Crop Progress Update – 6/1/20

According to the USDA, corn and soybean planting and emergence progress remained ahead of five year average levels during the week ending May 31st however planting progress continued to finish below analyst expectations for both corn and soybeans. The current corn and soybean crops identified to be in good or excellent condition each finished above analyst expectations.

Corn:

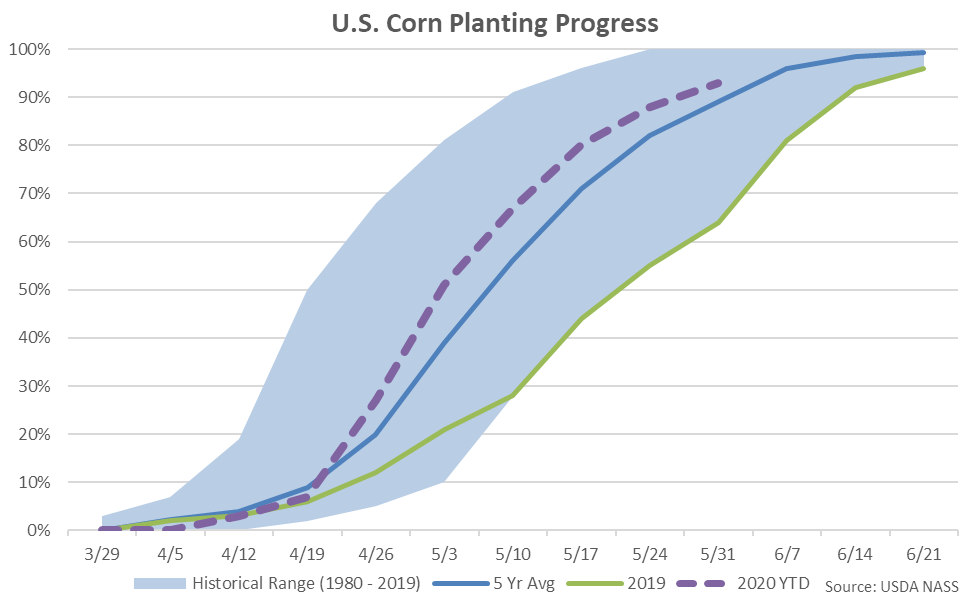

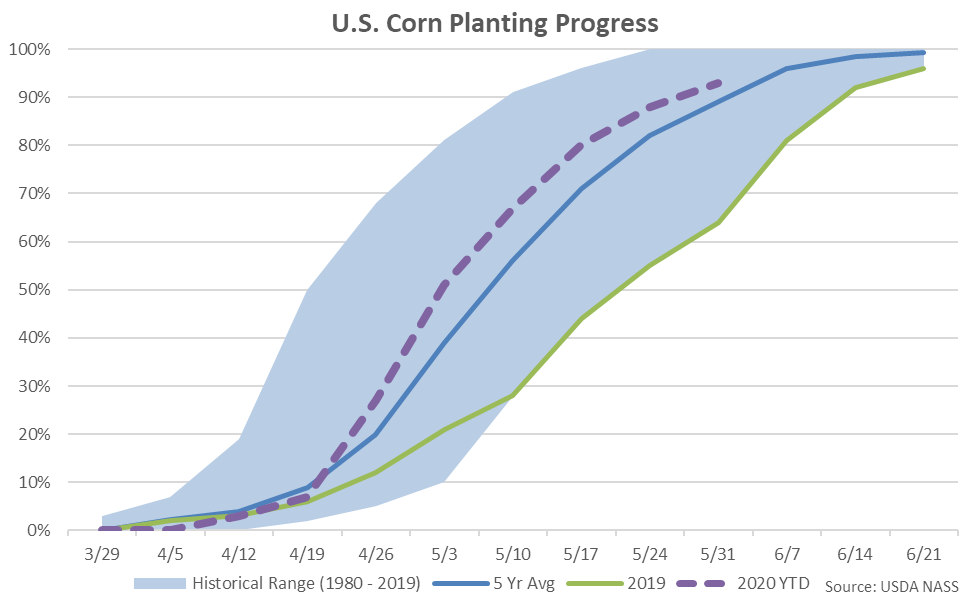

Corn plantings as of the week ending May 31st were 93% completed, finishing ahead of last year’s pace of 64% completed and the five year average pace of 89% completed. Corn planting progress finished slightly below average analyst expectations of 94% completed, however.

