U.S. Dairy Dry Product Stocks Update – May ’20

Executive Summary

U.S. dairy dry product stock figures provided by the USDA were recently updated with values spanning through Mar ’20. Highlights from the updated report include:

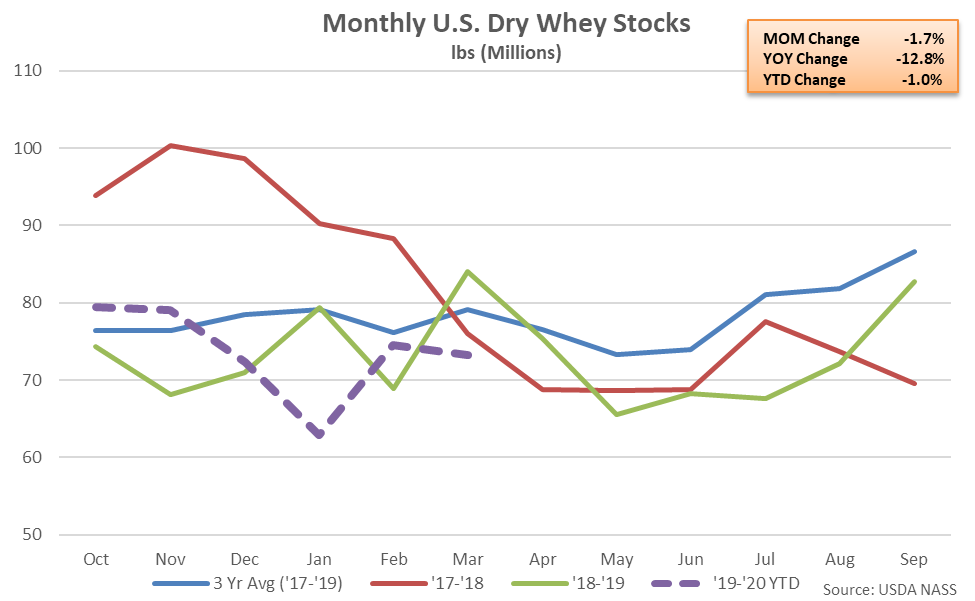

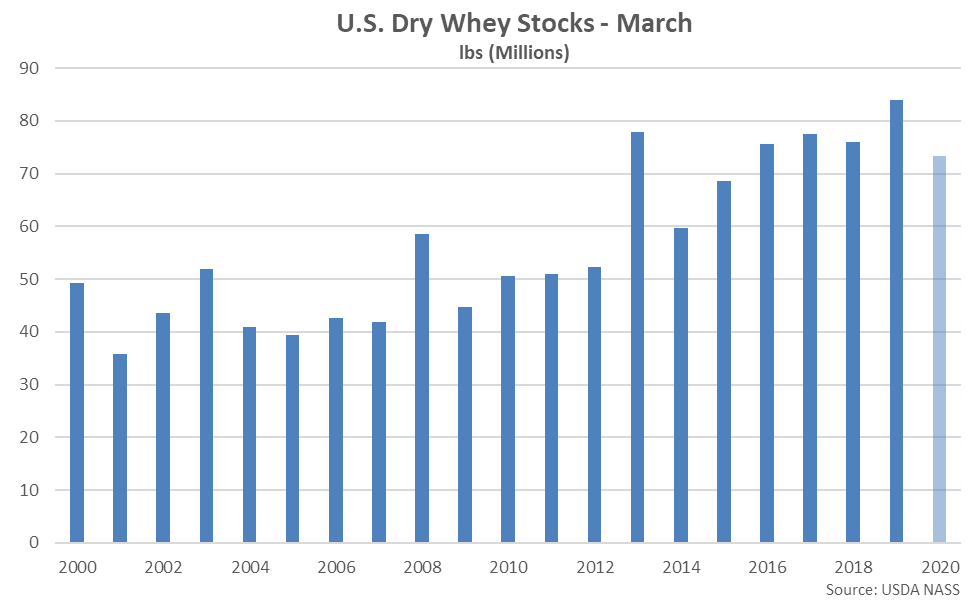

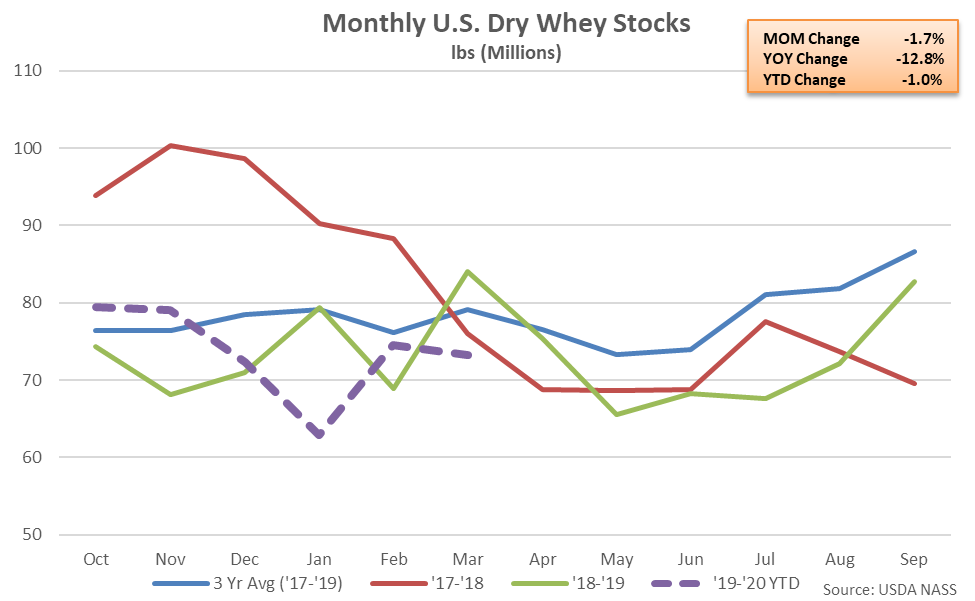

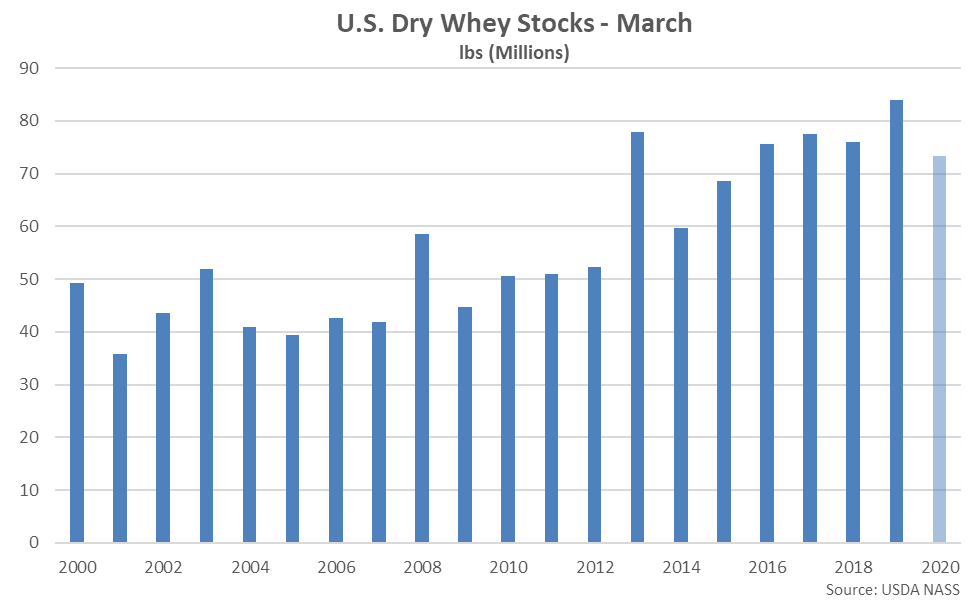

According to the USDA, Mar ’20 month-end dry whey stocks declined 1.7% from the previous month while finishing 12.8% lower on a YOY basis and reaching a five year low seasonal level. The YOY decline in dry whey stocks was just the second experienced throughout the past seven months. The MOM decline in dry whey stocks of 1.2 million pounds, or 1.7%, was a contraseasonal move when compared to the ten year average February – March seasonal build in dry whey stocks of 3.0 million pounds, or 5.5%. Dry whey production increased 5.4% on a YOY basis throughout Mar ’20, finishing higher for the seventh time in the past eight months.

According to the USDA, Mar ’20 month-end dry whey stocks declined 1.7% from the previous month while finishing 12.8% lower on a YOY basis and reaching a five year low seasonal level. The YOY decline in dry whey stocks was just the second experienced throughout the past seven months. The MOM decline in dry whey stocks of 1.2 million pounds, or 1.7%, was a contraseasonal move when compared to the ten year average February – March seasonal build in dry whey stocks of 3.0 million pounds, or 5.5%. Dry whey production increased 5.4% on a YOY basis throughout Mar ’20, finishing higher for the seventh time in the past eight months.

