U.S. Dairy Dry Product Stocks Update – Sep ’21

Executive Summary

U.S. dairy dry product stock figures provided by the USDA were recently updated with values spanning through Jul ’21. Highlights from the updated report include:

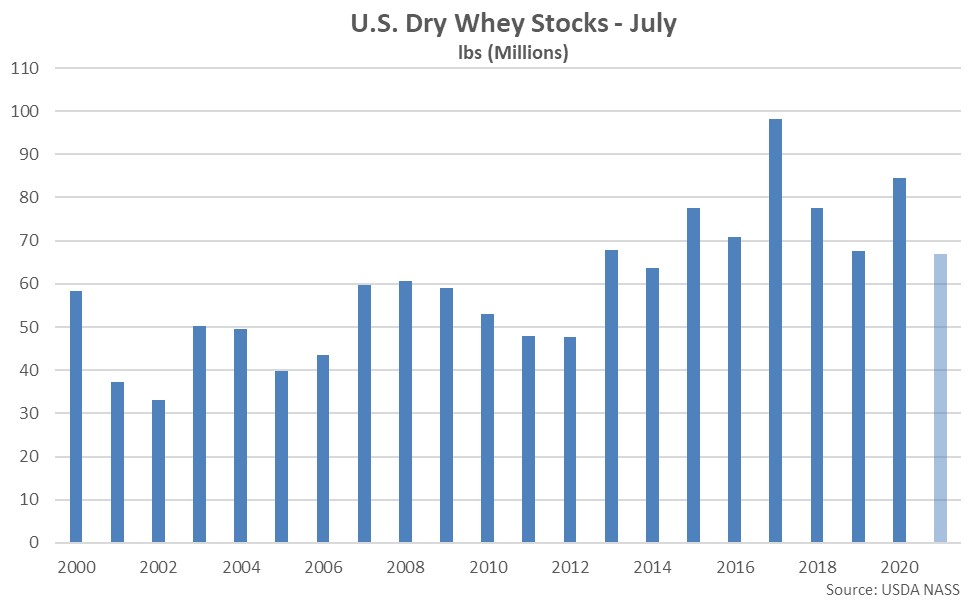

- U.S. dry whey stocks remained lower on a YOY basis for the tenth time in the past 11 months throughout Jul ’21, finishing 20.9% below previous year figures and remaining at a seven year low seasonal level.

- Jul ’21 U.S. nonfat dry milk stocks declined contraseasonally from the previous month but finished 2.7% above previous year levels, remaining at a record high seasonal level.