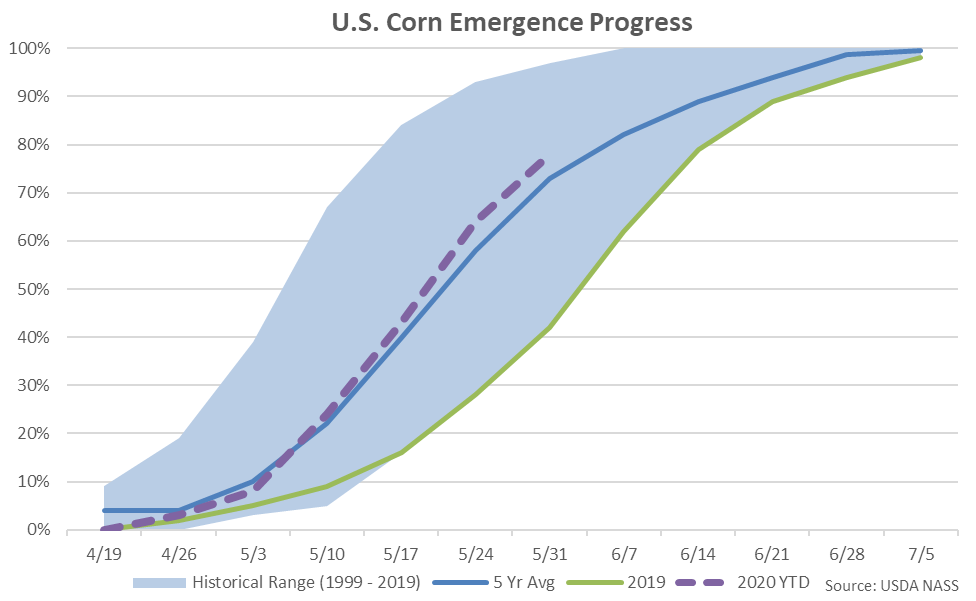

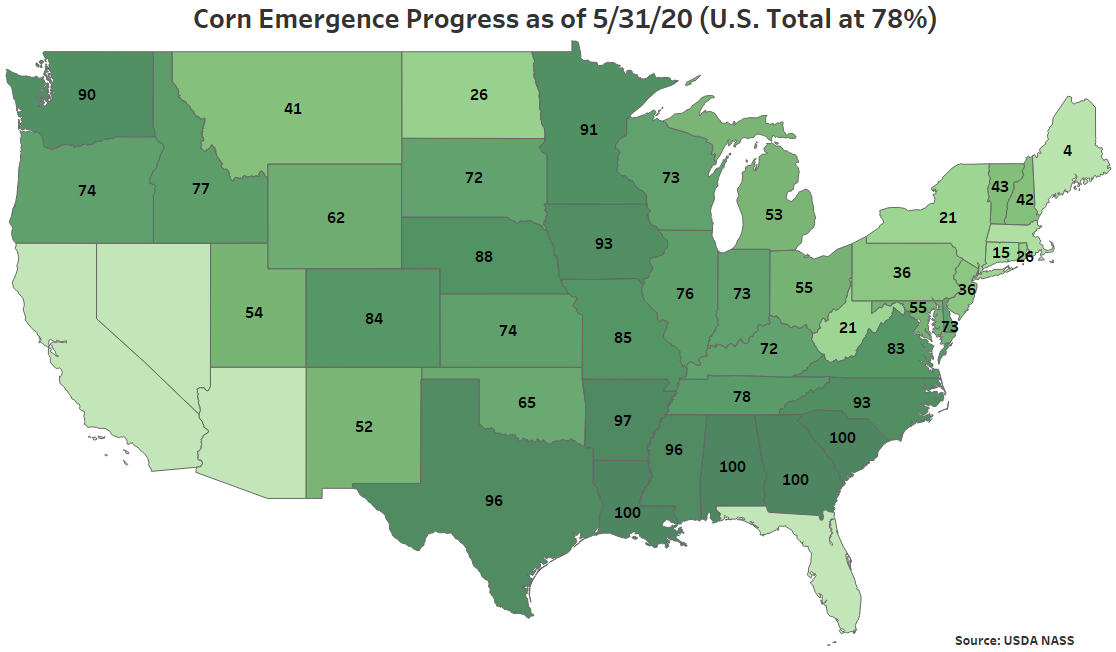

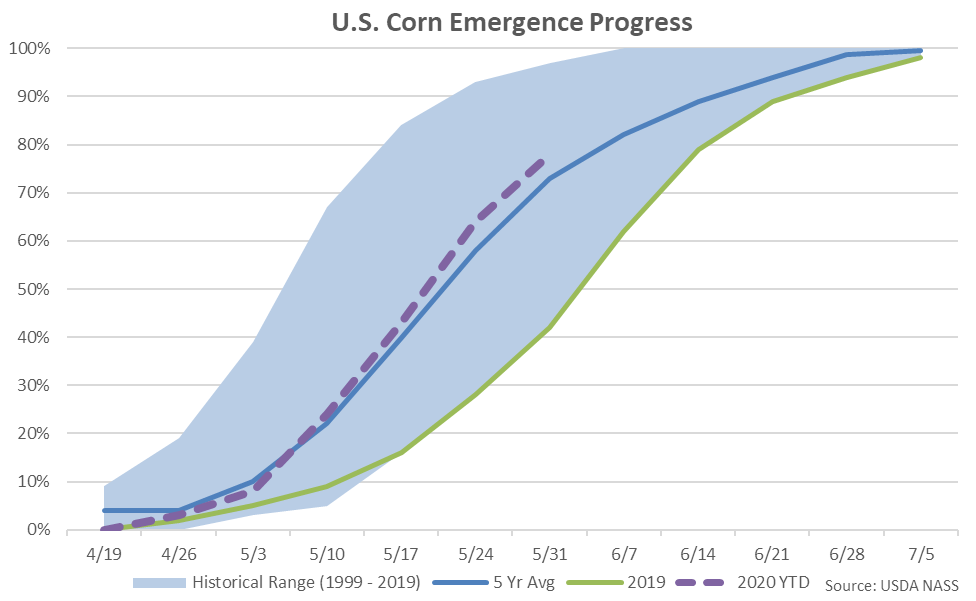

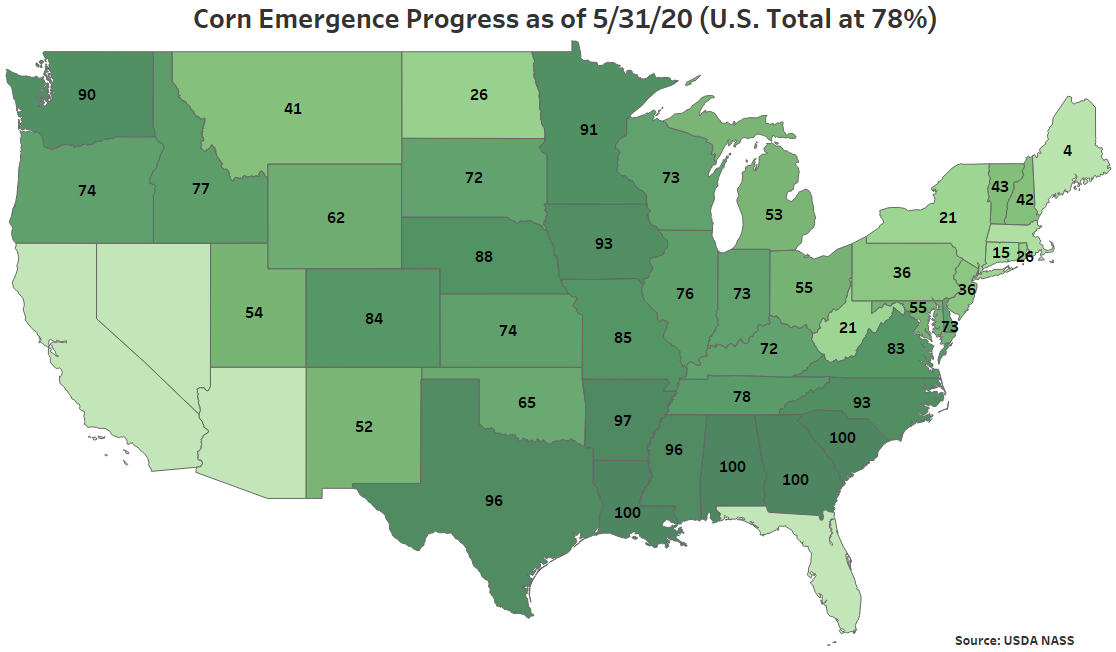

Corn emergence as of the week ending May 31st was 78% completed, finishing ahead of last year’s pace of 42% completed and the five year average pace of 73% completed.

Corn emergence as of the week ending May 31st was 78% completed, finishing ahead of last year’s pace of 42% completed and the five year average pace of 73% completed.

