New Zealand Milk Production Update – Dec ’16

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Nov ’16. Highlights from the updated report include:

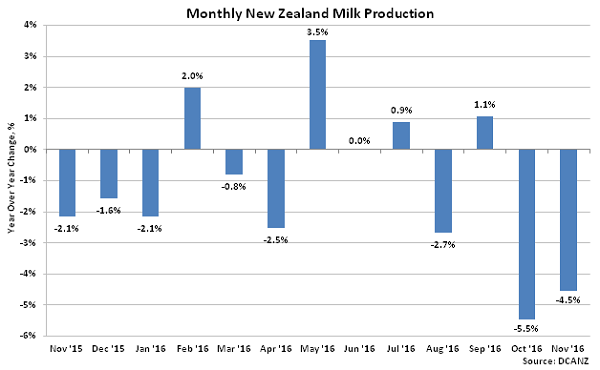

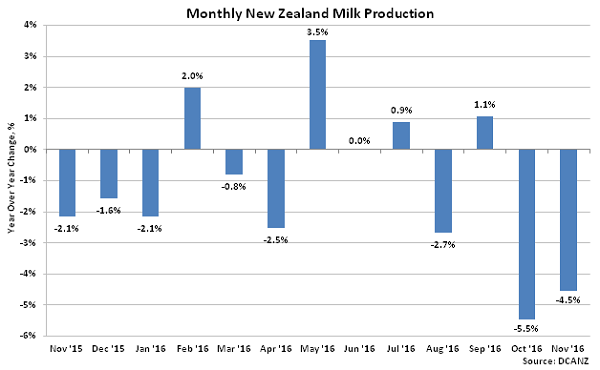

The YOY decline in production volumes experienced during Nov ’16 was the second largest experienced throughout the past 14 months on a percentage basis, trailing only the Oct ’16 decline. Unfavorable weather conditions experienced across most dairying regions of New Zealand during the peak production months of October and November contributed to the recently experienced significant declines in production.

The YOY decline in production volumes experienced during Nov ’16 was the second largest experienced throughout the past 14 months on a percentage basis, trailing only the Oct ’16 decline. Unfavorable weather conditions experienced across most dairying regions of New Zealand during the peak production months of October and November contributed to the recently experienced significant declines in production.

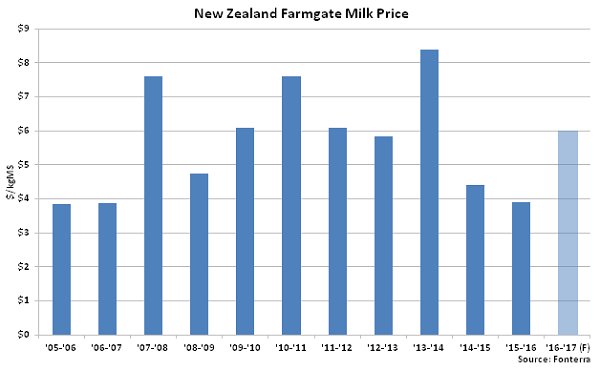

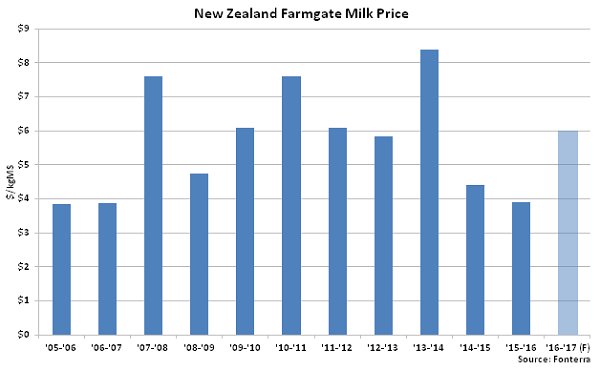

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. The ’16-’17 farmgate milk price forecast has been revised higher a total of three times over the past five months, however, as a gradual rebalancing of global supply and demand continues to take place. The current ’16-’17 farmgate milk price forecast of $6.00/kgMS is 53.8% above ’15-’16 price levels and 7.8% above three year average prices.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. The ’16-’17 farmgate milk price forecast has been revised higher a total of three times over the past five months, however, as a gradual rebalancing of global supply and demand continues to take place. The current ’16-’17 farmgate milk price forecast of $6.00/kgMS is 53.8% above ’15-’16 price levels and 7.8% above three year average prices.

