EIA Drilling Productivity Report Update – Jan ’17

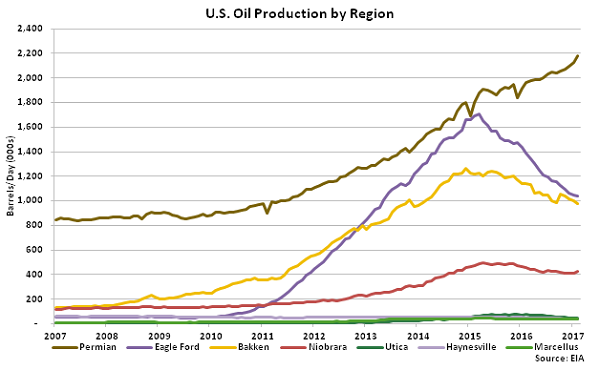

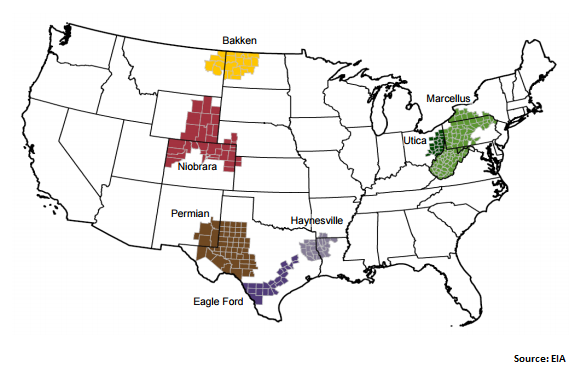

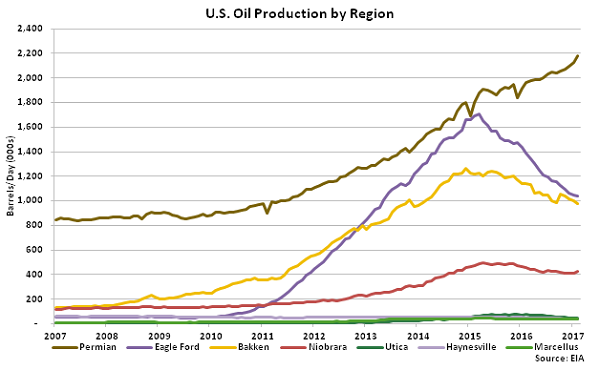

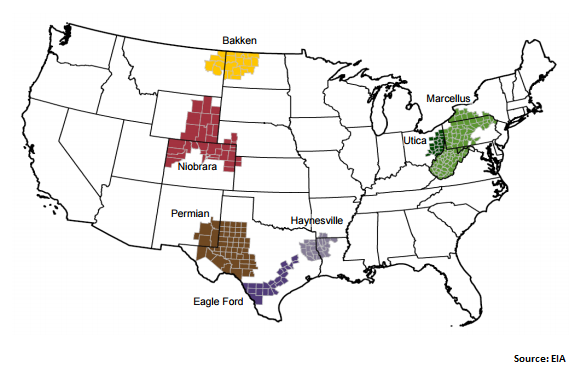

According to the EIA’s January Drilling Productivity Report, U.S. oil output is expected to begin to increase throughout the early months of 2017. The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation, estimates of drilling productivity, and estimated changes in production from existing wells to provide estimated changes in oil production for the seven key regions shown below. The seven regions analyzed have accounted for 95% of domestic oil production growth from 2011-2013.

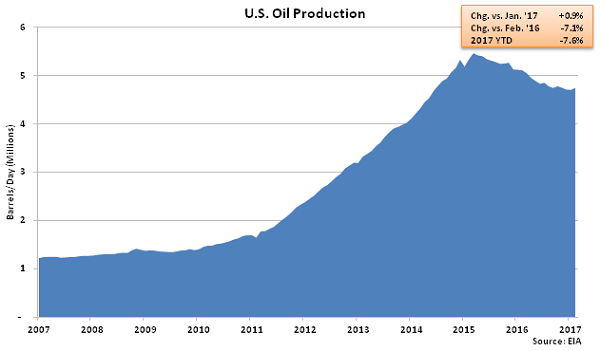

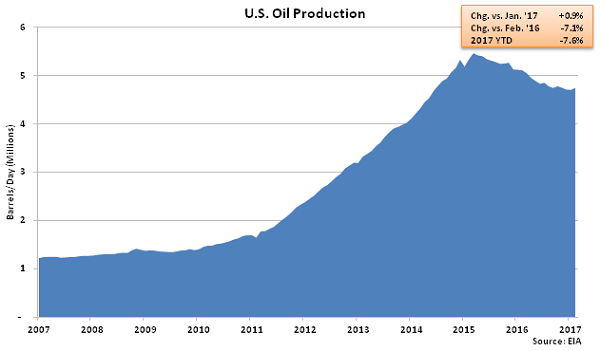

Jan ’17 production was revised 3.6% higher than the previous month figures but is expected to remain 6,000 barrels per day (bpd), or 0.1%, below Dec ’16 production levels. Feb ’17 production levels are expected to increase 41,000 bpd from the Jan ’17 revised production levels to 4.75 million bpd, finishing higher for the first time in four months. Despite finishing higher on a MOM basis, Feb ’17 production forecasts would remain 7.1% below previous year levels, however.

