U.S. Dairy Dry Product Stocks Update – Sep ’19

Executive Summary

U.S. dairy dry product stock figures provided by USDA were recently updated with values spanning through Jul ’19. Highlights from the updated report include:

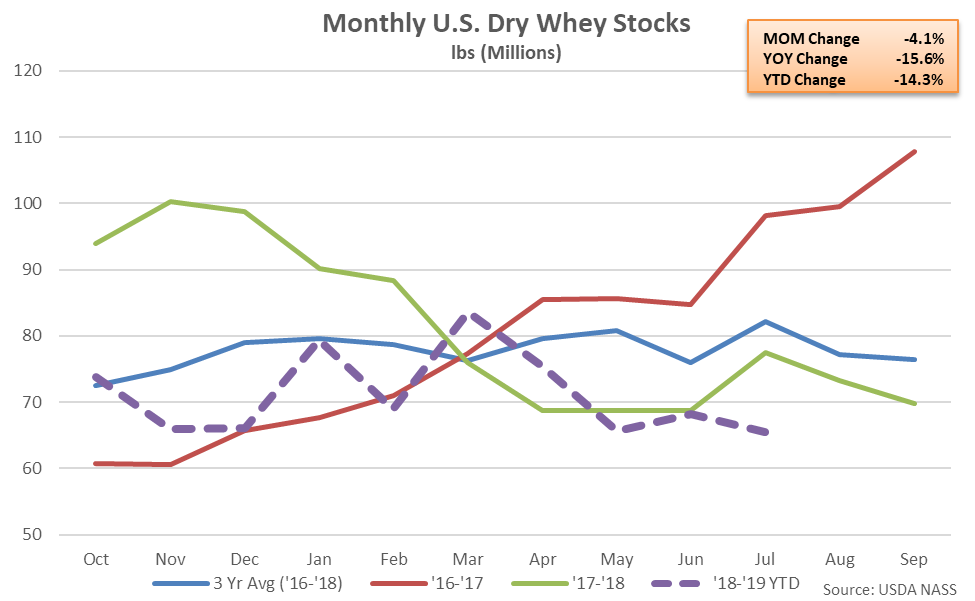

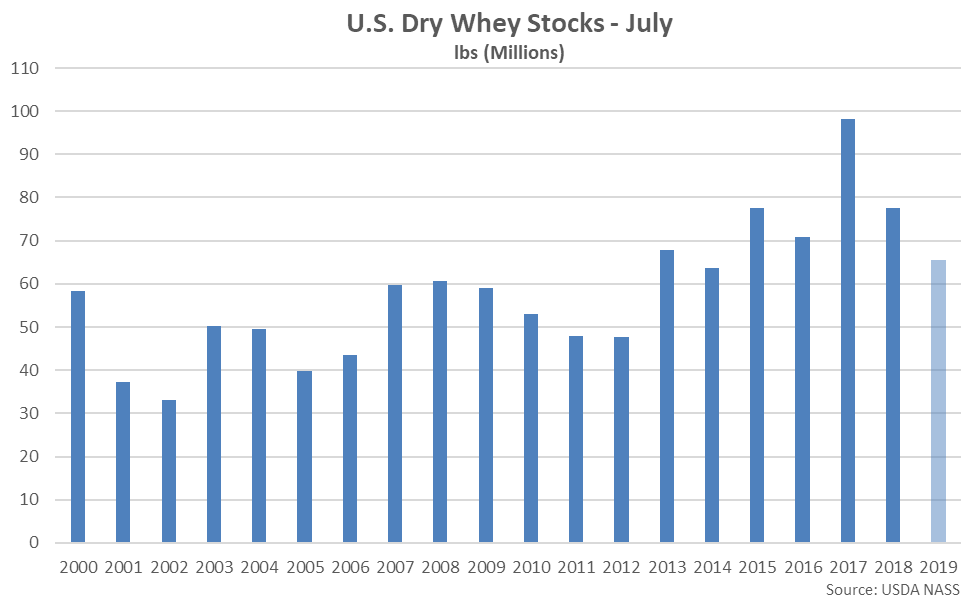

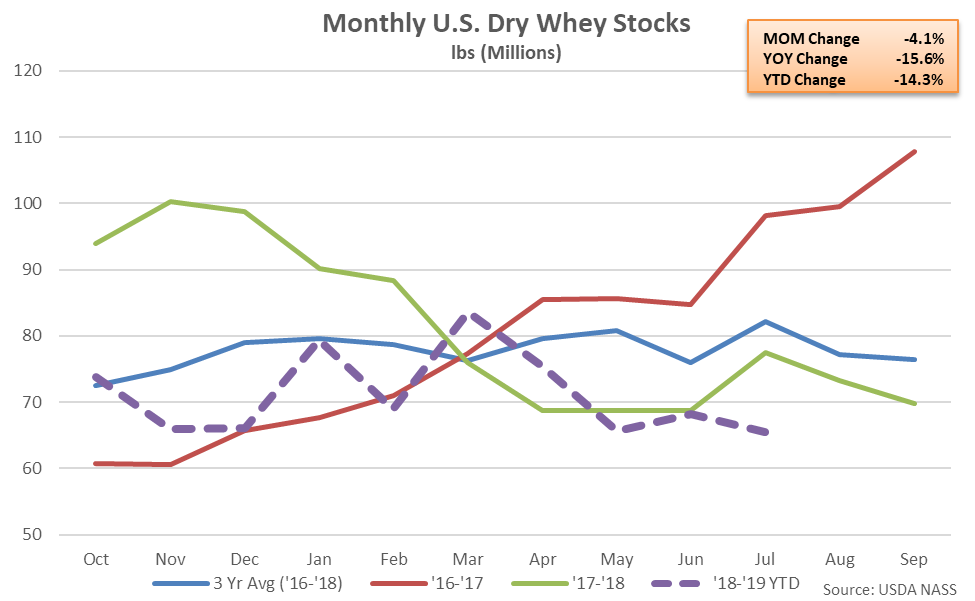

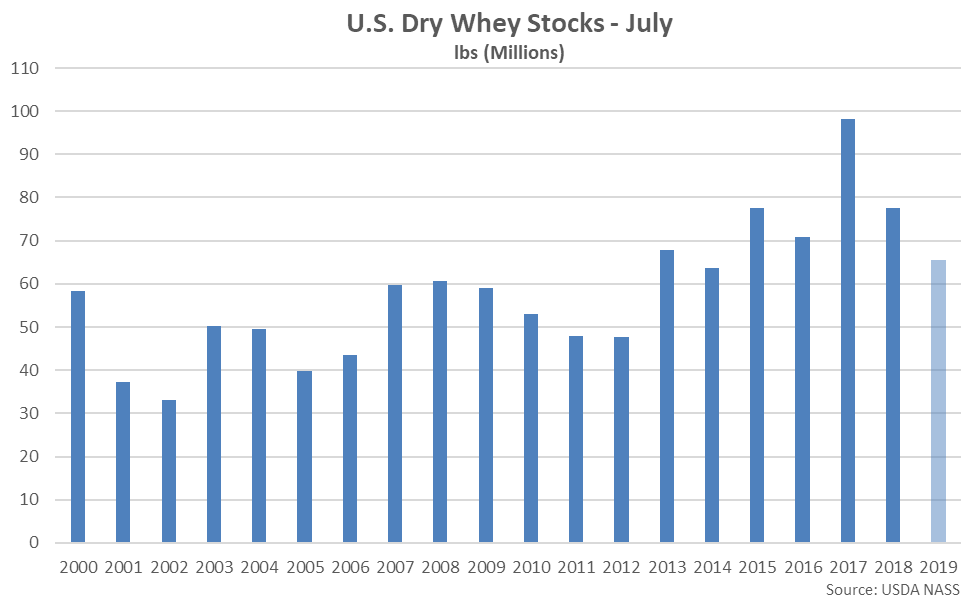

Jul ’19 month-end dry whey stocks declined 4.1% MOM to a 32 month low level, finishing 15.6% lower on a YOY basis. Dry whey stocks reached a five year seasonal low level for the month of July, finishing 20.3% below three year average seasonal figures. The MOM decline in dry whey stocks of 2.8 million pounds, or 4.1%, was a contraseasonal move when compared to the ten year average June – July seasonal build in dry whey stocks of 2.7 million pounds, or 4.1%. Dry whey production declined 8.9% on a YOY basis throughout Jul ’19, contributing to the contraseasonal decline in stocks.

