Crop Progress Update – 8/16/21

According to the USDA, the percentage of corn and soybeans identified to be in good or excellent condition as of the week ending Aug 15th each declined from the previous week, finishing below analyst expectations.

Corn:

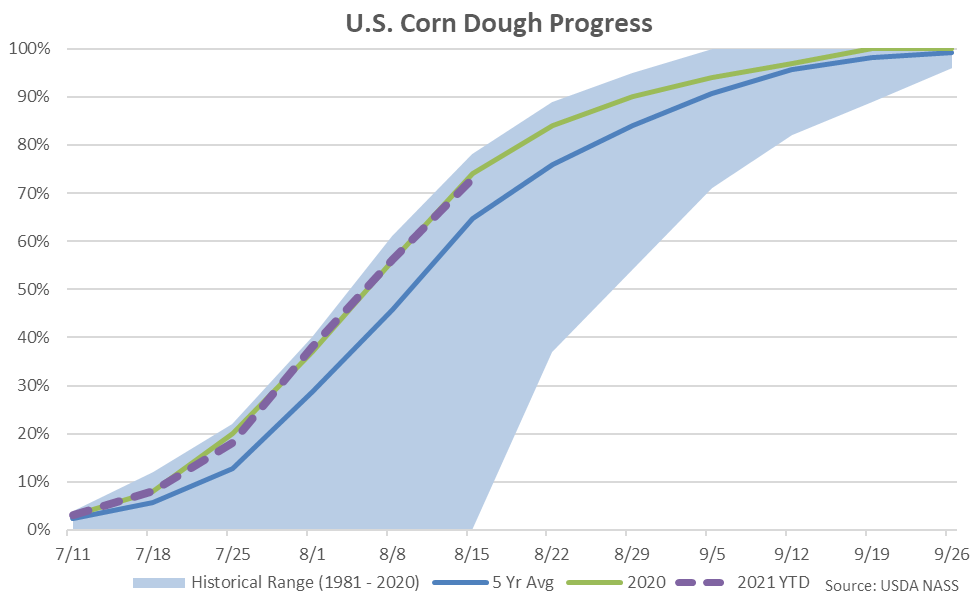

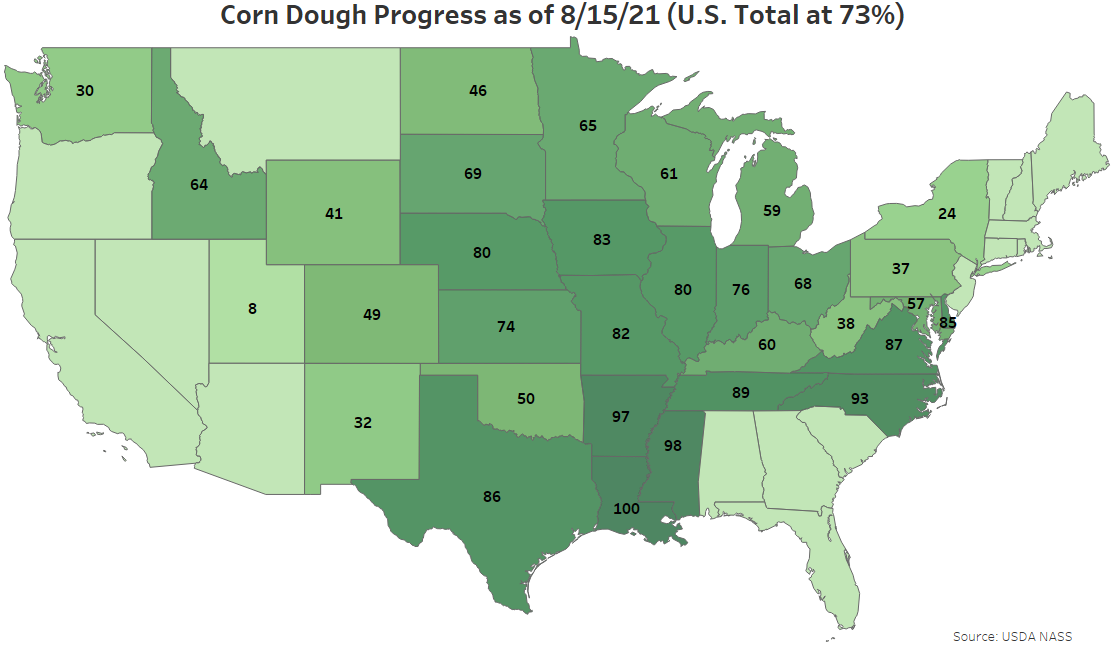

