U.S. Cattle & Hogs Production Update – Jan ’17

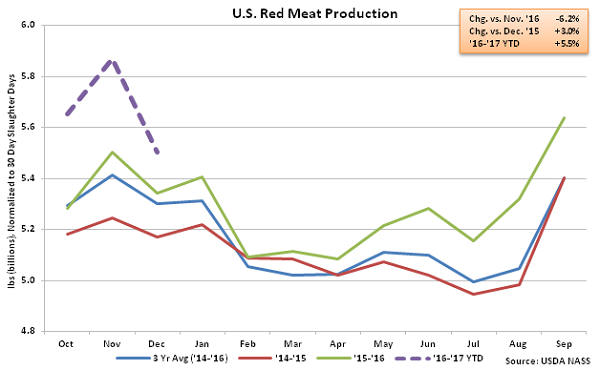

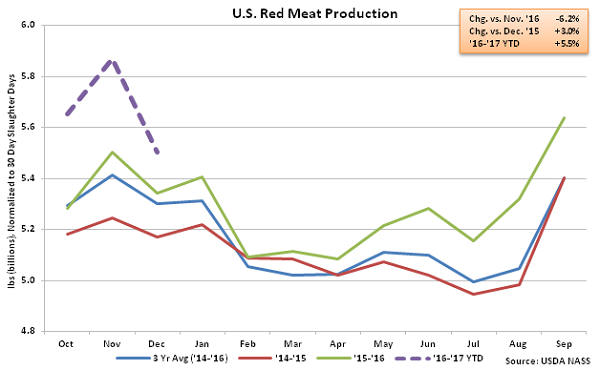

According to USDA, U.S. commercial red meat production totaled 4.40 billion pounds in

Dec ’16, finishing 6.2% lower MOM but 3.0% above the previous year when normalized for slaughter days. Total red meat production reached a record seasonal high for the month of December, finishing 1.7% above the previous record high reached during 2007. Total red meat production has increased on a YOY basis over 23 consecutive months through December however the MOM decline in total red meat production of 6.2% was larger than the ten year average November – December seasonal decline of 3.8%. ’15-’16 annual U.S. red meat production increased 3.3% YOY, finishing at an eight year high, while ’16-’17 YTD red meat production is up an additional 5.5% throughout the first quarter of the production season.

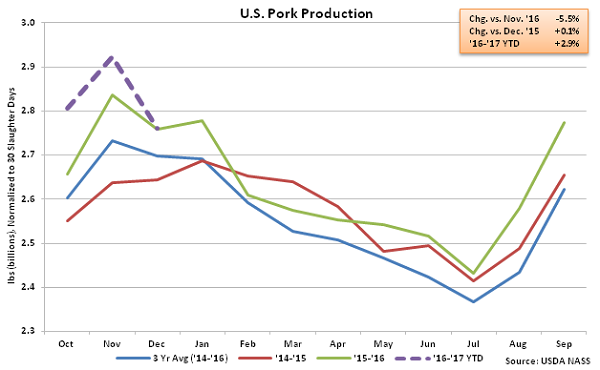

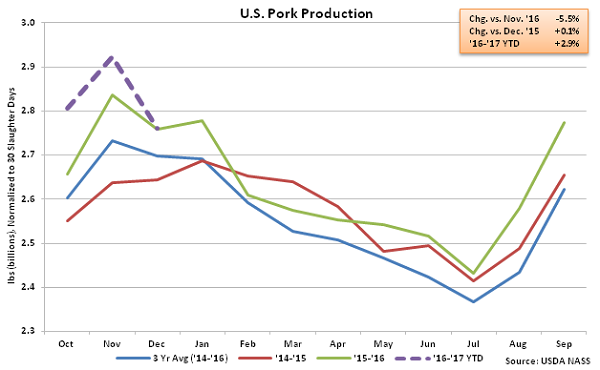

Pork – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 0.1% YOY

Dec ’16 U.S. pork production of 2.21 billion pounds declined 5.5% MOM but remained 0.1% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. pork production has increased on a YOY basis over eight consecutive months through December however the MOM decline in pork production of 5.5% was larger than the ten year average seasonal decline of 3.2%. Dec ’16 total hogs slaughtered increased 1.0% YOY, more than offsetting a 0.7% YOY decline in average weights/head. ’15-’16 annual U.S. pork production increased 2.2% YOY, finishing at a record annual high, while ’16-’17 YTD pork production is up an additional 2.9% throughout the first quarter of the production season.

Pork – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 0.1% YOY

Dec ’16 U.S. pork production of 2.21 billion pounds declined 5.5% MOM but remained 0.1% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. pork production has increased on a YOY basis over eight consecutive months through December however the MOM decline in pork production of 5.5% was larger than the ten year average seasonal decline of 3.2%. Dec ’16 total hogs slaughtered increased 1.0% YOY, more than offsetting a 0.7% YOY decline in average weights/head. ’15-’16 annual U.S. pork production increased 2.2% YOY, finishing at a record annual high, while ’16-’17 YTD pork production is up an additional 2.9% throughout the first quarter of the production season.