Additional Report Details

Dry Whey – Stocks Remain at a Seven Year Low Seasonal Level, Down 20.9% YOY

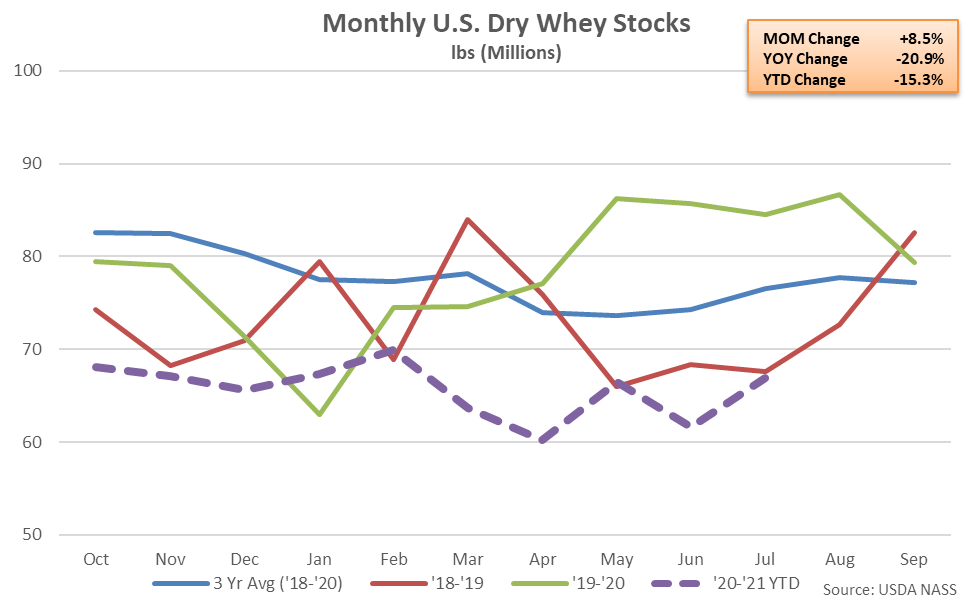

According to the USDA, Jul ’21 month-end dry whey stocks rebounded seasonally to a five month high level but finished 20.9% below previous year levels, remaining at a seven year low seasonal level. The YOY decline in dry whey stocks was the tenth experienced throughout the past 11 months.

The month-over-month increase in dry whey stocks of 5.2 million pounds, or 8.5%, was larger than the ten year average June – July seasonal build in dry whey stocks of 1.5 million pounds, or 1.7%. Previous month dry whey stock levels were revised 2.4% below levels previously stated, contributing to the larger than typical seasonal increase. Dry whey production declined 2.3% on a YOY basis throughout Jul ’21, finishing below previous year figures for the 11th time in the past 13 months.

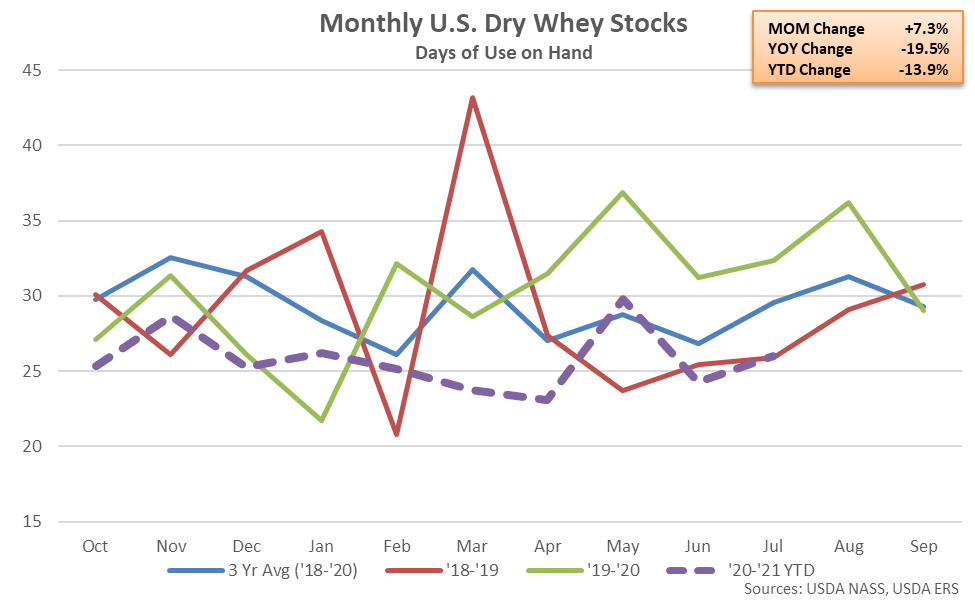

On a days of usage basis, Jul ’21 U.S. dry whey stocks also remained lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, dry whey stocks on a days of usage basis finished 19.5% lower YOY, declining on a YOY basis for the tenth time in the past 11 months.

