Soybean Complex Crushing & Stocks Update – Feb ’20

Executive Summary

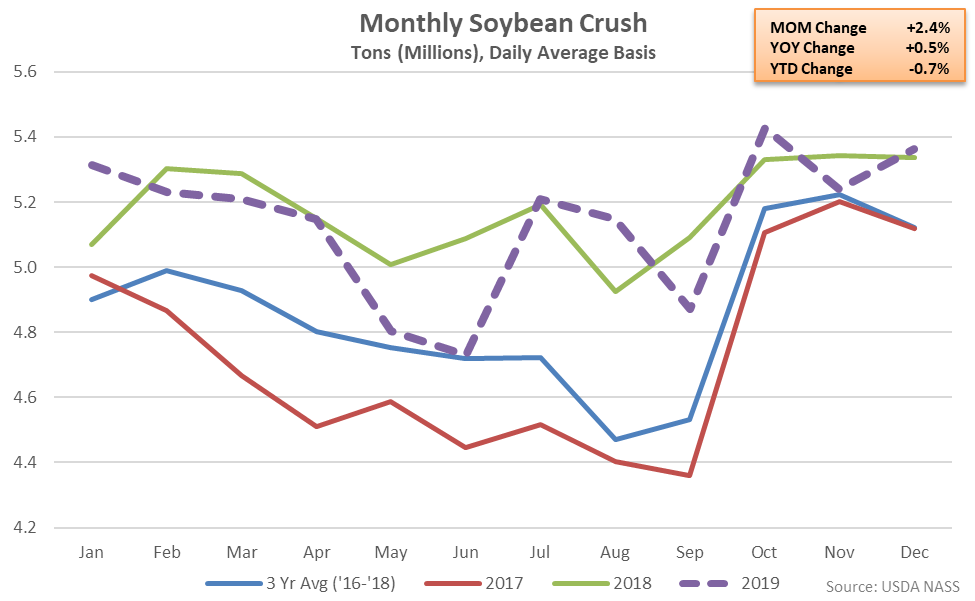

U.S. soybean crush and stocks figures provided by USDA were recently updated with values spanning through Dec ’19. Highlights from the updated report include:

