U.S. Dairy Cow Slaughter Update – Jun ’20

Executive Summary

U.S. dairy cow slaughter figures provided by the USDA were recently updated with values spanning through May ’20. Highlights from the updated report include:

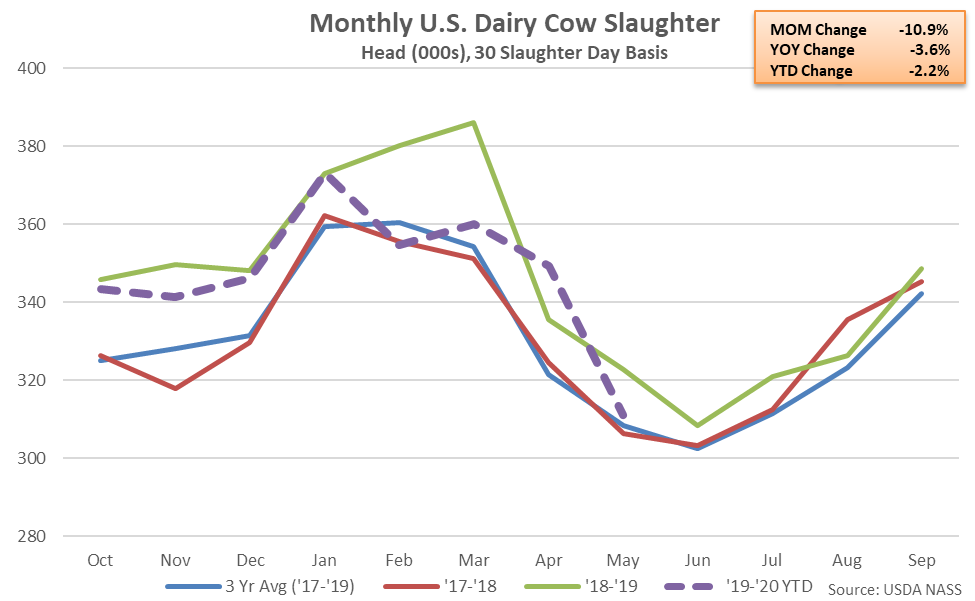

