U.S. Livestock & Meat Trade Update – Nov ’20

Executive Summary

U.S. livestock and meat trade figures provided by the USDA were recently updated with values spanning through Sep ’20. Highlights from the updated report include:

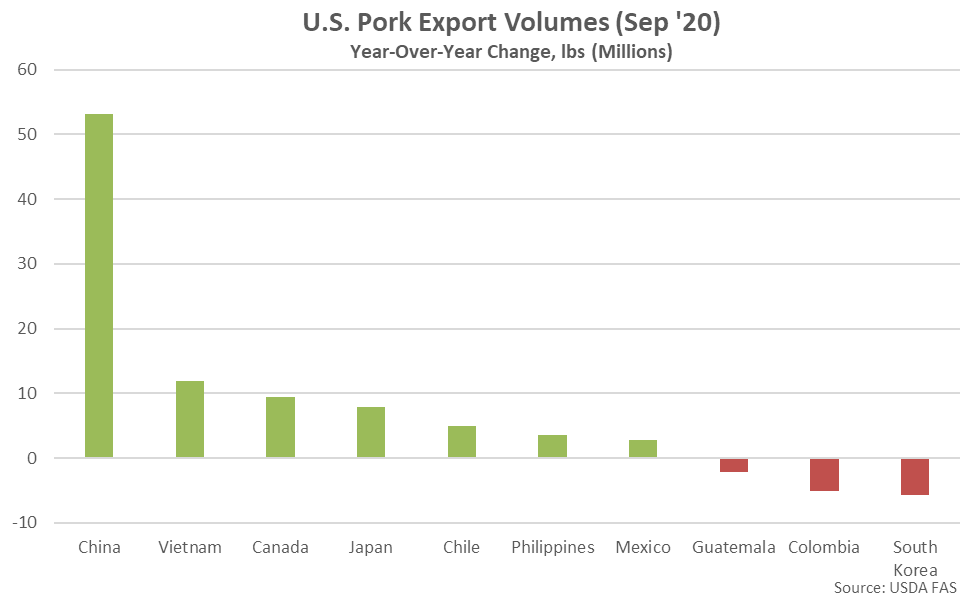

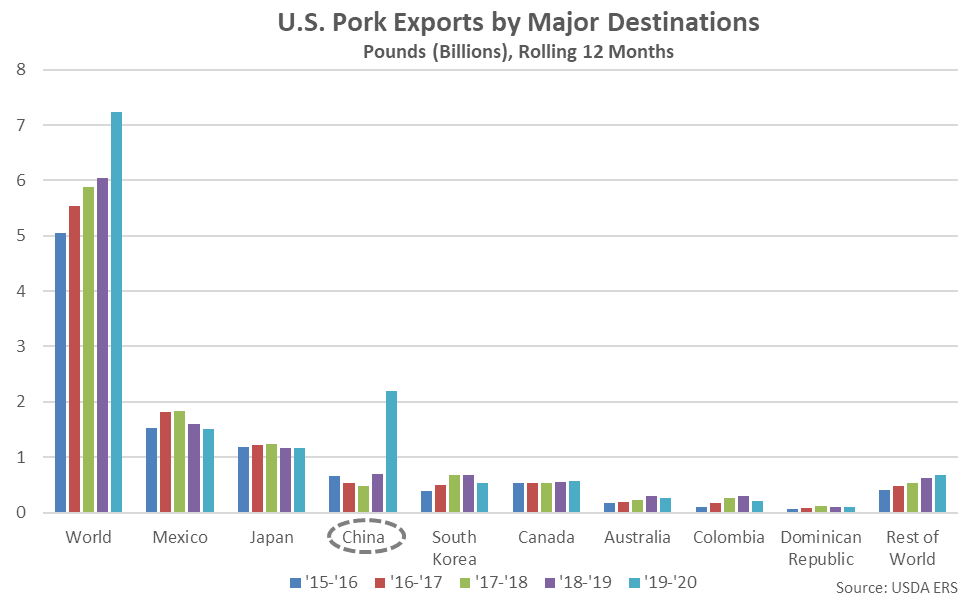

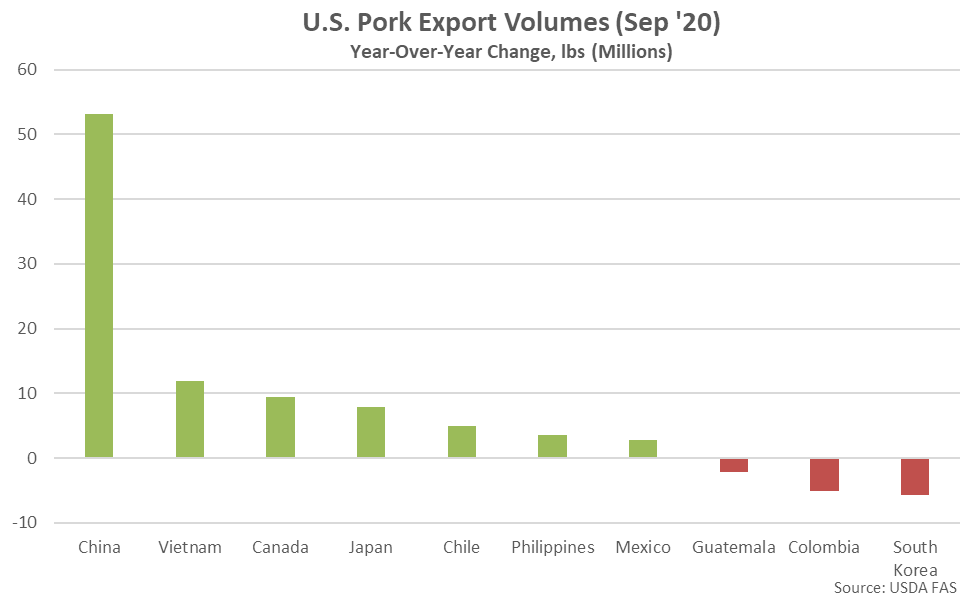

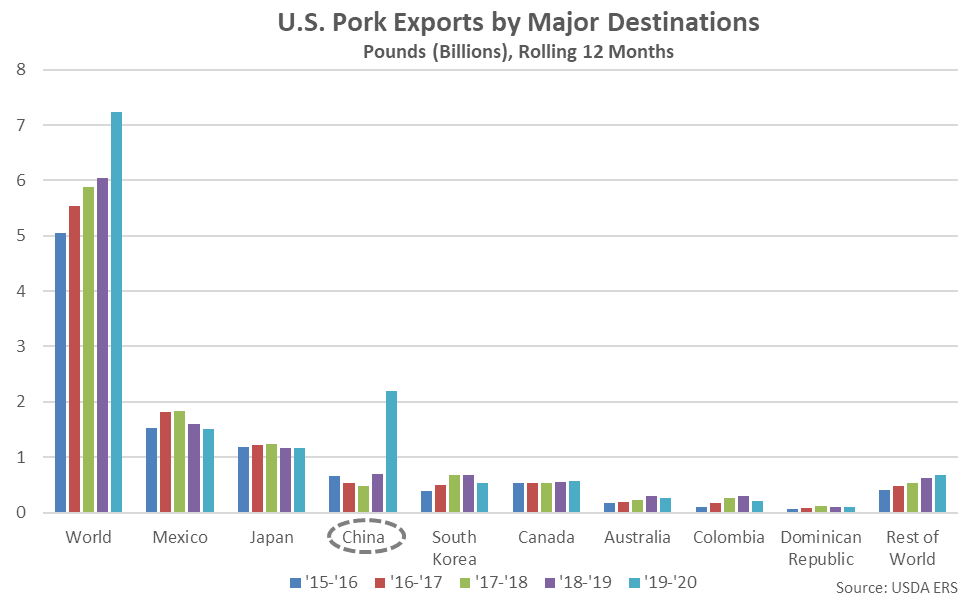

Mexico and Japan have historically been the largest importers of U.S. pork products, accounting for nearly half of the total U.S. pork export volumes throughout the past five years. Combined U.S. pork export volumes destined to Mexico and Japan have declined by 3.4% on a YOY basis throughout the past 12 months, however. Throughout the past 12 months, YOY increases in U.S. pork exports have been led by product destined to China, Hong Kong & Taiwan, while shipments destined to South Korea have declined most significantly on a YOY basis over the period.

Mexico and Japan have historically been the largest importers of U.S. pork products, accounting for nearly half of the total U.S. pork export volumes throughout the past five years. Combined U.S. pork export volumes destined to Mexico and Japan have declined by 3.4% on a YOY basis throughout the past 12 months, however. Throughout the past 12 months, YOY increases in U.S. pork exports have been led by product destined to China, Hong Kong & Taiwan, while shipments destined to South Korea have declined most significantly on a YOY basis over the period.

