U.S. Livestock Cold Storage Update – Dec ’19

Executive Summary

U.S. cold storage figures provided by USDA were recently updated with values spanning through Nov ’19. Highlights from the updated report include:

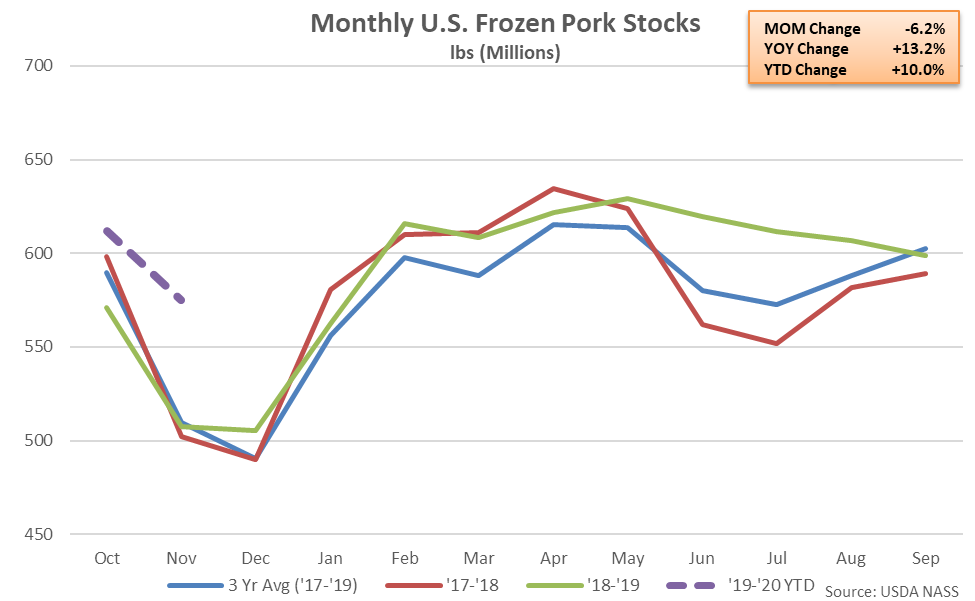

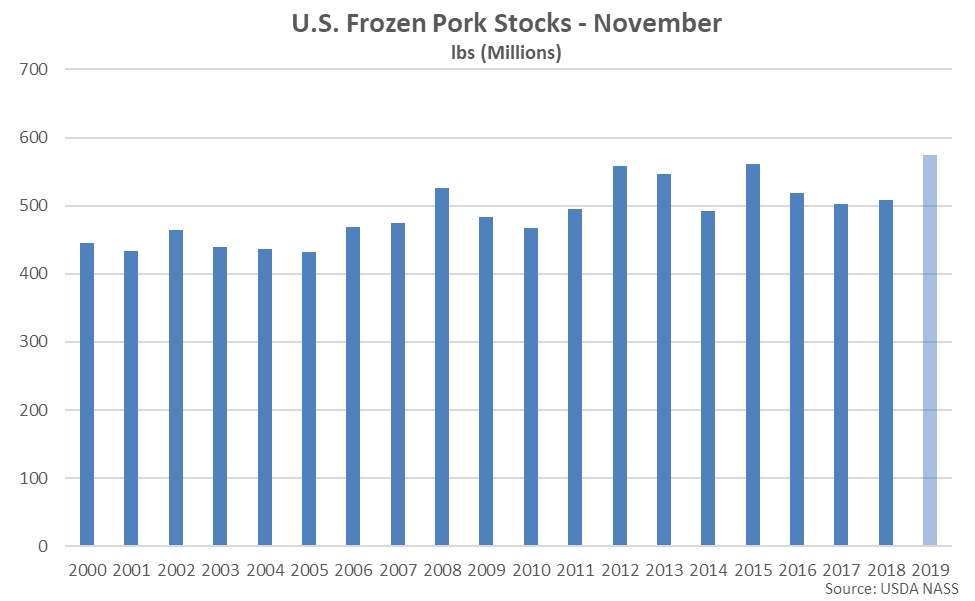

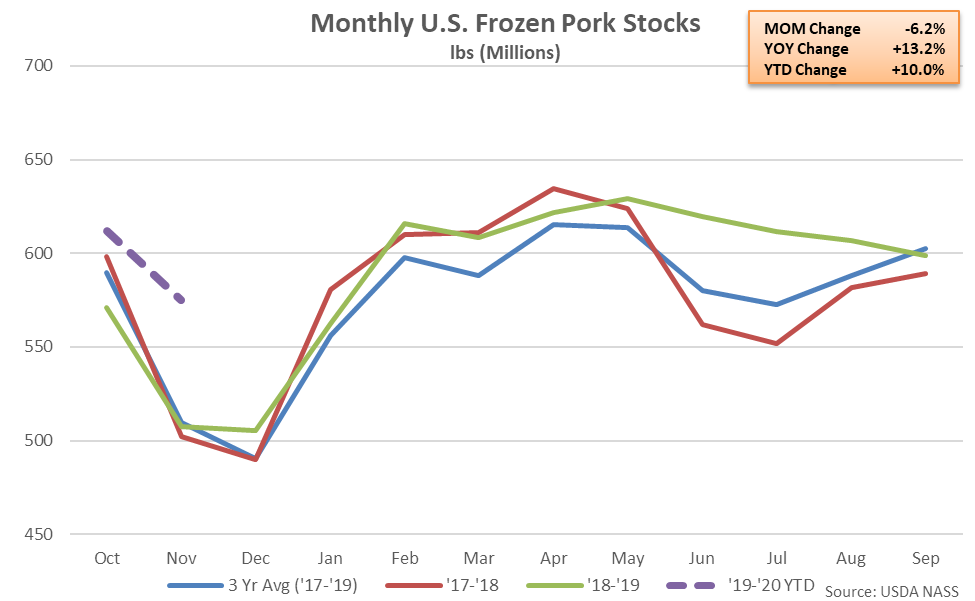

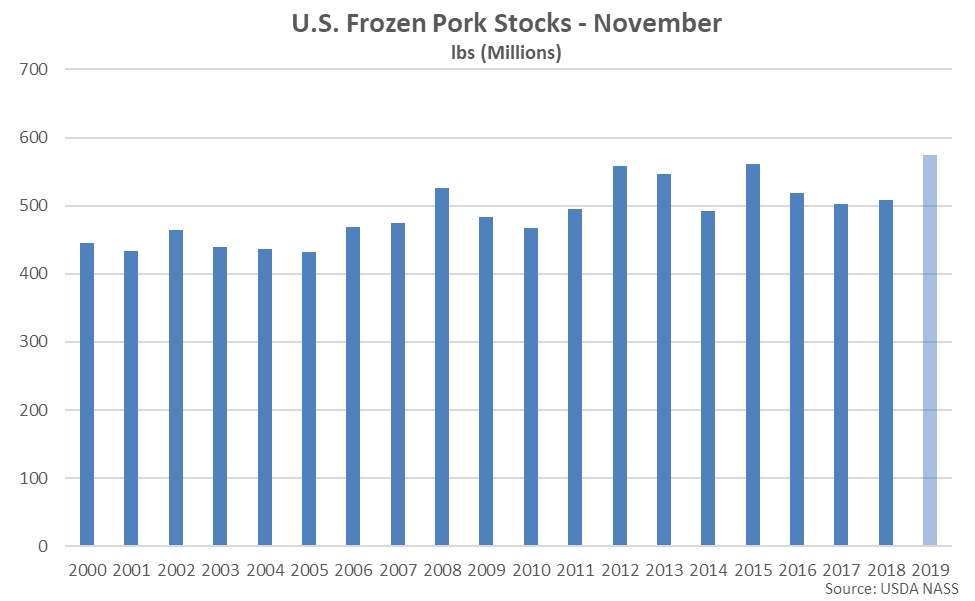

According to USDA, Nov ’19 U.S. frozen pork stocks declined seasonally to a ten month low level but remained 13.2% higher on a YOY basis, reaching a record high seasonal level. The YOY increase in pork stocks was the largest experienced throughout the past four years on a percentage basis. Pork stocks have finished higher on a YOY basis over seven consecutive months through November. The MOM decline in pork stocks of 37.1 million pounds, or 6.1%, was slightly smaller than the ten year average October – November seasonal decline in stocks of 42.7 million pounds, or 7.4%. The October – November decline in pork stocks was the smallest experienced throughout the past six years.

According to USDA, Nov ’19 U.S. frozen pork stocks declined seasonally to a ten month low level but remained 13.2% higher on a YOY basis, reaching a record high seasonal level. The YOY increase in pork stocks was the largest experienced throughout the past four years on a percentage basis. Pork stocks have finished higher on a YOY basis over seven consecutive months through November. The MOM decline in pork stocks of 37.1 million pounds, or 6.1%, was slightly smaller than the ten year average October – November seasonal decline in stocks of 42.7 million pounds, or 7.4%. The October – November decline in pork stocks was the smallest experienced throughout the past six years.