Jul ’19 month-end dry whey stocks declined 4.1% MOM to a 32 month low level, finishing 15.6% lower on a YOY basis. Dry whey stocks reached a five year seasonal low level for the month of July, finishing 20.3% below three year average seasonal figures. The MOM decline in dry whey stocks of 2.8 million pounds, or 4.1%, was a contraseasonal move when compared to the ten year average June – July seasonal build in dry whey stocks of 2.7 million pounds, or 4.1%. Dry whey production declined 8.9% on a YOY basis throughout Jul ’19, contributing to the contraseasonal decline in stocks.

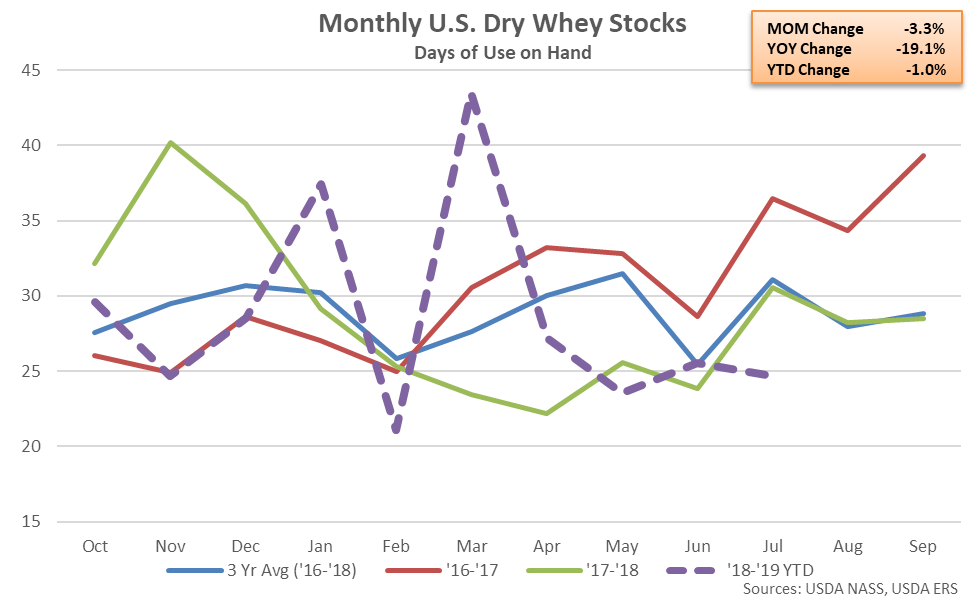

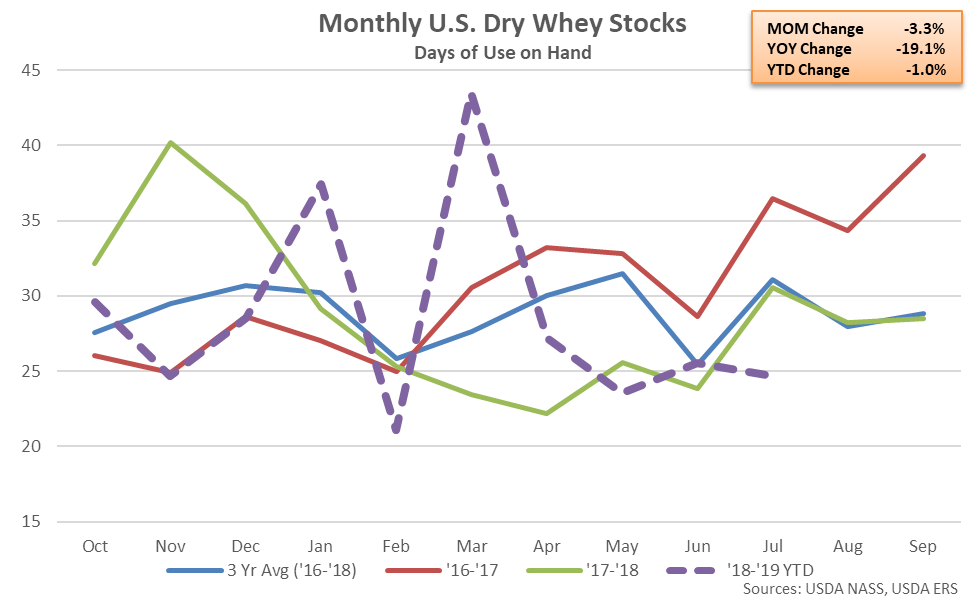

On a days of usage basis, Jul ’19 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished down 19.1% YOY, declining YOY for the second time in the past three months.