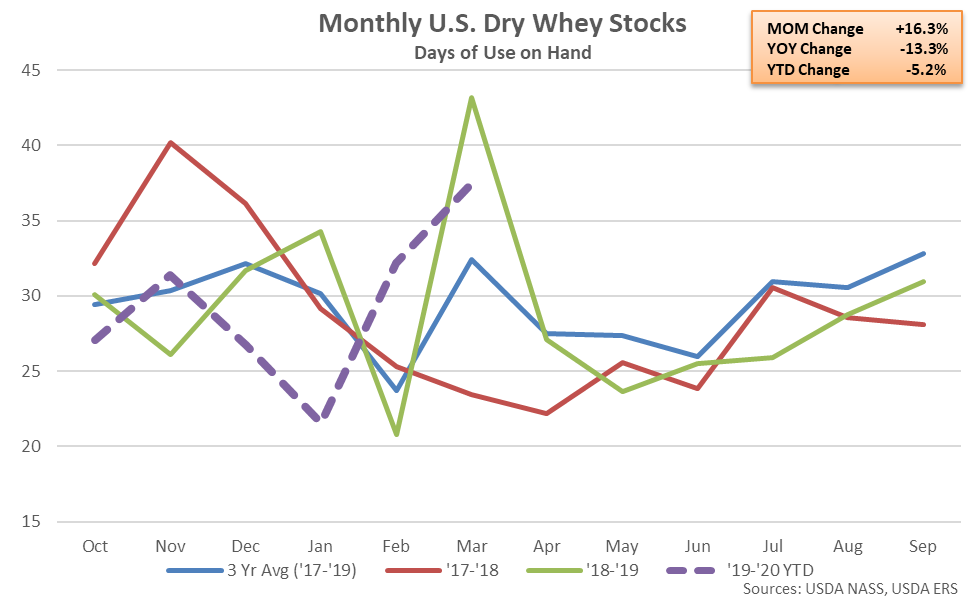

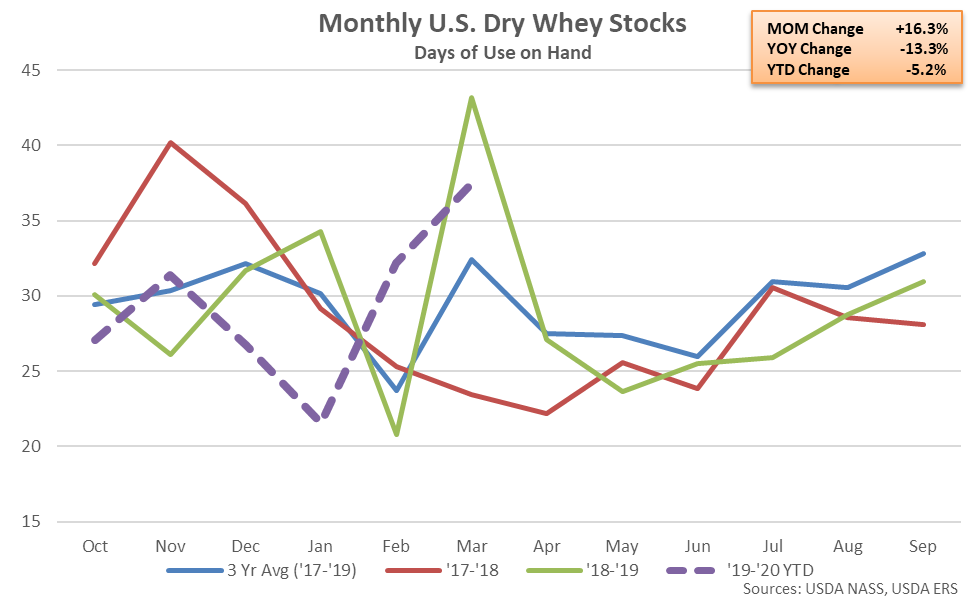

On a days of usage basis, Mar ’20 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, dry whey stocks on a days of usage basis finished 13.3% lower YOY, declining on a YOY basis for the third time in the past four months.

On a days of usage basis, Mar ’20 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, dry whey stocks on a days of usage basis finished 13.3% lower YOY, declining on a YOY basis for the third time in the past four months.

