Crop Progress Update – 10/4/21

According to the USDA, the percentage of corn and soybeans identified to be in good or excellent condition as of Oct 3rd each remained unchanged from the previous week, finishing equal to analyst expectations. Corn harvest progress finished equal to analyst expectations throughout the week while soybean harvest progress finished ahead of analyst expectations.

Corn:

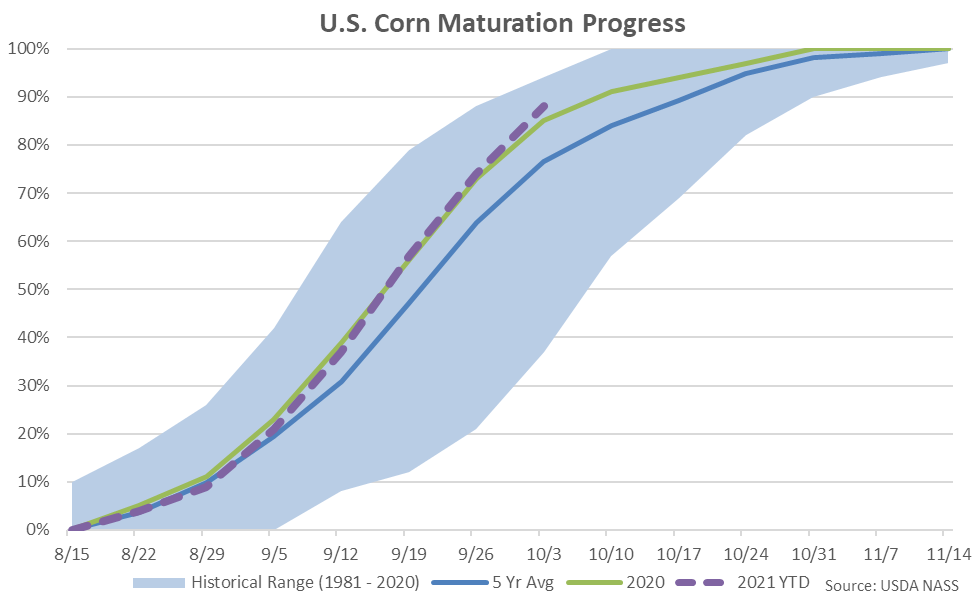

Corn maturation as of the week ending Oct 3rd was 88% complete, finishing ahead of last year’s pace of 85% completed and the five year average pace of 77% completed.