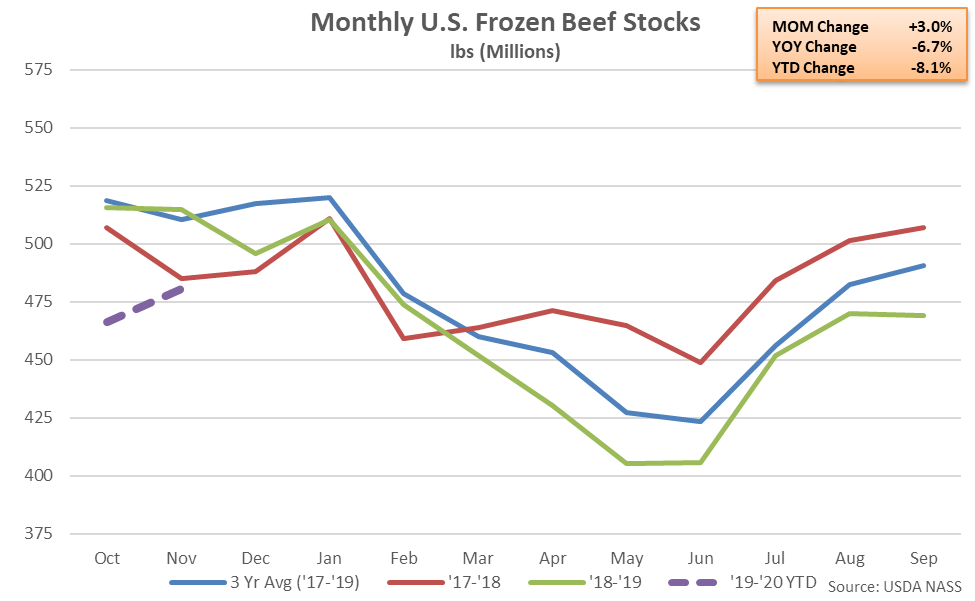

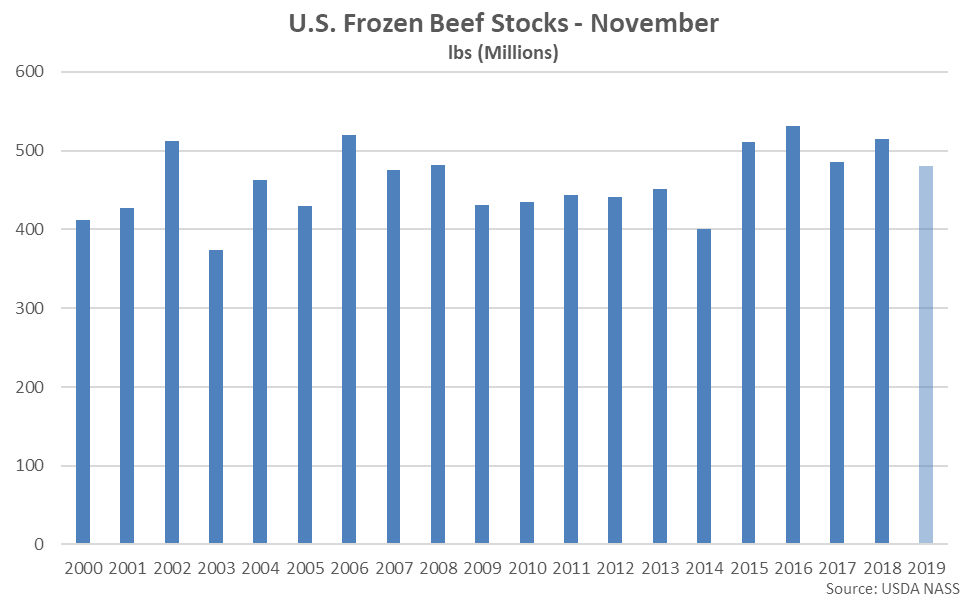

Beef – Stocks Remain Lower on a YOY Basis for the Ninth Consecutive Month, Finish Down 6.7%

Beef – Stocks Remain Lower on a YOY Basis for the Ninth Consecutive Month, Finish Down 6.7%

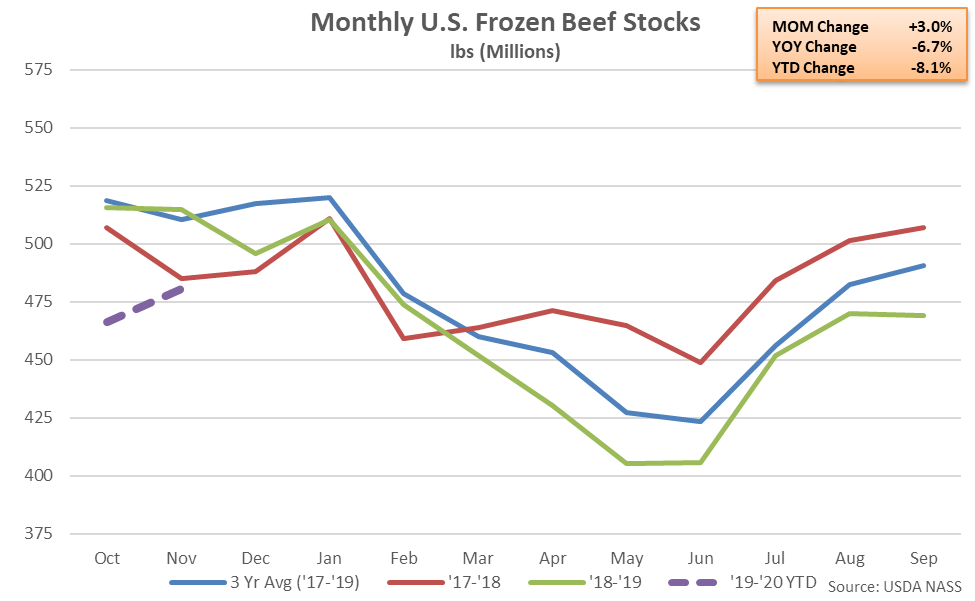

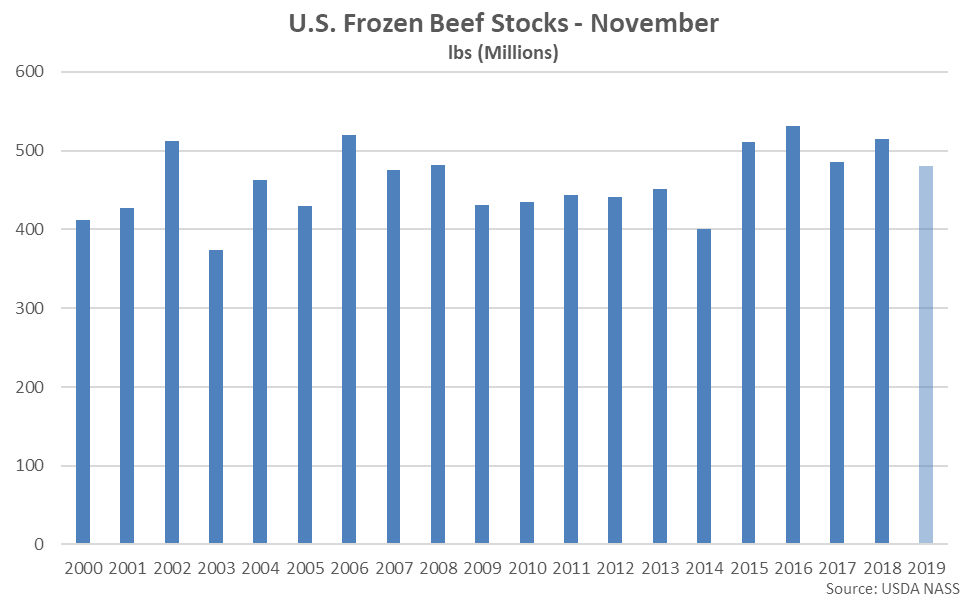

Nov ’19 U.S. frozen beef stocks increased to a ten month high level but remained 6.7% lower on a YOY basis, finishing at a five year low seasonal level. The YOY decline in beef stocks was the ninth experienced in a row. The MOM increase in beef stocks of 14.1 million pounds, or 3.0%, was larger than the ten year average October – November seasonal build in stocks of 6.9 million pounds, or 1.8%. The October – November increase in beef stocks was the largest experienced throughout the past five years.

