDM stocks of 23.1 million pounds, or 13.7%. Sep ’16 NFDM stocks finished 48.9% above three year average figures for the month of September.