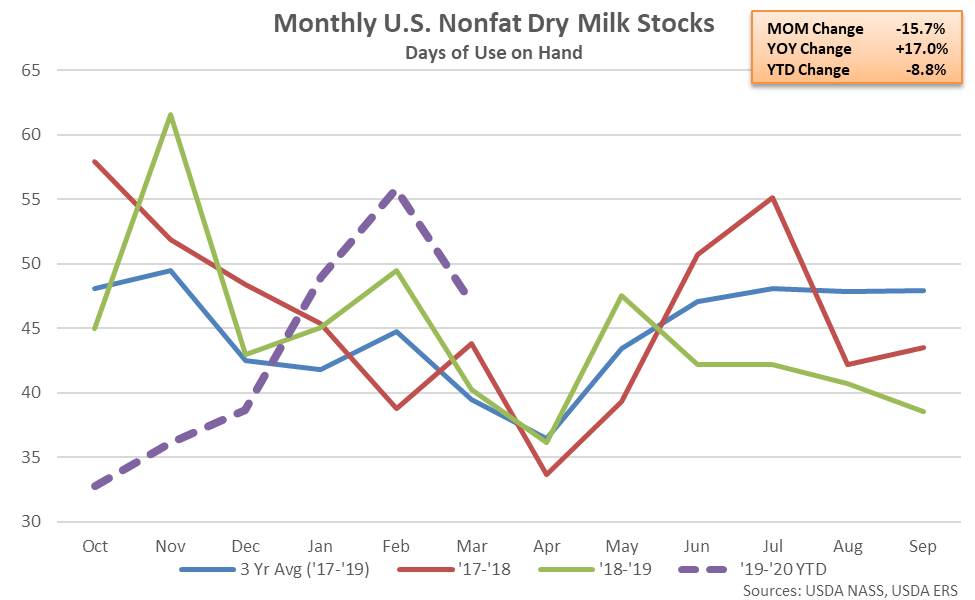

Nonfat Dry Milk – Stocks Increase to a Record High Level, Finish up 20.5% YOY

Nonfat Dry Milk – Stocks Increase to a Record High Level, Finish up 20.5% YOY

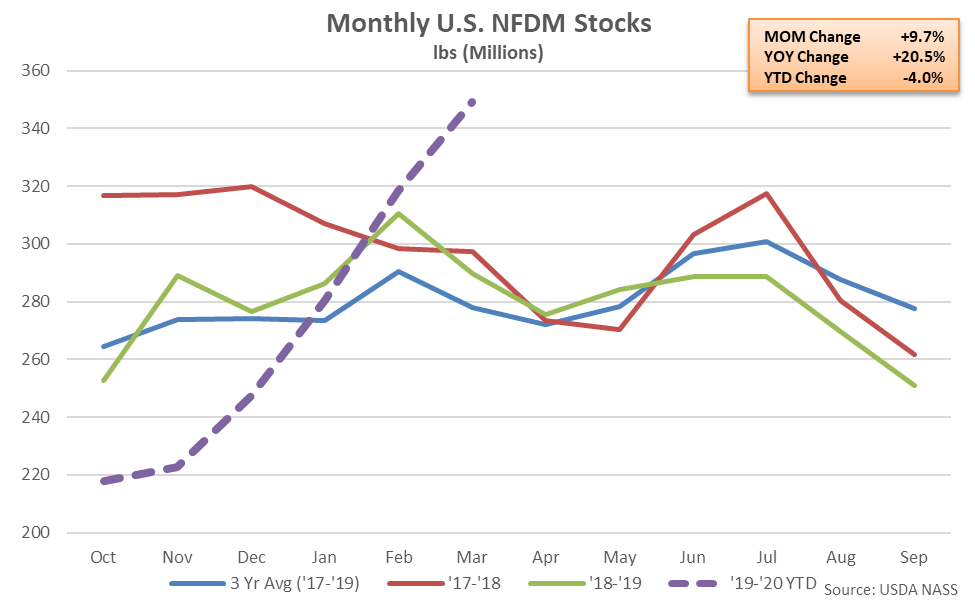

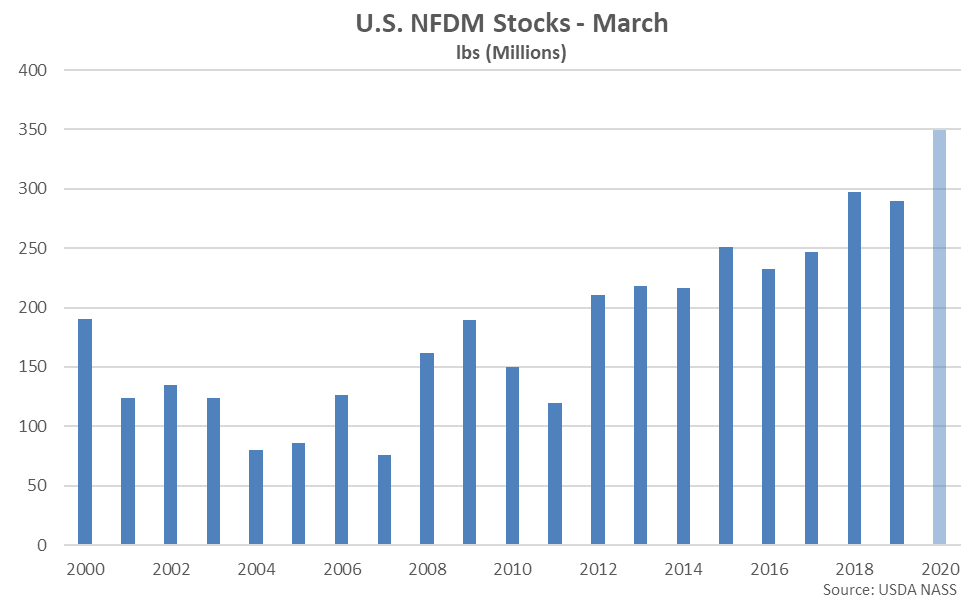

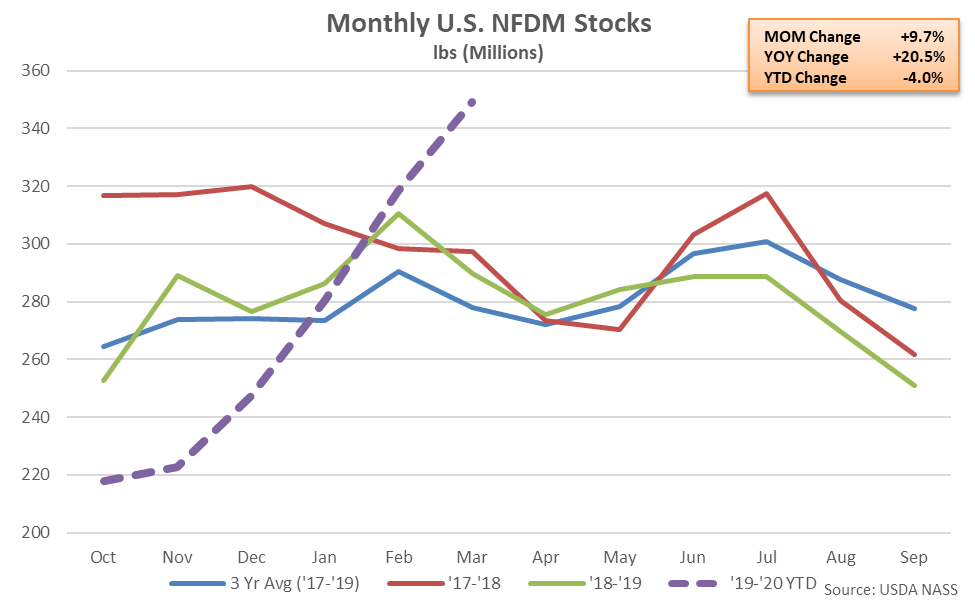

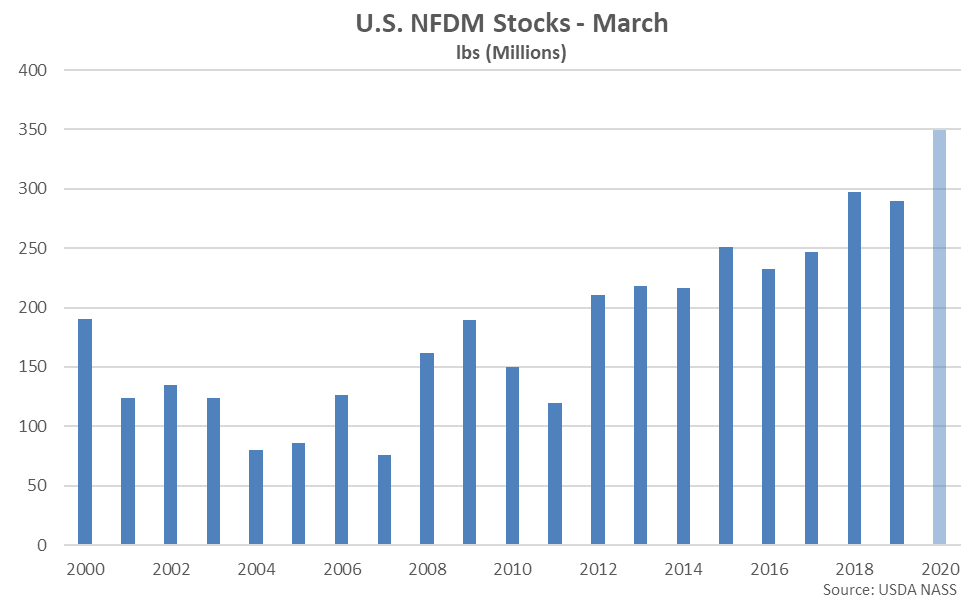

Mar ’20 month-end nonfat dry milk (NFDM) stocks increased 9.7% month-over-month to a record high level, finishing 20.5% higher on a YOY basis. The YOY increase in NFDM stocks was the second experienced in a row and the largest experienced throughout the past two years on a percentage basis. NFDM stocks had finished lower on a YOY basis over eight consecutive months prior to the two most recent increases