Dairy WASDE Update – Mar ’17

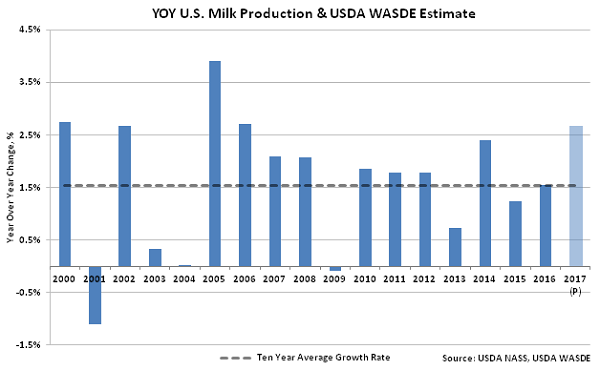

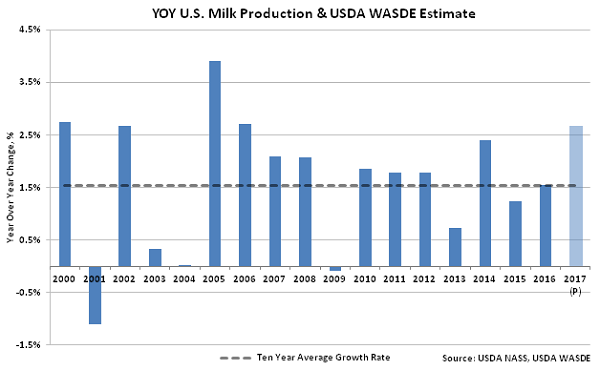

According to the March USDA World Agricultural Supply and Demand Estimate (WASDE) report, the 2017 U.S. milk production projection was raised for the third consecutive month as stronger than expected milk cow numbers more than offset reduced growth in milk per cow yields. 2017 projected milk production of 217.5 billion pounds was raised by 0.1 billion pounds, finishing at the highest projected figure on record. 2017 projected milk production equates to a 2.7% YOY increase from 2016 production levels when adjusted for leap year. The projected increase in milk production would be the largest experienced throughout the past 11 years on a percentage basis.

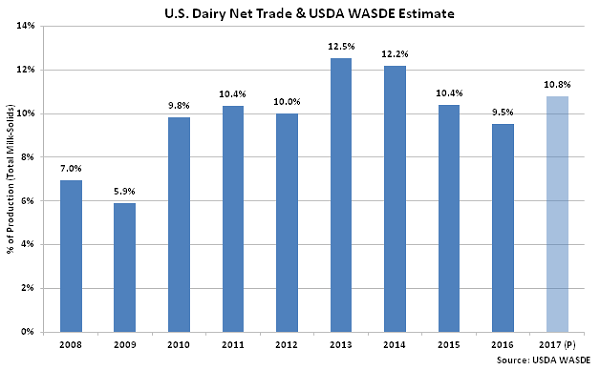

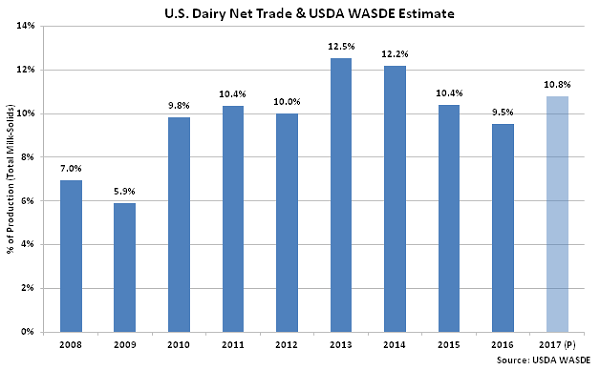

Export forecasts for 2017 were unchanged on a milk-fat basis but reduced slightly on a skim-solids basis as strong competition within international skim milk powder markets is expected to continue. 2017 import forecasts were unchanged from the previous month on both a milk-fat basis and-solids basis. The 2017 projected dairy export volumes translated to 14.6% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2017 U.S. net dairy trade of 10.8% was reduced slightly from the previous month but is expected to remain at three year high levels.

Export forecasts for 2017 were unchanged on a milk-fat basis but reduced slightly on a skim-solids basis as strong competition within international skim milk powder markets is expected to continue. 2017 import forecasts were unchanged from the previous month on both a milk-fat basis and-solids basis. The 2017 projected dairy export volumes translated to 14.6% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2017 U.S. net dairy trade of 10.8% was reduced slightly from the previous month but is expected to remain at three year high levels.

