EU-28 Dairy Intervention Update – Jun ’20

Executive Summary

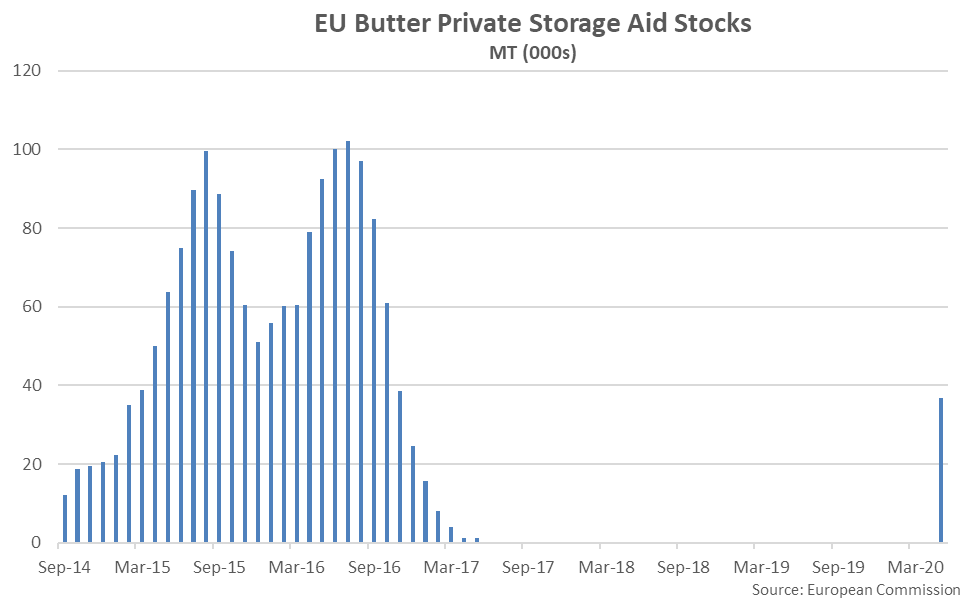

Dairy private storage aid and intervention schemes have been made available to European dairy producers and processors in response to price declines and volatility associated with COVID-19. Highlights through the end of May ’20 include:

