Soybean Complex Crushing & Stocks Update – Apr ’20

Executive Summary

U.S. soybean crush and stocks figures provided by USDA were recently updated with values spanning through Feb ’20. Highlights from the updated report include:

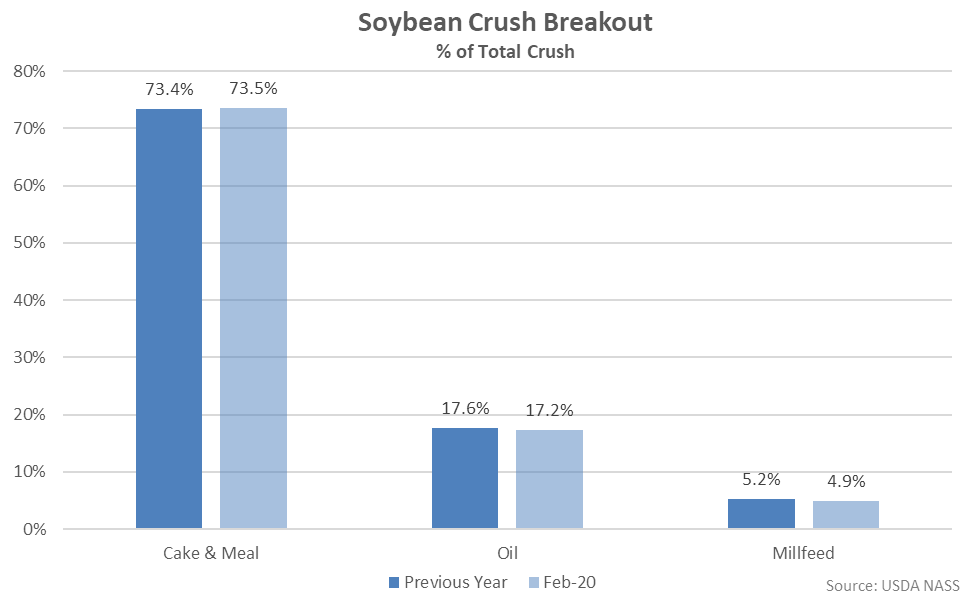

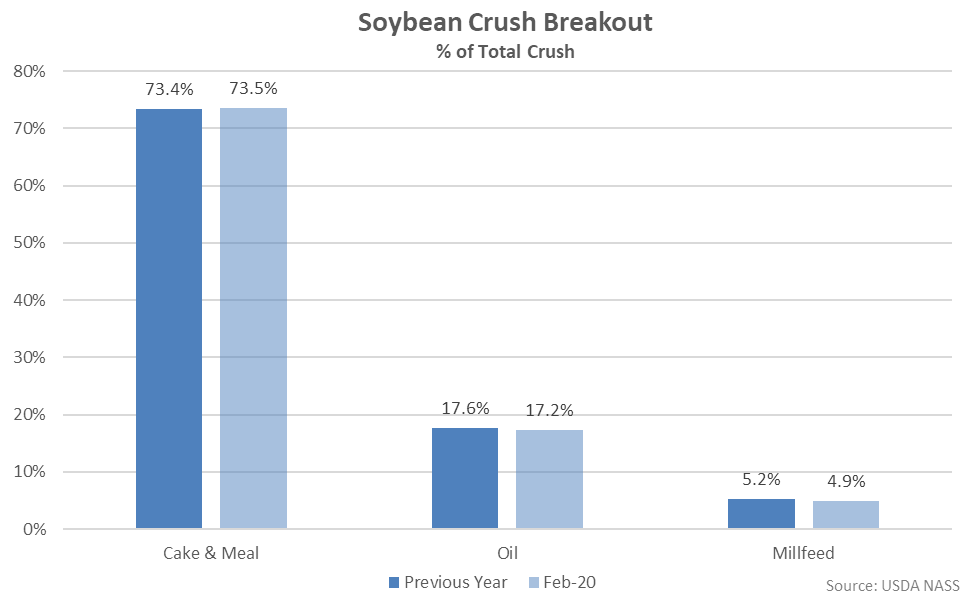

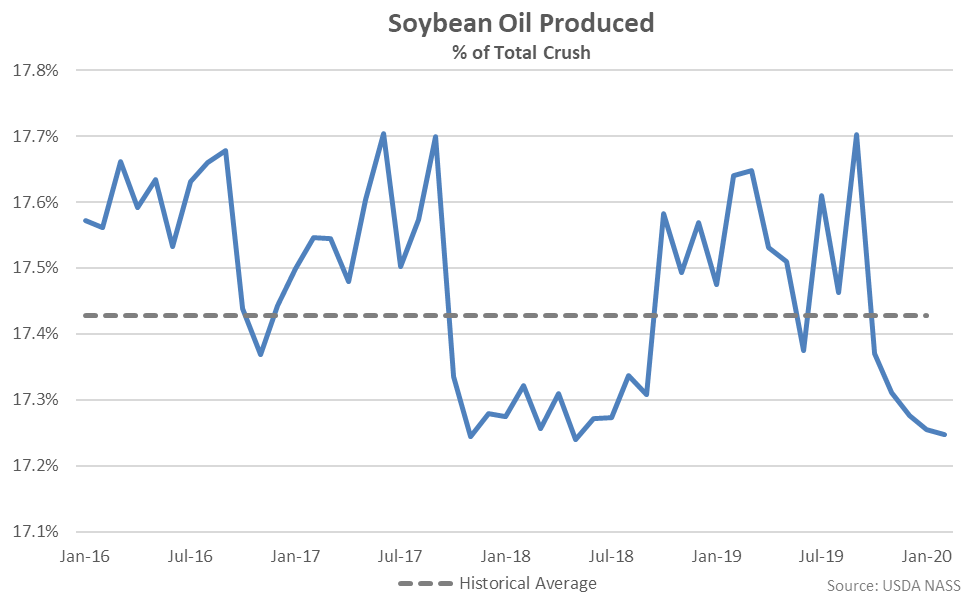

Cake & meal accounted for 73.5% of the total soybean crush throughout Feb ’20, up slightly from the previous year, while oil accounted for 17.2% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.5% of