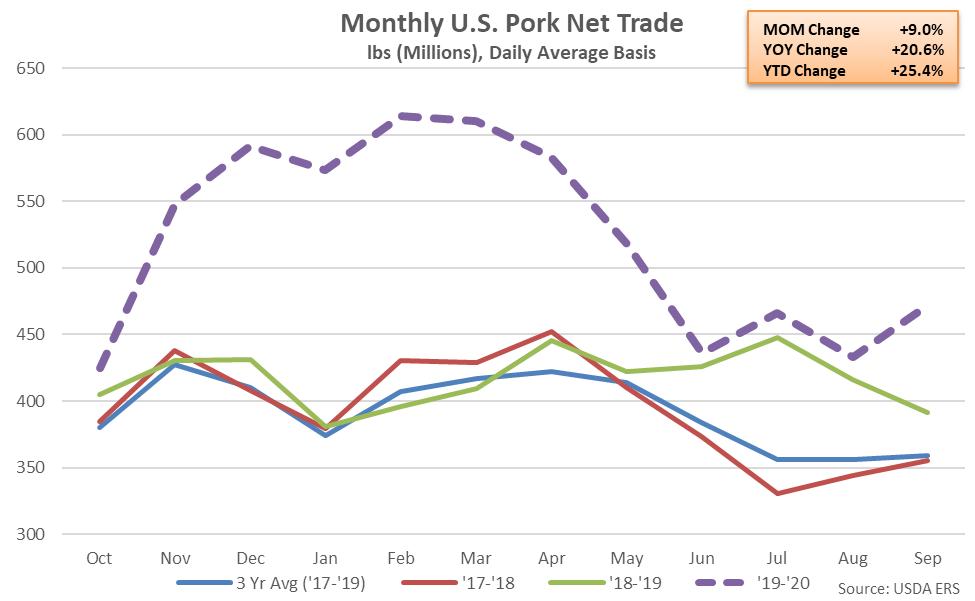

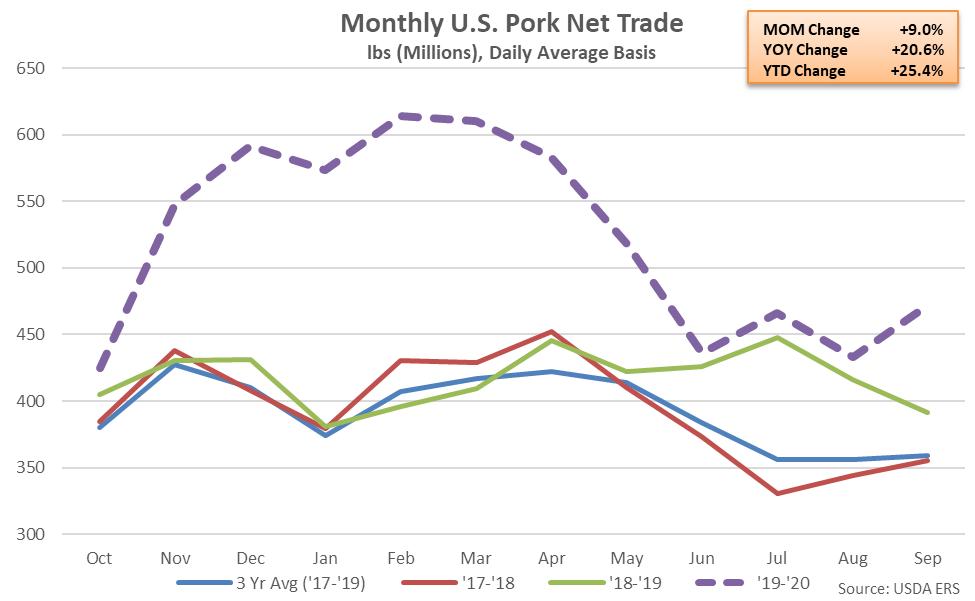

U.S. pork import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 0.9%. The increase in pork export volumes, coupled with the decline in import volumes, resulted in U.S. net pork trade finishing up 20.6% YOY during Sep ’20, reaching a record high seasonal level. The YOY increase in net pork trade was the 17th experienced in a row.

’18-’19 annual net pork trade increased 5.6% YOY, finishing at a record high level for the second consecutive year. ’19-’20 annual net pork trade increased by an additional 25.4% on a YOY basis.

U.S. pork import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 0.9%. The increase in pork export volumes, coupled with the decline in import volumes, resulted in U.S. net pork trade finishing up 20.6% YOY during Sep ’20, reaching a record high seasonal level. The YOY increase in net pork trade was the 17th experienced in a row.

’18-’19 annual net pork trade increased 5.6% YOY, finishing at a record high level for the second consecutive year. ’19-’20 annual net pork trade increased by an additional 25.4% on a YOY basis.

