U.S. Cattle & Hogs Production Update – Dec ’19

Executive Summary

U.S. livestock slaughter figures provided by USDA were recently updated with values spanning through Nov ‘19. Highlights from the updated report include:

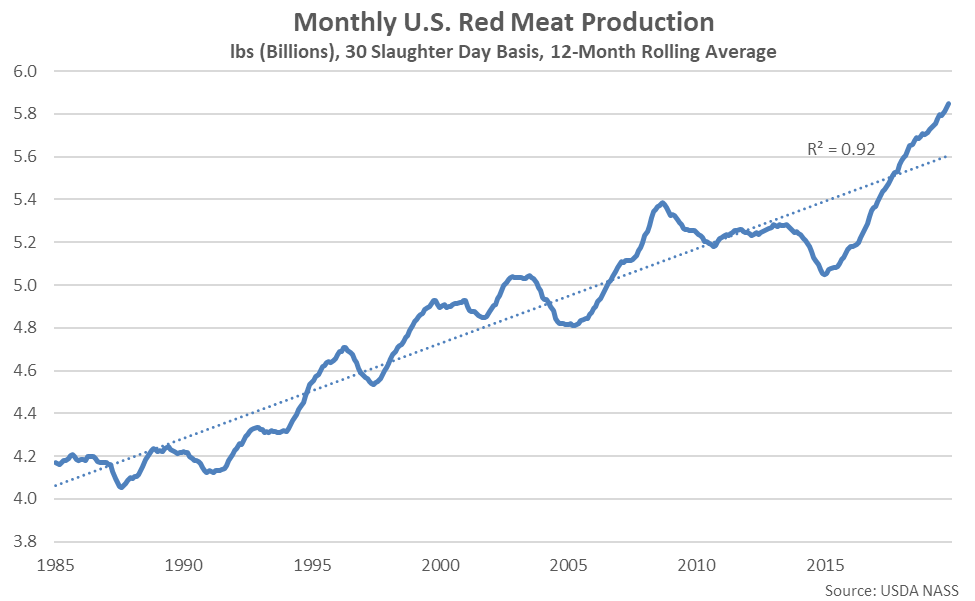

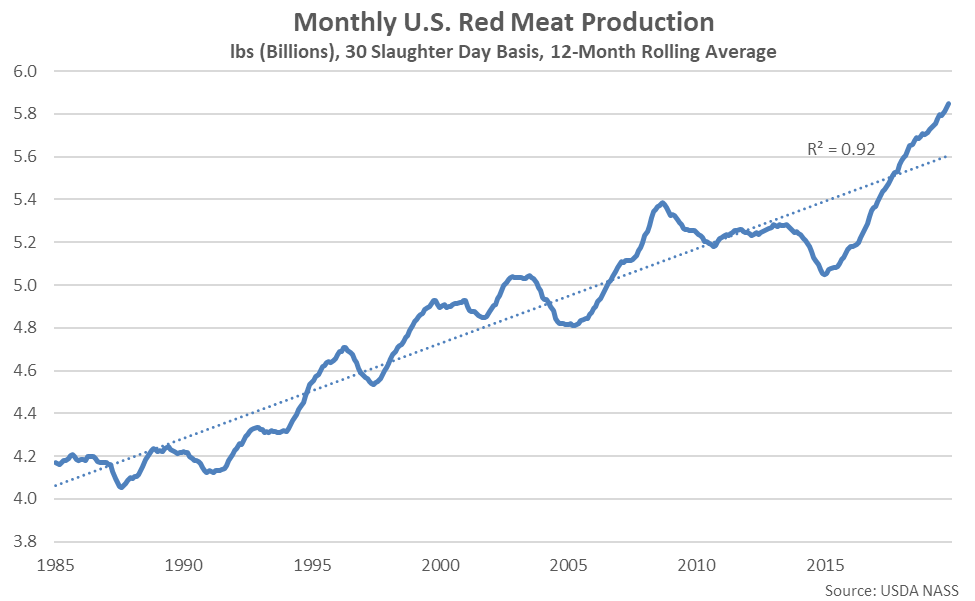

Total 12-month rolling average red meat production finished above trendline for the 27th consecutive month throughout Nov ’19. The Nov ’19 deviation from trendline increased to an 11 year high level.

Total 12-month rolling average red meat production finished above trendline for the 27th consecutive month throughout Nov ’19. The Nov ’19 deviation from trendline increased to an 11 year high level.