the total soybean crush throughout Feb ’20, up slightly from the previous year, while oil accounted for 17.2% of the total soybean crush, down slightly from the previous year.

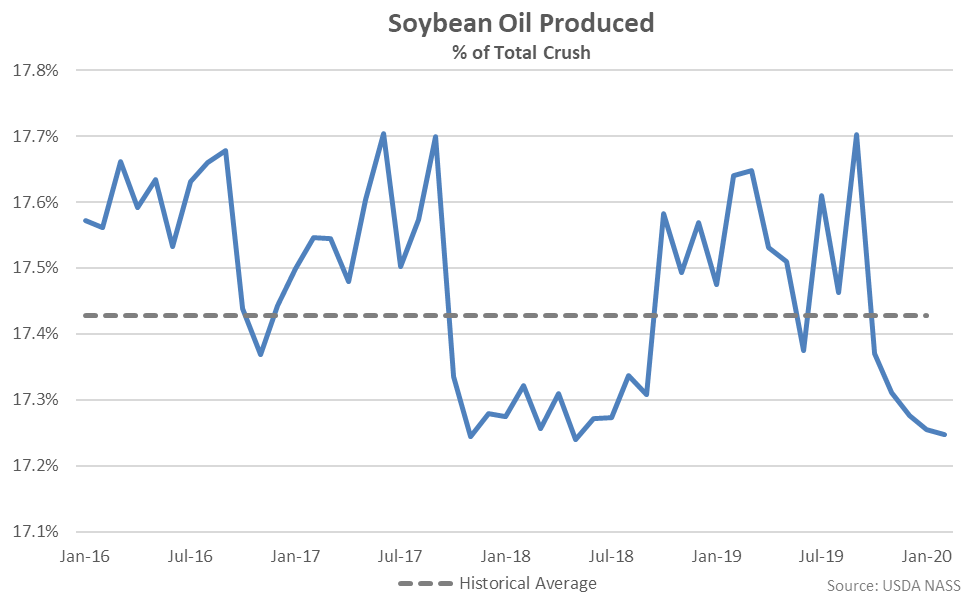

Feb ’20 soybean oil produced as a percentage of total crush declined to a 21 month low level, finishing below historical average figures for the fifth consecutive month.

Feb ’20 soybean oil produced as a percentage of total crush declined to a 21 month low level, finishing below historical average figures for the fifth consecutive month.