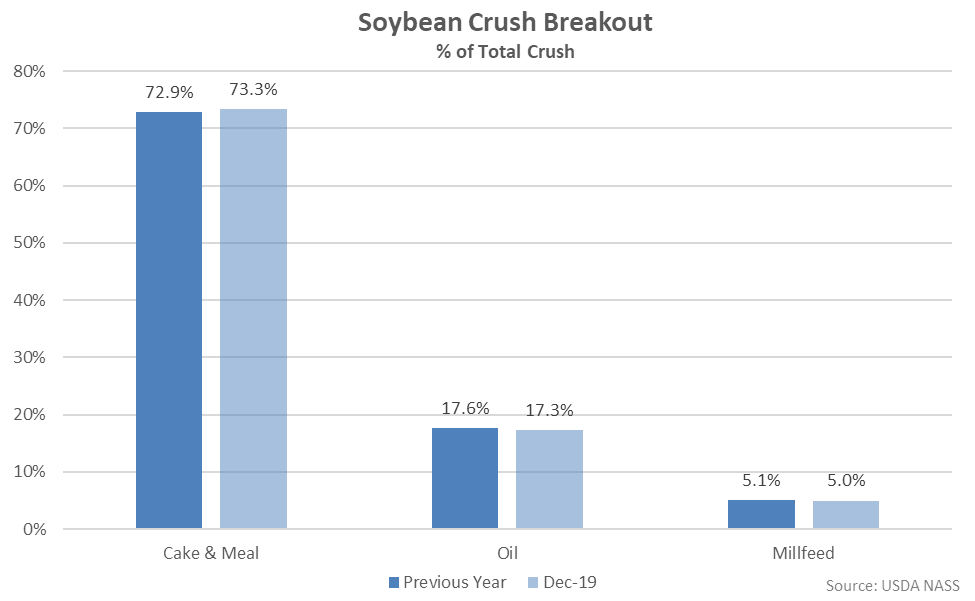

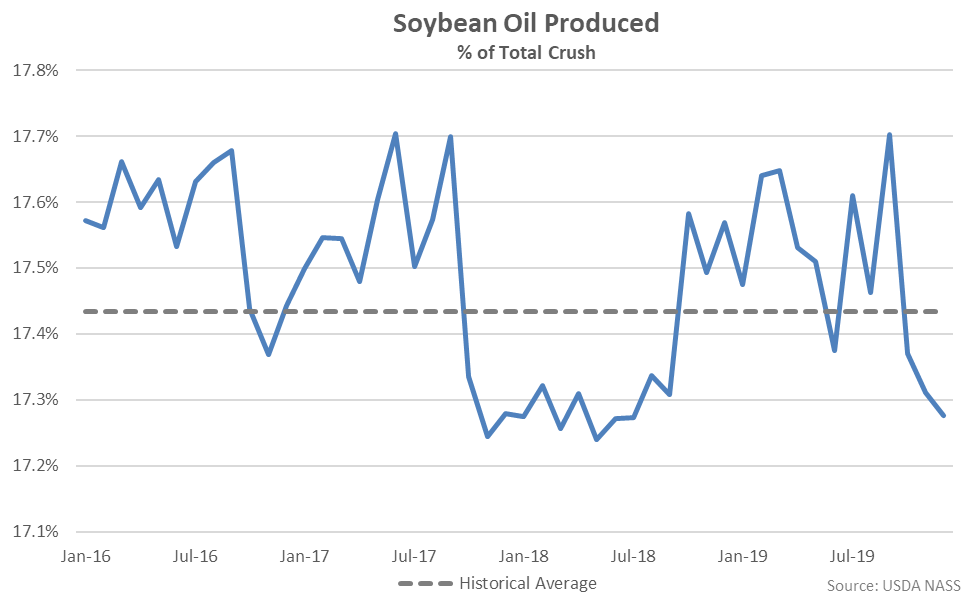

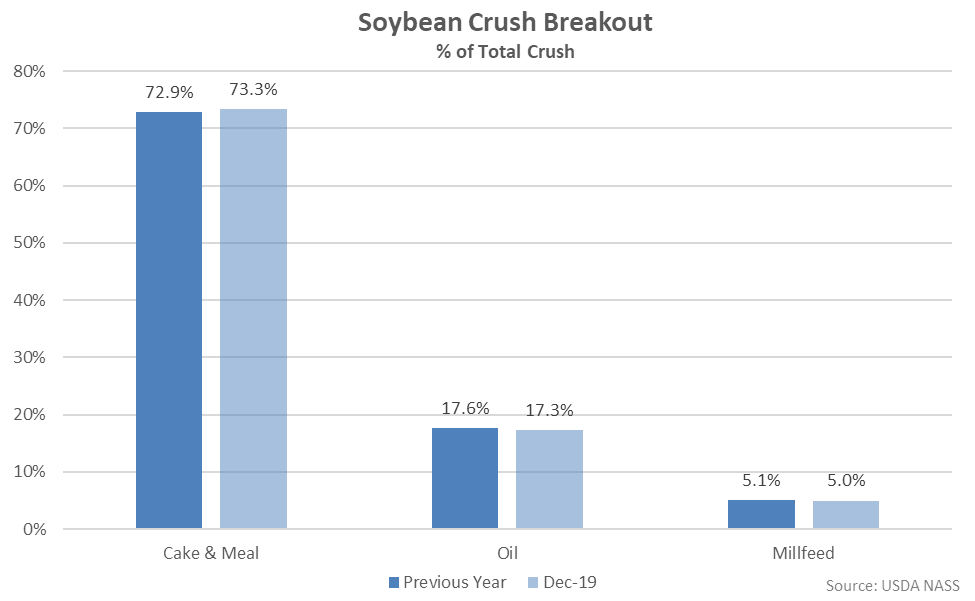

Cake & meal accounted for 73.3% of the total soybean crush throughout Dec ’19, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.3% of the total soybean crush throughout Dec ’19, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