Nov ’19 U.S. frozen beef stocks increased to a ten month high level but remained 6.7% lower on a YOY basis, finishing at a five year low seasonal level. The YOY decline in beef stocks was the ninth experienced in a row. The MOM increase in beef stocks of 14.1 million pounds, or 3.0%, was larger than the ten year average October – November seasonal build in stocks of 6.9 million pounds, or 1.8%. The October – November increase in beef stocks was the largest experienced throughout the past five years.

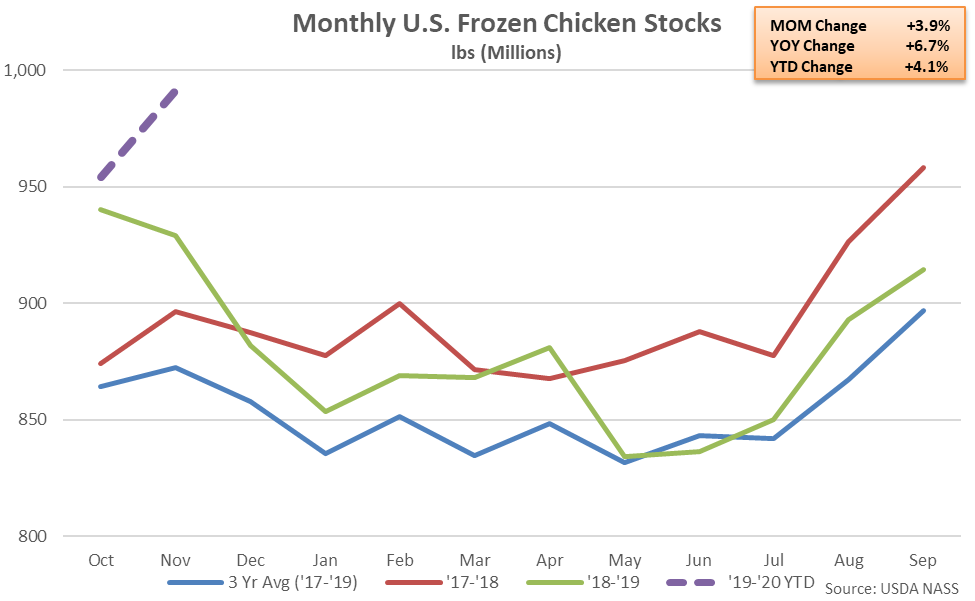

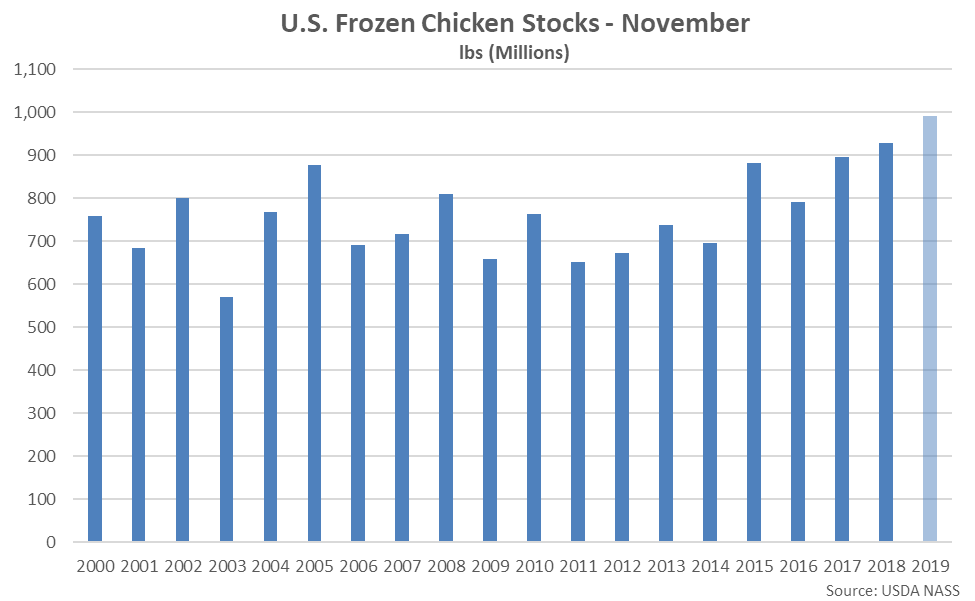

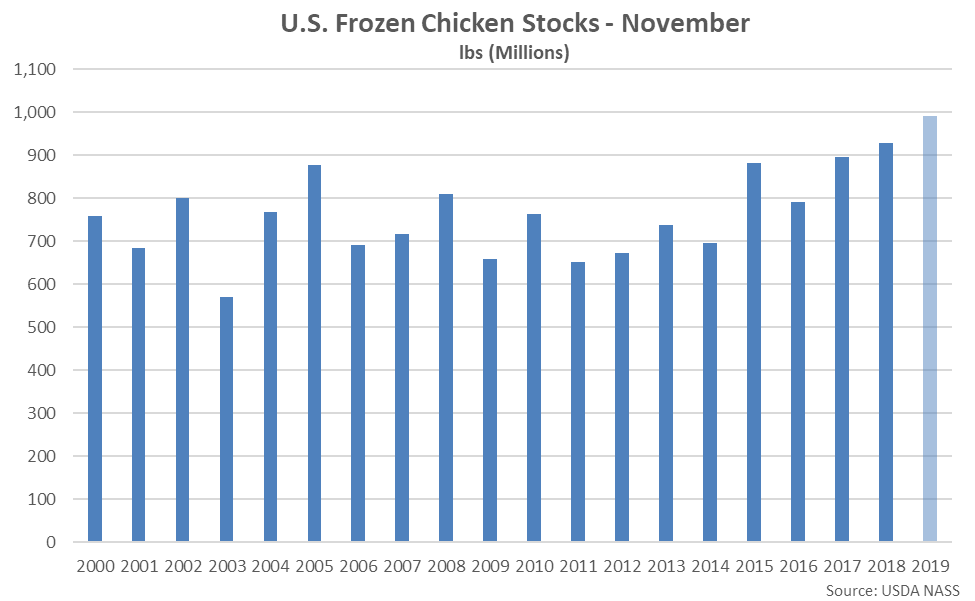

Chicken – Stocks Reach a Record High Monthly Storage Level, Finish up 6.7% YOY

Chicken – Stocks Reach a Record High Monthly Storage Level, Finish up 6.7% YOY

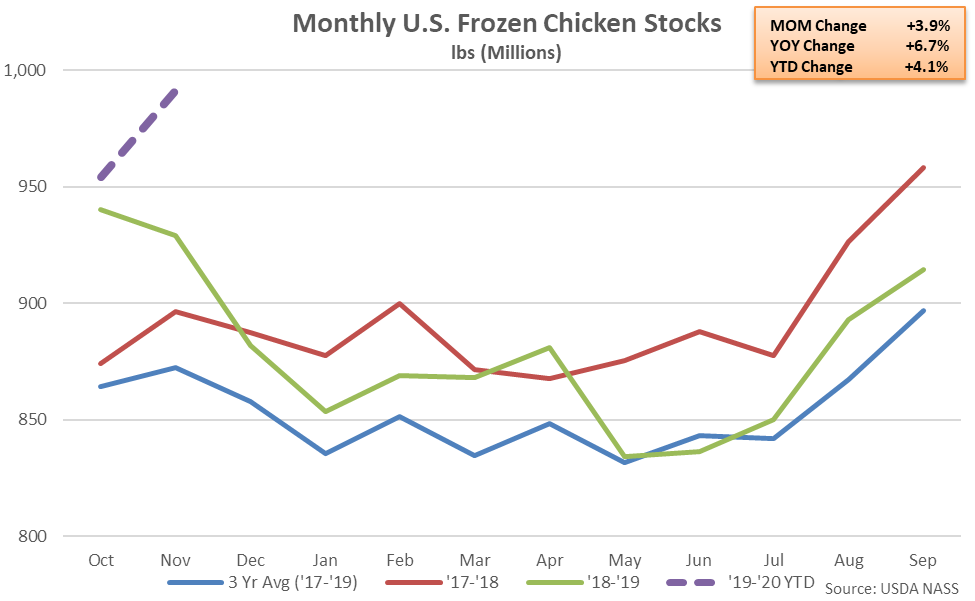

Nov ’19 U.S. frozen chicken stocks increased 3.9% MOM to a record high monthly storage level, finishing 6.7% higher on a YOY basis. The YOY increase in chicken stocks was the second experienced in a row and the largest experienced throughout the past 13 months on a percentage basis. The MOM increase in chicken stocks of 37.2 million pounds, or 3.9%, was larger than the ten year average October – November seasonal build in stocks of 13.0 million pounds, or 1.8%.

Nov ’19 U.S. frozen chicken stocks increased 3.9% MOM to a record high monthly storage level, finishing 6.7% higher on a YOY basis. The YOY increase in chicken stocks was the second experienced in a row and the largest experienced throughout the past 13 months on a percentage basis. The MOM increase in chicken stocks of 37.2 million pounds, or 3.9%, was larger than the ten year average October – November seasonal build in stocks of 13.0 million pounds, or 1.8%.

