U.S. Beef Cow Inventory Update – Jul ’20

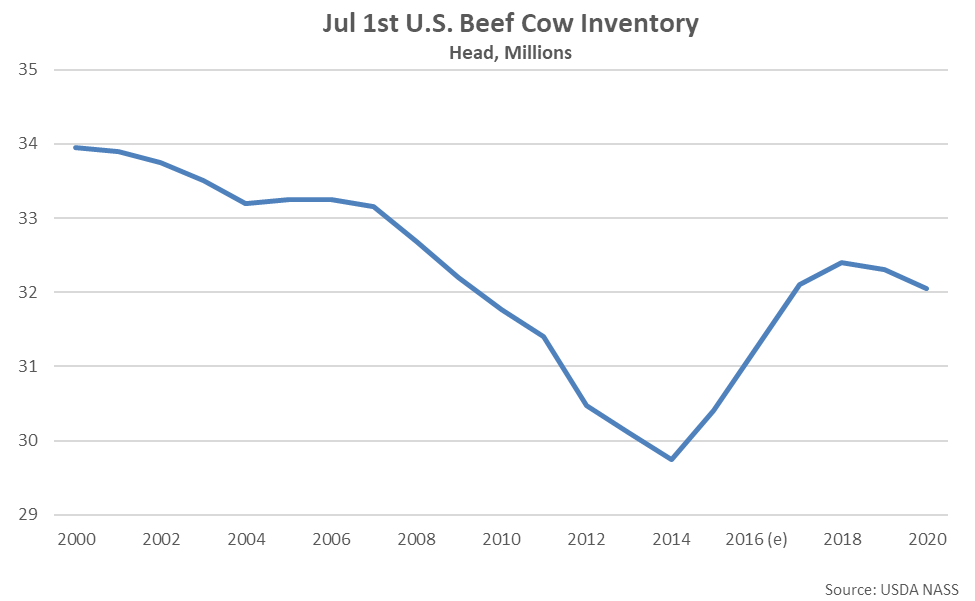

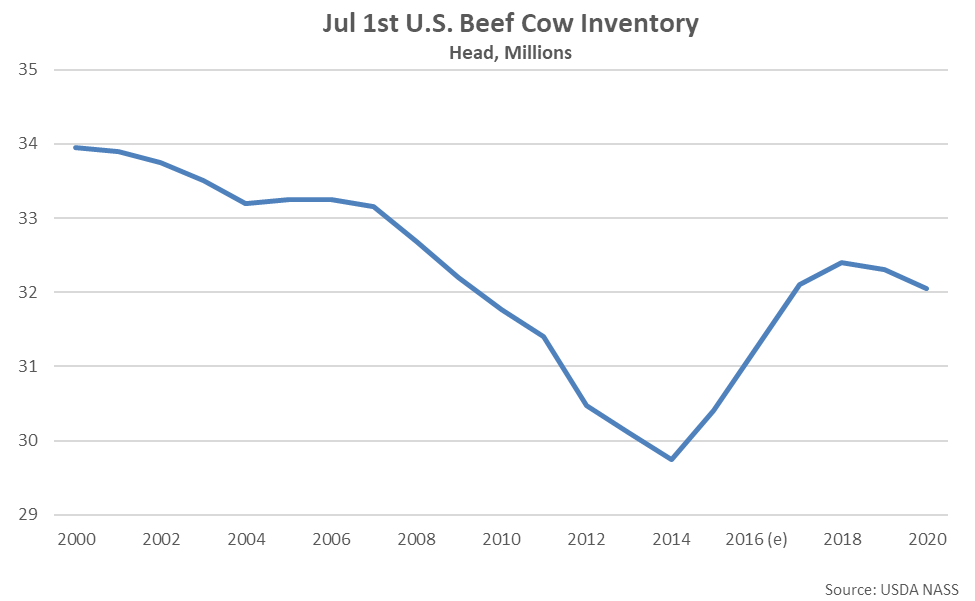

According to USDA’s semiannual cattle inventory report, the U.S. beef cow herd declined to a four year low seasonal level as of Jul ’20. The report showed that as of July 1st, 2020, the total U.S. beef cow herd stood at 32.05 million head, down 250,000 head, or 0.8%, from the previous year. The YOY decline in the beef cow herd was the largest experienced throughout the past six years. The U.S. beef cow herd reached a ten year seasonal high level as of Jul ’18, prior to declining throughout the past two years.

