U.S. Dairy Product Production Update – Dec ’21

Executive Summary

U.S. dairy product production figures provided by the USDA were recently updated with values spanning through Oct ’21. Highlights from the updated report include:

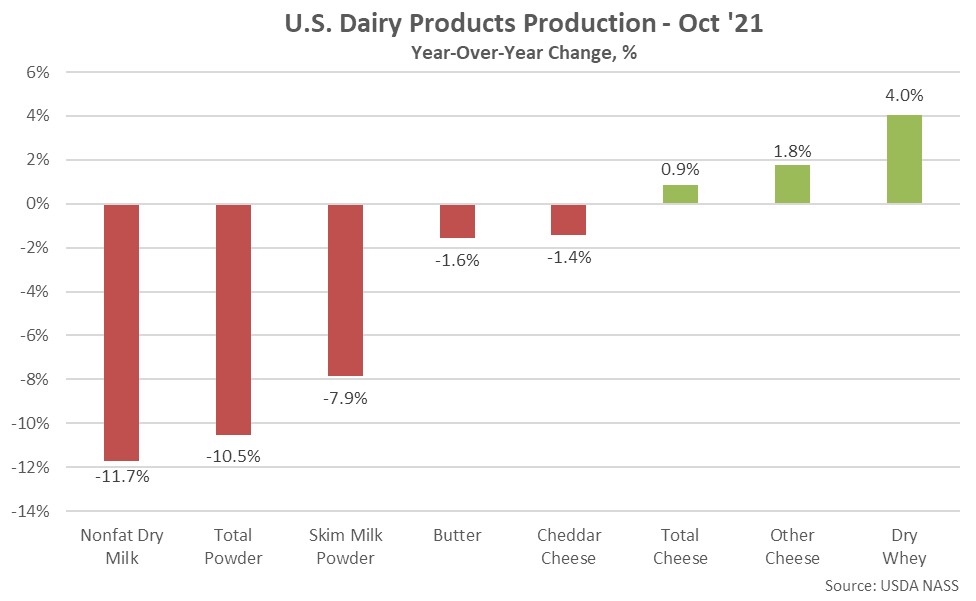

- Oct ’21 U.S. butter production declined 1.6% on a YOY basis, remaining at a three year low seasonal level for the second consecutive month.

- U.S. cheese production finished 0.9% above previous year levels throughout Oct ’21, remaining at a record high seasonal level for the 11th time in the past 12 months. Dry whey production finished higher on a YOY basis for just the third time in the past 17 months, increasing 4.0%.