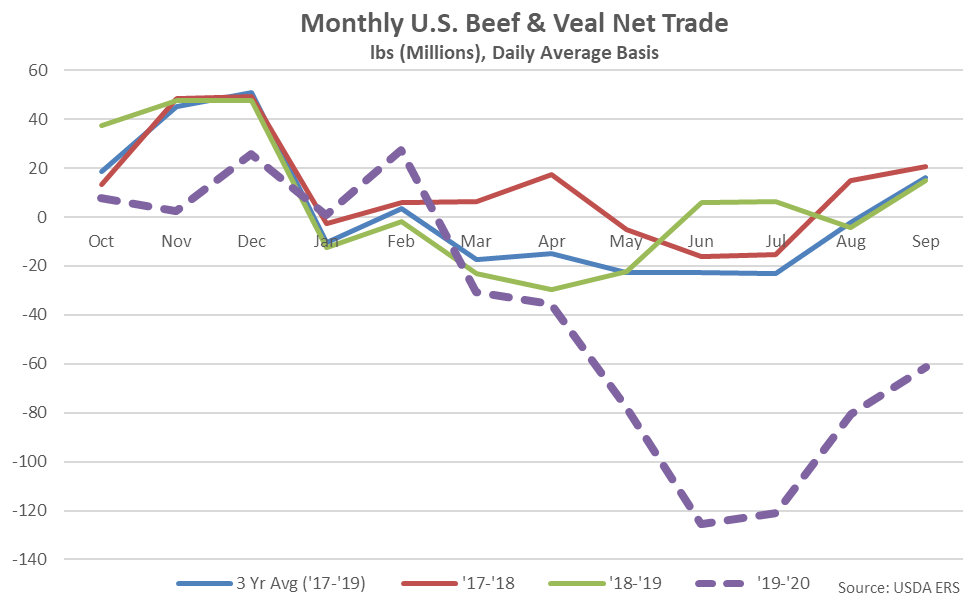

Beef & Veal – Net Trade Remains Negative as Imports Reach a Record High Seasonal Level

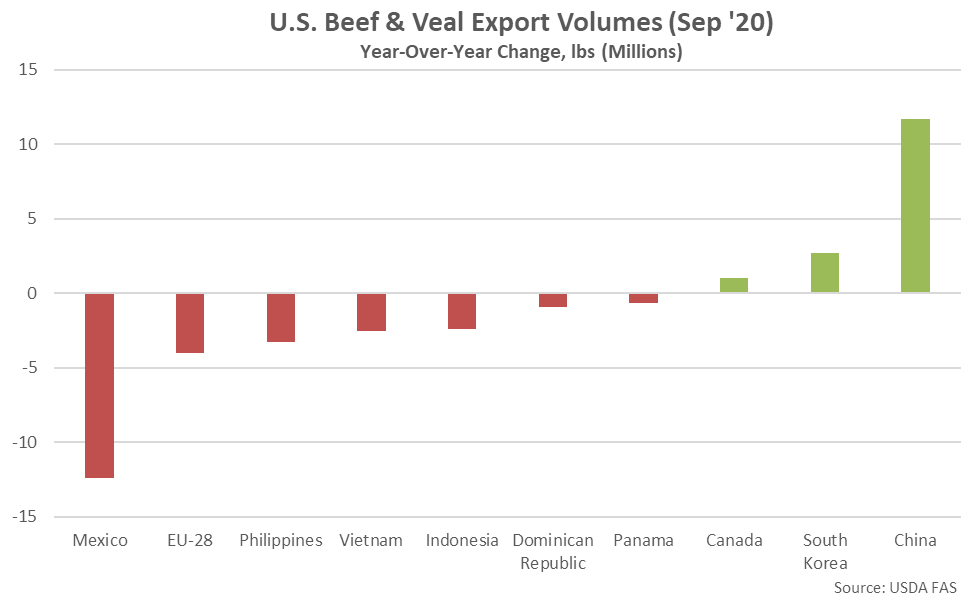

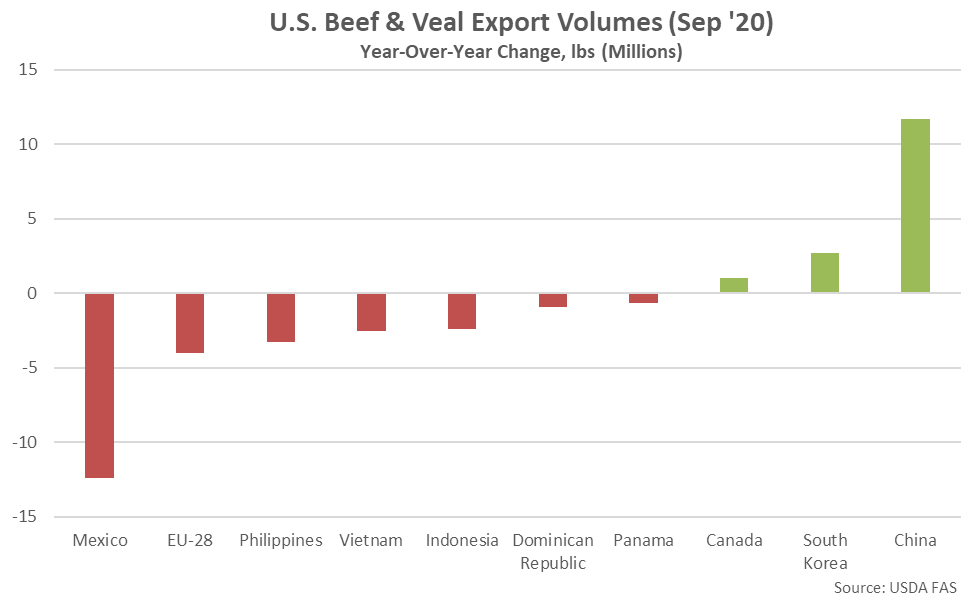

U.S. beef & veal export volumes declined on a YOY basis for the fifth time in the past six months during Sep ’20, finishing down 5.6% and reaching a four year seasonal low level. YOY declines in U.S. beef & veal export volumes were led by shipments destined to Mexico, followed by shipments destined to the EU-28, while shipments destined to China, Hong Kong & Taiwan finished most significantly higher on a YOY basis throughout the month.

Beef & Veal – Net Trade Remains Negative as Imports Reach a Record High Seasonal Level

U.S. beef & veal export volumes declined on a YOY basis for the fifth time in the past six months during Sep ’20, finishing down 5.6% and reaching a four year seasonal low level. YOY declines in U.S. beef & veal export volumes were led by shipments destined to Mexico, followed by shipments destined to the EU-28, while shipments destined to China, Hong Kong & Taiwan finished most significantly higher on a YOY basis throughout the month.

