U.S. Oil Rig Count Update – 11/17/21

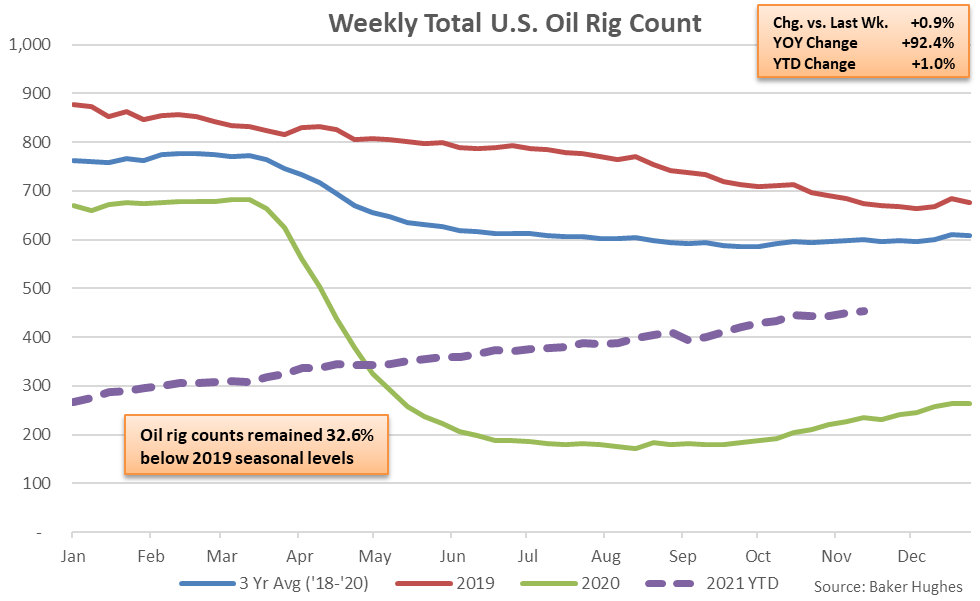

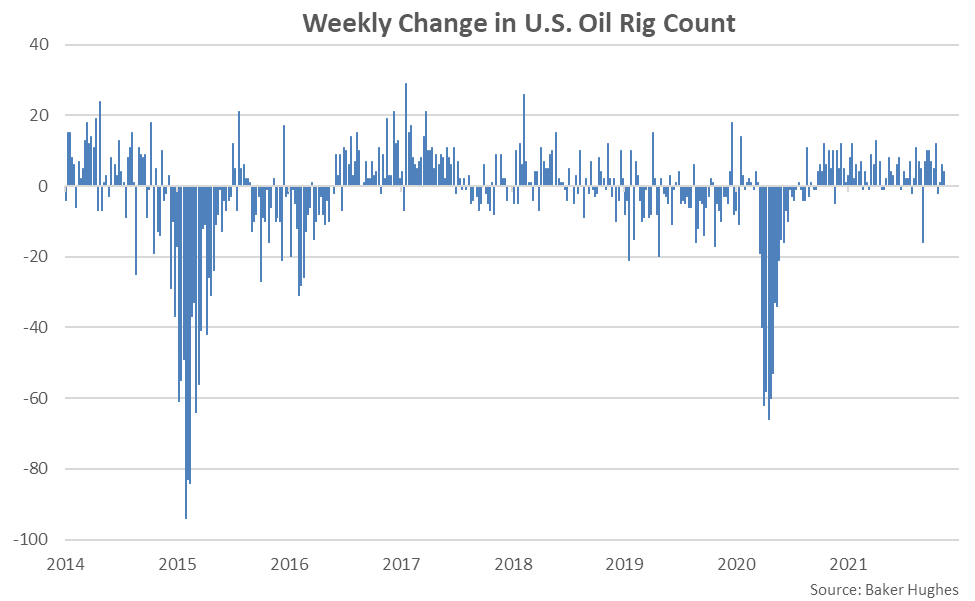

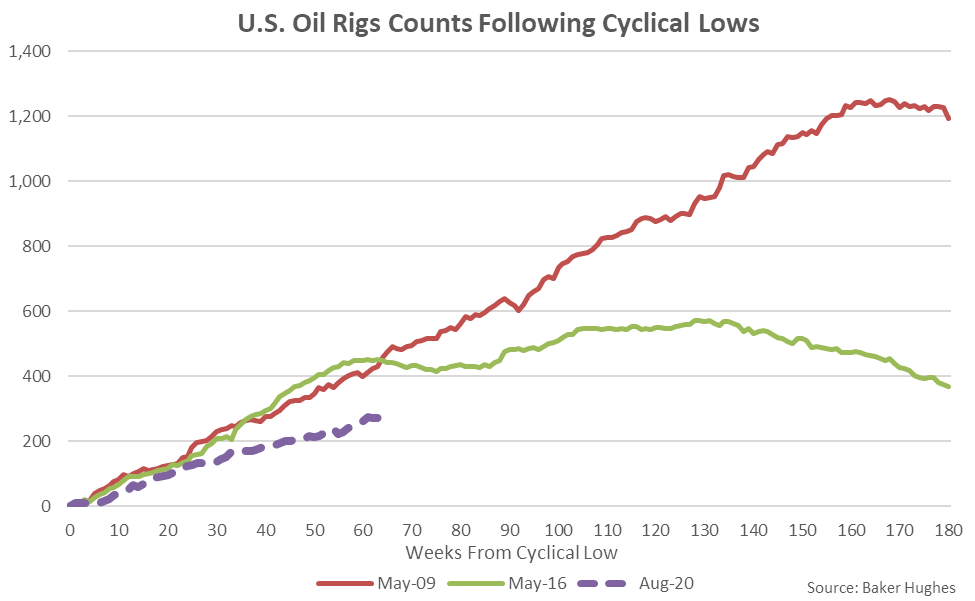

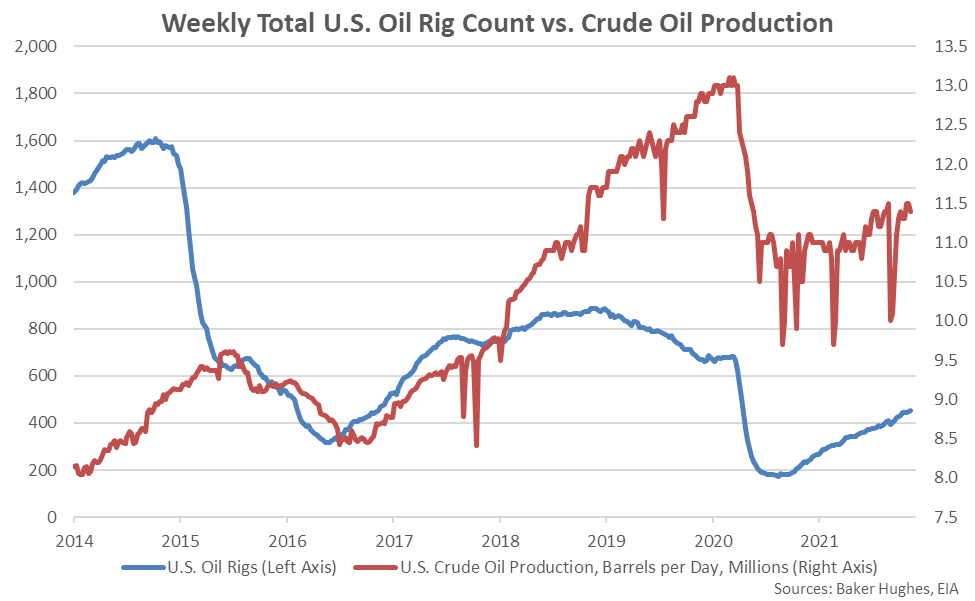

According to Baker Hughes, U.S. oil rig counts rebounded to a 19 month high level during the week ending Nov 12th. Nov 12th week ending oil rig counts increased 0.9% from the previous week while finishing 92.4% above previous year levels. Oil rig counts remained 32.6% below pre-pandemic seasonal levels and 