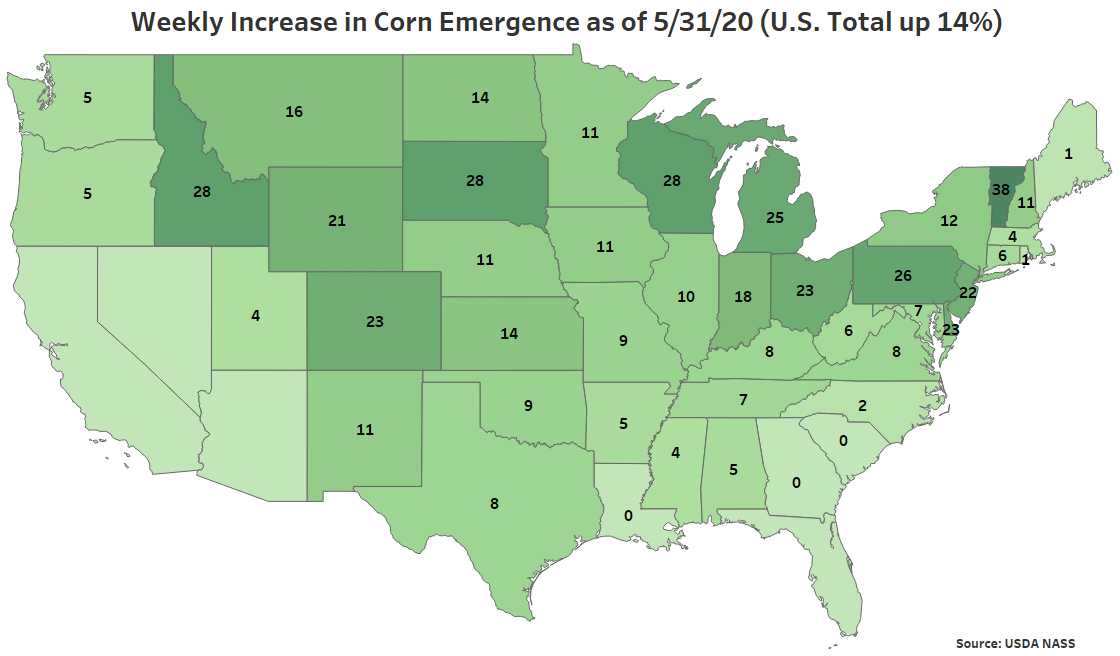

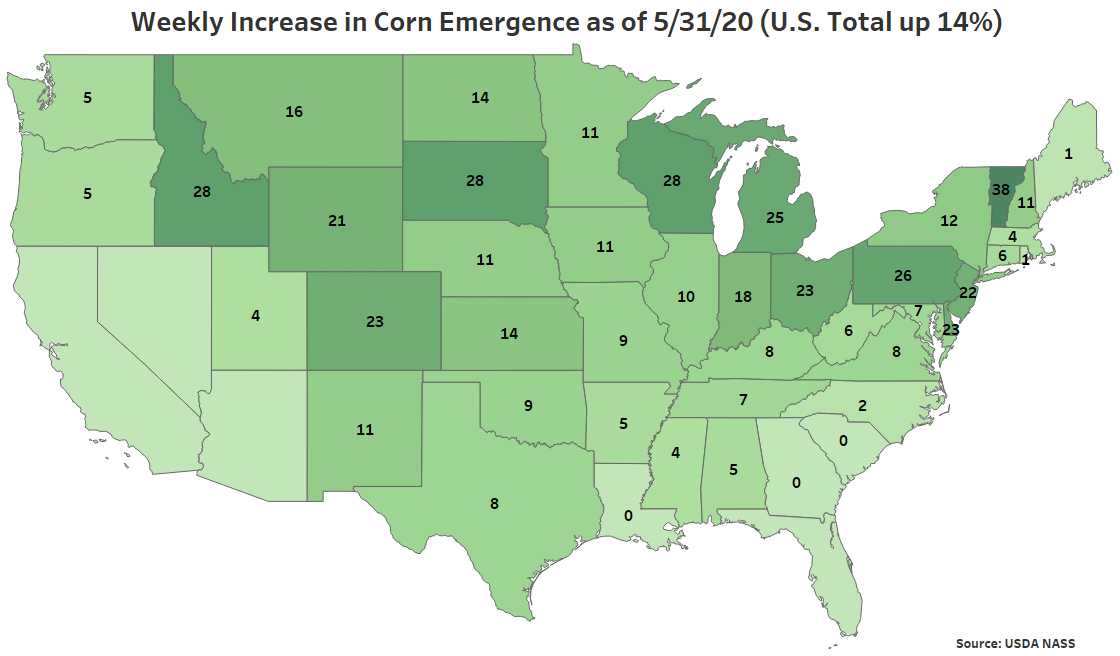

An additional 14% of the total U.S. corn crop emerged during the week ending May 31st. Weekly increases in corn emergence on a percentage basis were led by Vermont, followed by Wisconsin, South Dakota and Idaho.

An additional 14% of the total U.S. corn crop emerged during the week ending May 31st. Weekly increases in corn emergence on a percentage basis were led by Vermont, followed by Wisconsin, South Dakota and Idaho.

74% of the current corn crop was identified to be in good or excellent condition as of the week ending May 29th, up four percent from the previous week. The current corn crop identified to be in good or excellent condition finished above analyst expectations of 71%. Just four percent of the current corn crop was identified as very poor or poor, down one percent from the previous week.

Soybeans:

