U.S. Livestock Cold Storage Update – Jan ’17

Executive Summary

U.S. cold storage figures provided by USDA were recently updated with values spanning through Dec ’16. Highlights from the updated report include:

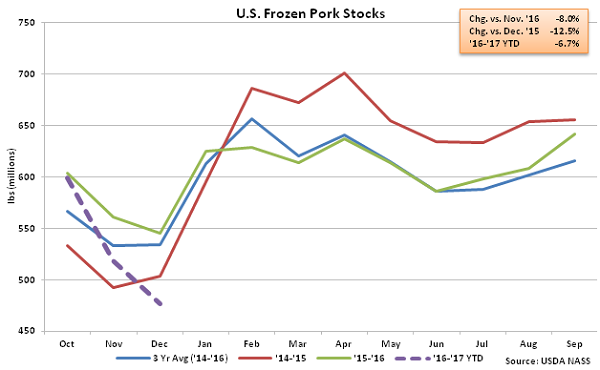

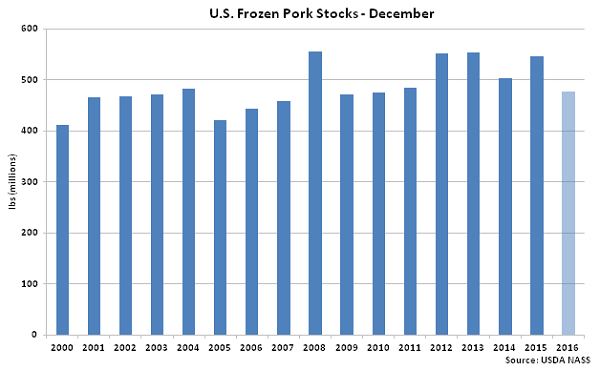

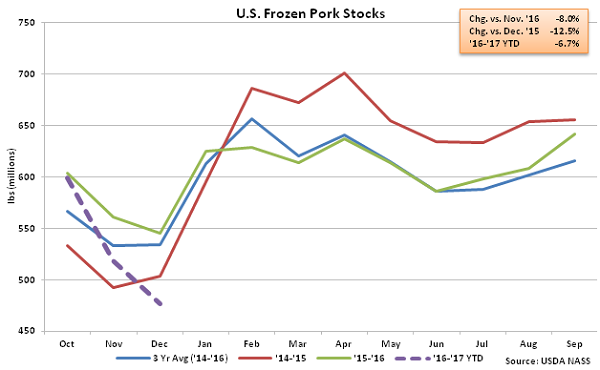

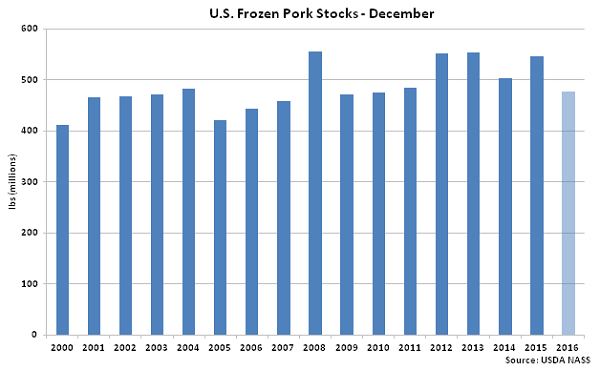

According to USDA, Dec ’16 U.S. frozen pork stocks of 477.2 million pounds declined 8.0% MOM and 12.5% YOY, reaching a five year low. Pork stocks have finished lower on a YOY basis over 11 consecutive months through December. The MOM decline in pork stocks of 41.6 million pounds, or 8.0%, was significantly larger than the ten year average November – December seasonal decline in stocks of 3.1 million pounds, or 0.7%, contributing to the continued YOY declines. Dec ’16 pork stocks finished 10.7% below three year average figures for the month of December.

According to USDA, Dec ’16 U.S. frozen pork stocks of 477.2 million pounds declined 8.0% MOM and 12.5% YOY, reaching a five year low. Pork stocks have finished lower on a YOY basis over 11 consecutive months through December. The MOM decline in pork stocks of 41.6 million pounds, or 8.0%, was significantly larger than the ten year average November – December seasonal decline in stocks of 3.1 million pounds, or 0.7%, contributing to the continued YOY declines. Dec ’16 pork stocks finished 10.7% below three year average figures for the month of December.

