U.S. Dairy Product Production Update – Apr ’20

Executive Summary

U.S. dairy product production figures provided by the USDA were recently updated with values spanning through Feb ’20. Highlights from the updated report include:

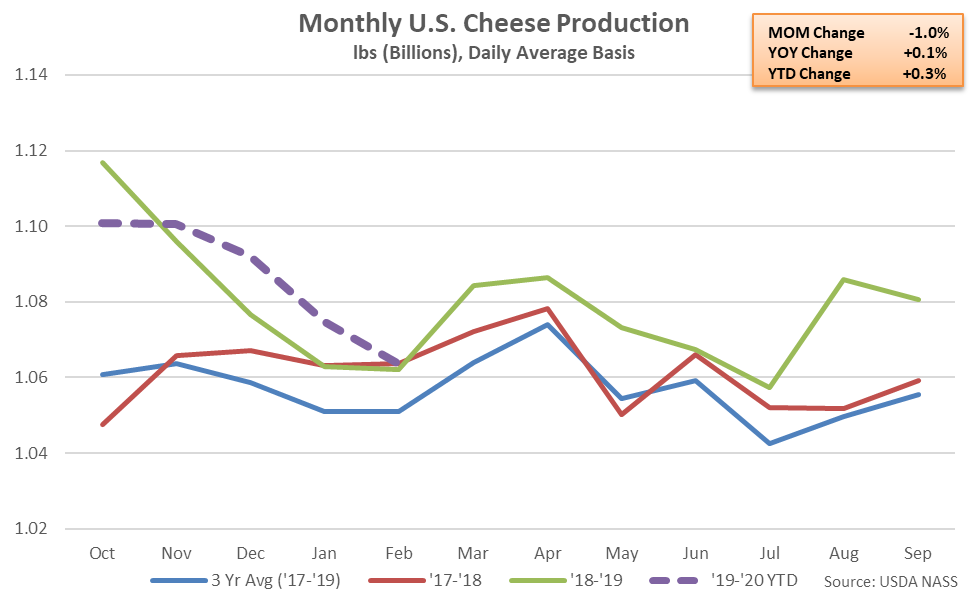

Cheese – Production Finishes at the Second Highest Seasonal Level on Record, up 0.1% YOY

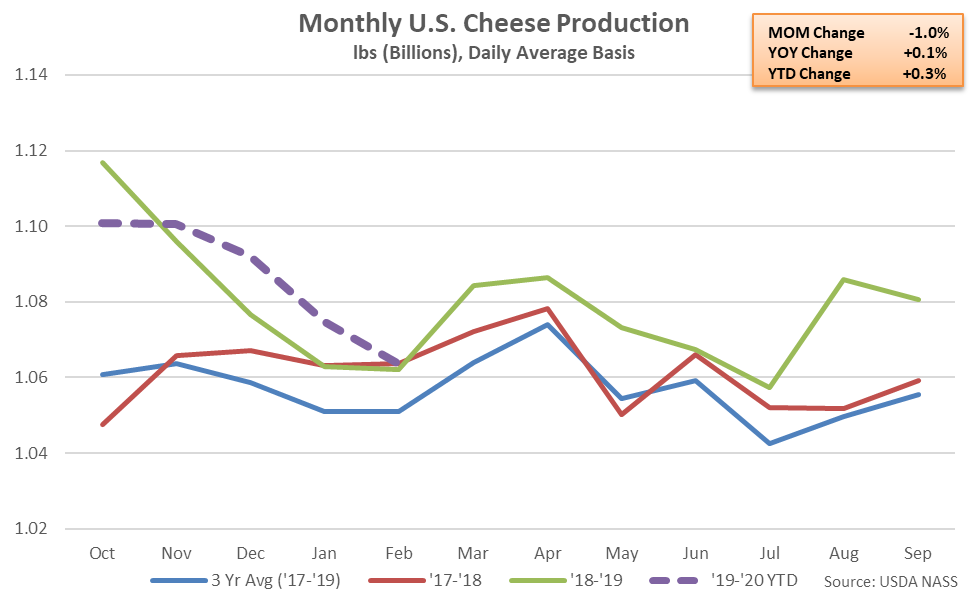

U.S. cheese production declined to a seven month low level during Feb ’20 but remained 0.1% higher on a YOY basis, finishing higher for the 11th time in the past 12 months and reaching the second highest seasonal level on record. Higher YOY production experienced throughout the Central U.S. (+2.4%) more than offset lower production experienced throughout the Western U.S. (-1.7%) and Atlantic U.S. (-1.9%). Cheddar cheese production increased 3.7% on a YOY basis throughout the month, more than offsetting a 1.3% YOY decline in other-than-cheddar cheese production.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however. ’19-’20 YTD cheese production has increased an additional 0.3% on a YOY basis throughout the first five months of the production season.