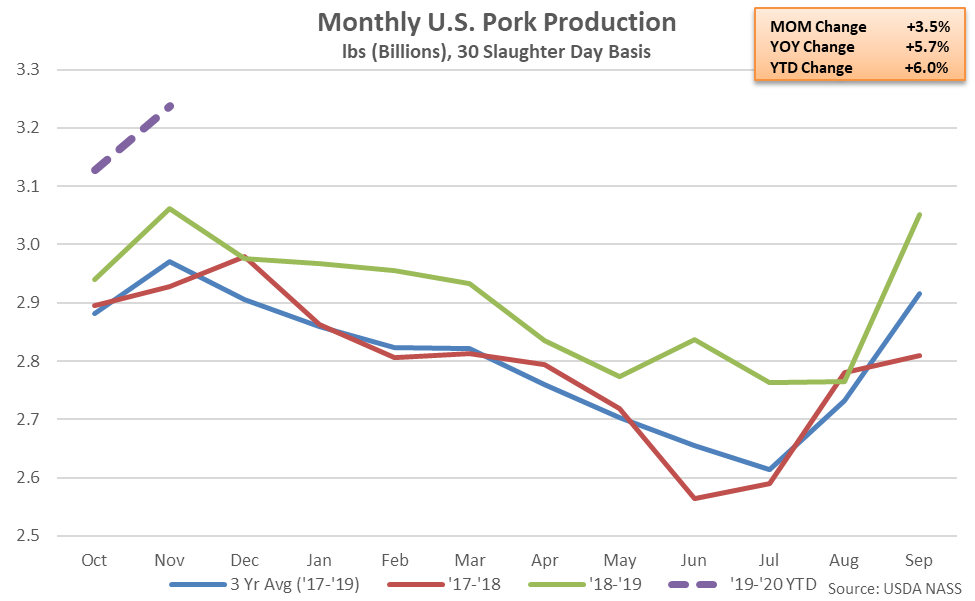

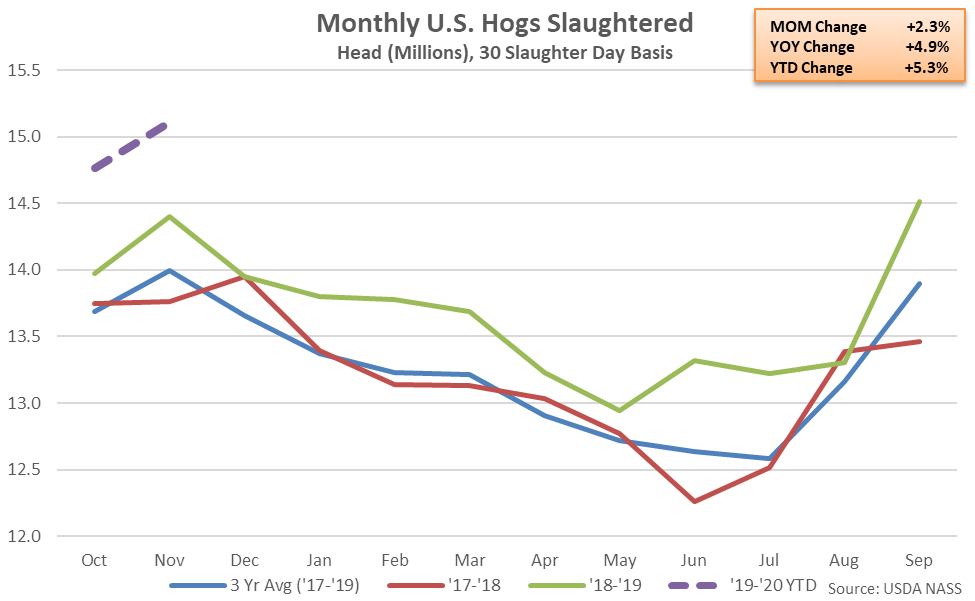

Pork – Production Reaches a Record High Monthly Level, Finishes up 5.7% YOY

Pork – Production Reaches a Record High Monthly Level, Finishes up 5.7% YOY

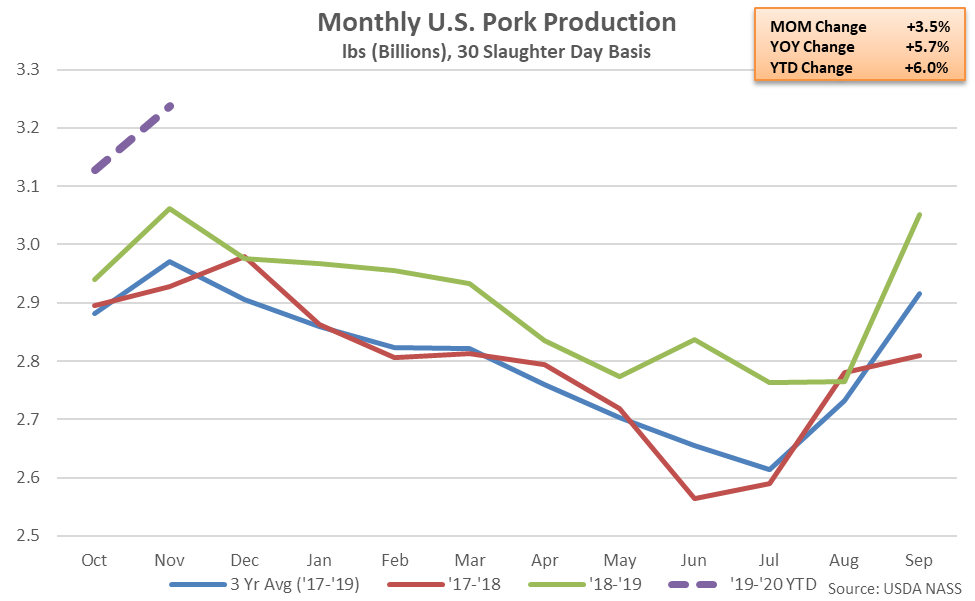

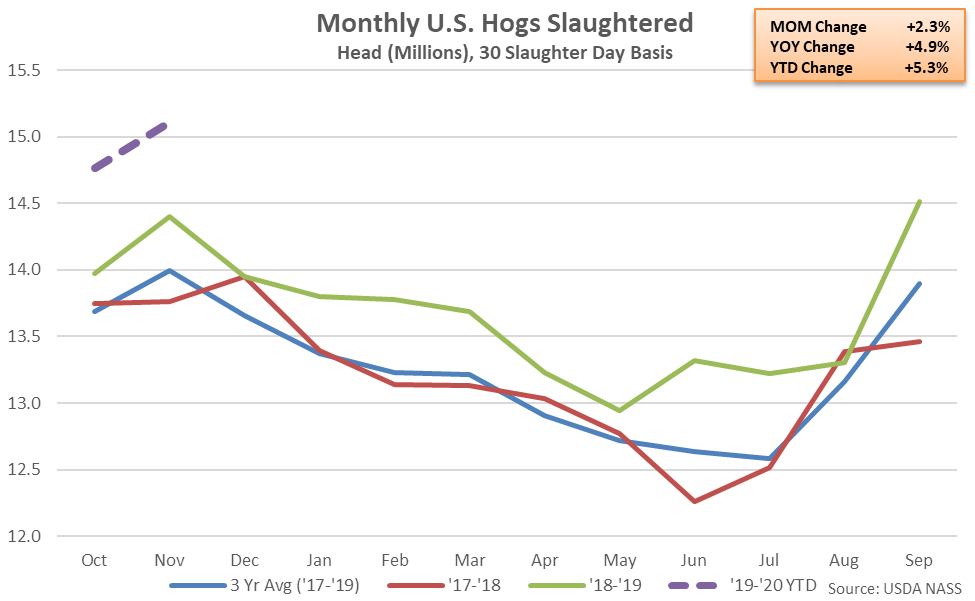

Nov ’19 U.S. pork production increased 3.5% MOM and 5.7% YOY when normalizing for slaughter days, reaching a record high monthly level for the second consecutive month. The YOY increase in pork production was the tenth experienced throughout the past 11 months. The Nov ’19 total number of hogs slaughtered increased 4.9% YOY throughout the month while average weights/head finished 1.1% higher YOY. The MOM increase in pork production of 3.5% was slightly smaller than the ten year average October – November seasonal build of 3.9%. ’18-’19 annual pork production increased 3.9% YOY, finishing at a record high level.