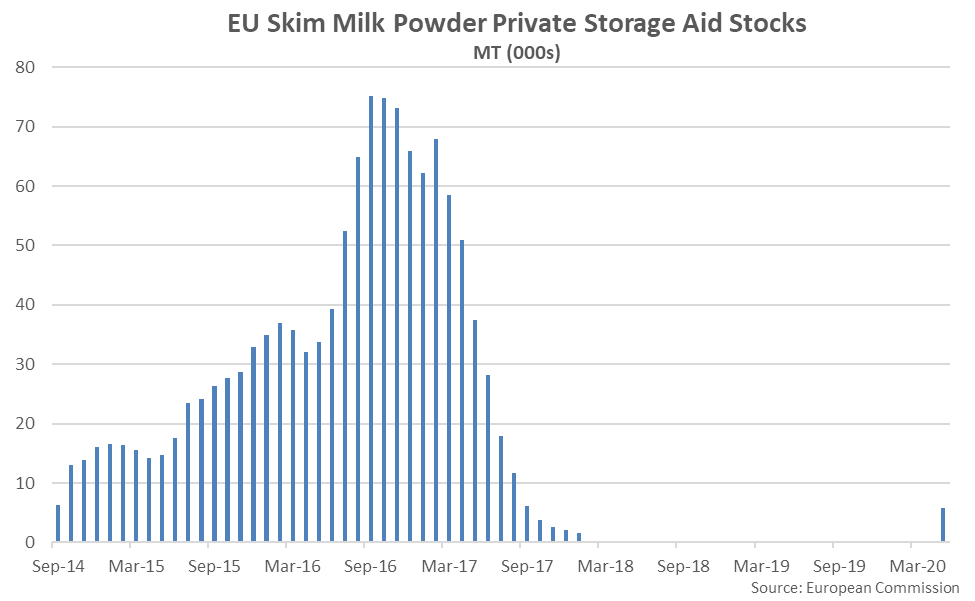

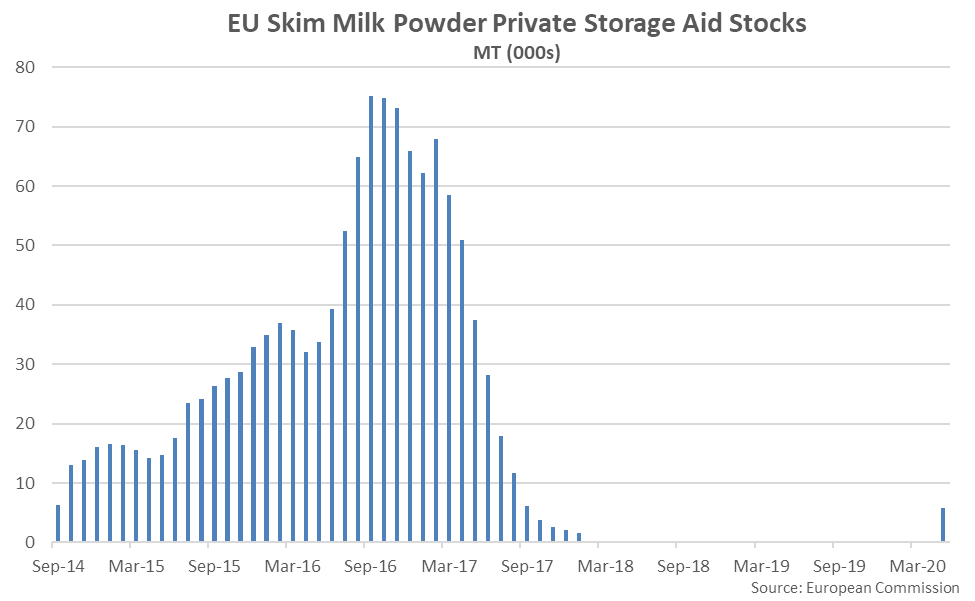

SMP PSA stocks reached a record high of 75,000 tons during Sep ’16 but were gradually withdrawn throughout 2017. PSA SMP stocks have been fully withdrawn throughout the past 26 months up until 5,800 tons were added in May ’20.

SMP PSA stocks reached a record high of 75,000 tons during Sep ’16 but were gradually withdrawn throughout 2017. PSA SMP stocks have been fully withdrawn throughout the past 26 months up until 5,800 tons were added in May ’20.