Cheese – Production Finishes at the Second Highest Seasonal Level on Record, up 0.1% YOY

U.S. cheese production declined to a seven month low level during Feb ’20 but remained 0.1% higher on a YOY basis, finishing higher for the 11th time in the past 12 months and reaching the second highest seasonal level on record. Higher YOY production experienced throughout the Central U.S. (+2.4%) more than offset lower production experienced throughout the Western U.S. (-1.7%) and Atlantic U.S. (-1.9%). Cheddar cheese production increased 3.7% on a YOY basis throughout the month, more than offsetting a 1.3% YOY decline in other-than-cheddar cheese production.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however. ’19-’20 YTD cheese production has increased an additional 0.3% on a YOY basis throughout the first five months of the production season.

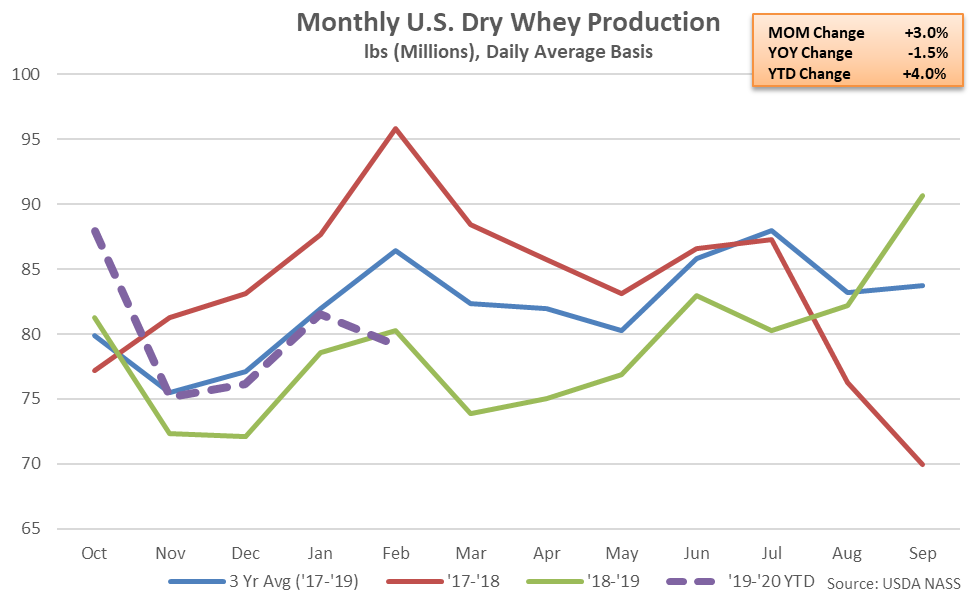

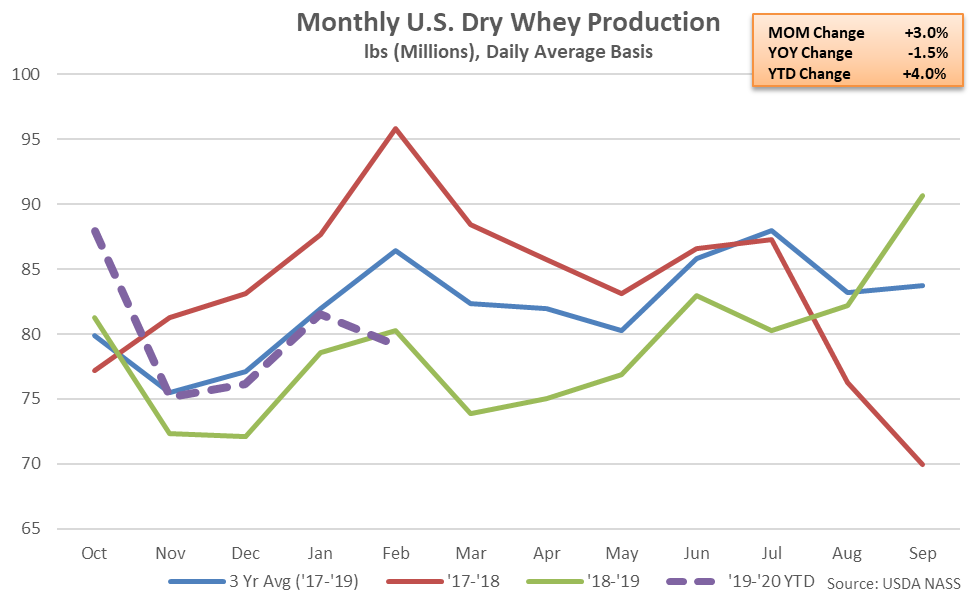

Dry Whey – Production Declines YOY for the First Time in Seven Months, Finishes Down 1.5%

U.S. dry whey production declined 1.5% on a YOY basis during Feb ’20, finishing lower for the first time in the past seven months. Lower YOY production experienced throughout the Western U.S. (-26.9%) more than offset higher production experienced throughout the Central U.S. (+17.2%) and Atlantic U.S. (+2.6%). Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the 13th consecutive month during Feb ’20, finishing down 10.1%, while combined production of dry whey, WPC and WPI finished 4.8% lower.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low. ’19-’20 YTD dry whey production has rebounded by 4.0% on a YOY basis throughout the first five months of the production season, despite the most recent decline, while combined production of dry whey, WPC and WPI has increased 0.1%.

Dry Whey – Production Declines YOY for the First Time in Seven Months, Finishes Down 1.5%

U.S. dry whey production declined 1.5% on a YOY basis during Feb ’20, finishing lower for the first time in the past seven months. Lower YOY production experienced throughout the Western U.S. (-26.9%) more than offset higher production experienced throughout the Central U.S. (+17.2%) and Atlantic U.S. (+2.6%). Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the 13th consecutive month during Feb ’20, finishing down 10.1%, while combined production of dry whey, WPC and WPI finished 4.8% lower.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low. ’19-’20 YTD dry whey production has rebounded by 4.0% on a YOY basis throughout the first five months of the production season, despite the most recent decline, while combined production of dry whey, WPC and WPI has increased 0.1%.

