U.S. Ethanol Exports Update – Sep ’20

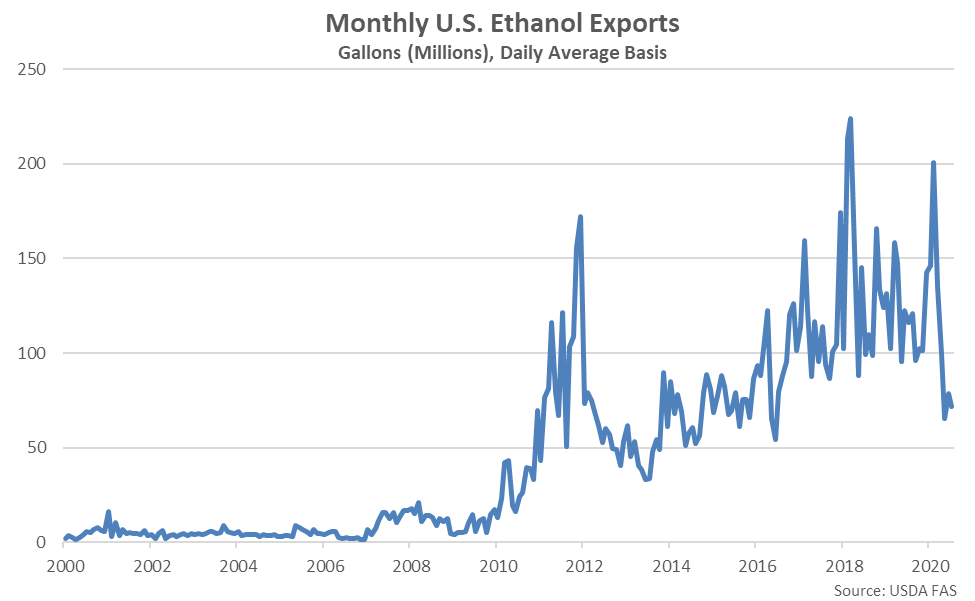

Jul ’20 U.S. Ethanol Export Volumes Remained Near Recent Four Year Low Levels

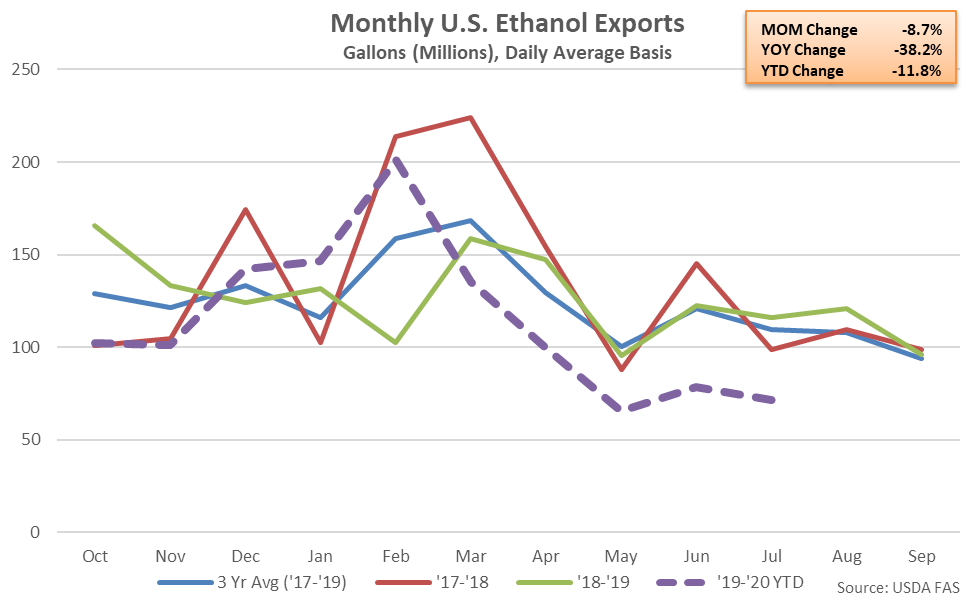

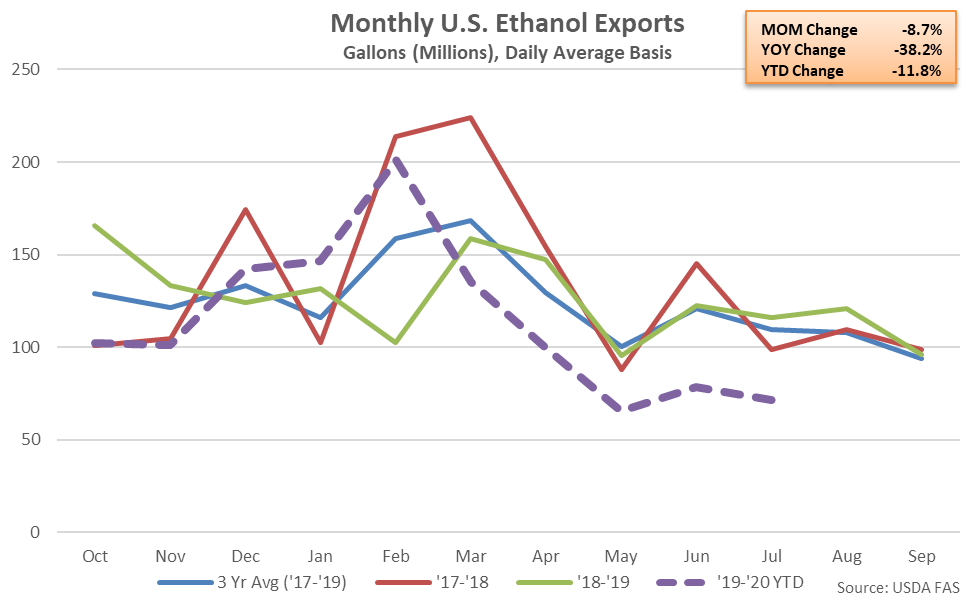

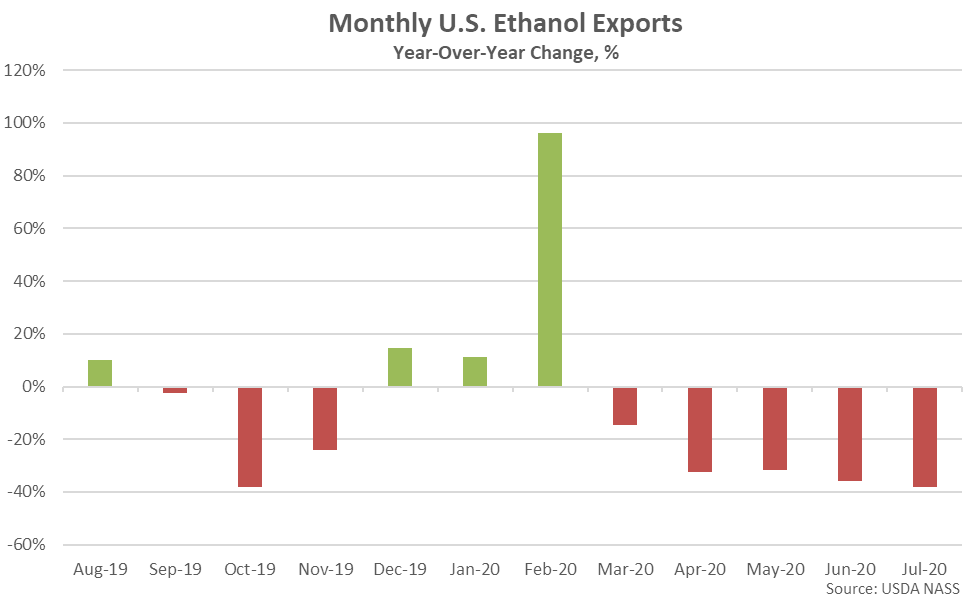

Jul ’20 U.S. Ethanol Export Volumes Declined 8.7% MOM and 38.2% YOY

Jul ’20 U.S. Ethanol Export Volumes Declined 8.7% MOM and 38.2% YOY

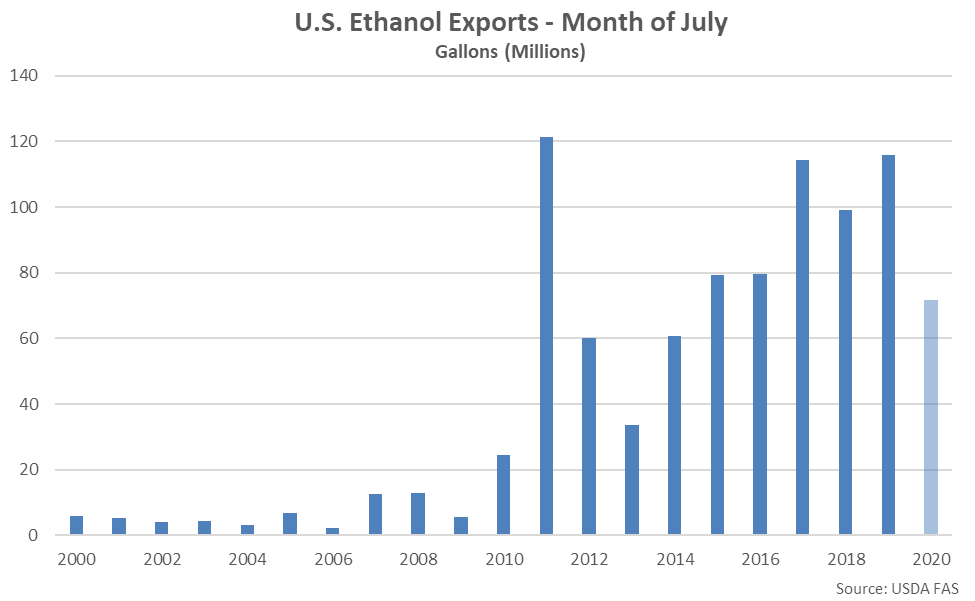

