Quarterly Grain Stocks Update – Sep ’21

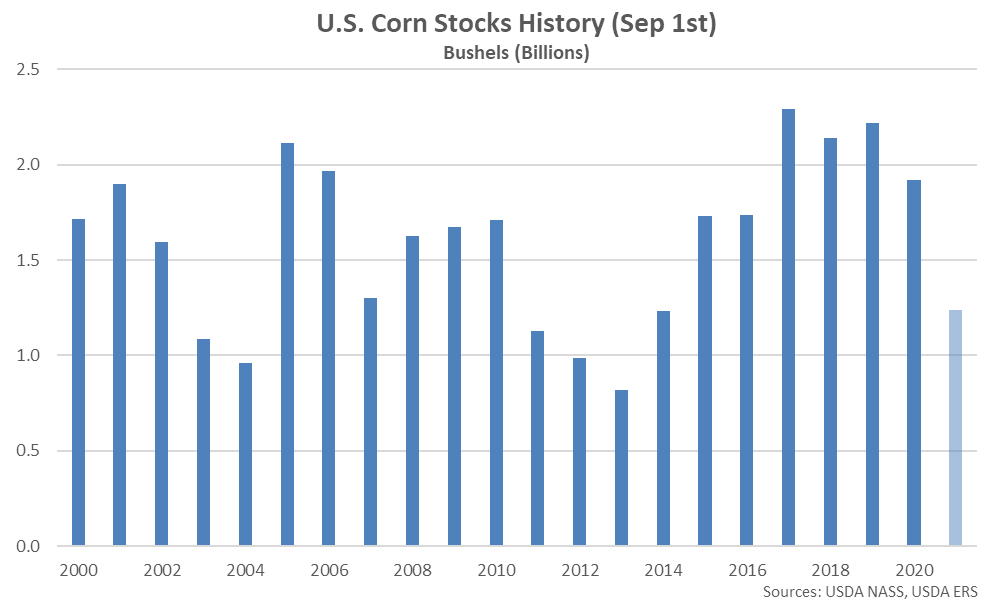

Corn – Sep 1st Stocks Reach a Seven Year Low Seasonal Level but Finish Above Expectations

Corn stored in all positions as of September 1st, 2021 totaled 1.24 billion bushels, down 35.6% from the previous year and reaching a seven year low seasonal level. Corn stocks finished 7.1% above average analyst estimates of 1.16 billion bushels, however. Stocks indicated disappearance of 2.87 billion bushels from the previous quarter, 6.8% below the drawdown experienced during the same period last year.

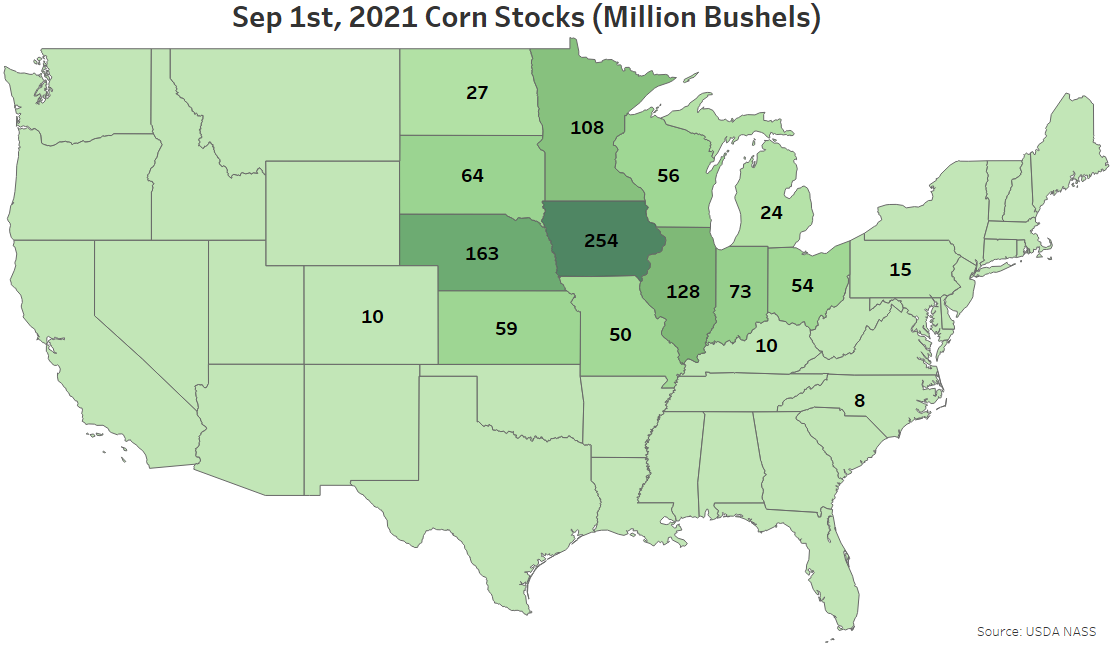

Sep 1st corn stocks were most significant within Iowa, followed by Nebraska and Illinois. The aforementioned states combined to account for nearly 45% of the total U.S. corn stocks.