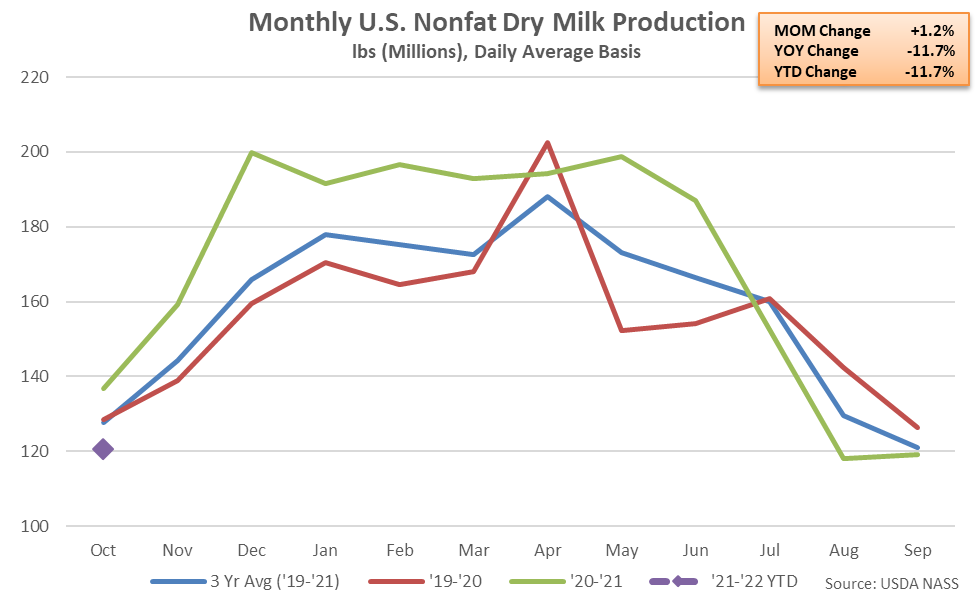

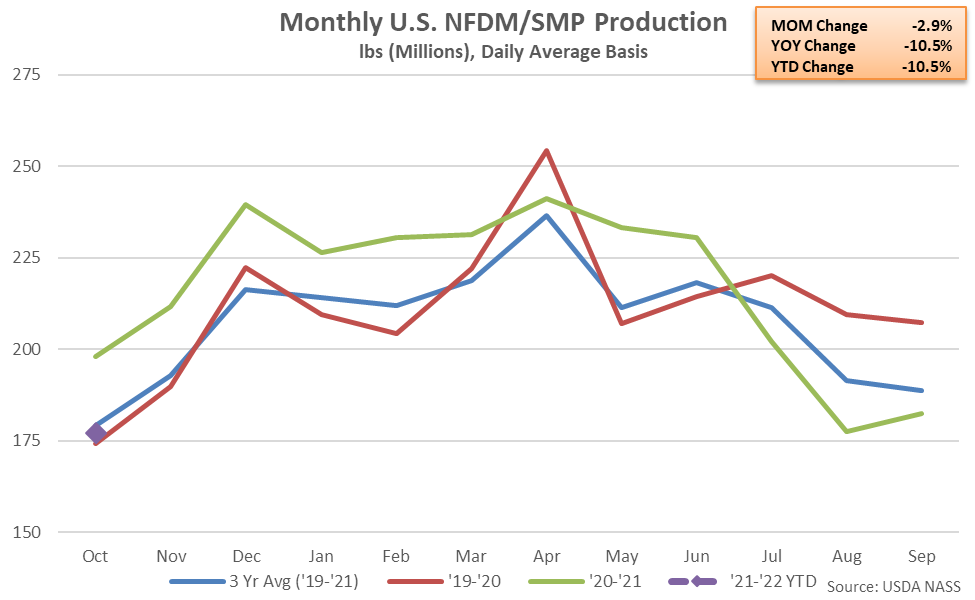

- Combined production of U.S. nonfat dry milk and skim milk powder declined 10.5% on a YOY basis throughout Oct ’21, finishing below previous year levels for the fourth consecutive month. Nonfat dry milk production declined 11.7% on a YOY basis throughout the month while skim milk powder production finished 7.9% below previous year levels.