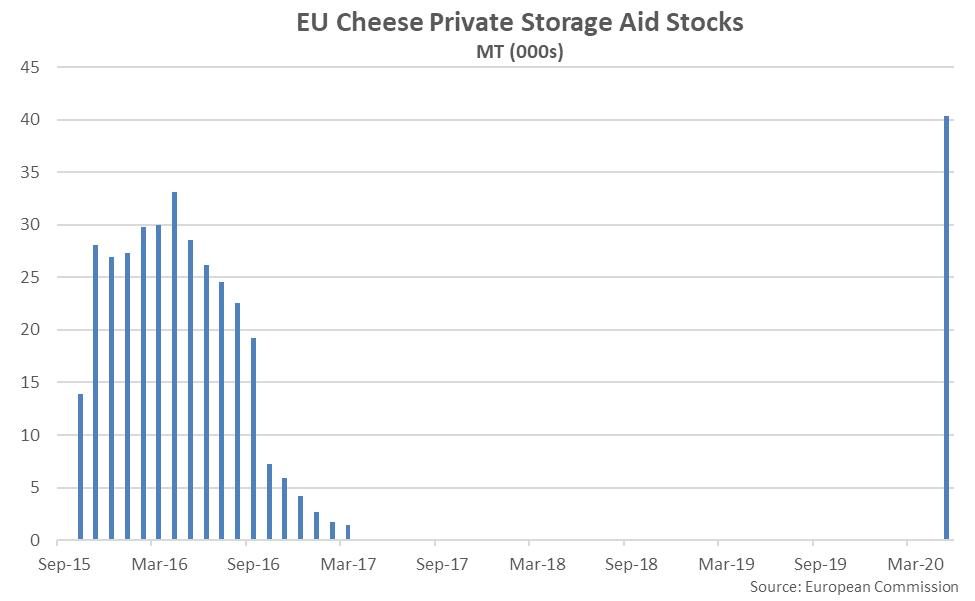

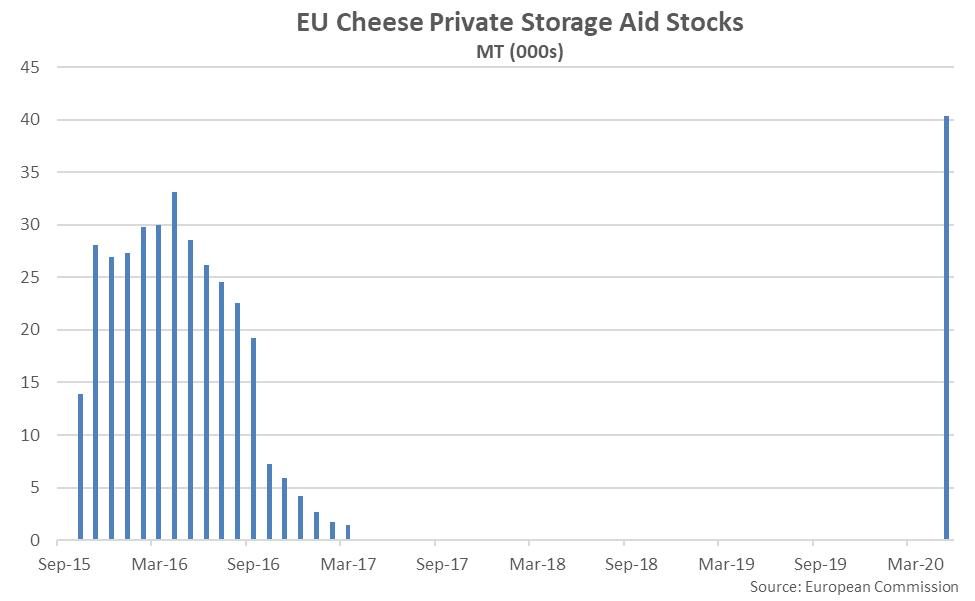

PSA has historically been made available for only butter and SMP however PSA for cheese was reopened during Oct ’15 and again in May ’20, allowing for a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. PSA cheese stocks reached a record high level of 40,300 tons throughout May ’20, exceeding the previous high of 33,100 tons experienced during Apr ’16. Individual member state PSA cheese stock limits have been reached for Ireland, Italy, Spain, Sweden and the United Kingdom through the end of May. The aforementioned member states combined to account for over 60% of the recent increase in PSA cheese stocks.

PSA has historically been made available for only butter and SMP however PSA for cheese was reopened during Oct ’15 and again in May ’20, allowing for a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. PSA cheese stocks reached a record high level of 40,300 tons throughout May ’20, exceeding the previous high of 33,100 tons experienced during Apr ’16. Individual member state PSA cheese stock limits have been reached for Ireland, Italy, Spain, Sweden and the United Kingdom through the end of May. The aforementioned member states combined to account for over 60% of the recent increase in PSA cheese stocks.