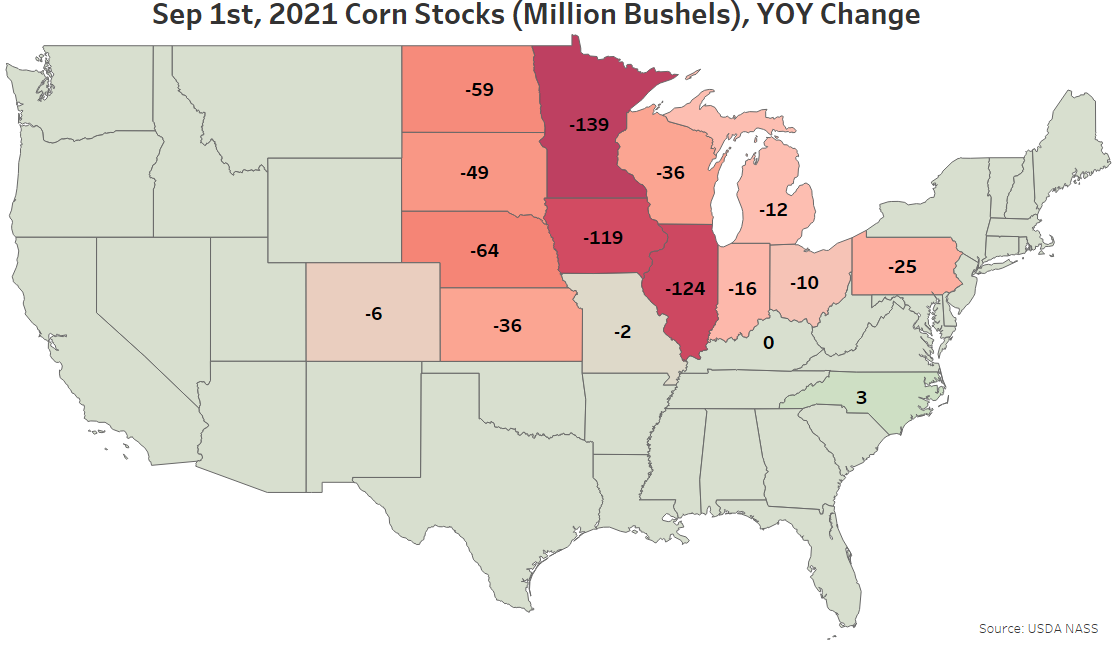

The most significant YOY decline in Sep 1st corn stocks was experienced throughout Minnesota, followed by declines experienced throughout Illinois and Iowa.

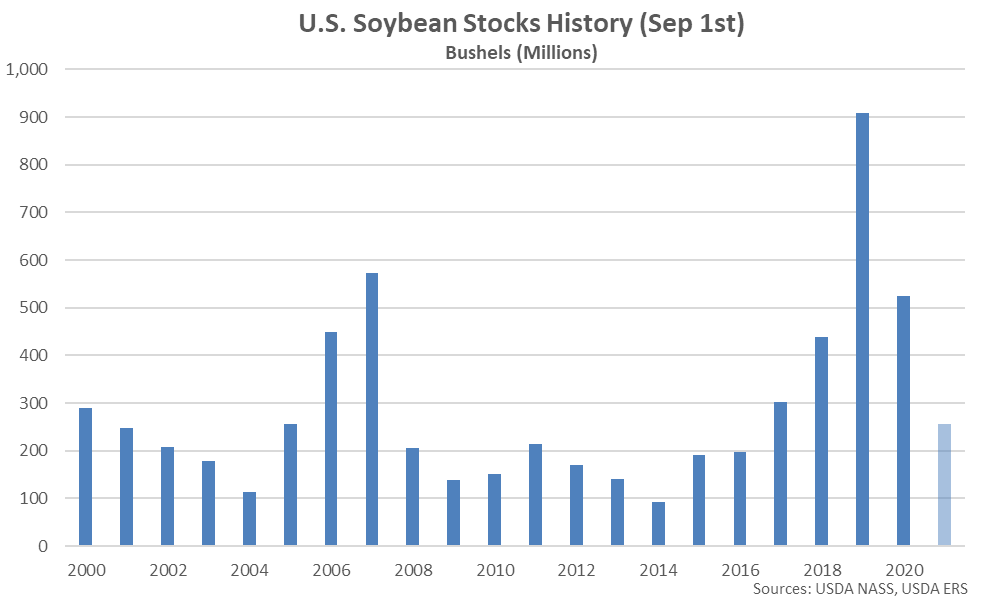

Soybeans – Sep 1st Stocks Reach a Five Year Low Seasonal Level but Finish Above Expectations