Nov ’19 U.S. pork production increased 3.5% MOM and 5.7% YOY when normalizing for slaughter days, reaching a record high monthly level for the second consecutive month. The YOY increase in pork production was the tenth experienced throughout the past 11 months. The Nov ’19 total number of hogs slaughtered increased 4.9% YOY throughout the month while average weights/head finished 1.1% higher YOY. The MOM increase in pork production of 3.5% was slightly smaller than the ten year average October – November seasonal build of 3.9%. ’18-’19 annual pork production increased 3.9% YOY, finishing at a record high level.

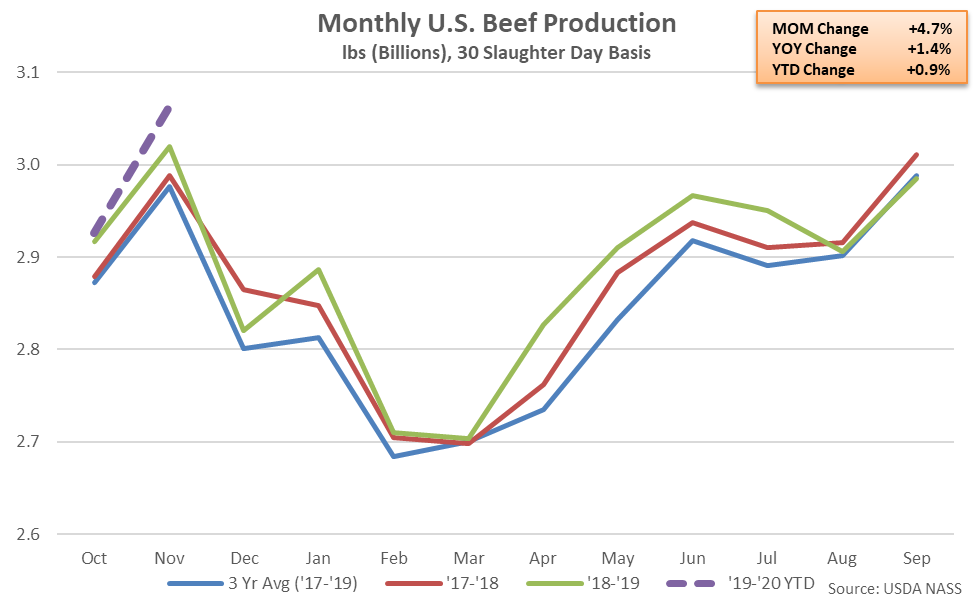

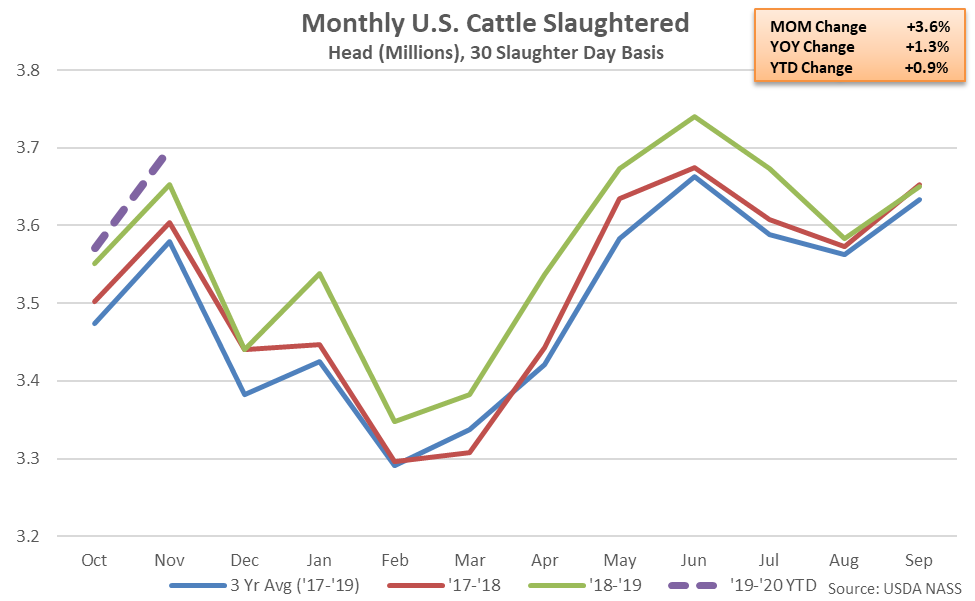

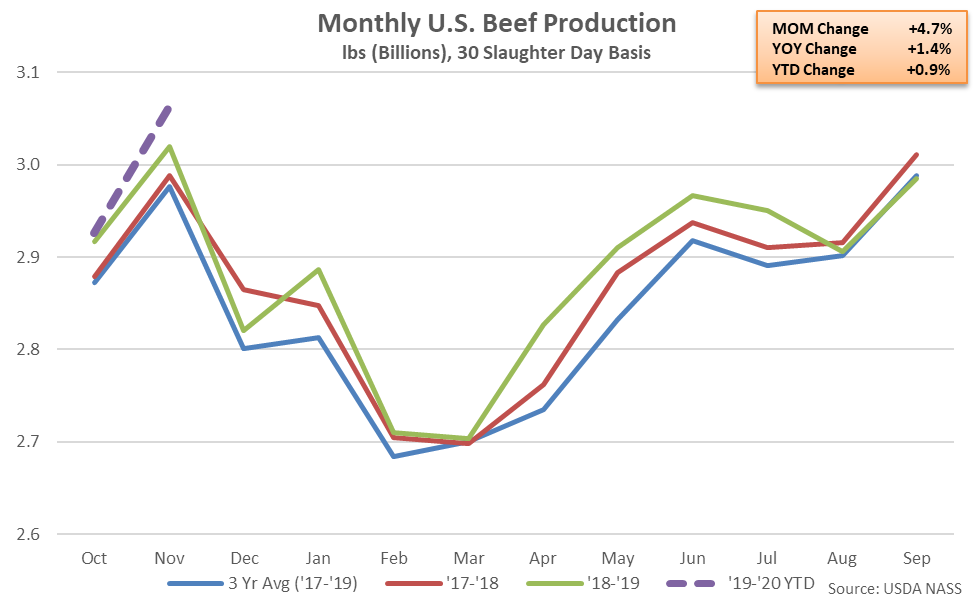

Beef – Production Reaches a Record High Seasonal Level, Finishes up 1.4% YOY

Beef – Production Reaches a Record High Seasonal Level, Finishes up 1.4% YOY

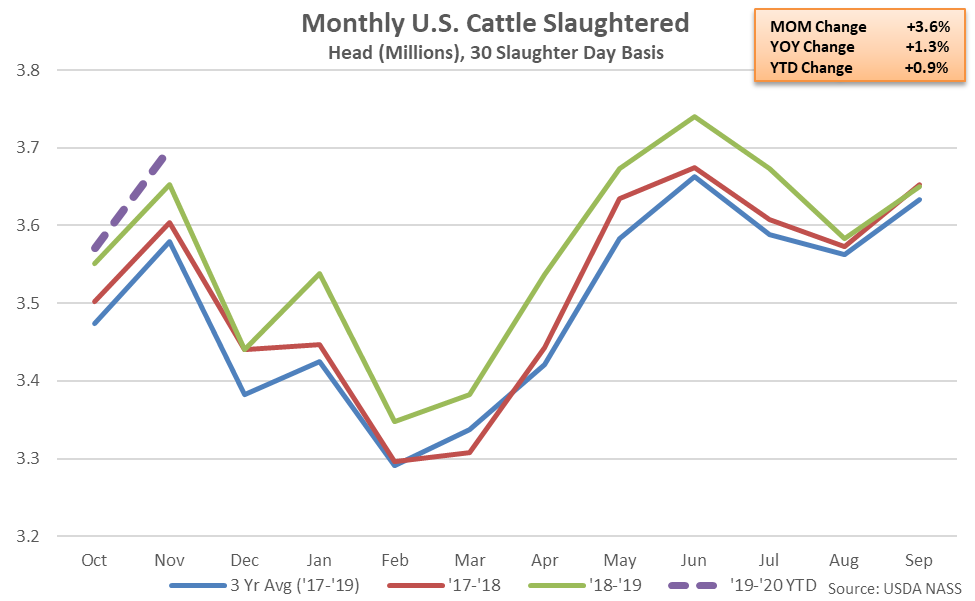

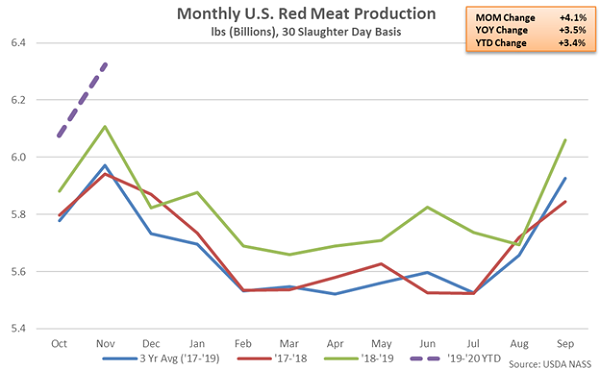

Nov ’19 U.S. beef production increased 4.7% MOM and 1.4% YOY when normalizing for slaughter days, reaching a record high seasonal level and the second highest monthly figure on record. The Nov ’19 total number of cattle slaughtered increased 1.3% YOY throughout the month while average weights/head finished 0.4% higher YOY. The MOM increase in beef production of 4.7% was significantly greater than the ten year average October – November seasonal build of 1.2%. ’18-’19 annual beef production increased 0.6% YOY, finishing at a 16 year high level.

Nov ’19 U.S. beef production increased 4.7% MOM and 1.4% YOY when normalizing for slaughter days, reaching a record high seasonal level and the second highest monthly figure on record. The Nov ’19 total number of cattle slaughtered increased 1.3% YOY throughout the month while average weights/head finished 0.4% higher YOY. The MOM increase in beef production of 4.7% was significantly greater than the ten year average October – November seasonal build of 1.2%. ’18-’19 annual beef production increased 0.6% YOY, finishing at a 16 year high level.