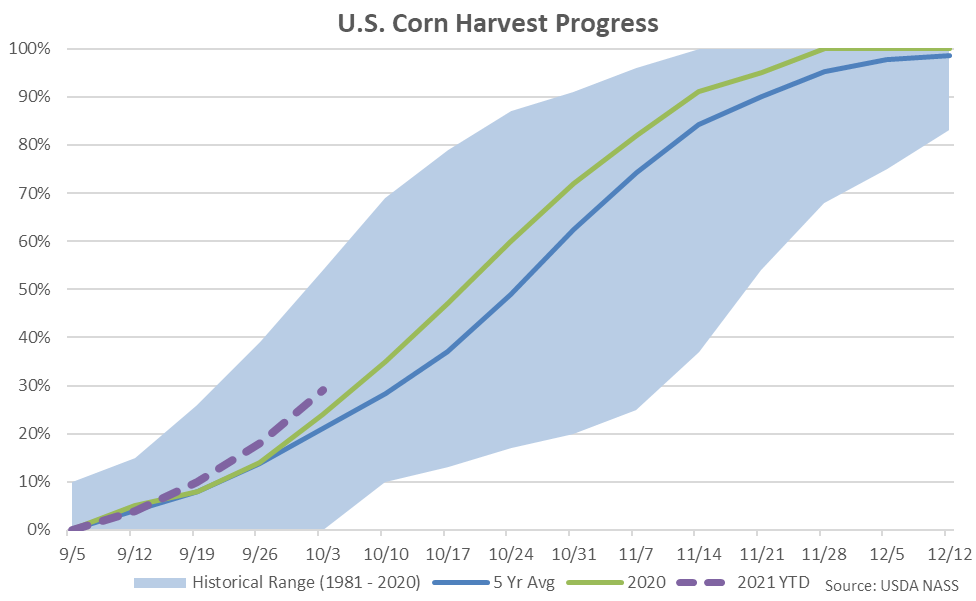

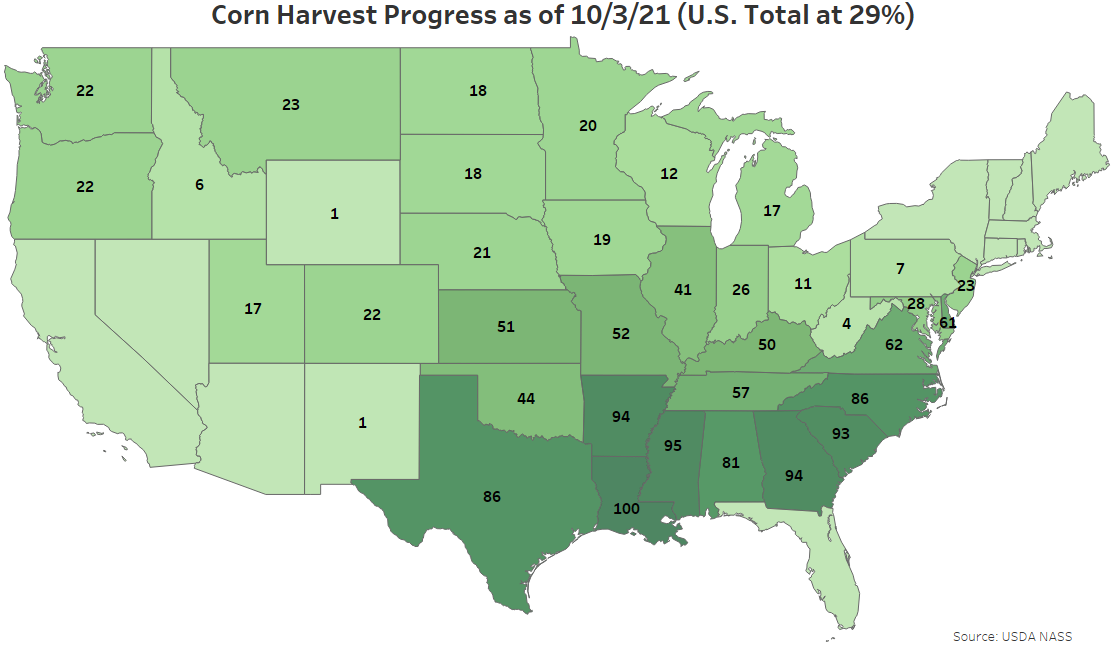

Corn harvest progress as of the week ending Oct 3rd was 29% complete, finishing ahead of last year’s pace of 24% completed and the five year average pace of 22% completed. Corn harvest progress finished consistent with analyst expectations.