Soybeans stored in all positions as of September 1st, 2021 totaled 256 million bushels, down 51.2% from the previous year and reaching a five year low seasonal level. Soybean stocks finished 47.2% above average analyst estimates of 174 million bushels, however. Stocks indicated disappearance of 513 million bushels from the previous quarter, 40.1% below the drawdown experienced during the same period last year.

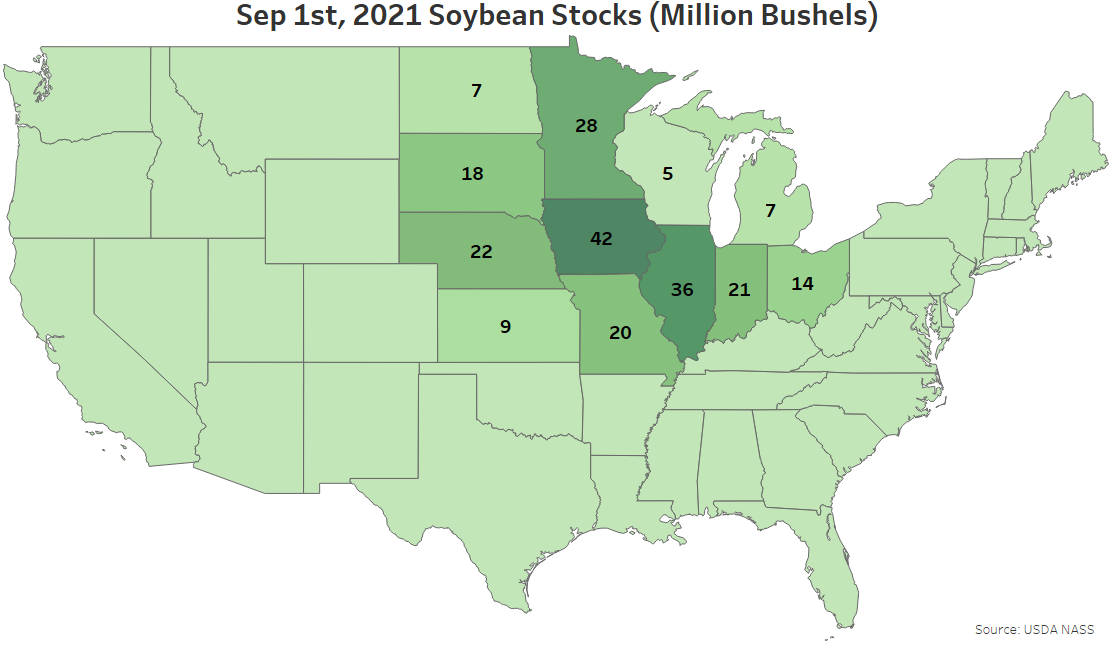

Sep 1st soybean stocks were most significant within Iowa, followed by Illinois and Minnesota. The aforementioned states combined to account for over 40% of the total U.S. soybean stocks.

