U.S. Cattle & Hogs Production Update – Jun ’21

Executive Summary

U.S. cattle & hog production figures provided by the USDA were recently updated with values spanning through May ’21. Highlights from the updated report include:

- May ’21 U.S. commercial red meat production declined contraseasonally to a 12 month low level but remained 9.3% higher on a YOY basis. Total red meat production volumes finished 3.9% below 2019 seasonal levels, however.

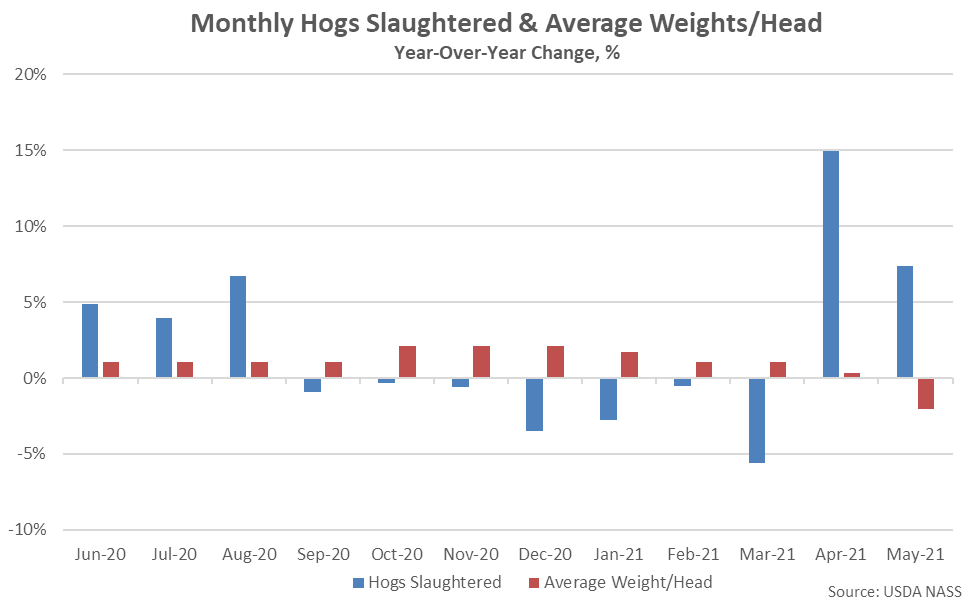

- U.S. pork production declined seasonally to a 12 month low level throughout May ’21 but remained 5.4% higher on a YOY basis. The total number of hogs slaughtered increased 7.4% on a YOY basis throughout May ’21, more than offsetting a 2.0% YOY decline in average weights per head.

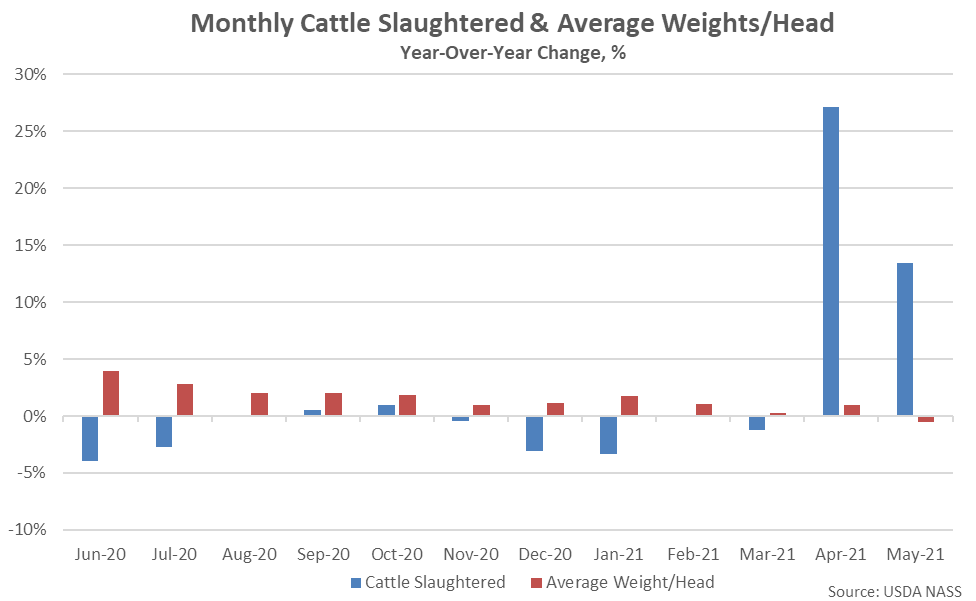

- U.S. beef production declined contraseasonally to a 12 month low level throughout May ’21 but remained 9.3% higher on a YOY basis. The total number of cattle slaughtered increased 13.4% on a YOY basis throughout May ’21, more than offsetting a 0.5% YOY decline in average weights per head.

