Chinese Dairy Imports Update – Jan ’17

Executive Summary

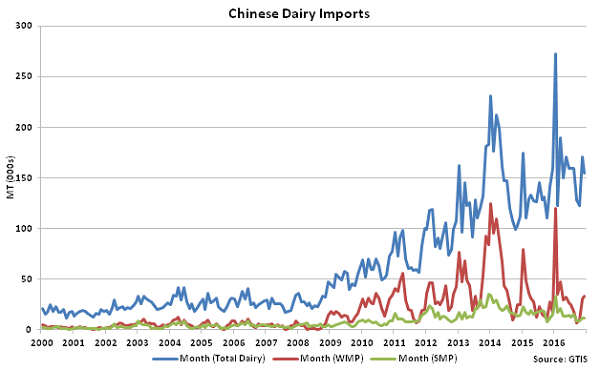

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Dec ’16. Highlights from the updated report include:

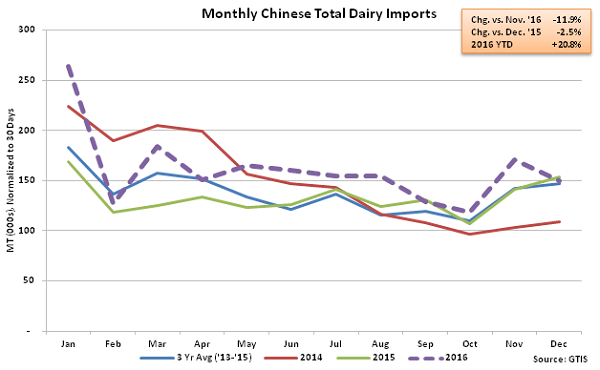

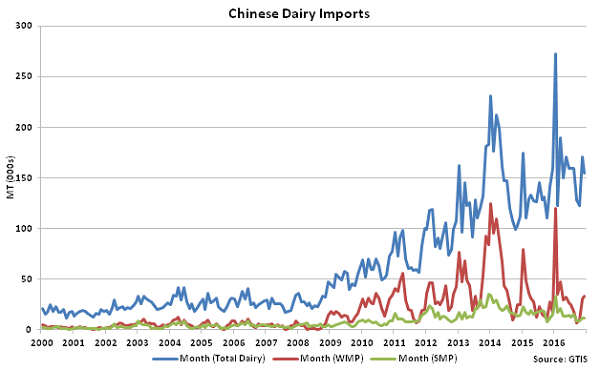

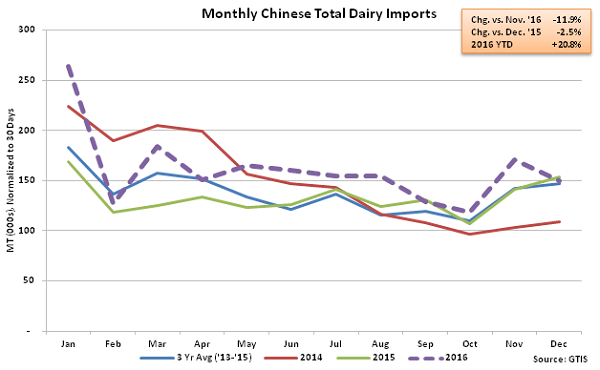

Dec ’16 Total Chinese Dairy Import Volumes Declined 11.9% MOM and 2.5% YOY

Dec ’16 Total Chinese Dairy Import Volumes Declined 11.9% MOM and 2.5% YOY