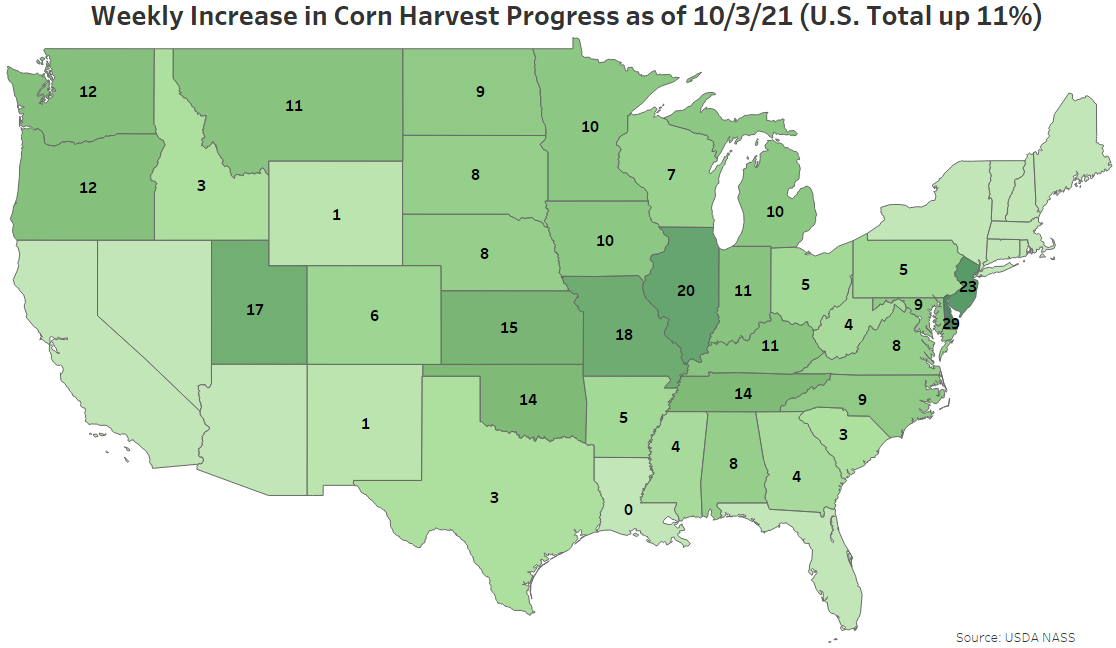

An additional 11% of the total U.S. corn crop was harvested during the week ending Oct 3rd. Weekly increases in corn harvest on a percentage basis were led by Delaware, followed by New Jersey and Illinois.