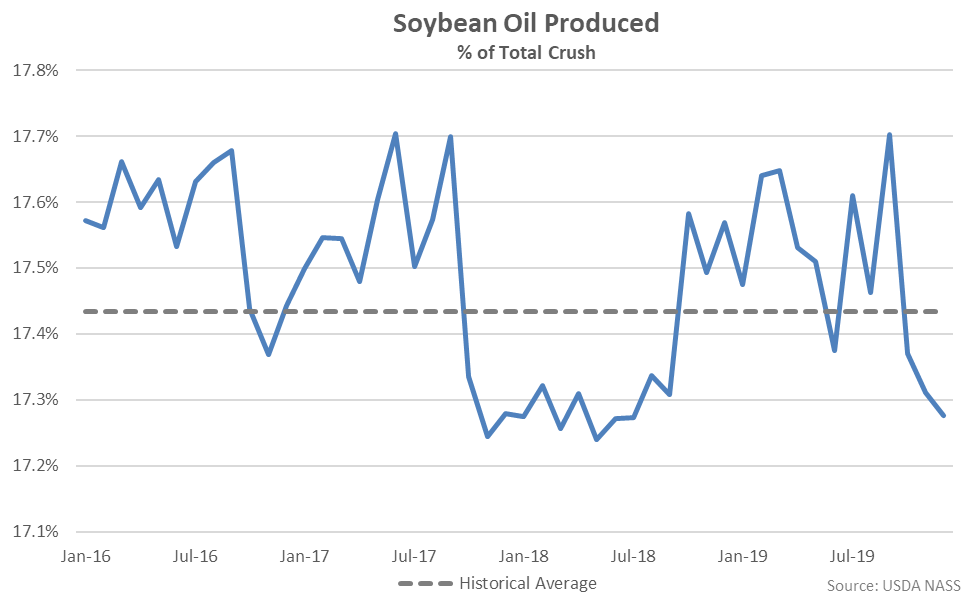

Dec ’19 soybean oil produced as a percentage of total crush declined to a 17 month low level, finishing below historical average figures for the third consecutive month.

Dec ’19 soybean oil produced as a percentage of total crush declined to a 17 month low level, finishing below historical average figures for the third consecutive month.

