Grain WASDE Update – Mar ’17

Corn – U.S. Production and Usage Unchanged, Global Stocks Projected Higher on Greater Production

Corn – U.S. Production and Usage Unchanged, Global Stocks Projected Higher on Greater Production

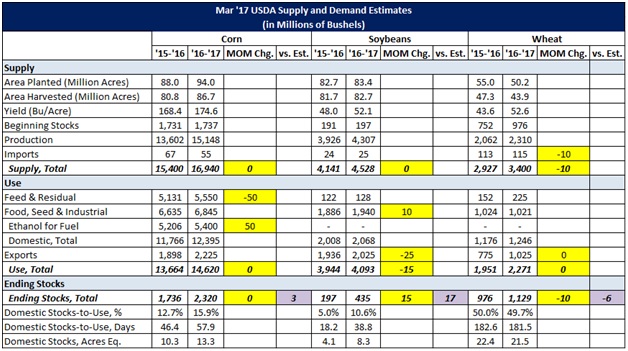

- ’16-’17 U.S. ending stocks of 2.320 billion bushels above expectations of 2.317 billion bushels

- ’16-’17 global ending stocks of 220.68 million MT above expectations of 218.51 million MT

- ’16-’17 U.S. ending stocks of 435 million bushels above expectations of 418 million bushels

- ’16-’17 global ending stocks of 82.82 million MT above expectations of 81.52 million MT

- ’16-’17 U.S. ending stocks of 1.129 billion bushels below expectations of 1.135 billion bushels

- ’16-’17 global ending stocks of 249.94 million MT above expectations of 248.62 million MT