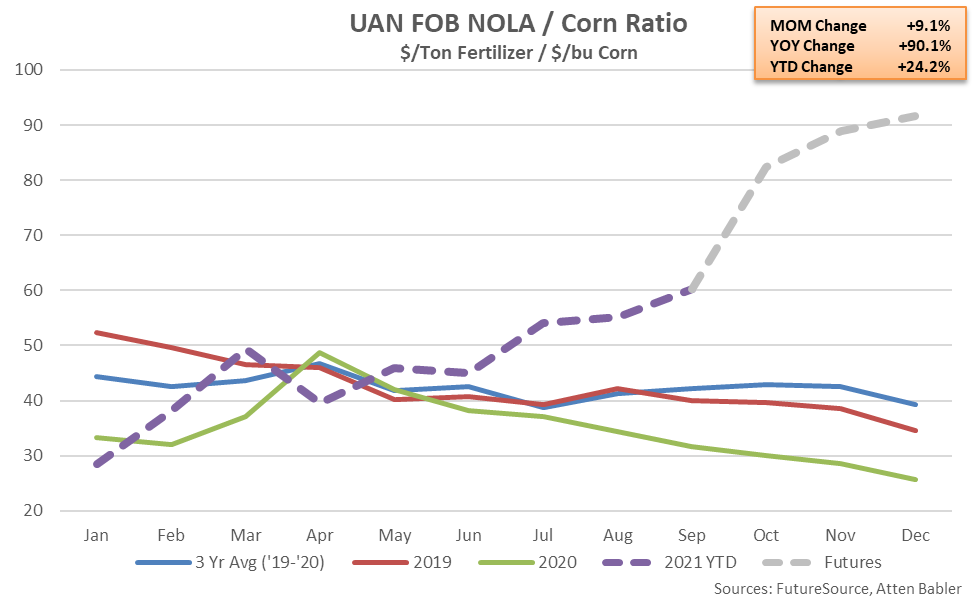

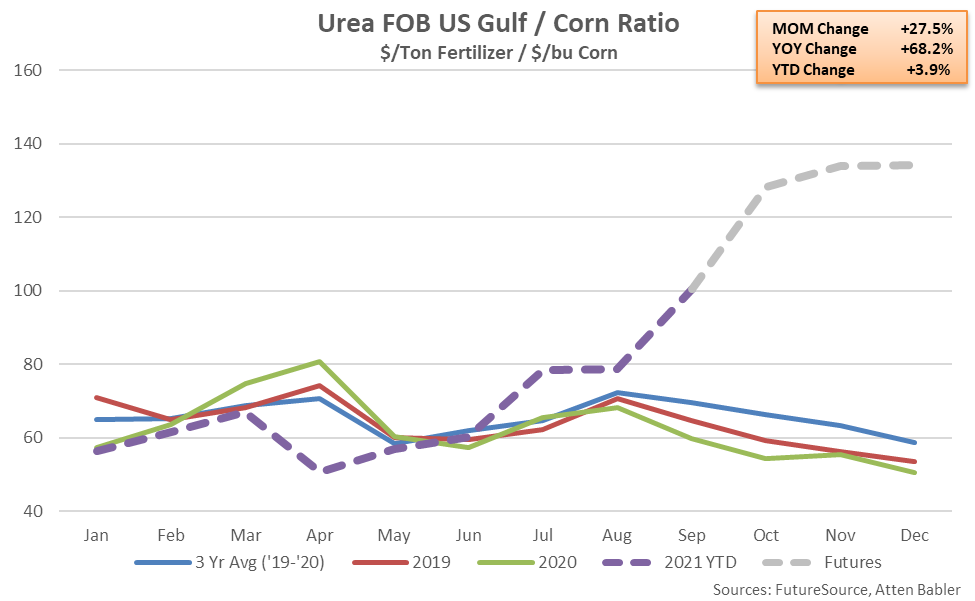

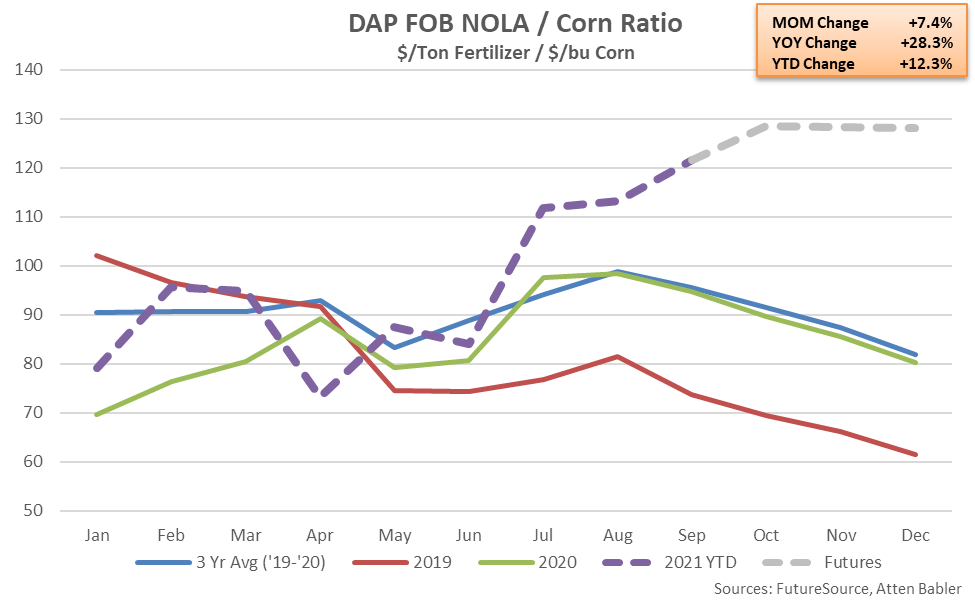

Fertilizer to Corn Price Ratio Update – Oct ’21

U.S. fertilizer prices reached long-term high levels through Sep ’21, with additional price appreciation expected based on futures data available through the end of 2021. When indexed to corn prices, Sep ’21 Urea FOB US Gulf prices finished 68.2% above previous year levels, while Q4 ’21 futures prices are currently 147.0% above previous year levels. Sep ’21 DAP FOB NOLA and UAN FOB NOLA prices finished 28.3% and 90.1% above previous year levels when indexed to corn prices, respectively, with Q4 ’21 futures prices up 50.7% for DAP and 211.8% for UAN.

U.S. fertilizer prices have risen following plant shutdowns associated with Hurricane Ida. Global supplies are also deemed to be tight, with several European facilities shutting down due to a parabolic rise in natural gas prices.

Sep ’21 Urea FOB US Gulf / Corn Prices are up 68.2% YOY, with Q4 ’21 Prices up 147.0% YOY

Sep ’21 DAP FOB NOLA / Corn Prices are up 28.3% YOY, with Q4 ’21 Prices up 50.7% YOY

Sep ’21 UAN FOB NOLA / Corn Prices are up 90.1% YOY, with Q4 ’21 Prices up 211.8% YOY