On a days of usage basis, Jul ’19 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished down 19.1% YOY, declining YOY for the second time in the past three months.

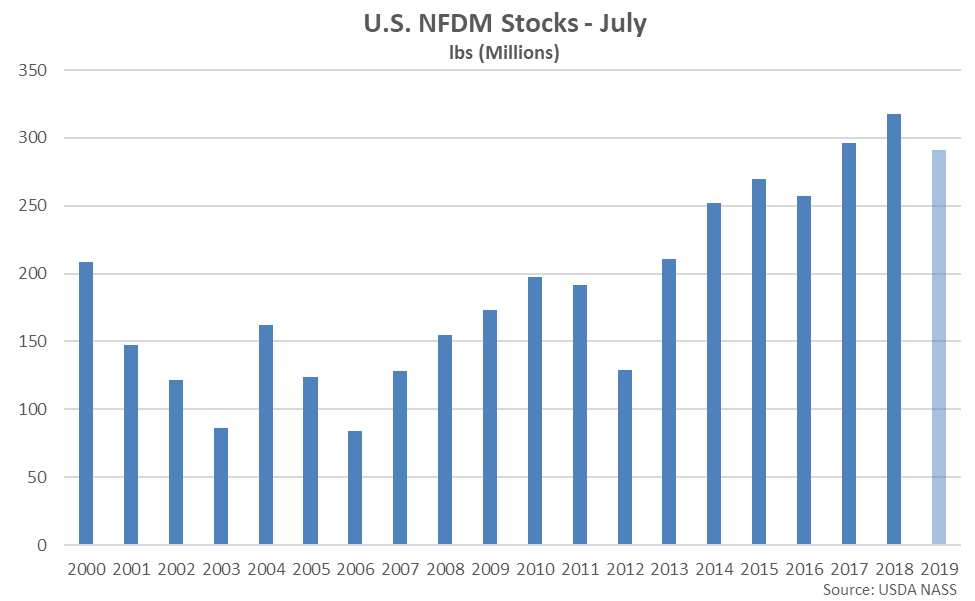

Nonfat Dry Milk – Stocks Decline 8.3% YOY, Finish at a Three Year Seasonal Low Level

Nonfat Dry Milk – Stocks Decline 8.3% YOY, Finish at a Three Year Seasonal Low Level