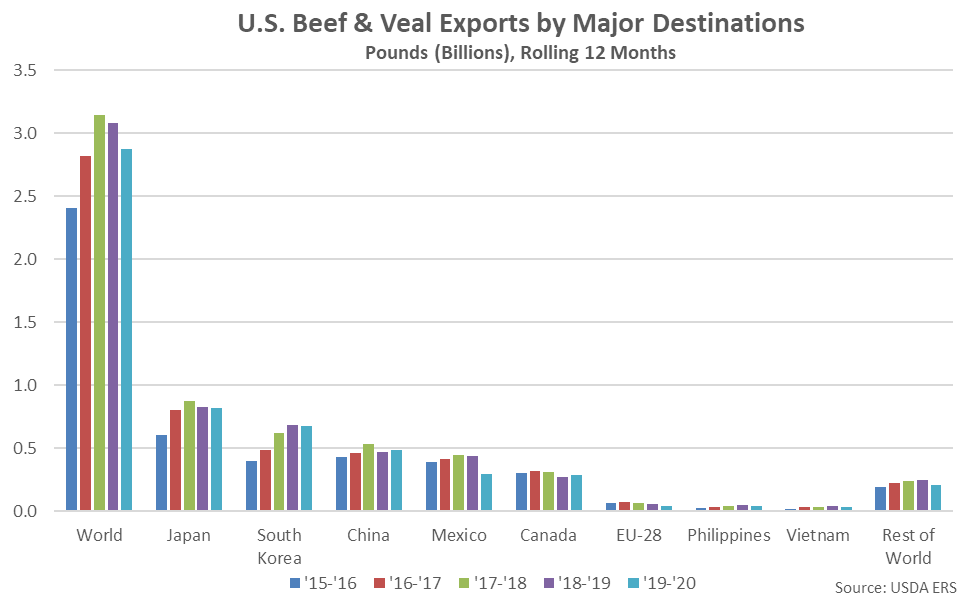

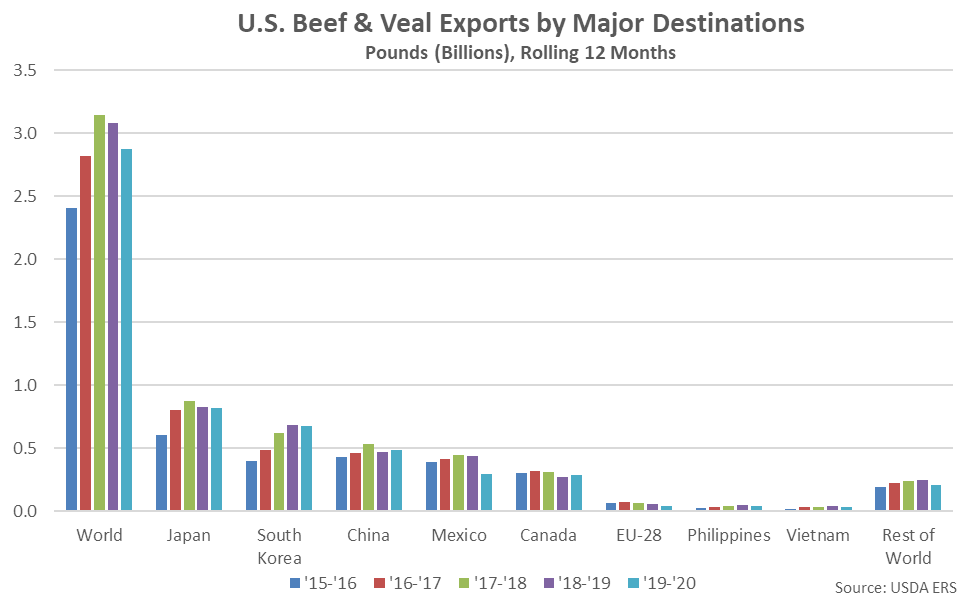

Japan, South Korea, China, Hong Kong & Taiwan, Mexico and Canada have historically been the largest importers of U.S. beef & veal products, combining to account for nearly 90% of the total U.S. beef & veal export volumes throughout the past five years. Throughout the past 12 months, U.S. beef & veal export volumes destined to Mexico have declined most significantly on a YOY basis, while shipments destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis over the period.

Japan, South Korea, China, Hong Kong & Taiwan, Mexico and Canada have historically been the largest importers of U.S. beef & veal products, combining to account for nearly 90% of the total U.S. beef & veal export volumes throughout the past five years. Throughout the past 12 months, U.S. beef & veal export volumes destined to Mexico have declined most significantly on a YOY basis, while shipments destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis over the period.

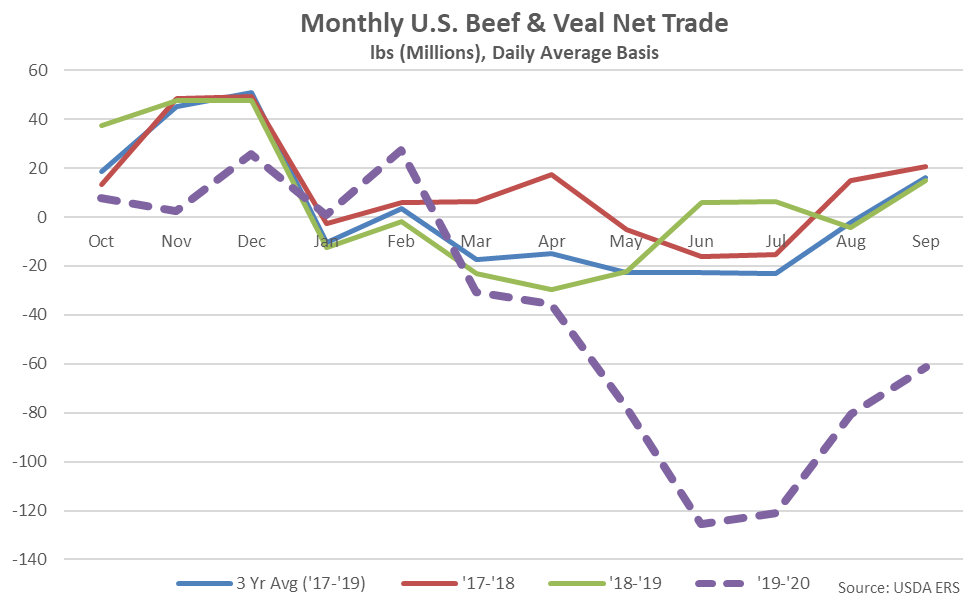

Sep ’20 U.S. beef & veal import volumes remained higher on a YOY basis for the fourth consecutive month, finishing up 26.0% and reaching a record high seasonal level. Beef & veal import volumes continued to exceed export volumes for the seventh consecutive month during Sep ’20, resulting in U.S. beef & veal net trade finishing at a negative level.

’18-’19 annual beef & veal net trade finished at a positive level for the second consecutive year however beef & veal net trade remained 54.2% below previous year levels. ’19-’20 annual net beef & veal trade declined to a negative level, however.

Sep ’20 U.S. beef & veal import volumes remained higher on a YOY basis for the fourth consecutive month, finishing up 26.0% and reaching a record high seasonal level. Beef & veal import volumes continued to exceed export volumes for the seventh consecutive month during Sep ’20, resulting in U.S. beef & veal net trade finishing at a negative level.