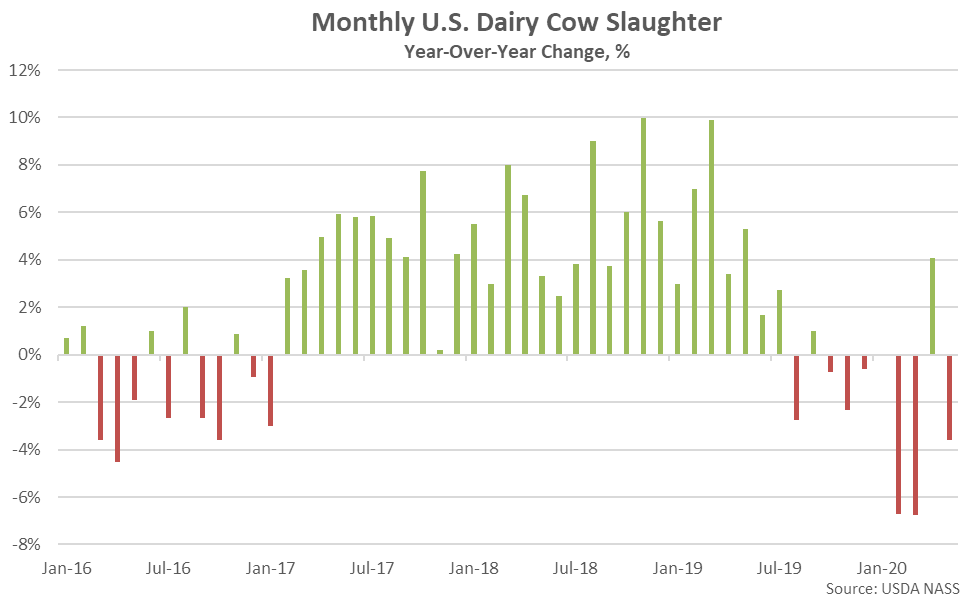

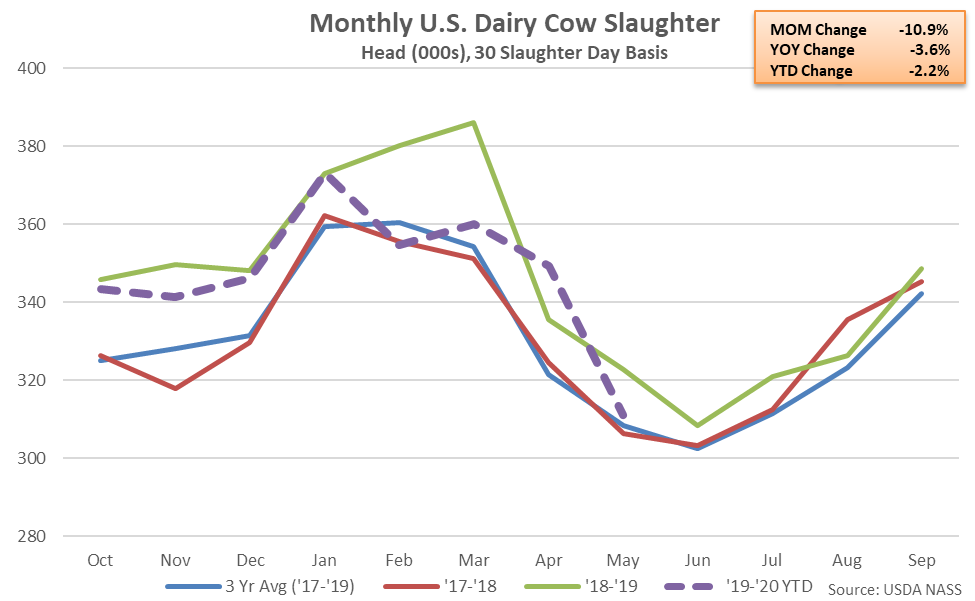

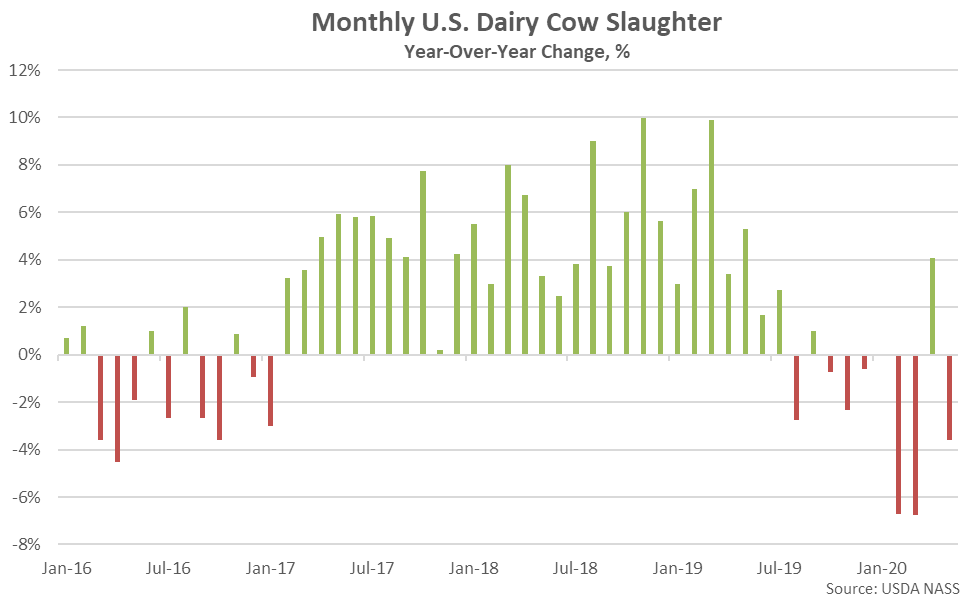

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to finishing flat or lower throughout eight of the past ten months through May ’20.

