Chinese Dairy Imports Update – Nov ’16

Chinese Dairy Imports Update – Nov ’16

Executive Summary

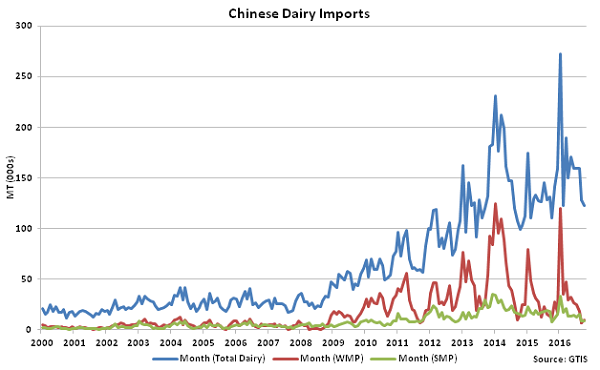

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Oct ’16. Highlights from the updated report include:

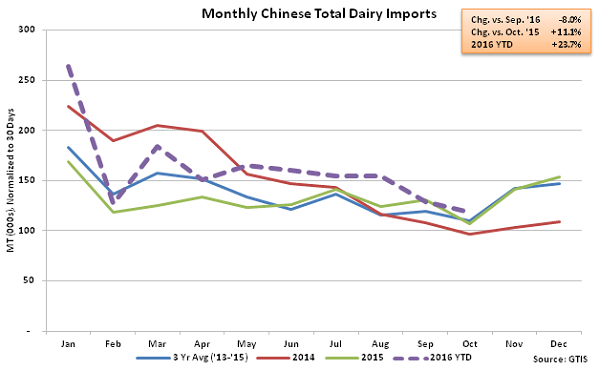

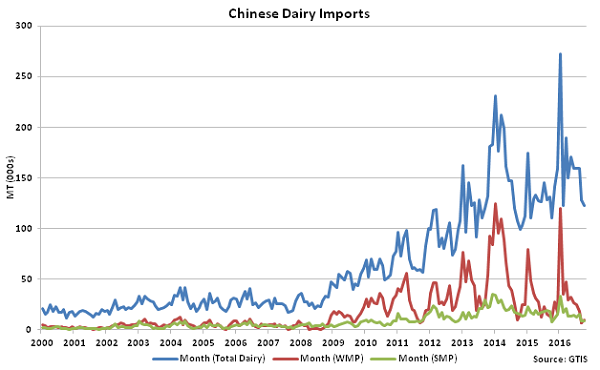

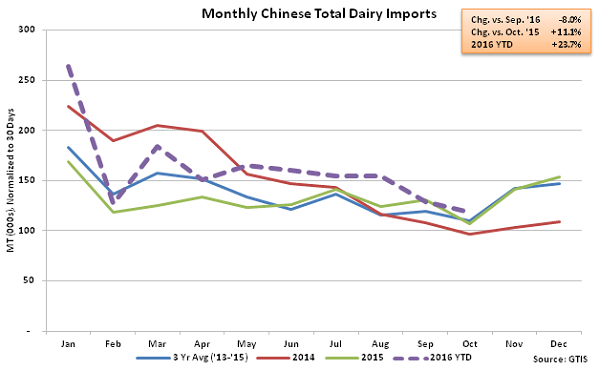

Oct ’16 Total Chinese Dairy Import Volumes Declined 8.0% MOM but Finishing up 11.1% YOY

Oct ’16 Total Chinese Dairy Import Volumes Declined 8.0% MOM but Finishing up 11.1% YOY