’18-’19 annual beef & veal net trade finished at a positive level for the second consecutive year however beef & veal net trade remained 54.2% below previous year levels. ’19-’20 annual net beef & veal trade declined to a negative level, however.

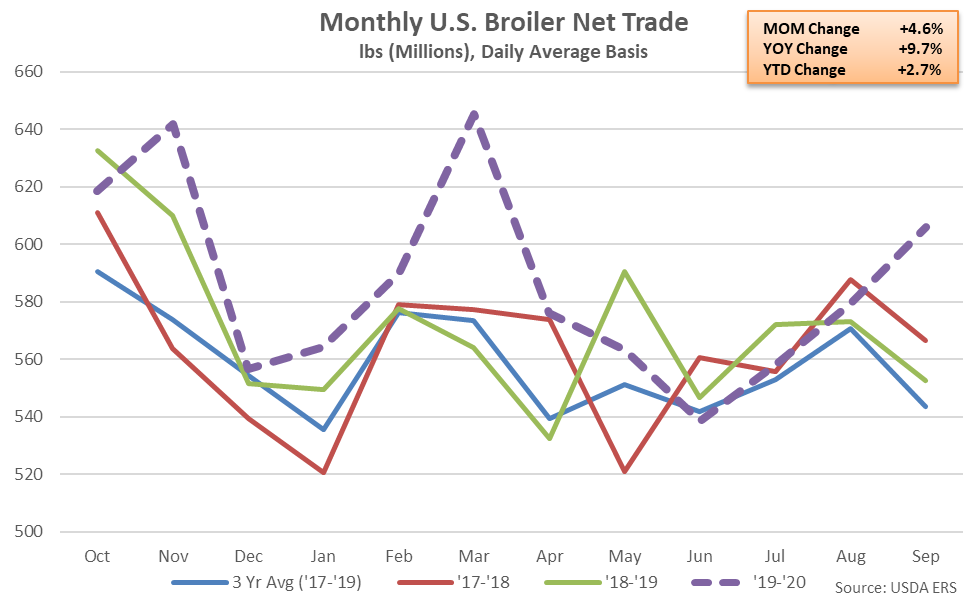

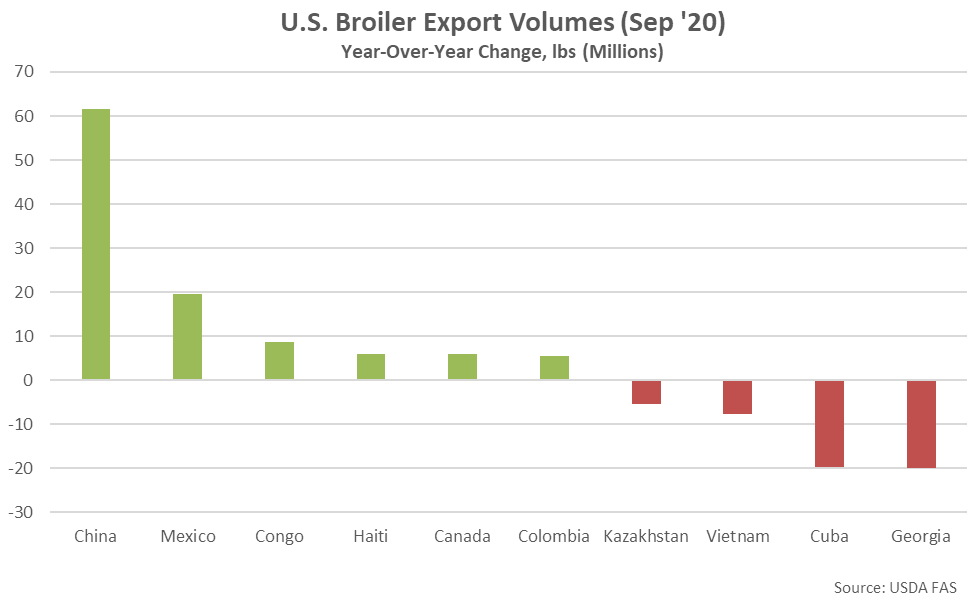

Broilers – Net Trade Reaches an Eight Year Seasonal High Level, Finishes up 9.7% YOY

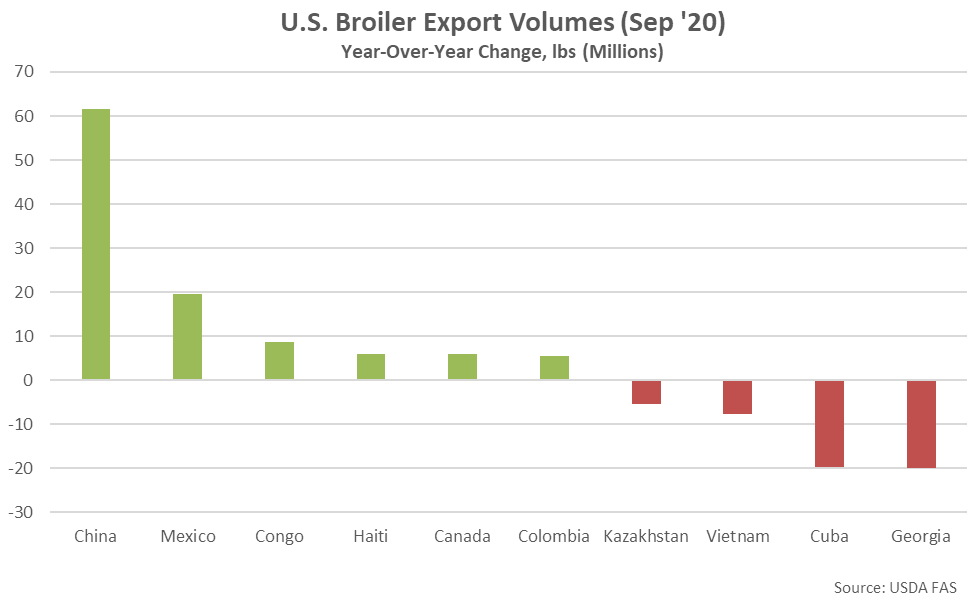

U.S. broiler export volumes finished higher on a YOY basis for the second consecutive month throughout Sep ’20, increasing by 9.3% and reaching a nine year seasonal high level. YOY increases in U.S. broiler export volumes were led by shipments destined to China, Hong Kong & Taiwan, while export volumes destined to Georgia and Cuba declined most significantly on a YOY basis throughout the month.

Broilers – Net Trade Reaches an Eight Year Seasonal High Level, Finishes up 9.7% YOY

U.S. broiler export volumes finished higher on a YOY basis for the second consecutive month throughout Sep ’20, increasing by 9.3% and reaching a nine year seasonal high level. YOY increases in U.S. broiler export volumes were led by shipments destined to China, Hong Kong & Taiwan, while export volumes destined to Georgia and Cuba declined most significantly on a YOY basis throughout the month.