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to finishing flat or lower throughout eight of the past ten months through May ’20.

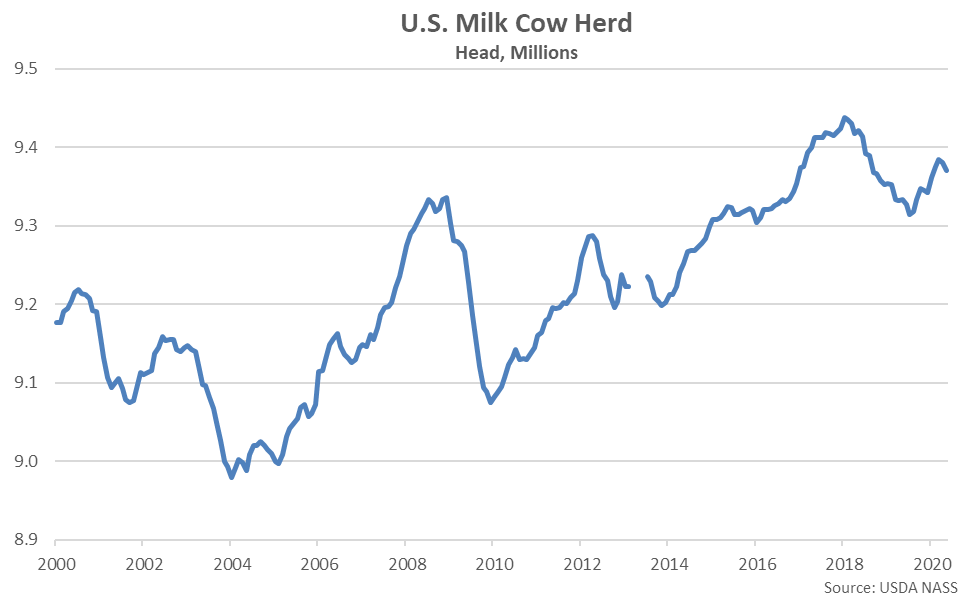

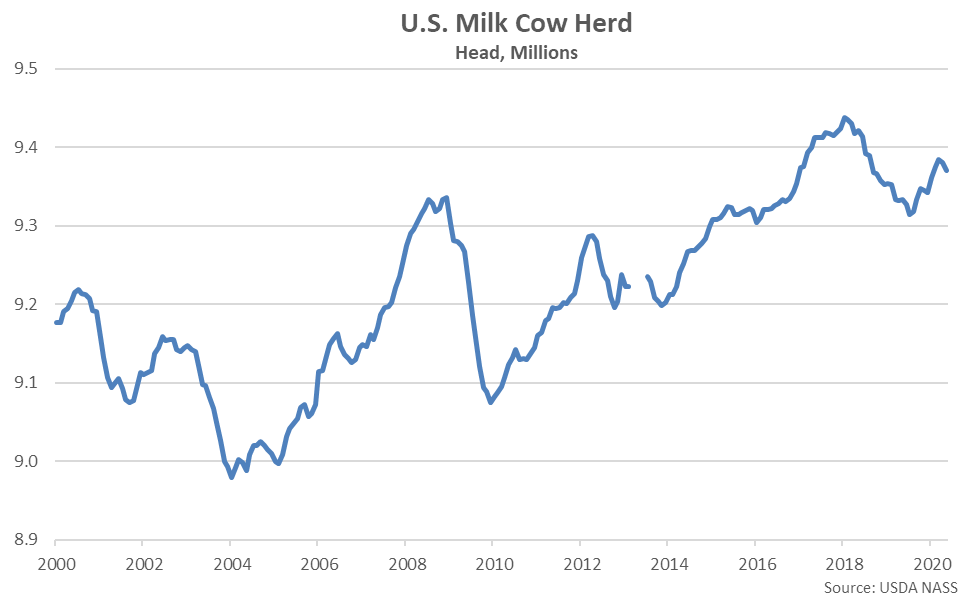

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through May ’20. The May ’20 U.S. milk cow herd declined 11,000 head from the previous month, reaching a four month low level, but remained 37,000 head above previous year levels.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through May ’20. The May ’20 U.S. milk cow herd declined 11,000 head from the previous month, reaching a four month low level, but remained 37,000 head above previous year levels.