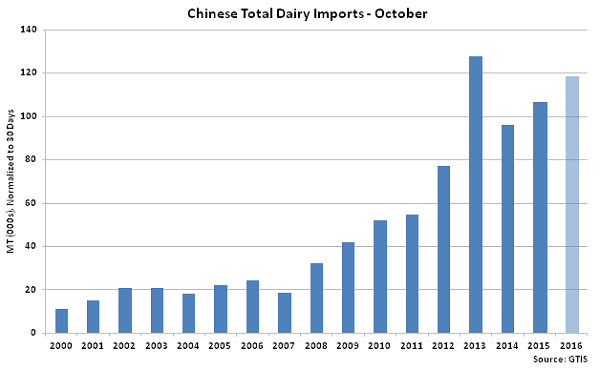

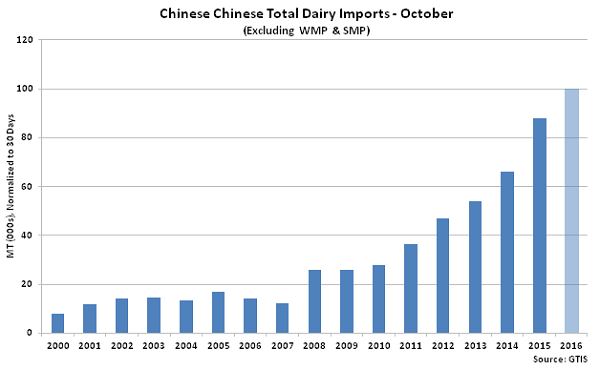

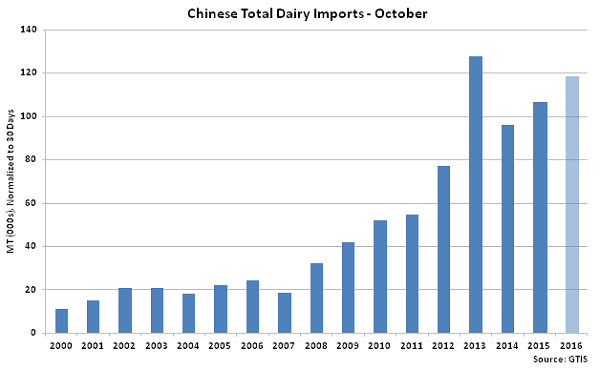

Total Chinese Dairy Import Volumes Finished at the Second Highest October Figure

Total Chinese Dairy Import Volumes Finished at the Second Highest October Figure

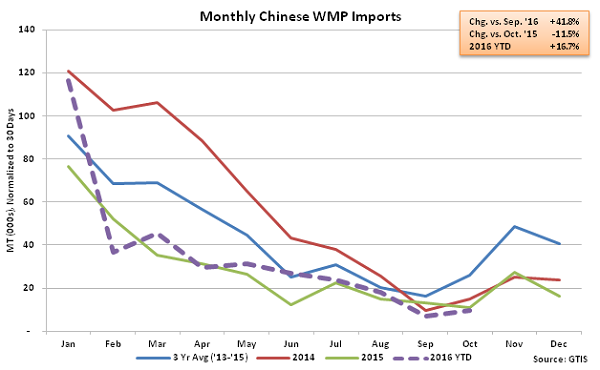

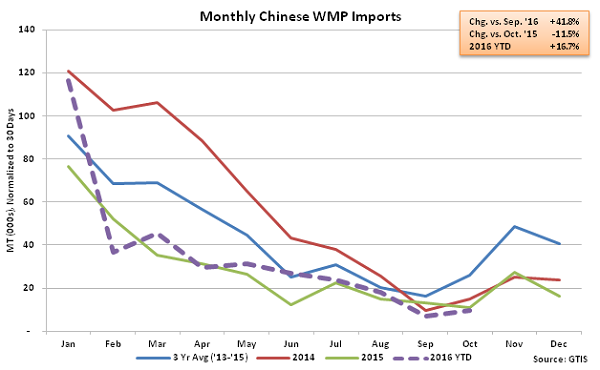

Oct ’16 Chinese WMP Import Volumes Increased 41.8% MOM but Remained Down 11.5% YOY

Oct ’16 Chinese WMP Import Volumes Increased 41.8% MOM but Remained Down 11.5% YOY