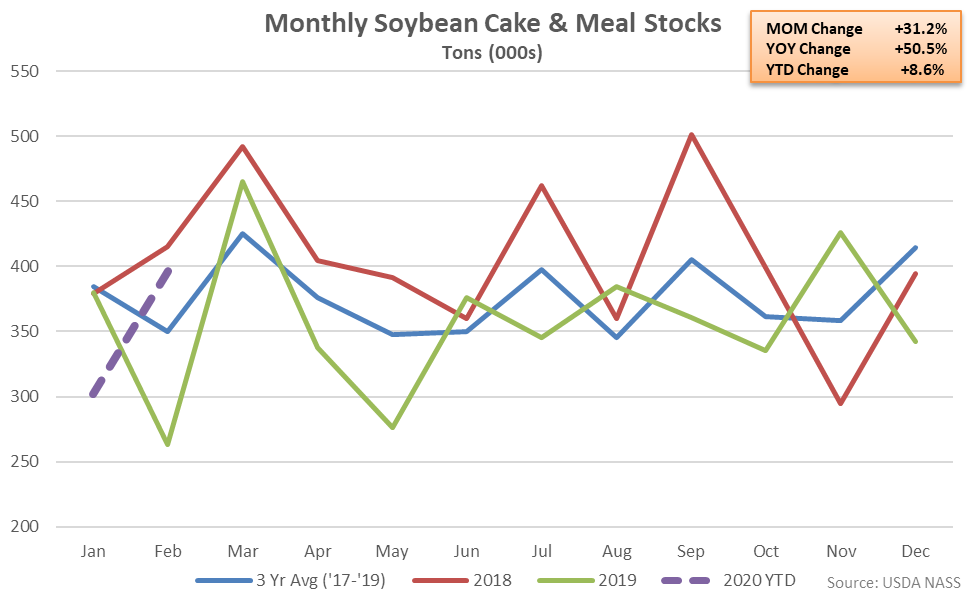

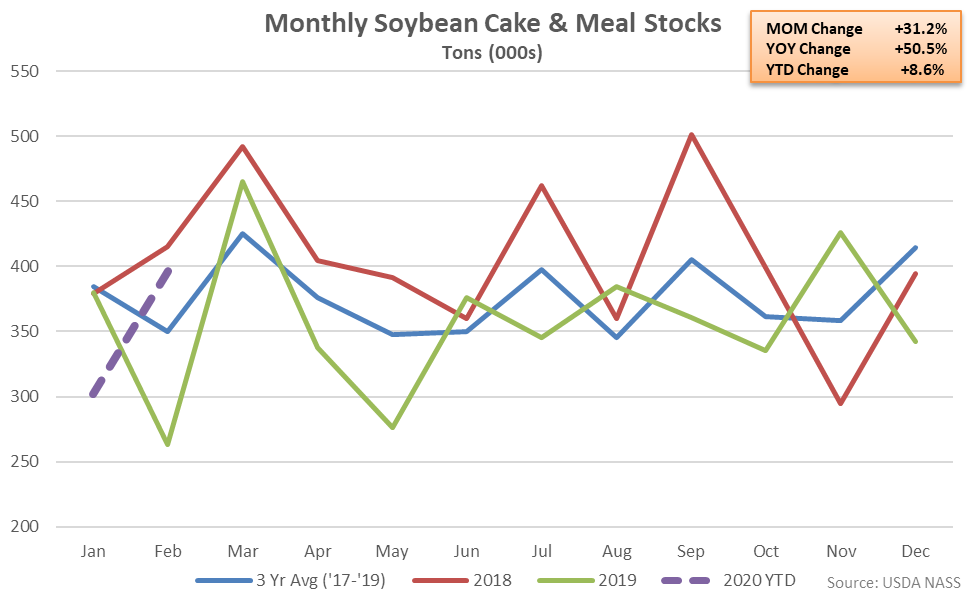

Soybean Cake & Meal Stocks – Stocks Finish 50.5% Higher YOY

Feb ’20 U.S. soybean cake & meal stocks increased 31.2% MOM and 50.5% YOY, finishing higher on a YOY basis for the first time in the past three months. The YOY increase in soybean cake & meal stocks was the largest experienced throughout the past 23 months on a percentage basis. The month-over-month increase in soybean cake & meal stocks of 31.2% was a contraseasonal move when compared to the three year January – February average seasonal decline in stocks of 9.0%. Feb ’20 soybean cake & meal stocks finished 13.2% above three year average seasonal levels, finishing higher for the first time in the past three months.