Corn dough as of the week ending Aug 15th was 73% complete, finishing slightly behind last year’s pace of 74% completed but remaining ahead of the five year average pace of 68% completed.

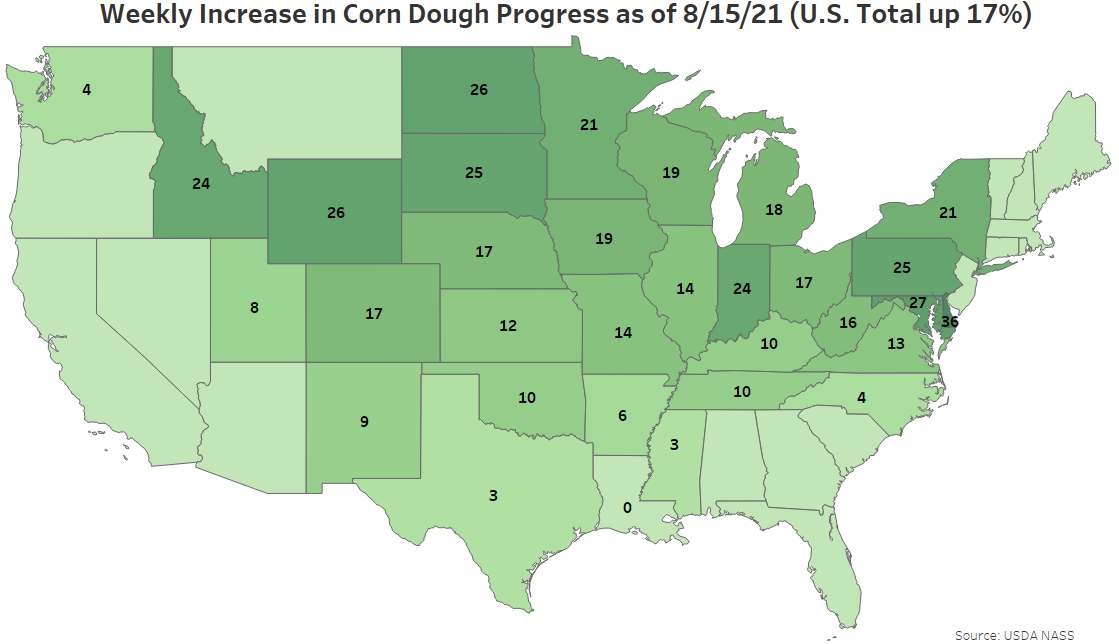

An additional 17% of the total U.S. corn crop reached the dough stage during the week ending Aug 15th. Weekly increases in corn dough on a percentage basis were led by Delaware, followed by Maryland.

