Global Milk Production Update – Jun ’21

Executive Summary

Milk production figures throughout the major dairy exporting regions of New Zealand, the EU-27+UK, the U.S., Australia and Argentina were recently updated with values spanning through Apr ’21. Highlights from the updated figures include:

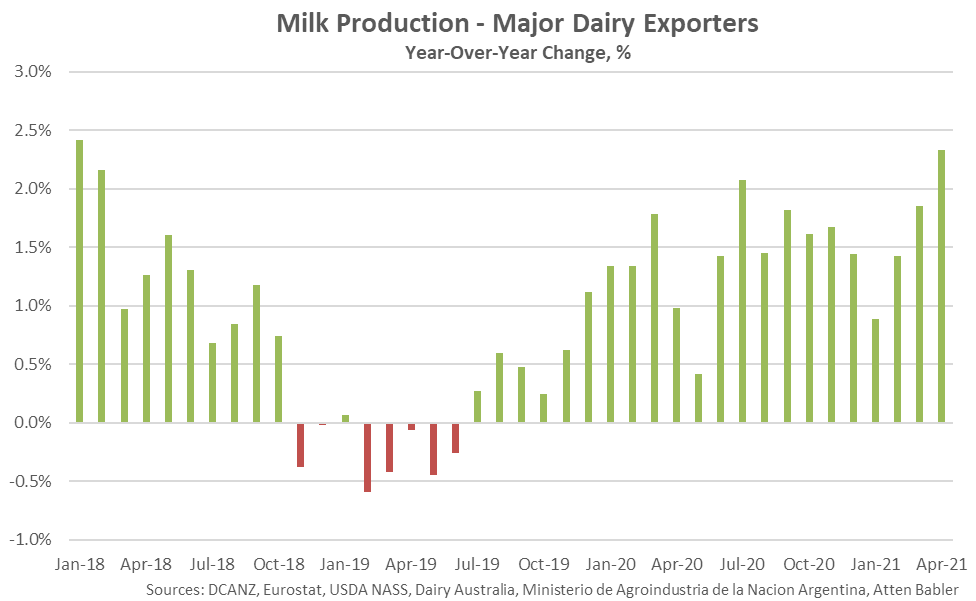

- Combined milk production within the major dairy exporting regions reached a record high monthly level throughout Apr ’21, finishing 2.3% above previous year figures. The YOY increase in combined milk production volumes was the largest experienced throughout the past three years on a percentage basis.

