Dairy FX Indices vs. USD Index – Aug ’20

The Atten Babler Commodities Dairy Foreign Exchange (FX) Indices have remained higher than the U.S. Dollar Index and Trade Weighted U.S. Dollar Index through the end of Jul ’20, primarily due to the mix of currencies included within the indices.

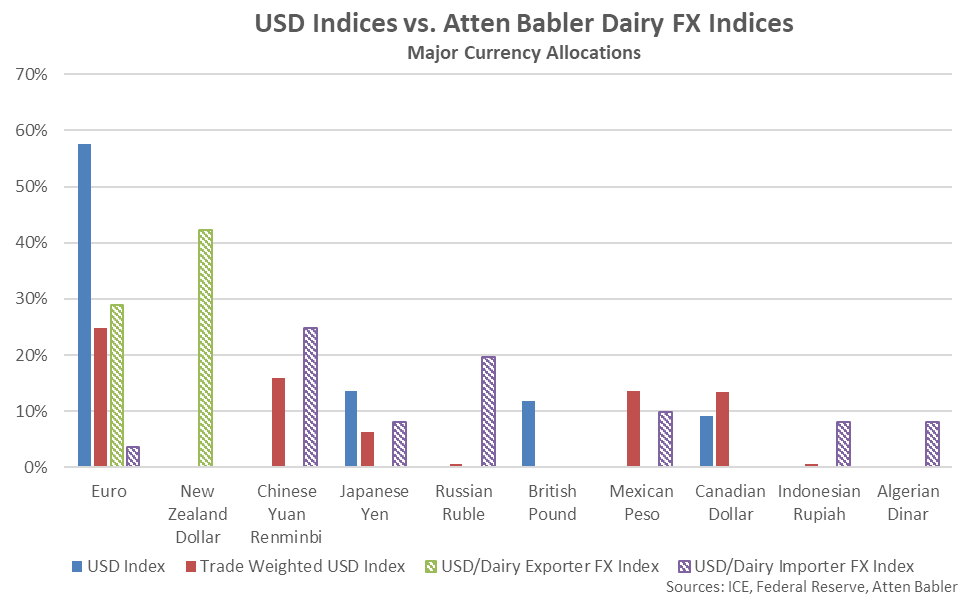

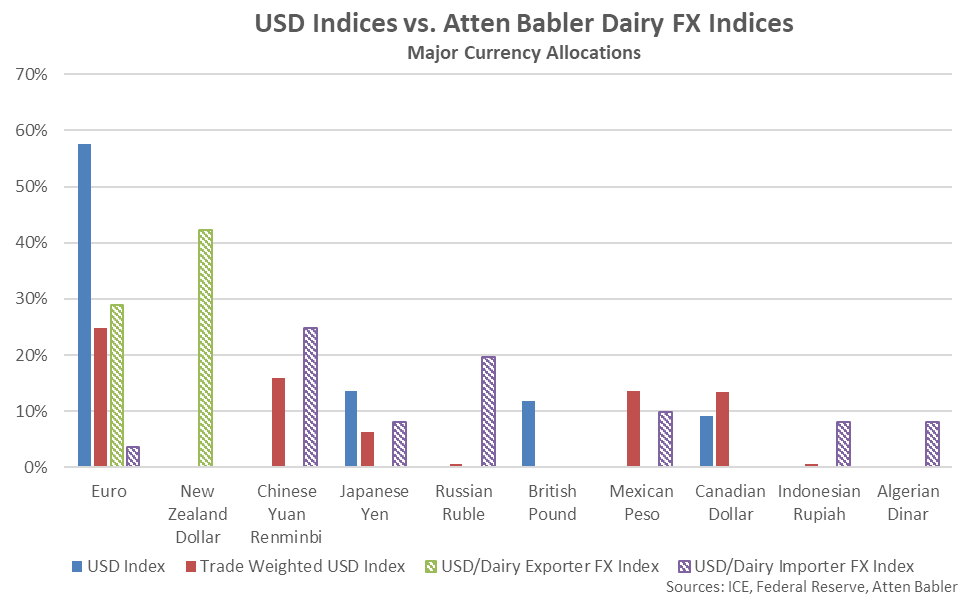

The U.S. Dollar Index is a measure of the value of the U.S. dollar relative to a basket of foreign currencies including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. Within the U.S. Dollar Index, the euro accounts for over half of the total weighting while the Japanese yen and British pound account for an additional quarter of the index. The Trade Weighted U.S. Dollar Index is a reflection of the value of the U.S. dollar relative to a basket of foreign currencies of major U.S. trading partners including the euro, Chinese yuan renminbi, Mexican peso, Canadian dollar and Japanese yen.

In contrast, the USD/Dairy Exporter FX Index has heavy weightings of the New Zealand dollar and euro while the USD/Dairy Importer FX Index has heavy weightings of the Chinese yuan renminbi, Russian ruble, Mexican peso, Japanese yen, Indonesian rupiah and Algerian dinar.