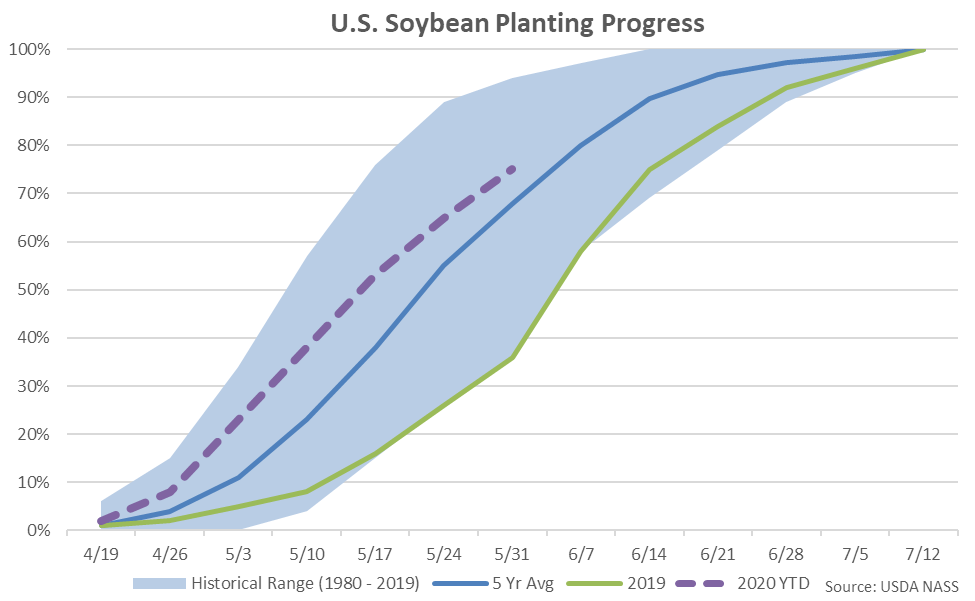

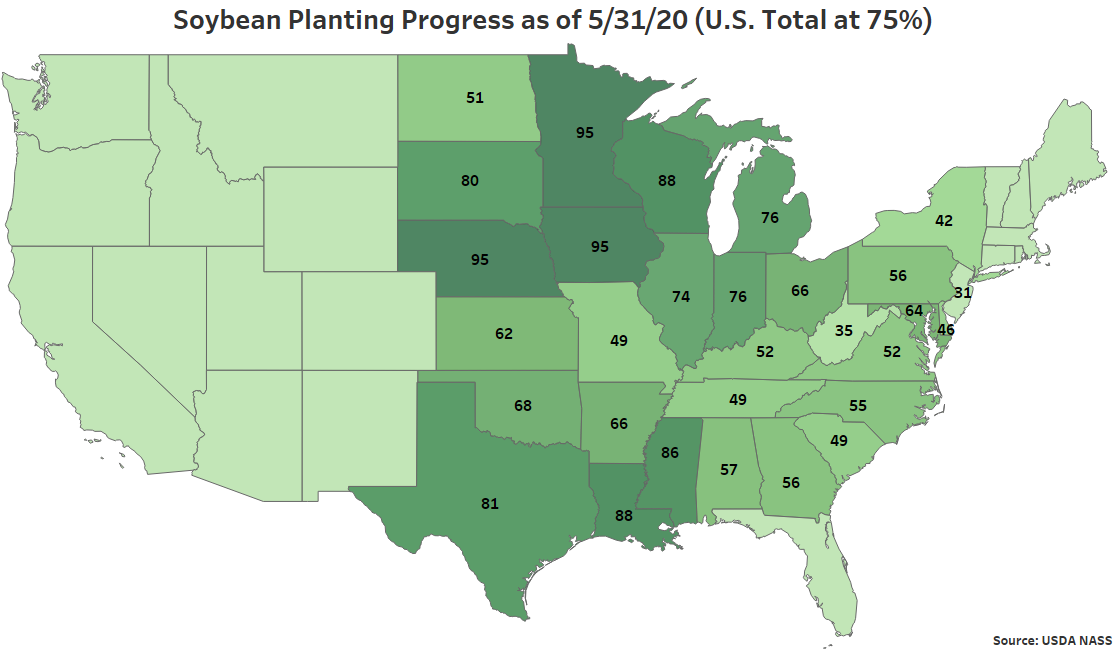

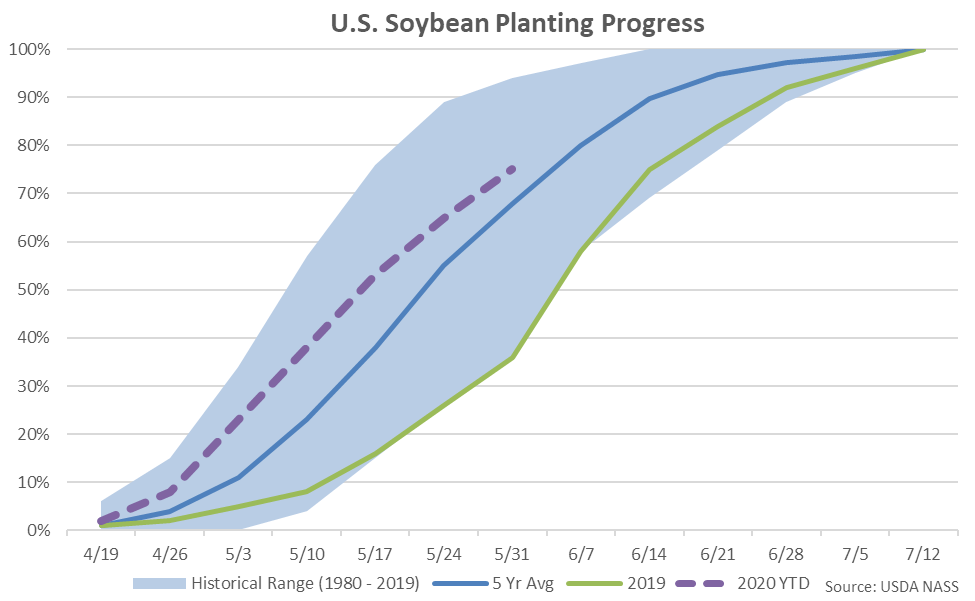

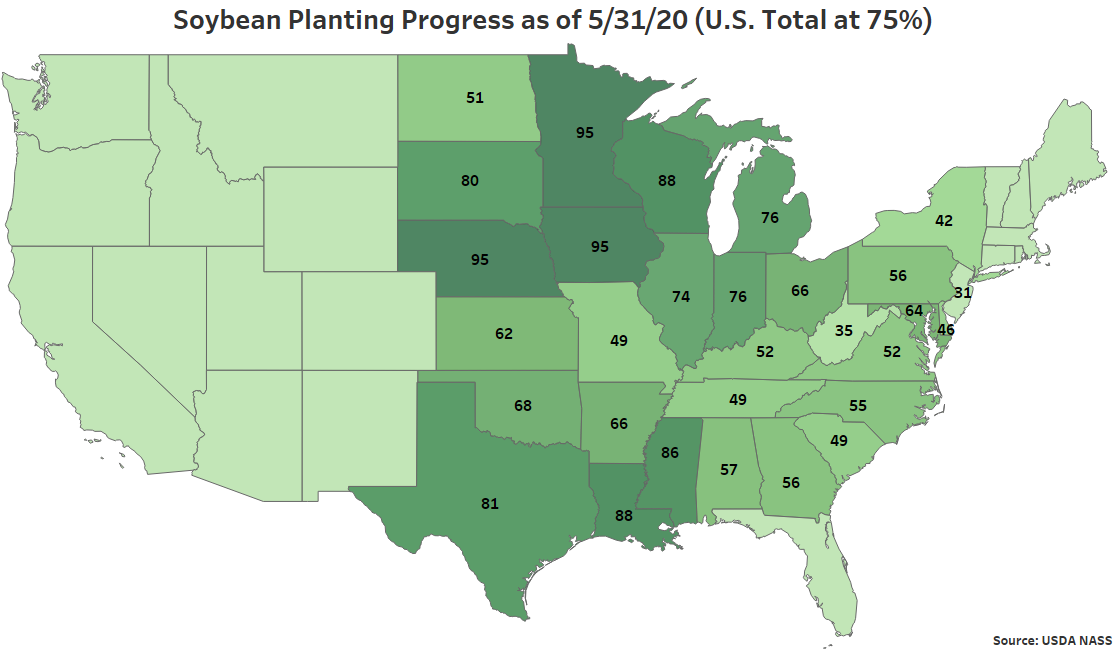

Soybean plantings as of the week ending May 31st were 75% completed, finishing ahead of last year’s pace of 36% completed and the five year average pace of 68% completed. Soybean planting progress finished below average analyst expectations of 79% completed, however.

74% of the current corn crop was identified to be in good or excellent condition as of the week ending May 29th, up four percent from the previous week. The current corn crop identified to be in good or excellent condition finished above analyst expectations of 71%. Just four percent of the current corn crop was identified as very poor or poor, down one percent from the previous week.

Soybeans:

Soybean plantings as of the week ending May 31st were 75% completed, finishing ahead of last year’s pace of 36% completed and the five year average pace of 68% completed. Soybean planting progress finished below average analyst expectations of 79% completed, however.