Soybean Cake & Meal Stocks – Stocks Finish 50.5% Higher YOY

Feb ’20 U.S. soybean cake & meal stocks increased 31.2% MOM and 50.5% YOY, finishing higher on a YOY basis for the first time in the past three months. The YOY increase in soybean cake & meal stocks was the largest experienced throughout the past 23 months on a percentage basis. The month-over-month increase in soybean cake & meal stocks of 31.2% was a contraseasonal move when compared to the three year January – February average seasonal decline in stocks of 9.0%. Feb ’20 soybean cake & meal stocks finished 13.2% above three year average seasonal levels, finishing higher for the first time in the past three months.

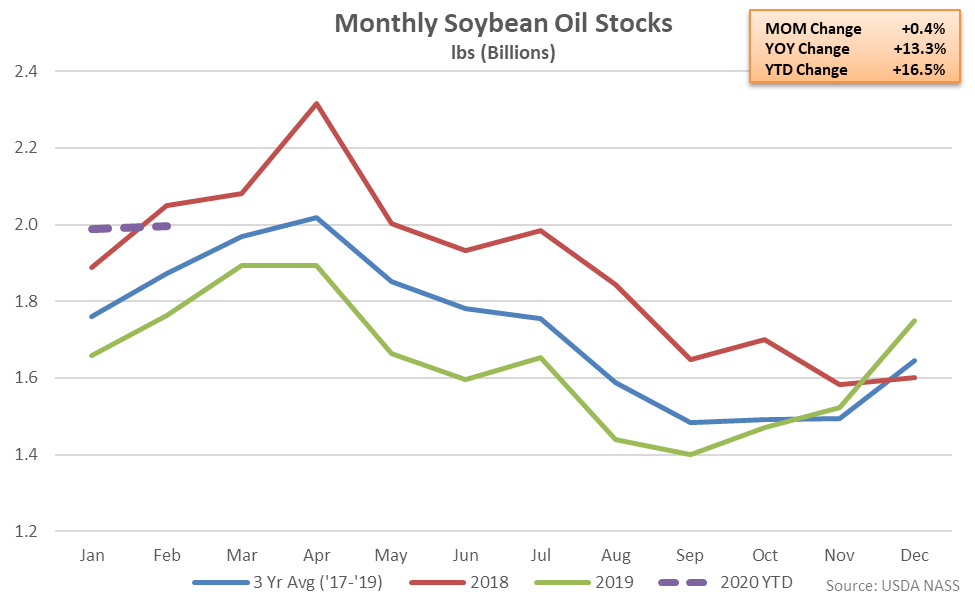

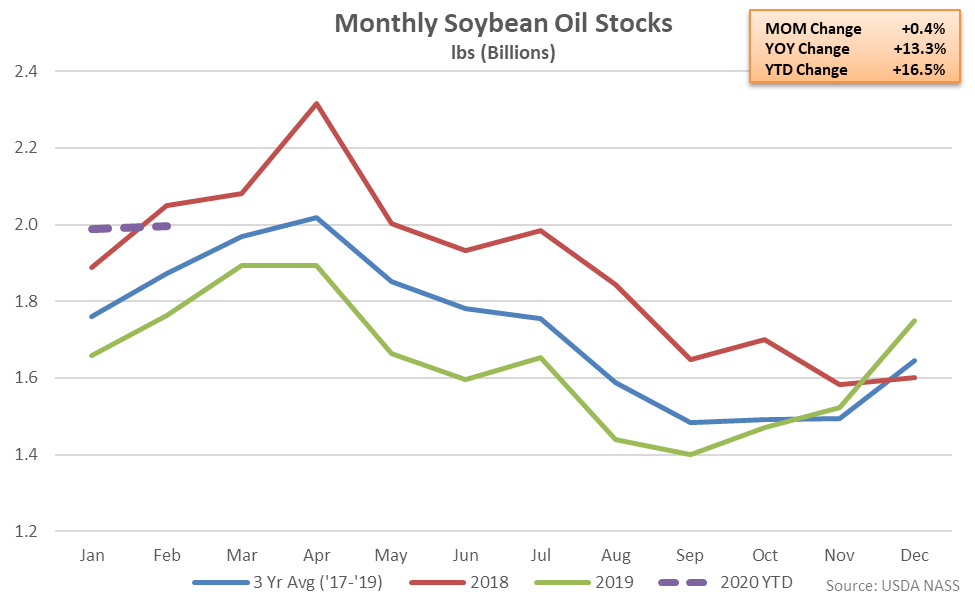

Soybean Oil Stocks – Stocks Reach a 21 Month High Level, Finish up 13.3% YOY

Feb ’20 U.S. soybean oil stocks increased 0.4% MOM to a 21 month high level, finishing 13.3% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past three months. The month-over-month increase in soybean oil stocks of 0.4% was smaller than the three year January – February average seasonal build of 6.3%, however. Feb ’20 soybean oil stocks finished 6.7% above three year average seasonal levels, finishing higher for the fourth consecutive month.

Soybean Oil Stocks – Stocks Reach a 21 Month High Level, Finish up 13.3% YOY

Feb ’20 U.S. soybean oil stocks increased 0.4% MOM to a 21 month high level, finishing 13.3% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past three months. The month-over-month increase in soybean oil stocks of 0.4% was smaller than the three year January – February average seasonal build of 6.3%, however. Feb ’20 soybean oil stocks finished 6.7% above three year average seasonal levels, finishing higher for the fourth consecutive month.