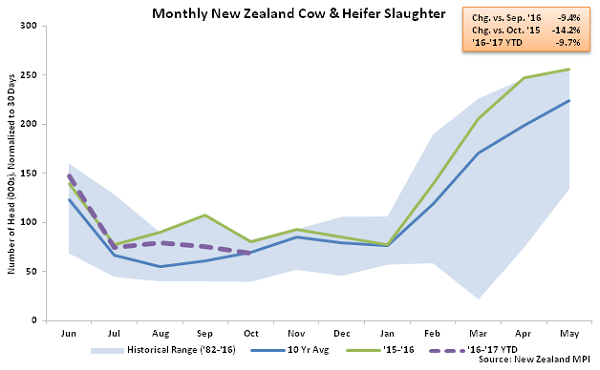

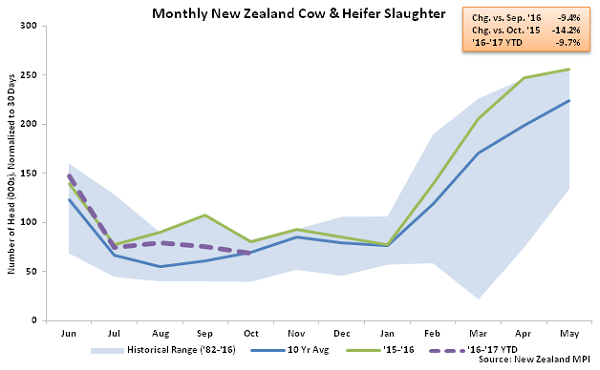

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 9.7% in total over the first five months of the ’16-’17 production season, however, as a 19.2% decline in slaughter rates has been experienced throughout the past three months. New Zealand cow & heifer slaughter rates declined by 14.2% YOY during Oct ’16 to a three year seasonal low however slaughter rates remained just 0.8% below ten year average figures.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 9.7% in total over the first five months of the ’16-’17 production season, however, as a 19.2% decline in slaughter rates has been experienced throughout the past three months. New Zealand cow & heifer slaughter rates declined by 14.2% YOY during Oct ’16 to a three year seasonal low however slaughter rates remained just 0.8% below ten year average figures.

- New Zealand milk production volumes finished lower on a YOY basis for the second consecutive month during Nov ’16, declining by 4.5%. The YOY decline in production volumes was the second largest experienced throughout the past 14 months on a percentage basis, trailing only the Oct ’16 decline.

- ’16-’17 New Zealand farmgate milk price projections were revised higher for the third time in the past four months during Nov ’16, increasing to a value of $6.00/kgMS. The current ’16-’17 farmgate milk price forecast is 53.8% above ’15-’16 price levels and 7.8% above three year average price levels.

- New Zealand cow & heifer slaughter rates reached a record annual high during the ’15-’16 production season but have declined by 9.7% on a YOY basis throughout the first five months of the ’16-’17 production season. New Zealand cow & heifer slaughter rates declined by 14.2% YOY during Oct ’16, finishing at a three year seasonal low.

The YOY decline in production volumes experienced during Nov ’16 was the second largest experienced throughout the past 14 months on a percentage basis, trailing only the Oct ’16 decline. Unfavorable weather conditions experienced across most dairying regions of New Zealand during the peak production months of October and November contributed to the recently experienced significant declines in production.

The YOY decline in production volumes experienced during Nov ’16 was the second largest experienced throughout the past 14 months on a percentage basis, trailing only the Oct ’16 decline. Unfavorable weather conditions experienced across most dairying regions of New Zealand during the peak production months of October and November contributed to the recently experienced significant declines in production.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. The ’16-’17 farmgate milk price forecast has been revised higher a total of three times over the past five months, however, as a gradual rebalancing of global supply and demand continues to take place. The current ’16-’17 farmgate milk price forecast of $6.00/kgMS is 53.8% above ’15-’16 price levels and 7.8% above three year average prices.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. The ’16-’17 farmgate milk price forecast has been revised higher a total of three times over the past five months, however, as a gradual rebalancing of global supply and demand continues to take place. The current ’16-’17 farmgate milk price forecast of $6.00/kgMS is 53.8% above ’15-’16 price levels and 7.8% above three year average prices.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 9.7% in total over the first five months of the ’16-’17 production season, however, as a 19.2% decline in slaughter rates has been experienced throughout the past three months. New Zealand cow & heifer slaughter rates declined by 14.2% YOY during Oct ’16 to a three year seasonal low however slaughter rates remained just 0.8% below ten year average figures.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 9.7% in total over the first five months of the ’16-’17 production season, however, as a 19.2% decline in slaughter rates has been experienced throughout the past three months. New Zealand cow & heifer slaughter rates declined by 14.2% YOY during Oct ’16 to a three year seasonal low however slaughter rates remained just 0.8% below ten year average figures.