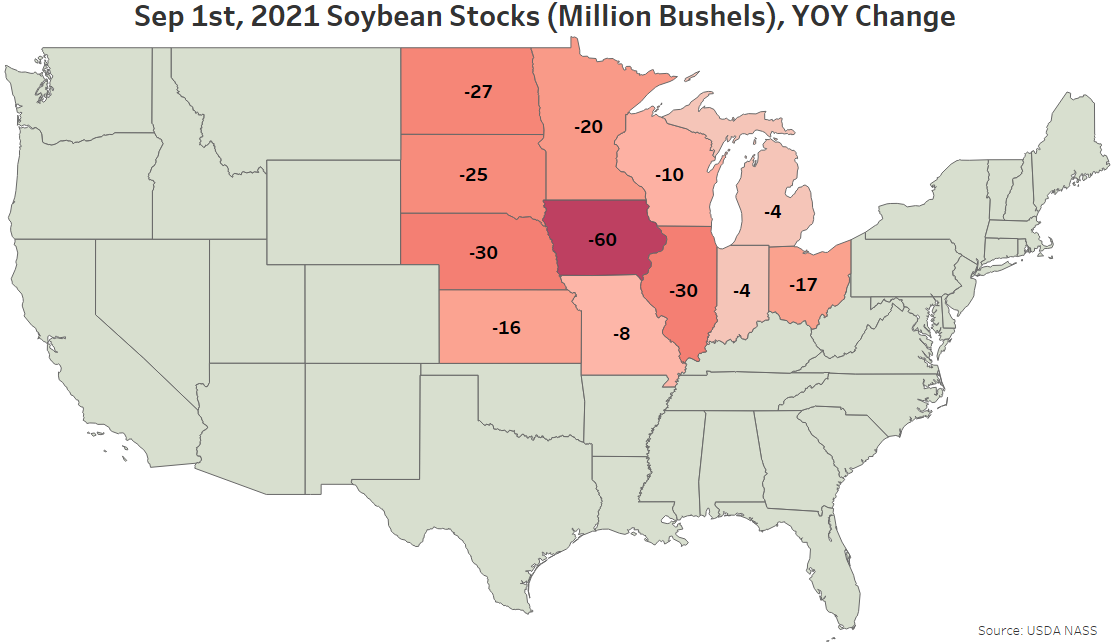

The most significant YOY decline in Sep 1st soybean stocks was experienced throughout Iowa, followed by declines experienced throughout Illinois and Nebraska.

