Crop Progress Update – 8/9/21

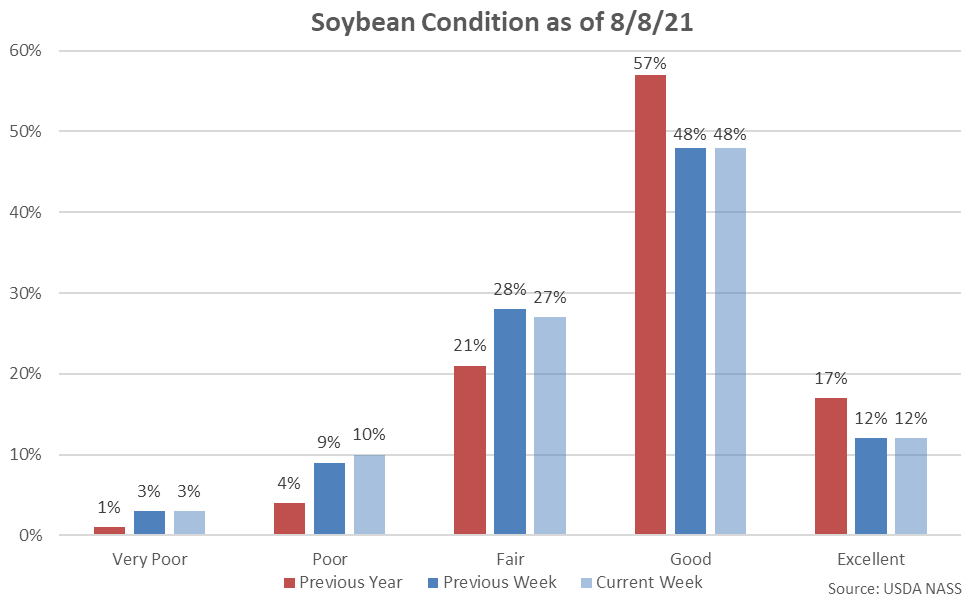

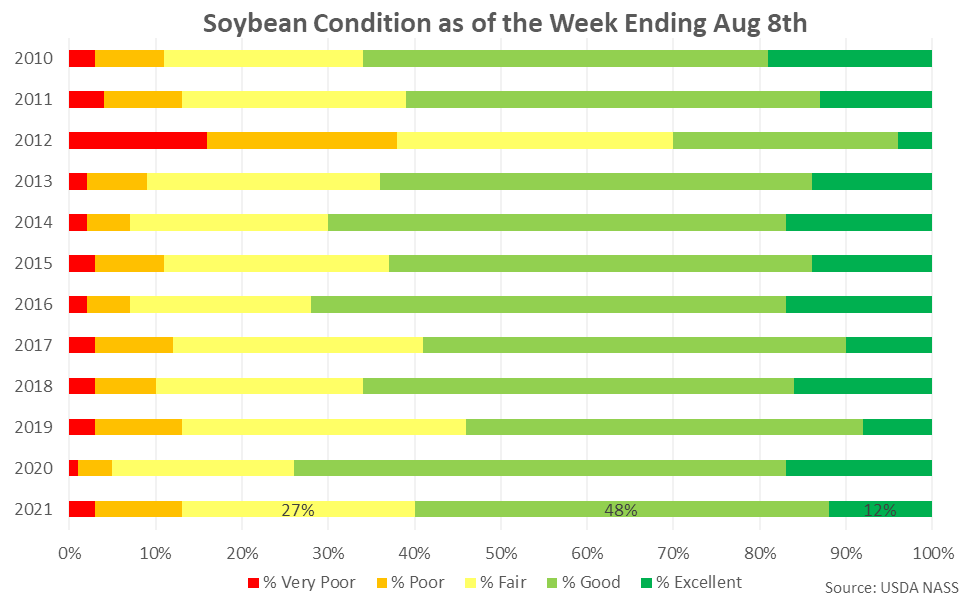

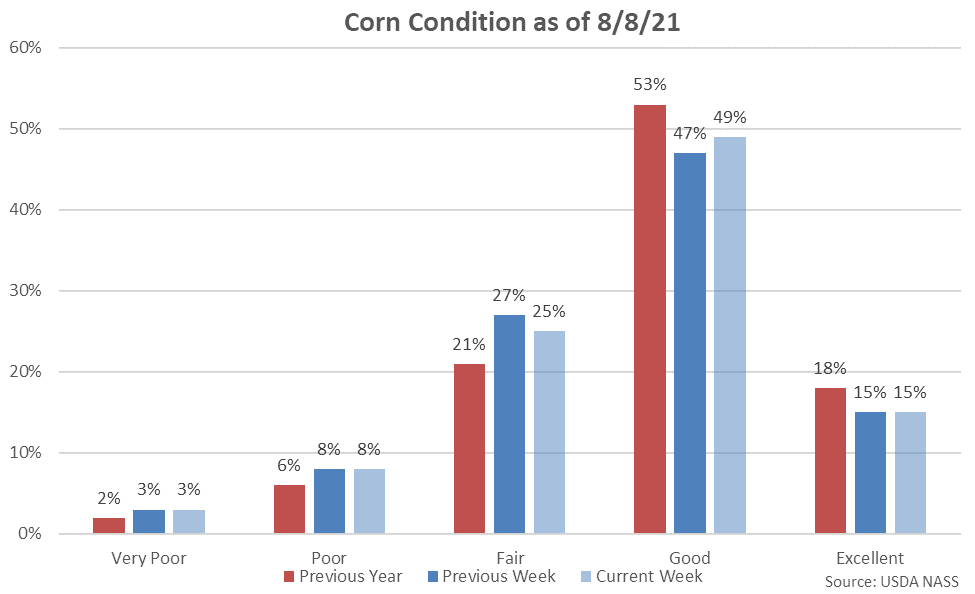

According to the USDA, the percentage of corn identified to be in good or excellent condition as of the week ending Aug 8th increased from the previous week, finishing above analyst expectations. The percentage of soybeans identified to be