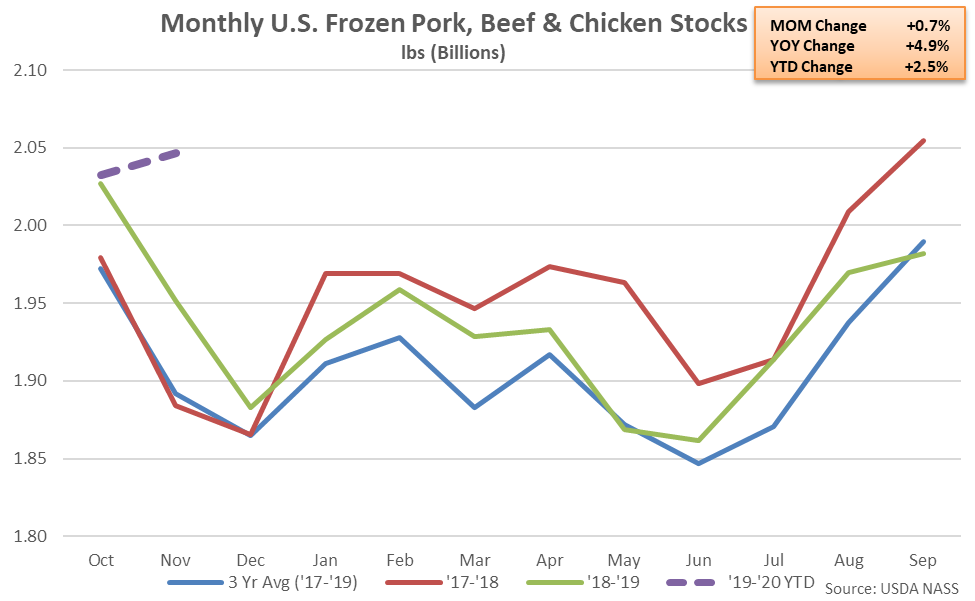

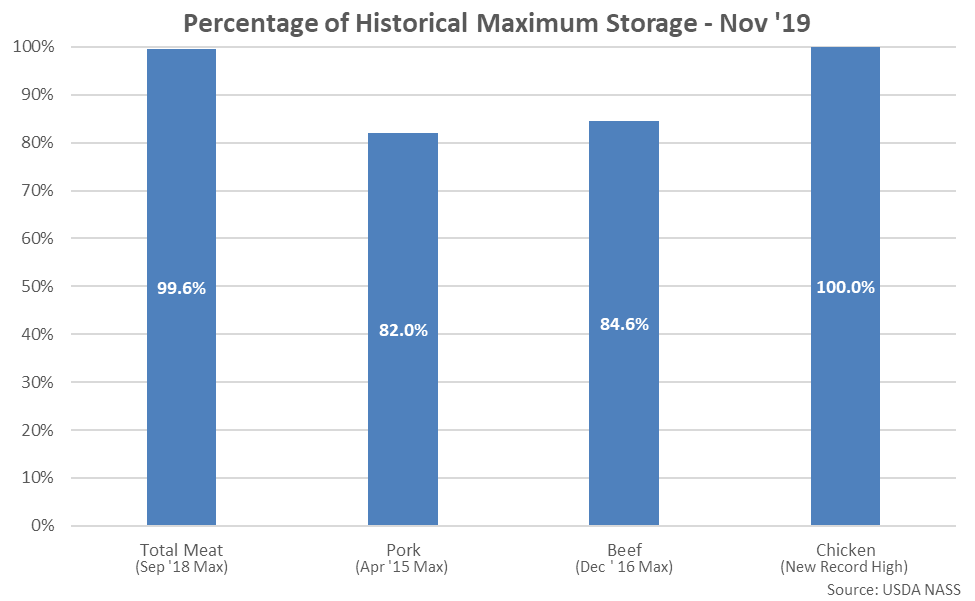

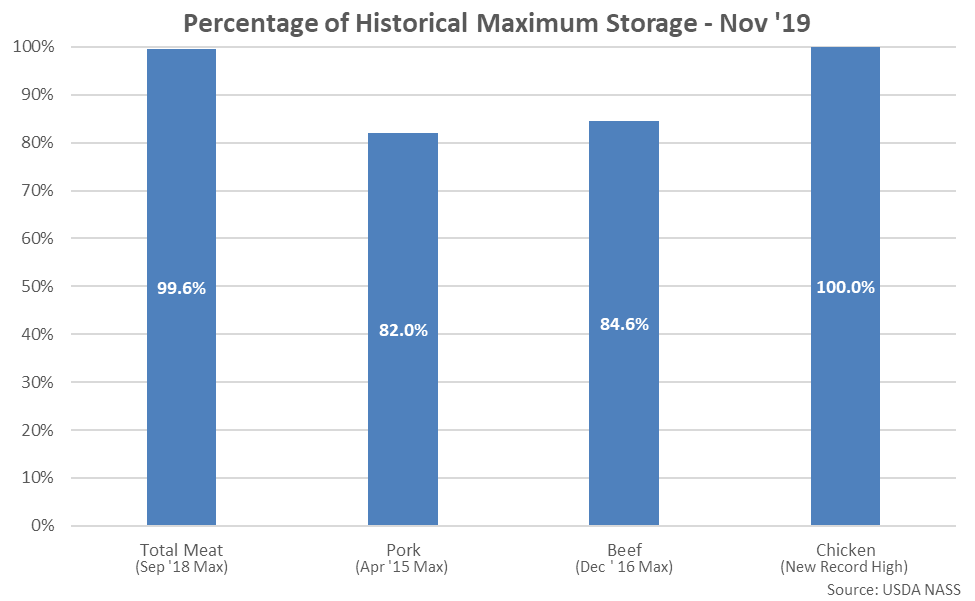

Overall, Nov ’19 combined U.S. pork, beef and chicken stocks finished just 0.4% below the Sep ’18 record high level. Individually, Nov ’19 chicken stocks reached a record high monthly storage level while beef and pork stocks finished within 16% and 18% of historical maximum storage levels, respectively.

Overall, Nov ’19 combined U.S. pork, beef and chicken stocks finished just 0.4% below the Sep ’18 record high level. Individually, Nov ’19 chicken stocks reached a record high monthly storage level while beef and pork stocks finished within 16% and 18% of historical maximum storage levels, respectively.