Additional Report Details

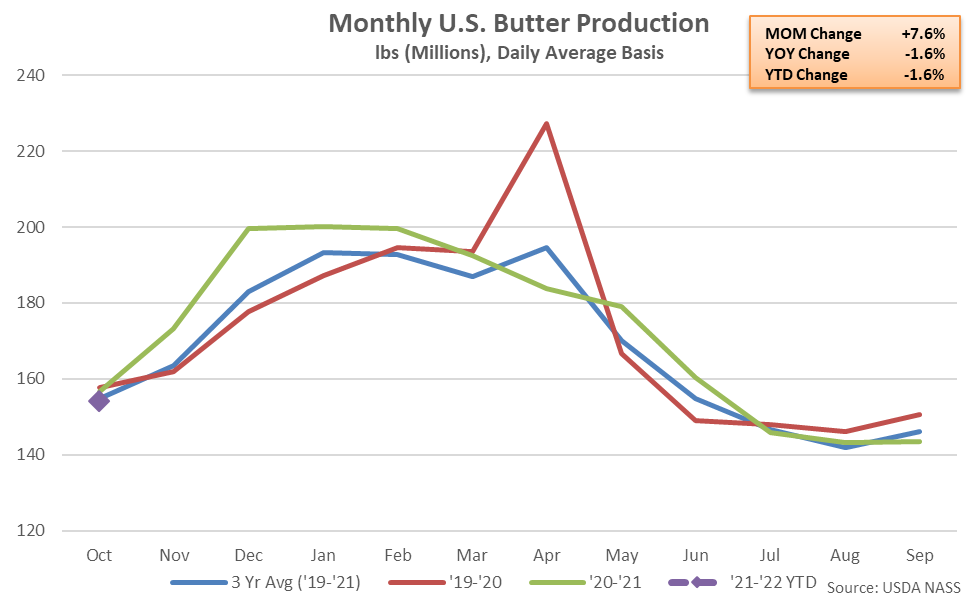

Butter – Production Remains at a Three Year Low Seasonal Level, Down 1.6% YOY

According to the USDA, U.S. butter production increased seasonally to a four month high level but finished 1.6% below previous year levels, remaining at a three year low seasonal level for the second consecutive month. YOY declines in butter production experienced throughout the Atlantic U.S. (-28.0%) and Central U.S. (-6.9%) more than offset a 6.7% YOY increase in Western U.S. production.

’20-’21 annual butter production finished 0.8% above previous year levels, reaching the highest annual level on record for the fourth consecutive year.

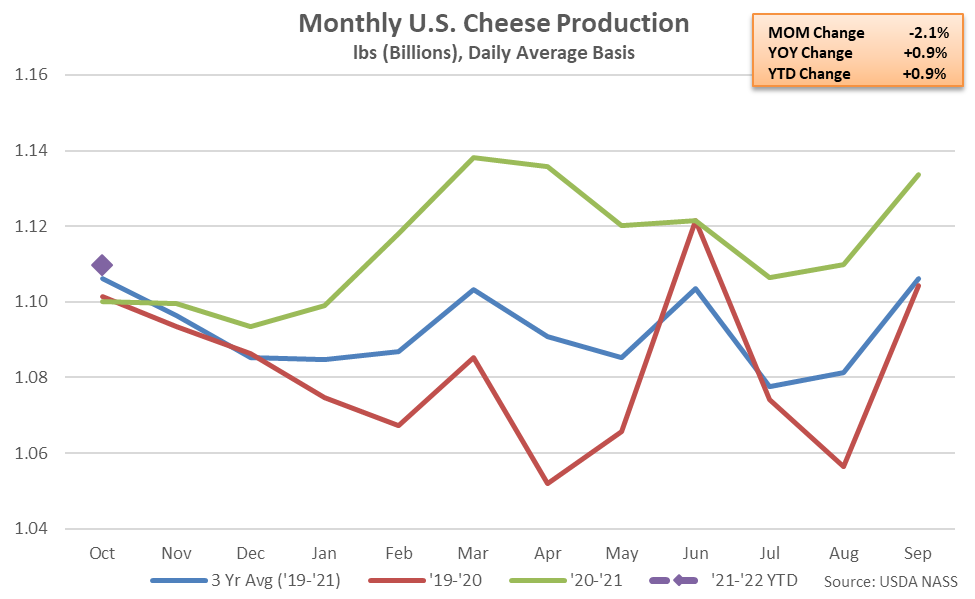

Cheese – Production Remains at a Record High Seasonal Level, Finishes up 0.9% YOY

U.S. cheese production finished 0.9% higher on a YOY basis throughout Oct ’21, remaining at a record high seasonal level for the 11th time in the past 12 months. YOY increases in cheese production experienced throughout the Central U.S. (+2.4%) and Western U.S. (+0.7%) more than offset a 4.2% YOY decline in Atlantic U.S. production.

Other-than-cheddar cheese production increased 1.8% on a YOY basis throughout the month, more than offsetting a 1.4% YOY decline in cheddar cheese production. The YOY decline in cheddar cheese production was just the second experienced throughout the past 16 months.

’20-’21 annual cheese production finished 3.0% above previous year levels, increasing on a YOY basis for the 20th consecutive year and reaching a record high annual level. Cheddar cheese production increased 4.0% on a YOY basis throughout the year while other-than-cheddar cheese production finished 2.6% above previous year levels.