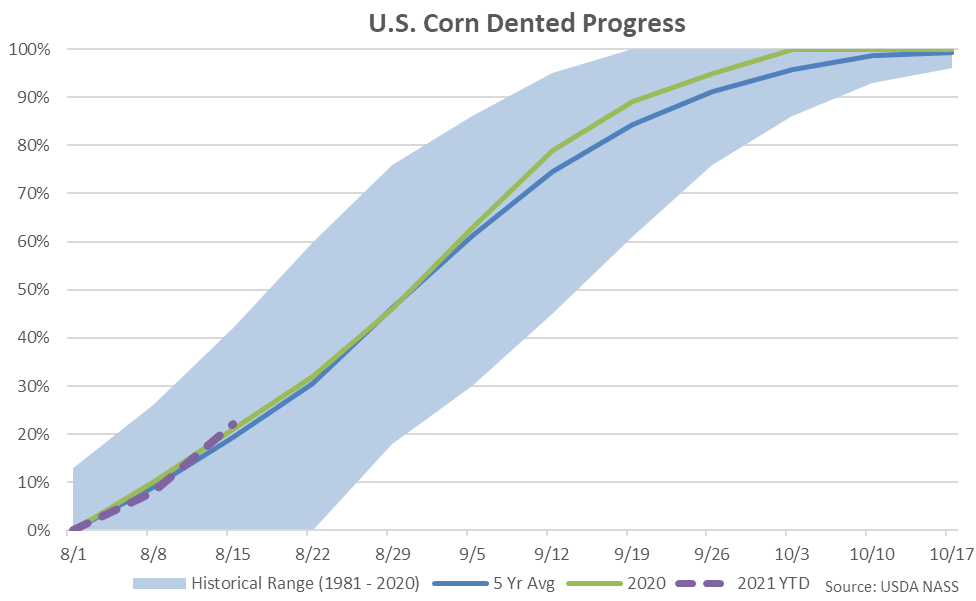

Corn dent as of the week ending Aug 15th was 22% complete, finishing slightly ahead of last year’s pace of 21% completed and equal to the five year average pace.