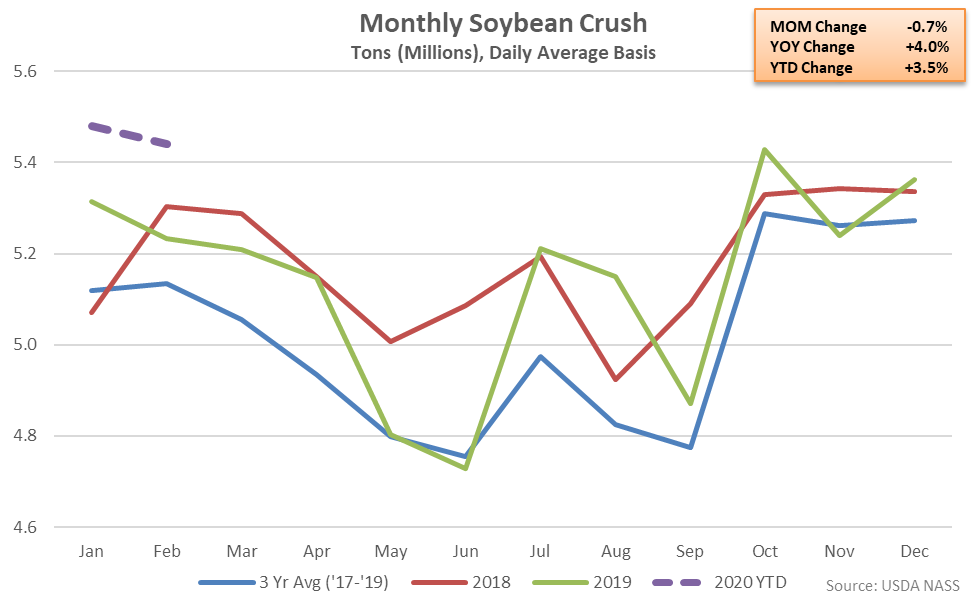

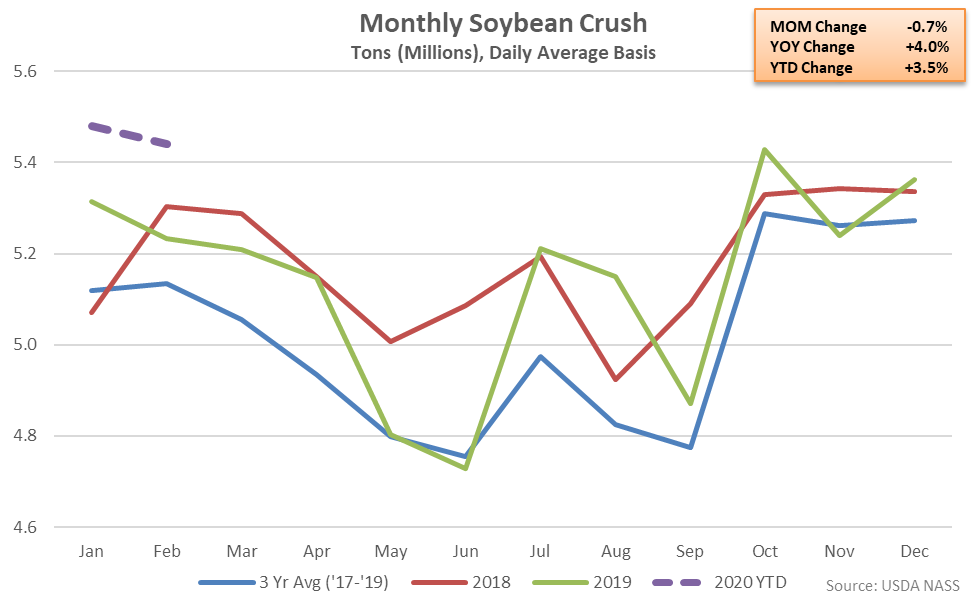

- U.S. soybean crushings increased 4.0% on a YOY basis during Feb ’20, reaching a record high seasonal level.

- U.S. soybean cake & meal stocks finished 50.5% higher on a YOY basis during Feb ’20, increasing on a YOY basis for the first time in the past three months.

- U.S. soybean oil stocks finished 13.3% higher on a YOY basis during Feb ’20, reaching a 21 month high level, overall.

Cake & meal accounted for 73.5% of the total soybean crush throughout Feb ’20, up slightly from the previous year, while oil accounted for 17.2% of the total soybean crush, down slightly from the previous year.

Cake & meal accounted for 73.5% of the total soybean crush throughout Feb ’20, up slightly from the previous year, while oil accounted for 17.2% of the total soybean crush, down slightly from the previous year.

Feb ’20 soybean oil produced as a percentage of total crush declined to a 21 month low level, finishing below historical average figures for the fifth consecutive month.

Feb ’20 soybean oil produced as a percentage of total crush declined to a 21 month low level, finishing below historical average figures for the fifth consecutive month.

Soybean Cake & Meal Stocks – Stocks Finish 50.5% Higher YOY

Feb ’20 U.S. soybean cake & meal stocks increased 31.2% MOM and 50.5% YOY, finishing higher on a YOY basis for the first time in the past three months. The YOY increase in soybean cake & meal stocks was the largest experienced throughout the past 23 months on a percentage basis. The month-over-month increase in soybean cake & meal stocks of 31.2% was a contraseasonal move when compared to the three year January – February average seasonal decline in stocks of 9.0%. Feb ’20 soybean cake & meal stocks finished 13.2% above three year average seasonal levels, finishing higher for the first time in the past three months.