Jan ’17 production was revised 3.6% higher than the previous month figures but is expected to remain 6,000 barrels per day (bpd), or 0.1%, below Dec ’16 production levels. Feb ’17 production levels are expected to increase 41,000 bpd from the Jan ’17 revised production levels to 4.75 million bpd, finishing higher for the first time in four months. Despite finishing higher on a MOM basis, Feb ’17 production forecasts would remain 7.1% below previous year levels, however.

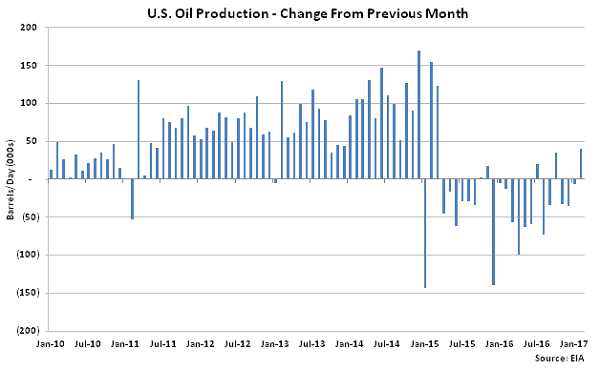

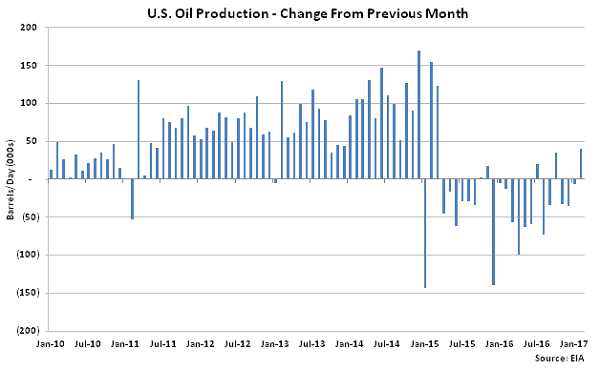

Projected MOM declines in oil production had been exhibited over ten of the past 12 months prior to the increase projected to occur in Feb ’17. The Feb ’17 MOM increase in oil production would be the largest experienced throughout the past 23 months on a percentage basis.

Projected MOM declines in oil production had been exhibited over ten of the past 12 months prior to the increase projected to occur in Feb ’17. The Feb ’17 MOM increase in oil production would be the largest experienced throughout the past 23 months on a percentage basis.

Oil production is expected to remain strong within the Permian region, more than offsetting continued declines in production within the Eagle Ford and Bakken regions. Production within the Permian region is expected to increase 53,000 bpd (2.5%), more than offsetting a 3,000 bpd (0.3%) decline in production within the Eagle Ford region and a 20,000 bpd (2.0%) decline in production within the Bakken region.

Oil production is expected to remain strong within the Permian region, more than offsetting continued declines in production within the Eagle Ford and Bakken regions. Production within the Permian region is expected to increase 53,000 bpd (2.5%), more than offsetting a 3,000 bpd (0.3%) decline in production within the Eagle Ford region and a 20,000 bpd (2.0%) decline in production within the Bakken region.

Jan ’17 production was revised 3.6% higher than the previous month figures but is expected to remain 6,000 barrels per day (bpd), or 0.1%, below Dec ’16 production levels. Feb ’17 production levels are expected to increase 41,000 bpd from the Jan ’17 revised production levels to 4.75 million bpd, finishing higher for the first time in four months. Despite finishing higher on a MOM basis, Feb ’17 production forecasts would remain 7.1% below previous year levels, however.

Jan ’17 production was revised 3.6% higher than the previous month figures but is expected to remain 6,000 barrels per day (bpd), or 0.1%, below Dec ’16 production levels. Feb ’17 production levels are expected to increase 41,000 bpd from the Jan ’17 revised production levels to 4.75 million bpd, finishing higher for the first time in four months. Despite finishing higher on a MOM basis, Feb ’17 production forecasts would remain 7.1% below previous year levels, however.

Projected MOM declines in oil production had been exhibited over ten of the past 12 months prior to the increase projected to occur in Feb ’17. The Feb ’17 MOM increase in oil production would be the largest experienced throughout the past 23 months on a percentage basis.

Projected MOM declines in oil production had been exhibited over ten of the past 12 months prior to the increase projected to occur in Feb ’17. The Feb ’17 MOM increase in oil production would be the largest experienced throughout the past 23 months on a percentage basis.

Oil production is expected to remain strong within the Permian region, more than offsetting continued declines in production within the Eagle Ford and Bakken regions. Production within the Permian region is expected to increase 53,000 bpd (2.5%), more than offsetting a 3,000 bpd (0.3%) decline in production within the Eagle Ford region and a 20,000 bpd (2.0%) decline in production within the Bakken region.

Oil production is expected to remain strong within the Permian region, more than offsetting continued declines in production within the Eagle Ford and Bakken regions. Production within the Permian region is expected to increase 53,000 bpd (2.5%), more than offsetting a 3,000 bpd (0.3%) decline in production within the Eagle Ford region and a 20,000 bpd (2.0%) decline in production within the Bakken region.