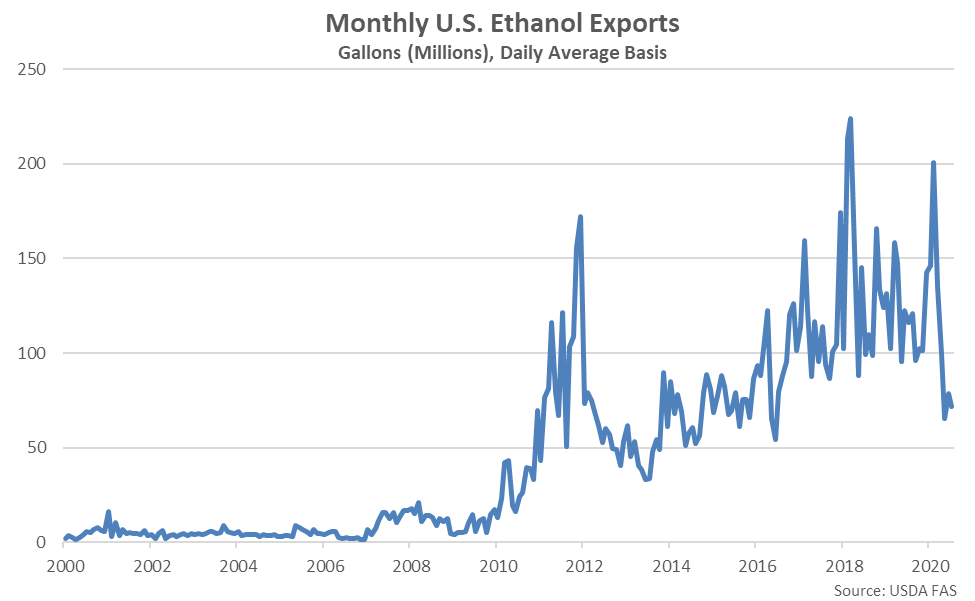

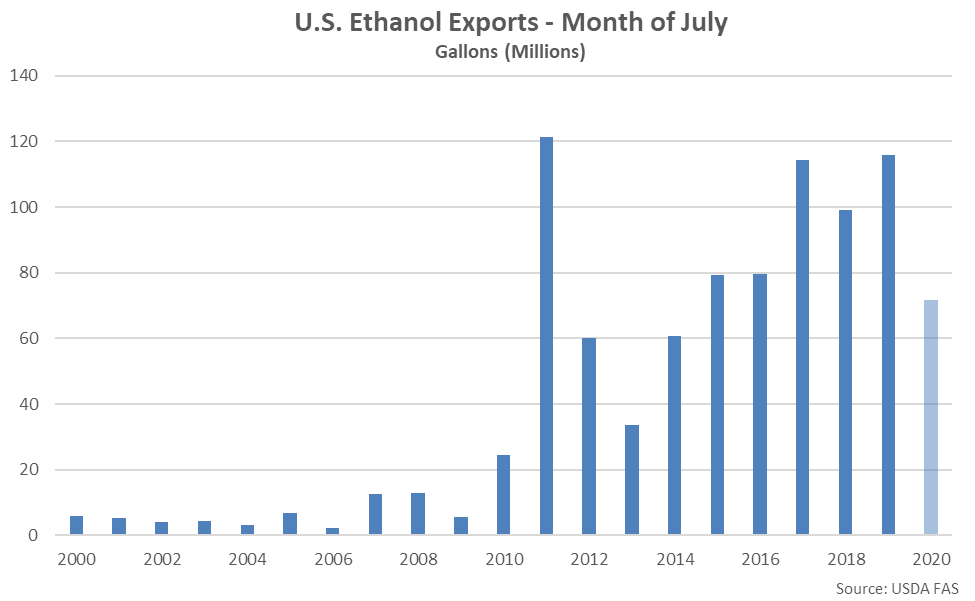

Jul ’20 U.S. Ethanol Export Volumes Reached a Six Year Seasonal Low Level

Jul ’20 U.S. Ethanol Export Volumes Reached a Six Year Seasonal Low Level

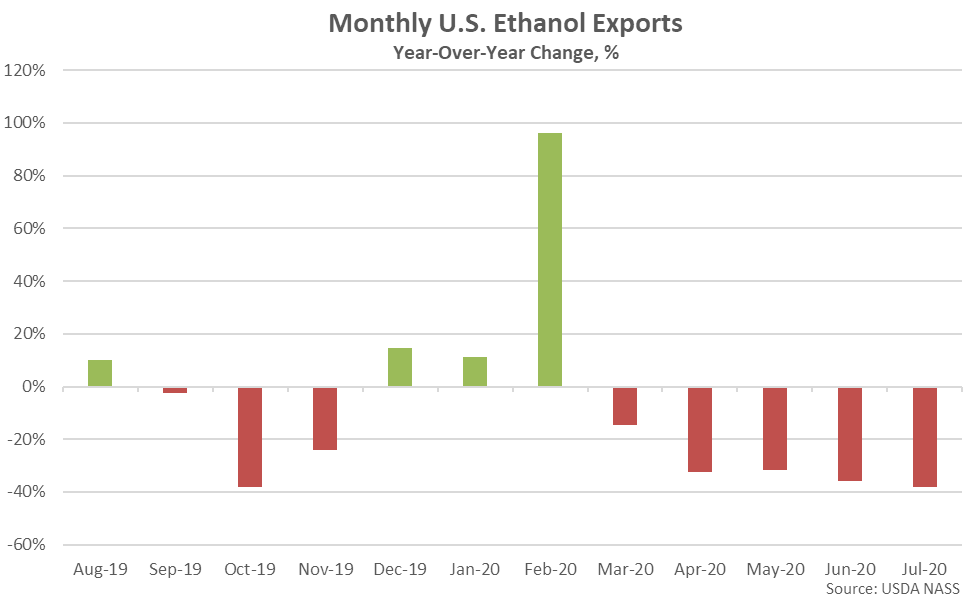

The Jul ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fifth Experienced in a Row

The Jul ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fifth Experienced in a Row

