U.S. Livestock Cold Storage Update – Aug ’20

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

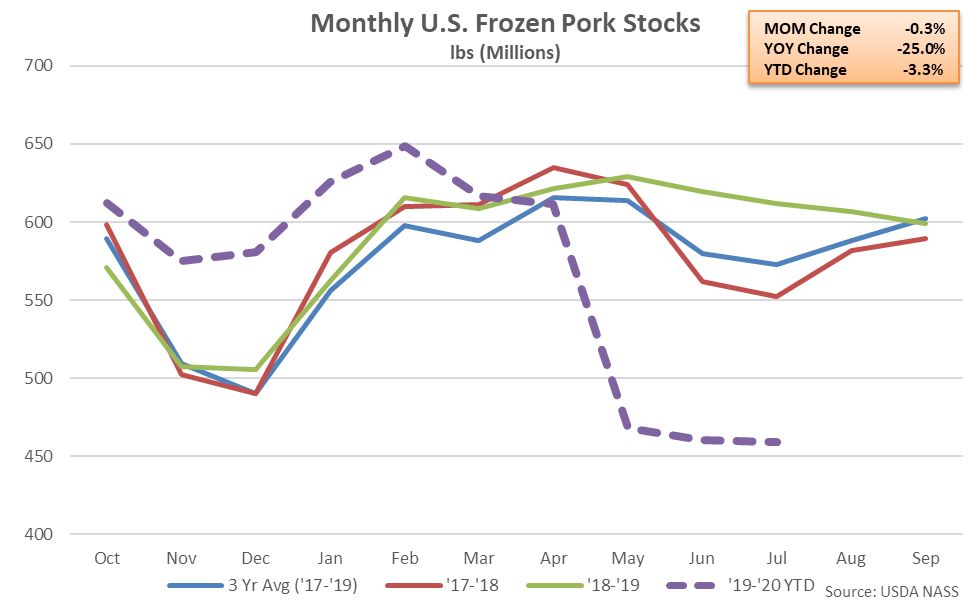

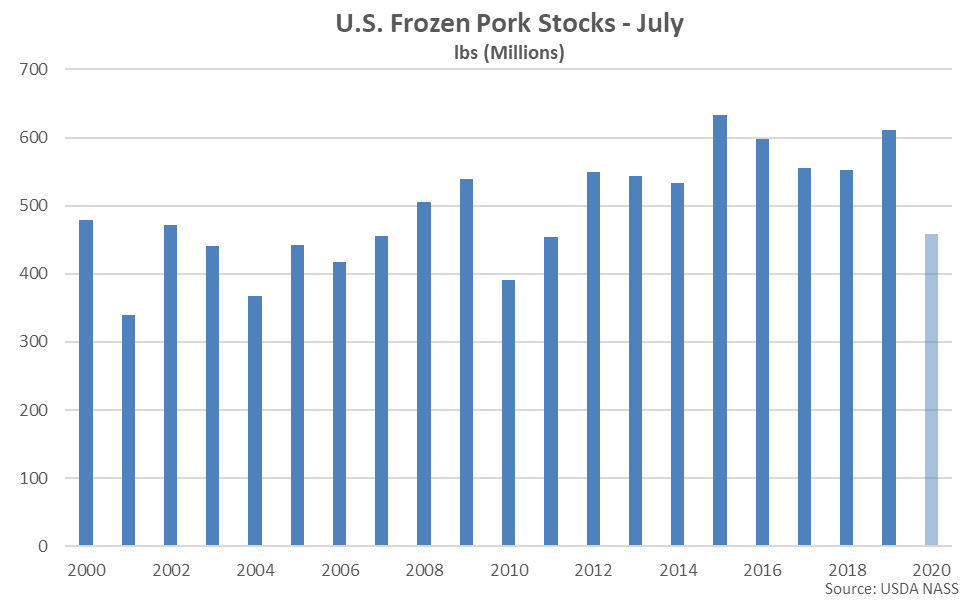

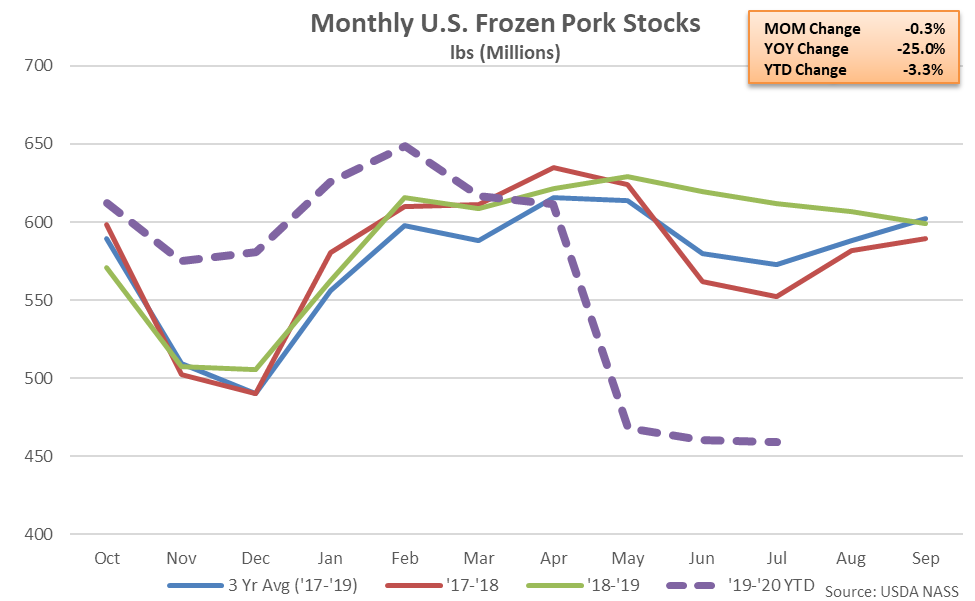

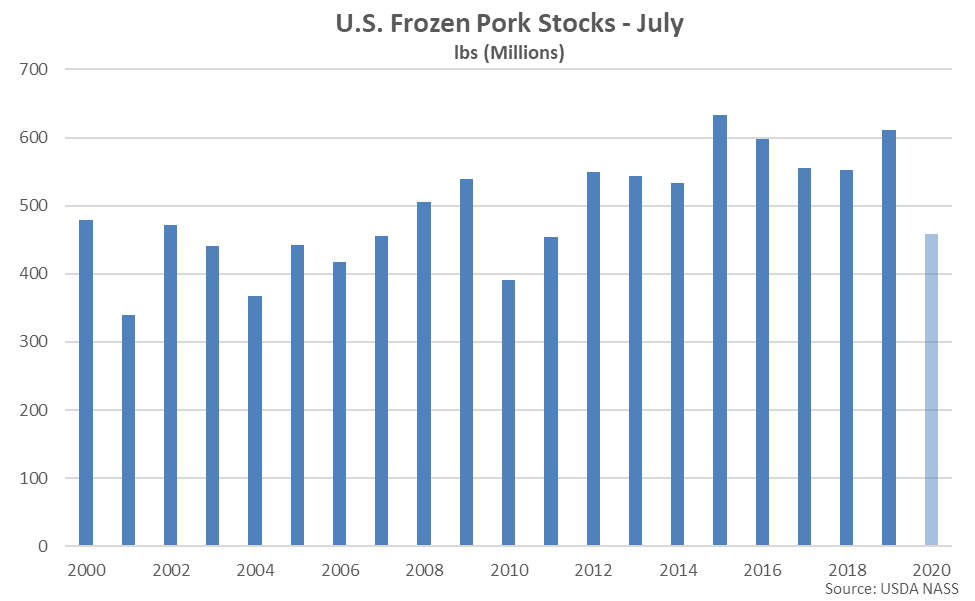

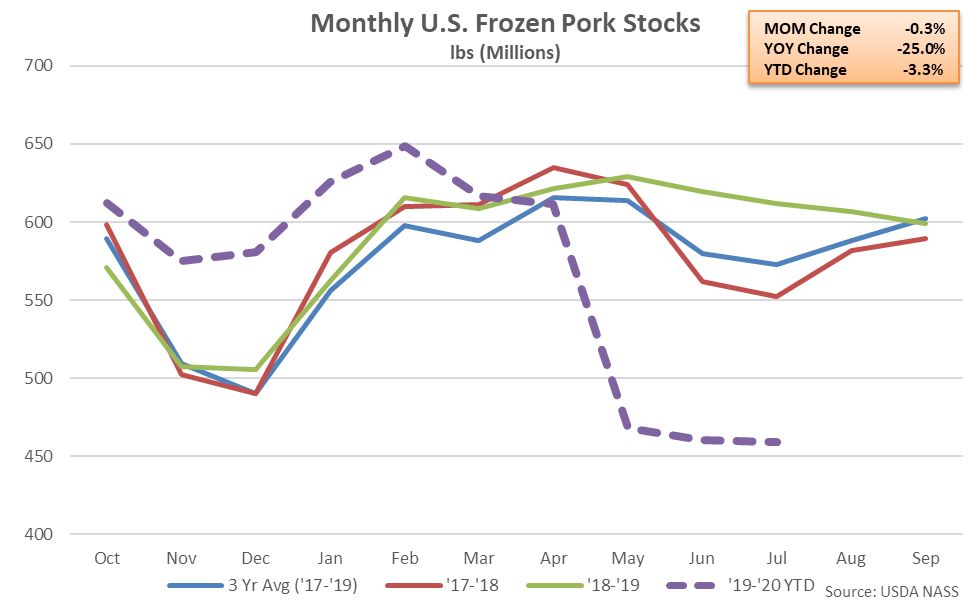

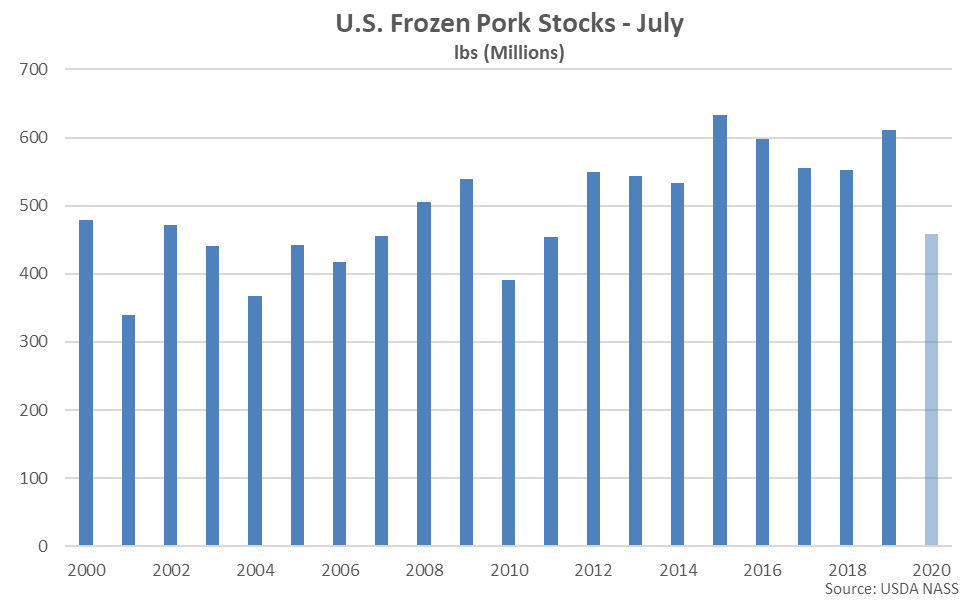

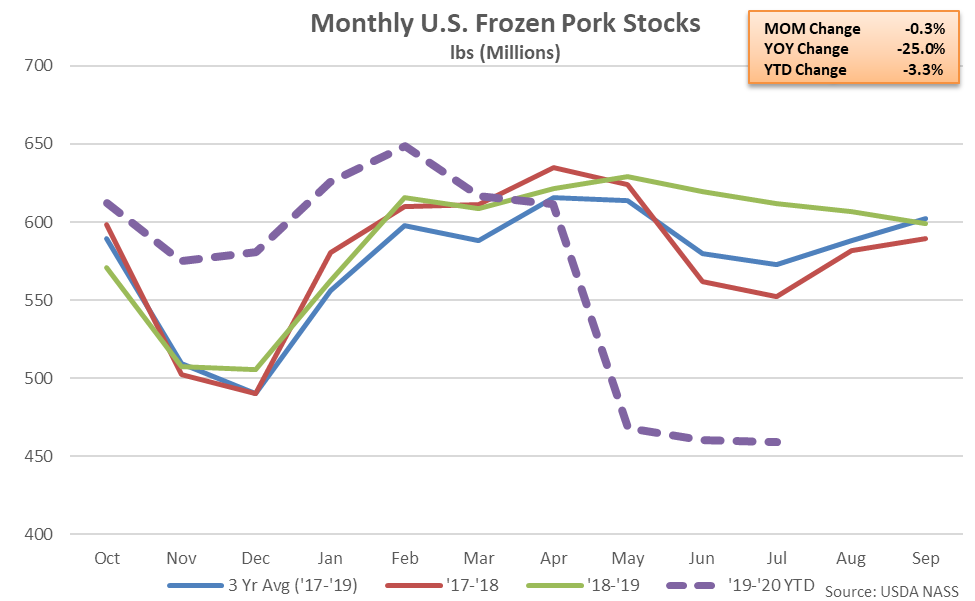

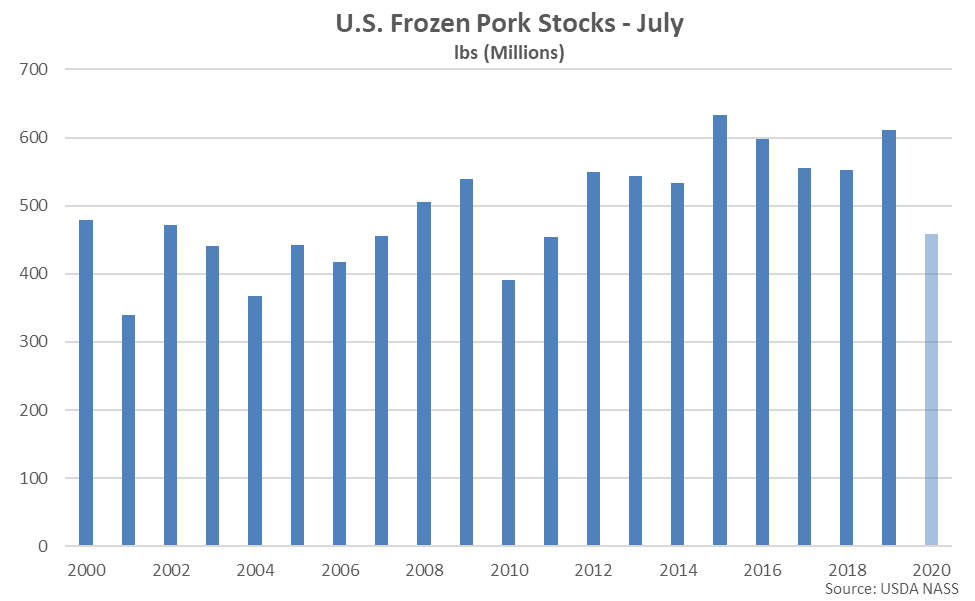

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

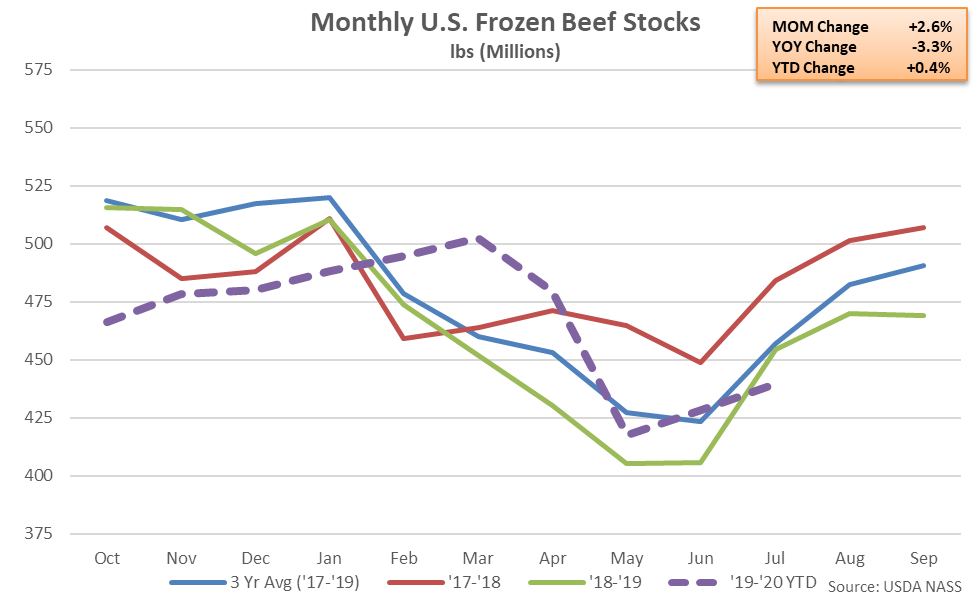

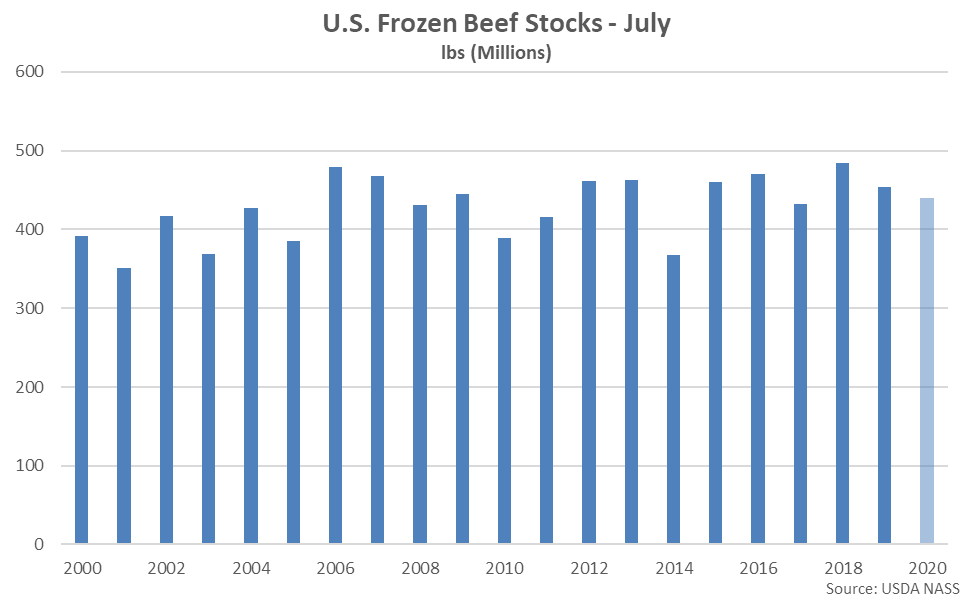

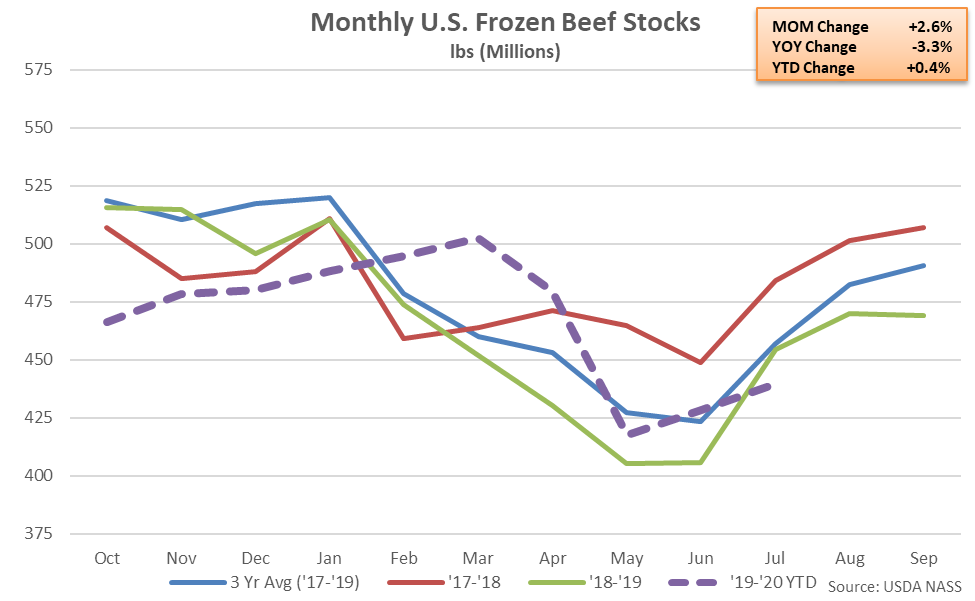

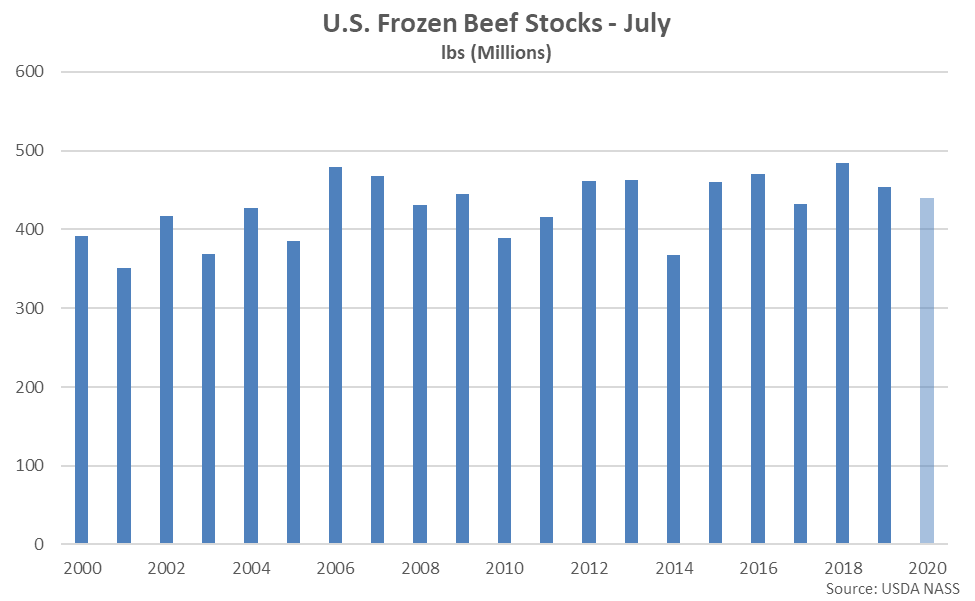

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

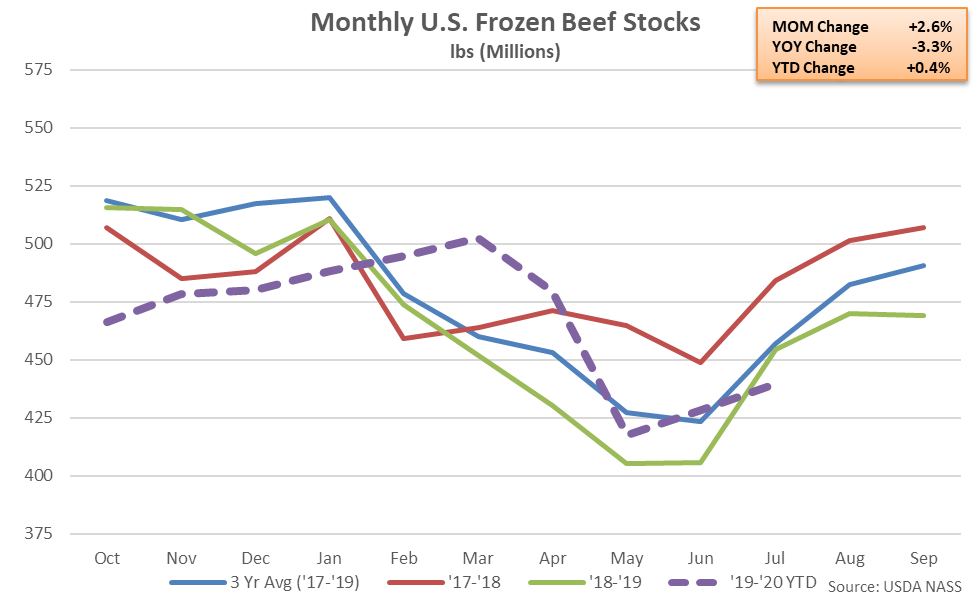