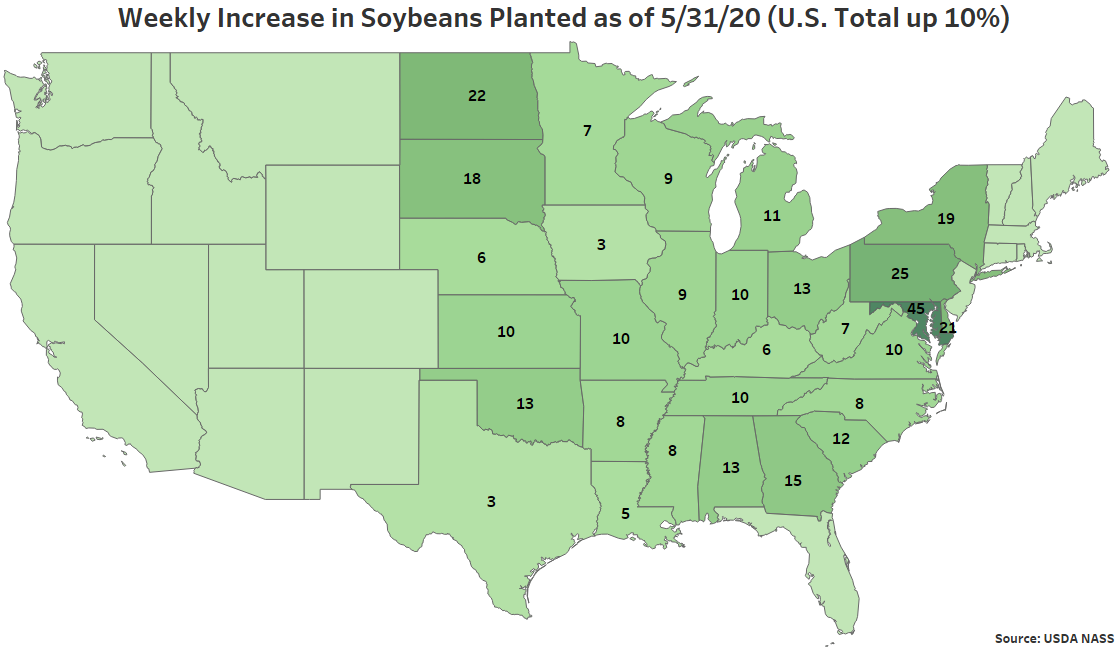

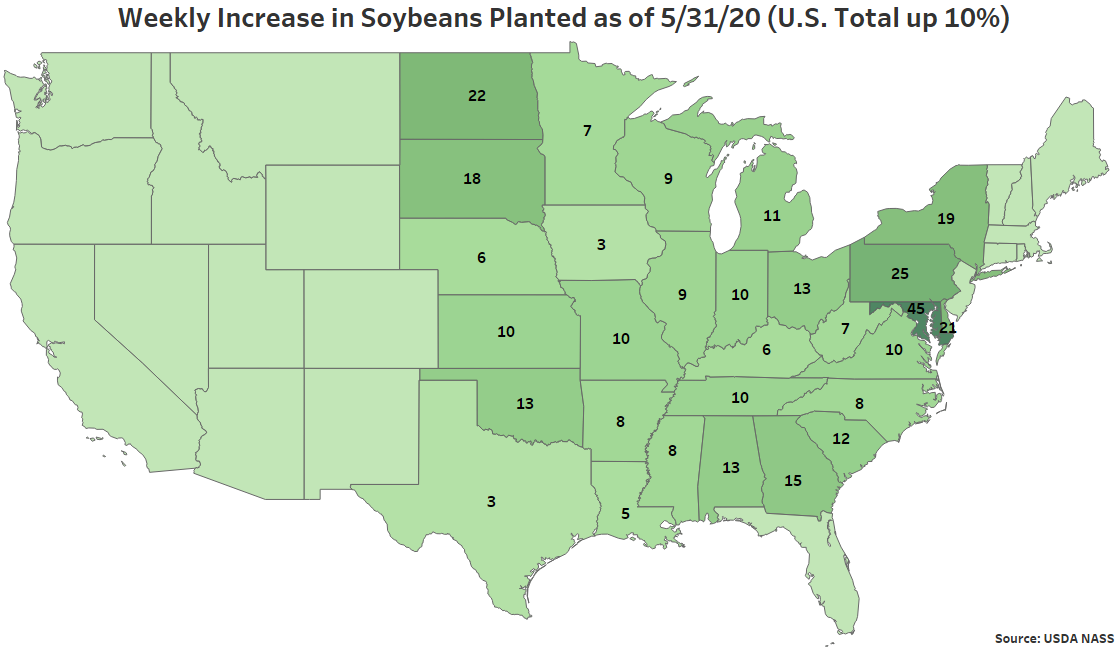

An additional ten percent of the total U.S. soybean crop was planted during the week ending May 31st. Weekly increases in soybean plantings on a percentage basis were led by Maryland, followed by Pennsylvania and North Dakota.

An additional ten percent of the total U.S. soybean crop was planted during the week ending May 31st. Weekly increases in soybean plantings on a percentage basis were led by Maryland, followed by Pennsylvania and North Dakota.