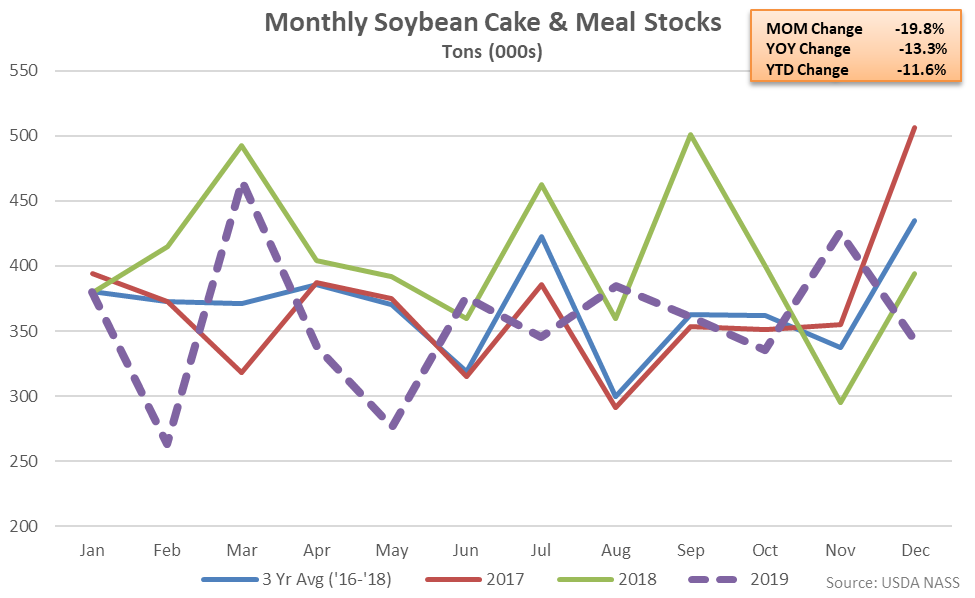

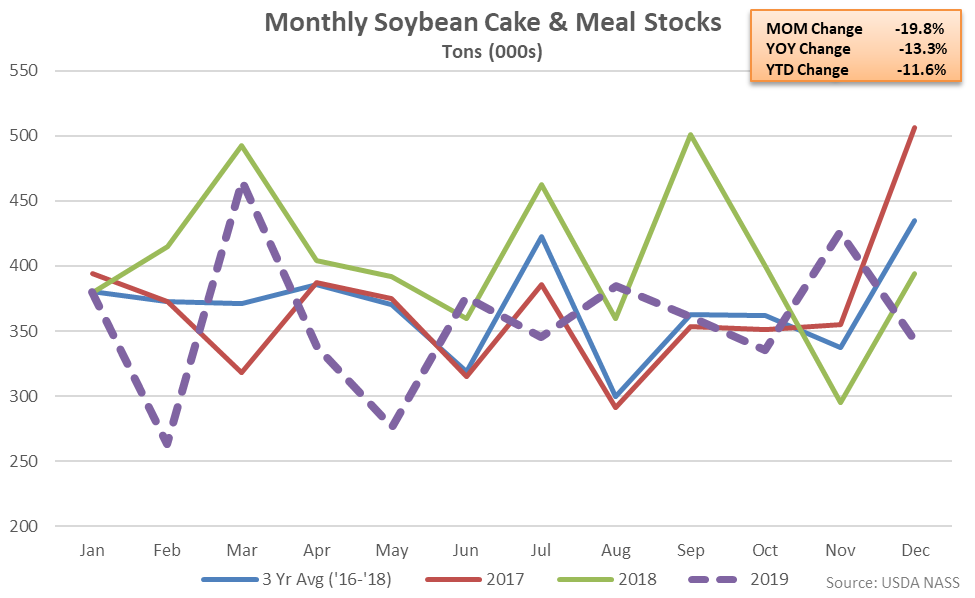

Soybean Cake & Meal Stocks – Stocks Finish 13.3% Lower YOY, Reach a Four Year Seasonal Low Level

Dec ’19 U.S. soybean cake & meal stocks declined 19.8% MOM and 13.3% YOY, finishing lower on a YOY basis for the third time in the past four months and reaching a four year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 19.8% was a contraseasonal move when compared to the three year November – December seasonal average increase in stocks of 29.3%. Dec ’19 soybean cake & meal stocks finished 21.3% below three year average seasonal levels.

Soybean Cake & Meal Stocks – Stocks Finish 13.3% Lower YOY, Reach a Four Year Seasonal Low Level

Dec ’19 U.S. soybean cake & meal stocks declined 19.8% MOM and 13.3% YOY, finishing lower on a YOY basis for the third time in the past four months and reaching a four year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 19.8% was a contraseasonal move when compared to the three year November – December seasonal average increase in stocks of 29.3%. Dec ’19 soybean cake & meal stocks finished 21.3% below three year average seasonal levels.