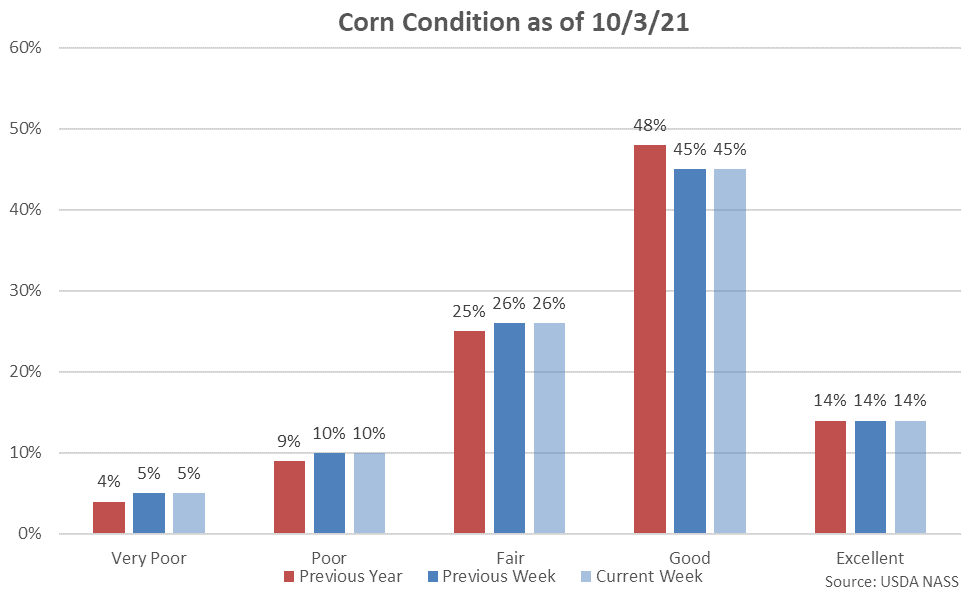

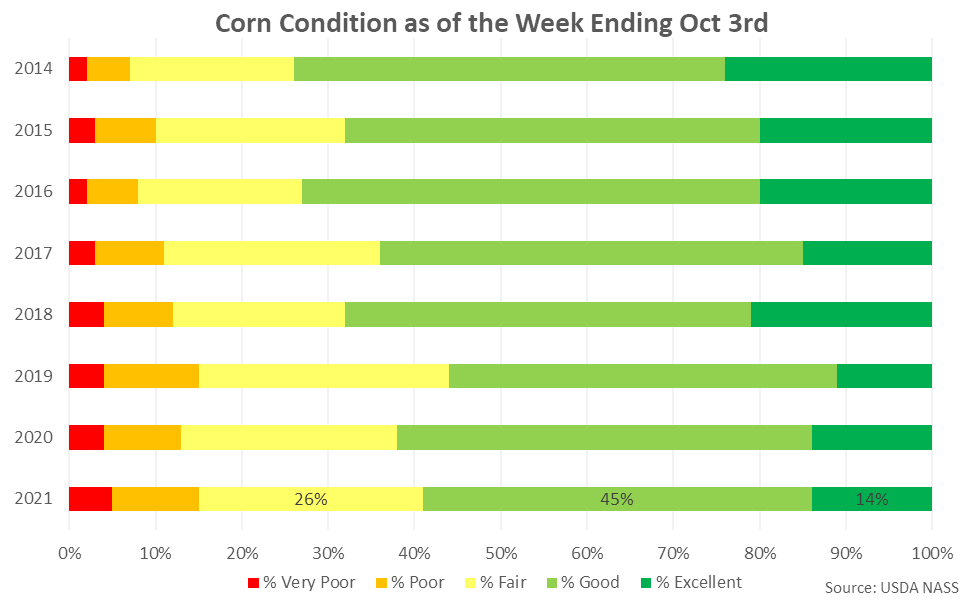

59% of the current corn crop was identified to be in good or excellent condition as of the week ending Oct 3rd, unchanged from the previous week. The current corn crop identified to be in good or excellent condition finished consistent with analyst expectations. 15% of the current corn crop was identified to be in very poor or poor condition, also unchanged from the previous week.

Soybeans:

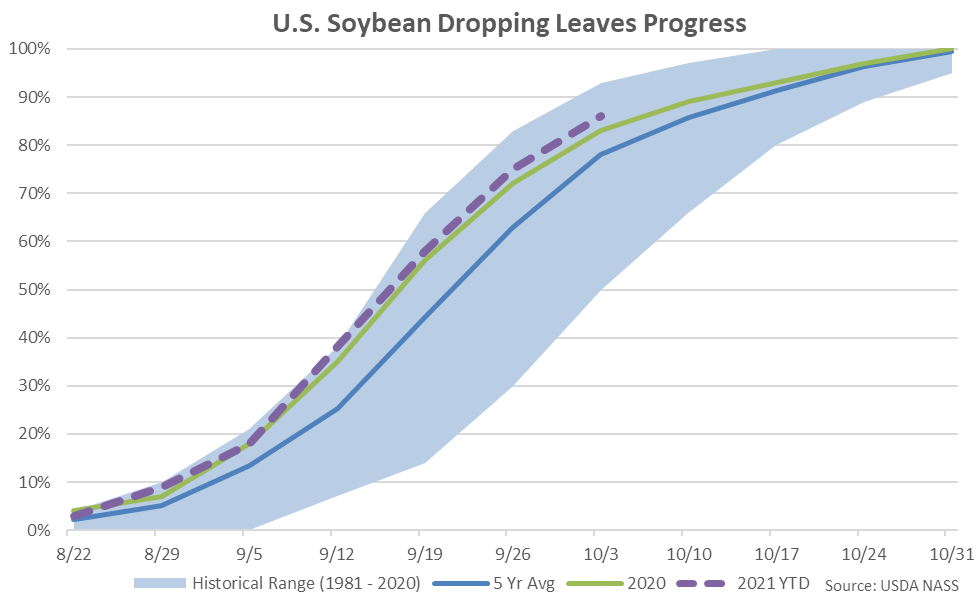

86% of the soybean crop has dropped leaves as of the week ending Oct 3rd, finishing ahead of last year’s pace of 83% completed and the five year average pace of 80% completed.