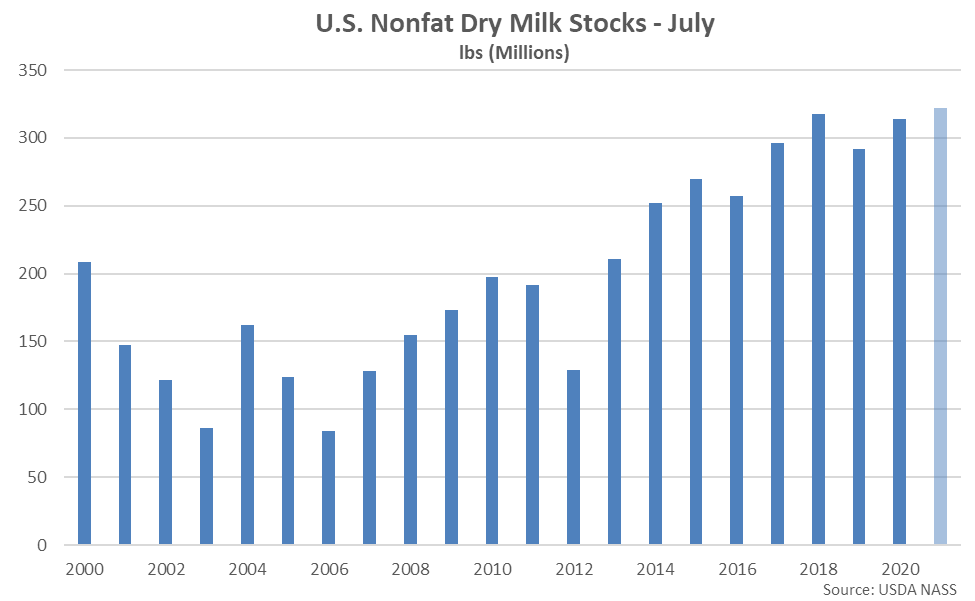

Nonfat Dry Milk – Stocks Remain at a Record High Seasonal Level, up 2.7% YOY

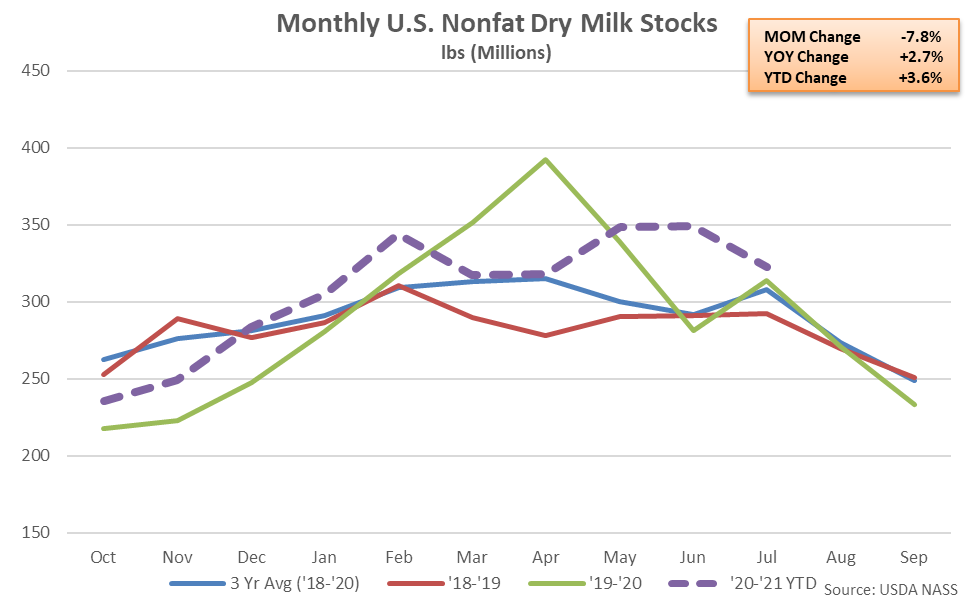

Jul ’21 month-end nonfat dry milk (NFDM) stocks declined from the 14 month high level experienced throughout the previous month but remained 2.7% above previous year levels, reaching a record high seasonal level. The YOY increase in NFDM stocks was the third experienced in a row.

The month-over-month decline in NFDM stocks of 27.1 million pounds, or 7.8%, was a contraseasonal move when compared to the ten year average June – July seasonal build in stocks of 7.3 million pounds, or 2.4%. NFDM production declined 5.3% on a YOY basis throughout Jul ’21, reaching a three year low seasonal level.