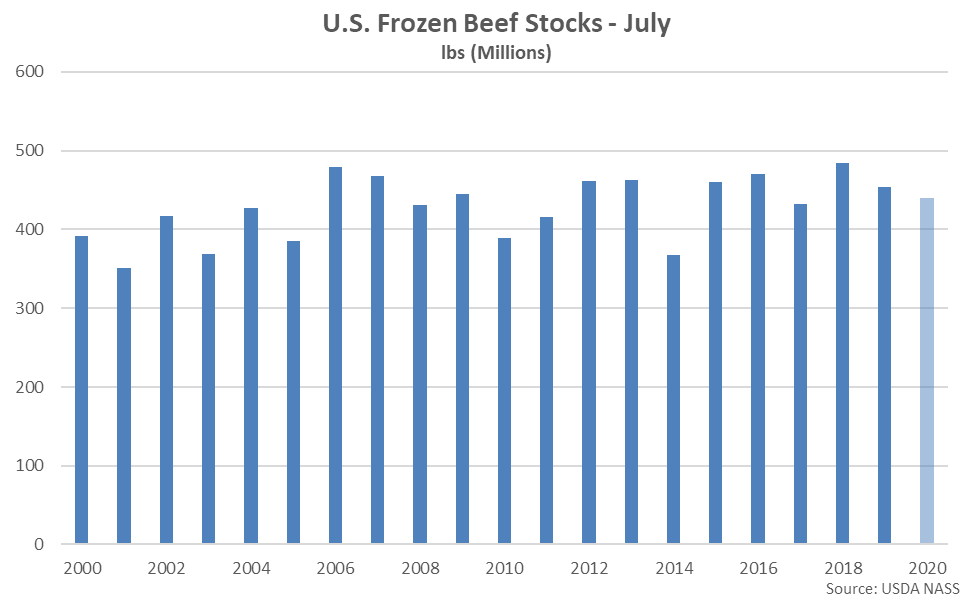

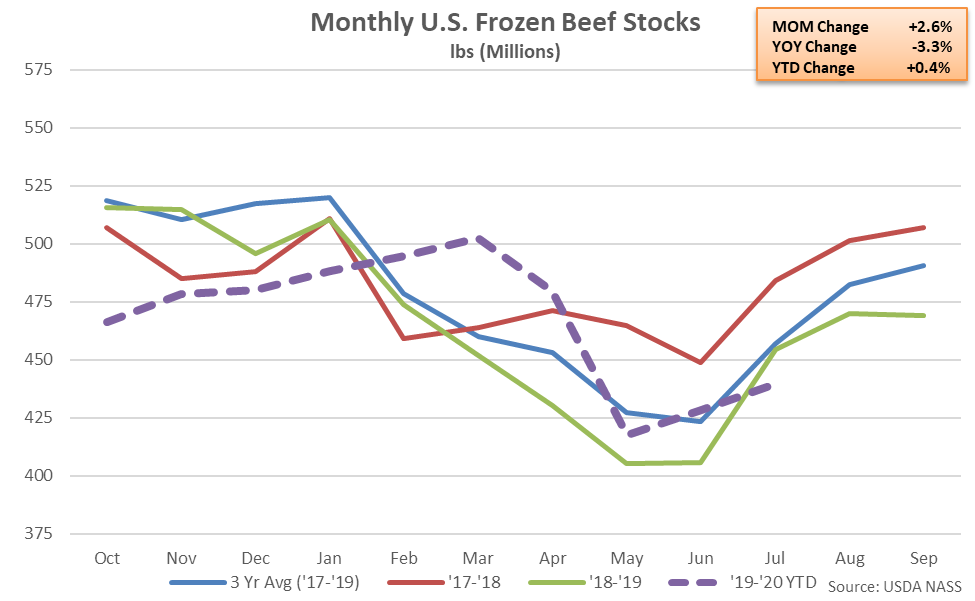

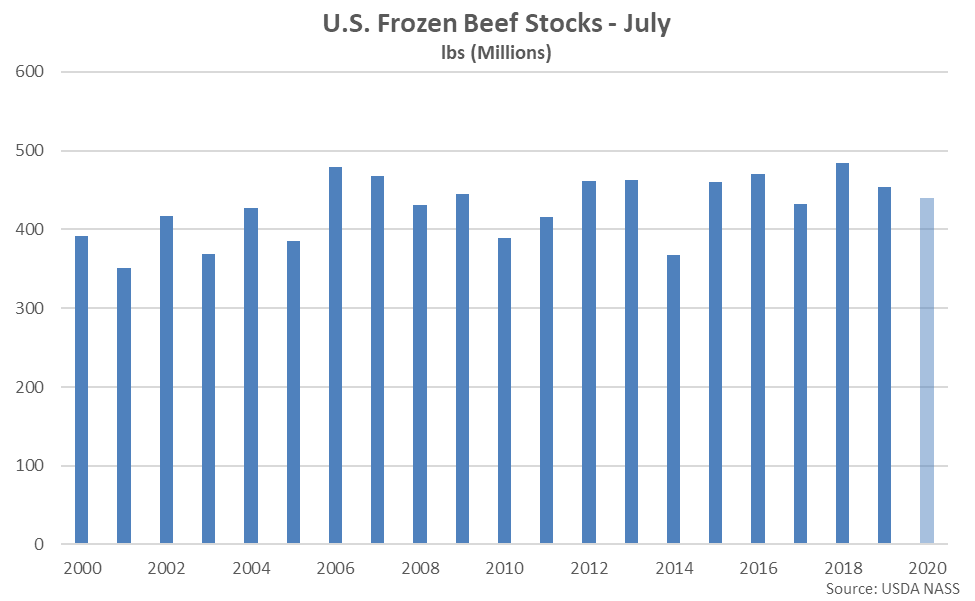

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

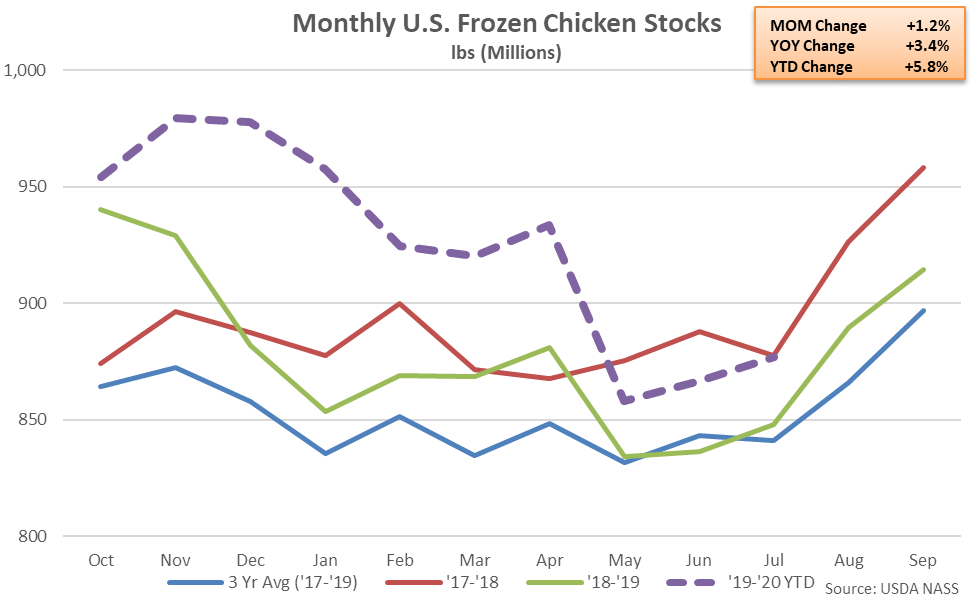

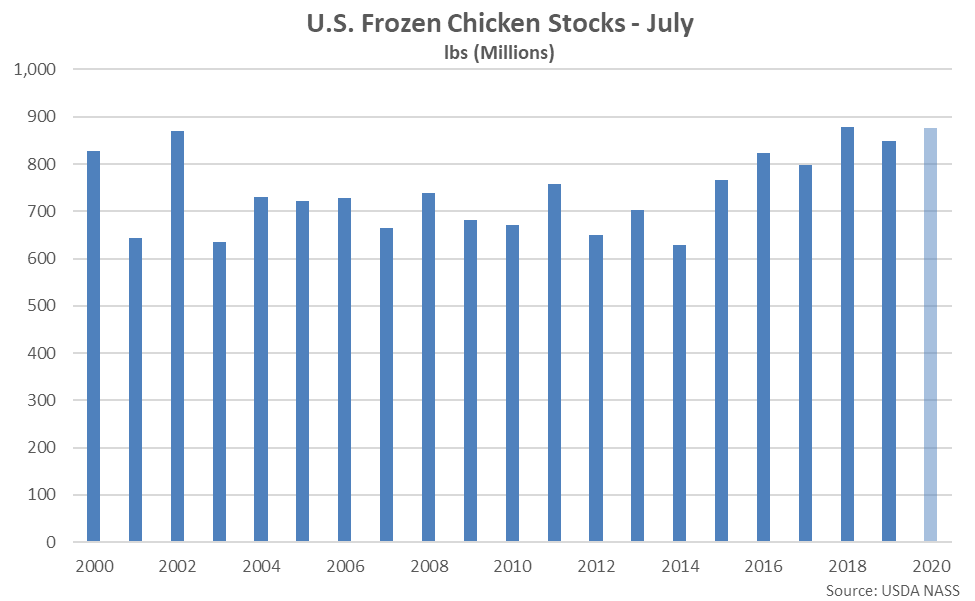

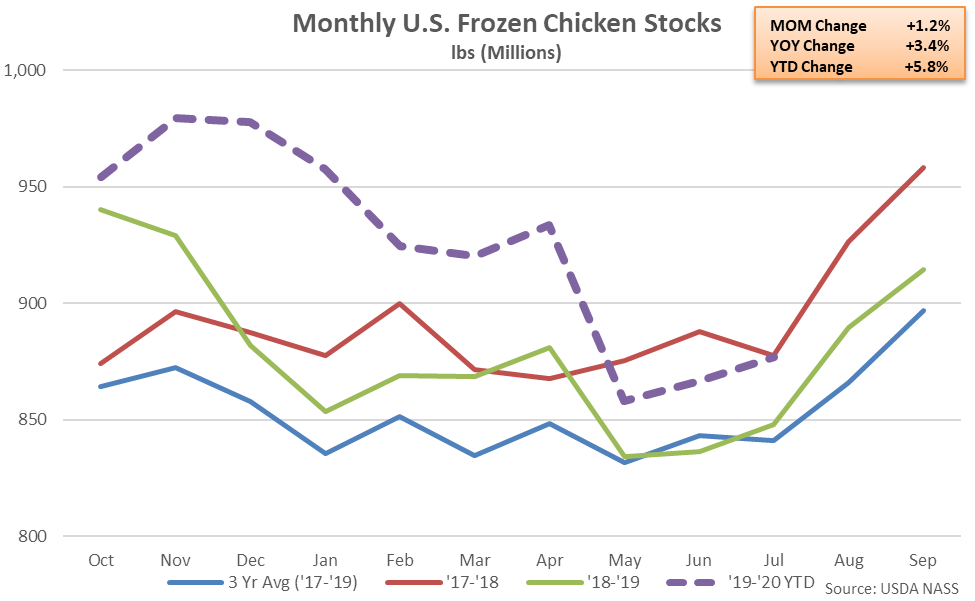

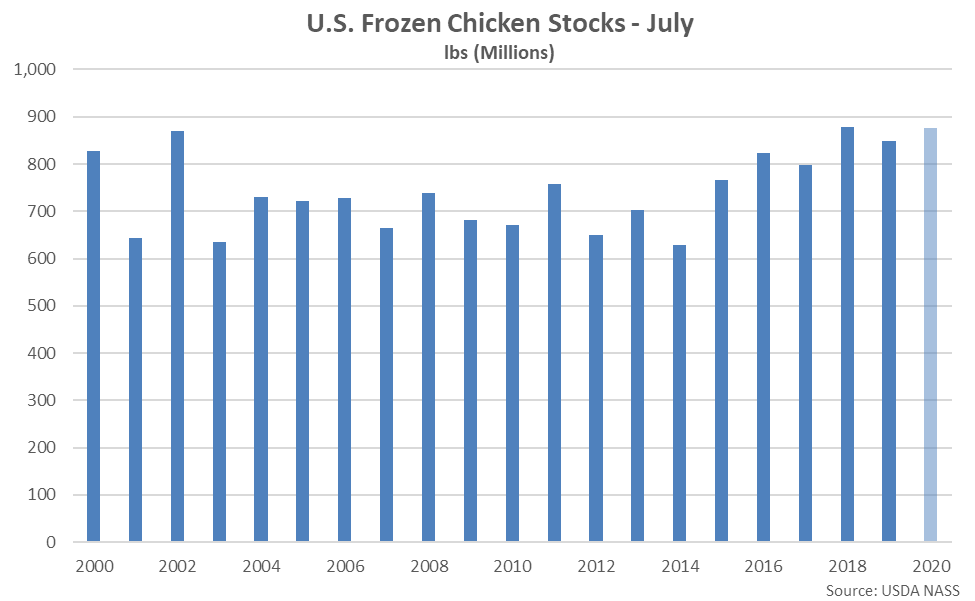

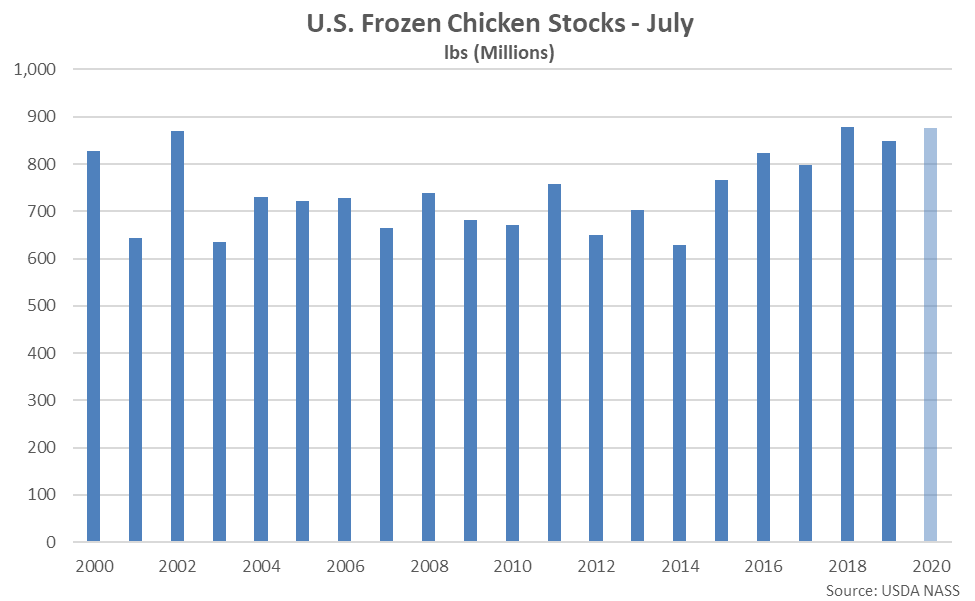

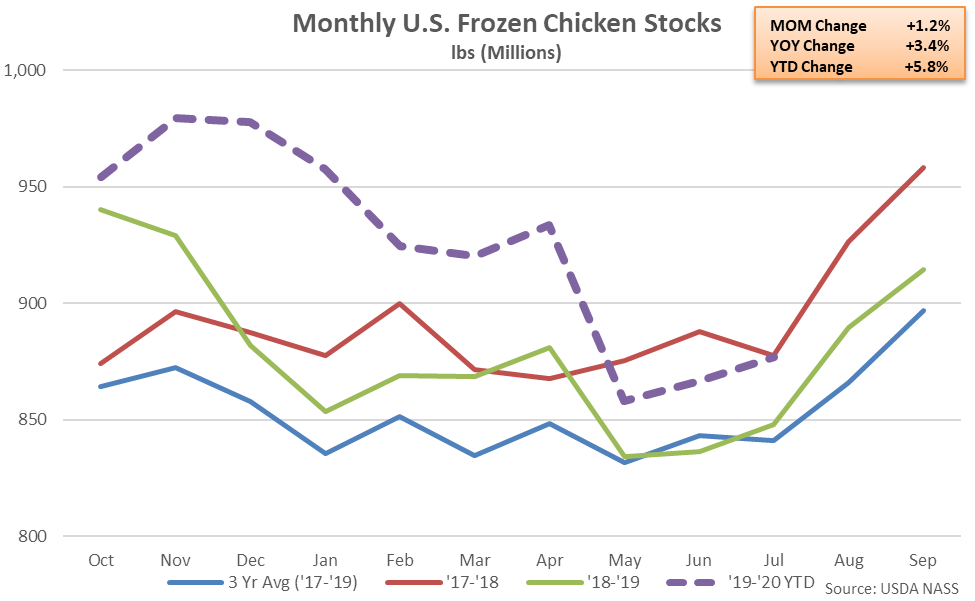

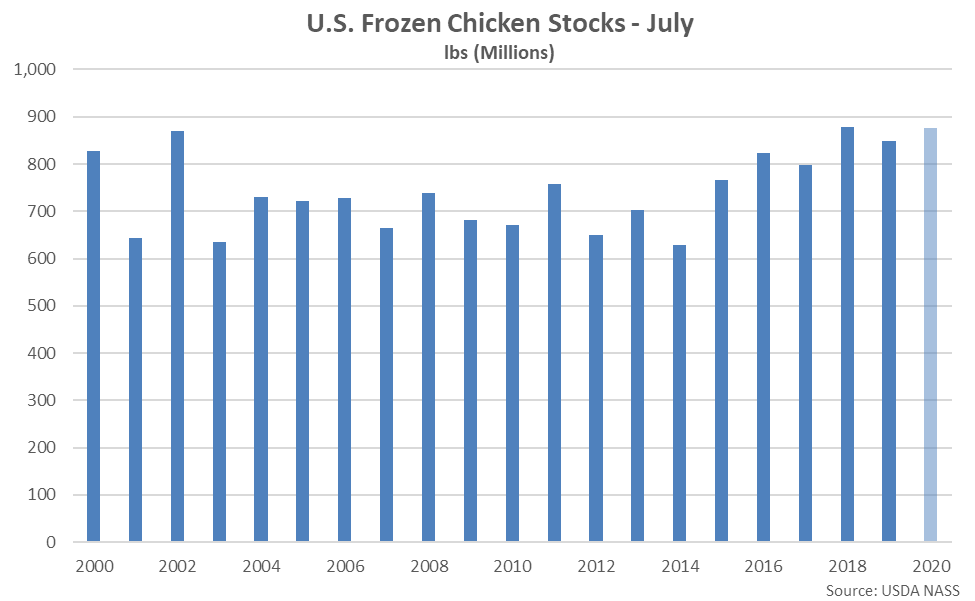

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

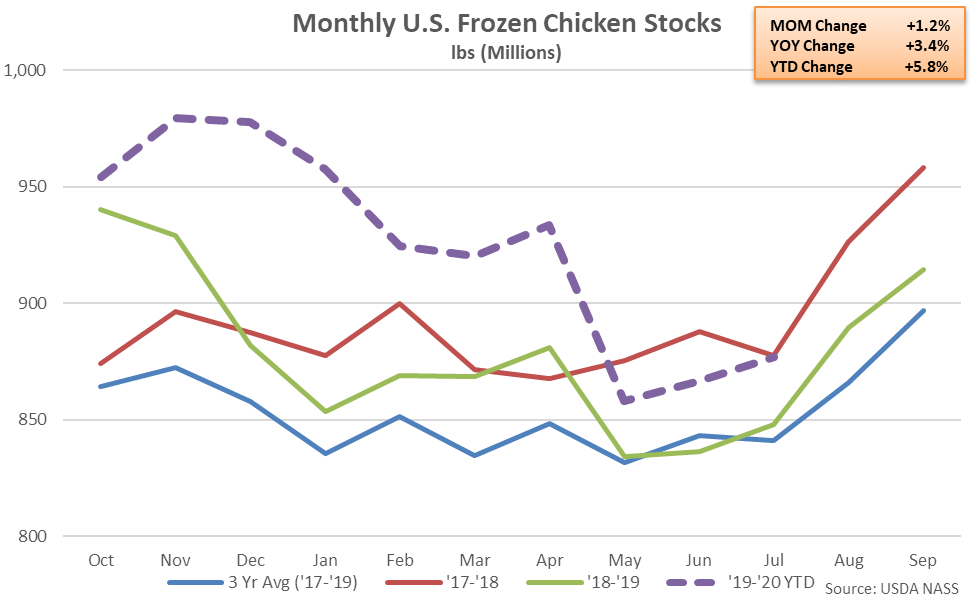

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

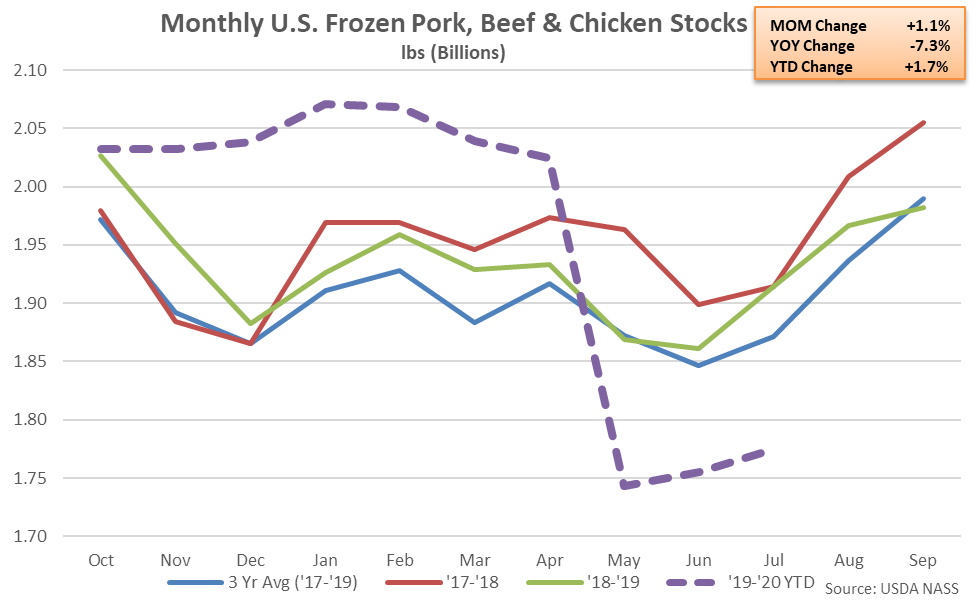

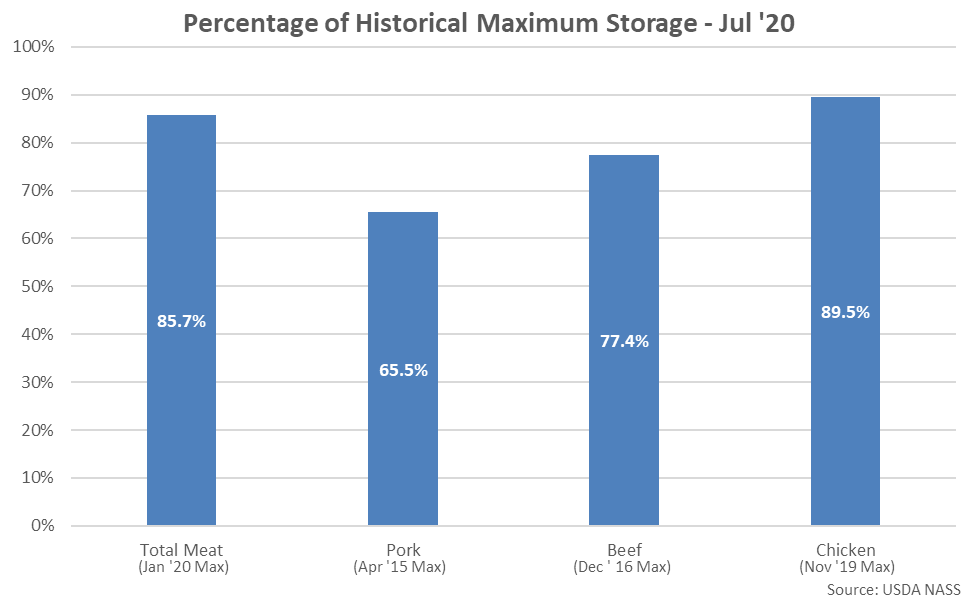

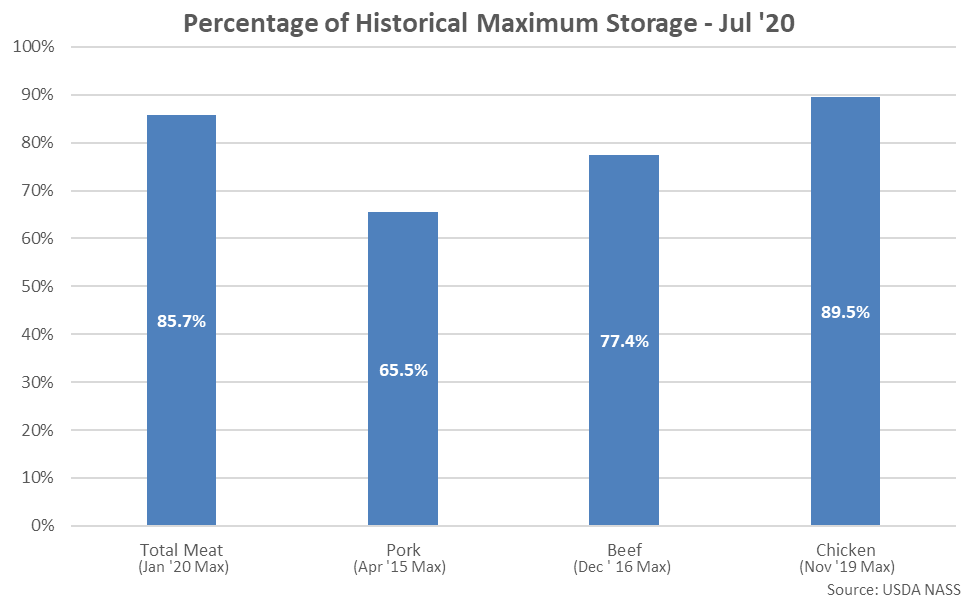