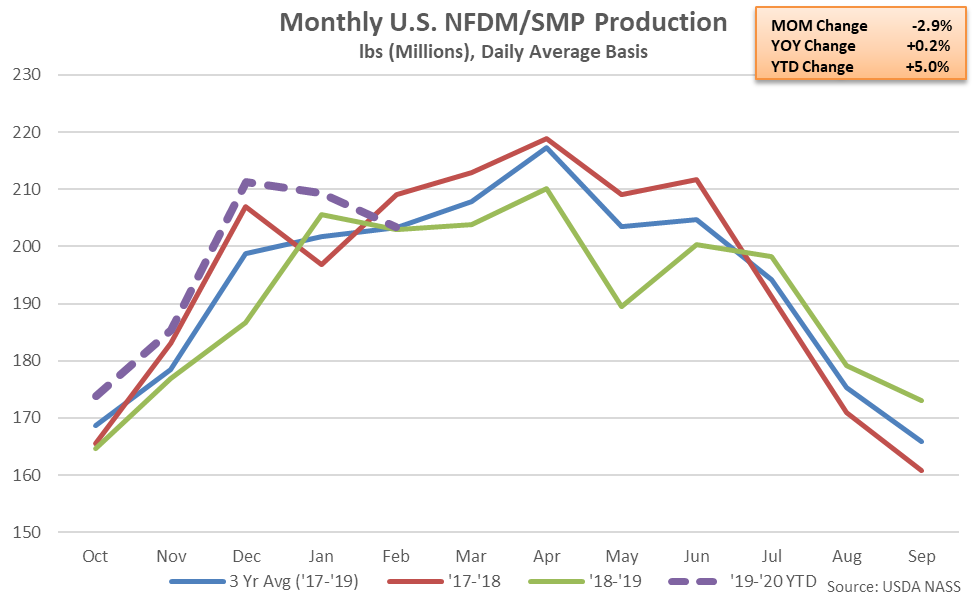

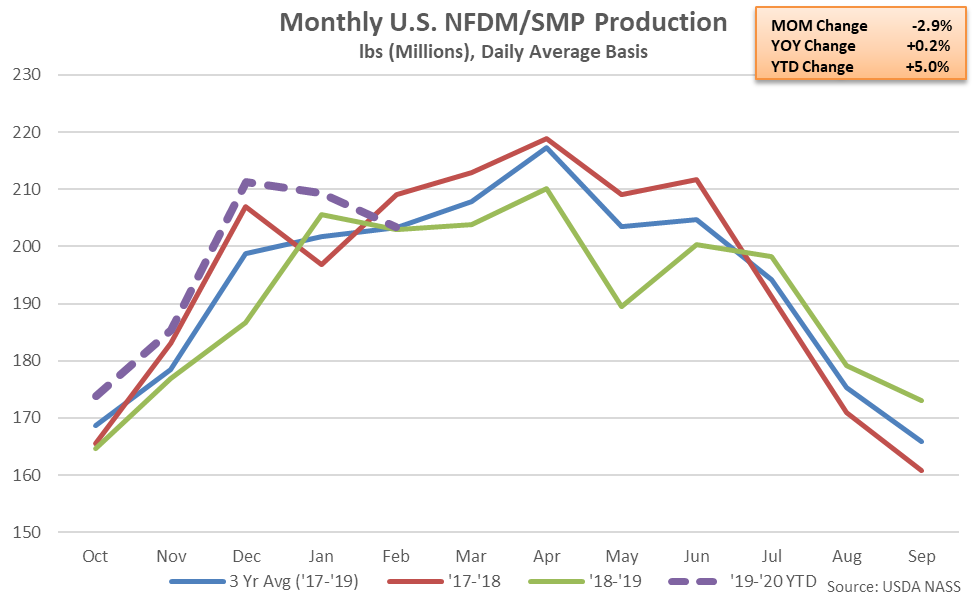

NFDM/SMP – Combined Production Higher YOY for the Eighth Consecutive Month, Finishes up 0.2%