in good or excellent condition as of the week ending Aug 8th remained unchanged from the previous week, however, finishing consistent with analyst expectations.

Corn:

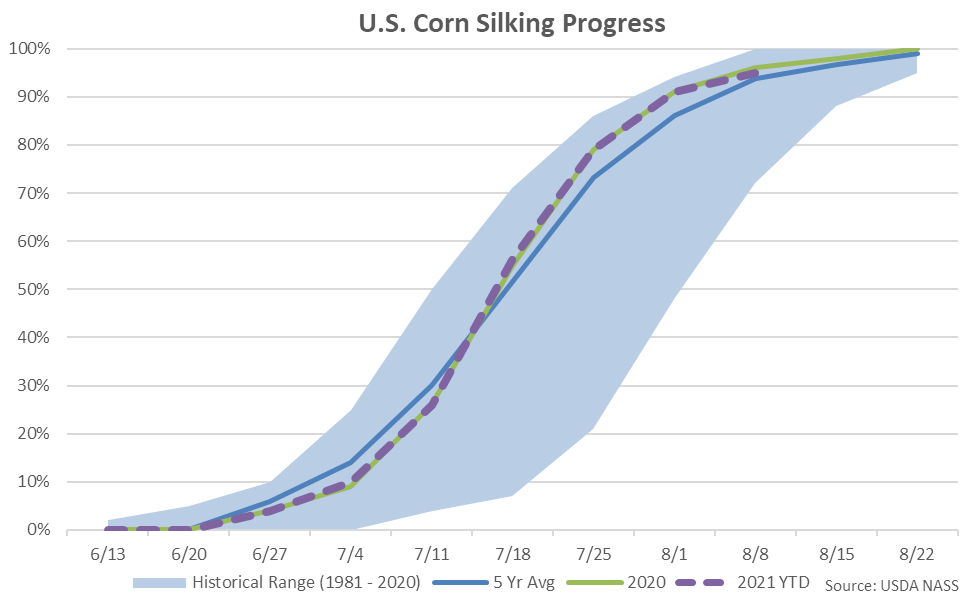

Corn silking as of the week ending Aug 8th was 95% complete, finishing slightly behind last year’s pace of 96% completed but slightly ahead of the five year average pace of 94% completed.