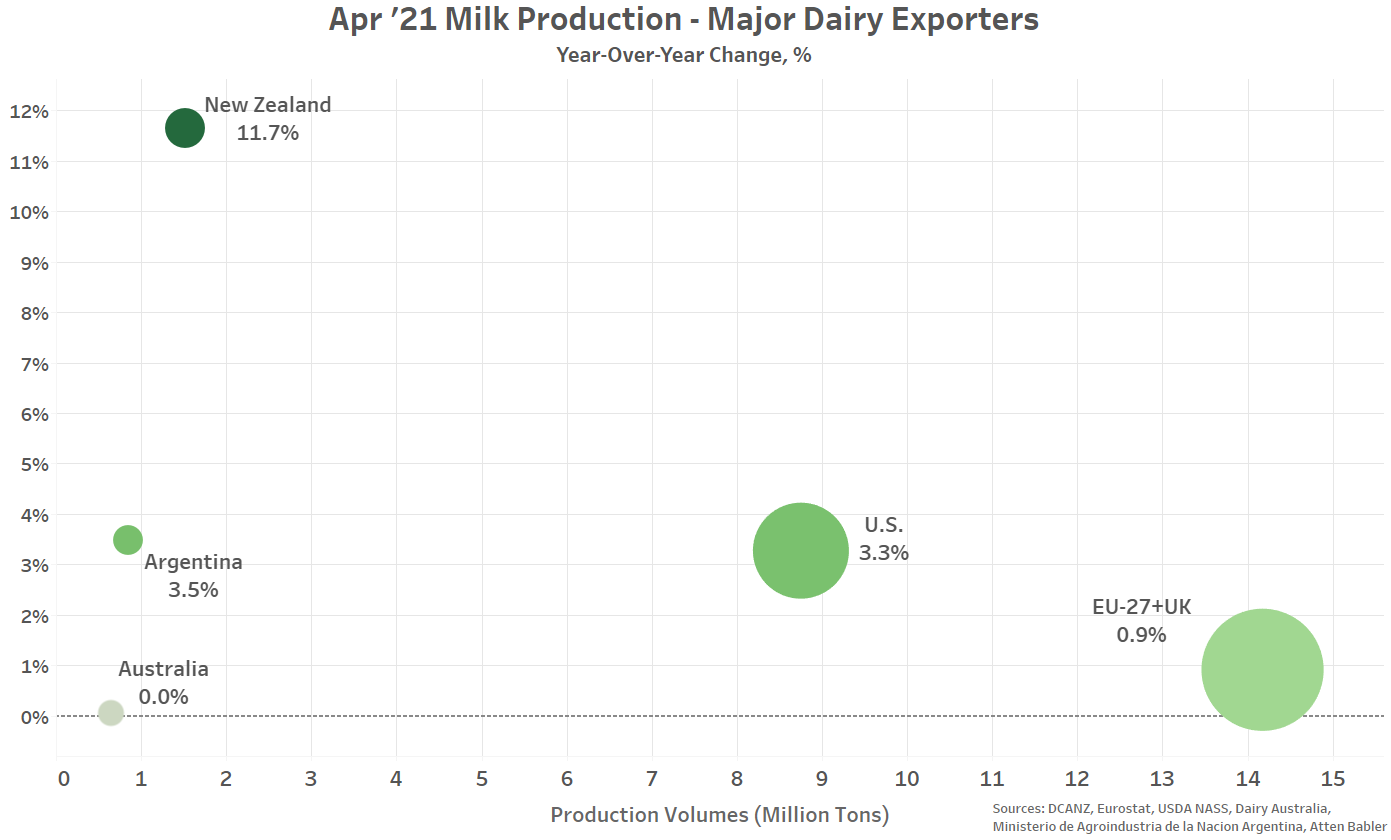

- Apr ’21 YOY increases in milk production on a percentage basis were led by New Zealand, followed by Argentina, the U.S. and the EU-27+UK. Production finished flat on a YOY basis throughout the Australia during Apr ’21.

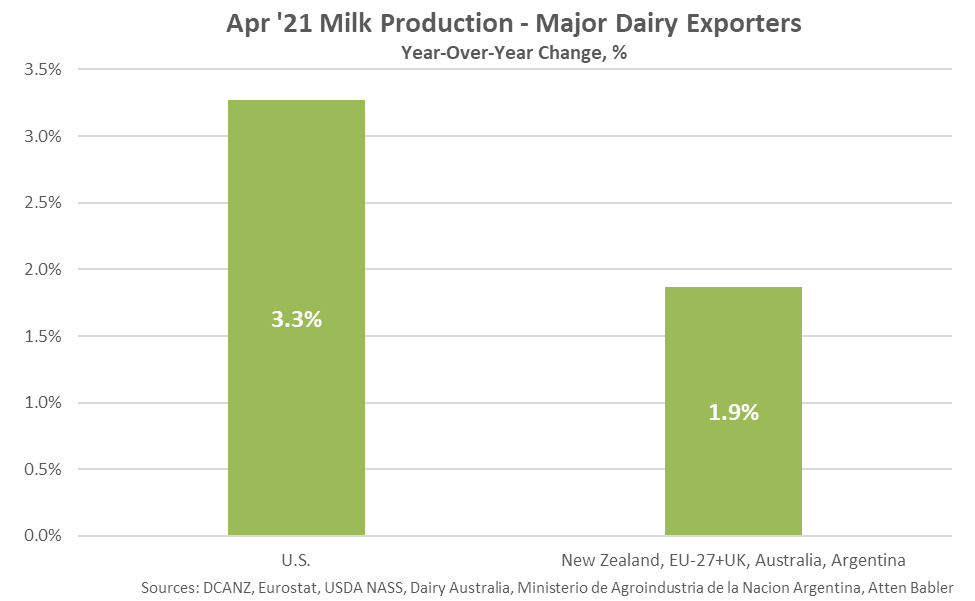

- Milk production growth throughout the U.S. continued to outpace growth experienced throughout the other major dairy exporting regions for the tenth consecutive month throughout Apr ’21.