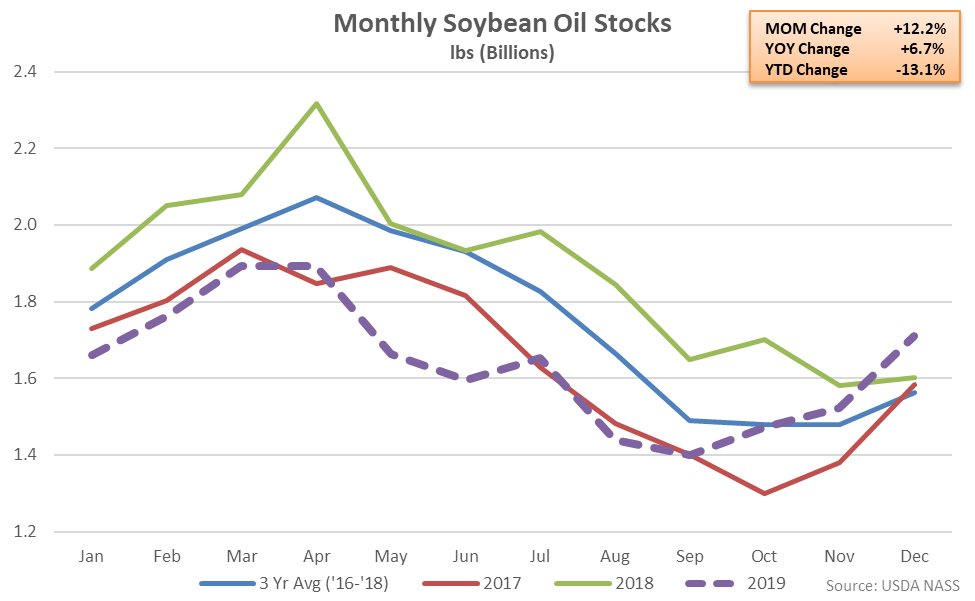

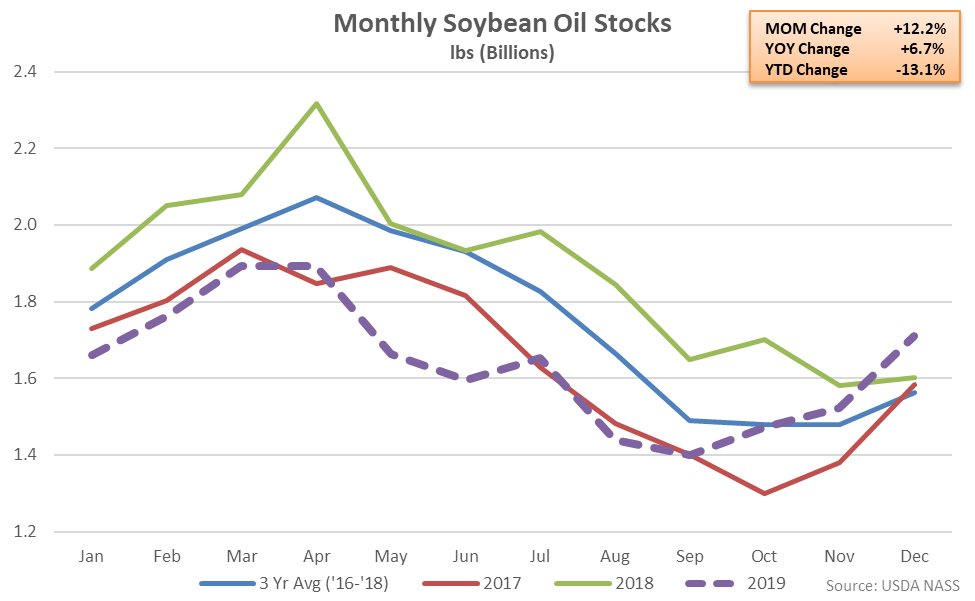

Soybean Oil Stocks – Stocks Finish 6.7% Higher YOY, Reach a Five Year Seasonal High Level

Dec ’19 U.S. soybean oil stocks increased 12.2% MOM to a ten month high level while finishing 6.7% above previous year volumes and reaching a five year seasonal high level. The YOY increase in soybean oil stocks was the first experienced throughout the past 12 months. The seasonal build in soybean oil stocks of 12.2% was greater than the three year November – December seasonal average build of 6.1%. Dec ’19 soybean oil stocks finished 9.3% above three year average seasonal levels, finishing higher for the second consecutive month.

Soybean Oil Stocks – Stocks Finish 6.7% Higher YOY, Reach a Five Year Seasonal High Level

Dec ’19 U.S. soybean oil stocks increased 12.2% MOM to a ten month high level while finishing 6.7% above previous year volumes and reaching a five year seasonal high level. The YOY increase in soybean oil stocks was the first experienced throughout the past 12 months. The seasonal build in soybean oil stocks of 12.2% was greater than the three year November – December seasonal average build of 6.1%. Dec ’19 soybean oil stocks finished 9.3% above three year average seasonal levels, finishing higher for the second consecutive month.