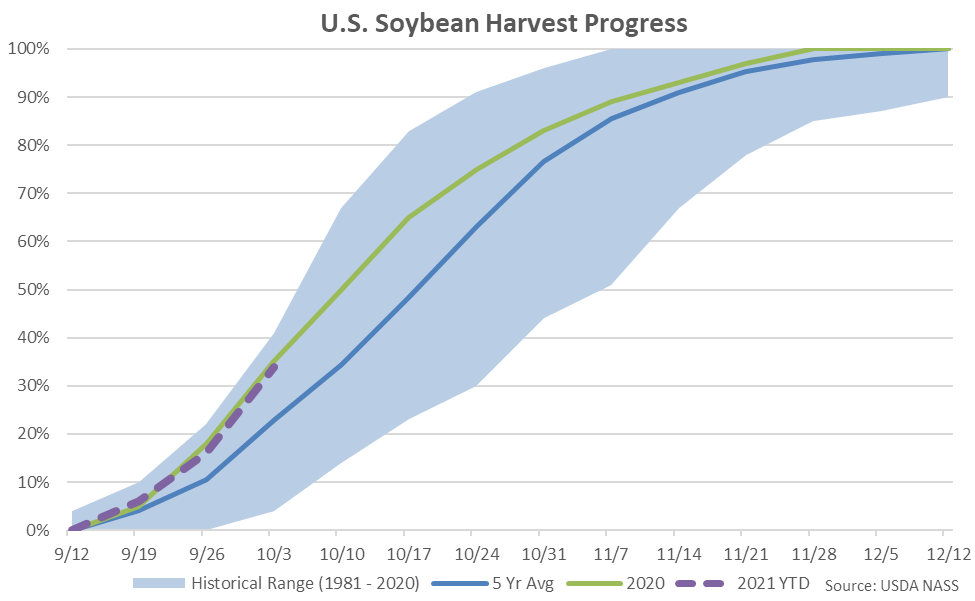

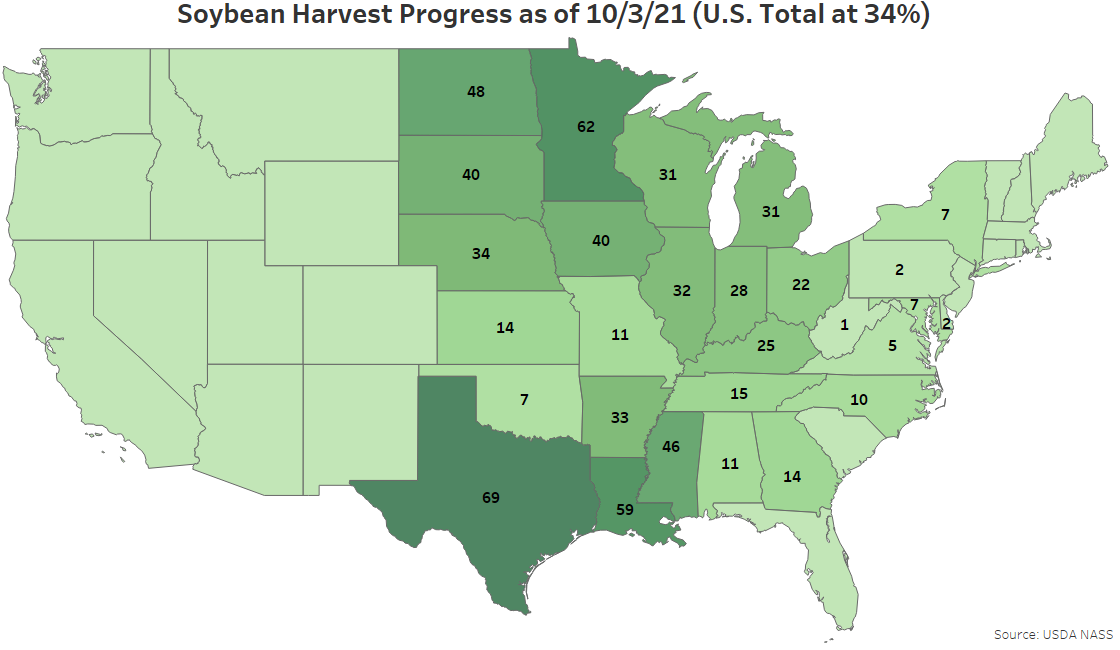

Soybean harvest progress as of the week ending Oct 3rd was 34% complete, finishing slightly behind last year’s pace of 35% completed but remaining ahead of the five year average pace of 26% completed. Soybean harvest progress