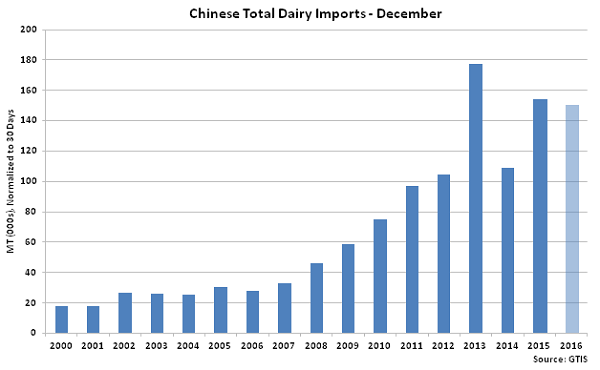

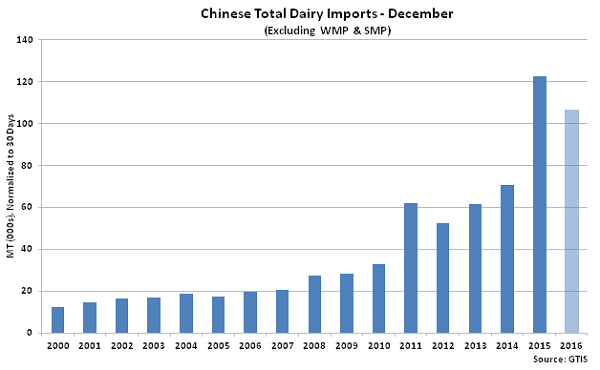

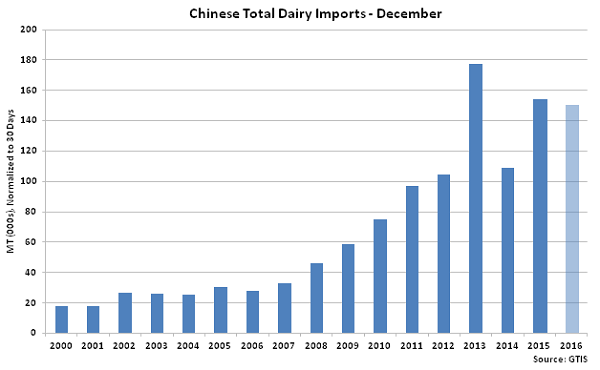

Total Chinese Dairy Import Volumes Remained at the Third Highest December Figure

Total Chinese Dairy Import Volumes Remained at the Third Highest December Figure

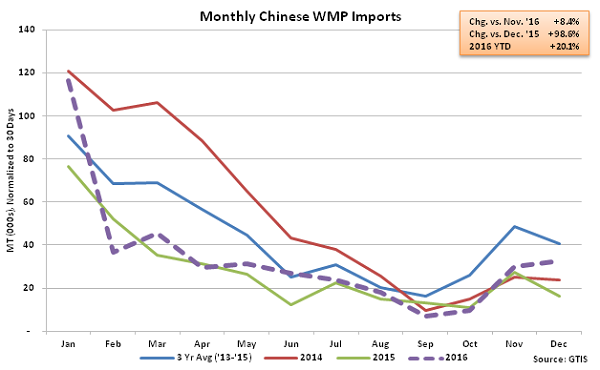

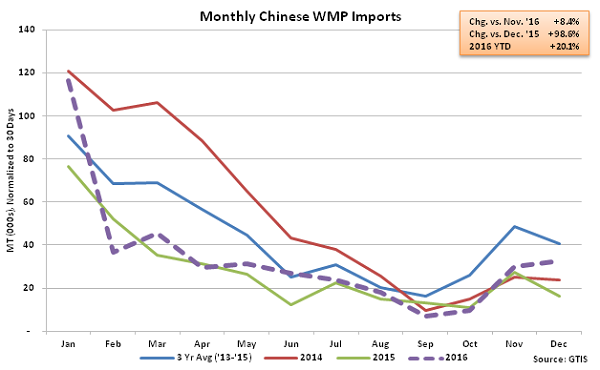

Dec ’16 Chinese WMP Import Volumes Increased 8.4% MOM and 98.6% YOY

Dec ’16 Chinese WMP Import Volumes Increased 8.4% MOM and 98.6% YOY