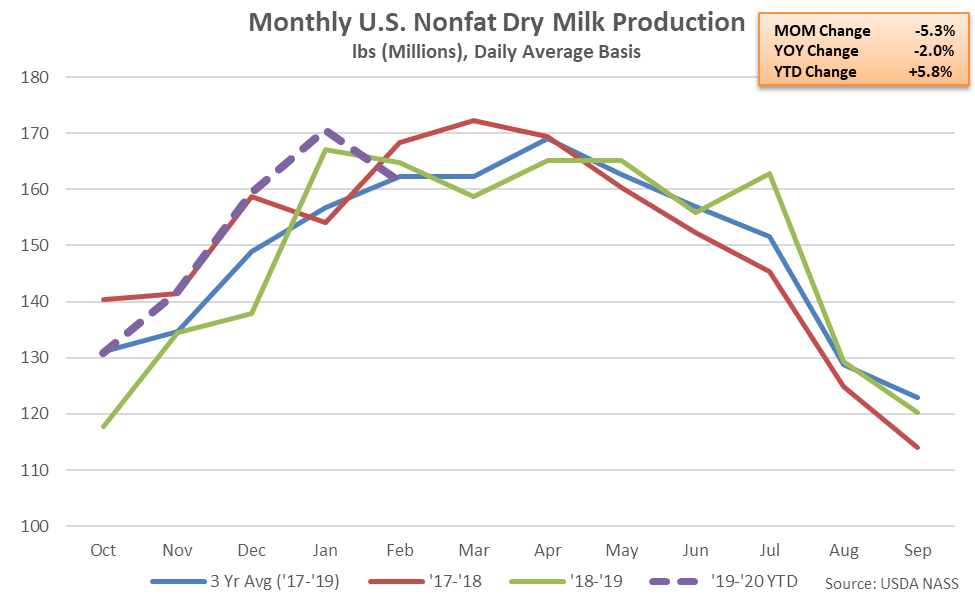

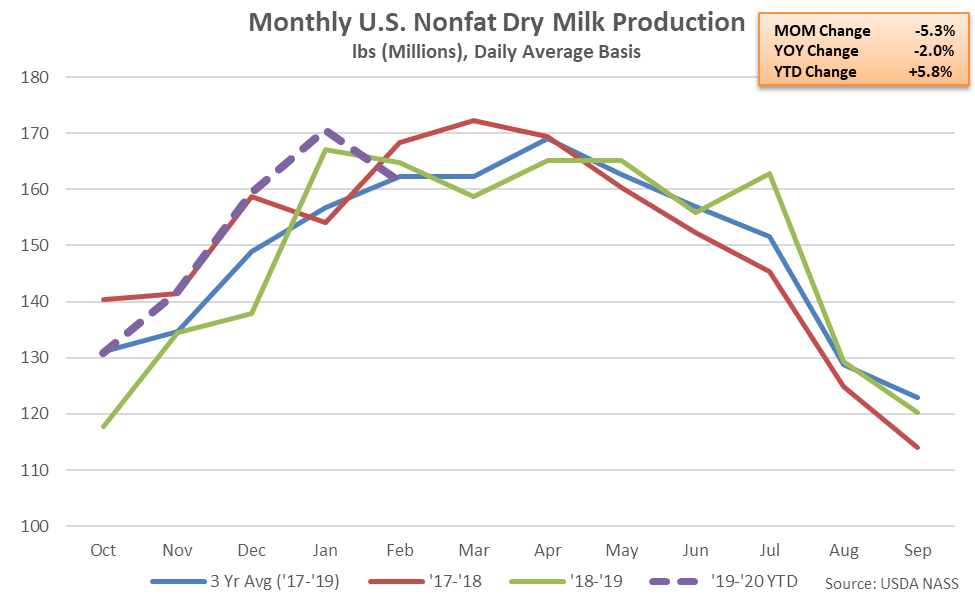

U.S. nonfat dry milk (NFDM) production declined on a YOY basis for the first time in the past ten months during Feb ’20, finishing down 2.0% and reaching a three year low seasonal level. Lower YOY production experienced throughout the Central U.S. (-8.0%) and Atlantic U.S. (-3.6%) more than offset higher production experienced throughout the Western U.S. (+0.4%).

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished higher on a YOY basis for the fourth consecutive month during Feb ’20, however, increasing by 9.6%. Feb ’20 combined production of NFDM and SMP increased 0.2% on a YOY basis, finishing higher for eighth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. Production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period. ’19-’20 YTD combined production of NFDM and SMP has rebounded by 5.0% on a YOY basis throughout the first five months of the production season.

NFDM/SMP – Combined Production Higher YOY for the Eighth Consecutive Month, Finishes up 0.2%

U.S. nonfat dry milk (NFDM) production declined on a YOY basis for the first time in the past ten months during Feb ’20, finishing down 2.0% and reaching a three year low seasonal level. Lower YOY production experienced throughout the Central U.S. (-8.0%) and Atlantic U.S. (-3.6%) more than offset higher production experienced throughout the Western U.S. (+0.4%).

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished higher on a YOY basis for the fourth consecutive month during Feb ’20, however, increasing by 9.6%. Feb ’20 combined production of NFDM and SMP increased 0.2% on a YOY basis, finishing higher for eighth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. Production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period. ’19-’20 YTD combined production of NFDM and SMP has rebounded by 5.0% on a YOY basis throughout the first five months of the production season.