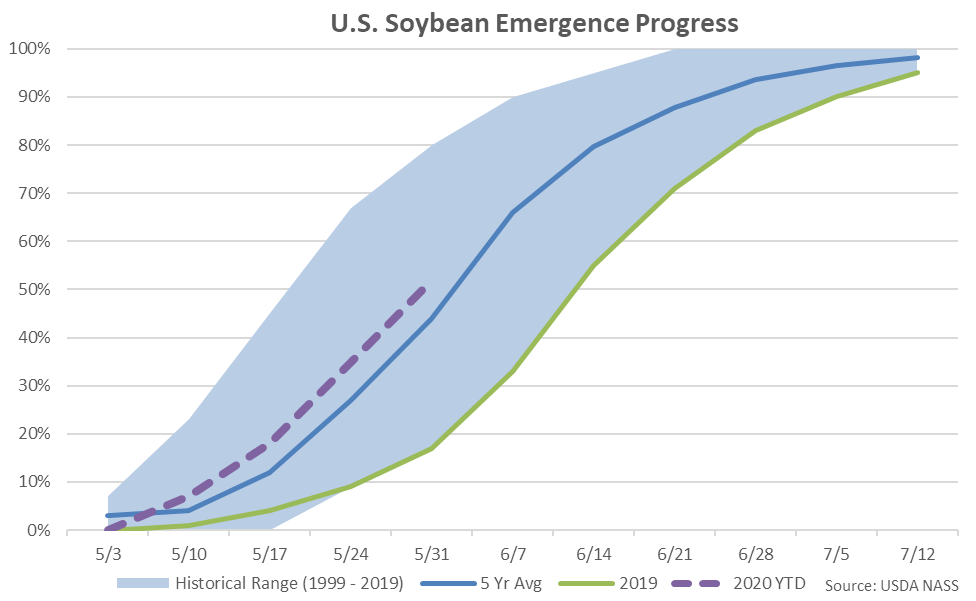

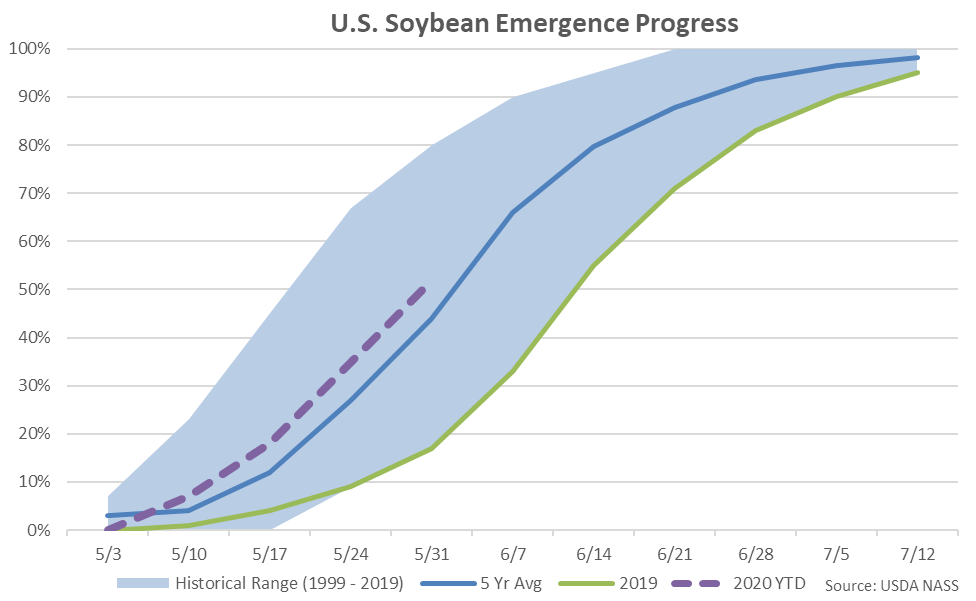

Soybean emergence as of the week ending May 31st was 52% completed, finishing ahead of last year’s pace of 17% completed and the five year average pace of 44% completed.

Soybean emergence as of the week ending May 31st was 52% completed, finishing ahead of last year’s pace of 17% completed and the five year average pace of 44% completed.

70% of the current soybean crop was identified to be in good or excellent condition as of the week ending May 31st, with just four percent of the current soybean crop being identified as very poor or poor. The current soybean crop identified to be in good or excellent condition finished above analyst expectations of 68%.

70% of the current soybean crop was identified to be in good or excellent condition as of the week ending May 31st, with just four percent of the current soybean crop being identified as very poor or poor. The current soybean crop identified to be in good or excellent condition finished above analyst expectations of 68%.

Corn emergence as of the week ending May 31st was 78% completed, finishing ahead of last year’s pace of 42% completed and the five year average pace of 73% completed.

Corn emergence as of the week ending May 31st was 78% completed, finishing ahead of last year’s pace of 42% completed and the five year average pace of 73% completed.

An additional 14% of the total U.S. corn crop emerged during the week ending May 31st. Weekly increases in corn emergence on a percentage basis were led by Vermont, followed by Wisconsin, South Dakota and Idaho.

An additional 14% of the total U.S. corn crop emerged during the week ending May 31st. Weekly increases in corn emergence on a percentage basis were led by Vermont, followed by Wisconsin, South Dakota and Idaho.

74% of the current corn crop was identified to be in good or excellent condition as of the week ending May 29th, up four percent from the previous week. The current corn crop identified to be in good or excellent condition finished above analyst expectations of 71%. Just four percent of the current corn crop was identified as very poor or poor, down one percent from the previous week.

Soybeans:

Soybean plantings as of the week ending May 31st were 75% completed, finishing ahead of last year’s pace of 36% completed and the five year average pace of 68% completed. Soybean planting progress finished below average analyst expectations of 79% completed, however.

74% of the current corn crop was identified to be in good or excellent condition as of the week ending May 29th, up four percent from the previous week. The current corn crop identified to be in good or excellent condition finished above analyst expectations of 71%. Just four percent of the current corn crop was identified as very poor or poor, down one percent from the previous week.

Soybeans:

Soybean plantings as of the week ending May 31st were 75% completed, finishing ahead of last year’s pace of 36% completed and the five year average pace of 68% completed. Soybean planting progress finished below average analyst expectations of 79% completed, however.

An additional ten percent of the total U.S. soybean crop was planted during the week ending May 31st. Weekly increases in soybean plantings on a percentage basis were led by Maryland, followed by Pennsylvania and North Dakota.

An additional ten percent of the total U.S. soybean crop was planted during the week ending May 31st. Weekly increases in soybean plantings on a percentage basis were led by Maryland, followed by Pennsylvania and North Dakota.

Soybean emergence as of the week ending May 31st was 52% completed, finishing ahead of last year’s pace of 17% completed and the five year average pace of 44% completed.

Soybean emergence as of the week ending May 31st was 52% completed, finishing ahead of last year’s pace of 17% completed and the five year average pace of 44% completed.

70% of the current soybean crop was identified to be in good or excellent condition as of the week ending May 31st, with just four percent of the current soybean crop being identified as very poor or poor. The current soybean crop identified to be in good or excellent condition finished above analyst expectations of 68%.

70% of the current soybean crop was identified to be in good or excellent condition as of the week ending May 31st, with just four percent of the current soybean crop being identified as very poor or poor. The current soybean crop identified to be in good or excellent condition finished above analyst expectations of 68%.