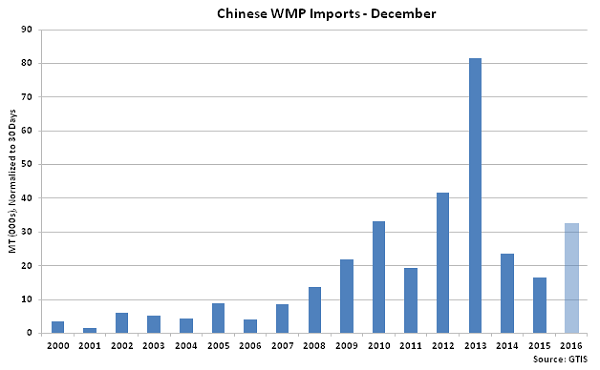

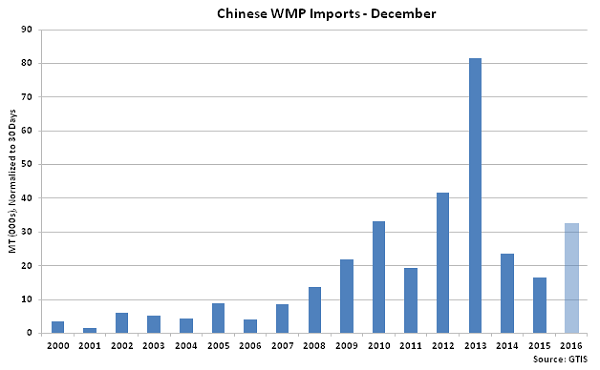

Chinese WMP Imports Finished at a Three Year High for the Month of December

Chinese WMP Imports Finished at a Three Year High for the Month of December

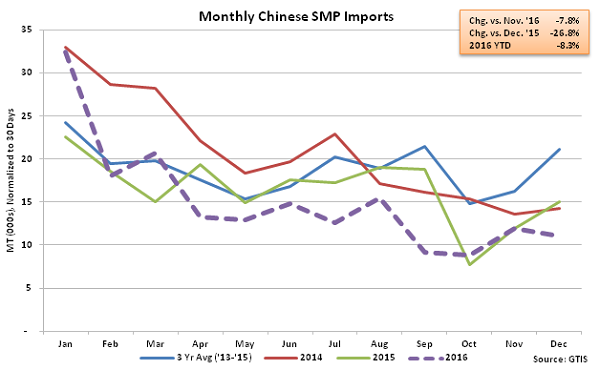

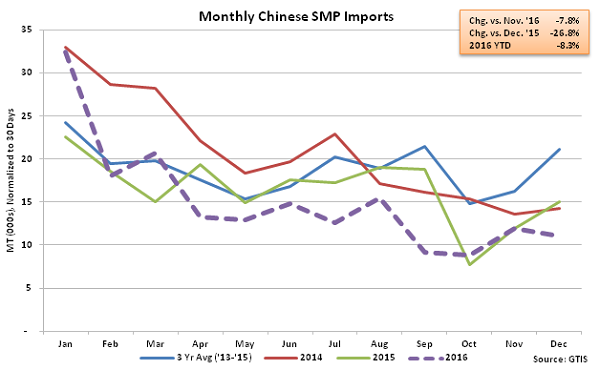

Dec ’16 Chinese SMP Import Volumes Declined 7.8% MOM and 26.8% YOY

Dec ’16 Chinese SMP Import Volumes Declined 7.8% MOM and 26.8% YOY