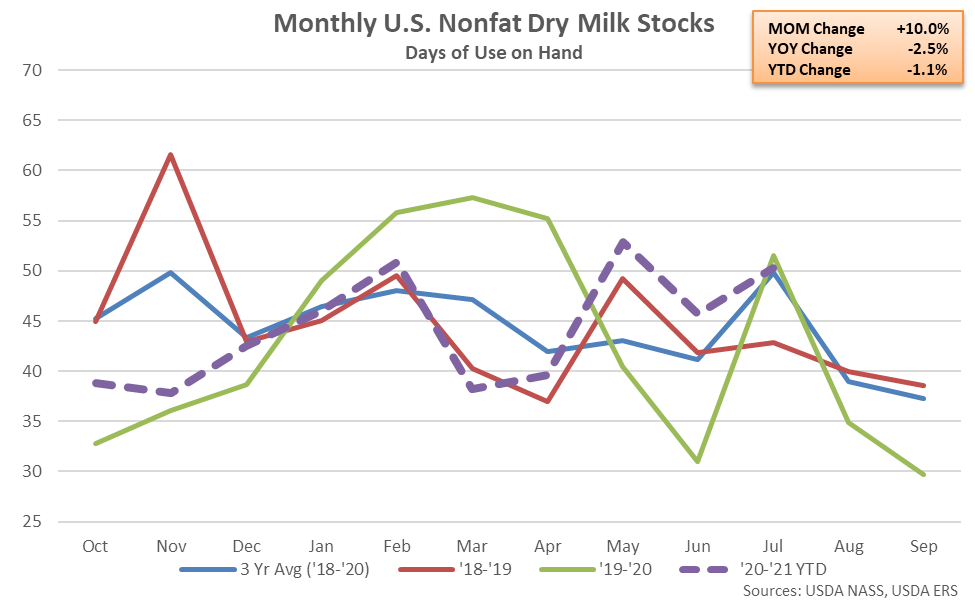

On a days of usage basis, Jul ’21 U.S. NFDM stocks finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of July, NFDM stocks on a days of usage basis finished 2.5% below previous year figures, declining on a YOY basis for the first time in the past three months.

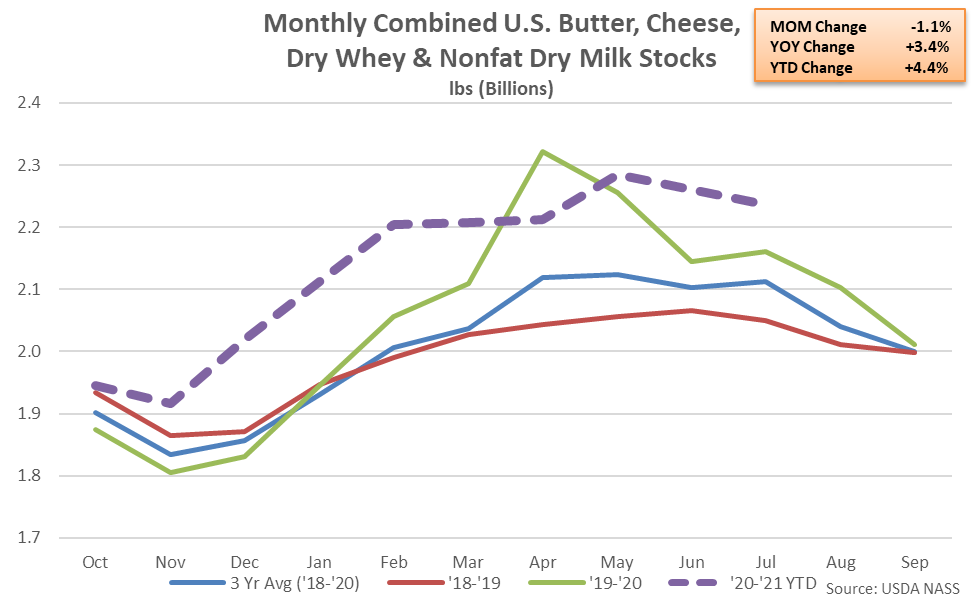

Combined Dairy Product Stocks – Stocks Remain at a Record High Seasonal Level, Finish up 3.4% YOY

Jul ’21 combined stocks of butter, cheese, dry whey and NFDM finished 3.4% above previous year levels, reaching a record high seasonal level for the month of July. Combined dairy product stocks have reached record high seasonal levels over 17 of the past 18 months through Jul ’21.