Coronavirus Food Assistance Program 2 Update – Sep ’20

President Trump and U.S. Secretary of Agriculture Sonny Perdue announced on September 17th that the USDA will implement a second round of Coronavirus Food Assistance Program payments. The newly implemented Coronavirus Food Assistance Program 2 (CFAP 2) is expected to provide up to $14 billion in relief to producers of various commodities including dairy, livestock and row crops. The $14 billion in relief included within CFAP 2 is in addition to the $19 billion included in CFAP 1.

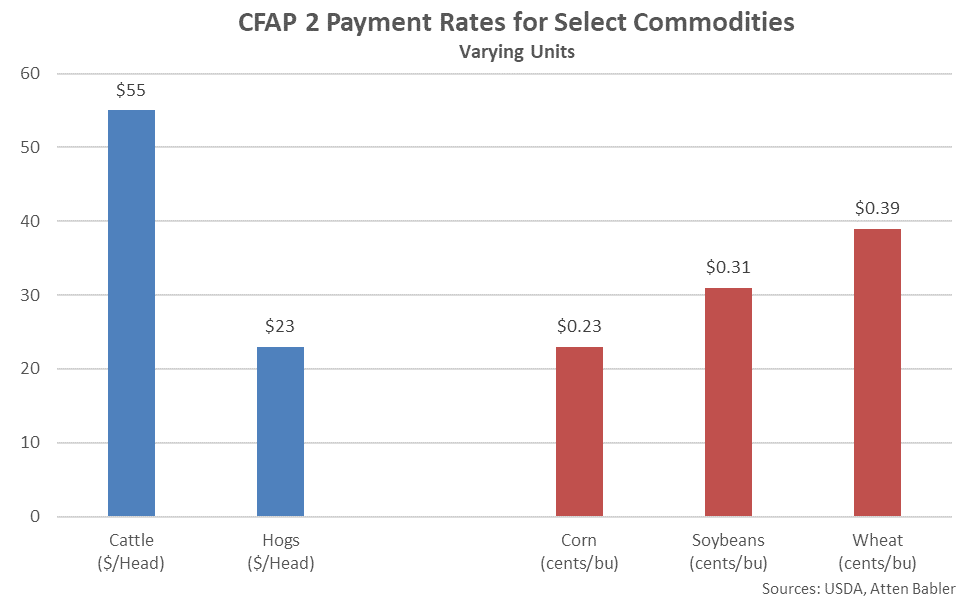

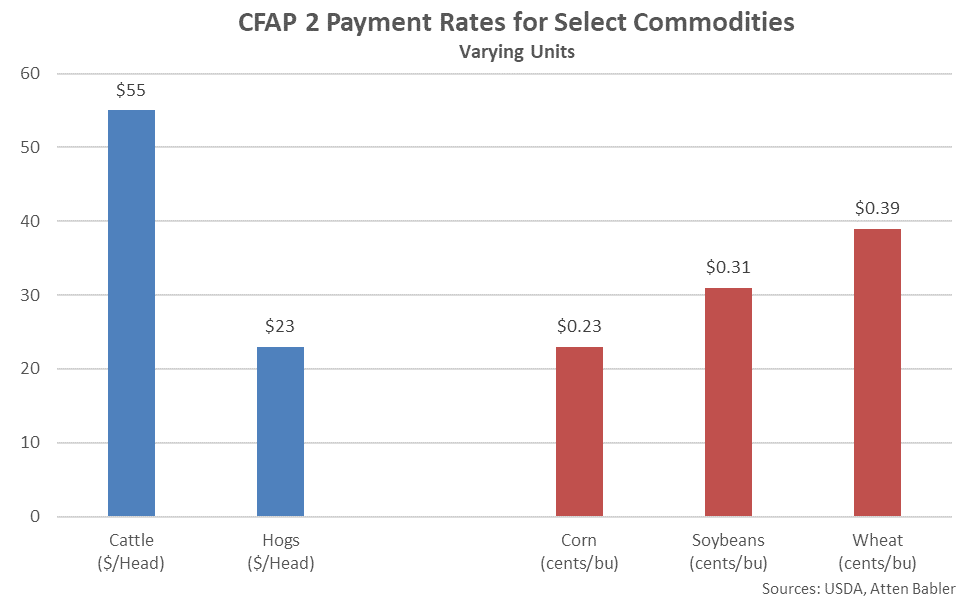

Within CFAP 2, dairy producers will effectively be paid $2.16/cwt for their actual milk production experienced from April through August. Cattle producers will be paid $55/head multiplied by the maximum inventory from April 16th through August 31st while hog producers will be paid $23/head for their maximum inventory over the same period. Effective payment rates for crops include $0.23/bu for corn, $0.31/bu for soybeans and $0.39/bu for all classes of wheat.