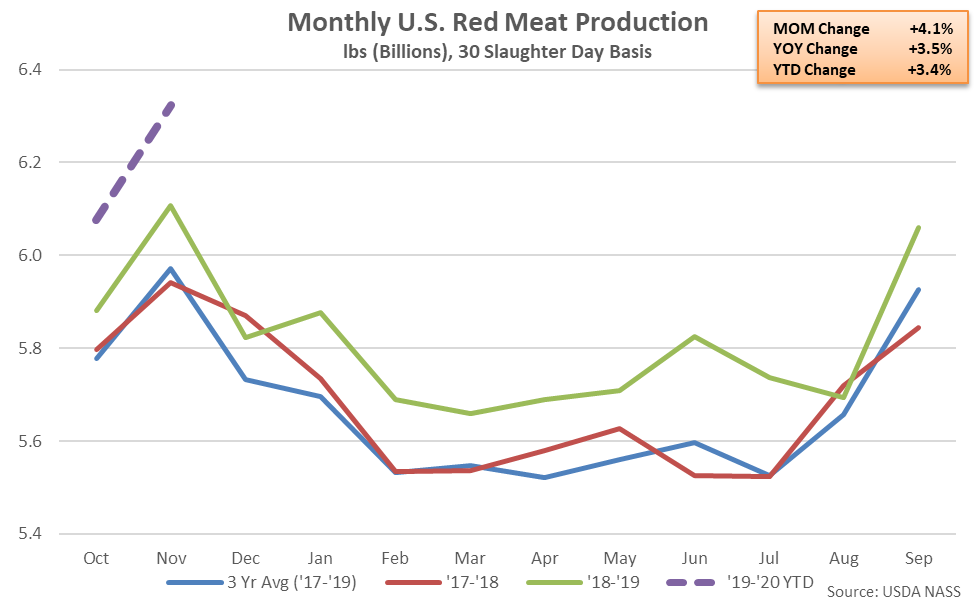

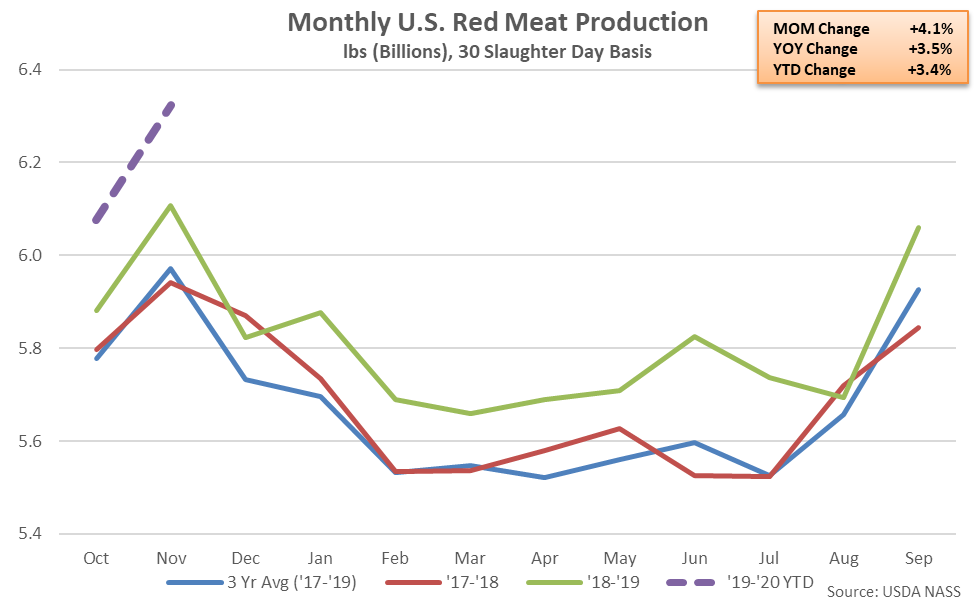

- Nov ’19 U.S. commercial red meat production increased 3.5% on a YOY basis, reaching a record high monthly level. The YOY increase in total red meat production was the tenth experienced throughout the past 11 months.

- Nov ’19 U.S. pork production increased 5.7% on a YOY basis, reaching a record high monthly level for the second consecutive month. The total number of hogs slaughtered increased 4.9% YOY throughout the month while average weights/head finished 1.1% higher.

- Nov ’19 U.S. beef production increased 1.4% on a YOY basis, reaching a record high seasonal high level. The total number of cattle slaughtered increased 1.3% YOY throughout the month while average weights/head finished 0.4% higher.

Total 12-month rolling average red meat production finished above trendline for the 27th consecutive month throughout Nov ’19. The Nov ’19 deviation from trendline increased to an 11 year high level.

Total 12-month rolling average red meat production finished above trendline for the 27th consecutive month throughout Nov ’19. The Nov ’19 deviation from trendline increased to an 11 year high level.

Pork – Production Reaches a Record High Monthly Level, Finishes up 5.7% YOY

Pork – Production Reaches a Record High Monthly Level, Finishes up 5.7% YOY

Nov ’19 U.S. pork production increased 3.5% MOM and 5.7% YOY when normalizing for slaughter days, reaching a record high monthly level for the second consecutive month. The YOY increase in pork production was the tenth experienced throughout the past 11 months. The Nov ’19 total number of hogs slaughtered increased 4.9% YOY throughout the month while average weights/head finished 1.1% higher YOY. The MOM increase in pork production of 3.5% was slightly smaller than the ten year average October – November seasonal build of 3.9%. ’18-’19 annual pork production increased 3.9% YOY, finishing at a record high level.