Additional Report Details

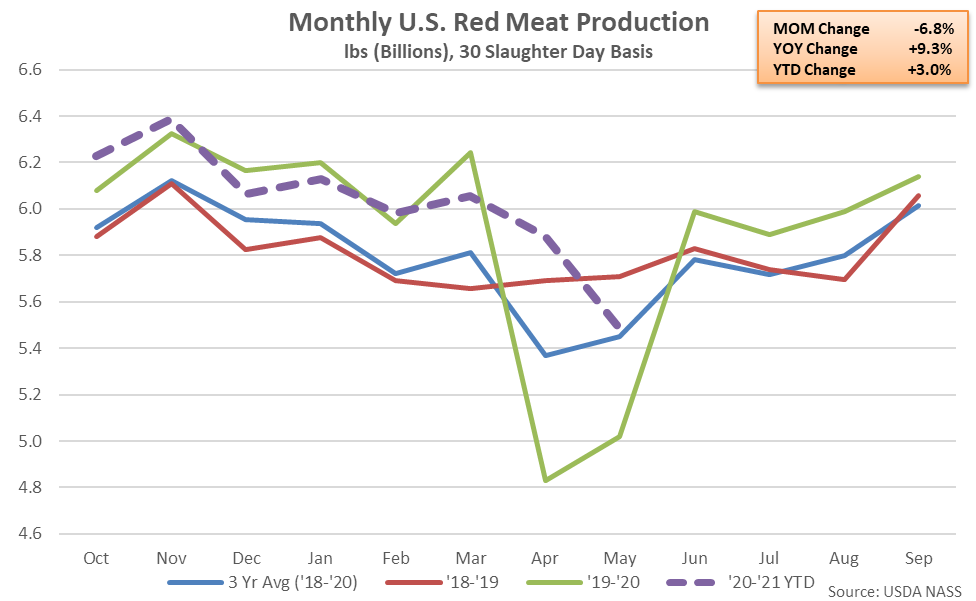

Total Red Meat – Production Declines Contraseasonally to a 12 Month Low, Remains up 9.3% YOY

According to the USDA, May ’21 U.S. commercial red meat production declined contraseasonally to a 12 month low level but remained 9.3% above previous year levels when normalizing for slaughter days. Red meat production was reduced significantly throughout May of 2020 as several major packing plants were closed due to COVID-19. May ’21 red meat production finished 3.9% below 2019 seasonal levels. Total red meat production declined 6.8% from April – May when normalizing for slaughter days, which was a contraseasonal move when compared to the ten year average April – May build in production of 2.0% and the largest seasonal decline experienced throughout the past 75 years.

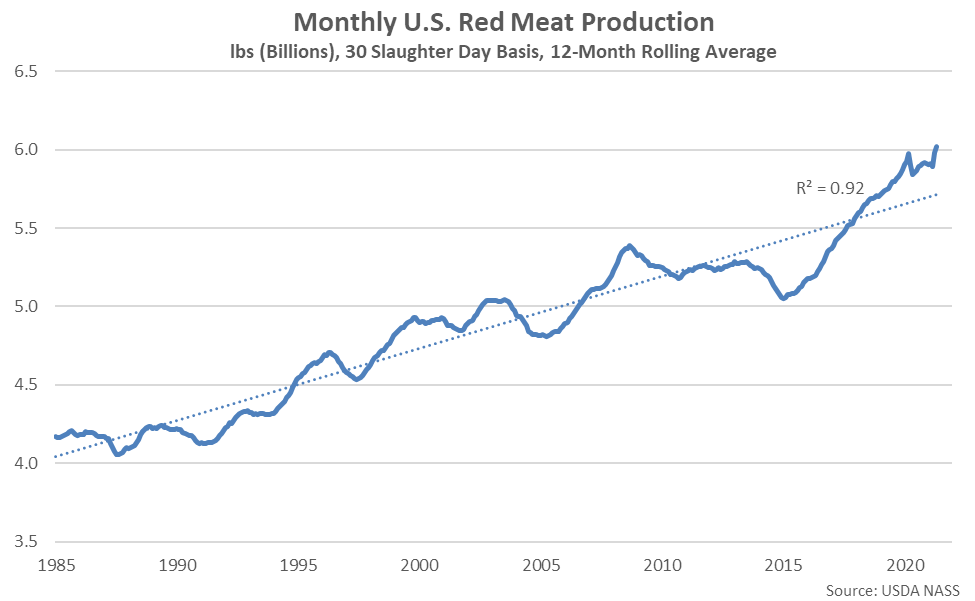

’19-’20 annual red meat production finished 1.5% higher on a YOY basis, reaching a record high level for the fourth consecutive year. ’20-’21 YTD red meat production has increased by an additional 3.0% on a YOY basis throughout the first two thirds of the production season.

Total 12-month rolling average red meat production remained above trendline for the 45th consecutive month throughout May ’21. The most recent deviation from trendline was the second largest experienced on record.