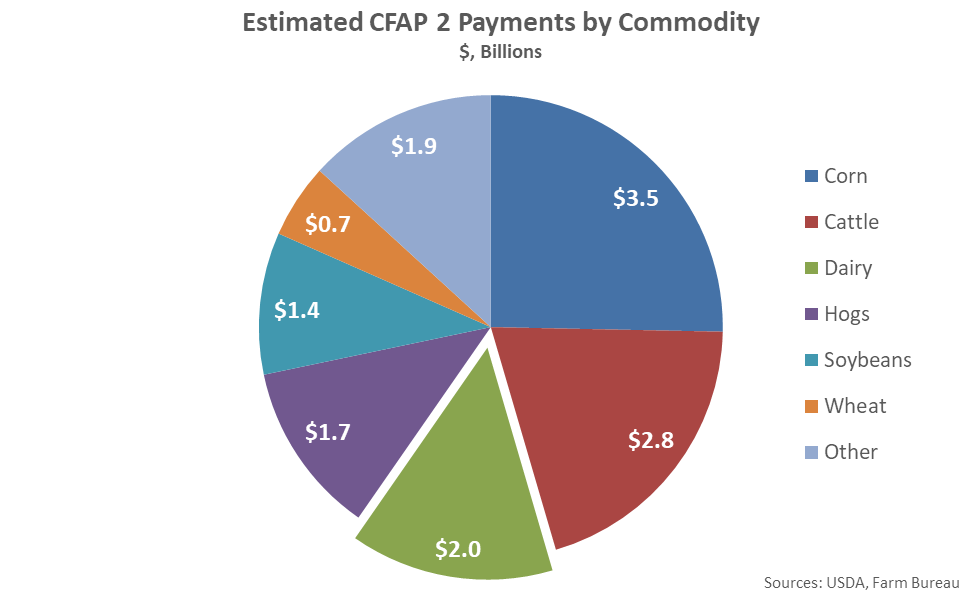

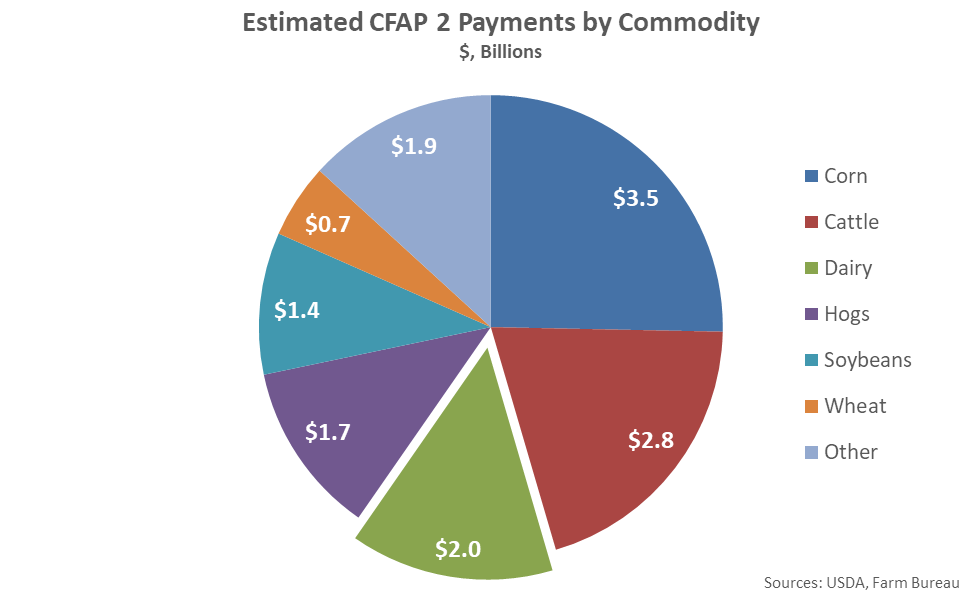

CFAP 2 dairy payments are equivalent to 72% of the initial CFAP 1 payments based on internal estimates. National milk production for the April – August period is currently estimated at 933 million cwt. Without factoring in payment limitations outlined in the subsequent section, gross estimated dairy payments using the $2.16/cwt payment rate amount to just over $2.0 billion. CFAP 2 payments are expected to be most significant for corn producers, followed by beef cattle producers and dairy producers.

CFAP 2 dairy payments are equivalent to 72% of the initial CFAP 1 payments based on internal estimates. National milk production for the April – August period is currently estimated at 933 million cwt. Without factoring in payment limitations outlined in the subsequent section, gross estimated dairy payments using the $2.16/cwt payment rate amount to just over $2.0 billion. CFAP 2 payments are expected to be most significant for corn producers, followed by beef cattle producers and dairy producers.