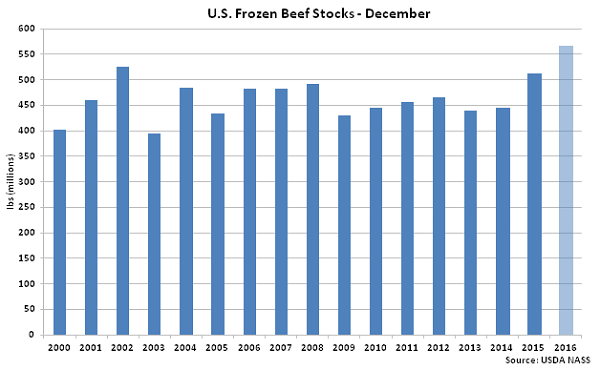

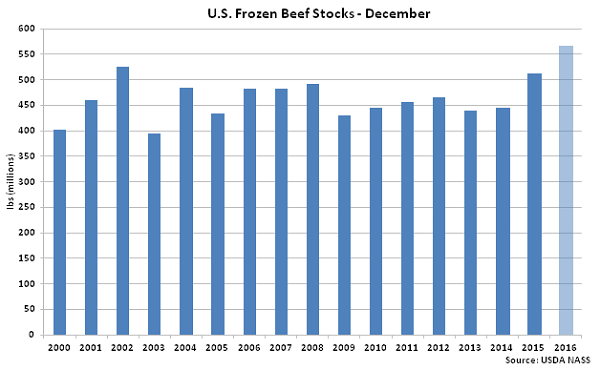

Beef – Stocks Reach a Record Monthly High, Finish up 10.6% YOY

Beef – Stocks Reach a Record Monthly High, Finish up 10.6% YOY

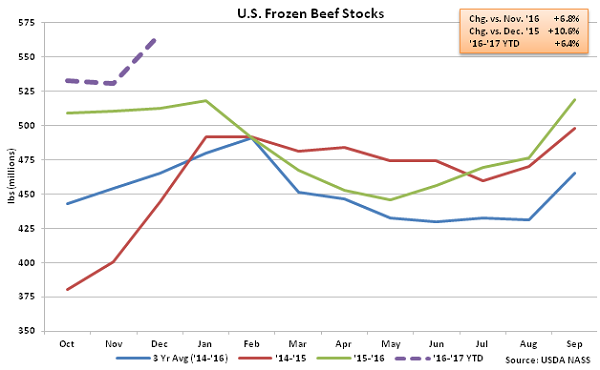

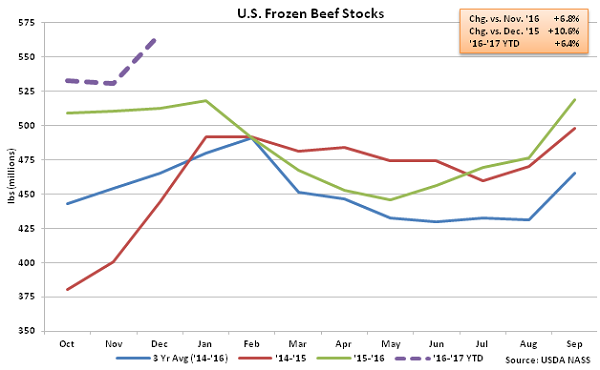

Dec ’16 U.S. frozen beef stocks of 567.0 million pounds increased 6.8% MOM and 10.6% YOY, finishing at a record monthly high for the second time in three months. Beef stocks have increased on a YOY basis over six consecutive months through December. The MOM increase in beef stocks of 36.0 million pounds, or 6.8%, was significantly larger than the ten year average November – December seasonal increase in stocks of 6.1 million pounds, or 1.6%. Dec ’16 beef stocks finished 21.8% above three year average figures for the month of December and 6.4% above the previous monthly record high experienced during Oct ’16.

Dec ’16 U.S. frozen beef stocks of 567.0 million pounds increased 6.8% MOM and 10.6% YOY, finishing at a record monthly high for the second time in three months. Beef stocks have increased on a YOY basis over six consecutive months through December. The MOM increase in beef stocks of 36.0 million pounds, or 6.8%, was significantly larger than the ten year average November – December seasonal increase in stocks of 6.1 million pounds, or 1.6%. Dec ’16 beef stocks finished 21.8% above three year average figures for the month of December and 6.4% above the previous monthly record high experienced during Oct ’16.