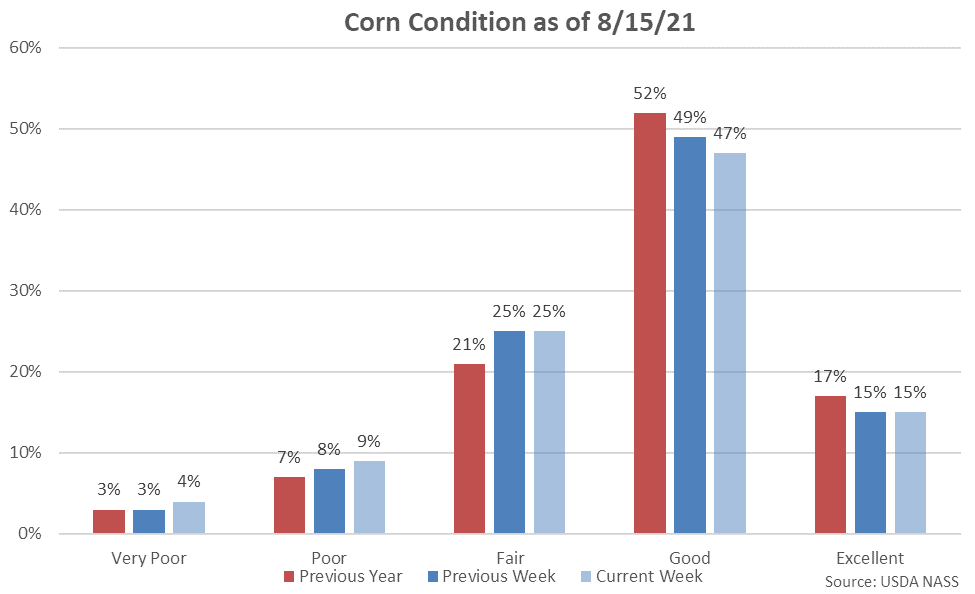

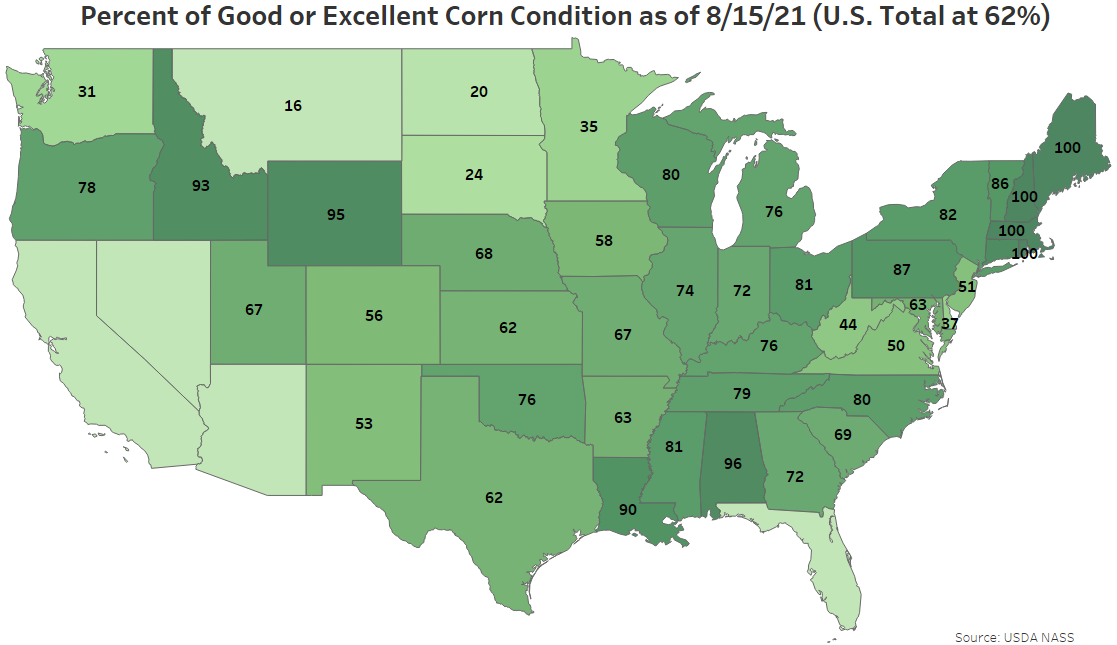

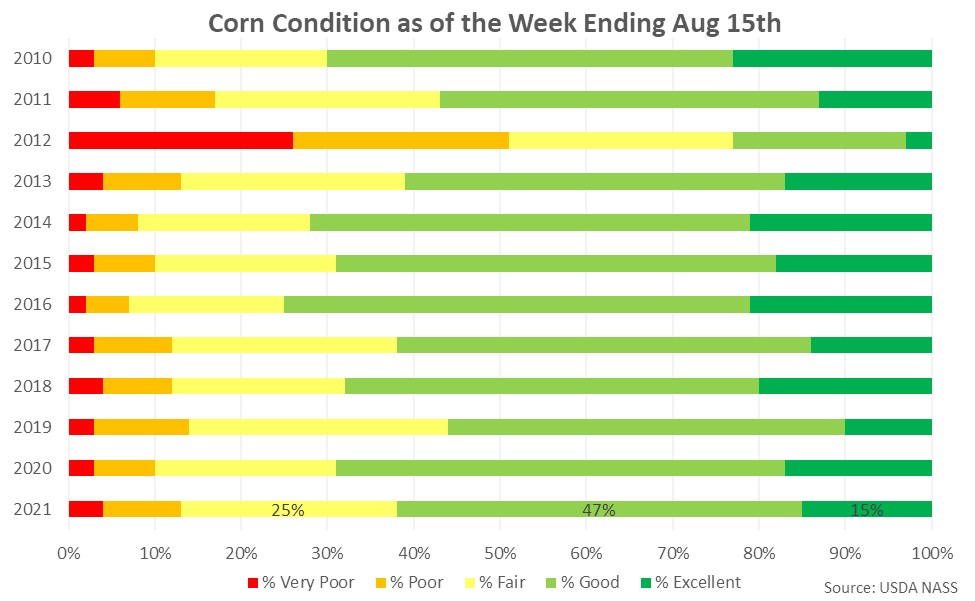

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Aug 15th, down two percent from the previous week. The current corn crop identified to be in good or excellent condition finished below analyst expectations of 64%. 13% of the current corn crop was identified to be in very poor or poor condition, up two percent from the previous week.