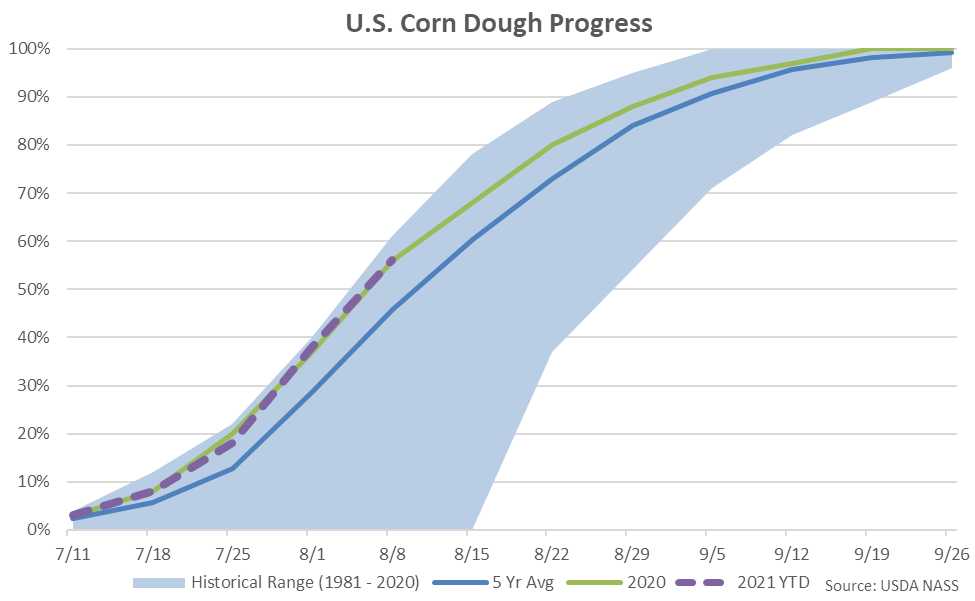

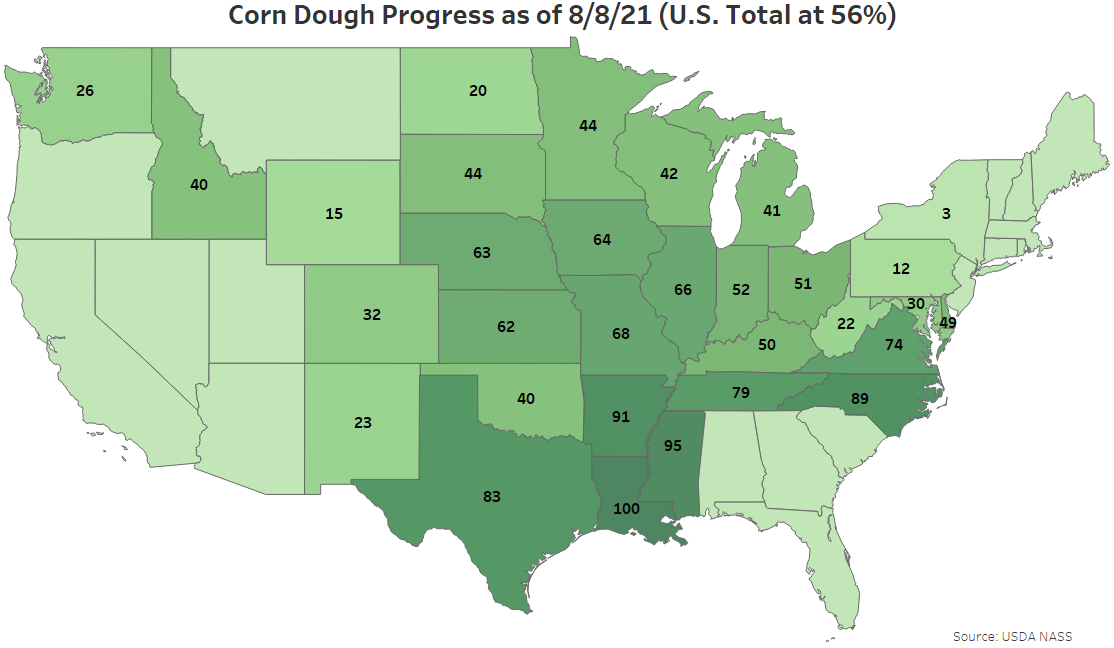

Corn dough as of the week ending Aug 8th was 56% complete, finishing equal to last year’s pace and ahead of the five year average pace of 51% completed.

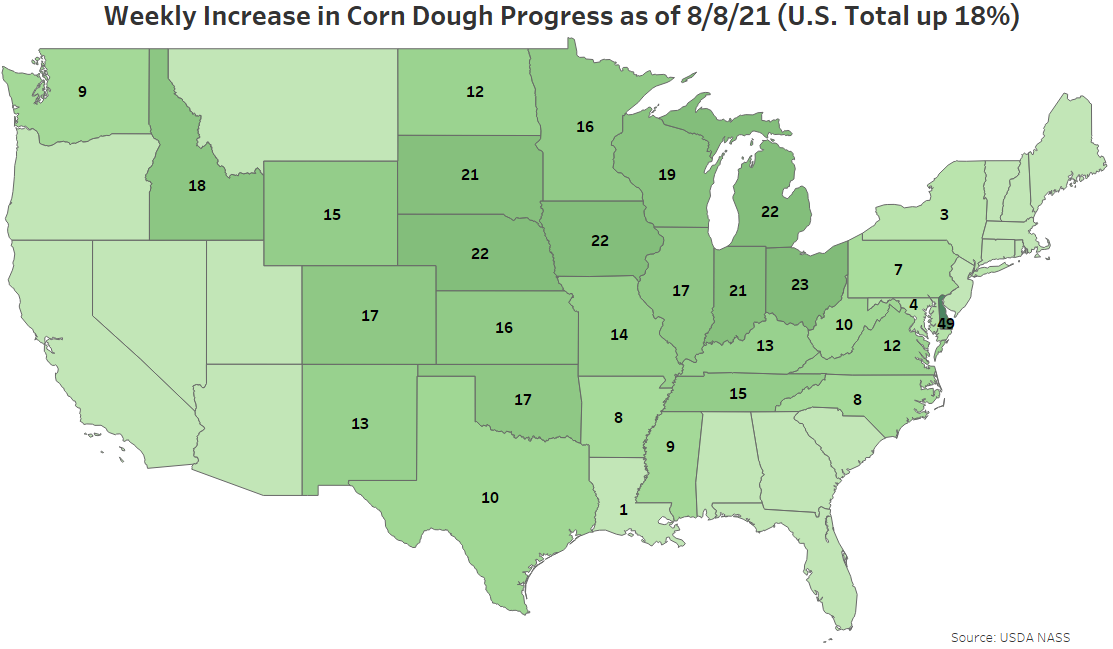

An additional 18% of the total U.S. corn crop reached the dough stage during the week ending Aug 8th. Weekly increases in corn dough on a percentage basis were led by Delaware, followed by Ohio.

Corn dent as of the week ending Aug 8th was eight percent complete, finishing behind last year’s pace of ten percent completed and the five year average pace of 11% completed.

