Grain & Oilseeds WASDE Update – Aug ’20

Corn – U.S. and Global Ending Stocks Below Private Estimates

Corn – U.S. and Global Ending Stocks Below Private Estimates

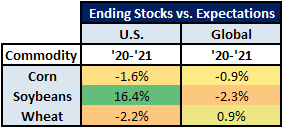

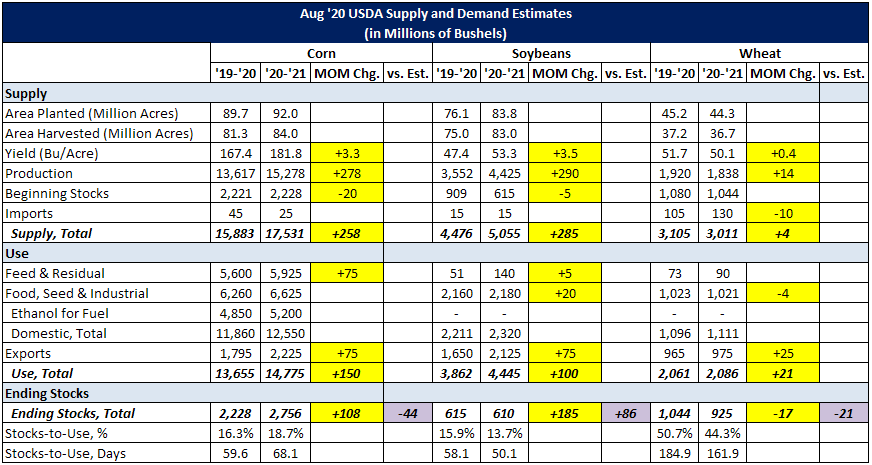

- ’20-’21 U.S. ending stocks of 2.756 billion bushels below expectations

- ’20-’21 global ending stocks of 317.5 million MT below expectations

- ’20-’21 U.S. ending stocks of 610 million bushels significantly expectations

- ’20-’21 global ending stocks of 95.4 million MT below expectations

- ’20-’21 U.S. ending stocks of 925 million bushels below expectations

- ’20-’21 global ending stocks of 316.8 million MT above expectations