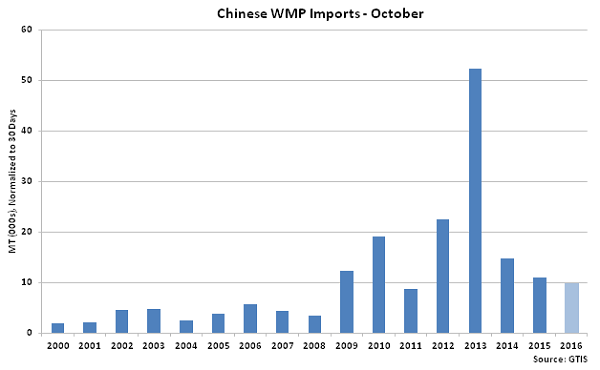

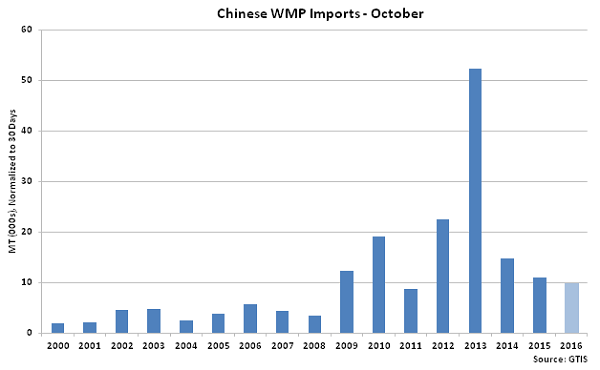

Chinese WMP Imports Finished at a Five Year Low for the Month of October

Chinese WMP Imports Finished at a Five Year Low for the Month of October

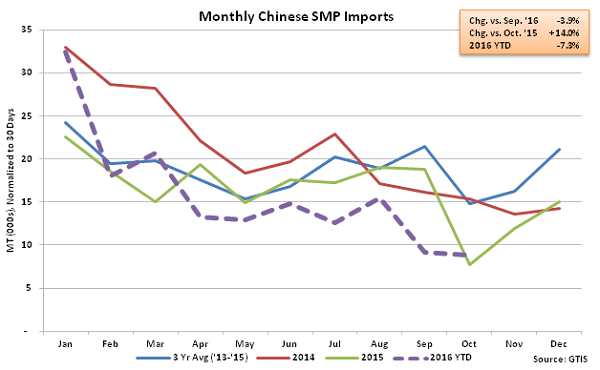

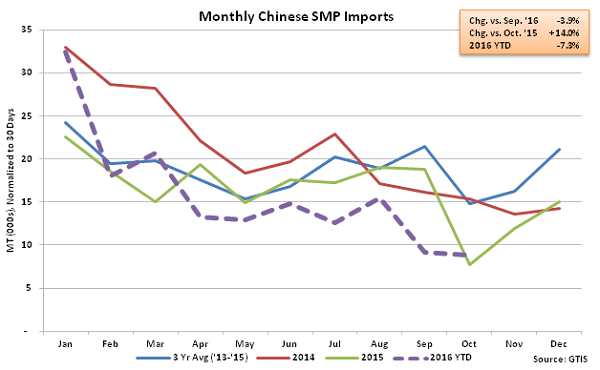

Oct ’16 Chinese SMP Import Volumes Declined 3.9% MOM but Remained up 14.0% YOY

Oct ’16 Chinese SMP Import Volumes Declined 3.9% MOM but Remained up 14.0% YOY

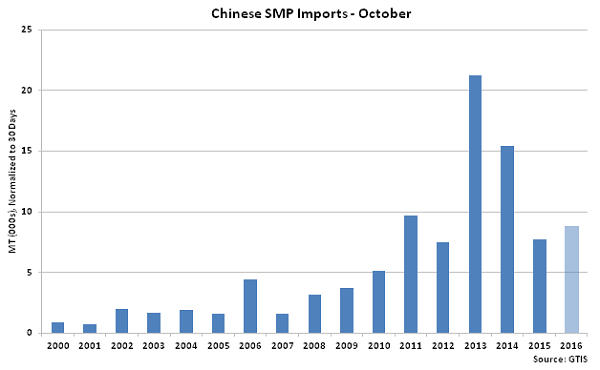

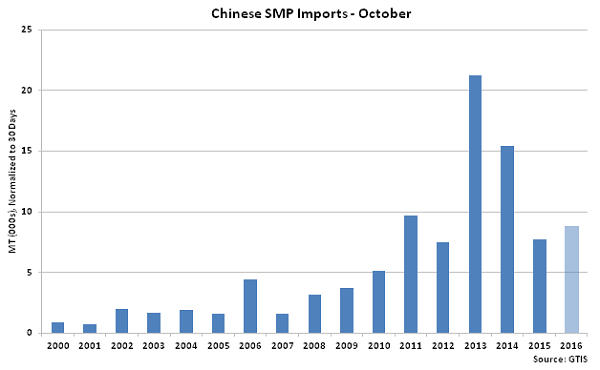