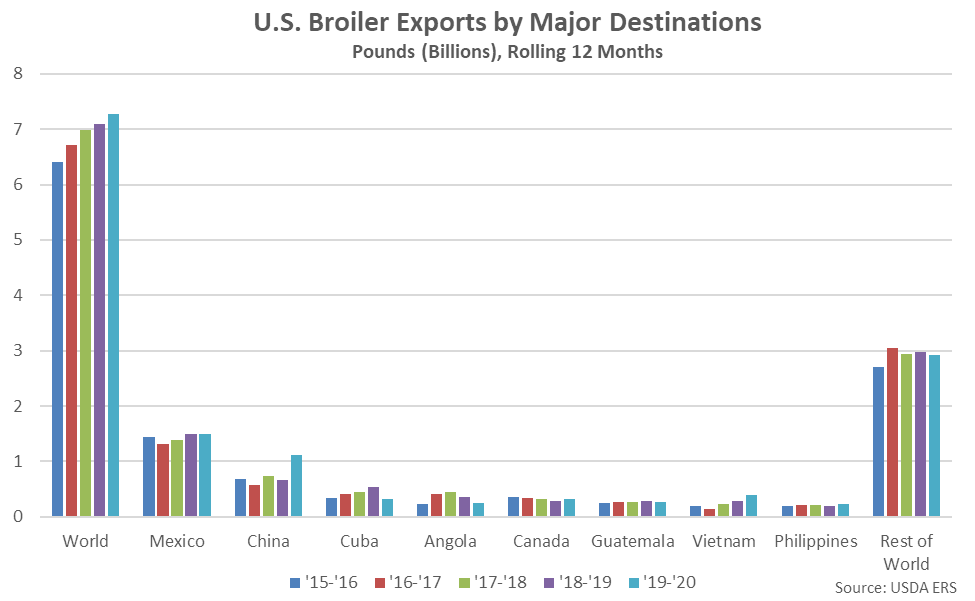

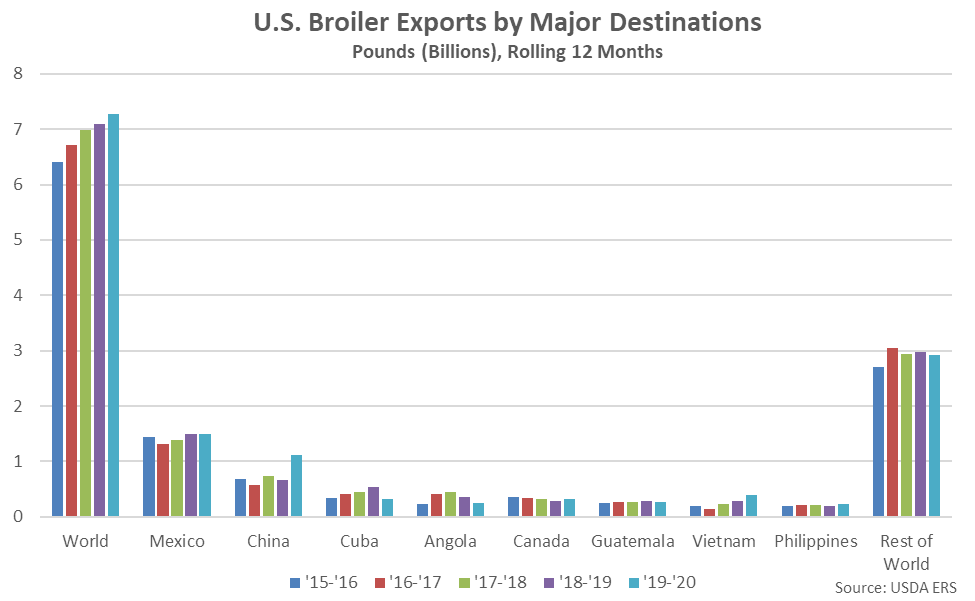

Mexico has historically been the largest importer of U.S. broilers, accounting for over one fifth of the total U.S. broiler export volumes throughout the past five years. Throughout the past 12 months, U.S. broiler export volumes destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis, followed by volumes destined to Vietnam, while shipments destined to Cuba and Angola have declined most significantly on a YOY basis over the period.

Mexico has historically been the largest importer of U.S. broilers, accounting for over one fifth of the total U.S. broiler export volumes throughout the past five years. Throughout the past 12 months, U.S. broiler export volumes destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis, followed by volumes destined to Vietnam, while shipments destined to Cuba and Angola have declined most significantly on a YOY basis over the period.

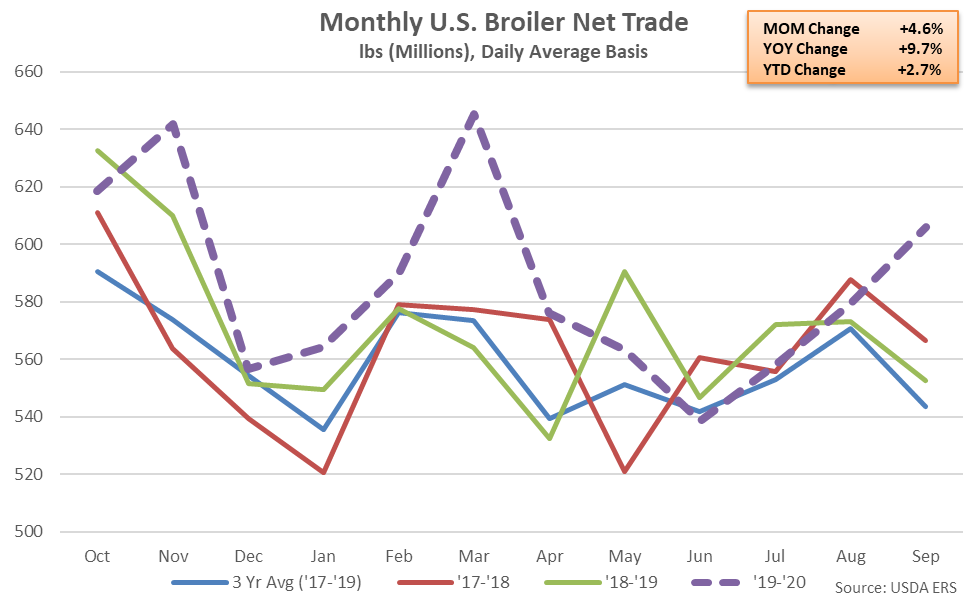

U.S. broiler import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 7.4%. Broiler import volumes remained at insignificant levels relative to export volumes as Sep ’20 imports amounted to just 1.9% of export volumes. The YOY increase in broiler export volumes, coupled with the decline in import volumes, resulted in U.S. broiler net trade finishing 9.7% higher on a YOY basis during Sep ’20. Broiler net trade reached an eight year seasonal high level for the month of September.