Soybeans:

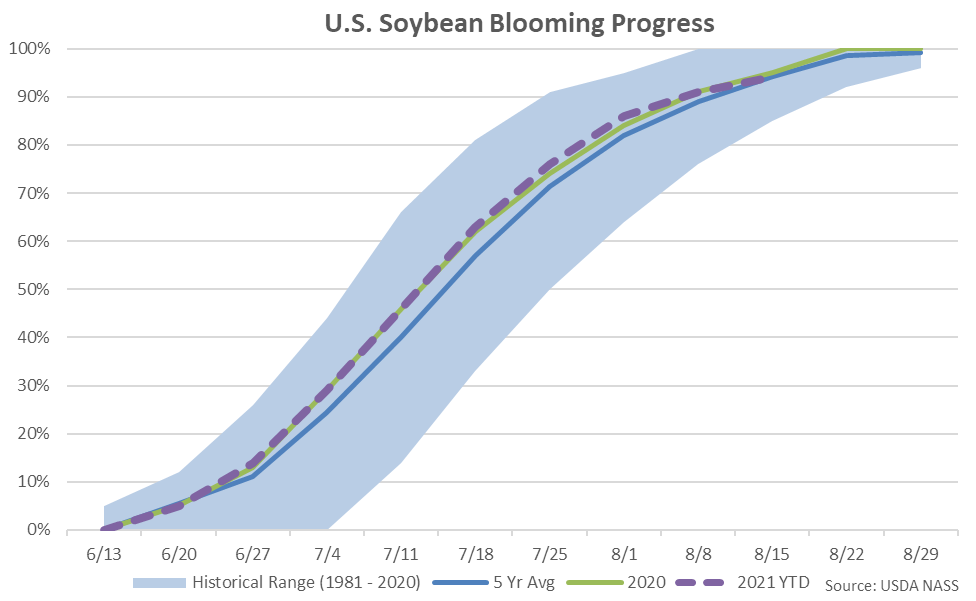

Soybean blooming as of the week ending Aug 15th was 94% complete, finishing slightly behind last year’s pace of 95% completed but remaining equal to the five year average pace.