finished ahead of analyst expectations of 32% completed.

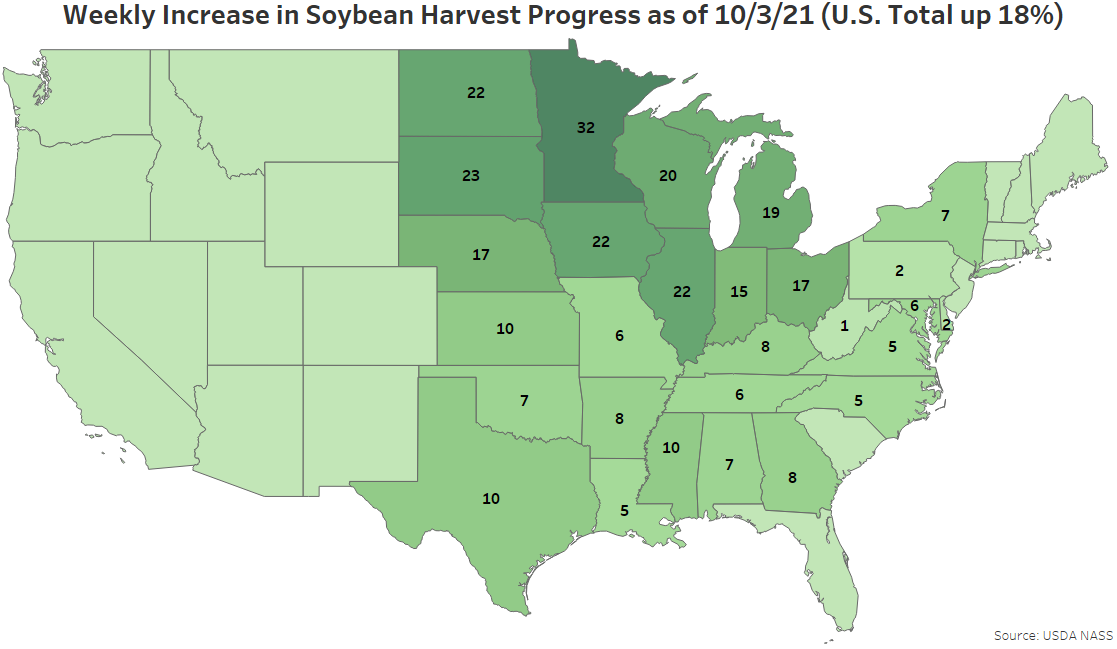

An additional 18% of the total U.S. soybean crop was harvested during the week ending Oct 3rd. Weekly increases in soybean harvest on a percentage basis were led by Minnesota, followed by South Dakota.