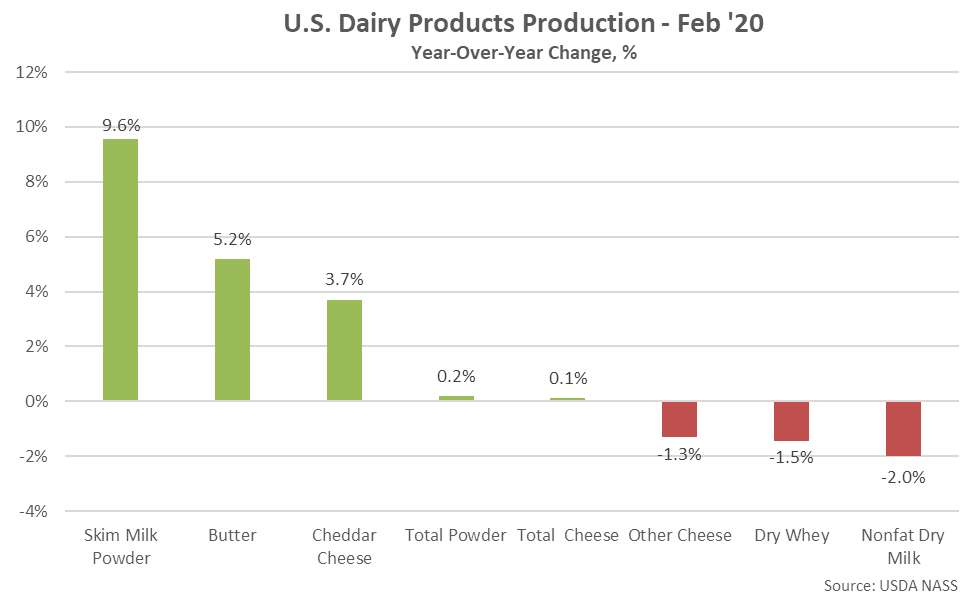

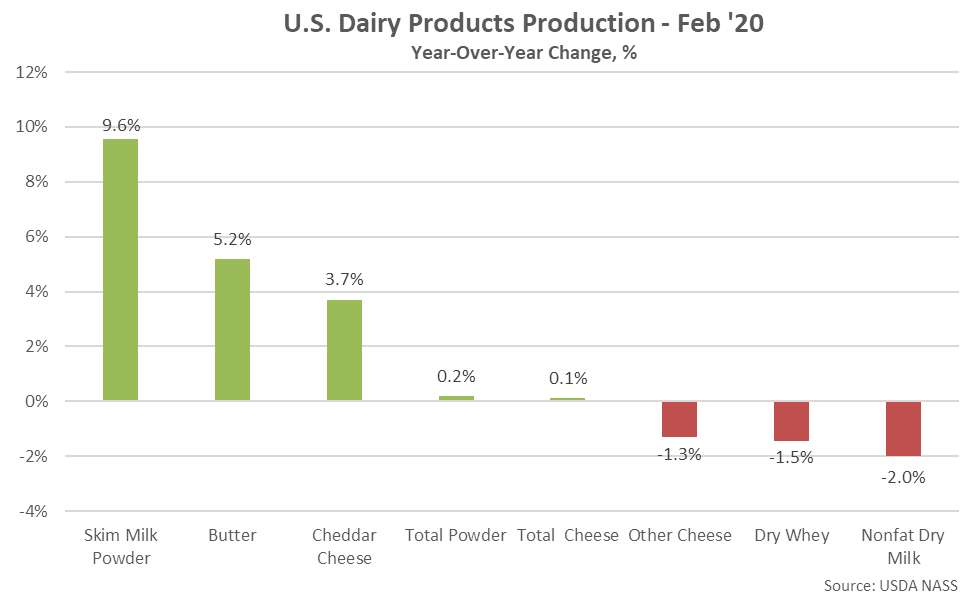

Overall, skim milk powder production increased most significantly YOY on a percentage basis during Feb ’20, while nonfat dry milk production declined most significantly on a percentage basis throughout the month.

Overall, skim milk powder production increased most significantly YOY on a percentage basis during Feb ’20, while nonfat dry milk production declined most significantly on a percentage basis throughout the month.