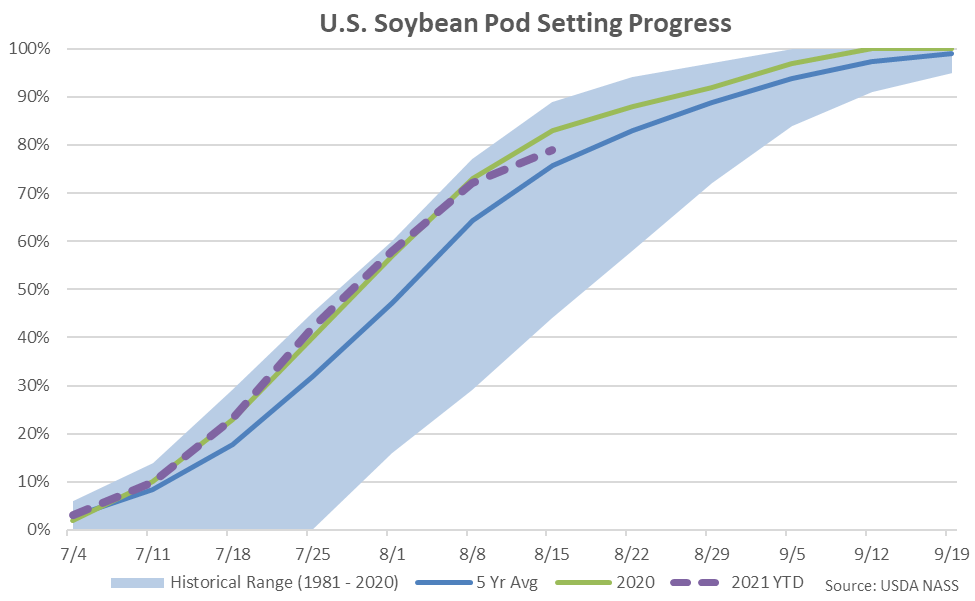

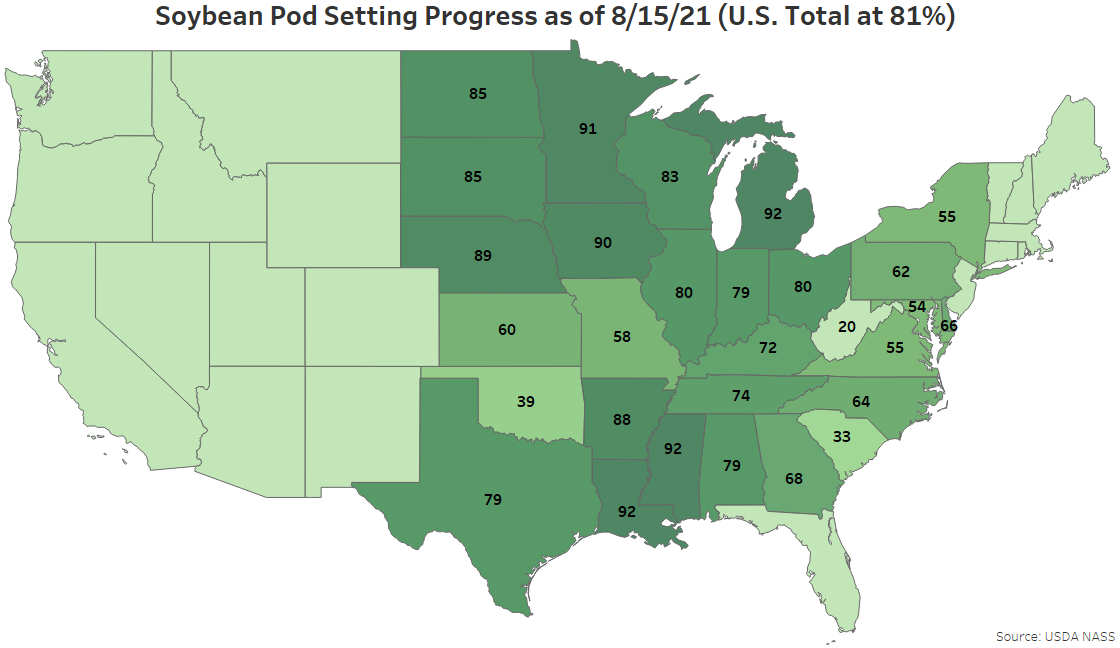

Soybean pod setting as of the week ending Aug 15th was 81% complete, finishing slightly behind last year’s pace of 83% completed but remaining slightly ahead of the five year average pace of 79% completed.