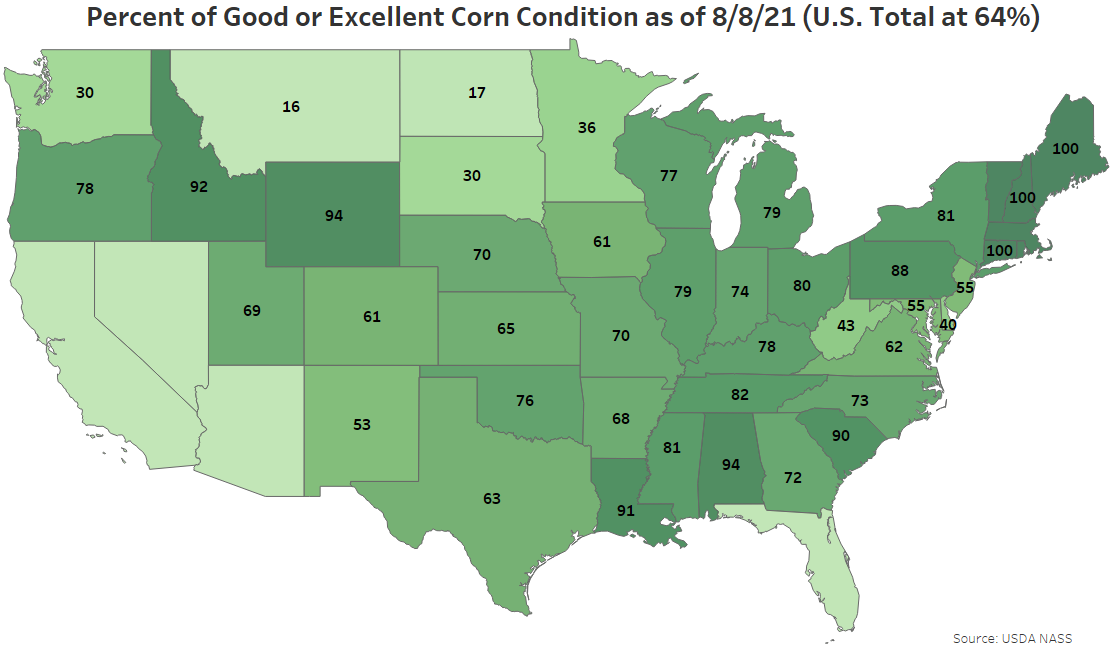

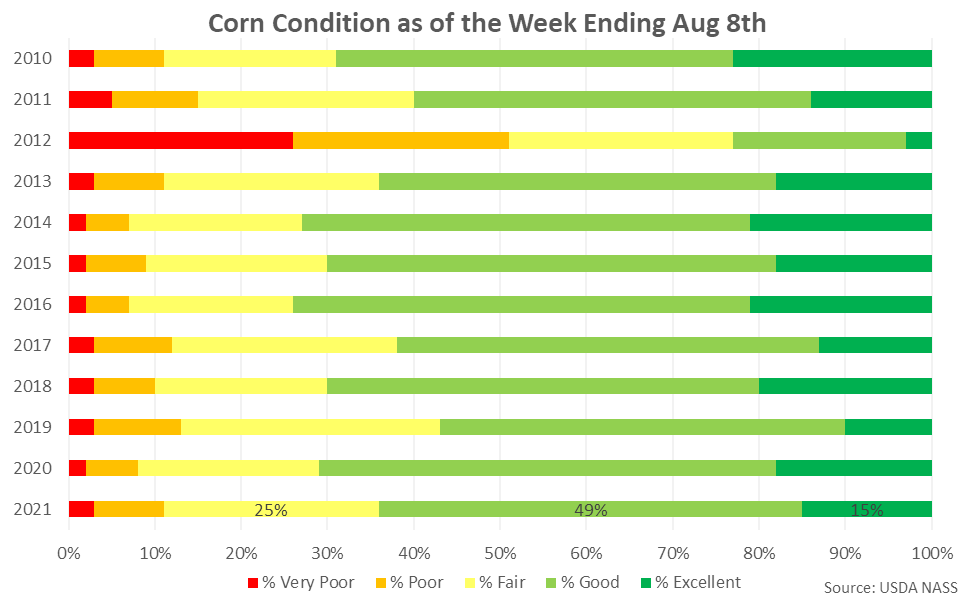

64% of the current corn crop was identified to be in good or excellent condition as of the week ending Aug 8th, up two percent from the previous week. The current corn crop identified to be in good or excellent condition finished above analyst expectations of 62%. 11% of the current corn crop was identified to be in very poor or poor condition, unchanged from the previous week.