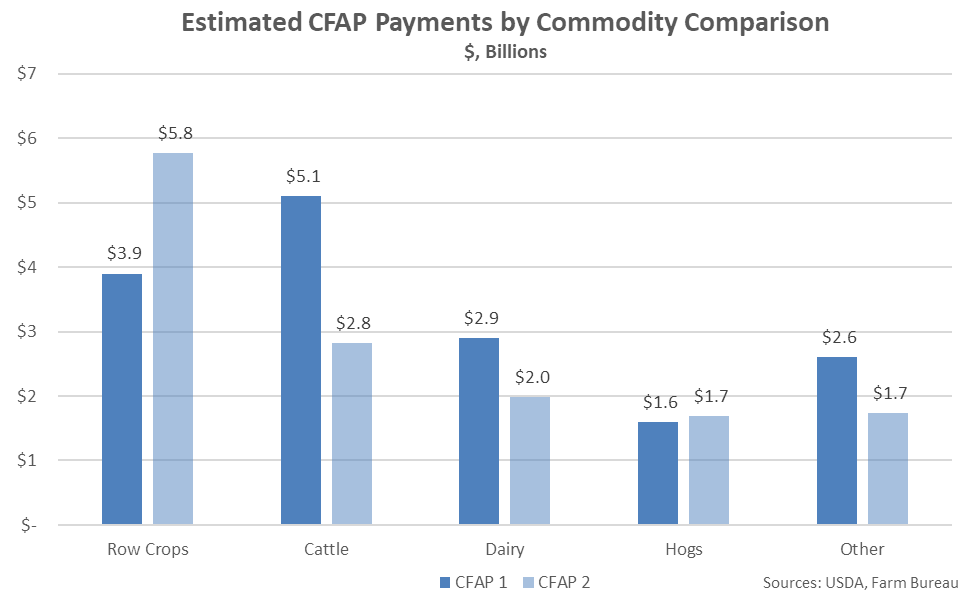

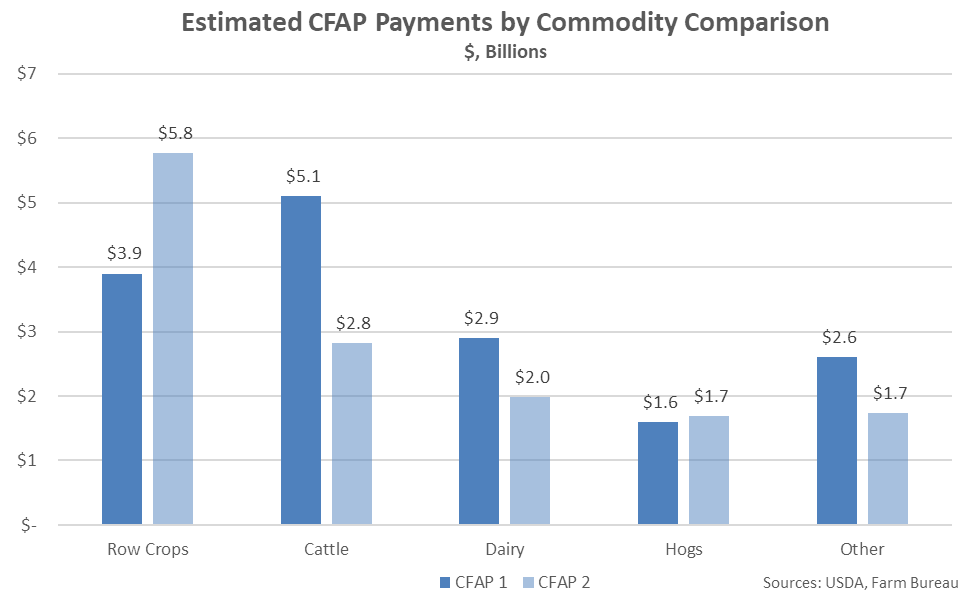

CFAP 2 row crop payments are expected to increase most significantly from CFAP 1, while cattle payments declined most significantly from the original program.

CFAP 2 row crop payments are expected to increase most significantly from CFAP 1, while cattle payments declined most significantly from the original program.