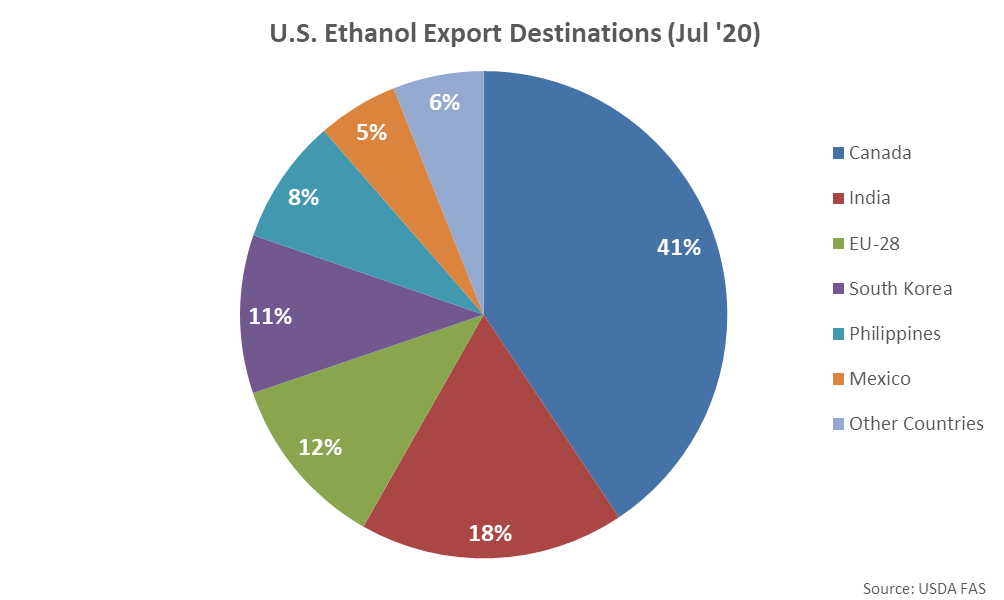

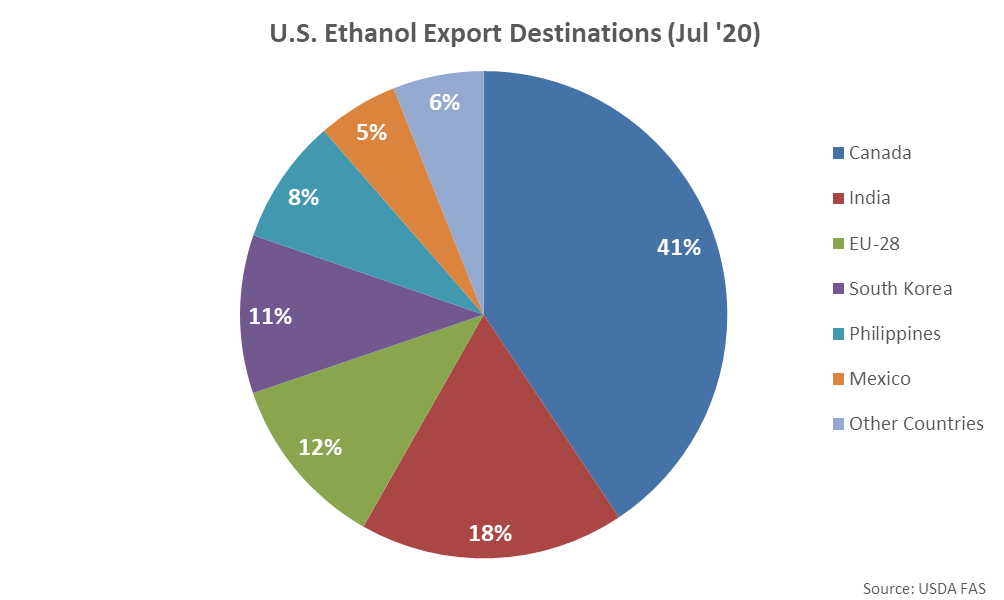

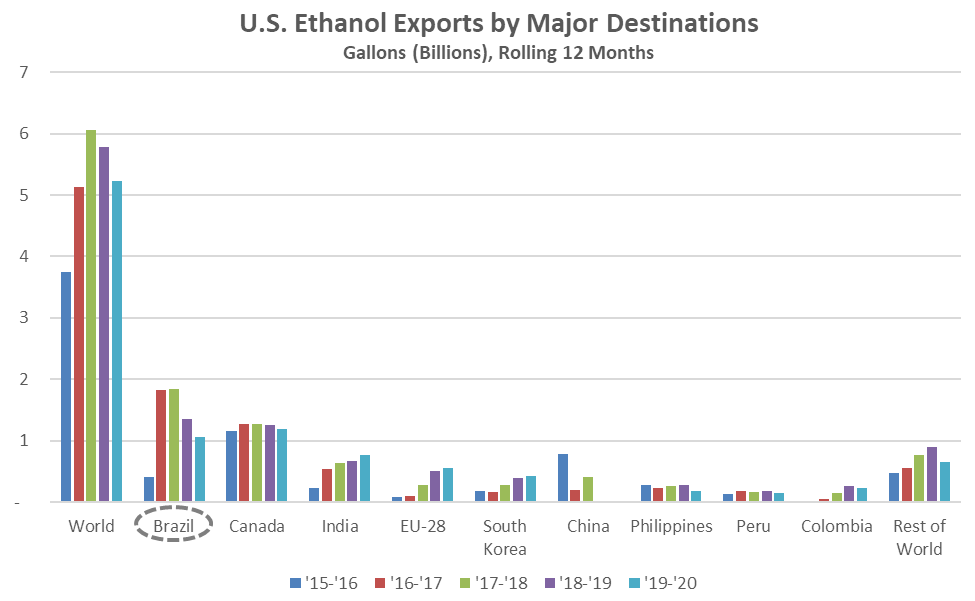

Canada was the Top Destination for U.S. Ethanol Exports During Jul ’20

Canada was the Top Destination for U.S. Ethanol Exports During Jul ’20

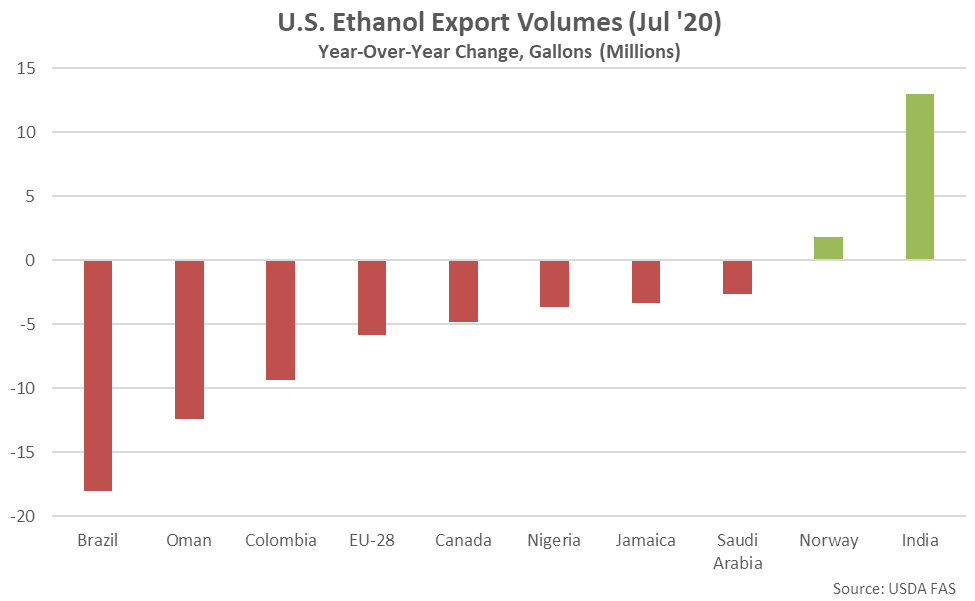

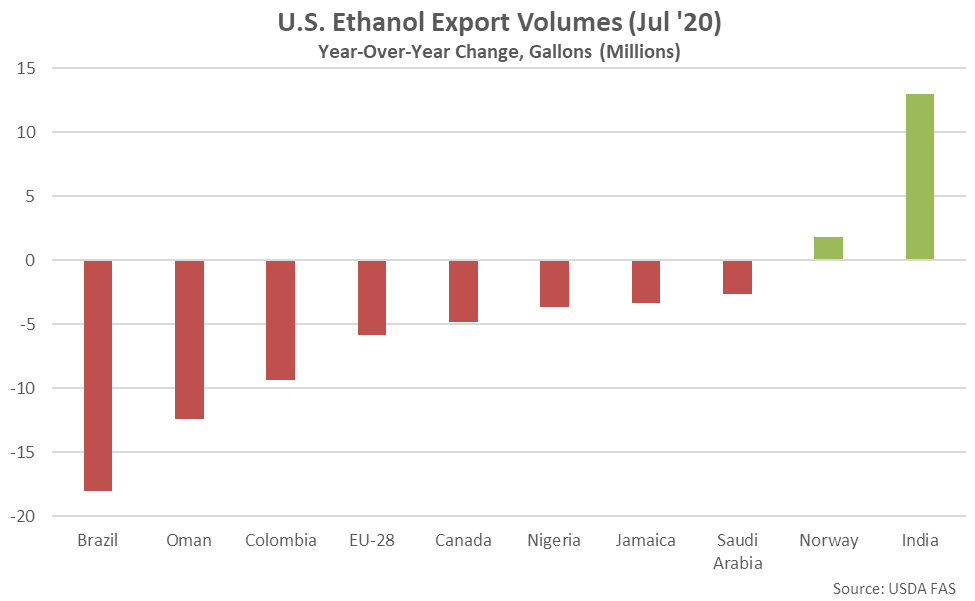

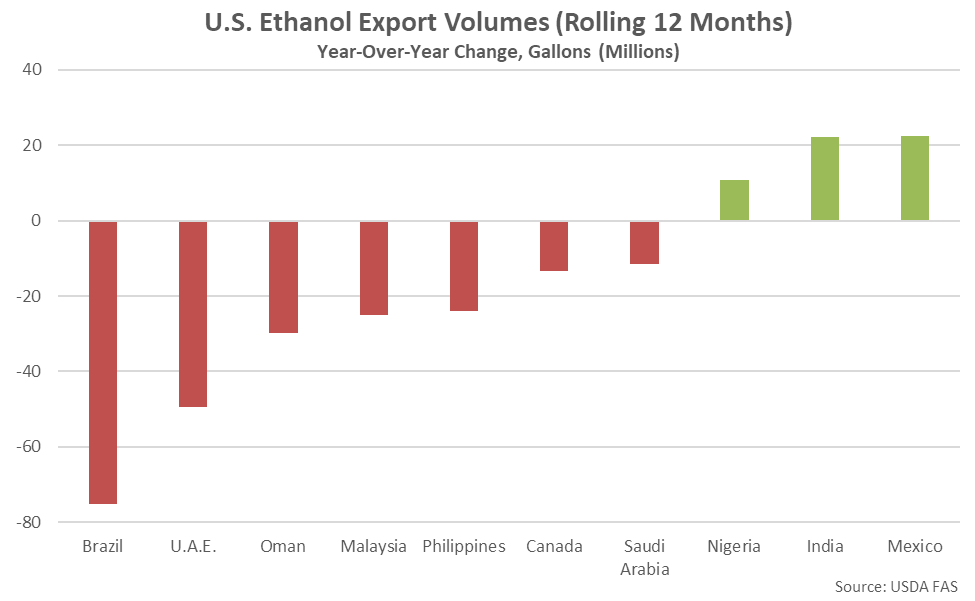

Jul ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

Jul ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