in stock volumes. The MOM increase in NFDM stocks of 30.9 million pounds, or 9.7%, was significantly greater than the ten year average February – March seasonal build in NFDM stocks of 3.0 million pounds, or 2.0%. NFDM production increased 6.7% on a YOY basis throughout Mar ‘20, finishing higher for the tenth time in the past 11 months.

Mar ’20 month-end nonfat dry milk (NFDM) stocks increased 9.7% month-over-month to a record high level, finishing 20.5% higher on a YOY basis. The YOY increase in NFDM stocks was the second experienced in a row and the largest experienced throughout the past two years on a percentage basis. NFDM stocks had finished lower on a YOY basis over eight consecutive months prior to the two most recent increases in stock volumes. The MOM increase in NFDM stocks of 30.9 million pounds, or 9.7%, was significantly greater than the ten year average February – March seasonal build in NFDM stocks of 3.0 million pounds, or 2.0%. NFDM production increased 6.7% on a YOY basis throughout Mar ‘20, finishing higher for the tenth time in the past 11 months.

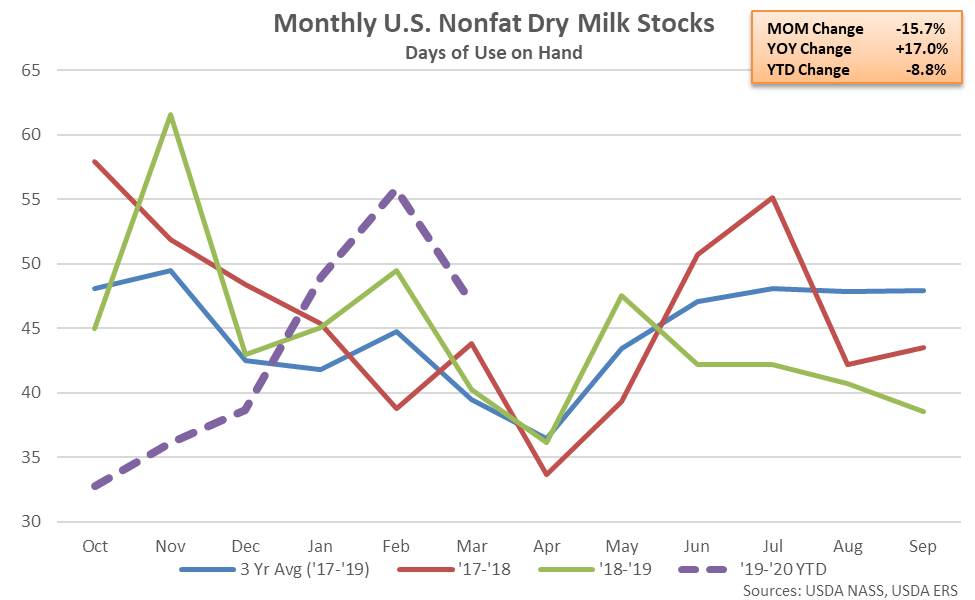

On a days of usage basis, Mar ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, NFDM stocks on a days of usage basis finished 17.0% higher YOY, increasing on a YOY basis for the third consecutive month.

On a days of usage basis, Mar ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, NFDM stocks on a days of usage basis finished 17.0% higher YOY, increasing on a YOY basis for the third consecutive month.