’18-’19 annual net broiler trade finished up 1.7% YOY, reaching a five year high, despite declines experienced throughout the final months of the production season. ’19-’20 annual net broiler trade increased by an additional 2.7% on a YOY basis.

U.S. broiler import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 7.4%. Broiler import volumes remained at insignificant levels relative to export volumes as Sep ’20 imports amounted to just 1.9% of export volumes. The YOY increase in broiler export volumes, coupled with the decline in import volumes, resulted in U.S. broiler net trade finishing 9.7% higher on a YOY basis during Sep ’20. Broiler net trade reached an eight year seasonal high level for the month of September.

’18-’19 annual net broiler trade finished up 1.7% YOY, reaching a five year high, despite declines experienced throughout the final months of the production season. ’19-’20 annual net broiler trade increased by an additional 2.7% on a YOY basis.

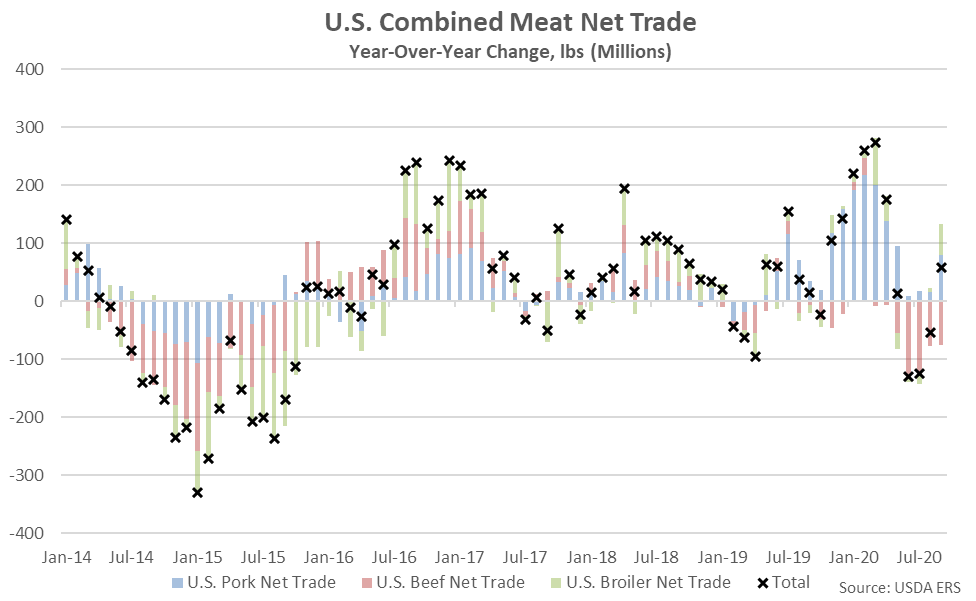

Combined Net Trade

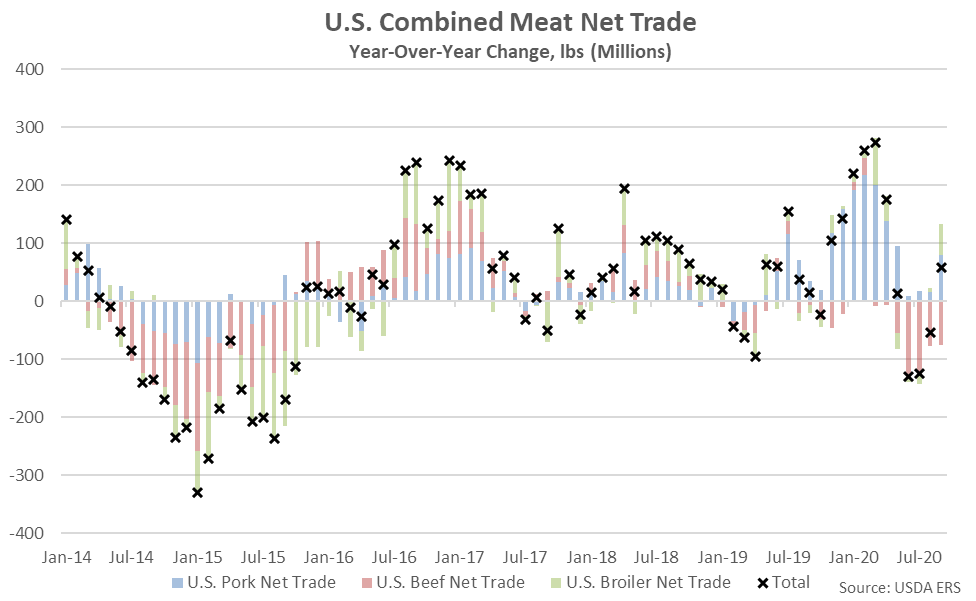

Overall, combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the first time in the past four months during Sep ’20, finishing up 58.0 million pounds, or 6.0%. Combined net trade of U.S. pork, beef and broilers had reached an eight and a half year high growth rate throughout the month of March, prior to decelerating throughout the next several months.

Combined Net Trade

Overall, combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the first time in the past four months during Sep ’20, finishing up 58.0 million pounds, or 6.0%. Combined net trade of U.S. pork, beef and broilers had reached an eight and a half year high growth rate throughout the month of March, prior to decelerating throughout the next several months.

- U.S. net pork trade increased on a YOY basis for the 17th consecutive month during Sep ’20, finishing up 20.6% and reaching a record high seasonal level. Pork export volumes increased 17.2% on a YOY basis throughout the month, driven higher by continued growth in volumes destined to China, Hong Kong & Taiwan.

- U.S. beef & veal export volumes declined on a YOY basis for the fifth time in the past six months throughout Sep ’20, reaching a four year seasonal low level, while import volumes reached a record high seasonal level. Net beef & veal trade remained at a negative level for the seventh consecutive month.

- U.S. net broiler trade reached an eight year seasonal high level, finishing 9.7% higher on a YOY basis.

Mexico and Japan have historically been the largest importers of U.S. pork products, accounting for nearly half of the total U.S. pork export volumes throughout the past five years. Combined U.S. pork export volumes destined to Mexico and Japan have declined by 3.4% on a YOY basis throughout the past 12 months, however. Throughout the past 12 months, YOY increases in U.S. pork exports have been led by product destined to China, Hong Kong & Taiwan, while shipments destined to South Korea have declined most significantly on a YOY basis over the period.

Mexico and Japan have historically been the largest importers of U.S. pork products, accounting for nearly half of the total U.S. pork export volumes throughout the past five years. Combined U.S. pork export volumes destined to Mexico and Japan have declined by 3.4% on a YOY basis throughout the past 12 months, however. Throughout the past 12 months, YOY increases in U.S. pork exports have been led by product destined to China, Hong Kong & Taiwan, while shipments destined to South Korea have declined most significantly on a YOY basis over the period.

U.S. pork import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 0.9%. The increase in pork export volumes, coupled with the decline in import volumes, resulted in U.S. net pork trade finishing up 20.6% YOY during Sep ’20, reaching a record high seasonal level. The YOY increase in net pork trade was the 17th experienced in a row.