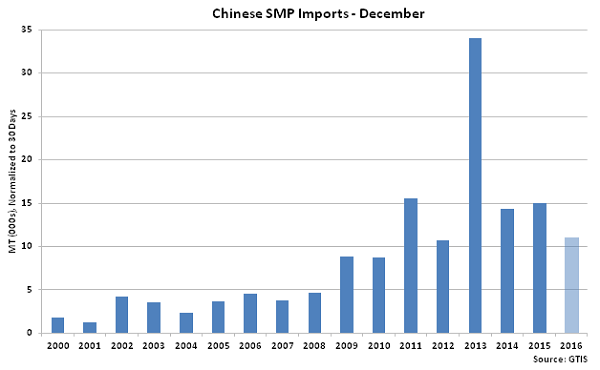

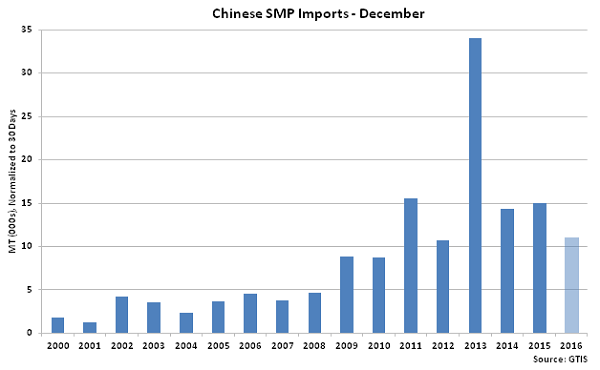

Chinese SMP Imports Finished at a Four Year Low for the Month of December

Chinese SMP Imports Finished at a Four Year Low for the Month of December

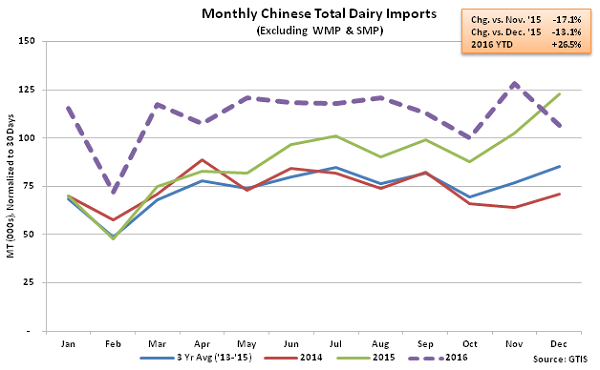

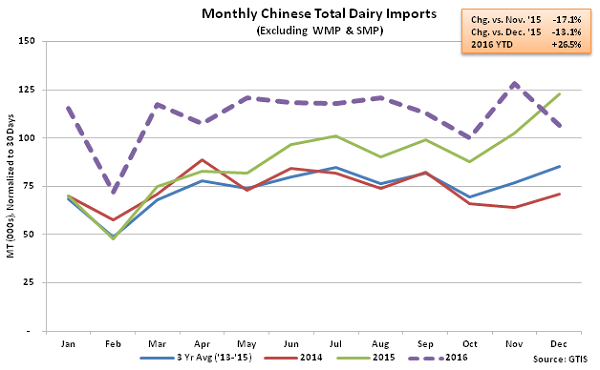

Dec ’16 Chinese Dairy Imports Excluding WMP & SMP Declined 17.1% MOM and 13.1% YOY

Dec ’16 Chinese Dairy Imports Excluding WMP & SMP Declined 17.1% MOM and 13.1% YOY