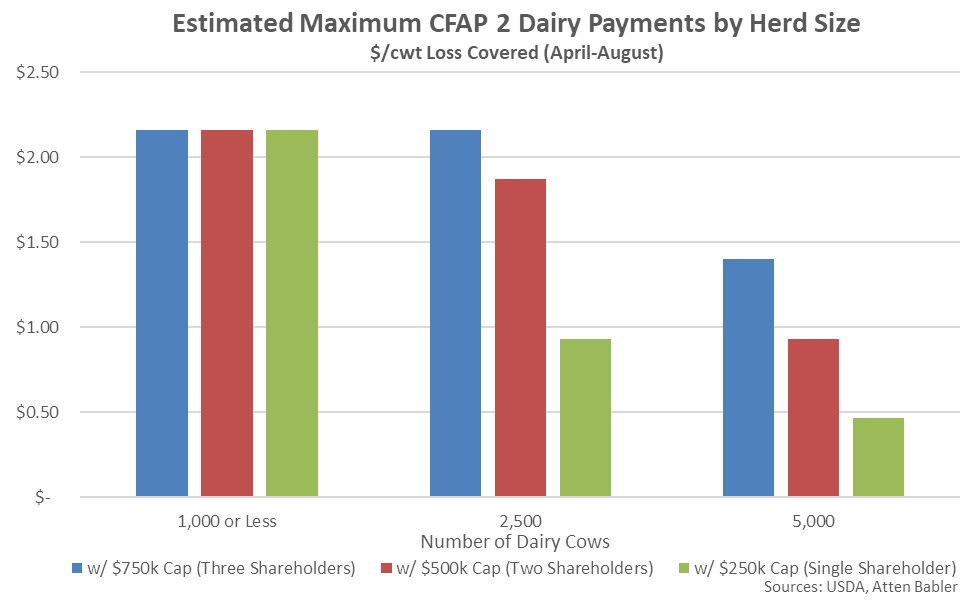

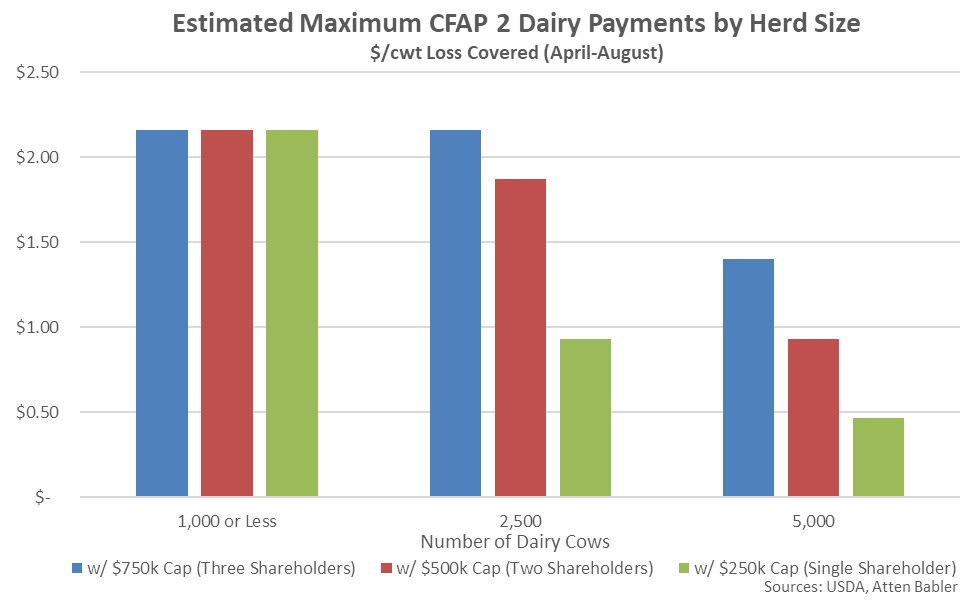

CFAP 2 payments are subject to a per person and legal entity payment limitation of $250,000 respective of all eligible commodities. The payment limitation is separate from the CFAP 1 payment limit. Corporations, limited liability companies and limited partnerships may receive up to $750,000 based on the number of shareholders.[1] Other eligibility requirements apply, consistent with CFAP 1.[2]

Payment limitations will significantly reduce the per cwt payments made to relatively larger dairy producers, as shown in the chart below. The chart below assumes average milk per cow of 70 pounds per day throughout the months of April – August. In addition, the chart below assumes the $14 billion in payments is sufficient to meet all requests. Payments begin to cap out for single shareholder producers with milk cow herds greater than 1,080 cows based on the assumptions outlined above. Over half of all U.S. milk production volumes are produced from herds exceeding 1,000 cows while herds exceeding 2,500 cows account for over a third of all U.S. milk production volumes.

CFAP 2 payments are subject to a per person and legal entity payment limitation of $250,000 respective of all eligible commodities. The payment limitation is separate from the CFAP 1 payment limit. Corporations, limited liability companies and limited partnerships may receive up to $750,000 based on the number of shareholders.[1] Other eligibility requirements apply, consistent with CFAP 1.[2]

Payment limitations will significantly reduce the per cwt payments made to relatively larger dairy producers, as shown in the chart below. The chart below assumes average milk per cow of 70 pounds per day throughout the months of April – August. In addition, the chart below assumes the $14 billion in payments is sufficient to meet all requests. Payments begin to cap out for single shareholder producers with milk cow herds greater than 1,080 cows based on the assumptions outlined above. Over half of all U.S. milk production volumes are produced from herds exceeding 1,000 cows while herds exceeding 2,500 cows account for over a third of all U.S. milk production volumes.

The USDA’s Farm Service Agency will begin accepting CFAP 2 applications from producers beginning Sep 21st. Applications will be accepted through Dec 11th. Additional information and application forms can be found at www.farmers.gov/cfap.