Intervention Schemes

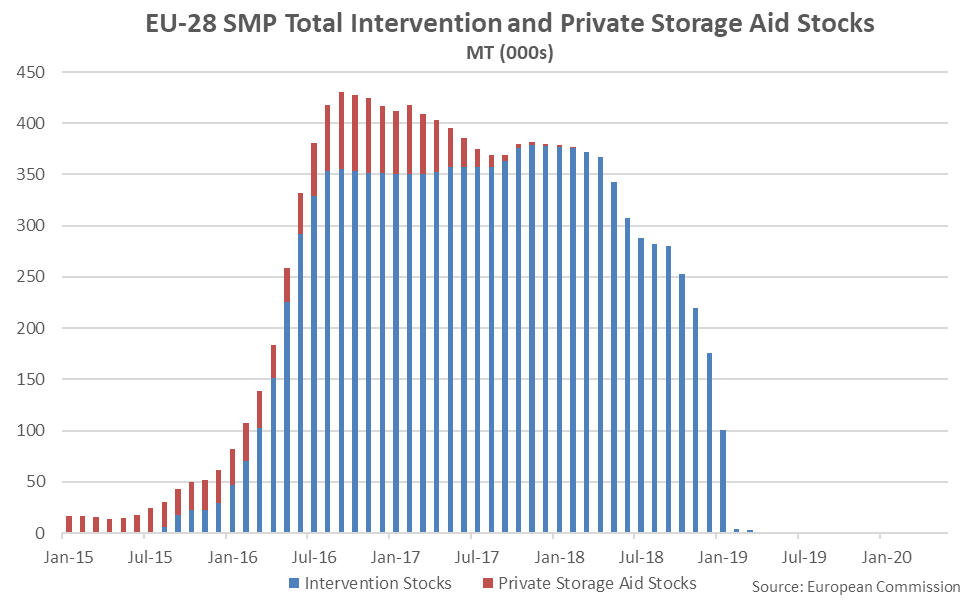

EU-28 dairy intervention schemes, which involve selling quantities of products into government owned storage to help stabilize prices, have historically been made available to producers. Under intervention schemes, the European Commission can purchase up to 50,000 tons of butter and 109,000 tons of skim milk powder (SMP) and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year. The 2020 intervention schemes opened at the beginning of Mar ’20 and will be made available until the end of Sep ’20.