Soybeans:

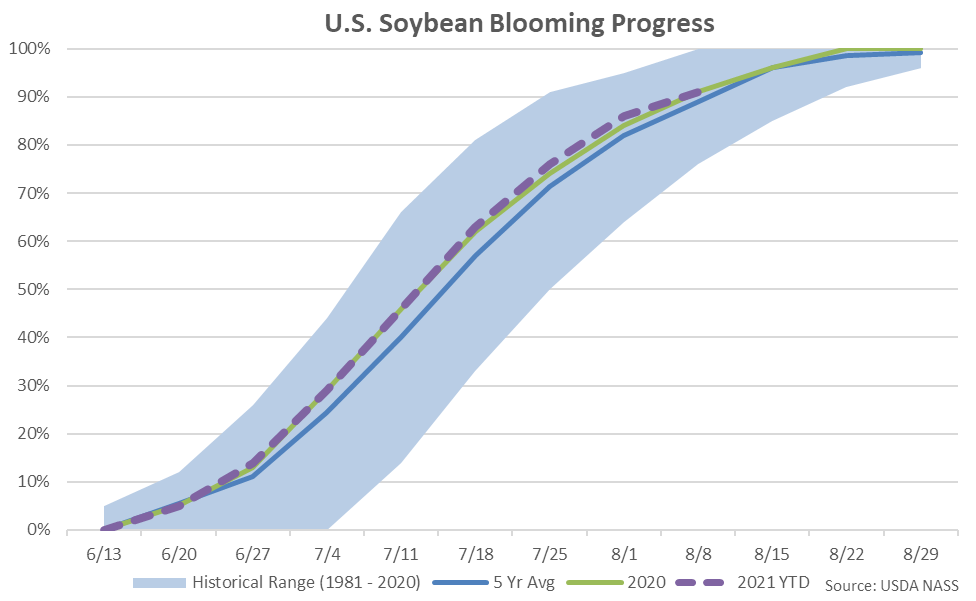

Soybean blooming as of the week ending Aug 8th was 91% complete, finishing equal to last year’s pace and ahead of the five year average pace of 89% completed.