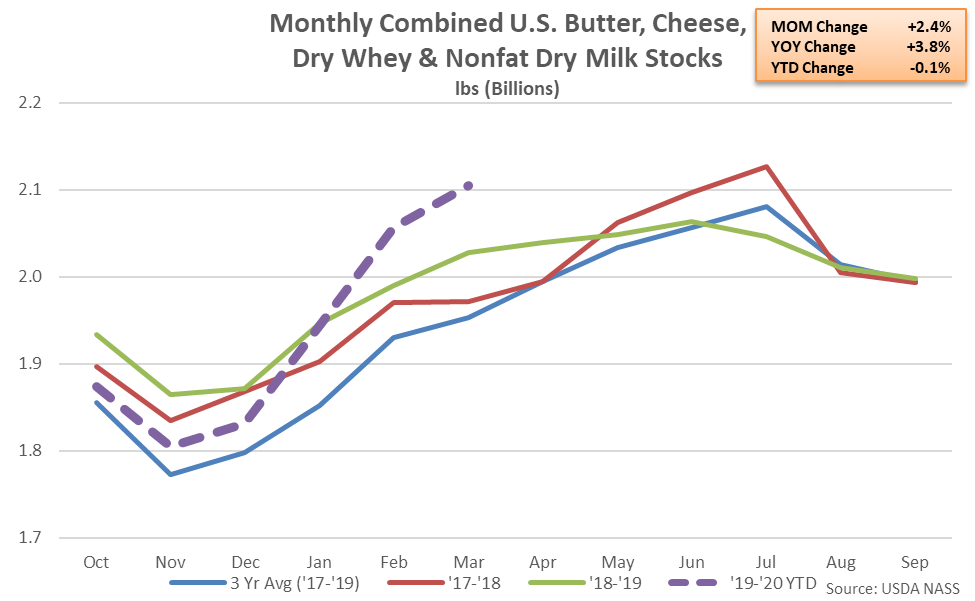

Combined Dairy Product Stocks – Stocks Increase YOY for the Second Consecutive Month, up 3.8%

Combined Dairy Product Stocks – Stocks Increase YOY for the Second Consecutive Month, up 3.8%

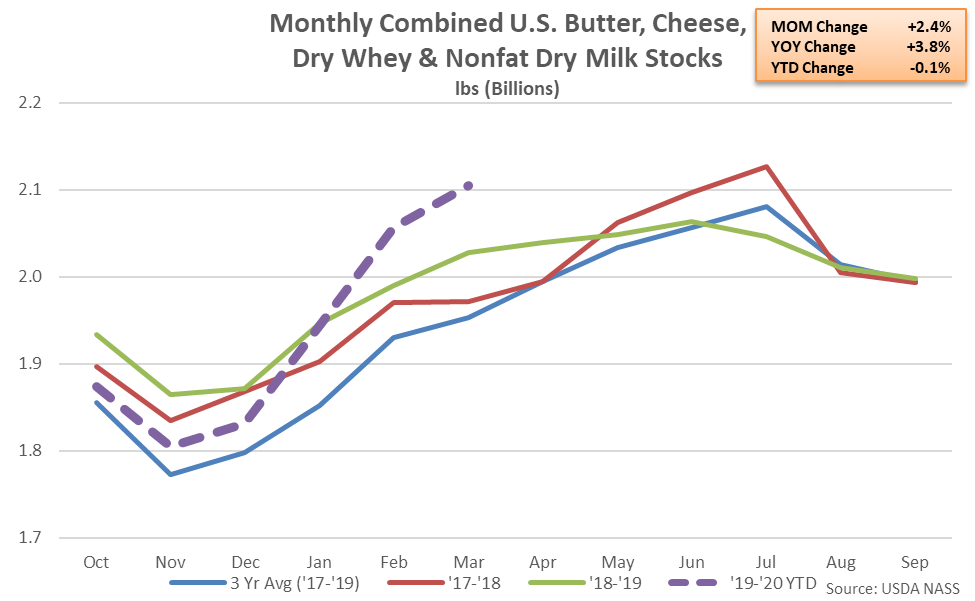

Mar ’20 combined stocks of butter, cheese, dry whey and NFDM increased 3.8% on a YOY basis, finishing higher for the second consecutive month. Combined dairy product stocks reached a record high seasonal level for the month of March.