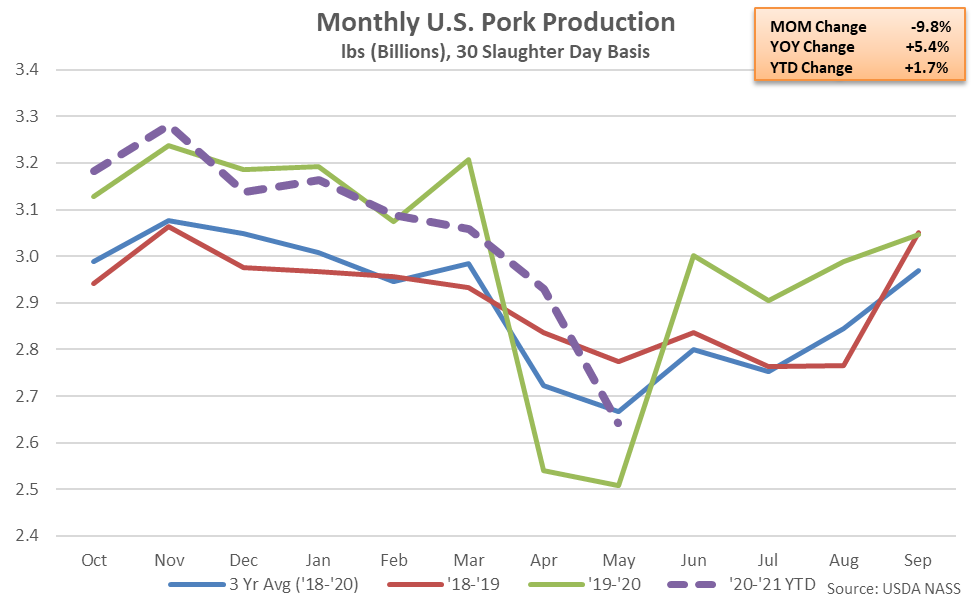

Pork – Production Declines to a 12 Month Low, Remains up 5.4% YOY

May ’21 U.S. pork production declined to a 12 month low level but remained 5.4% above previous year levels when normalizing for slaughter days. The May ’21 total number of hogs slaughtered increased 7.4% YOY throughout the month, more than offsetting a 2.0% decline in average weights per head. May ’21 pork production remained 4.7% below 2019 seasonal levels, however. Pork production declined 9.8% from April – May when normalizing for slaughter days, which was greater than the ten year average April – May decline in production of 1.4%.

’19-’20 annual pork production finished 3.3% higher on a YOY basis, reaching a record high level for the sixth consecutive year. ’20-’21 YTD pork production has increased by an additional 1.7% on a YOY basis throughout the first two thirds of the production season.

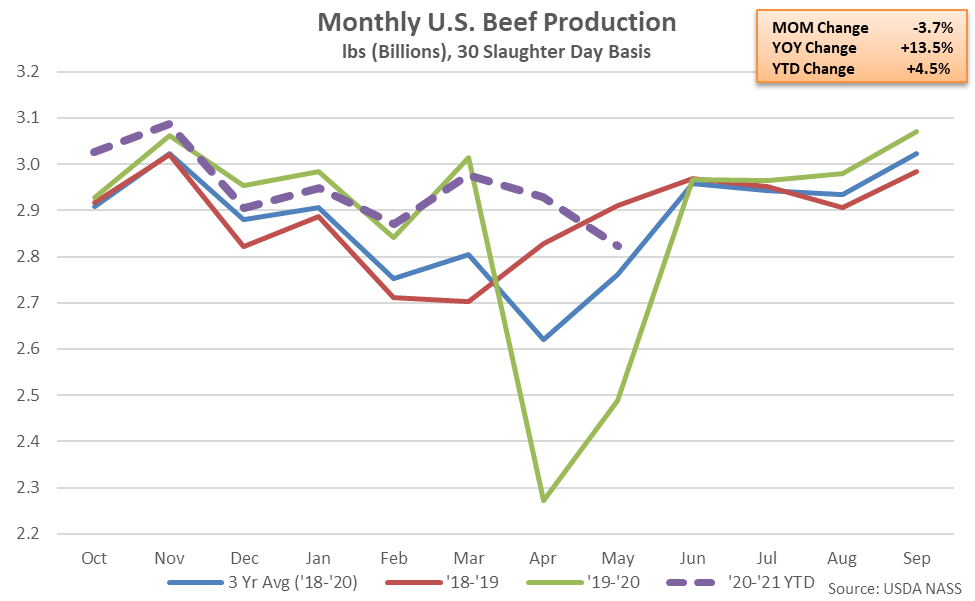

Beef – Production Declines Contraseasonally to a 12 Month Low, Remains up 13.5% YOY

May ’21 U.S. beef production declined contraseasonally to a 12 month low level but remained 13.5% above previous year levels when normalizing for slaughter days. The May ’21 total number of cattle slaughtered increased 13.4% YOY throughout the month, more than offsetting a 0.5% decline in average weights per head. May ’21 beef production remained 3.0% below 2019 seasonal levels, however. Beef production declined 3.7% from April – May when normalizing for slaughter days, which was a contraseasonal move when compared to the ten year average April – May build in production of 5.4% and the largest seasonal decline experienced throughout the past 73 years.

’19-’20 annual beef production declined 0.2% on a YOY basis from the 16 year high level experienced throughout the previous production season. ’20-’21 YTD beef production has rebounded by 4.5% on a YOY basis throughout the first two thirds of the production season and is on pace to reach a record high annual level.