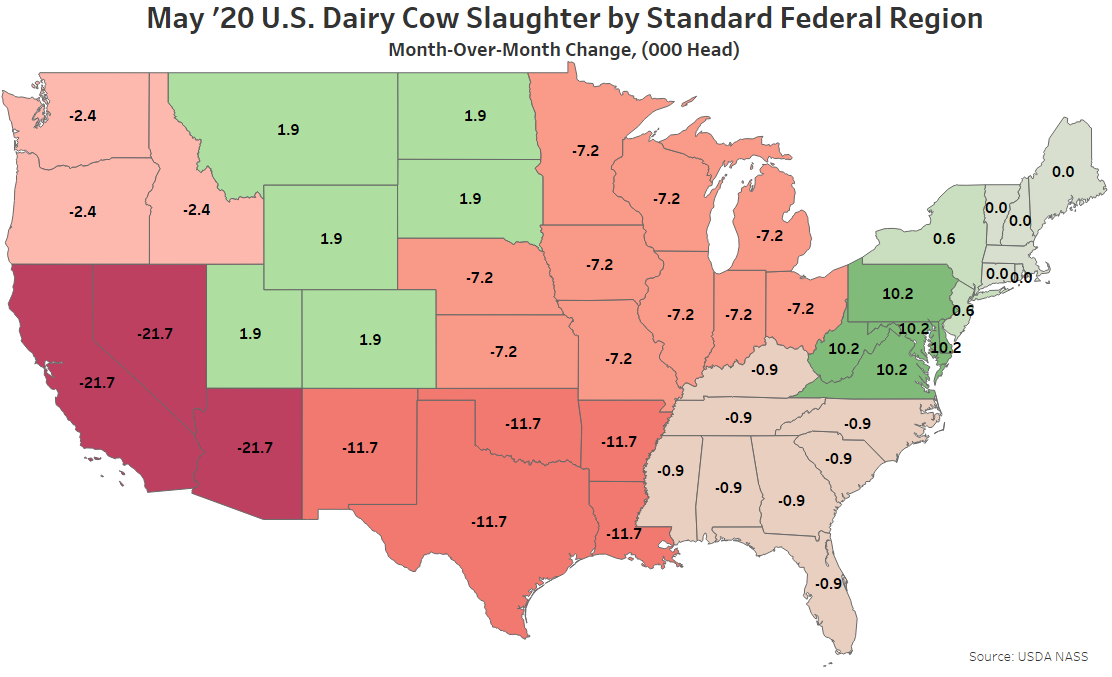

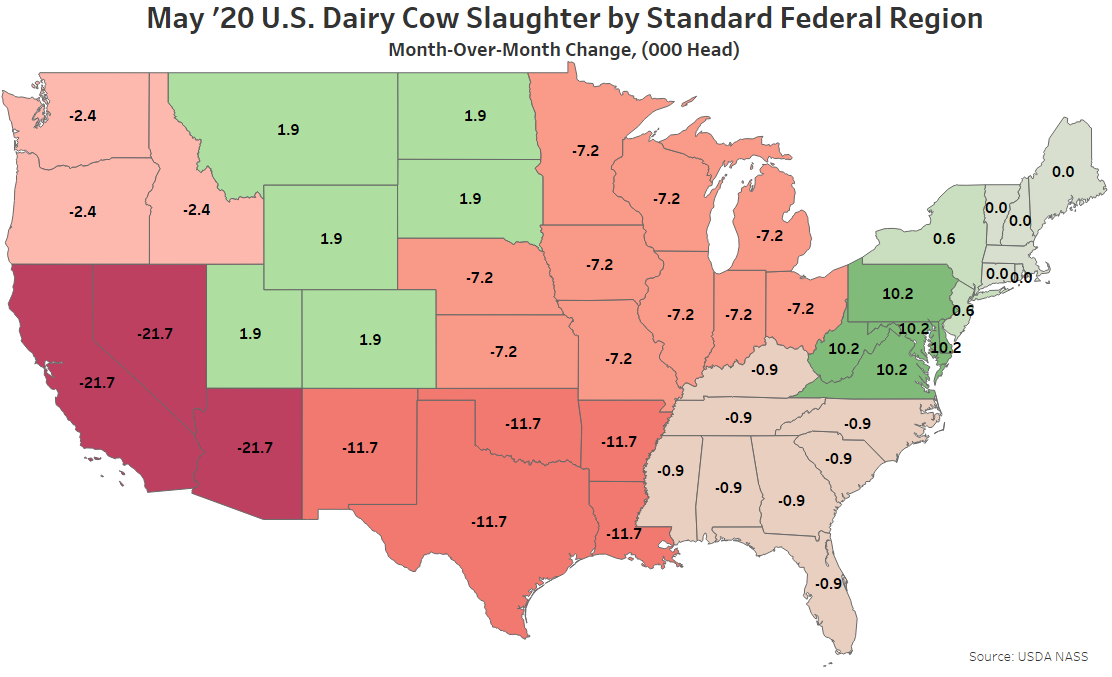

Month-over-month declines in dairy cow slaughter rates were most significant throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), while slaughter rates throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) increased most significantly from the previous month.

Month-over-month declines in dairy cow slaughter rates were most significant throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), while slaughter rates throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) increased most significantly from the previous month.