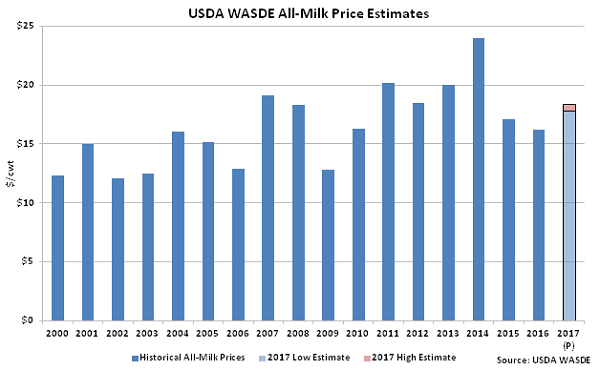

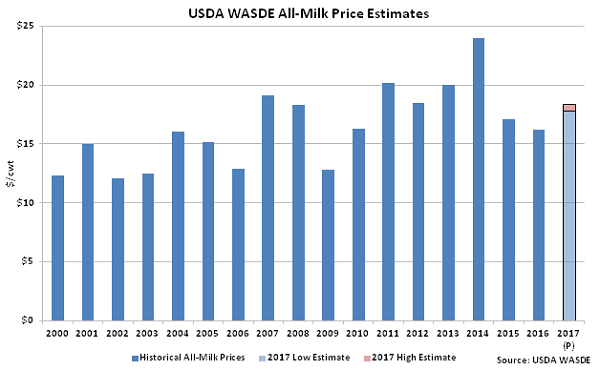

The 2017 butter price forecast was raised on continued demand strength however the cheese price forecast was reduced as high stocks are expected to pressure prices. The whey price forecast was raised on recent market strength while the nonfat dry milk price forecast was lowered on expectations of slower export growth due to increased competition from global competitors. The 2017 Class III price forecast was raised $0.10/cwt from the previous month at the midpoint, finishing at $16.60-$17.20/cwt, as higher whey prices more than offset reduced cheese prices. The 2017 Class IV price forecast was lowered $0.30/cwt from the previous month at the midpoint, finishing at $14.85-$15.55/cwt, as weaker nonfat dry milk prices more than offset increased butter prices. The 2017 projected All-Milk price of $17.80-$18.40/cwt was raised by $0.05/cwt at the midpoint, finishing 11.7% above 2016 price levels.

The 2017 butter price forecast was raised on continued demand strength however the cheese price forecast was reduced as high stocks are expected to pressure prices. The whey price forecast was raised on recent market strength while the nonfat dry milk price forecast was lowered on expectations of slower export growth due to increased competition from global competitors. The 2017 Class III price forecast was raised $0.10/cwt from the previous month at the midpoint, finishing at $16.60-$17.20/cwt, as higher whey prices more than offset reduced cheese prices. The 2017 Class IV price forecast was lowered $0.30/cwt from the previous month at the midpoint, finishing at $14.85-$15.55/cwt, as weaker nonfat dry milk prices more than offset increased butter prices. The 2017 projected All-Milk price of $17.80-$18.40/cwt was raised by $0.05/cwt at the midpoint, finishing 11.7% above 2016 price levels.

Export forecasts for 2017 were unchanged on a milk-fat basis but reduced slightly on a skim-solids basis as strong competition within international skim milk powder markets is expected to continue. 2017 import forecasts were unchanged from the previous month on both a milk-fat basis and-solids basis. The 2017 projected dairy export volumes translated to 14.6% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2017 U.S. net dairy trade of 10.8% was reduced slightly from the previous month but is expected to remain at three year high levels.

Export forecasts for 2017 were unchanged on a milk-fat basis but reduced slightly on a skim-solids basis as strong competition within international skim milk powder markets is expected to continue. 2017 import forecasts were unchanged from the previous month on both a milk-fat basis and-solids basis. The 2017 projected dairy export volumes translated to 14.6% of total U.S. milk solids production while import volumes were equivalent to 3.8% of total U.S. milk solids production. 2017 U.S. net dairy trade of 10.8% was reduced slightly from the previous month but is expected to remain at three year high levels.

The 2017 butter price forecast was raised on continued demand strength however the cheese price forecast was reduced as high stocks are expected to pressure prices. The whey price forecast was raised on recent market strength while the nonfat dry milk price forecast was lowered on expectations of slower export growth due to increased competition from global competitors. The 2017 Class III price forecast was raised $0.10/cwt from the previous month at the midpoint, finishing at $16.60-$17.20/cwt, as higher whey prices more than offset reduced cheese prices. The 2017 Class IV price forecast was lowered $0.30/cwt from the previous month at the midpoint, finishing at $14.85-$15.55/cwt, as weaker nonfat dry milk prices more than offset increased butter prices. The 2017 projected All-Milk price of $17.80-$18.40/cwt was raised by $0.05/cwt at the midpoint, finishing 11.7% above 2016 price levels.

The 2017 butter price forecast was raised on continued demand strength however the cheese price forecast was reduced as high stocks are expected to pressure prices. The whey price forecast was raised on recent market strength while the nonfat dry milk price forecast was lowered on expectations of slower export growth due to increased competition from global competitors. The 2017 Class III price forecast was raised $0.10/cwt from the previous month at the midpoint, finishing at $16.60-$17.20/cwt, as higher whey prices more than offset reduced cheese prices. The 2017 Class IV price forecast was lowered $0.30/cwt from the previous month at the midpoint, finishing at $14.85-$15.55/cwt, as weaker nonfat dry milk prices more than offset increased butter prices. The 2017 projected All-Milk price of $17.80-$18.40/cwt was raised by $0.05/cwt at the midpoint, finishing 11.7% above 2016 price levels.