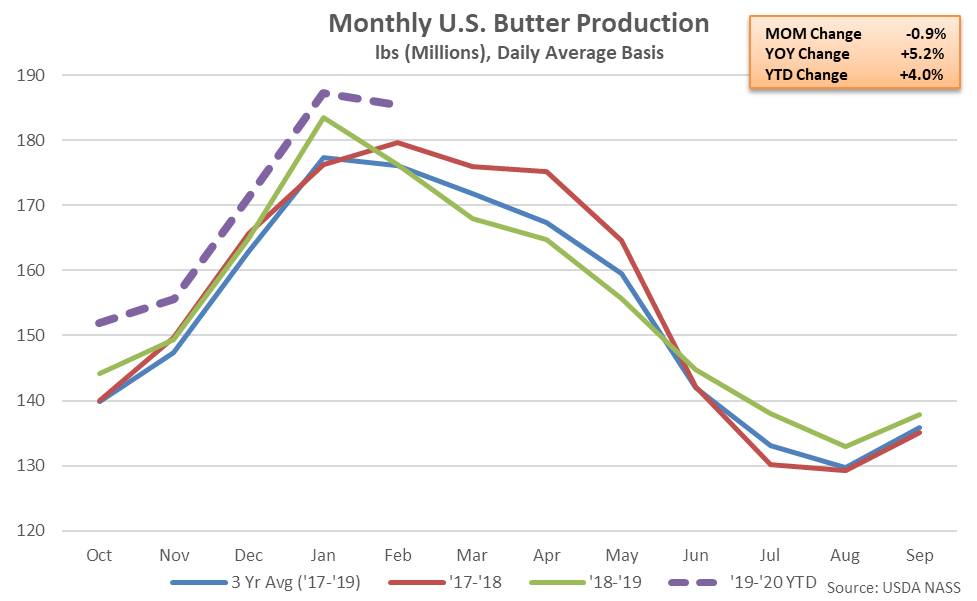

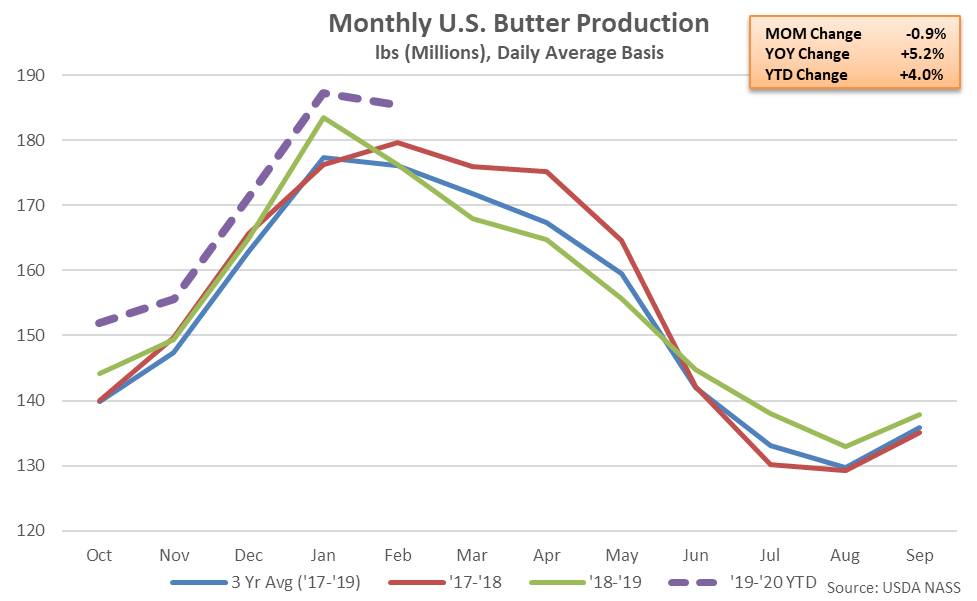

- U.S. butter production increased on a YOY basis for the ninth consecutive month during Feb ’20, finishing up 5.2% and reaching a seven year high seasonal level.

- U.S. cheese production increased 0.1% on a YOY basis during Feb ’20, reaching the second highest seasonal level on record, however dry whey production declined on a YOY basis for the first time in the past seven months, finishing down 1.5%.

- Combined production of U.S. nonfat dry milk and skim milk powder increased 0.2% on a YOY basis during Feb ’20, finishing higher for the eighth consecutive month. Skim milk powder production increased 9.6% YOY throughout the month, more than offsetting a 2.0% YOY decline in nonfat dry milk production.

Cheese – Production Finishes at the Second Highest Seasonal Level on Record, up 0.1% YOY

U.S. cheese production declined to a seven month low level during Feb ’20 but remained 0.1% higher on a YOY basis, finishing higher for the 11th time in the past 12 months and reaching the second highest seasonal level on record. Higher YOY production experienced throughout the Central U.S. (+2.4%) more than offset lower production experienced throughout the Western U.S. (-1.7%) and Atlantic U.S. (-1.9%). Cheddar cheese production increased 3.7% on a YOY basis throughout the month, more than offsetting a 1.3% YOY decline in other-than-cheddar cheese production.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however. ’19-’20 YTD cheese production has increased an additional 0.3% on a YOY basis throughout the first five months of the production season.