Mar ’20 combined stocks of butter, cheese, dry whey and NFDM increased 3.8% on a YOY basis, finishing higher for the second consecutive month. Combined dairy product stocks reached a record high seasonal level for the month of March.

- U.S. dry whey stocks finished 12.8% lower on a YOY basis, reaching a five year low seasonal level.

- U.S. nonfat dry milk stocks increased to a record high level throughout Mar ’20, finishing 20.5% higher on a YOY basis.

According to the USDA, Mar ’20 month-end dry whey stocks declined 1.7% from the previous month while finishing 12.8% lower on a YOY basis and reaching a five year low seasonal level. The YOY decline in dry whey stocks was just the second experienced throughout the past seven months. The MOM decline in dry whey stocks of 1.2 million pounds, or 1.7%, was a contraseasonal move when compared to the ten year average February – March seasonal build in dry whey stocks of 3.0 million pounds, or 5.5%. Dry whey production increased 5.4% on a YOY basis throughout Mar ’20, finishing higher for the seventh time in the past eight months.

According to the USDA, Mar ’20 month-end dry whey stocks declined 1.7% from the previous month while finishing 12.8% lower on a YOY basis and reaching a five year low seasonal level. The YOY decline in dry whey stocks was just the second experienced throughout the past seven months. The MOM decline in dry whey stocks of 1.2 million pounds, or 1.7%, was a contraseasonal move when compared to the ten year average February – March seasonal build in dry whey stocks of 3.0 million pounds, or 5.5%. Dry whey production increased 5.4% on a YOY basis throughout Mar ’20, finishing higher for the seventh time in the past eight months.

On a days of usage basis, Mar ’20 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, dry whey stocks on a days of usage basis finished 13.3% lower YOY, declining on a YOY basis for the third time in the past four months.

On a days of usage basis, Mar ’20 U.S. dry whey stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, dry whey stocks on a days of usage basis finished 13.3% lower YOY, declining on a YOY basis for the third time in the past four months.

Nonfat Dry Milk – Stocks Increase to a Record High Level, Finish up 20.5% YOY

Nonfat Dry Milk – Stocks Increase to a Record High Level, Finish up 20.5% YOY

Mar ’20 month-end nonfat dry milk (NFDM) stocks increased 9.7% month-over-month to a record high level, finishing 20.5% higher on a YOY basis. The YOY increase in NFDM stocks was the second experienced in a row and the largest experienced throughout the past two years on a percentage basis. NFDM stocks had finished lower on a YOY basis over eight consecutive months prior to the two most recent increases in stock volumes. The MOM increase in NFDM stocks of 30.9 million pounds, or 9.7%, was significantly greater than the ten year average February – March seasonal build in NFDM stocks of 3.0 million pounds, or 2.0%. NFDM production increased 6.7% on a YOY basis throughout Mar ‘20, finishing higher for the tenth time in the past 11 months.

Mar ’20 month-end nonfat dry milk (NFDM) stocks increased 9.7% month-over-month to a record high level, finishing 20.5% higher on a YOY basis. The YOY increase in NFDM stocks was the second experienced in a row and the largest experienced throughout the past two years on a percentage basis. NFDM stocks had finished lower on a YOY basis over eight consecutive months prior to the two most recent increases in stock volumes. The MOM increase in NFDM stocks of 30.9 million pounds, or 9.7%, was significantly greater than the ten year average February – March seasonal build in NFDM stocks of 3.0 million pounds, or 2.0%. NFDM production increased 6.7% on a YOY basis throughout Mar ‘20, finishing higher for the tenth time in the past 11 months.

On a days of usage basis, Mar ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, NFDM stocks on a days of usage basis finished 17.0% higher YOY, increasing on a YOY basis for the third consecutive month.

On a days of usage basis, Mar ’20 U.S. NFDM stocks also finished higher YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, NFDM stocks on a days of usage basis finished 17.0% higher YOY, increasing on a YOY basis for the third consecutive month.

Combined Dairy Product Stocks – Stocks Increase YOY for the Second Consecutive Month, up 3.8%

Combined Dairy Product Stocks – Stocks Increase YOY for the Second Consecutive Month, up 3.8%

Mar ’20 combined stocks of butter, cheese, dry whey and NFDM increased 3.8% on a YOY basis, finishing higher for the second consecutive month. Combined dairy product stocks reached a record high seasonal level for the month of March.

Mar ’20 combined stocks of butter, cheese, dry whey and NFDM increased 3.8% on a YOY basis, finishing higher for the second consecutive month. Combined dairy product stocks reached a record high seasonal level for the month of March.