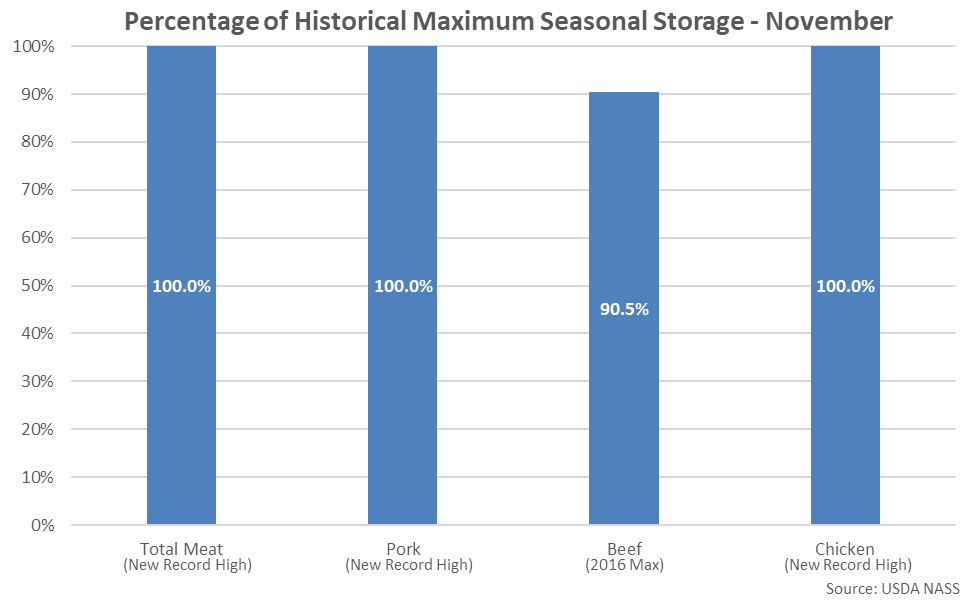

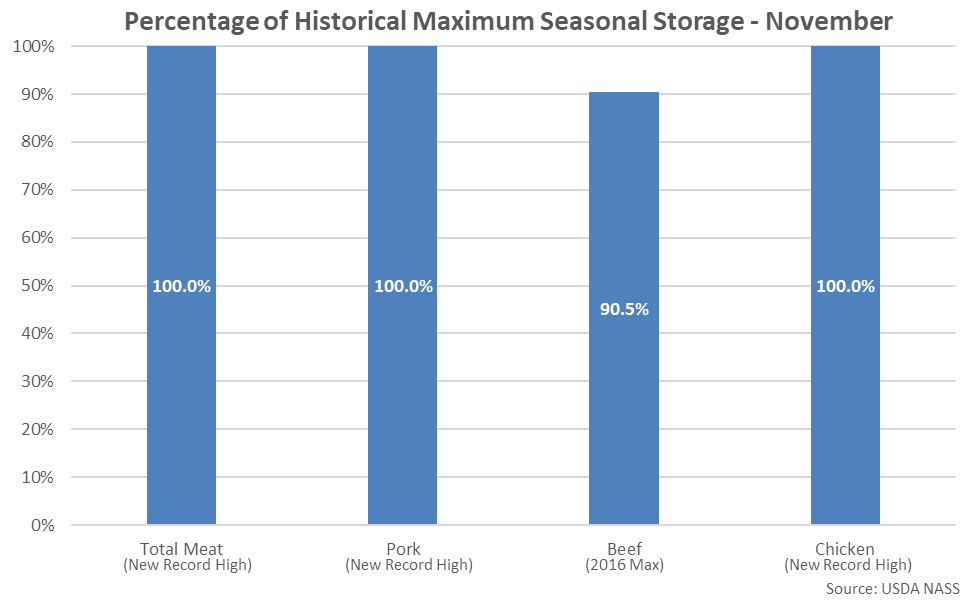

Nov ’19 combined U.S. pork, beef and chicken stocks reached a record high seasonal level for the month of November. Individually, Nov ’19 pork and chicken stocks each finished at record high seasonal levels while beef stocks finished 10% below record high historical seasonal levels.

Nov ’19 combined U.S. pork, beef and chicken stocks reached a record high seasonal level for the month of November. Individually, Nov ’19 pork and chicken stocks each finished at record high seasonal levels while beef stocks finished 10% below record high historical seasonal levels.

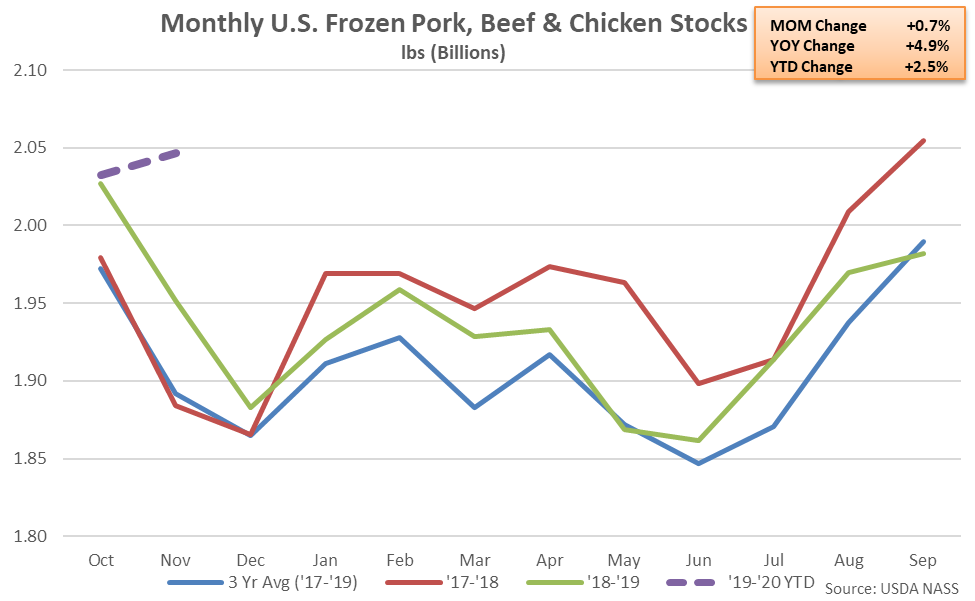

Nov ’19 combined U.S. pork, beef and chicken stocks finished 4.9% higher on a YOY basis. The Nov ’19 YOY increase in combined U.S. pork, beef and chicken stocks was the second experienced in a row and the largest experienced throughout the past 14 months.