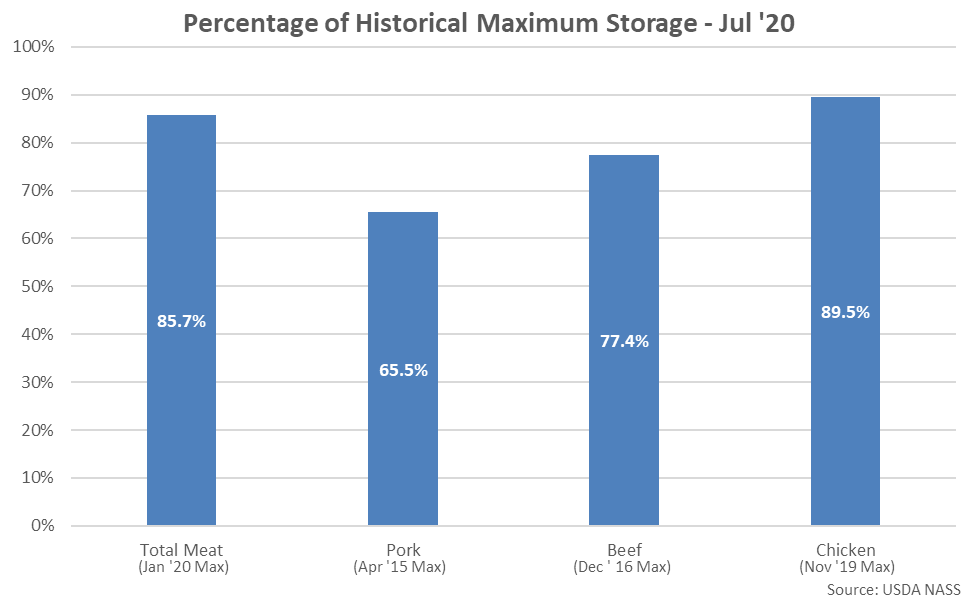

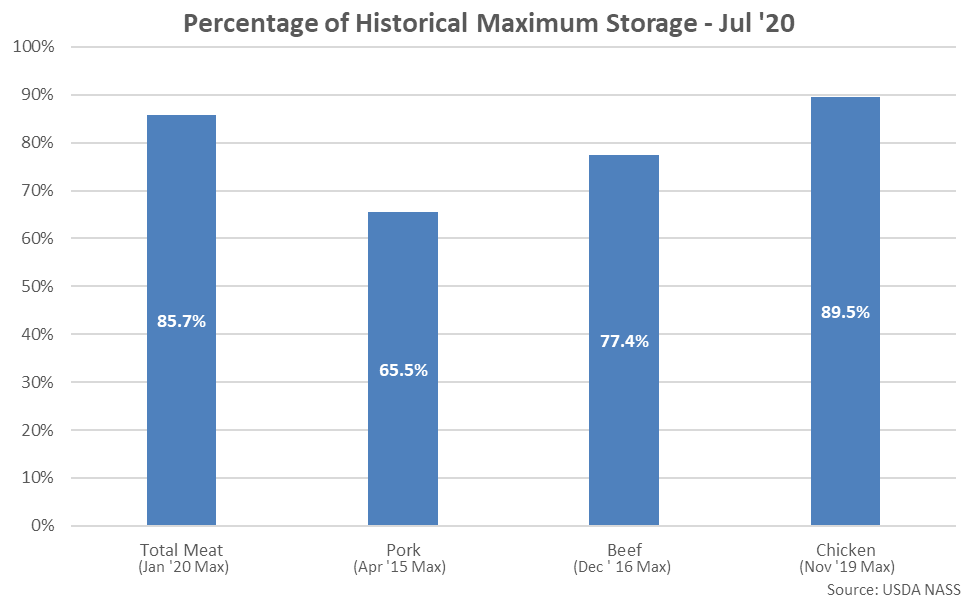

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

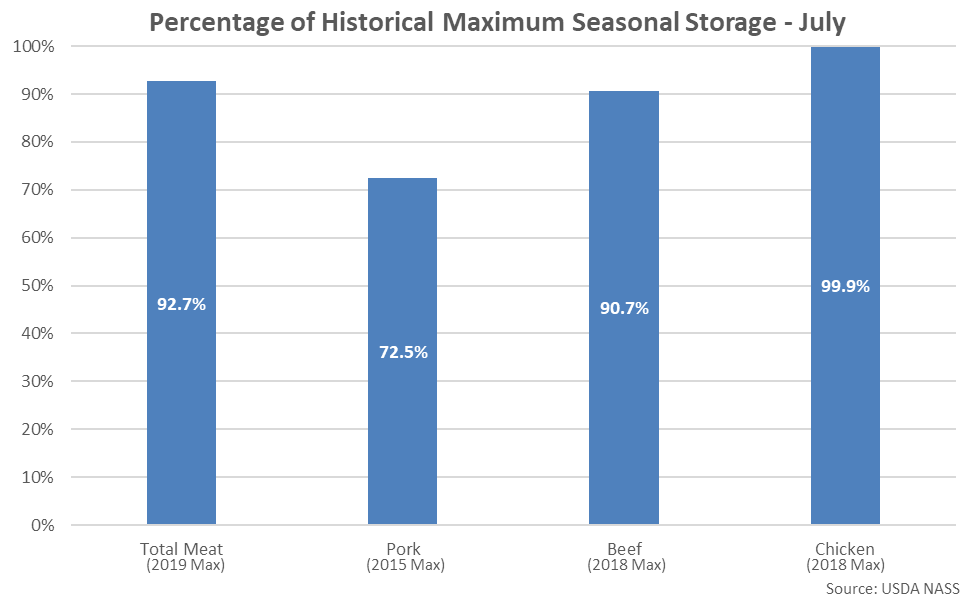

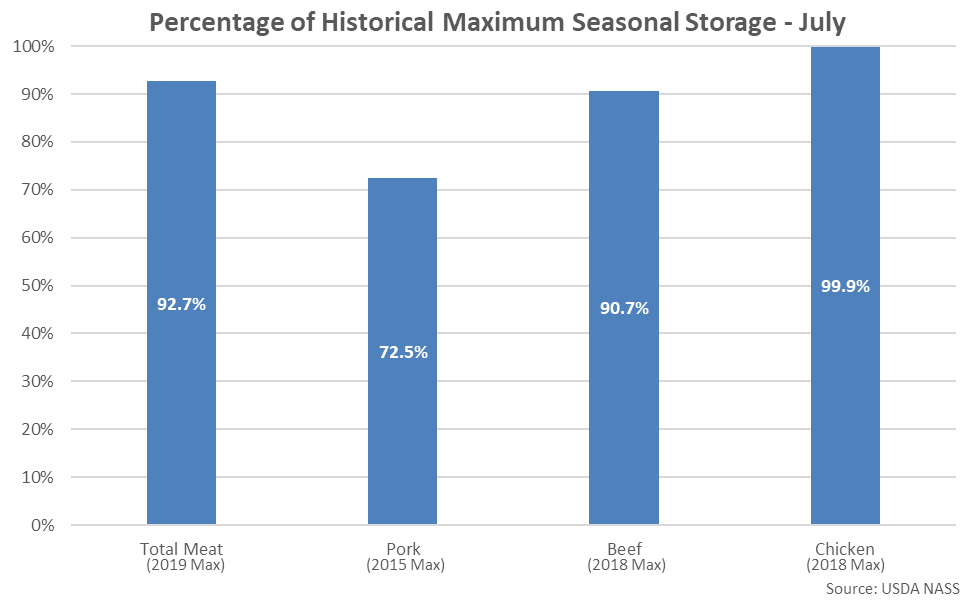

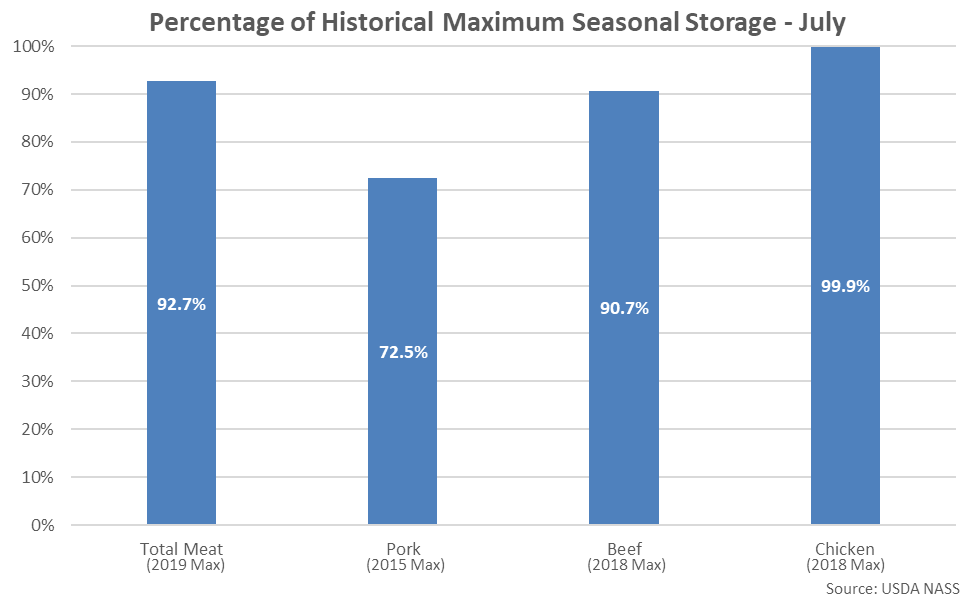

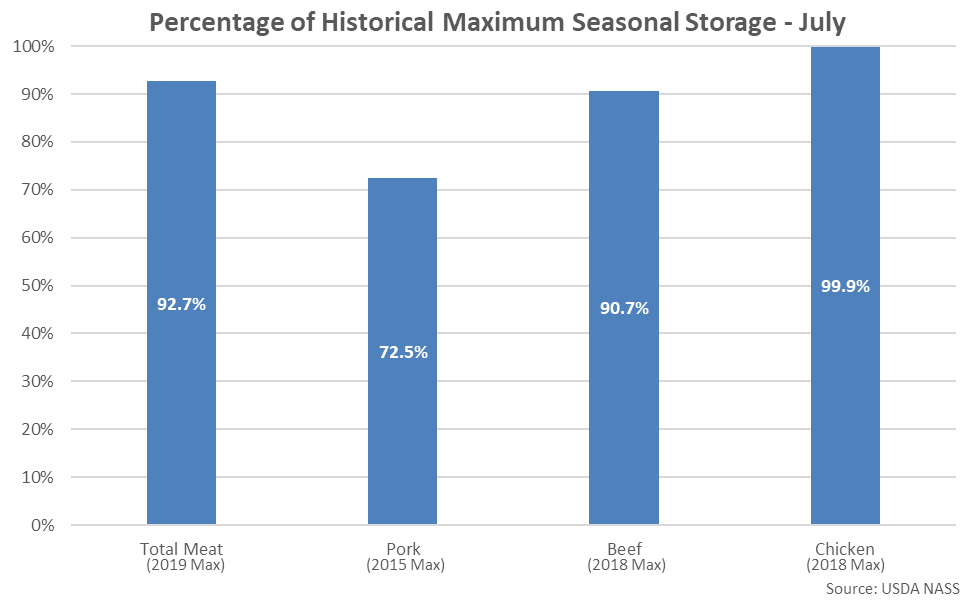

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

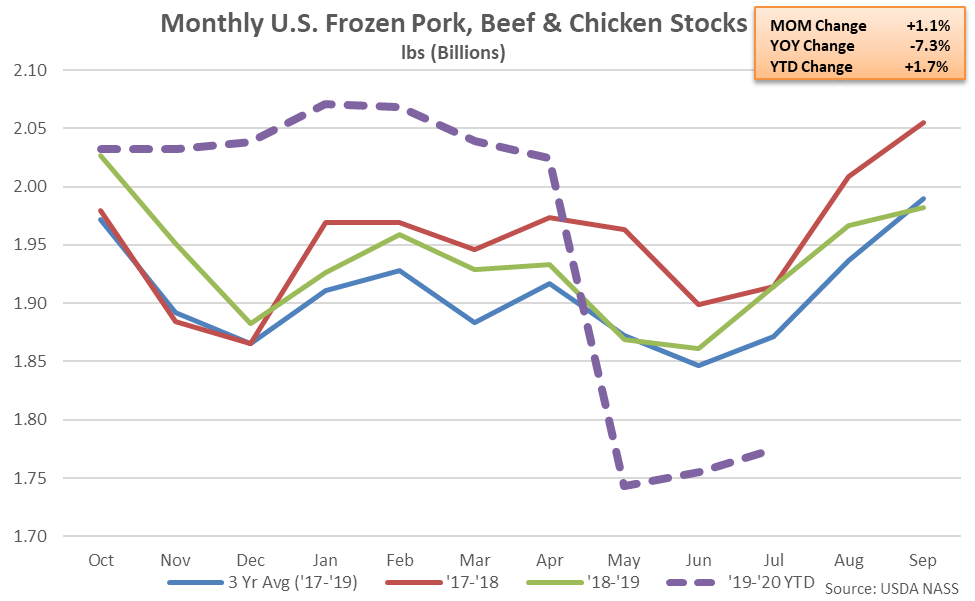

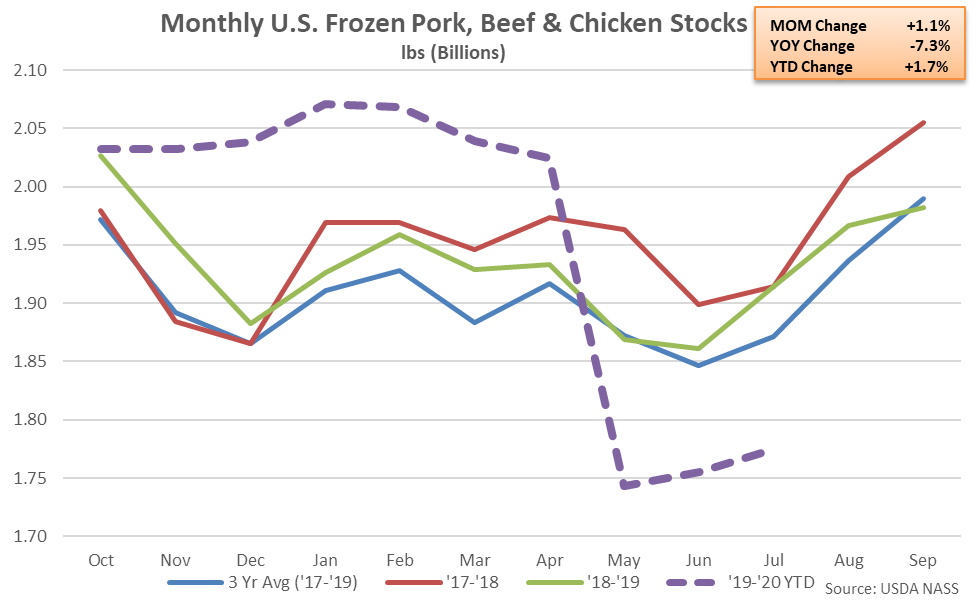

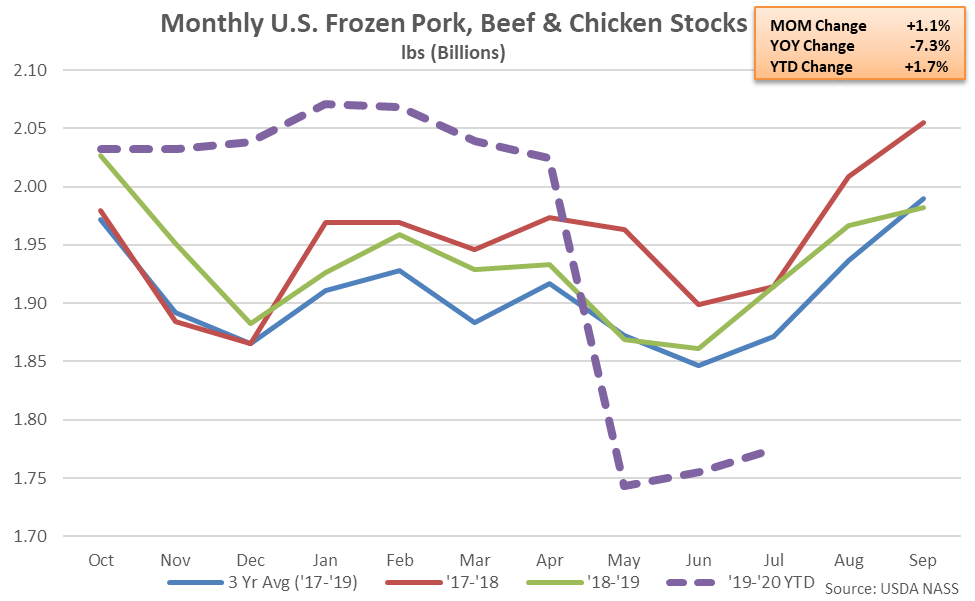

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

- U.S. pork stocks declined to an eight and a half year low level during Jul ’20, finishing 25.0% below previous year volumes.