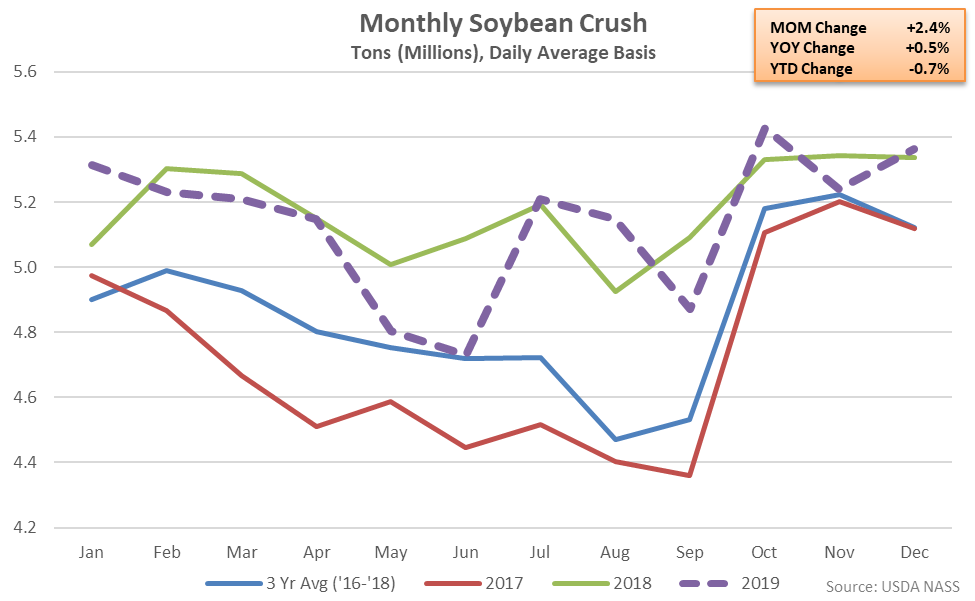

- Dec ’19 U.S. soybean crushings increased 0.5% on a YOY basis, reaching a record high seasonal level.

- Dec ’19 U.S. soybean cake & meal stocks finished 13.3% lower on a YOY basis, reaching a four year seasonal low level.

- Dec ’19 U.S. soybean oil stocks finished 6.7% higher on a YOY basis, reaching a five year high seasonal level. The YOY increase in soybean oil stocks was the first experienced throughout the past 12 months.

Cake & meal accounted for 73.3% of the total soybean crush throughout Dec ’19, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.3% of the total soybean crush throughout Dec ’19, up slightly from the previous year, while oil accounted for 17.3% of the total soybean crush, down slightly from the previous year.

Dec ’19 soybean oil produced as a percentage of total crush declined to a 17 month low level, finishing below historical average figures for the third consecutive month.

Dec ’19 soybean oil produced as a percentage of total crush declined to a 17 month low level, finishing below historical average figures for the third consecutive month.

Soybean Cake & Meal Stocks – Stocks Finish 13.3% Lower YOY, Reach a Four Year Seasonal Low Level

Dec ’19 U.S. soybean cake & meal stocks declined 19.8% MOM and 13.3% YOY, finishing lower on a YOY basis for the third time in the past four months and reaching a four year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 19.8% was a contraseasonal move when compared to the three year November – December seasonal average increase in stocks of 29.3%. Dec ’19 soybean cake & meal stocks finished 21.3% below three year average seasonal levels.

Soybean Cake & Meal Stocks – Stocks Finish 13.3% Lower YOY, Reach a Four Year Seasonal Low Level

Dec ’19 U.S. soybean cake & meal stocks declined 19.8% MOM and 13.3% YOY, finishing lower on a YOY basis for the third time in the past four months and reaching a four year seasonal low level. The month-over-month decline in soybean cake & meal stocks of 19.8% was a contraseasonal move when compared to the three year November – December seasonal average increase in stocks of 29.3%. Dec ’19 soybean cake & meal stocks finished 21.3% below three year average seasonal levels.

Soybean Oil Stocks – Stocks Finish 6.7% Higher YOY, Reach a Five Year Seasonal High Level

Dec ’19 U.S. soybean oil stocks increased 12.2% MOM to a ten month high level while finishing 6.7% above previous year volumes and reaching a five year seasonal high level. The YOY increase in soybean oil stocks was the first experienced throughout the past 12 months. The seasonal build in soybean oil stocks of 12.2% was greater than the three year November – December seasonal average build of 6.1%. Dec ’19 soybean oil stocks finished 9.3% above three year average seasonal levels, finishing higher for the second consecutive month.

Soybean Oil Stocks – Stocks Finish 6.7% Higher YOY, Reach a Five Year Seasonal High Level

Dec ’19 U.S. soybean oil stocks increased 12.2% MOM to a ten month high level while finishing 6.7% above previous year volumes and reaching a five year seasonal high level. The YOY increase in soybean oil stocks was the first experienced throughout the past 12 months. The seasonal build in soybean oil stocks of 12.2% was greater than the three year November – December seasonal average build of 6.1%. Dec ’19 soybean oil stocks finished 9.3% above three year average seasonal levels, finishing higher for the second consecutive month.