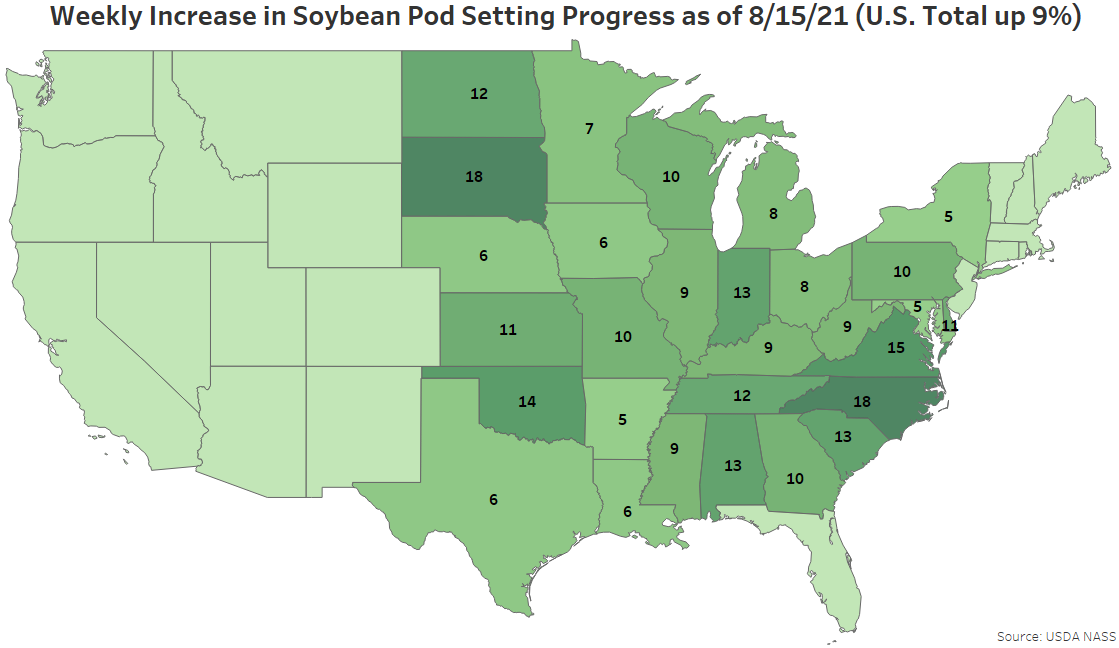

An additional nine percent of the total U.S. soybean crop set pods during the week ending Aug 15th. Weekly increases in soybean pod setting on a percentage basis were led by South Dakota and North Carolina, followed by Virginia.