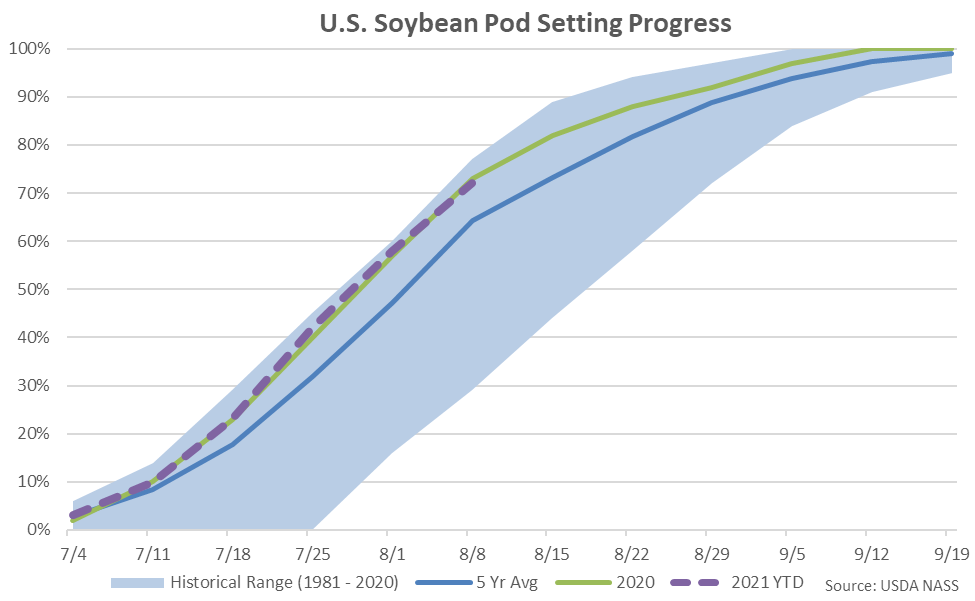

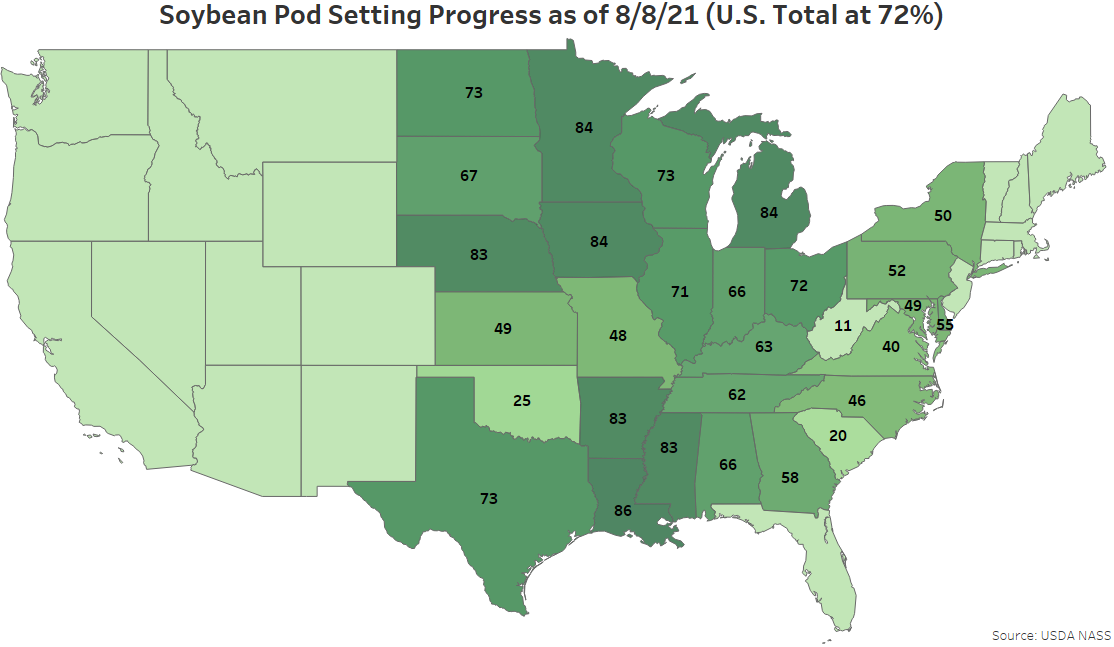

Soybean pod setting as of the week ending Aug 8th was 72% complete, finishing slightly behind last year’s pace of 73% completed but ahead of the five year average pace of 68% completed.