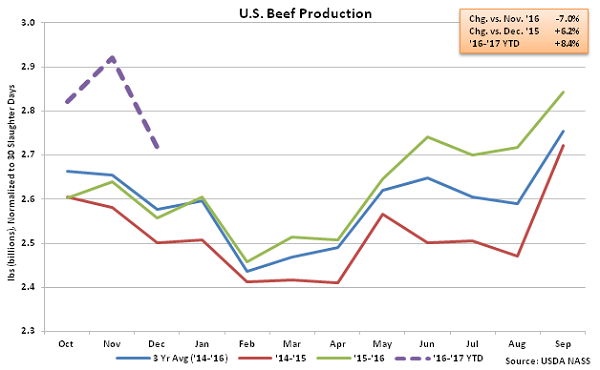

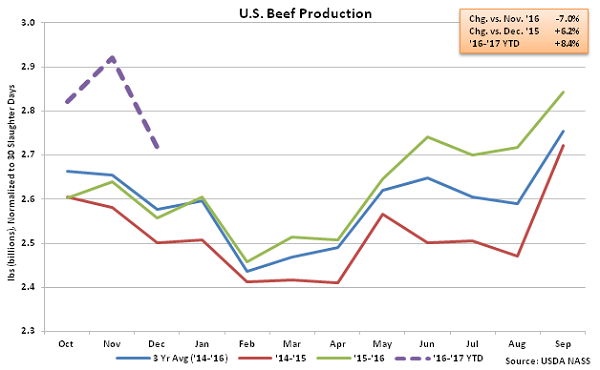

Beef – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 6.2% YOY

Dec ’16 U.S. beef production of 2.17 billion pounds declined 7.0% MOM but remained 6.2% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. beef production has increased on a YOY basis over 14 consecutive months through December however the MOM decline in beef production of 7.0% was larger than the ten year average seasonal decline of 4.4%. The Dec ’16 total number of cattle slaughtered increased by 6.5% YOY, more than offsetting a 0.5% YOY decline in average weights/head. ’15-’16 annual U.S. beef production rebounded 4.4% from the 11 year low experienced during the previous year while ’16-’17 YTD beef production is up an additional 8.4% throughout the first quarter of the production season.

Beef – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 6.2% YOY

Dec ’16 U.S. beef production of 2.17 billion pounds declined 7.0% MOM but remained 6.2% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. beef production has increased on a YOY basis over 14 consecutive months through December however the MOM decline in beef production of 7.0% was larger than the ten year average seasonal decline of 4.4%. The Dec ’16 total number of cattle slaughtered increased by 6.5% YOY, more than offsetting a 0.5% YOY decline in average weights/head. ’15-’16 annual U.S. beef production rebounded 4.4% from the 11 year low experienced during the previous year while ’16-’17 YTD beef production is up an additional 8.4% throughout the first quarter of the production season.

Pork – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 0.1% YOY

Dec ’16 U.S. pork production of 2.21 billion pounds declined 5.5% MOM but remained 0.1% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. pork production has increased on a YOY basis over eight consecutive months through December however the MOM decline in pork production of 5.5% was larger than the ten year average seasonal decline of 3.2%. Dec ’16 total hogs slaughtered increased 1.0% YOY, more than offsetting a 0.7% YOY decline in average weights/head. ’15-’16 annual U.S. pork production increased 2.2% YOY, finishing at a record annual high, while ’16-’17 YTD pork production is up an additional 2.9% throughout the first quarter of the production season.

Pork – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 0.1% YOY

Dec ’16 U.S. pork production of 2.21 billion pounds declined 5.5% MOM but remained 0.1% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. pork production has increased on a YOY basis over eight consecutive months through December however the MOM decline in pork production of 5.5% was larger than the ten year average seasonal decline of 3.2%. Dec ’16 total hogs slaughtered increased 1.0% YOY, more than offsetting a 0.7% YOY decline in average weights/head. ’15-’16 annual U.S. pork production increased 2.2% YOY, finishing at a record annual high, while ’16-’17 YTD pork production is up an additional 2.9% throughout the first quarter of the production season.

Beef – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 6.2% YOY

Dec ’16 U.S. beef production of 2.17 billion pounds declined 7.0% MOM but remained 6.2% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. beef production has increased on a YOY basis over 14 consecutive months through December however the MOM decline in beef production of 7.0% was larger than the ten year average seasonal decline of 4.4%. The Dec ’16 total number of cattle slaughtered increased by 6.5% YOY, more than offsetting a 0.5% YOY decline in average weights/head. ’15-’16 annual U.S. beef production rebounded 4.4% from the 11 year low experienced during the previous year while ’16-’17 YTD beef production is up an additional 8.4% throughout the first quarter of the production season.

Beef – Production Declines MOM but Remains at a Record Seasonal High, Finishes up 6.2% YOY

Dec ’16 U.S. beef production of 2.17 billion pounds declined 7.0% MOM but remained 6.2% above the previous year figures when normalized for slaughter days, reaching a record seasonal high for the month of December. U.S. beef production has increased on a YOY basis over 14 consecutive months through December however the MOM decline in beef production of 7.0% was larger than the ten year average seasonal decline of 4.4%. The Dec ’16 total number of cattle slaughtered increased by 6.5% YOY, more than offsetting a 0.5% YOY decline in average weights/head. ’15-’16 annual U.S. beef production rebounded 4.4% from the 11 year low experienced during the previous year while ’16-’17 YTD beef production is up an additional 8.4% throughout the first quarter of the production season.