Nov ’19 U.S. pork production increased 3.5% MOM and 5.7% YOY when normalizing for slaughter days, reaching a record high monthly level for the second consecutive month. The YOY increase in pork production was the tenth experienced throughout the past 11 months. The Nov ’19 total number of hogs slaughtered increased 4.9% YOY throughout the month while average weights/head finished 1.1% higher YOY. The MOM increase in pork production of 3.5% was slightly smaller than the ten year average October – November seasonal build of 3.9%. ’18-’19 annual pork production increased 3.9% YOY, finishing at a record high level.

Beef – Production Reaches a Record High Seasonal Level, Finishes up 1.4% YOY

Beef – Production Reaches a Record High Seasonal Level, Finishes up 1.4% YOY

Nov ’19 U.S. beef production increased 4.7% MOM and 1.4% YOY when normalizing for slaughter days, reaching a record high seasonal level and the second highest monthly figure on record. The Nov ’19 total number of cattle slaughtered increased 1.3% YOY throughout the month while average weights/head finished 0.4% higher YOY. The MOM increase in beef production of 4.7% was significantly greater than the ten year average October – November seasonal build of 1.2%. ’18-’19 annual beef production increased 0.6% YOY, finishing at a 16 year high level.

Nov ’19 U.S. beef production increased 4.7% MOM and 1.4% YOY when normalizing for slaughter days, reaching a record high seasonal level and the second highest monthly figure on record. The Nov ’19 total number of cattle slaughtered increased 1.3% YOY throughout the month while average weights/head finished 0.4% higher YOY. The MOM increase in beef production of 4.7% was significantly greater than the ten year average October – November seasonal build of 1.2%. ’18-’19 annual beef production increased 0.6% YOY, finishing at a 16 year high level.