48.9% below the three and a half year high levels experienced during November of 2018, however. The current rebound in oil rig counts has been slower than rebounds from cyclical lows experienced throughout both 2009 and 2016.

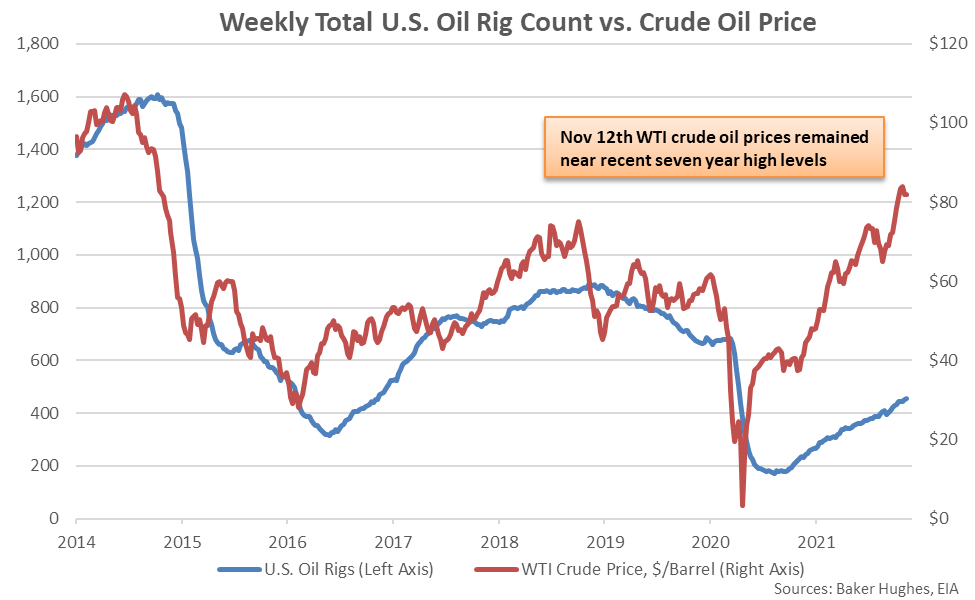

Oil rig counts declined sharply throughout the first half of 2020 in response to lower WTI crude oil prices. More recently, WTI crude oil prices rebounded to a seven year level during the final week of October and have remained elevated since.