Cheese – Production Finishes at the Second Highest Seasonal Level on Record, up 0.1% YOY

U.S. cheese production declined to a seven month low level during Feb ’20 but remained 0.1% higher on a YOY basis, finishing higher for the 11th time in the past 12 months and reaching the second highest seasonal level on record. Higher YOY production experienced throughout the Central U.S. (+2.4%) more than offset lower production experienced throughout the Western U.S. (-1.7%) and Atlantic U.S. (-1.9%). Cheddar cheese production increased 3.7% on a YOY basis throughout the month, more than offsetting a 1.3% YOY decline in other-than-cheddar cheese production.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however. ’19-’20 YTD cheese production has increased an additional 0.3% on a YOY basis throughout the first five months of the production season.

Dry Whey – Production Declines YOY for the First Time in Seven Months, Finishes Down 1.5%

U.S. dry whey production declined 1.5% on a YOY basis during Feb ’20, finishing lower for the first time in the past seven months. Lower YOY production experienced throughout the Western U.S. (-26.9%) more than offset higher production experienced throughout the Central U.S. (+17.2%) and Atlantic U.S. (+2.6%). Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the 13th consecutive month during Feb ’20, finishing down 10.1%, while combined production of dry whey, WPC and WPI finished 4.8% lower.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low. ’19-’20 YTD dry whey production has rebounded by 4.0% on a YOY basis throughout the first five months of the production season, despite the most recent decline, while combined production of dry whey, WPC and WPI has increased 0.1%.

Dry Whey – Production Declines YOY for the First Time in Seven Months, Finishes Down 1.5%

U.S. dry whey production declined 1.5% on a YOY basis during Feb ’20, finishing lower for the first time in the past seven months. Lower YOY production experienced throughout the Western U.S. (-26.9%) more than offset higher production experienced throughout the Central U.S. (+17.2%) and Atlantic U.S. (+2.6%). Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the 13th consecutive month during Feb ’20, finishing down 10.1%, while combined production of dry whey, WPC and WPI finished 4.8% lower.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low. ’19-’20 YTD dry whey production has rebounded by 4.0% on a YOY basis throughout the first five months of the production season, despite the most recent decline, while combined production of dry whey, WPC and WPI has increased 0.1%.

NFDM/SMP – Combined Production Higher YOY for the Eighth Consecutive Month, Finishes up 0.2%

U.S. nonfat dry milk (NFDM) production declined on a YOY basis for the first time in the past ten months during Feb ’20, finishing down 2.0% and reaching a three year low seasonal level. Lower YOY production experienced throughout the Central U.S. (-8.0%) and Atlantic U.S. (-3.6%) more than offset higher production experienced throughout the Western U.S. (+0.4%).

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished higher on a YOY basis for the fourth consecutive month during Feb ’20, however, increasing by 9.6%. Feb ’20 combined production of NFDM and SMP increased 0.2% on a YOY basis, finishing higher for eighth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. Production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period. ’19-’20 YTD combined production of NFDM and SMP has rebounded by 5.0% on a YOY basis throughout the first five months of the production season.

NFDM/SMP – Combined Production Higher YOY for the Eighth Consecutive Month, Finishes up 0.2%

U.S. nonfat dry milk (NFDM) production declined on a YOY basis for the first time in the past ten months during Feb ’20, finishing down 2.0% and reaching a three year low seasonal level. Lower YOY production experienced throughout the Central U.S. (-8.0%) and Atlantic U.S. (-3.6%) more than offset higher production experienced throughout the Western U.S. (+0.4%).

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished higher on a YOY basis for the fourth consecutive month during Feb ’20, however, increasing by 9.6%. Feb ’20 combined production of NFDM and SMP increased 0.2% on a YOY basis, finishing higher for eighth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. Production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period. ’19-’20 YTD combined production of NFDM and SMP has rebounded by 5.0% on a YOY basis throughout the first five months of the production season.

Overall, skim milk powder production increased most significantly YOY on a percentage basis during Feb ’20, while nonfat dry milk production declined most significantly on a percentage basis throughout the month.

Overall, skim milk powder production increased most significantly YOY on a percentage basis during Feb ’20, while nonfat dry milk production declined most significantly on a percentage basis throughout the month.