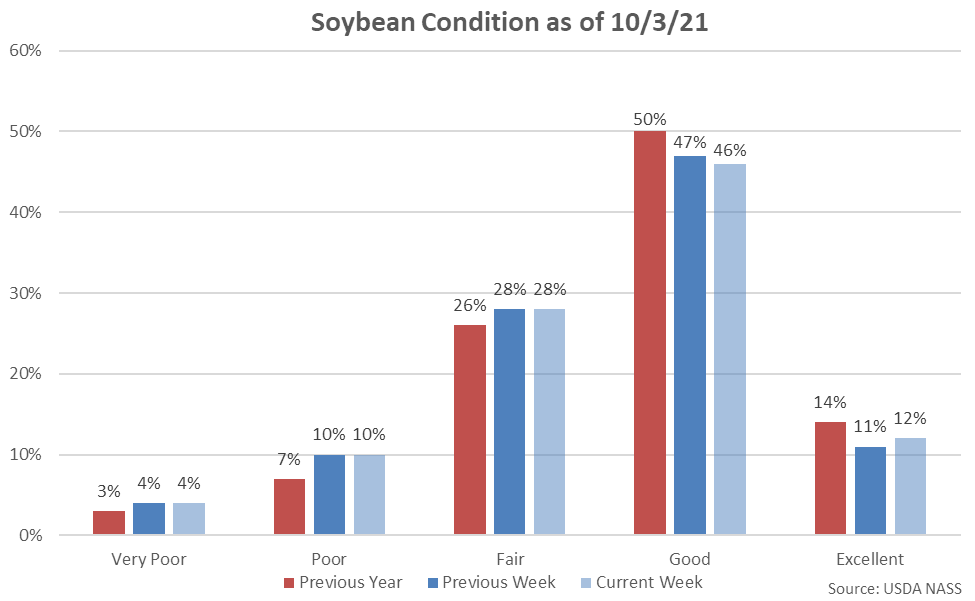

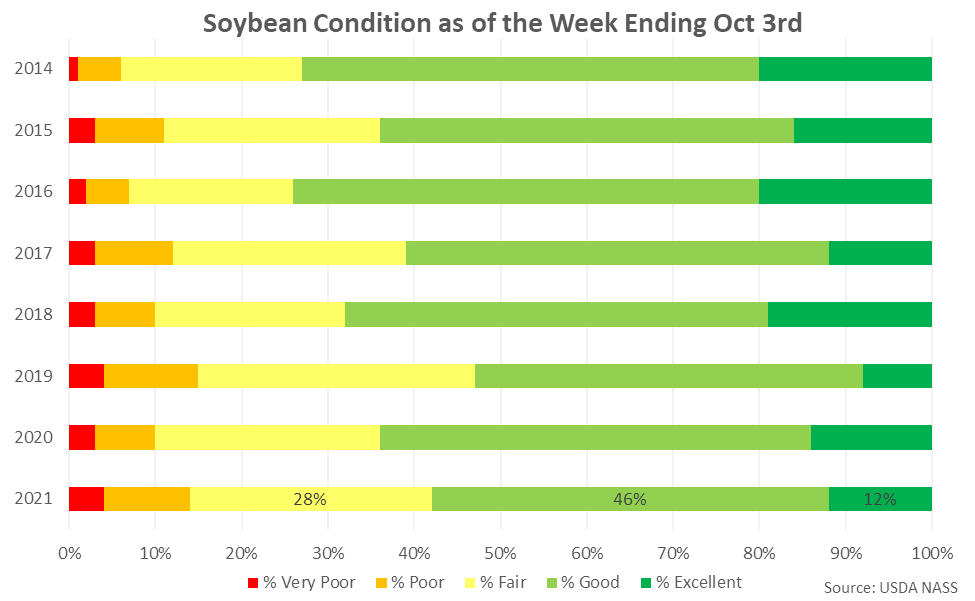

58% of the current soybean crop was identified to be in good or excellent condition as of the week ending Oct 3rd, unchanged from the previous week but up one percent in the ‘excellent’ category. The current soybean crop identified to be in good or excellent condition finished consistent with analyst expectations. 14% of the current soybean crop was identified to be in very poor or poor condition, also unchanged from the previous week.