U.S. LNG Export Capacity Update – Sep ’21

Executive Summary

U.S. liquefied natural gas (LNG) export capacity has continued to grow through the first half of 2021. Important points to consider include:

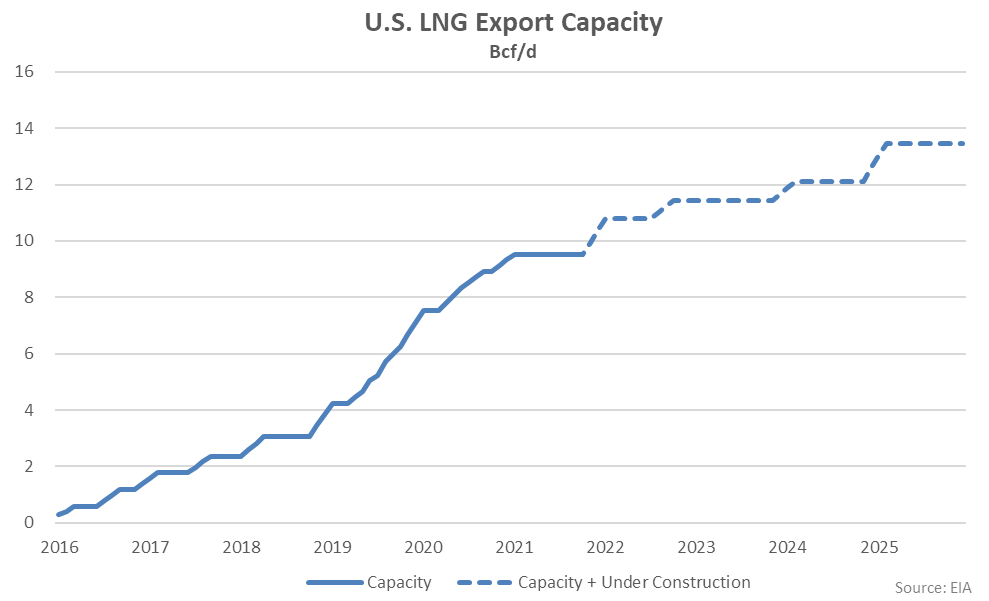

- U.S. LNG export capacity has reached record high annual levels over five consecutive years through 2020, a result of increased shale gas production. LNG export capacity is expected to continue to grow through years to come based on projects currently under construction and proposed.

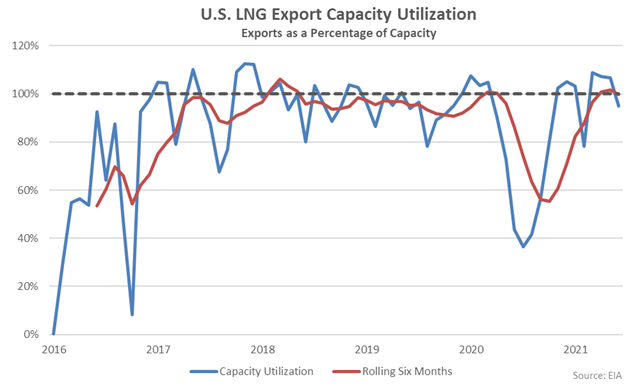

- U.S. LNG export capacity utilization remains high, despite the recently experienced increases in capacity rates. LNG export capacity utilization rates have averaged 99.8% throughout the first half of 2021.

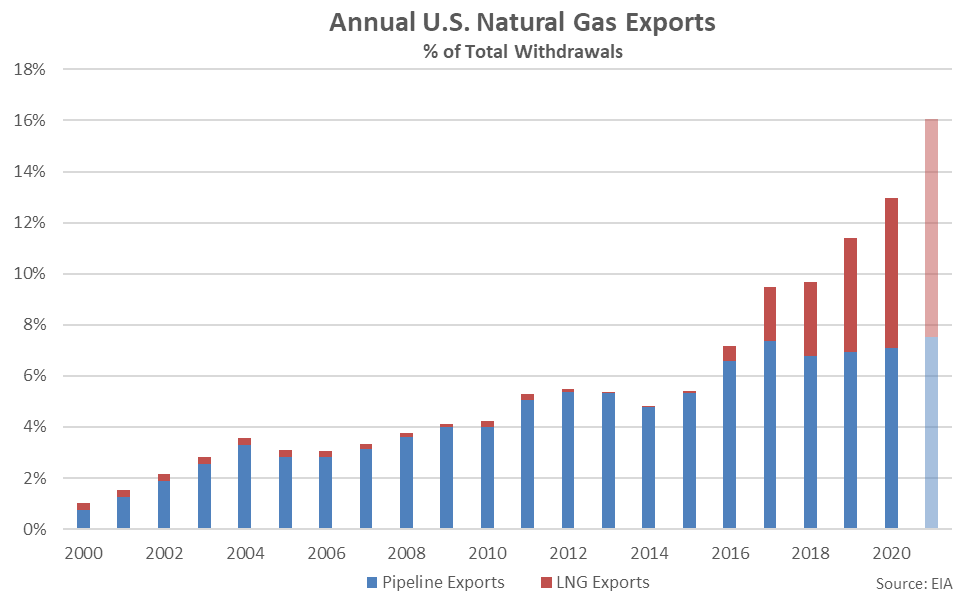

- U.S. LNG export volumes have accounted for a record high 8.5% of total U.S. natural gas withdrawals over the first half of 2021. 2021 YTD LNG export volumes are on pace to exceed natural gas pipeline export volumes for the first time on record.

LNG Export Capacity

U.S. LNG export capacity has grown significantly over recent years, driven higher by shale gas production. LNG export capacity has reached record high annual levels over five consecutive years through 2020, with total nameplate capacity reaching 9.5 billion cubic feet per day (Bcf/d). An additional 1.3 Bcf/d in export capacity currently under construction is expected to be in service by the end of 2021, representing a 13% increase from current levels. An additional 2.7 Bcf/d in export capacity currently under construction is expected to be completed between 2022-2025, while there is currently additional proposed export capacity in excess of 25.0 Bcf/d that is approved but does not have a final investment decision made on it.

LNG Export Capacity Utilization

U.S. LNG export capacity utilization averaged north of 95% throughout 2018, 2019 and the first quarter of 2020. COVID-19 related disruptions to utilization rates were experienced throughout the second and third quarters of 2020 however export rates rebounded to near capacity by the end of 2020. More recently, LNG export capacity utilization rates have averaged 99.8% throughout the first half of 2021.

LNG Exports as a % of Withdrawals

U.S. LNG export volumes as a percentage of U.S. natural gas withdrawals has reached record high levels over five consecutive years through 2020 but have remained below U.S. natural gas pipeline export volumes. U.S. LNG export volumes are on pace to exceed U.S. natural gas pipeline export volumes for the first time on record throughout 2021, accounting for 8.5% of total U.S. natural gas withdrawals over the first half of the year.