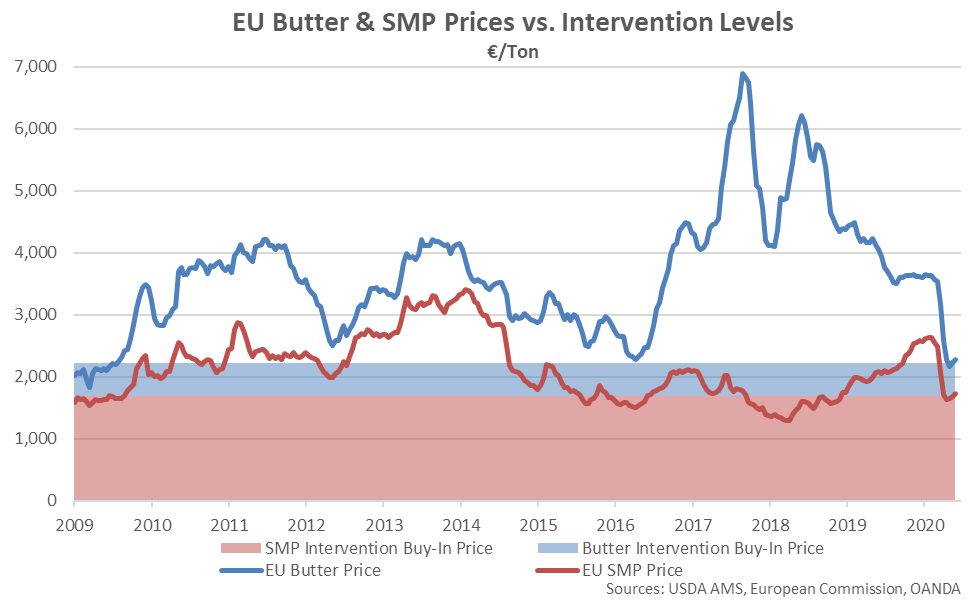

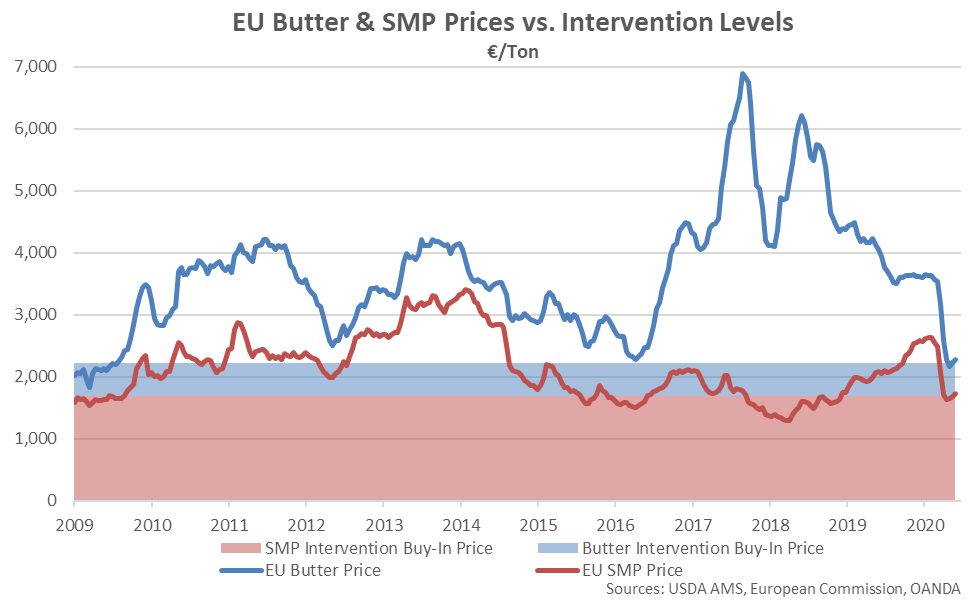

The trigger price for butter intervention has traditionally been set at €2,218/ton ($1.12/lb. equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price has been traditionally set at €1,698/ton ($0.86/lb. equivalent using a 0.90 USD/EUR exchange rate). Average European SMP and butter prices briefly fell below the intervention trigger price levels during early May ’20 but rebounded to levels 1.7% and 2.4% above the intervention trigger prices, respectively, as of the end of May ’20.

Intervention Schemes

EU-28 dairy intervention schemes, which involve selling quantities of products into government owned storage to help stabilize prices, have historically been made available to producers. Under intervention schemes, the European Commission can purchase up to 50,000 tons of butter and 109,000 tons of skim milk powder (SMP) and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year. The 2020 intervention schemes opened at the beginning of Mar ’20 and will be made available until the end of Sep ’20.

The trigger price for butter intervention has traditionally been set at €2,218/ton ($1.12/lb. equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price has been traditionally set at €1,698/ton ($0.86/lb. equivalent using a 0.90 USD/EUR exchange rate). Average European SMP and butter prices briefly fell below the intervention trigger price levels during early May ’20 but rebounded to levels 1.7% and 2.4% above the intervention trigger prices, respectively, as of the end of May ’20.