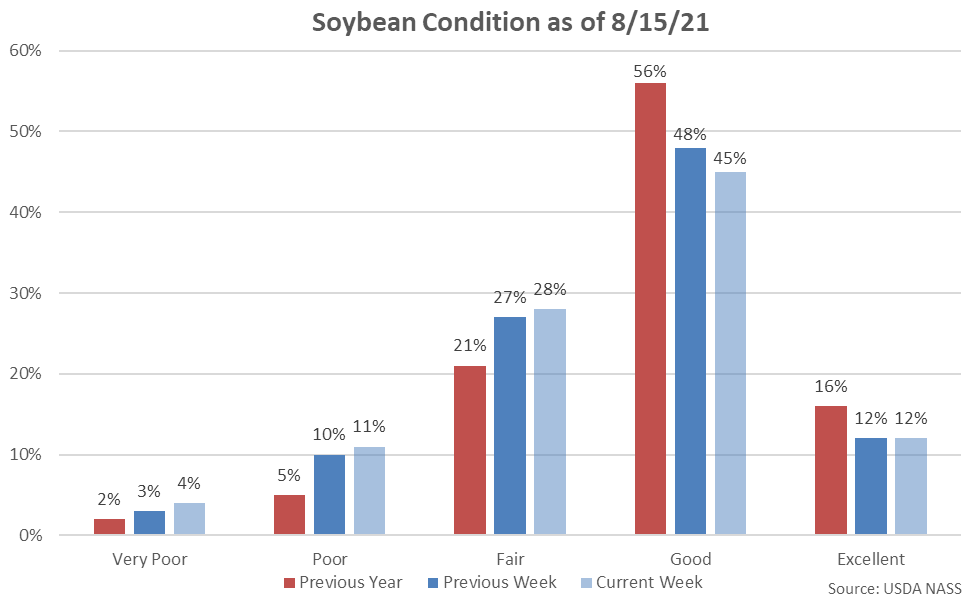

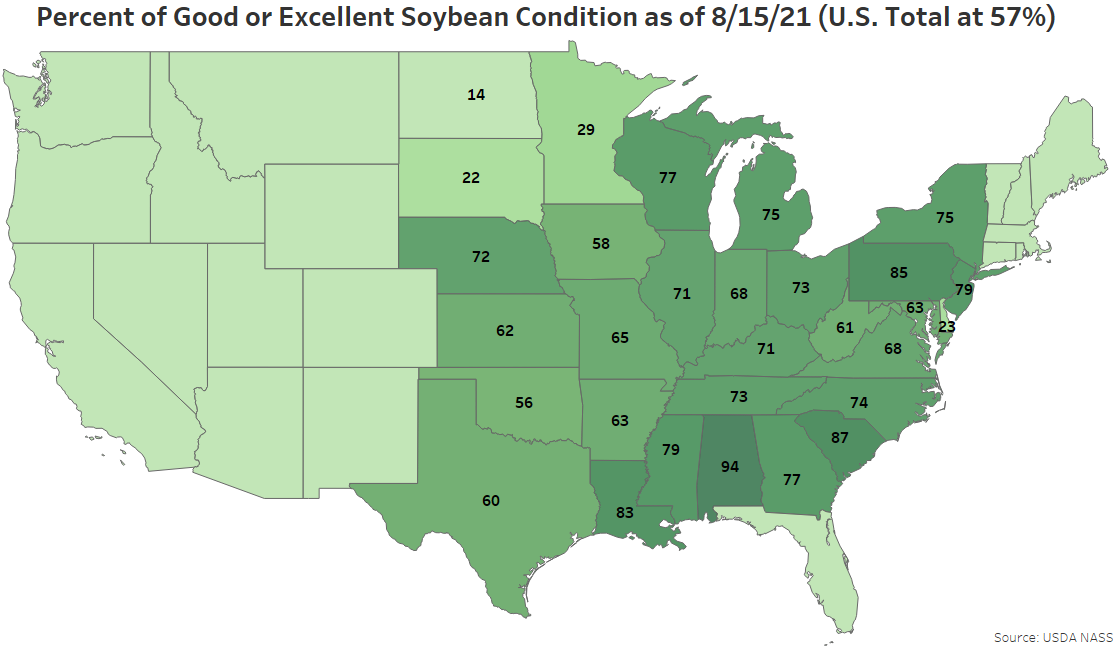

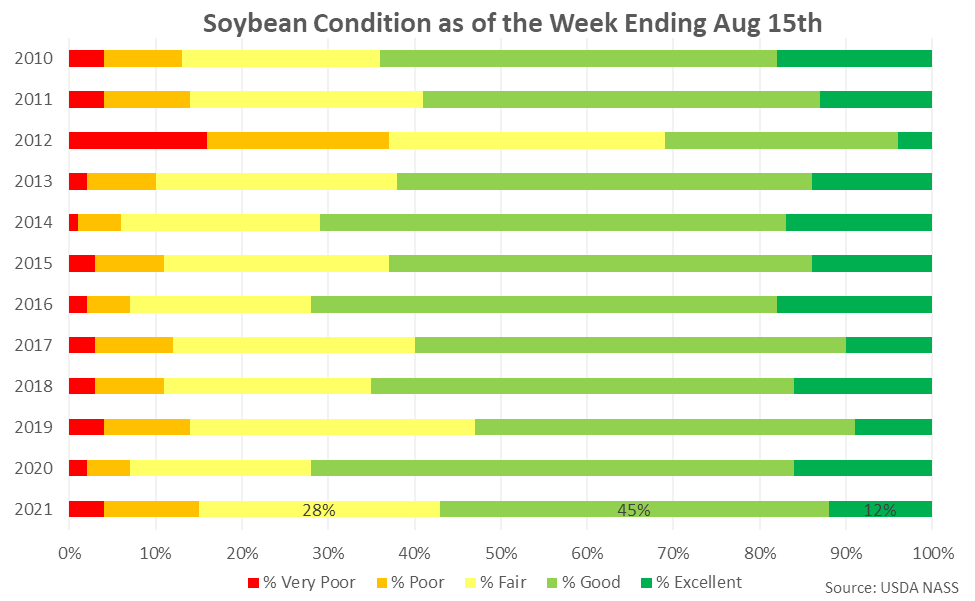

57% of the current soybean crop was identified to be in good or excellent condition as of the week ending Aug 15th, down three percent from the previous week. The current soybean crop identified to be in good or excellent condition finished below analyst expectations of 60%. 15% of the current soybean crop was identified to be in very poor or poor condition, up two percent from the previous week.