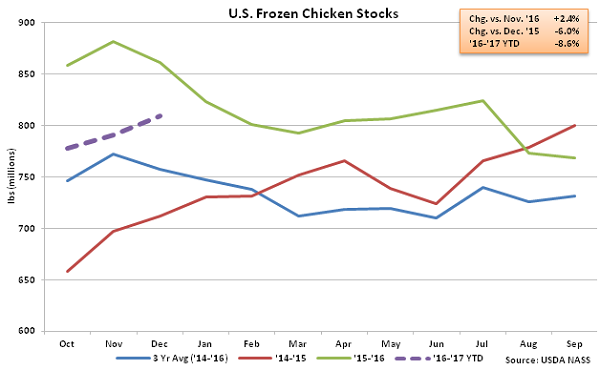

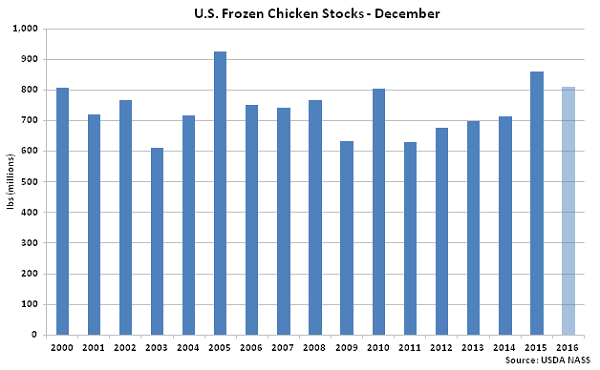

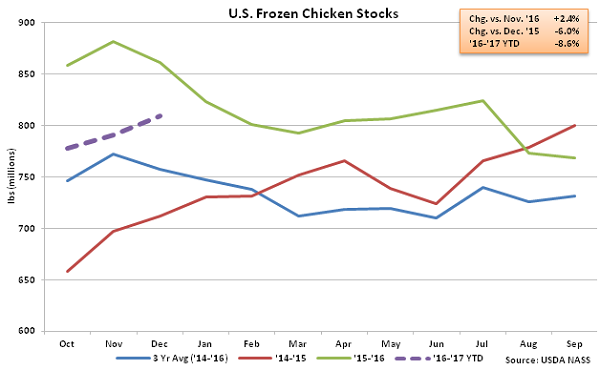

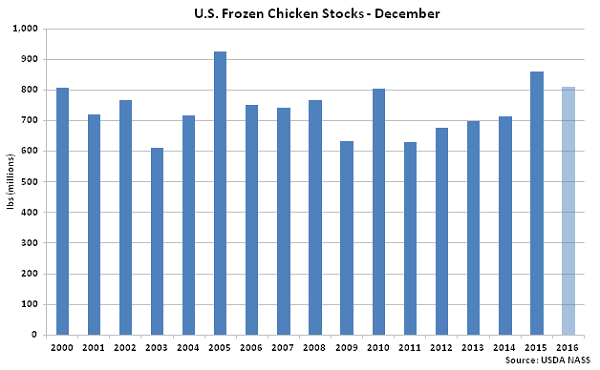

Chicken – Stocks Decline on a YOY Basis for the Fifth Consecutive Month, Finish Down 6.0%

Chicken – Stocks Decline on a YOY Basis for the Fifth Consecutive Month, Finish Down 6.0%

Dec ’16 U.S. frozen chicken stocks of 809.8 million pounds increased 2.4% MOM but remained lower on a YOY basis for the fifth consecutive month, finishing down 6.0%. U.S. chicken stocks had increased on a YOY basis over 20 consecutive months prior to the five most recent YOY declines.The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the ten year average November – December seasonal decline in stocks of 1.1 million pounds, or 0.1%. Despite remaining lower on a YOY basis, Dec ’16 chicken stocks finished 6.9% above three year average figures for the month of December.

Dec ’16 U.S. frozen chicken stocks of 809.8 million pounds increased 2.4% MOM but remained lower on a YOY basis for the fifth consecutive month, finishing down 6.0%. U.S. chicken stocks had increased on a YOY basis over 20 consecutive months prior to the five most recent YOY declines.The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the ten year average November – December seasonal decline in stocks of 1.1 million pounds, or 0.1%. Despite remaining lower on a YOY basis, Dec ’16 chicken stocks finished 6.9% above three year average figures for the month of December.