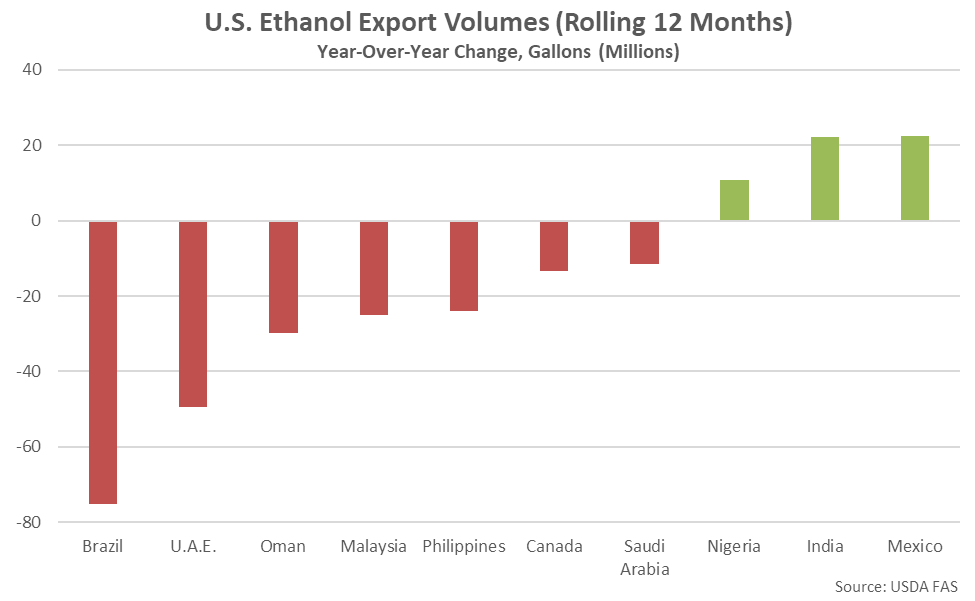

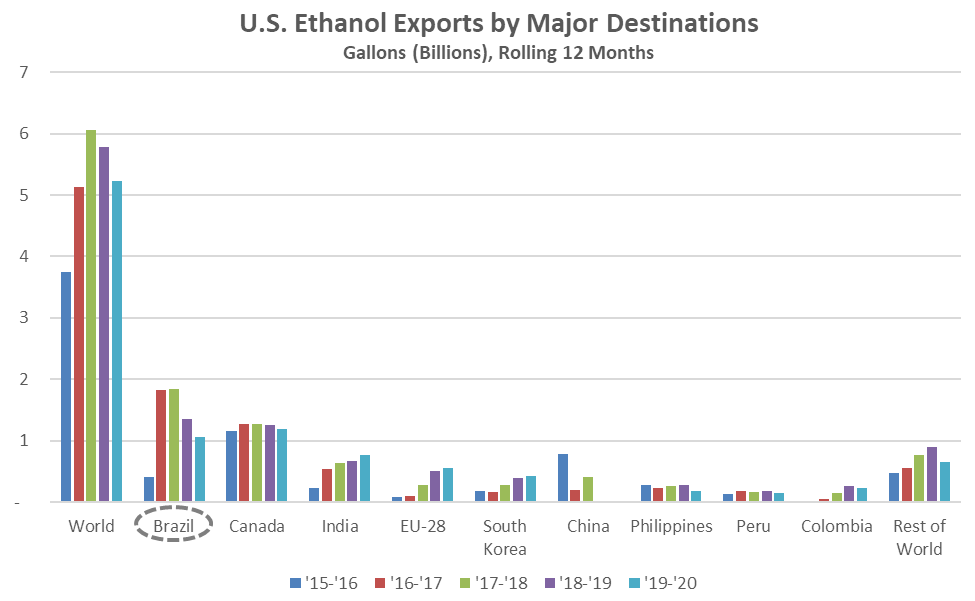

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

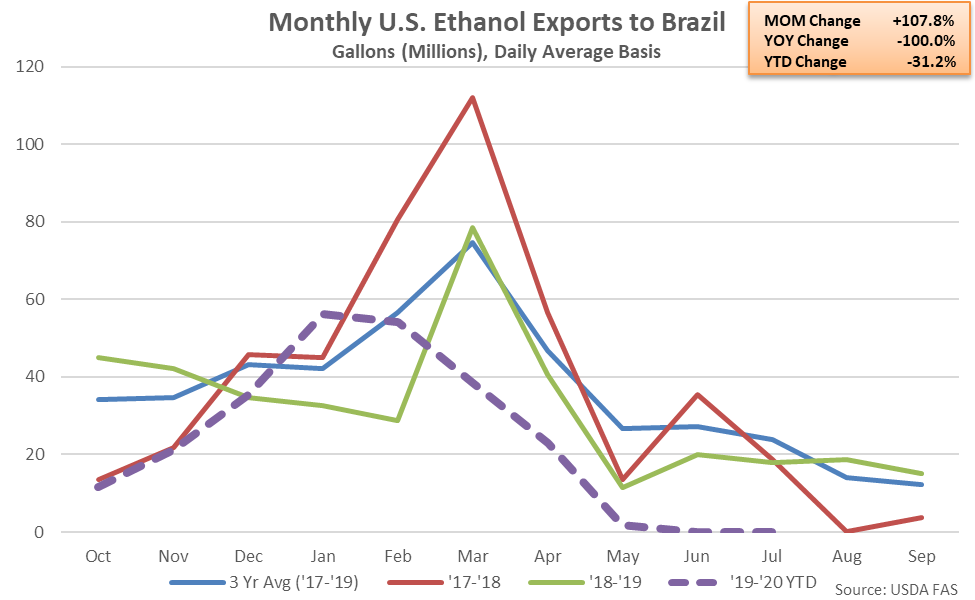

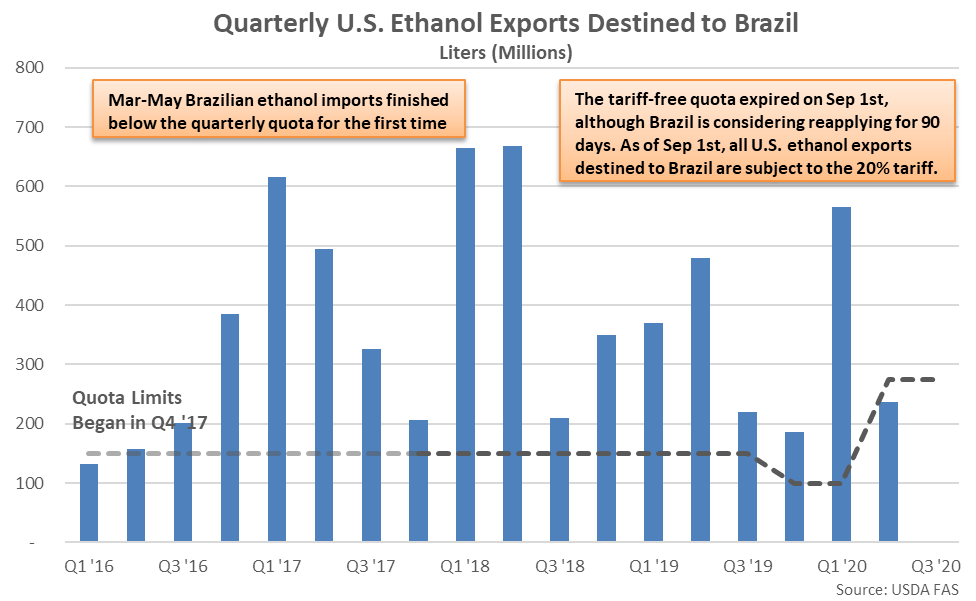

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

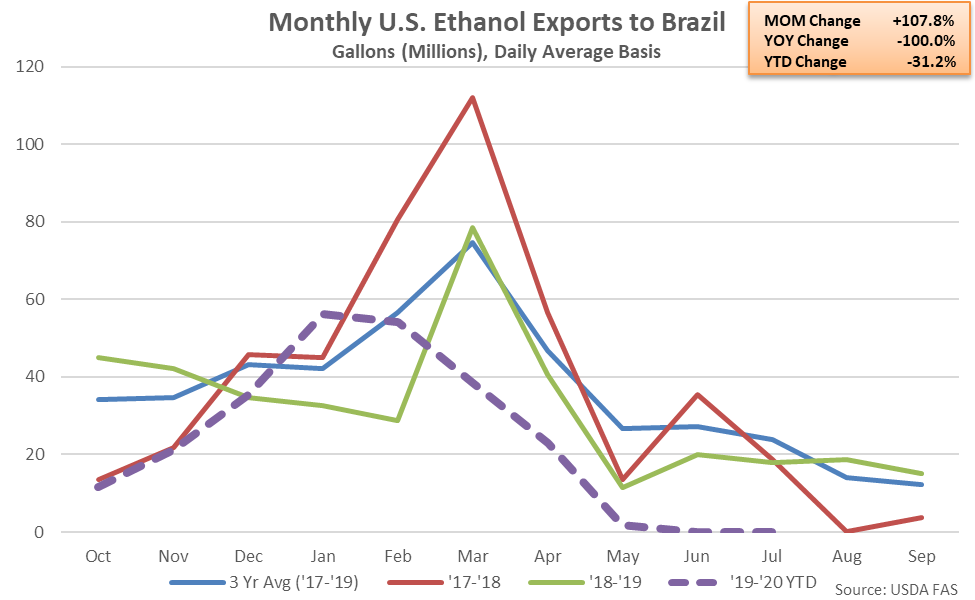

Jul ’20 U.S. Ethanol Exports to Brazil Remained Near Recent Four and a Half Year Low Levels

Jul ’20 U.S. Ethanol Exports to Brazil Remained Near Recent Four and a Half Year Low Levels