Nov ’19 combined U.S. pork, beef and chicken stocks finished 4.9% higher on a YOY basis. The Nov ’19 YOY increase in combined U.S. pork, beef and chicken stocks was the second experienced in a row and the largest experienced throughout the past 14 months.

- Nov ’19 U.S. pork stocks declined seasonally to a ten month low level but remained 13.2% higher on a YOY basis, reaching a record high seasonal level.

- Nov ’19 U.S. beef stocks remained lower on a YOY basis for the ninth consecutive month, finishing down 6.7% and reaching a five year low seasonal level.

- Nov ’19 U.S. chicken stocks reached a record high monthly storage level, finishing 6.7% higher YOY.

According to USDA, Nov ’19 U.S. frozen pork stocks declined seasonally to a ten month low level but remained 13.2% higher on a YOY basis, reaching a record high seasonal level. The YOY increase in pork stocks was the largest experienced throughout the past four years on a percentage basis. Pork stocks have finished higher on a YOY basis over seven consecutive months through November. The MOM decline in pork stocks of 37.1 million pounds, or 6.1%, was slightly smaller than the ten year average October – November seasonal decline in stocks of 42.7 million pounds, or 7.4%. The October – November decline in pork stocks was the smallest experienced throughout the past six years.

According to USDA, Nov ’19 U.S. frozen pork stocks declined seasonally to a ten month low level but remained 13.2% higher on a YOY basis, reaching a record high seasonal level. The YOY increase in pork stocks was the largest experienced throughout the past four years on a percentage basis. Pork stocks have finished higher on a YOY basis over seven consecutive months through November. The MOM decline in pork stocks of 37.1 million pounds, or 6.1%, was slightly smaller than the ten year average October – November seasonal decline in stocks of 42.7 million pounds, or 7.4%. The October – November decline in pork stocks was the smallest experienced throughout the past six years.

Beef – Stocks Remain Lower on a YOY Basis for the Ninth Consecutive Month, Finish Down 6.7%

Beef – Stocks Remain Lower on a YOY Basis for the Ninth Consecutive Month, Finish Down 6.7%

Nov ’19 U.S. frozen beef stocks increased to a ten month high level but remained 6.7% lower on a YOY basis, finishing at a five year low seasonal level. The YOY decline in beef stocks was the ninth experienced in a row. The MOM increase in beef stocks of 14.1 million pounds, or 3.0%, was larger than the ten year average October – November seasonal build in stocks of 6.9 million pounds, or 1.8%. The October – November increase in beef stocks was the largest experienced throughout the past five years.

Nov ’19 U.S. frozen beef stocks increased to a ten month high level but remained 6.7% lower on a YOY basis, finishing at a five year low seasonal level. The YOY decline in beef stocks was the ninth experienced in a row. The MOM increase in beef stocks of 14.1 million pounds, or 3.0%, was larger than the ten year average October – November seasonal build in stocks of 6.9 million pounds, or 1.8%. The October – November increase in beef stocks was the largest experienced throughout the past five years.

Chicken – Stocks Reach a Record High Monthly Storage Level, Finish up 6.7% YOY

Chicken – Stocks Reach a Record High Monthly Storage Level, Finish up 6.7% YOY

Nov ’19 U.S. frozen chicken stocks increased 3.9% MOM to a record high monthly storage level, finishing 6.7% higher on a YOY basis. The YOY increase in chicken stocks was the second experienced in a row and the largest experienced throughout the past 13 months on a percentage basis. The MOM increase in chicken stocks of 37.2 million pounds, or 3.9%, was larger than the ten year average October – November seasonal build in stocks of 13.0 million pounds, or 1.8%.

Nov ’19 U.S. frozen chicken stocks increased 3.9% MOM to a record high monthly storage level, finishing 6.7% higher on a YOY basis. The YOY increase in chicken stocks was the second experienced in a row and the largest experienced throughout the past 13 months on a percentage basis. The MOM increase in chicken stocks of 37.2 million pounds, or 3.9%, was larger than the ten year average October – November seasonal build in stocks of 13.0 million pounds, or 1.8%.

Overall, Nov ’19 combined U.S. pork, beef and chicken stocks finished just 0.4% below the Sep ’18 record high level. Individually, Nov ’19 chicken stocks reached a record high monthly storage level while beef and pork stocks finished within 16% and 18% of historical maximum storage levels, respectively.

Overall, Nov ’19 combined U.S. pork, beef and chicken stocks finished just 0.4% below the Sep ’18 record high level. Individually, Nov ’19 chicken stocks reached a record high monthly storage level while beef and pork stocks finished within 16% and 18% of historical maximum storage levels, respectively.

Nov ’19 combined U.S. pork, beef and chicken stocks reached a record high seasonal level for the month of November. Individually, Nov ’19 pork and chicken stocks each finished at record high seasonal levels while beef stocks finished 10% below record high historical seasonal levels.

Nov ’19 combined U.S. pork, beef and chicken stocks reached a record high seasonal level for the month of November. Individually, Nov ’19 pork and chicken stocks each finished at record high seasonal levels while beef stocks finished 10% below record high historical seasonal levels.

Nov ’19 combined U.S. pork, beef and chicken stocks finished 4.9% higher on a YOY basis. The Nov ’19 YOY increase in combined U.S. pork, beef and chicken stocks was the second experienced in a row and the largest experienced throughout the past 14 months.

Nov ’19 combined U.S. pork, beef and chicken stocks finished 4.9% higher on a YOY basis. The Nov ’19 YOY increase in combined U.S. pork, beef and chicken stocks was the second experienced in a row and the largest experienced throughout the past 14 months.