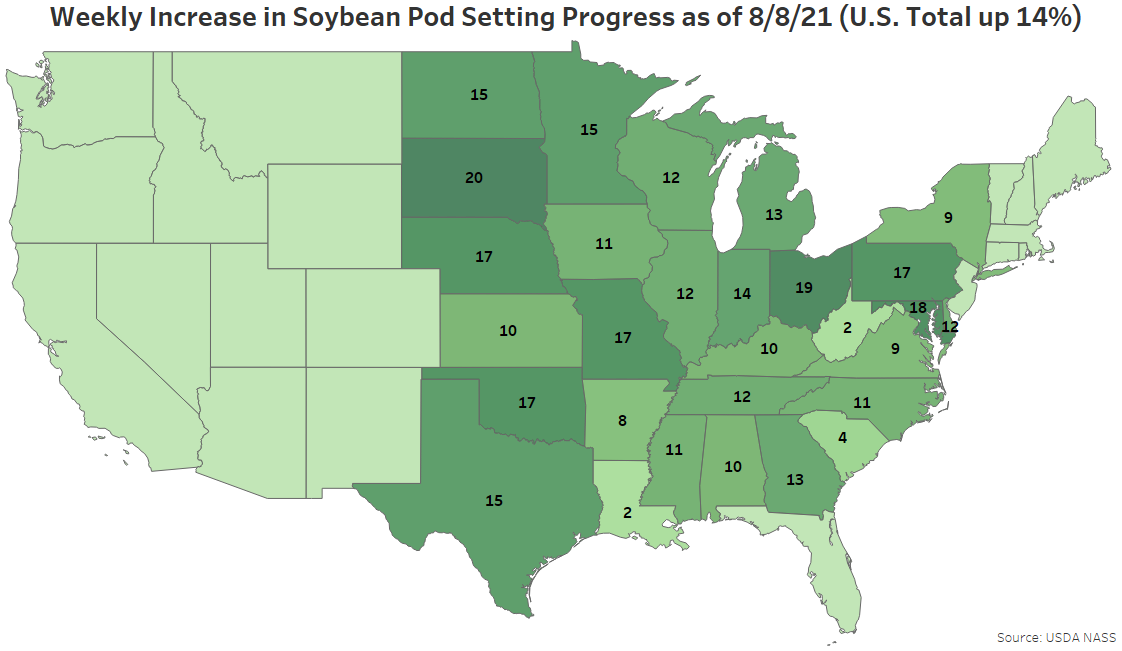

An additional 14% of the total U.S. soybean crop set pods during the week ending Aug 8th. Weekly increases in soybean pod setting on a percentage basis were led by South Dakota, followed by Ohio and Maryland.

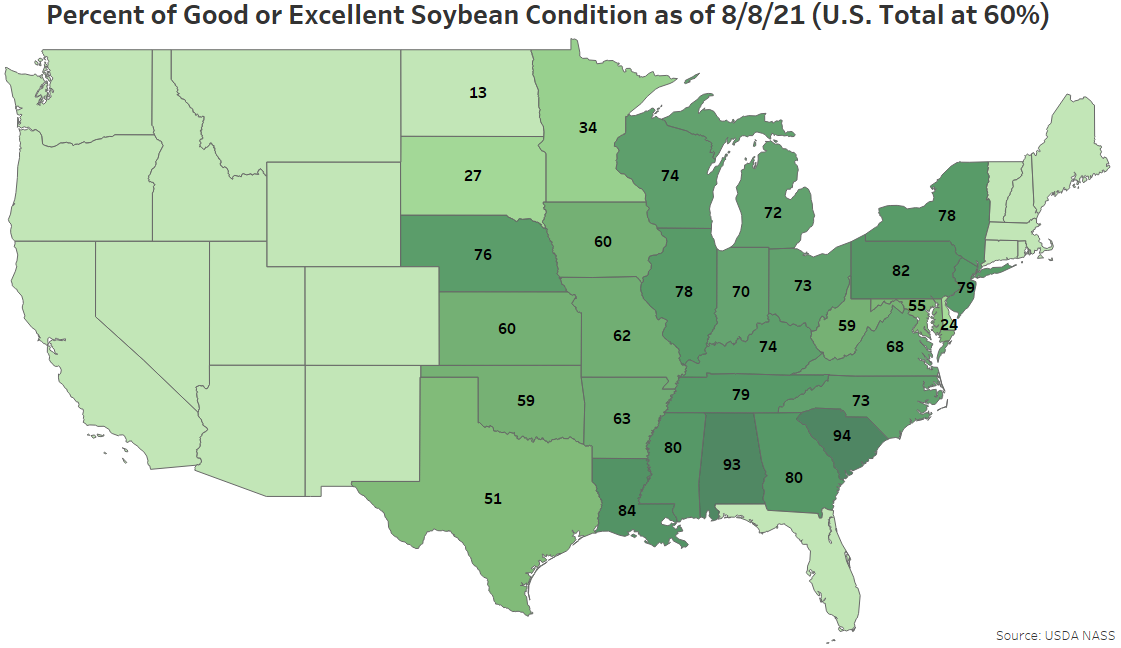

60% of the current soybean crop was identified to be in good or excellent condition as of the week ending Aug 8th, unchanged from the previous week. The current soybean crop identified to be in good or excellent condition finished consistent with analyst expectations. 13% of the current soybean crop was identified to be in very poor or poor condition, up one percent from the previous week.