The USDA’s Farm Service Agency will begin accepting CFAP 2 applications from producers beginning Sep 21st. Applications will be accepted through Dec 11th. Additional information and application forms can be found at www.farmers.gov/cfap.

CFAP 2 dairy payments are equivalent to 72% of the initial CFAP 1 payments based on internal estimates. National milk production for the April – August period is currently estimated at 933 million cwt. Without factoring in payment limitations outlined in the subsequent section, gross estimated dairy payments using the $2.16/cwt payment rate amount to just over $2.0 billion. CFAP 2 payments are expected to be most significant for corn producers, followed by beef cattle producers and dairy producers.

CFAP 2 dairy payments are equivalent to 72% of the initial CFAP 1 payments based on internal estimates. National milk production for the April – August period is currently estimated at 933 million cwt. Without factoring in payment limitations outlined in the subsequent section, gross estimated dairy payments using the $2.16/cwt payment rate amount to just over $2.0 billion. CFAP 2 payments are expected to be most significant for corn producers, followed by beef cattle producers and dairy producers.

CFAP 2 row crop payments are expected to increase most significantly from CFAP 1, while cattle payments declined most significantly from the original program.

CFAP 2 row crop payments are expected to increase most significantly from CFAP 1, while cattle payments declined most significantly from the original program.

CFAP 2 payments are subject to a per person and legal entity payment limitation of $250,000 respective of all eligible commodities. The payment limitation is separate from the CFAP 1 payment limit. Corporations, limited liability companies and limited partnerships may receive up to $750,000 based on the number of shareholders.[1] Other eligibility requirements apply, consistent with CFAP 1.[2]

Payment limitations will significantly reduce the per cwt payments made to relatively larger dairy producers, as shown in the chart below. The chart below assumes average milk per cow of 70 pounds per day throughout the months of April – August. In addition, the chart below assumes the $14 billion in payments is sufficient to meet all requests. Payments begin to cap out for single shareholder producers with milk cow herds greater than 1,080 cows based on the assumptions outlined above. Over half of all U.S. milk production volumes are produced from herds exceeding 1,000 cows while herds exceeding 2,500 cows account for over a third of all U.S. milk production volumes.

CFAP 2 payments are subject to a per person and legal entity payment limitation of $250,000 respective of all eligible commodities. The payment limitation is separate from the CFAP 1 payment limit. Corporations, limited liability companies and limited partnerships may receive up to $750,000 based on the number of shareholders.[1] Other eligibility requirements apply, consistent with CFAP 1.[2]

Payment limitations will significantly reduce the per cwt payments made to relatively larger dairy producers, as shown in the chart below. The chart below assumes average milk per cow of 70 pounds per day throughout the months of April – August. In addition, the chart below assumes the $14 billion in payments is sufficient to meet all requests. Payments begin to cap out for single shareholder producers with milk cow herds greater than 1,080 cows based on the assumptions outlined above. Over half of all U.S. milk production volumes are produced from herds exceeding 1,000 cows while herds exceeding 2,500 cows account for over a third of all U.S. milk production volumes.

The USDA’s Farm Service Agency will begin accepting CFAP 2 applications from producers beginning Sep 21st. Applications will be accepted through Dec 11th. Additional information and application forms can be found at www.farmers.gov/cfap.

The USDA’s Farm Service Agency will begin accepting CFAP 2 applications from producers beginning Sep 21st. Applications will be accepted through Dec 11th. Additional information and application forms can be found at www.farmers.gov/cfap.

- The limit is $750,000 if at least three shareholders contribute at least 400 hours of personal labor or active personal management or combination thereof with respect to the production of 2019 commodities. Similarly, the payment limit is $500,000 for corporate entities with two such shareholders. ↑

- Producers will also have to certify they meet an adjusted gross income limitation of $900,000 unless 75% or more of their income is derived from farming, ranching or forestry-related activities. Producers must also be in compliance with Highly Erodible Land and Wetland Conservation provisions. ↑