Chinese SMP Imports Remained 40.5% Below Three Year Average October Figures

Chinese SMP Imports Remained 40.5% Below Three Year Average October Figures

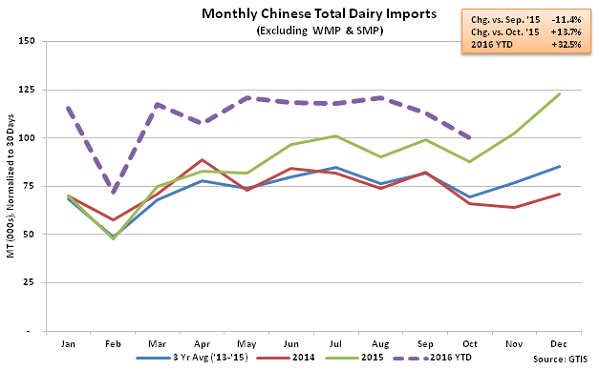

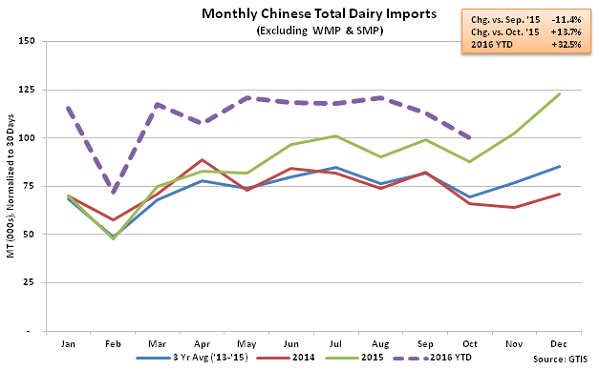

Oct ’16 Chinese Dairy Imports Excluding WMP & SMP Down 11.4% MOM but up 13.7% YOY

Oct ’16 Chinese Dairy Imports Excluding WMP & SMP Down 11.4% MOM but up 13.7% YOY

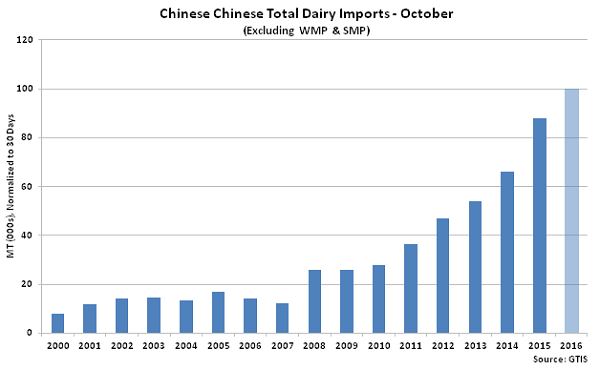

Chinese Dairy Imports Excluding WMP & SMP Finished at an October Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at an October Record High