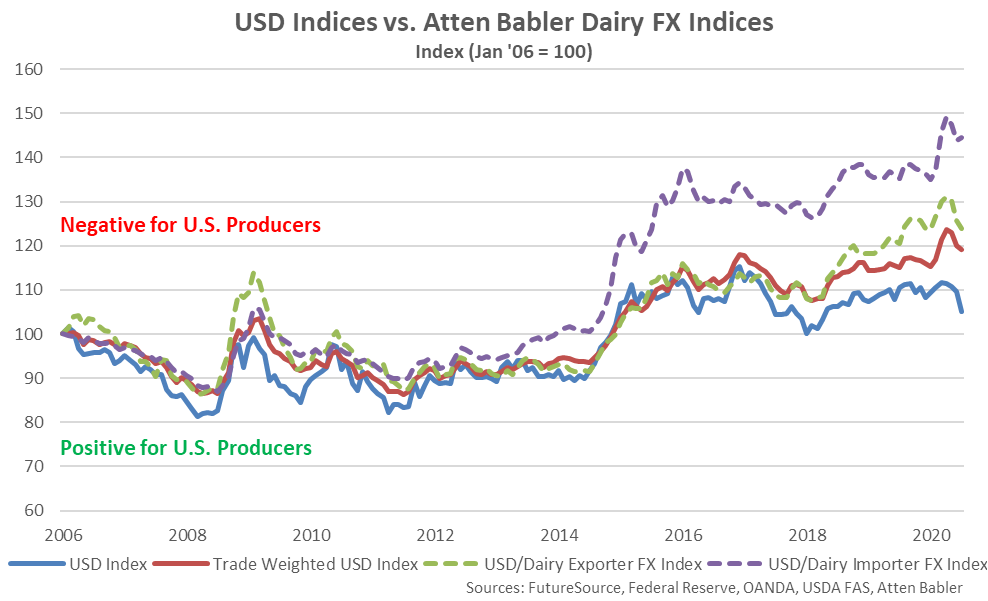

The differences in currency weightings can have a significant effect on the performance of the indices, as both the USD/Dairy Exporter FX Index and USD/Dairy Importer FX Index have outperformed the U.S. Dollar Index and Trade Weighted U.S. Dollar Index over recent years. The USD/Dairy Importer FX Index has strengthened most significantly since the beginning of 2019, driven higher by appreciation in the U.S. dollar relative to the Mexican peso, Brazilian real and Russian ruble. The USD/Dairy Exporter FX Index has exhibited significant appreciation against the Argentine peso and marginal gains against both the Australian dollar and New Zealand dollar over the same period, offsetting declines against the euro. U.S. Dollar Index has experienced declines against the euro, Japanese yen, British pound, Swedish krona and Swiss franc, with only marginal gains against the Canadian dollar while the Trade Weighted U.S. Dollar Index has experienced declines against the euro and Japanese yen but gains against the Chinese yuan renminbi, Mexican peso and Canadian dollar.

The differences in currency weightings can have a significant effect on the performance of the indices, as both the USD/Dairy Exporter FX Index and USD/Dairy Importer FX Index have outperformed the U.S. Dollar Index and Trade Weighted U.S. Dollar Index over recent years. The USD/Dairy Importer FX Index has strengthened most significantly since the beginning of 2019, driven higher by appreciation in the U.S. dollar relative to the Mexican peso, Brazilian real and Russian ruble. The USD/Dairy Exporter FX Index has exhibited significant appreciation against the Argentine peso and marginal gains against both the Australian dollar and New Zealand dollar over the same period, offsetting declines against the euro. U.S. Dollar Index has experienced declines against the euro, Japanese yen, British pound, Swedish krona and Swiss franc, with only marginal gains against the Canadian dollar while the Trade Weighted U.S. Dollar Index has experienced declines against the euro and Japanese yen but gains against the Chinese yuan renminbi, Mexican peso and Canadian dollar.

The USD/Dairy Exporter FX Index, USD/Dairy Importer FX Index and Trade Weighted U.S. Dollar Index have all declined to four month low levels through the end of July but remain at elevated levels, overall, even as the U.S. Dollar Index has declined to a two year low level. From the perspective of a U.S. dairy producer, a strengthening U.S. dollar reduces the competiveness of U.S. dairy exports, ultimately resulting in less foreign demand, all other factors being equal. Unfortunately for dairy producers, the mix of currencies used to calculate the U.S. Dollar Index is not representative of the major global dairy exporters and importers, with the U.S. dollar remaining stronger against the mix of exporting and importing countries.

The USD/Dairy Exporter FX Index, USD/Dairy Importer FX Index and Trade Weighted U.S. Dollar Index have all declined to four month low levels through the end of July but remain at elevated levels, overall, even as the U.S. Dollar Index has declined to a two year low level. From the perspective of a U.S. dairy producer, a strengthening U.S. dollar reduces the competiveness of U.S. dairy exports, ultimately resulting in less foreign demand, all other factors being equal. Unfortunately for dairy producers, the mix of currencies used to calculate the U.S. Dollar Index is not representative of the major global dairy exporters and importers, with the U.S. dollar remaining stronger against the mix of exporting and importing countries.