- U.S. beef stocks declined on a YOY basis for the first time in the past six months during Jul ‘20, finishing down 3.3% and reaching a three year seasonal low level.

- U.S. chicken stocks remained higher on a YOY basis for the tenth consecutive month during Jul ‘20, finishing up 3.4%.

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Jul ’20. Highlights from the updated report include:

- U.S. pork stocks declined to an eight and a half year low level during Jul ’20, finishing 25.0% below previous year volumes.

- U.S. beef stocks declined on a YOY basis for the first time in the past six months during Jul ‘20, finishing down 3.3% and reaching a three year seasonal low level.

- U.S. chicken stocks remained higher on a YOY basis for the tenth consecutive month during Jul ‘20, finishing up 3.4%.

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

According to the USDA, U.S. frozen pork stocks declined to an eight and a half year low level throughout Jul ’20, finishing 25.0% below previous year volumes. The YOY decline in pork stocks was the fourth experienced in a row. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the four most recent YOY declines. The MOM decline in pork stocks of 1.3 million pounds, or 0.3%, was smaller than the ten year average June – July seasonal decline in stocks of 14.2 million pounds, or 2.7%, however.

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

Beef – Stocks Decline on a YOY Basis for the First Time in Six Months, Finish Down 3.3%

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

U.S. frozen beef stocks rebounded to a three month high level but declined on a YOY basis for the first time in the past six months throughout Jul ’20, finishing down 3.3%. Beef stocks reached a three year seasonal low level for the month of July. The MOM increase in beef stocks of 11.1 million pounds, or 2.6%, was slightly larger than the ten year average June – July seasonal increase in stocks of 7.2 million pounds, or 1.9%.

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

Chicken – Stocks Remain Lower on a YOY Basis for the Tenth Consecutive Month, Finish up 3.4%

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

U.S. frozen chicken stocks rebounded to a three month high level throughout Jul ’20 while finishing 3.4% higher on a YOY basis The YOY increase in chicken stocks was the tenth experienced in a row. The MOM increase in chicken stocks of 10.1 million pounds, or 1.2%, was largely consistent with the ten year average June – July seasonal increase in stocks of 11.7 million pounds, or 1.8%. The MOM increase in stocks was in addition to a 1.4% upward revision to the previous month stocks level.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Overall, Jul ’20 combined U.S. pork, beef and chicken stocks finished 14.3% below the monthly record high level experienced throughout Jan ’20. Individually, Jul ’20 chicken stocks finished 11% below the record high storage level experienced throughout Nov ’19 while beef and pork stocks finished 23% and 35% below historical maximum storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 7.3% below the record high seasonal level experienced during July of 2019. Individually, Jul ’20 chicken stocks finished just 0.1% below the record high seasonal storage level while beef and pork stocks finished ten percent and 28% below record high seasonal storage levels, respectively.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.

Jul ’20 combined U.S. pork, beef and chicken stocks rebounded to a three month high level but remained 7.3% lower on a YOY basis. The Jul ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the third experienced in a row and the largest experienced throughout the past five and a half years on a percentage basis.