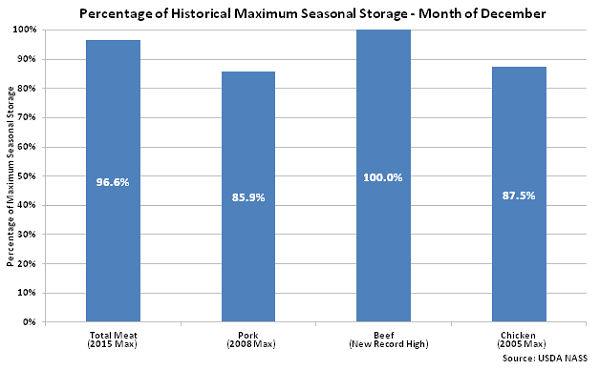

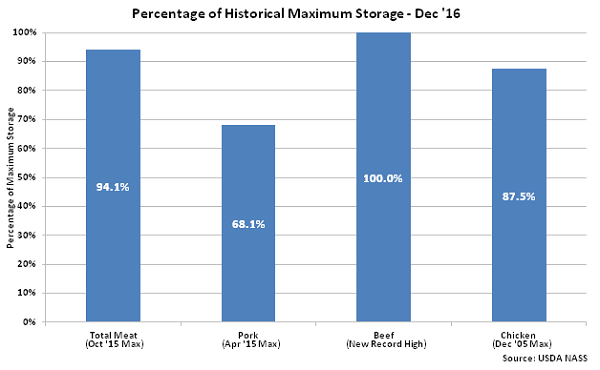

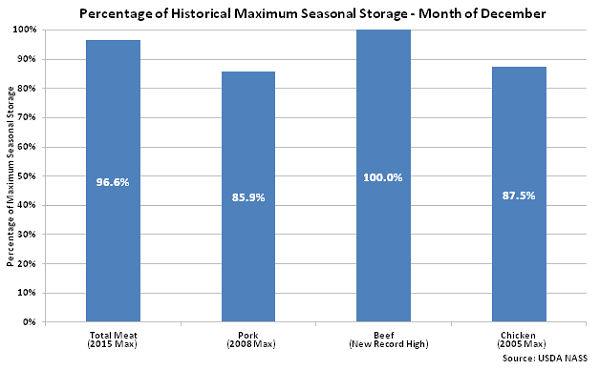

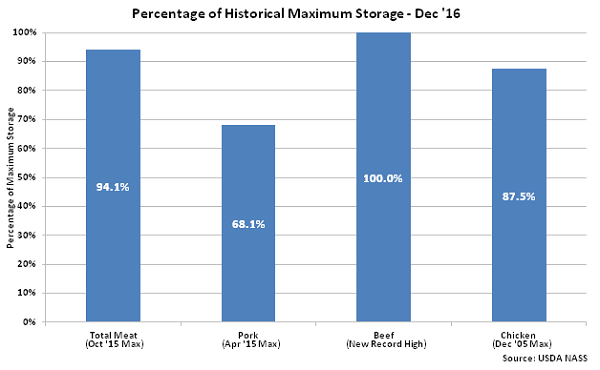

Overall, Dec ’16 combined U.S. pork, beef and chicken stocks finished 5.9% below the monthly record high experienced during Oct ’15. Individually, Dec ’16 beef stocks finished at a record high maximum storage level while chicken and pork stocks finished within 15% and 35% of historical maximum storage levels, respectively.

Overall, Dec ’16 combined U.S. pork, beef and chicken stocks finished 5.9% below the monthly record high experienced during Oct ’15. Individually, Dec ’16 beef stocks finished at a record high maximum storage level while chicken and pork stocks finished within 15% and 35% of historical maximum storage levels, respectively.

Dec ’16 chicken and pork stocks each finished within 15% of historical maximum seasonal storage levels for the month of December.

Dec ’16 chicken and pork stocks each finished within 15% of historical maximum seasonal storage levels for the month of December.

- Dec ’16 U.S. pork stocks remained lower on a YOY basis for the 11th consecutive month, finishing at a five year low overall, while chicken stocks declined on a YOY basis for the fifth month in a row during Dec ’16.

- U.S. beef stocks finished higher on a YOY basis for the sixth consecutive month during Dec ’16, finishing at a new monthly record high for the second time in the past three months.

- Dec ’16 combined U.S. pork, beef and chicken finished 5.9% below the record high experienced during Oct ’15, despite beef stocks finishing at an all-time record high.