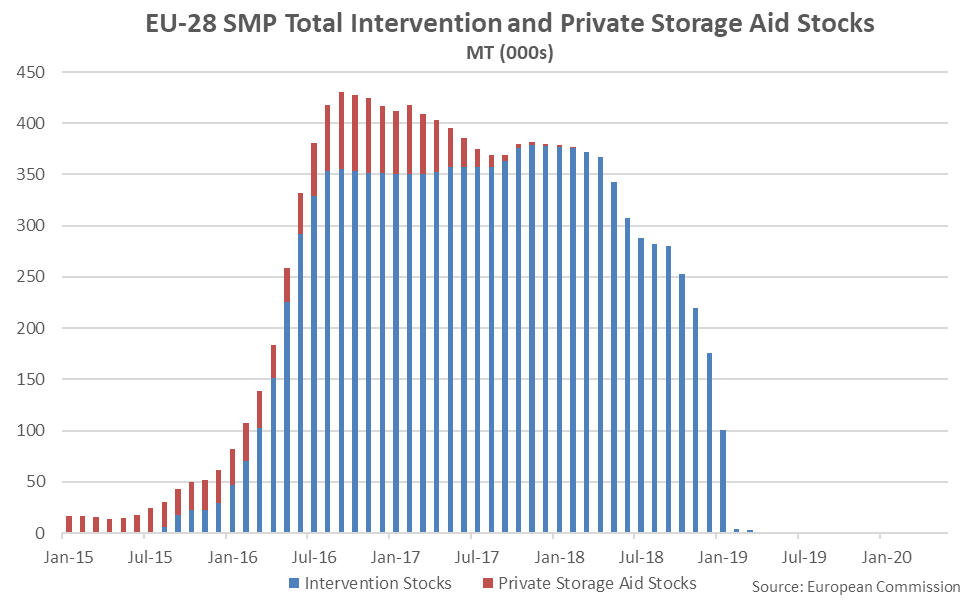

Significant quantities of SMP intervention stocks were purchased throughout 2016 as prices remained below intervention trigger price levels throughout the first half of the year. SMP stocks were rapidly withdrawn throughout the second half of 2018 and early months of 2019 via a tendering process, however. Minimal volumes of SMP entered intervention throughout May ’20 while butter intervention stocks have remained empty since the first half of 2012.

Significant quantities of SMP intervention stocks were purchased throughout 2016 as prices remained below intervention trigger price levels throughout the first half of the year. SMP stocks were rapidly withdrawn throughout the second half of 2018 and early months of 2019 via a tendering process, however. Minimal volumes of SMP entered intervention throughout May ’20 while butter intervention stocks have remained empty since the first half of 2012.

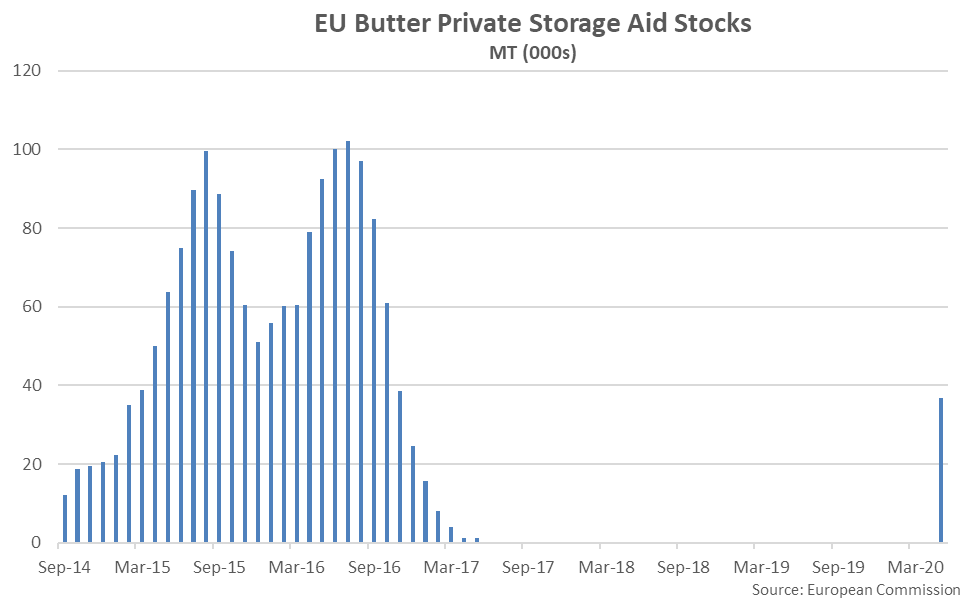

- EU private storage aid of butter, skim milk powder and cheese was reopened May 7th and will remain open until Jun 30th. Through the end of May, 5,800 tons of skim milk powder, 36,800 tons of butter and 40,300 tons of cheese have been added to private storage aid. Private storage aid cheese stocks reached a record high level through the end of May ’20, with over 40% of the scheme limit being filled.

- Intervention schemes for skim milk powder and butter were opened at the beginning of Mar ’20 and will run through the end of Sep ’20. Average European skim milk powder and butter prices briefly fell below the intervention trigger price during early May ’20 but rebounded to levels 1.7% and 2.4% above the intervention trigger prices, respectively, as of the end of May ’20.

- Significant quantities of skim milk powder intervention stocks were purchased throughout 2016 however stocks were rapidly withdrawn throughout the second half of 2018 and early months of 2019. Minimal volumes of skim milk powder entered intervention throughout May ’20 while butter intervention stocks have remained empty since 2012.