Soybean Cake & Meal Stocks – Stocks Finish 50.5% Higher YOY

Feb ’20 U.S. soybean cake & meal stocks increased 31.2% MOM and 50.5% YOY, finishing higher on a YOY basis for the first time in the past three months. The YOY increase in soybean cake & meal stocks was the largest experienced throughout the past 23 months on a percentage basis. The month-over-month increase in soybean cake & meal stocks of 31.2% was a contraseasonal move when compared to the three year January – February average seasonal decline in stocks of 9.0%. Feb ’20 soybean cake & meal stocks finished 13.2% above three year average seasonal levels, finishing higher for the first time in the past three months.

Soybean Oil Stocks – Stocks Reach a 21 Month High Level, Finish up 13.3% YOY

Feb ’20 U.S. soybean oil stocks increased 0.4% MOM to a 21 month high level, finishing 13.3% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past three months. The month-over-month increase in soybean oil stocks of 0.4% was smaller than the three year January – February average seasonal build of 6.3%, however. Feb ’20 soybean oil stocks finished 6.7% above three year average seasonal levels, finishing higher for the fourth consecutive month.

Soybean Oil Stocks – Stocks Reach a 21 Month High Level, Finish up 13.3% YOY

Feb ’20 U.S. soybean oil stocks increased 0.4% MOM to a 21 month high level, finishing 13.3% above previous year volumes. Soybean oil stocks had finished lower on a YOY basis throughout 11 consecutive months prior to finishing higher throughout each of the past three months. The month-over-month increase in soybean oil stocks of 0.4% was smaller than the three year January – February average seasonal build of 6.3%, however. Feb ’20 soybean oil stocks finished 6.7% above three year average seasonal levels, finishing higher for the fourth consecutive month.