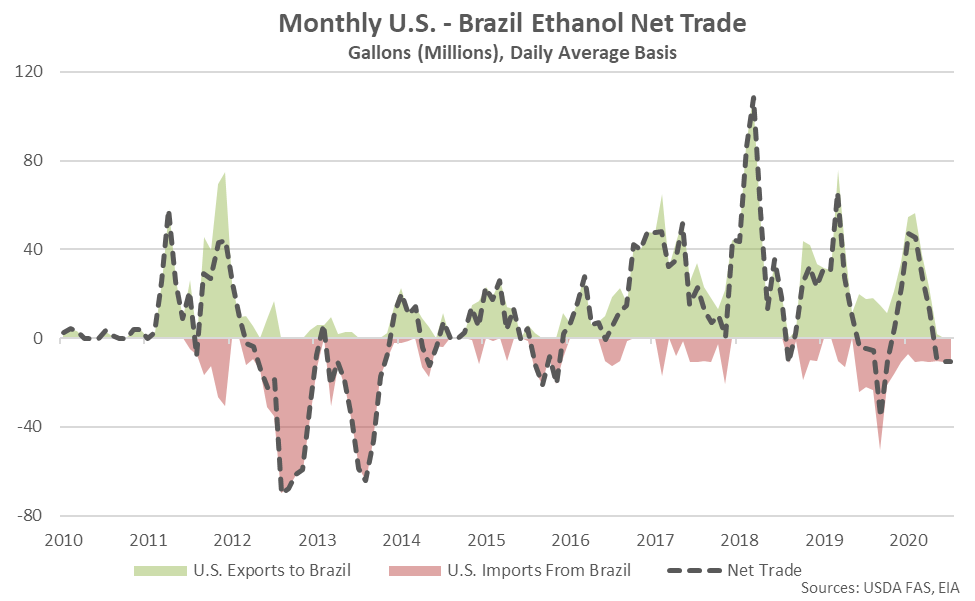

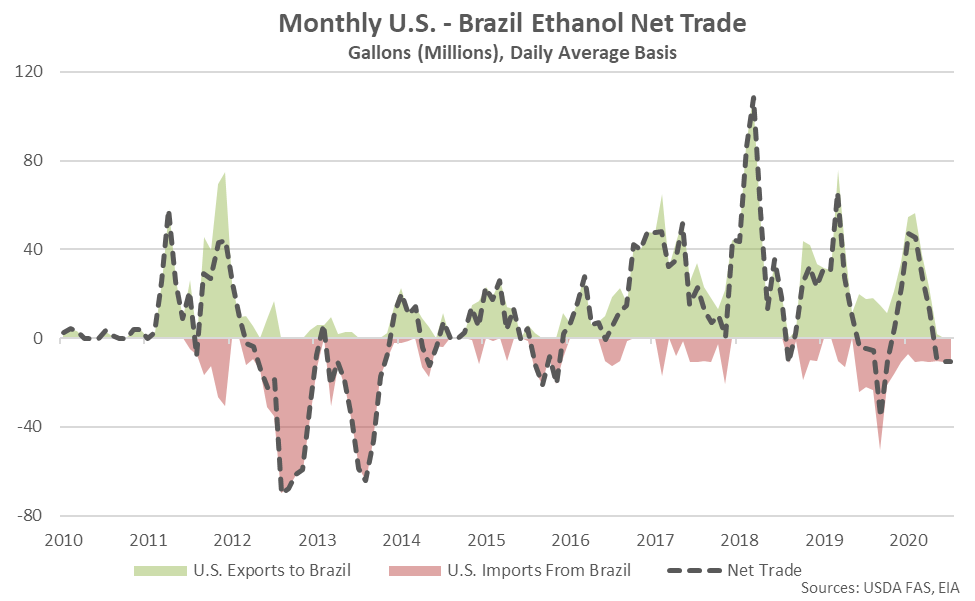

Jul ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Third Consecutive Month

Jul ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Third Consecutive Month

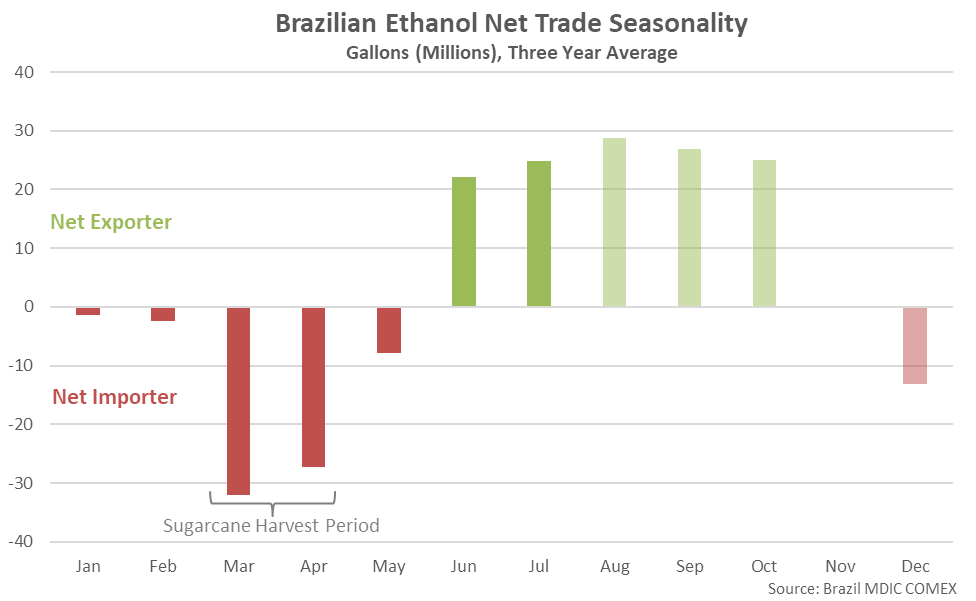

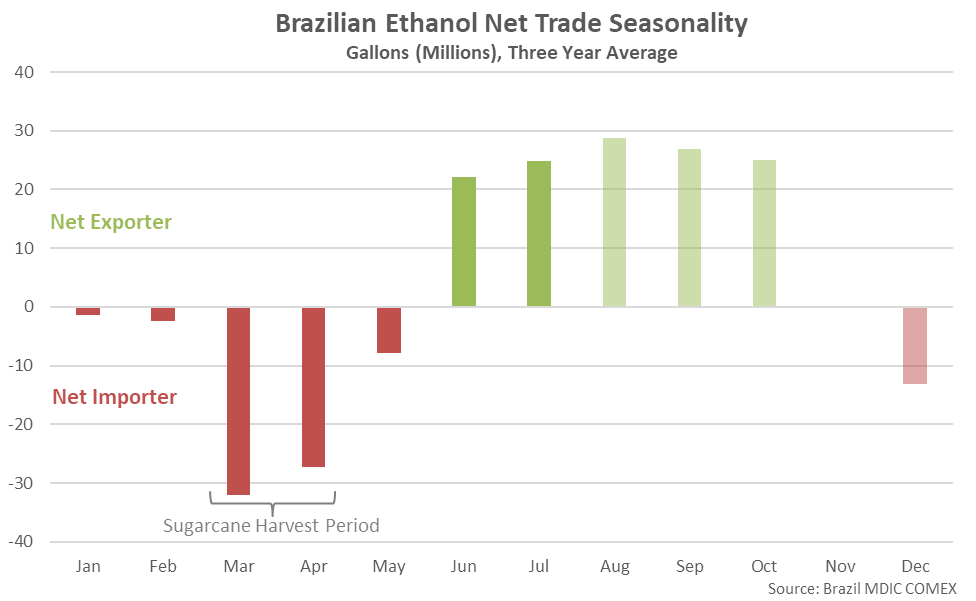

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of July