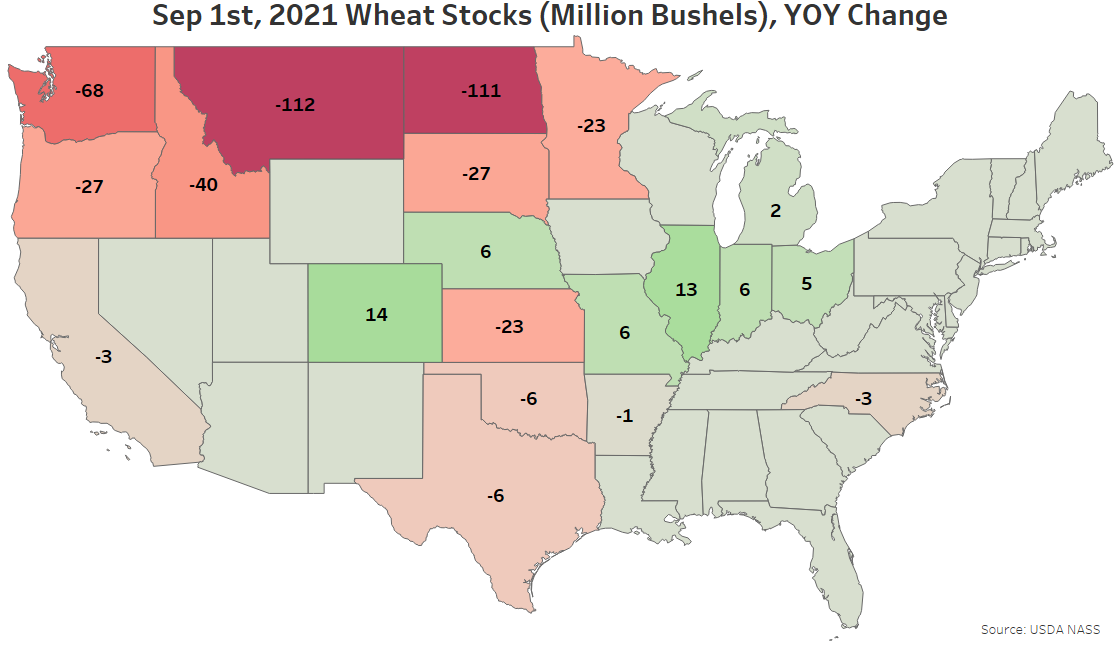

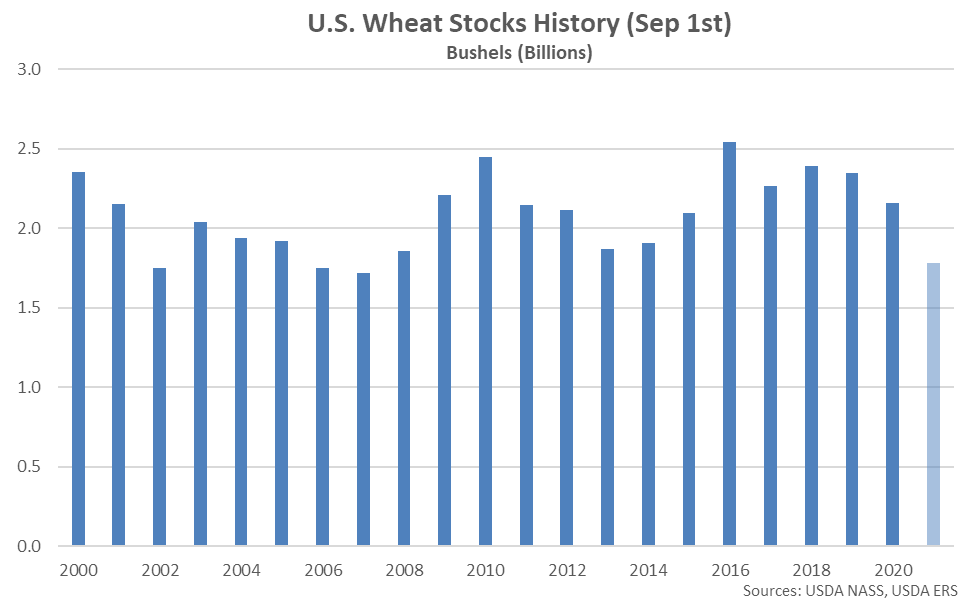

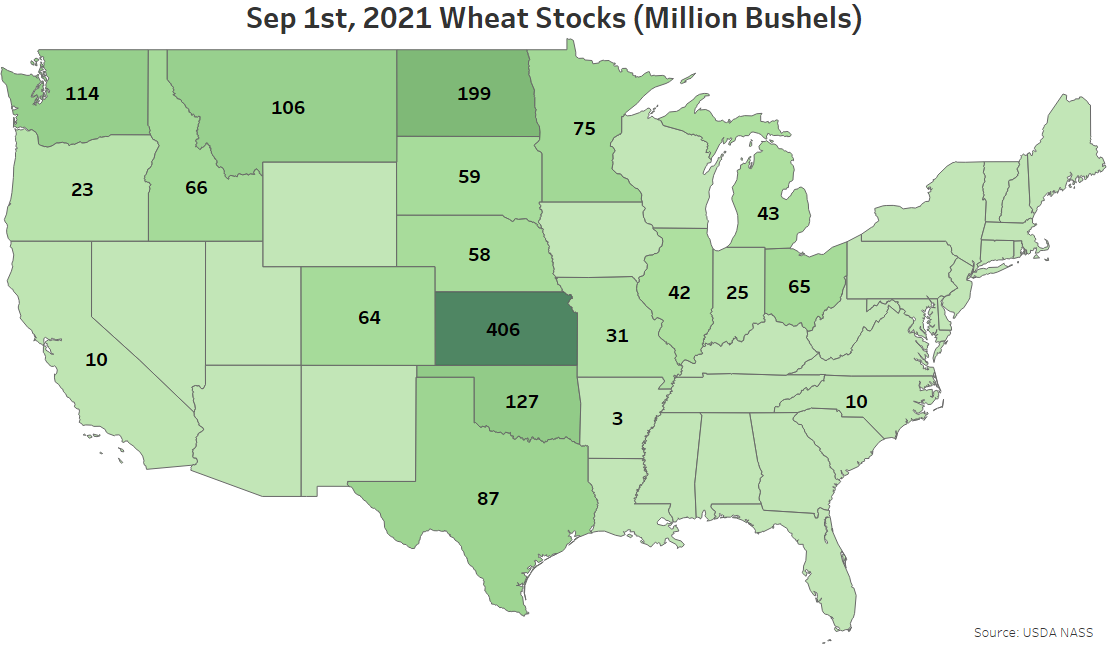

Wheat – Sep 1st Stocks Reach a 14 Year Low Seasonal Level, Finish Below Expectations

Wheat stored in all positions as of September 1st, 2021 totaled 1.78 billion bushels, finishing 17.5% below the previous year and reaching a 14 year low seasonal level. Wheat stocks finished 3.9% below average analyst estimates of 1.85 billion bushels. Stocks increased seasonally by 935 million bushels from the previous quarter, 17.2% below the build experienced during the same period last year.

Sep 1st wheat stocks were most significant within Kansas, followed by North Dakota and Oklahoma. The aforementioned states combined to account for nearly 40% of the total U.S. wheat stocks.

The most significant YOY declines in Sep 1st wheat stocks were experienced throughout Montana and North Dakota. Colorado experienced the largest YOY increase in wheat stocks.