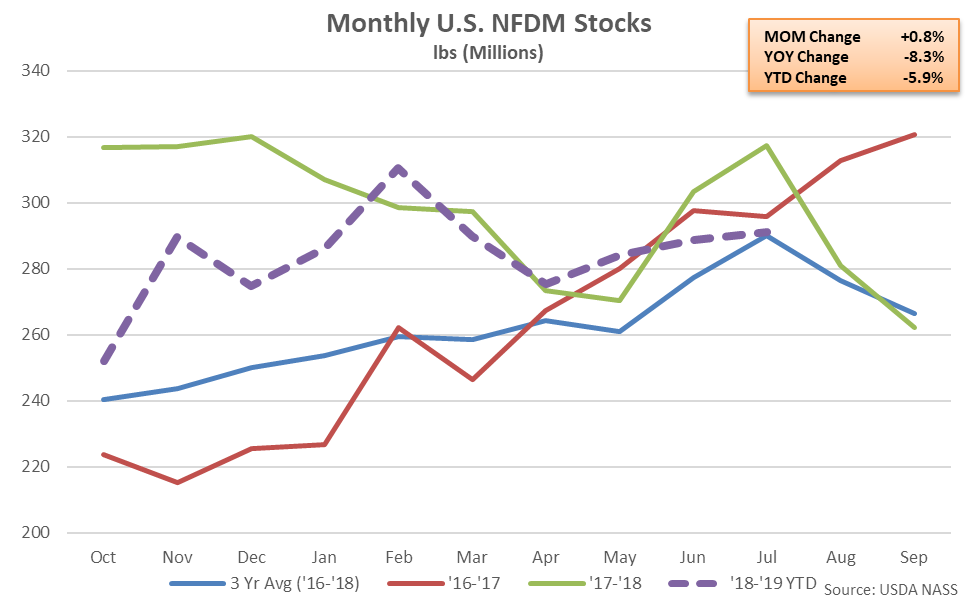

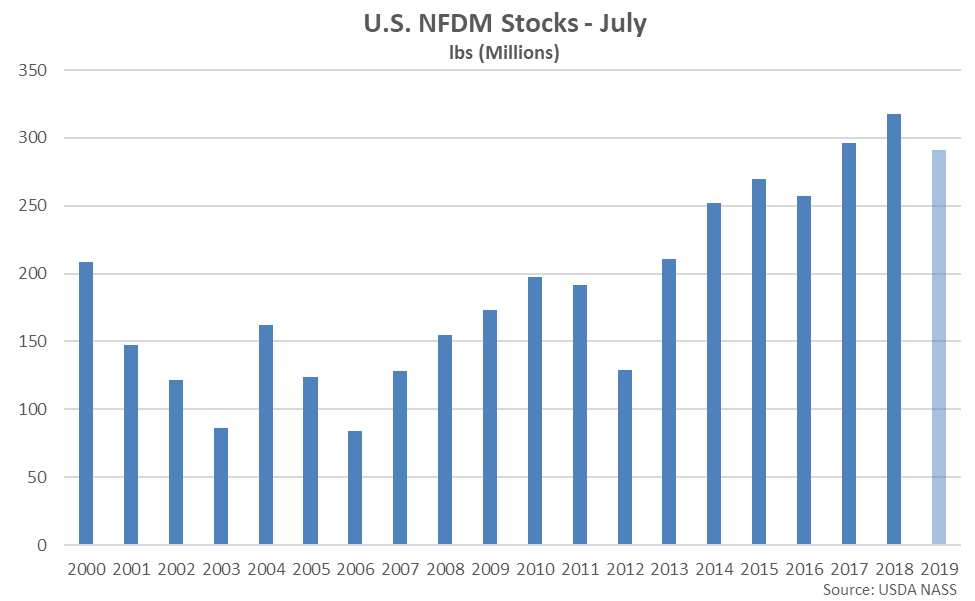

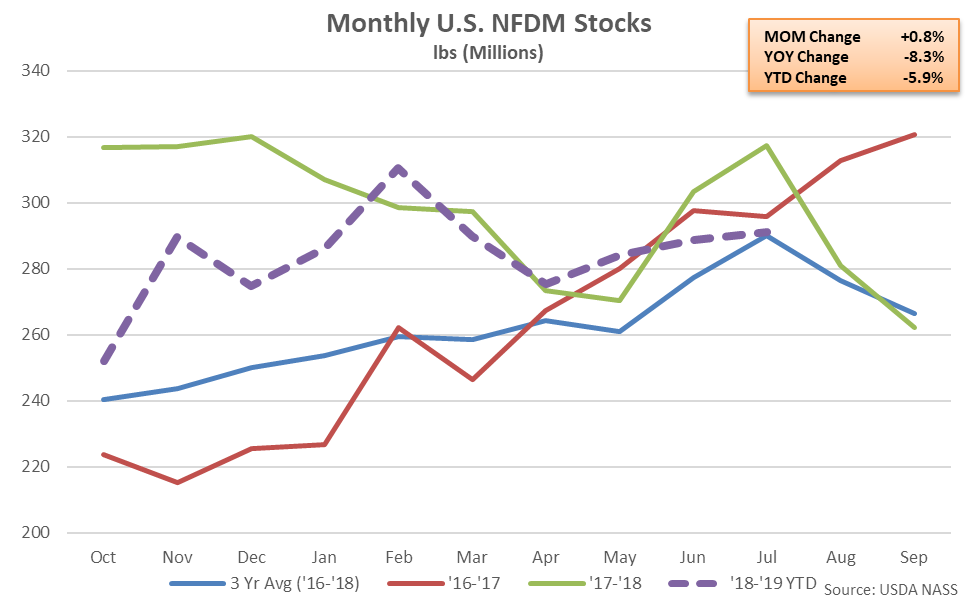

Jul ’19 month-end nonfat dry milk (NFDM) stocks increased 0.8% MOM to a five month high but remained 8.3% lower YOY, declining on a YOY basis for the second consecutive month. NFDM stocks reached a three year low seasonal level but remained 0.3% above three year average seasonal figures. The MOM increase in NFDM stocks of 2.3 million pounds, or 0.8%, was consistent with the ten year average June – July seasonal build in NFDM stocks of 3.2 million pounds, or 1.0%.

Jul ’19 month-end nonfat dry milk (NFDM) stocks increased 0.8% MOM to a five month high but remained 8.3% lower YOY, declining on a YOY basis for the second consecutive month. NFDM stocks reached a three year low seasonal level but remained 0.3% above three year average seasonal figures. The MOM increase in NFDM stocks of 2.3 million pounds, or 0.8%, was consistent with the ten year average June – July seasonal build in NFDM stocks of 3.2 million pounds, or 1.0%.