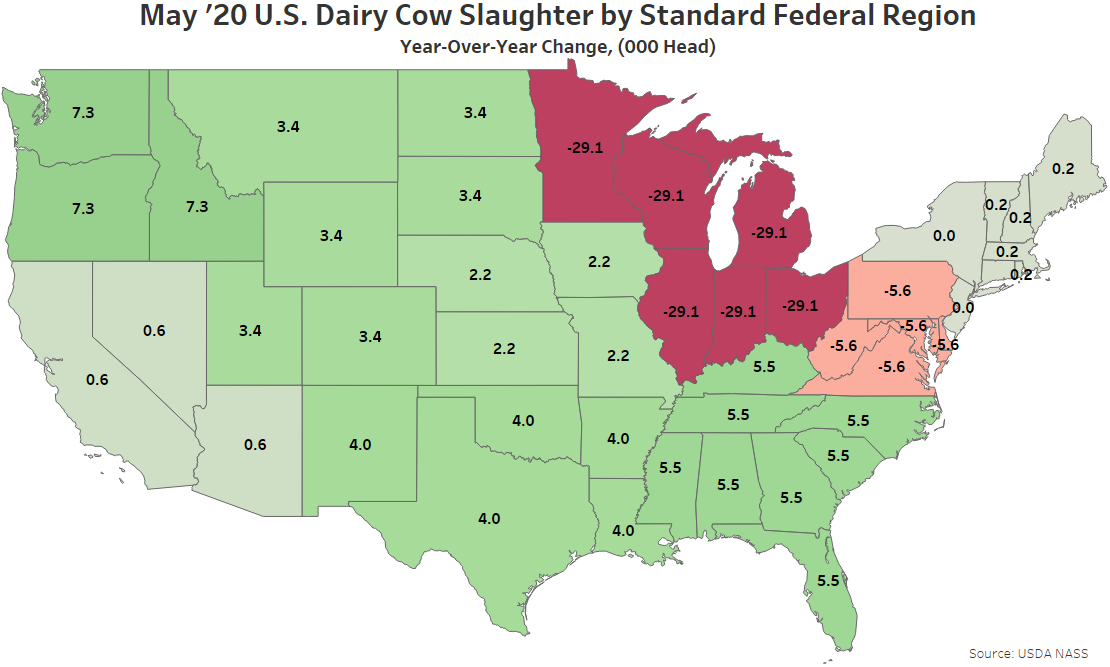

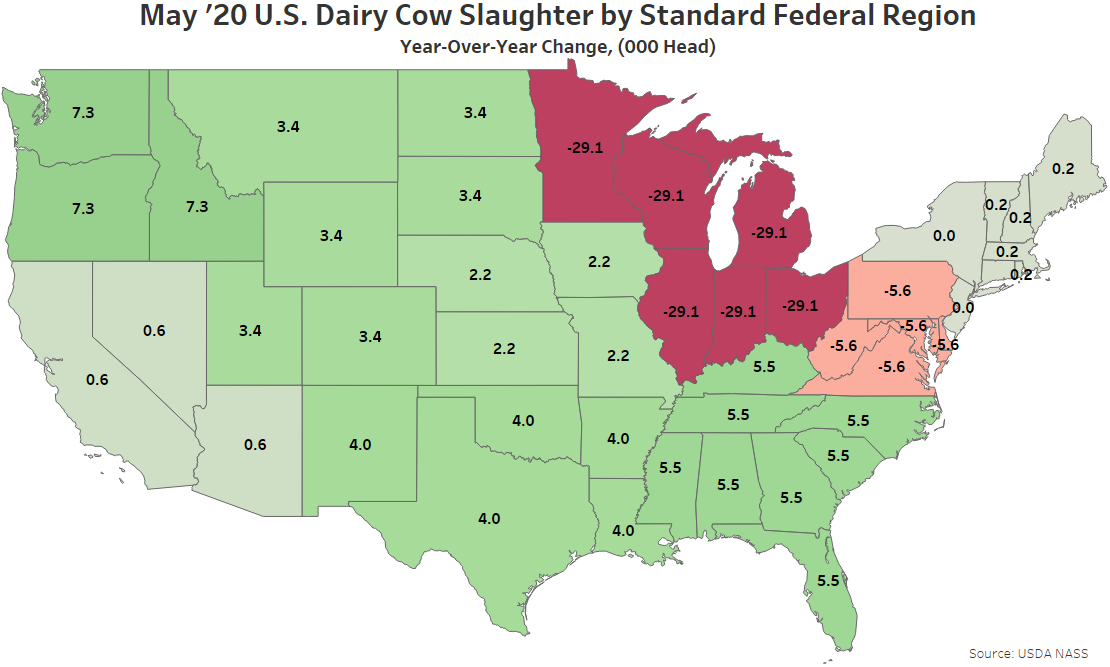

YOY declines in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

YOY declines in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

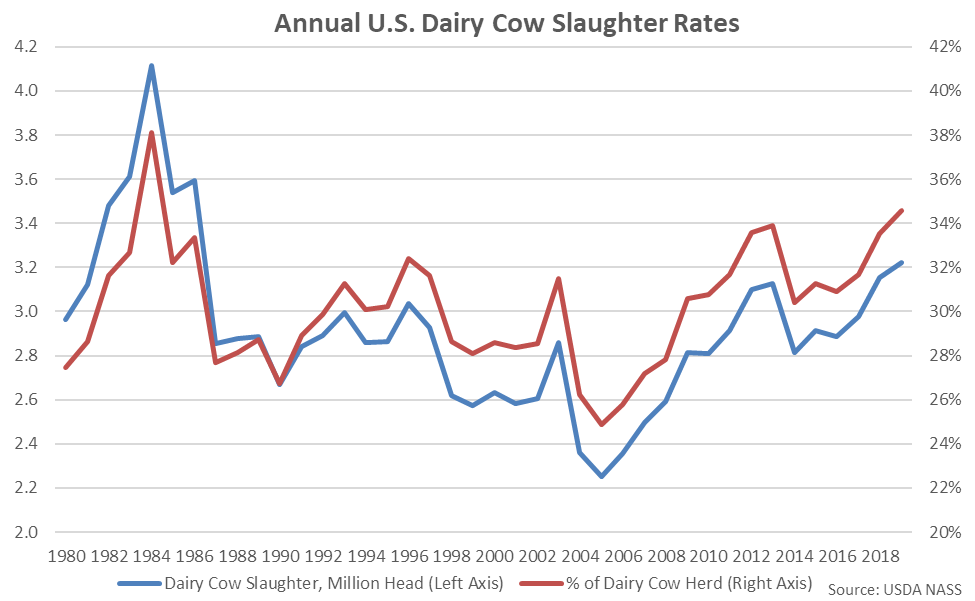

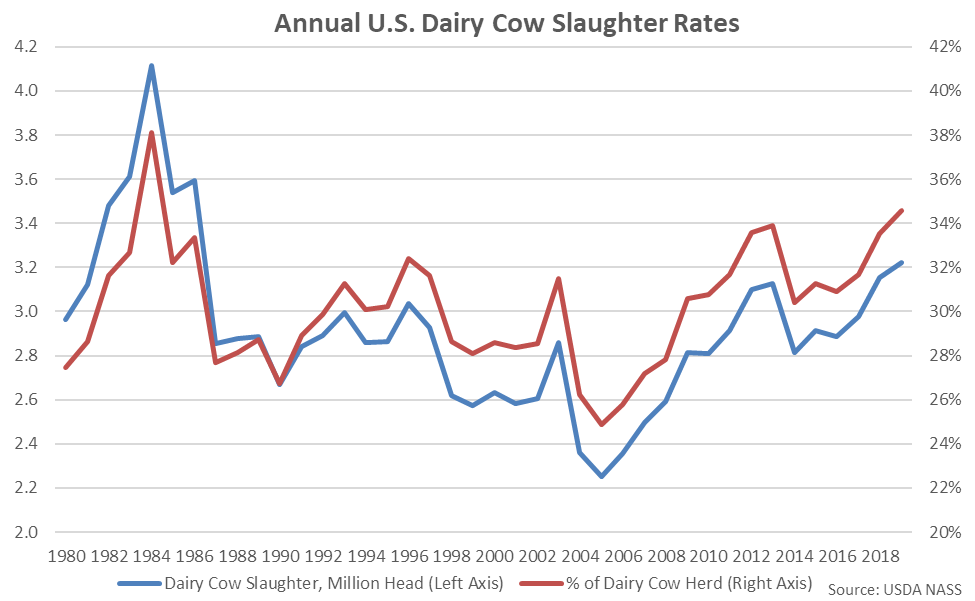

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.

- May ’20 U.S. dairy cow slaughter rates declined seasonally from the previous month while finishing 3.6% lower on a YOY basis when normalizing for slaughter days. Dairy cow slaughter rates have finished flat to lower on a YOY basis over eight of the past ten months through May ’20.

- Month-over-month declines in dairy cow slaughter rates were led by Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

- YOY declines in dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to finishing flat or lower throughout eight of the past ten months through May ’20.

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months prior to finishing flat or lower throughout eight of the past ten months through May ’20.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through May ’20. The May ’20 U.S. milk cow herd declined 11,000 head from the previous month, reaching a four month low level, but remained 37,000 head above previous year levels.

Recent declines in slaughter rates have contributed to the U.S. milk cow herd remaining higher on a YOY basis through May ’20. The May ’20 U.S. milk cow herd declined 11,000 head from the previous month, reaching a four month low level, but remained 37,000 head above previous year levels.

Month-over-month declines in dairy cow slaughter rates were most significant throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), while slaughter rates throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) increased most significantly from the previous month.

Month-over-month declines in dairy cow slaughter rates were most significant throughout Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), while slaughter rates throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia) increased most significantly from the previous month.

YOY declines in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

YOY declines in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while slaughter rates increased most significantly on a YOY basis throughout Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.

2019 annual dairy cow slaughter rates increased 4.4% on a YOY basis, reaching a 33 year high and a 35 year high level on a percentage of the total dairy cow herd basis.