Additional Report Details

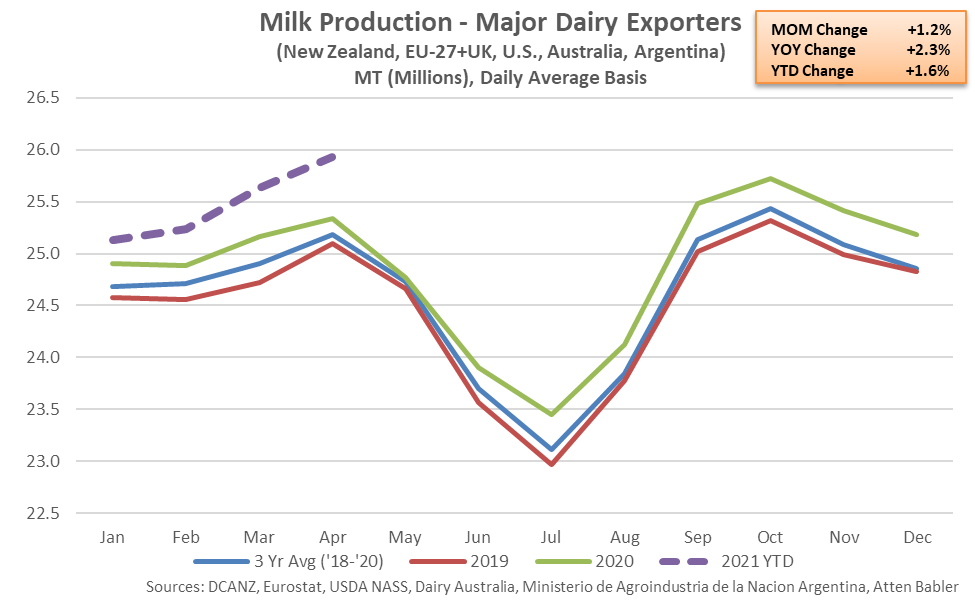

Combined milk production within the major dairy exporting regions of New Zealand, the EU-27+UK, the U.S., Australia and Argentina finished 2.3% higher on a YOY basis during Apr ’21, reaching a record high monthly level. Combined milk production within the major dairy exporting regions has reached record high seasonal levels over 11 consecutive months through Apr ’21. The aforementioned regions combined to account for 90% of global butter, cheese, whole milk powder and nonfat dry milk export volumes throughout 2020.

Combined milk production growth rates experienced throughout the major dairy exporting regions decelerated over much of 2018 but remained positive until Nov ’18, when production volumes declined on a YOY basis for the first time in the past 22 months. Combined milk production volumes finished largely flat or lower on a YOY basis over eight consecutive months through Jul ’19, prior to finishing higher throughout each of the past 22 months through Apr ’21. The Apr ’21 YOY increase in combined milk production volumes was the largest experienced throughout the past three years on a percentage basis.

Apr ’21 YOY increases in milk production on a percentage basis were led by New Zealand (+11.7%), followed by Argentina (+3.5%), the U.S. (+3.3%) and the EU-27+UK (+0.9%). Production finished flat on a YOY basis throughout the Australia. The EU-27+UK produces significantly more milk than the other dairy exporting regions, accounting for over half of the combined production within the five exporting regions throughout Apr ’21.

Excluding the U.S., milk production within the major dairy exporting regions increased by 1.9% on a YOY basis throughout the month of April, finishing below the growth rate exhibited within the U.S. for the tenth consecutive month.