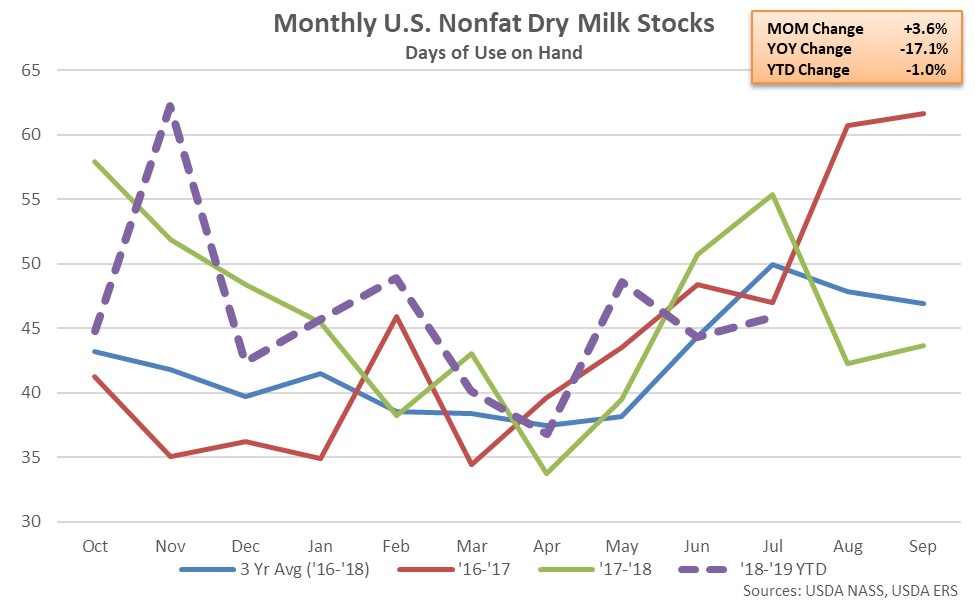

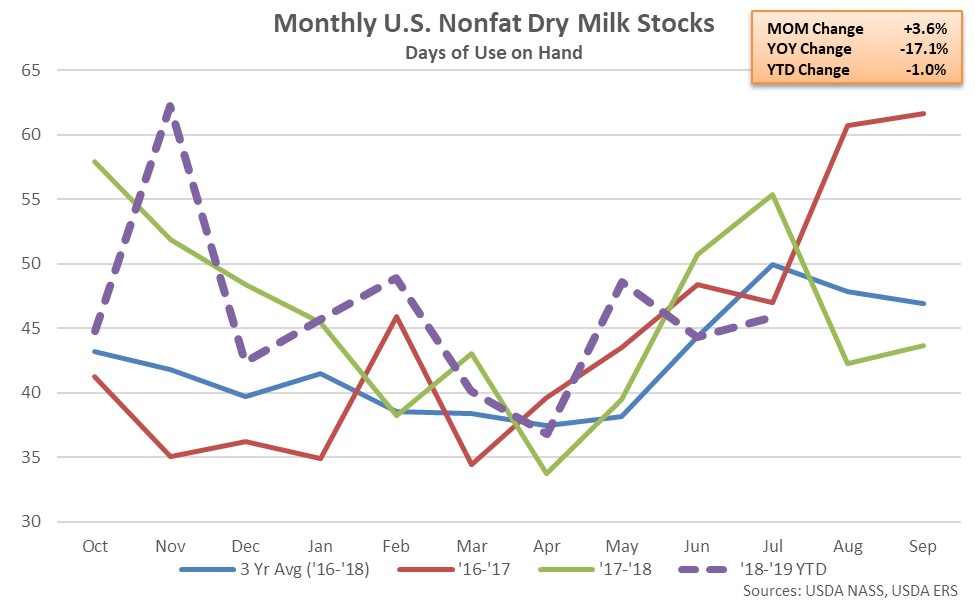

On a days of usage basis, Jul ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished down 17.1% YOY, declining YOY for the second consecutive month.

On a days of usage basis, Jul ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished down 17.1% YOY, declining YOY for the second consecutive month.

- Jul ’19 U.S. dry whey stocks declined contraseasonally to a 32 month low level, finishing 15.6% lower on a YOY basis.

- Jul ’19 U.S. nonfat dry milk stocks declined 8.3% YOY, reaching a three year seasonal low level but remaining slightly above three year average figures.

Jul ’19 month-end dry whey stocks declined 4.1% MOM to a 32 month low level, finishing 15.6% lower on a YOY basis. Dry whey stocks reached a five year seasonal low level for the month of July, finishing 20.3% below three year average seasonal figures. The MOM decline in dry whey stocks of 2.8 million pounds, or 4.1%, was a contraseasonal move when compared to the ten year average June – July seasonal build in dry whey stocks of 2.7 million pounds, or 4.1%. Dry whey production declined 8.9% on a YOY basis throughout Jul ’19, contributing to the contraseasonal decline in stocks.

Jul ’19 month-end dry whey stocks declined 4.1% MOM to a 32 month low level, finishing 15.6% lower on a YOY basis. Dry whey stocks reached a five year seasonal low level for the month of July, finishing 20.3% below three year average seasonal figures. The MOM decline in dry whey stocks of 2.8 million pounds, or 4.1%, was a contraseasonal move when compared to the ten year average June – July seasonal build in dry whey stocks of 2.7 million pounds, or 4.1%. Dry whey production declined 8.9% on a YOY basis throughout Jul ’19, contributing to the contraseasonal decline in stocks.