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of July

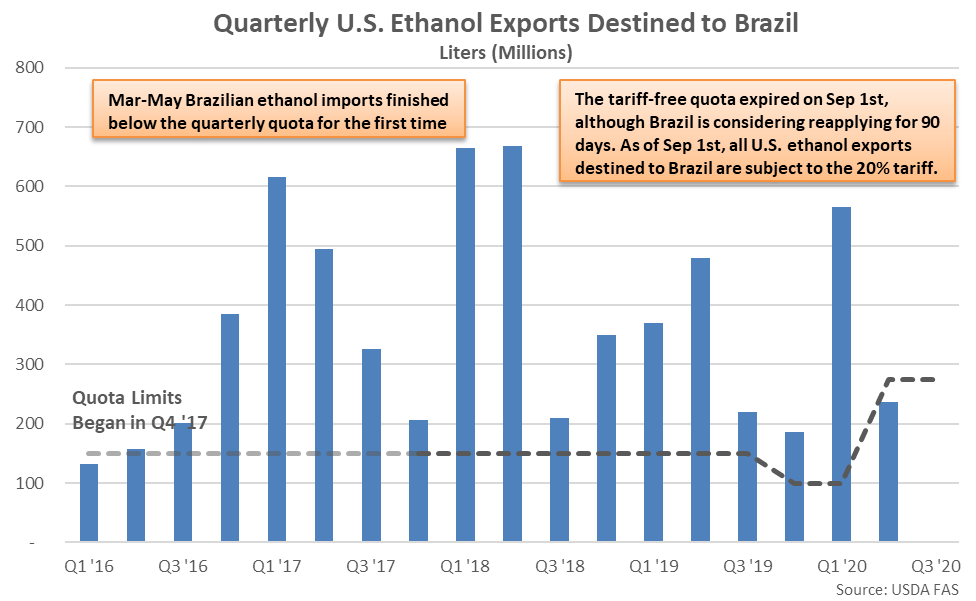

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

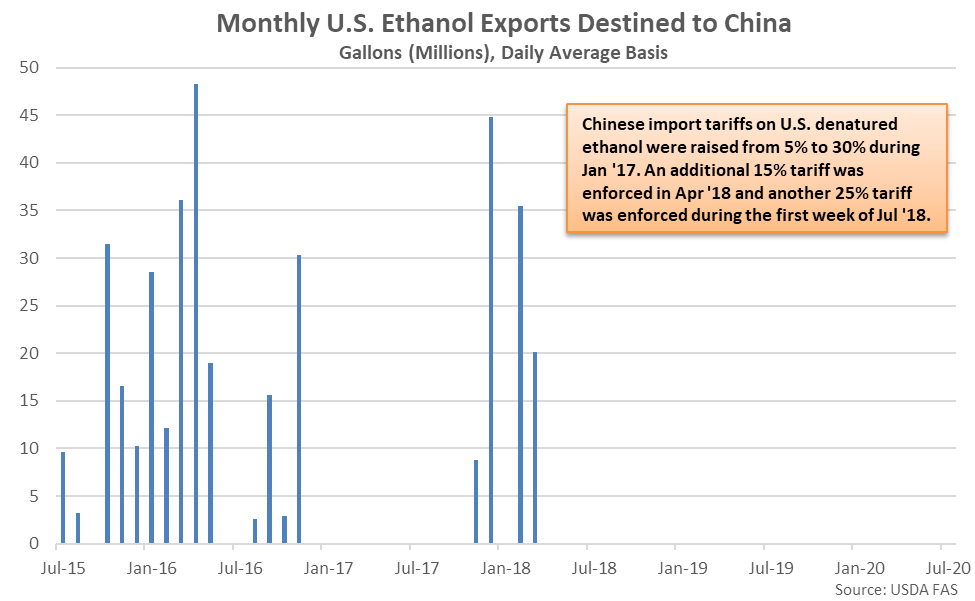

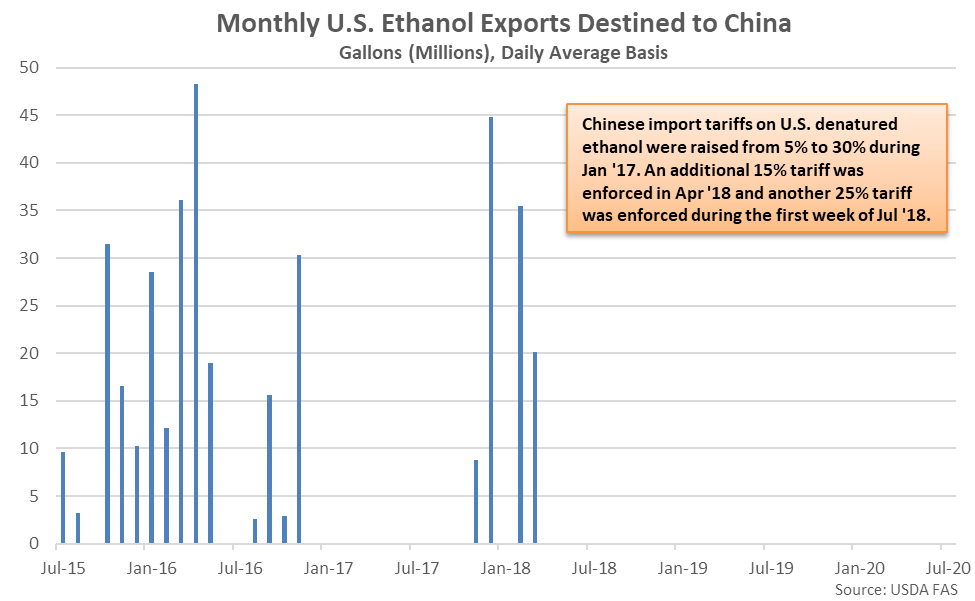

Jul ’20 U.S. Ethanol Exports Destined to China Reached a 28 Mo High but Remained Minimal

Jul ’20 U.S. Ethanol Exports Destined to China Reached a 28 Mo High but Remained Minimal