According to USDA, Dec ’16 U.S. frozen pork stocks of 477.2 million pounds declined 8.0% MOM and 12.5% YOY, reaching a five year low. Pork stocks have finished lower on a YOY basis over 11 consecutive months through December. The MOM decline in pork stocks of 41.6 million pounds, or 8.0%, was significantly larger than the ten year average November – December seasonal decline in stocks of 3.1 million pounds, or 0.7%, contributing to the continued YOY declines. Dec ’16 pork stocks finished 10.7% below three year average figures for the month of December.

According to USDA, Dec ’16 U.S. frozen pork stocks of 477.2 million pounds declined 8.0% MOM and 12.5% YOY, reaching a five year low. Pork stocks have finished lower on a YOY basis over 11 consecutive months through December. The MOM decline in pork stocks of 41.6 million pounds, or 8.0%, was significantly larger than the ten year average November – December seasonal decline in stocks of 3.1 million pounds, or 0.7%, contributing to the continued YOY declines. Dec ’16 pork stocks finished 10.7% below three year average figures for the month of December.

Beef – Stocks Reach a Record Monthly High, Finish up 10.6% YOY

Beef – Stocks Reach a Record Monthly High, Finish up 10.6% YOY

Dec ’16 U.S. frozen beef stocks of 567.0 million pounds increased 6.8% MOM and 10.6% YOY, finishing at a record monthly high for the second time in three months. Beef stocks have increased on a YOY basis over six consecutive months through December. The MOM increase in beef stocks of 36.0 million pounds, or 6.8%, was significantly larger than the ten year average November – December seasonal increase in stocks of 6.1 million pounds, or 1.6%. Dec ’16 beef stocks finished 21.8% above three year average figures for the month of December and 6.4% above the previous monthly record high experienced during Oct ’16.

Dec ’16 U.S. frozen beef stocks of 567.0 million pounds increased 6.8% MOM and 10.6% YOY, finishing at a record monthly high for the second time in three months. Beef stocks have increased on a YOY basis over six consecutive months through December. The MOM increase in beef stocks of 36.0 million pounds, or 6.8%, was significantly larger than the ten year average November – December seasonal increase in stocks of 6.1 million pounds, or 1.6%. Dec ’16 beef stocks finished 21.8% above three year average figures for the month of December and 6.4% above the previous monthly record high experienced during Oct ’16.

Chicken – Stocks Decline on a YOY Basis for the Fifth Consecutive Month, Finish Down 6.0%

Chicken – Stocks Decline on a YOY Basis for the Fifth Consecutive Month, Finish Down 6.0%

Dec ’16 U.S. frozen chicken stocks of 809.8 million pounds increased 2.4% MOM but remained lower on a YOY basis for the fifth consecutive month, finishing down 6.0%. U.S. chicken stocks had increased on a YOY basis over 20 consecutive months prior to the five most recent YOY declines.The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the ten year average November – December seasonal decline in stocks of 1.1 million pounds, or 0.1%. Despite remaining lower on a YOY basis, Dec ’16 chicken stocks finished 6.9% above three year average figures for the month of December.

Dec ’16 U.S. frozen chicken stocks of 809.8 million pounds increased 2.4% MOM but remained lower on a YOY basis for the fifth consecutive month, finishing down 6.0%. U.S. chicken stocks had increased on a YOY basis over 20 consecutive months prior to the five most recent YOY declines.The MOM increase in chicken stocks of 18.8 million pounds, or 2.4%, was a contraseasonal move when compared to the ten year average November – December seasonal decline in stocks of 1.1 million pounds, or 0.1%. Despite remaining lower on a YOY basis, Dec ’16 chicken stocks finished 6.9% above three year average figures for the month of December.

Overall, Dec ’16 combined U.S. pork, beef and chicken stocks finished 5.9% below the monthly record high experienced during Oct ’15. Individually, Dec ’16 beef stocks finished at a record high maximum storage level while chicken and pork stocks finished within 15% and 35% of historical maximum storage levels, respectively.

Overall, Dec ’16 combined U.S. pork, beef and chicken stocks finished 5.9% below the monthly record high experienced during Oct ’15. Individually, Dec ’16 beef stocks finished at a record high maximum storage level while chicken and pork stocks finished within 15% and 35% of historical maximum storage levels, respectively.

Dec ’16 chicken and pork stocks each finished within 15% of historical maximum seasonal storage levels for the month of December.

Dec ’16 chicken and pork stocks each finished within 15% of historical maximum seasonal storage levels for the month of December.