On a days of usage basis, Jul ’19 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished down 19.1% YOY, declining YOY for the second time in the past three months.

On a days of usage basis, Jul ’19 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished down 19.1% YOY, declining YOY for the second time in the past three months.

Nonfat Dry Milk – Stocks Decline 8.3% YOY, Finish at a Three Year Seasonal Low Level

Nonfat Dry Milk – Stocks Decline 8.3% YOY, Finish at a Three Year Seasonal Low Level

Jul ’19 month-end nonfat dry milk (NFDM) stocks increased 0.8% MOM to a five month high but remained 8.3% lower YOY, declining on a YOY basis for the second consecutive month. NFDM stocks reached a three year low seasonal level but remained 0.3% above three year average seasonal figures. The MOM increase in NFDM stocks of 2.3 million pounds, or 0.8%, was consistent with the ten year average June – July seasonal build in NFDM stocks of 3.2 million pounds, or 1.0%.

Jul ’19 month-end nonfat dry milk (NFDM) stocks increased 0.8% MOM to a five month high but remained 8.3% lower YOY, declining on a YOY basis for the second consecutive month. NFDM stocks reached a three year low seasonal level but remained 0.3% above three year average seasonal figures. The MOM increase in NFDM stocks of 2.3 million pounds, or 0.8%, was consistent with the ten year average June – July seasonal build in NFDM stocks of 3.2 million pounds, or 1.0%.

On a days of usage basis, Jul ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished down 17.1% YOY, declining YOY for the second consecutive month.

On a days of usage basis, Jul ’19 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished down 17.1% YOY, declining YOY for the second consecutive month.