SMP PSA stocks reached a record high of 75,000 tons during Sep ’16 but were gradually withdrawn throughout 2017. PSA SMP stocks have been fully withdrawn throughout the past 26 months up until 5,800 tons were added in May ’20.

SMP PSA stocks reached a record high of 75,000 tons during Sep ’16 but were gradually withdrawn throughout 2017. PSA SMP stocks have been fully withdrawn throughout the past 26 months up until 5,800 tons were added in May ’20.

PSA has historically been made available for only butter and SMP however PSA for cheese was reopened during Oct ’15 and again in May ’20, allowing for a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. PSA cheese stocks reached a record high level of 40,300 tons throughout May ’20, exceeding the previous high of 33,100 tons experienced during Apr ’16. Individual member state PSA cheese stock limits have been reached for Ireland, Italy, Spain, Sweden and the United Kingdom through the end of May. The aforementioned member states combined to account for over 60% of the recent increase in PSA cheese stocks.

PSA has historically been made available for only butter and SMP however PSA for cheese was reopened during Oct ’15 and again in May ’20, allowing for a maximum of 100,000 tons of cheese to be put into storage at subsidized rates, with additional volume limits for individual member states also in effect. PSA cheese stocks reached a record high level of 40,300 tons throughout May ’20, exceeding the previous high of 33,100 tons experienced during Apr ’16. Individual member state PSA cheese stock limits have been reached for Ireland, Italy, Spain, Sweden and the United Kingdom through the end of May. The aforementioned member states combined to account for over 60% of the recent increase in PSA cheese stocks.

Intervention Schemes

EU-28 dairy intervention schemes, which involve selling quantities of products into government owned storage to help stabilize prices, have historically been made available to producers. Under intervention schemes, the European Commission can purchase up to 50,000 tons of butter and 109,000 tons of skim milk powder (SMP) and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year. The 2020 intervention schemes opened at the beginning of Mar ’20 and will be made available until the end of Sep ’20.

The trigger price for butter intervention has traditionally been set at €2,218/ton ($1.12/lb. equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price has been traditionally set at €1,698/ton ($0.86/lb. equivalent using a 0.90 USD/EUR exchange rate). Average European SMP and butter prices briefly fell below the intervention trigger price levels during early May ’20 but rebounded to levels 1.7% and 2.4% above the intervention trigger prices, respectively, as of the end of May ’20.

Intervention Schemes

EU-28 dairy intervention schemes, which involve selling quantities of products into government owned storage to help stabilize prices, have historically been made available to producers. Under intervention schemes, the European Commission can purchase up to 50,000 tons of butter and 109,000 tons of skim milk powder (SMP) and, if exceeded, a tendering process takes place for additional volumes. Intervention schemes can be seasonal or in response to exceptional market conditions. The intervention scheme is typically open from the beginning of March until the end of September each year. The 2020 intervention schemes opened at the beginning of Mar ’20 and will be made available until the end of Sep ’20.

The trigger price for butter intervention has traditionally been set at €2,218/ton ($1.12/lb. equivalent using a 0.90 USD/EUR exchange rate), while the SMP intervention trigger price has been traditionally set at €1,698/ton ($0.86/lb. equivalent using a 0.90 USD/EUR exchange rate). Average European SMP and butter prices briefly fell below the intervention trigger price levels during early May ’20 but rebounded to levels 1.7% and 2.4% above the intervention trigger prices, respectively, as of the end of May ’20.

Significant quantities of SMP intervention stocks were purchased throughout 2016 as prices remained below intervention trigger price levels throughout the first half of the year. SMP stocks were rapidly withdrawn throughout the second half of 2018 and early months of 2019 via a tendering process, however. Minimal volumes of SMP entered intervention throughout May ’20 while butter intervention stocks have remained empty since the first half of 2012.

Significant quantities of SMP intervention stocks were purchased throughout 2016 as prices remained below intervention trigger price levels throughout the first half of the year. SMP stocks were rapidly withdrawn throughout the second half of 2018 and early months of 2019 via a tendering process, however. Minimal volumes of SMP entered intervention throughout May ’20 while butter intervention stocks have remained empty since the first half of 2012.