’18-’19 annual net pork trade increased 5.6% YOY, finishing at a record high level for the second consecutive year. ’19-’20 annual net pork trade increased by an additional 25.4% on a YOY basis.

U.S. pork import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 0.9%. The increase in pork export volumes, coupled with the decline in import volumes, resulted in U.S. net pork trade finishing up 20.6% YOY during Sep ’20, reaching a record high seasonal level. The YOY increase in net pork trade was the 17th experienced in a row.

’18-’19 annual net pork trade increased 5.6% YOY, finishing at a record high level for the second consecutive year. ’19-’20 annual net pork trade increased by an additional 25.4% on a YOY basis.

Beef & Veal – Net Trade Remains Negative as Imports Reach a Record High Seasonal Level

U.S. beef & veal export volumes declined on a YOY basis for the fifth time in the past six months during Sep ’20, finishing down 5.6% and reaching a four year seasonal low level. YOY declines in U.S. beef & veal export volumes were led by shipments destined to Mexico, followed by shipments destined to the EU-28, while shipments destined to China, Hong Kong & Taiwan finished most significantly higher on a YOY basis throughout the month.

Beef & Veal – Net Trade Remains Negative as Imports Reach a Record High Seasonal Level

U.S. beef & veal export volumes declined on a YOY basis for the fifth time in the past six months during Sep ’20, finishing down 5.6% and reaching a four year seasonal low level. YOY declines in U.S. beef & veal export volumes were led by shipments destined to Mexico, followed by shipments destined to the EU-28, while shipments destined to China, Hong Kong & Taiwan finished most significantly higher on a YOY basis throughout the month.

Japan, South Korea, China, Hong Kong & Taiwan, Mexico and Canada have historically been the largest importers of U.S. beef & veal products, combining to account for nearly 90% of the total U.S. beef & veal export volumes throughout the past five years. Throughout the past 12 months, U.S. beef & veal export volumes destined to Mexico have declined most significantly on a YOY basis, while shipments destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis over the period.

Japan, South Korea, China, Hong Kong & Taiwan, Mexico and Canada have historically been the largest importers of U.S. beef & veal products, combining to account for nearly 90% of the total U.S. beef & veal export volumes throughout the past five years. Throughout the past 12 months, U.S. beef & veal export volumes destined to Mexico have declined most significantly on a YOY basis, while shipments destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis over the period.

Sep ’20 U.S. beef & veal import volumes remained higher on a YOY basis for the fourth consecutive month, finishing up 26.0% and reaching a record high seasonal level. Beef & veal import volumes continued to exceed export volumes for the seventh consecutive month during Sep ’20, resulting in U.S. beef & veal net trade finishing at a negative level.

’18-’19 annual beef & veal net trade finished at a positive level for the second consecutive year however beef & veal net trade remained 54.2% below previous year levels. ’19-’20 annual net beef & veal trade declined to a negative level, however.

Sep ’20 U.S. beef & veal import volumes remained higher on a YOY basis for the fourth consecutive month, finishing up 26.0% and reaching a record high seasonal level. Beef & veal import volumes continued to exceed export volumes for the seventh consecutive month during Sep ’20, resulting in U.S. beef & veal net trade finishing at a negative level.

’18-’19 annual beef & veal net trade finished at a positive level for the second consecutive year however beef & veal net trade remained 54.2% below previous year levels. ’19-’20 annual net beef & veal trade declined to a negative level, however.

Broilers – Net Trade Reaches an Eight Year Seasonal High Level, Finishes up 9.7% YOY

U.S. broiler export volumes finished higher on a YOY basis for the second consecutive month throughout Sep ’20, increasing by 9.3% and reaching a nine year seasonal high level. YOY increases in U.S. broiler export volumes were led by shipments destined to China, Hong Kong & Taiwan, while export volumes destined to Georgia and Cuba declined most significantly on a YOY basis throughout the month.

Broilers – Net Trade Reaches an Eight Year Seasonal High Level, Finishes up 9.7% YOY

U.S. broiler export volumes finished higher on a YOY basis for the second consecutive month throughout Sep ’20, increasing by 9.3% and reaching a nine year seasonal high level. YOY increases in U.S. broiler export volumes were led by shipments destined to China, Hong Kong & Taiwan, while export volumes destined to Georgia and Cuba declined most significantly on a YOY basis throughout the month.

Mexico has historically been the largest importer of U.S. broilers, accounting for over one fifth of the total U.S. broiler export volumes throughout the past five years. Throughout the past 12 months, U.S. broiler export volumes destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis, followed by volumes destined to Vietnam, while shipments destined to Cuba and Angola have declined most significantly on a YOY basis over the period.

Mexico has historically been the largest importer of U.S. broilers, accounting for over one fifth of the total U.S. broiler export volumes throughout the past five years. Throughout the past 12 months, U.S. broiler export volumes destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis, followed by volumes destined to Vietnam, while shipments destined to Cuba and Angola have declined most significantly on a YOY basis over the period.

U.S. broiler import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 7.4%. Broiler import volumes remained at insignificant levels relative to export volumes as Sep ’20 imports amounted to just 1.9% of export volumes. The YOY increase in broiler export volumes, coupled with the decline in import volumes, resulted in U.S. broiler net trade finishing 9.7% higher on a YOY basis during Sep ’20. Broiler net trade reached an eight year seasonal high level for the month of September.

’18-’19 annual net broiler trade finished up 1.7% YOY, reaching a five year high, despite declines experienced throughout the final months of the production season. ’19-’20 annual net broiler trade increased by an additional 2.7% on a YOY basis.

U.S. broiler import volumes declined on a YOY basis for the second time in the past three months during Sep ’20, finishing down 7.4%. Broiler import volumes remained at insignificant levels relative to export volumes as Sep ’20 imports amounted to just 1.9% of export volumes. The YOY increase in broiler export volumes, coupled with the decline in import volumes, resulted in U.S. broiler net trade finishing 9.7% higher on a YOY basis during Sep ’20. Broiler net trade reached an eight year seasonal high level for the month of September.

’18-’19 annual net broiler trade finished up 1.7% YOY, reaching a five year high, despite declines experienced throughout the final months of the production season. ’19-’20 annual net broiler trade increased by an additional 2.7% on a YOY basis.

Combined Net Trade

Overall, combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the first time in the past four months during Sep ’20, finishing up 58.0 million pounds, or 6.0%. Combined net trade of U.S. pork, beef and broilers had reached an eight and a half year high growth rate throughout the month of March, prior to decelerating throughout the next several months.

Combined Net Trade

Overall, combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the first time in the past four months during Sep ’20, finishing up 58.0 million pounds, or 6.0%. Combined net trade of U.S. pork, beef and broilers had reached an eight and a half year high growth rate throughout the month of March, prior to decelerating throughout the next several months.