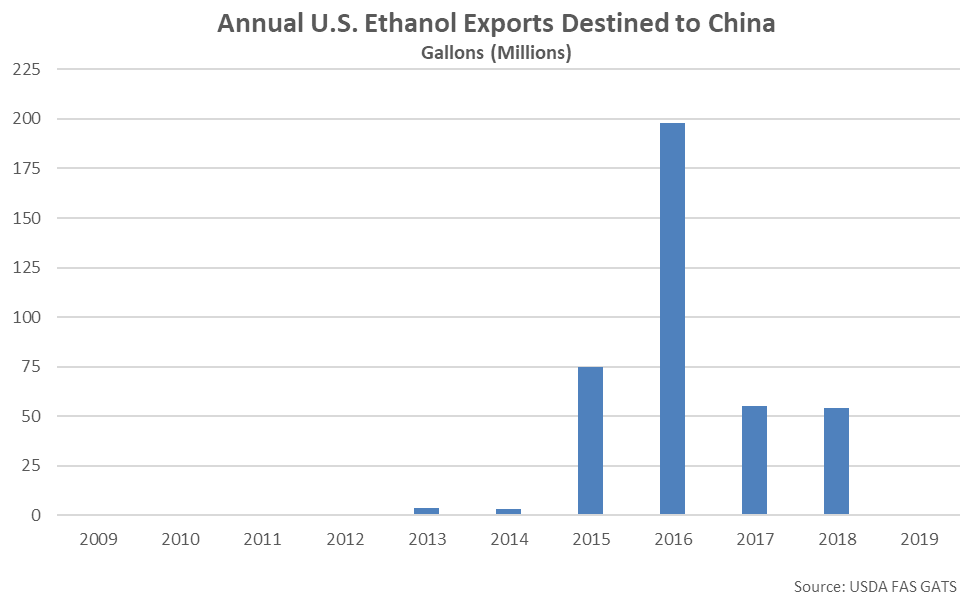

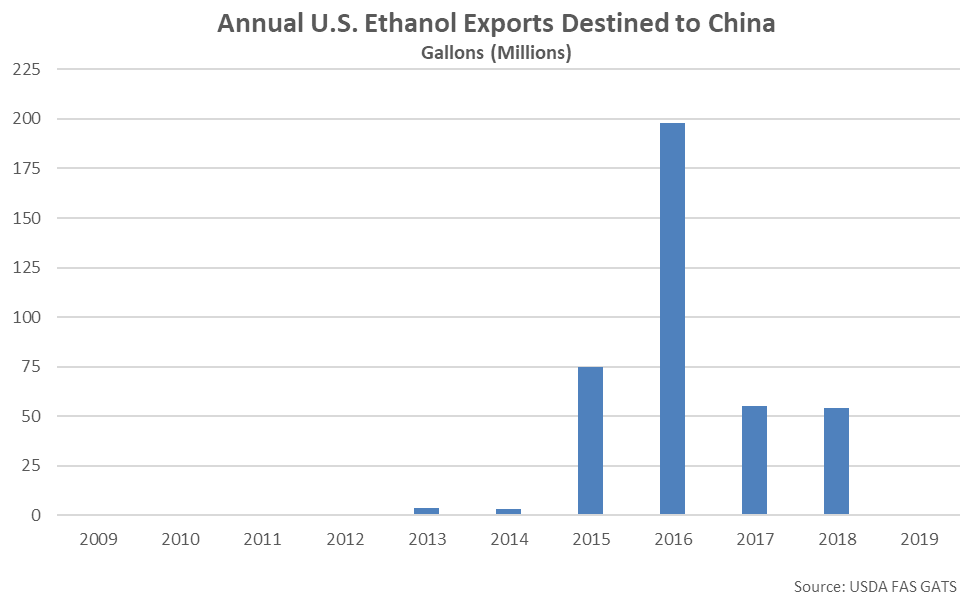

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

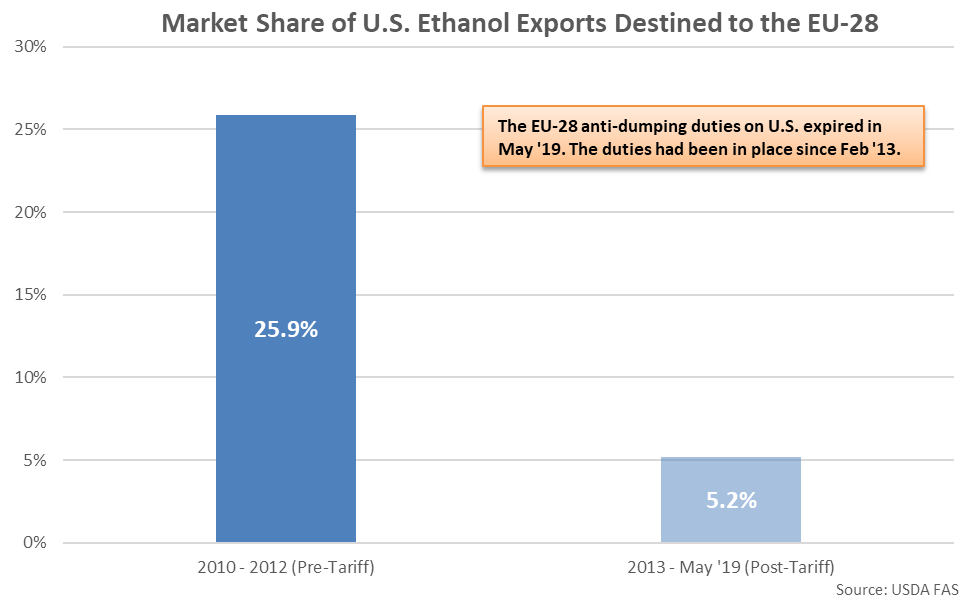

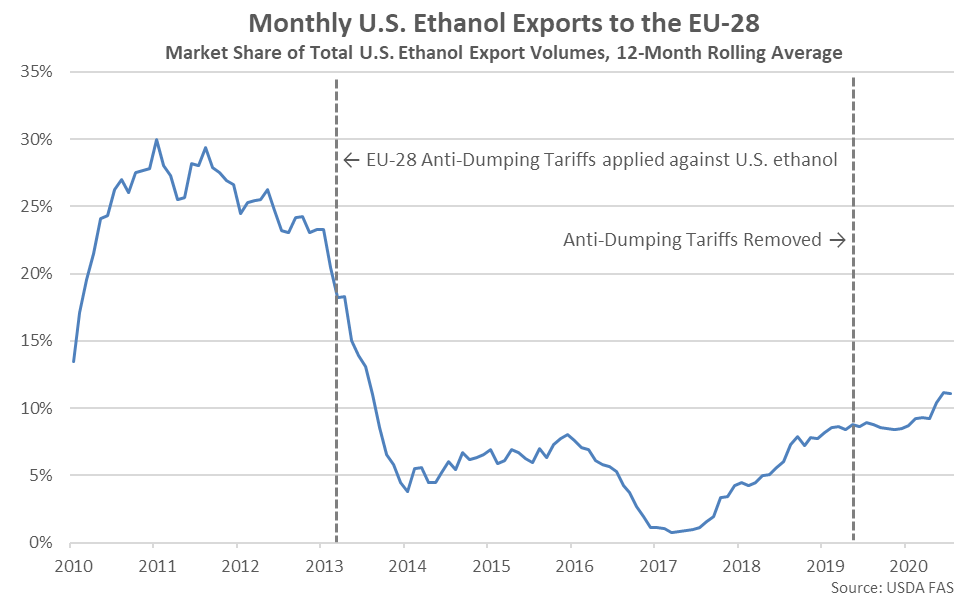

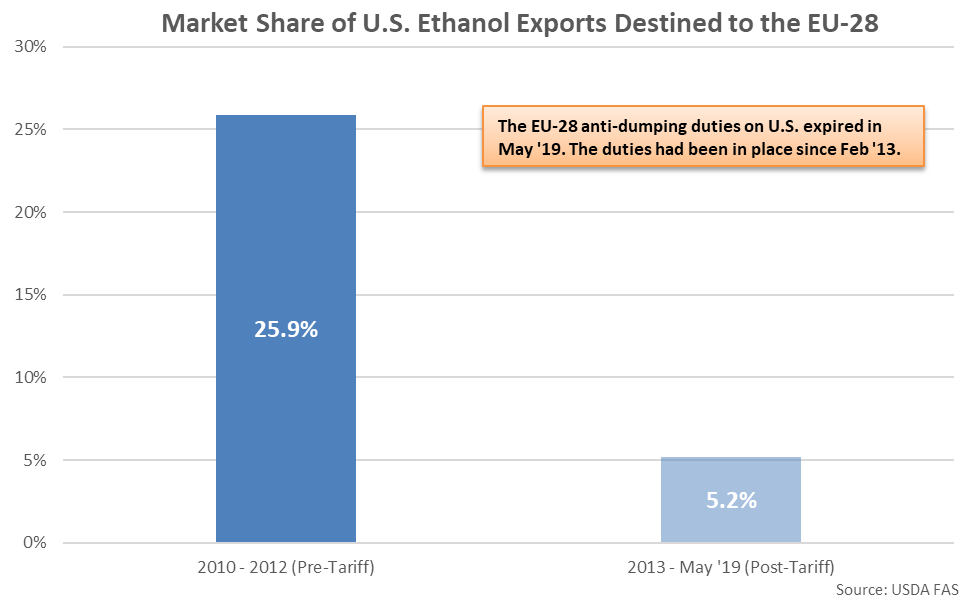

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jul ’19

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jul ’19

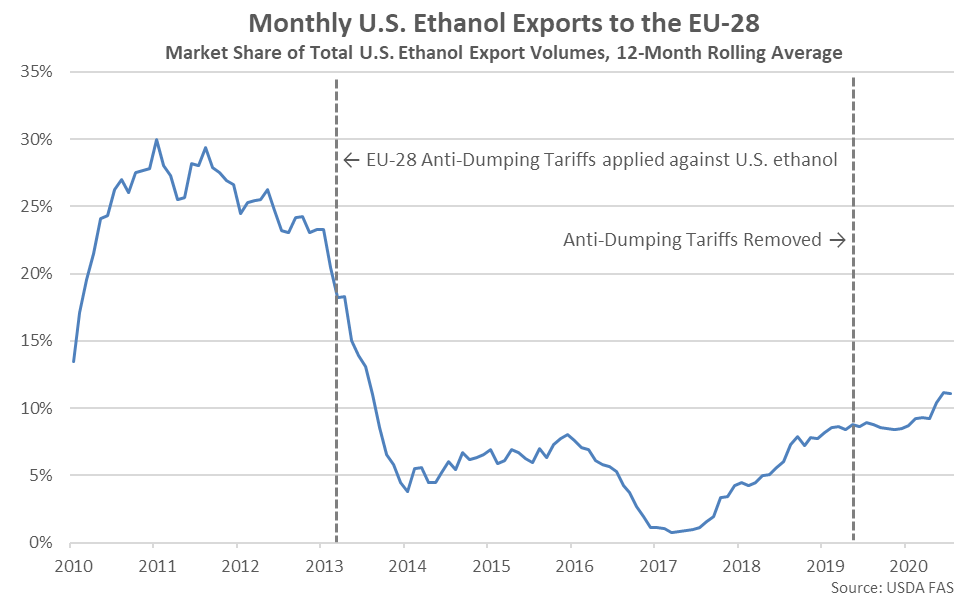

12-Mo Rolling Average EU-28 Market Share Remained Near Six and a Half Year High Levels

12-Mo Rolling Average EU-28 Market Share Remained Near Six and a Half Year High Levels

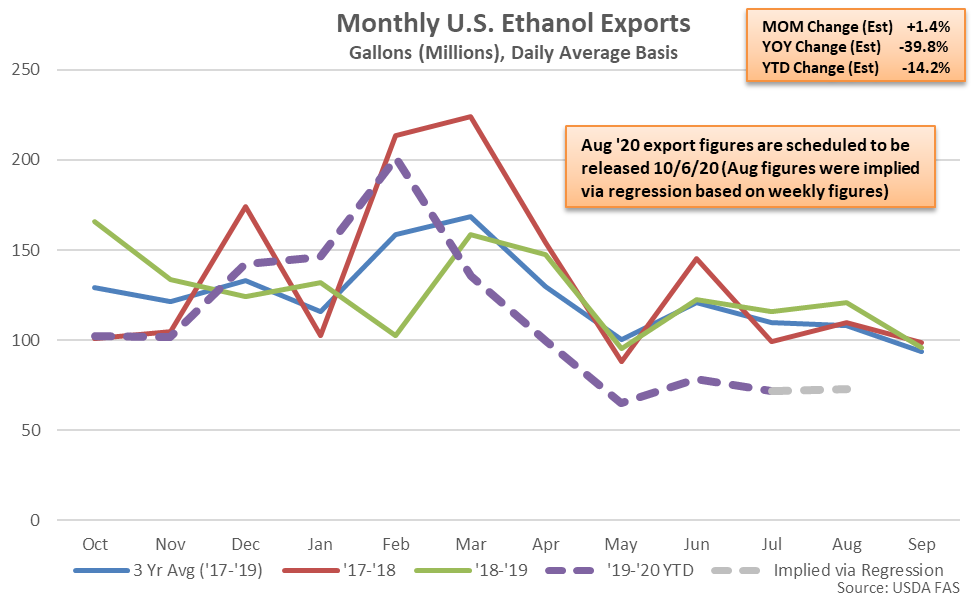

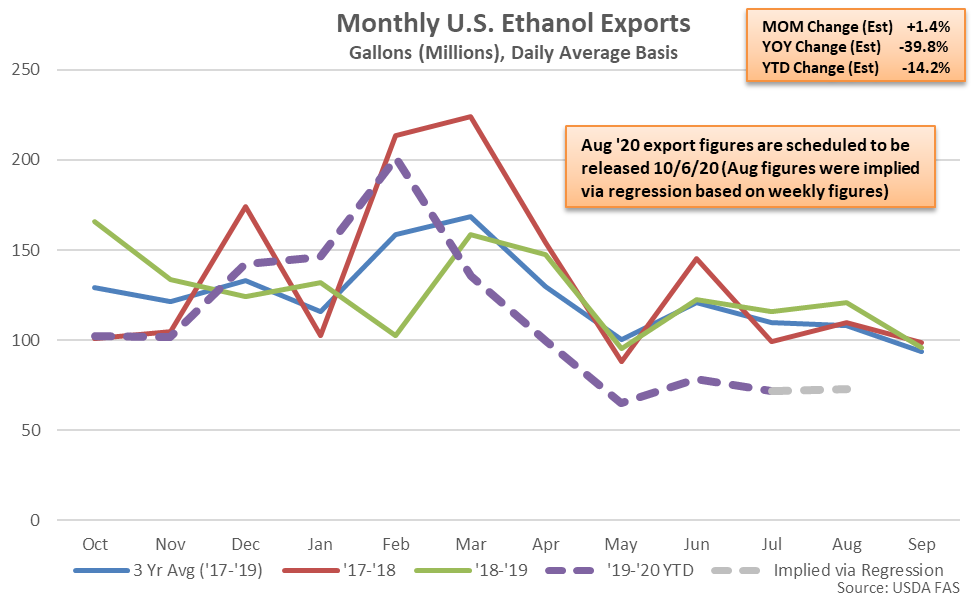

Aug ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 39.8%

Aug ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 39.8%

Jul ’20 U.S. Ethanol Export Volumes Declined 8.7% MOM and 38.2% YOY

Jul ’20 U.S. Ethanol Export Volumes Declined 8.7% MOM and 38.2% YOY

Jul ’20 U.S. Ethanol Export Volumes Reached a Six Year Seasonal Low Level

Jul ’20 U.S. Ethanol Export Volumes Reached a Six Year Seasonal Low Level

The Jul ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fifth Experienced in a Row

The Jul ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fifth Experienced in a Row

Canada was the Top Destination for U.S. Ethanol Exports During Jul ’20

Canada was the Top Destination for U.S. Ethanol Exports During Jul ’20

Jul ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

Jul ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

Jul ’20 U.S. Ethanol Exports to Brazil Remained Near Recent Four and a Half Year Low Levels

Jul ’20 U.S. Ethanol Exports to Brazil Remained Near Recent Four and a Half Year Low Levels

Jul ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Third Consecutive Month

Jul ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Third Consecutive Month

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of July

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of July

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

Jul ’20 U.S. Ethanol Exports Destined to China Reached a 28 Mo High but Remained Minimal

Jul ’20 U.S. Ethanol Exports Destined to China Reached a 28 Mo High but Remained Minimal

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jul ’19

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jul ’19

12-Mo Rolling Average EU-28 Market Share Remained Near Six and a Half Year High Levels

12-Mo Rolling Average EU-28 Market Share Remained Near Six and a Half Year High Levels

Aug ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 39.8%

Aug ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 39.8%