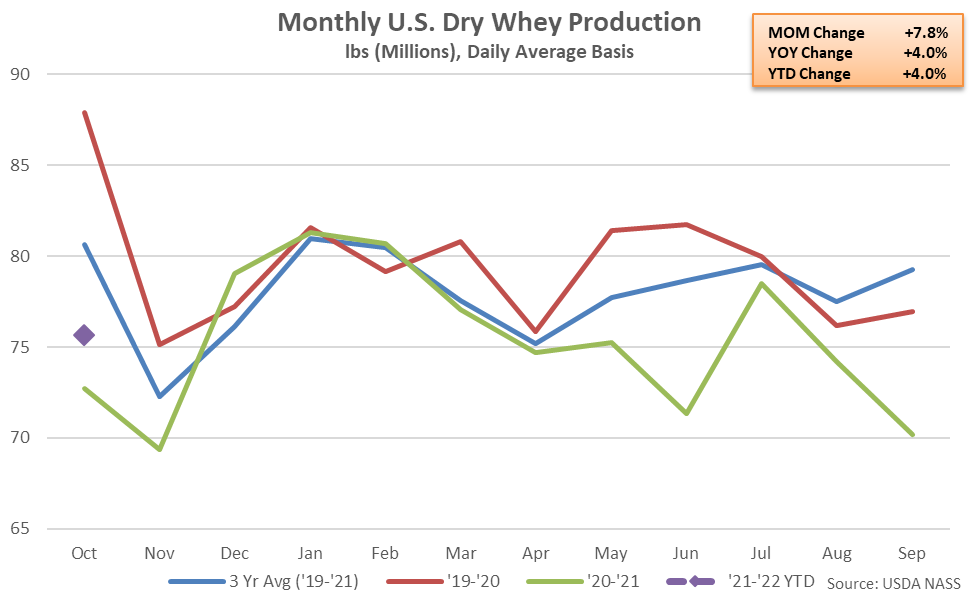

Dry Whey – Production Increases YOY for Just the Third Time in the Past 17 Months, up 4.0%

U.S. dry whey production increased 4.0% on a YOY basis throughout Oct ’21, finishing above previous year levels for just the third time in the past 17 months. Dry whey production volumes remained at the second lowest seasonal level experienced throughout the past six years, however. Higher dry whey production experienced throughout the Atlantic U.S. (+10.5%) and Central U.S. (+7.1%) more than offset an 8.0% YOY decline in Western U.S. production. Previous month dry whey production volumes were revised 7.3% below previous month levels.

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production volumes also finished above previous year levels throughout Oct ’21. Combined WPC and WPI production remained above previous year levels for the ninth time in the past 11 months during Oct ’21, increasing by 12.1%. Combined production of dry whey, WPC and WPI increased 7.3% on a YOY basis throughout Oct ’21, finishing above previous year levels for the first time in the past six months.

’20-’21 annual dry whey production finished 5.2% below previous year levels, reaching a seven year low annual level. ’20-’21 annual combined production of dry whey, WPC and WPI declined 2.1% on a YOY basis, reaching an eight year low annual level.

NFDM/SMP – Combined Production Remains Lower YOY, Down 10.5%

Oct ’21 U.S. nonfat dry milk (NFDM) production finished 11.7% below previous year levels, reaching a three year low seasonal level. The YOY decline in NFDM production was the fourth experienced in a row. YOY declines in NFDM production were widespread regionally and led by the Central U.S. (-33.8%), followed by the Atlantic U.S. (-14.0%) and Western U.S. (-2.0%).

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished lower on a YOY basis for the 11th consecutive month during Oct ’21, declining by 7.9%. Combined production of NFDM and SMP production finished 10.5% below previous year levels, declining on a YOY basis for the fourth consecutive month.

’20-’21 annual combined production of NFDM and SMP increased 2.7% YOY, reaching a record high annual level for the fifth consecutive year. Annual NFDM production volumes finished 9.5% above previous year levels, more than offsetting a 16.3% YOY decline in SMP production volumes.

Overall, nonfat dry milk production finished most significantly lower YOY on a percentage basis throughout Oct ’21, while dry whey production increased most significantly on a percentage basis throughout the month.