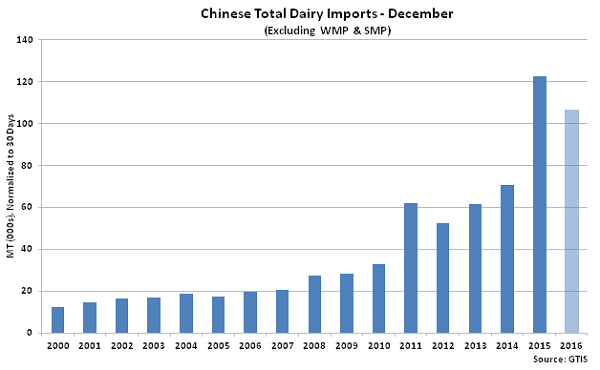

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Dec Figure

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Dec Figure

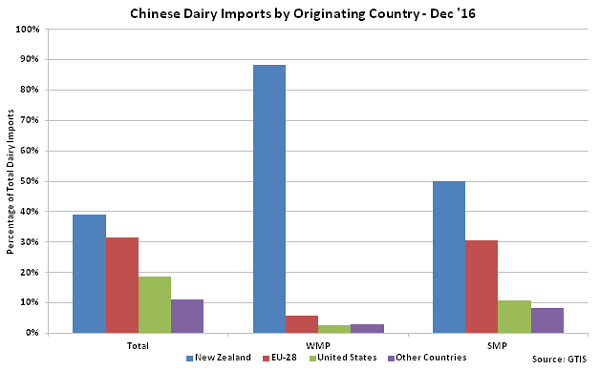

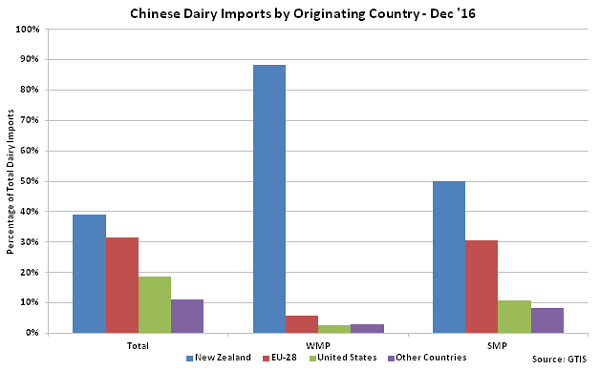

New Zealand Accounted for Over a Third of the Total Dec ’16 Chinese Dairy Import Volumes

New Zealand Accounted for Over a Third of the Total Dec ’16 Chinese Dairy Import Volumes

- Dec ’16 total Chinese dairy import volumes declined on a YOY basis for only the second time in the past 17 months, finishing 2.5% below the previous year.

- Chinese dairy import volumes originating from the EU-28 were particularly weak, finishing at a ten month low during Dec ’16. The 21.6% YOY decline in Chinese dairy import volumes originating from within the EU-28 more than offset a 26.6% YOY increase in import volumes originating from within New Zealand.

- Dec ’16 Chinese dairy imports excluding whole milk powder and skim milk powder declined a YOY basis for the first time in 20 months, finishing down 13.1%, but remained at the second highest December figure on record.

Dec ’16 Total Chinese Dairy Import Volumes Declined 11.9% MOM and 2.5% YOY

Dec ’16 Total Chinese Dairy Import Volumes Declined 11.9% MOM and 2.5% YOY

Total Chinese Dairy Import Volumes Remained at the Third Highest December Figure

Total Chinese Dairy Import Volumes Remained at the Third Highest December Figure

Dec ’16 Chinese WMP Import Volumes Increased 8.4% MOM and 98.6% YOY

Dec ’16 Chinese WMP Import Volumes Increased 8.4% MOM and 98.6% YOY

Chinese WMP Imports Finished at a Three Year High for the Month of December

Chinese WMP Imports Finished at a Three Year High for the Month of December

Dec ’16 Chinese SMP Import Volumes Declined 7.8% MOM and 26.8% YOY

Dec ’16 Chinese SMP Import Volumes Declined 7.8% MOM and 26.8% YOY

Chinese SMP Imports Finished at a Four Year Low for the Month of December

Chinese SMP Imports Finished at a Four Year Low for the Month of December

Dec ’16 Chinese Dairy Imports Excluding WMP & SMP Declined 17.1% MOM and 13.1% YOY

Dec ’16 Chinese Dairy Imports Excluding WMP & SMP Declined 17.1% MOM and 13.1% YOY

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Dec Figure

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Dec Figure

New Zealand Accounted for Over a Third of the Total Dec ’16 Chinese Dairy Import Volumes

New Zealand Accounted for Over a Third of the Total Dec ’16 Chinese Dairy Import Volumes