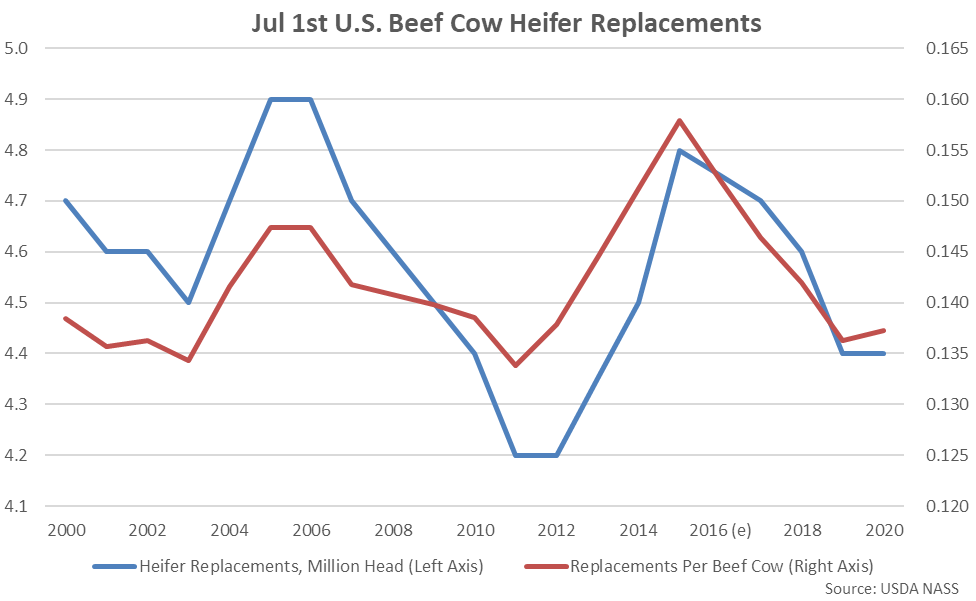

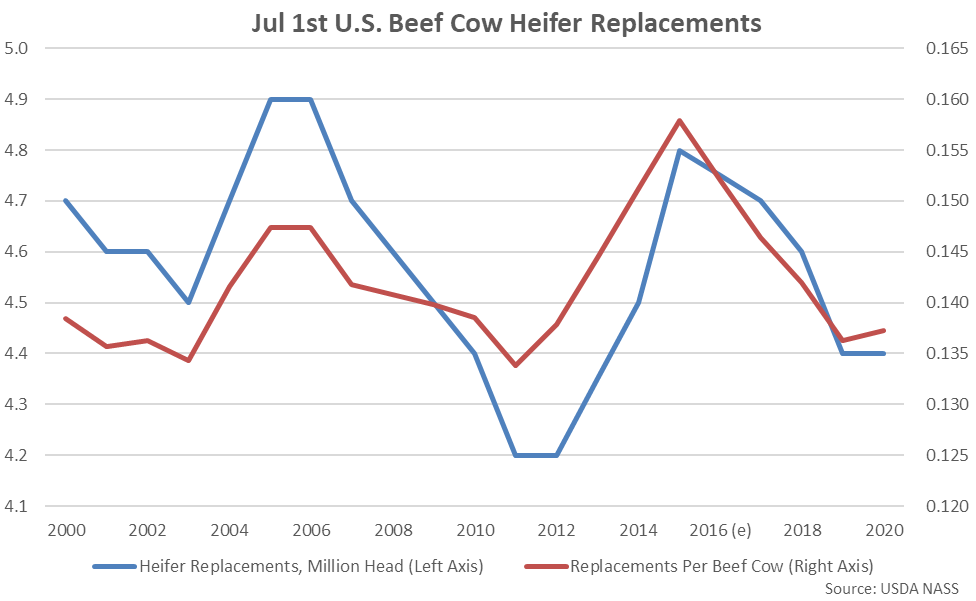

Beef heifer replacements of 4.4 million head were unchanged from the previous year as of Jul ’20, remaining at a six year low level. On a heifer replacement per beef cow basis, the Jul ’20 figure of 0.137 rebounded slightly from the eight year low level experienced throughout July of the previous year.

Beef heifer replacements of 4.4 million head were unchanged from the previous year as of Jul ’20, remaining at a six year low level. On a heifer replacement per beef cow basis, the Jul ’20 figure of 0.137 rebounded slightly from the eight year low level experienced throughout July of the previous year.

Beef heifer replacements of 4.4 million head were unchanged from the previous year as of Jul ’20, remaining at a six year low level. On a heifer replacement per beef cow basis, the Jul ’20 figure of 0.137 rebounded slightly from the eight year low level experienced throughout July of the previous year.

Beef heifer replacements of 4.4 million head were unchanged from the previous year as of Jul ’20, remaining at a six year low level. On a heifer replacement per beef cow basis, the Jul ’20 figure of 0.137 rebounded slightly from the eight year low level experienced throughout July of the previous year.