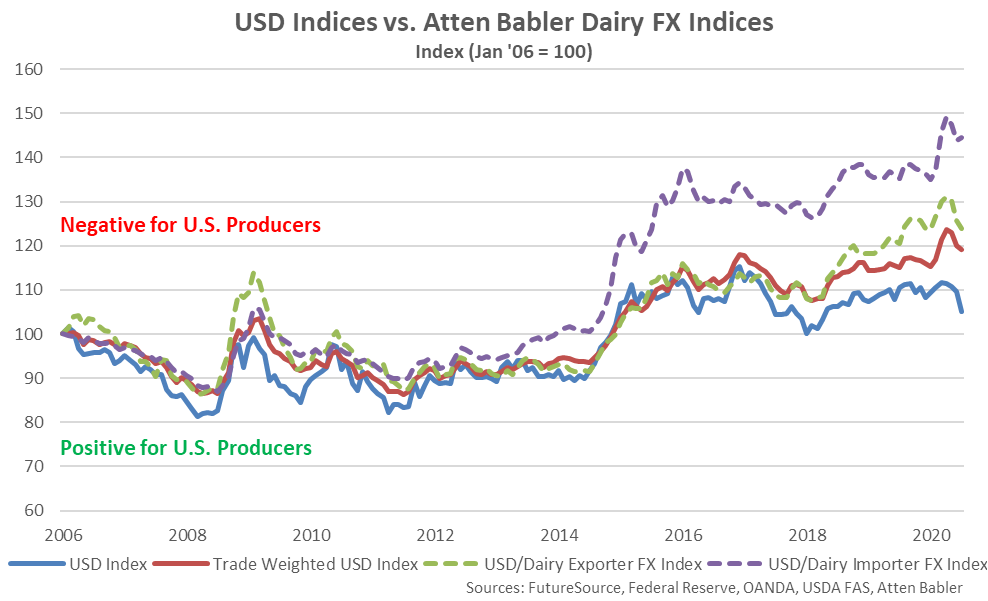

The differences in currency weightings can have a significant effect on the performance of the indices, as both the USD/Dairy Exporter FX Index and USD/Dairy Importer FX Index have outperformed the U.S. Dollar Index and Trade Weighted U.S. Dollar Index over recent years. The USD/Dairy Importer FX Index has strengthened most significantly since the beginning of 2019, driven higher by appreciation in the U.S. dollar relative to the Mexican peso, Brazilian real and Russian ruble. The USD/Dairy Exporter FX Index has exhibited significant appreciation against the Argentine peso and marginal gains against both the Australian dollar and New Zealand dollar over the same period, offsetting declines against the euro. U.S. Dollar Index has experienced declines against the euro, Japanese yen, British pound, Swedish krona and Swiss franc, with only marginal gains against the Canadian dollar while the Trade Weighted U.S. Dollar Index has experienced declines against the euro and Japanese yen but gains against the Chinese yuan renminbi, Mexican peso and Canadian dollar.

The differences in currency weightings can have a significant effect on the performance of the indices, as both the USD/Dairy Exporter FX Index and USD/Dairy Importer FX Index have outperformed the U.S. Dollar Index and Trade Weighted U.S. Dollar Index over recent years. The USD/Dairy Importer FX Index has strengthened most significantly since the beginning of 2019, driven higher by appreciation in the U.S. dollar relative to the Mexican peso, Brazilian real and Russian ruble. The USD/Dairy Exporter FX Index has exhibited significant appreciation against the Argentine peso and marginal gains against both the Australian dollar and New Zealand dollar over the same period, offsetting declines against the euro. U.S. Dollar Index has experienced declines against the euro, Japanese yen, British pound, Swedish krona and Swiss franc, with only marginal gains against the Canadian dollar while the Trade Weighted U.S. Dollar Index has experienced declines against the euro and Japanese yen but gains against the Chinese yuan renminbi, Mexican peso and Canadian dollar.

The USD/Dairy Exporter FX Index, USD/Dairy Importer FX Index and Trade Weighted U.S. Dollar Index have all declined to four month low levels through the end of July but remain at elevated levels, overall, even as the U.S. Dollar Index has declined to a two year low level. From the perspective of a U.S. dairy producer, a strengthening U.S. dollar reduces the competiveness of U.S. dairy exports, ultimately resulting in less foreign demand, all other factors being equal. Unfortunately for dairy producers, the mix of currencies used to calculate the U.S. Dollar Index is not representative of the major global dairy exporters and importers, with the U.S. dollar remaining stronger against the mix of exporting and importing countries.

The USD/Dairy Exporter FX Index, USD/Dairy Importer FX Index and Trade Weighted U.S. Dollar Index have all declined to four month low levels through the end of July but remain at elevated levels, overall, even as the U.S. Dollar Index has declined to a two year low level. From the perspective of a U.S. dairy producer, a strengthening U.S. dollar reduces the competiveness of U.S. dairy exports, ultimately resulting in less foreign demand, all other factors being equal. Unfortunately for dairy producers, the mix of currencies used to calculate the U.S. Dollar Index is not representative of the major global dairy exporters and importers, with the U.S. dollar remaining stronger against the mix of exporting and importing countries.