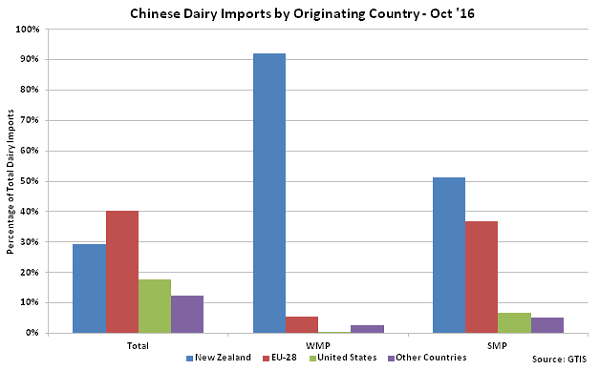

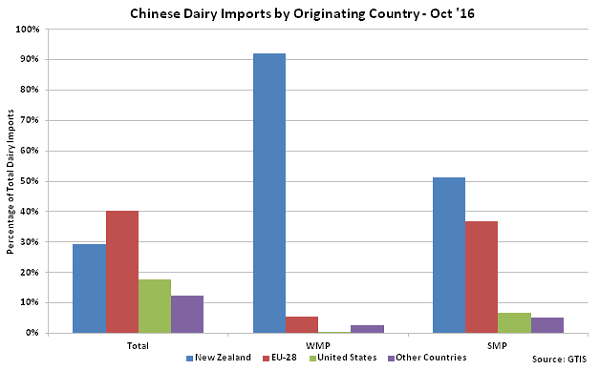

The EU-28 Accounted for Over 40% of the Total Oct ’16 Chinese Dairy Import Volumes

The EU-28 Accounted for Over 40% of the Total Oct ’16 Chinese Dairy Import Volumes

- Oct ’16 total Chinese dairy import volumes declined seasonally to a 12 month low but finished higher on a YOY basis for the 14th first time in the past 15 months, finishing up 11.1%.

- Chinese dairy import volumes originating from within the EU-28 exceeded volumes originating from within New Zealand for the seventh consecutive month during Oct ’16, accounting for over 40% of total import volumes.

- Oct ’16 Chinese dairy imports excluding whole milk powder and skim milk powder remained particularly strong, finishing up 13.7% YOY to a new record high for the month of October.

Oct ’16 Total Chinese Dairy Import Volumes Declined 8.0% MOM but Finishing up 11.1% YOY

Oct ’16 Total Chinese Dairy Import Volumes Declined 8.0% MOM but Finishing up 11.1% YOY

Total Chinese Dairy Import Volumes Finished at the Second Highest October Figure

Total Chinese Dairy Import Volumes Finished at the Second Highest October Figure

Oct ’16 Chinese WMP Import Volumes Increased 41.8% MOM but Remained Down 11.5% YOY

Oct ’16 Chinese WMP Import Volumes Increased 41.8% MOM but Remained Down 11.5% YOY

Chinese WMP Imports Finished at a Five Year Low for the Month of October

Chinese WMP Imports Finished at a Five Year Low for the Month of October

Oct ’16 Chinese SMP Import Volumes Declined 3.9% MOM but Remained up 14.0% YOY

Oct ’16 Chinese SMP Import Volumes Declined 3.9% MOM but Remained up 14.0% YOY

Chinese SMP Imports Remained 40.5% Below Three Year Average October Figures

Chinese SMP Imports Remained 40.5% Below Three Year Average October Figures

Oct ’16 Chinese Dairy Imports Excluding WMP & SMP Down 11.4% MOM but up 13.7% YOY

Oct ’16 Chinese Dairy Imports Excluding WMP & SMP Down 11.4% MOM but up 13.7% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at an October Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at an October Record High

The EU-28 Accounted for Over 40% of the Total Oct ’16 Chinese Dairy Import Volumes

The EU-28 Accounted for Over 40% of the Total Oct ’16 Chinese Dairy Import Volumes