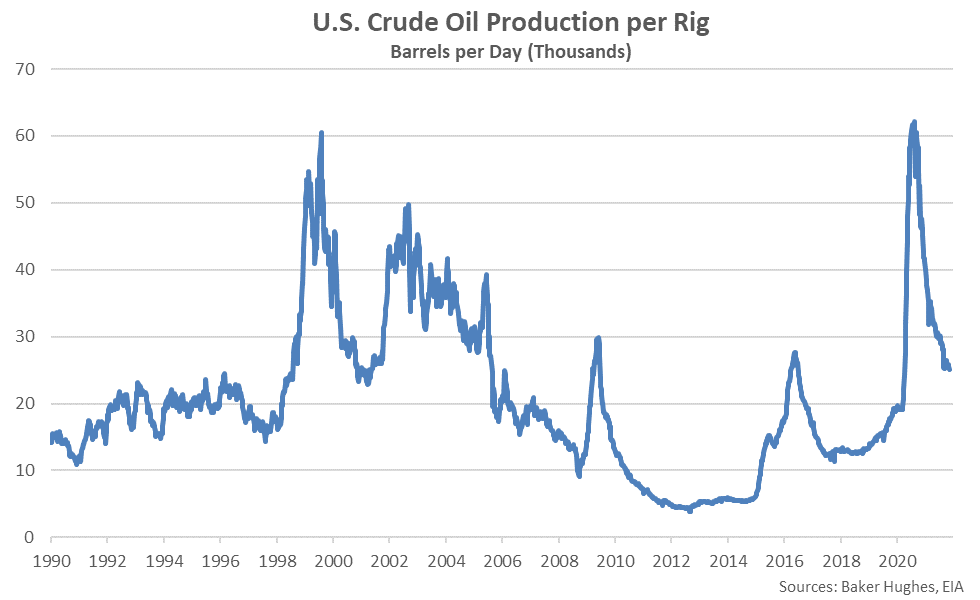

Crude oil production volumes reached a 15 month high level during the final week of August, prior to returning to a six month low level during the first week of September, a result of declines associated with Hurricane Ida. Crude oil production levels rebounded to pre-Hurricane Ida levels over more recent weeks however oil production per rig reached a 19 month low level throughout the week ending Nov 12th.

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2021

Nov 12th Oil Rig Counts Increased 0.9% Week-Over-Week While Finishing 92.4% Higher YOY

The Nov 12th Week-Over-Week Increase in Oil Rigs was the 23rd in the Past 28 Weeks

The Current Rebound in U.S. Oil Rig Counts Remains Slower Than Previous Cycles

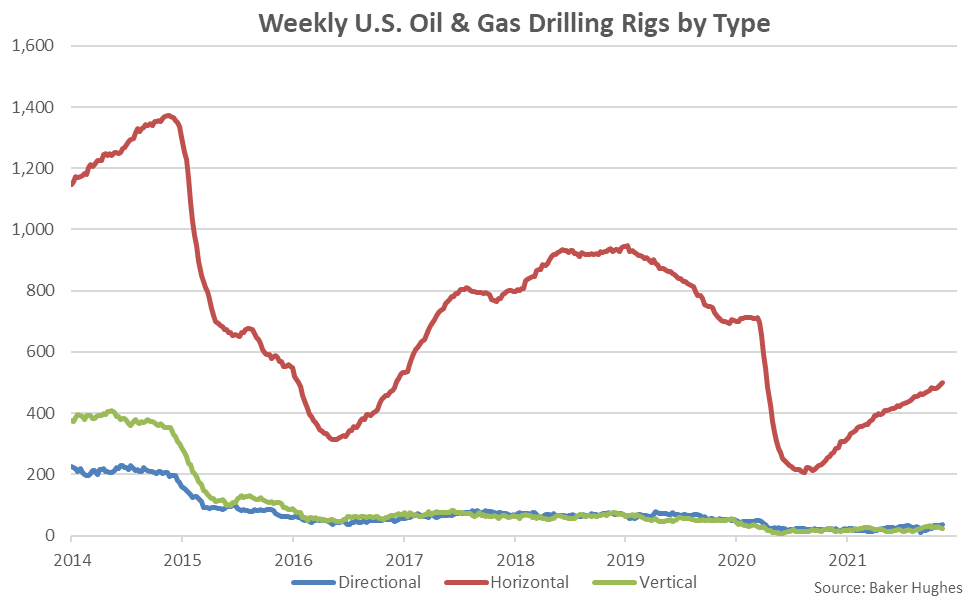

Horizontal Rigs Have Accounted for 94% of the Rebound in Total Rigs Since Aug ’20

Nov 12th Crude Oil Production Volumes Remained Near Pre-Hurricane Ida Highs

Nov 12th Crude Oil Production per Rig Declined to a 19 Month Low Level