U.S. Livestock & Meat Trade Update – Dec ’21

Executive Summary

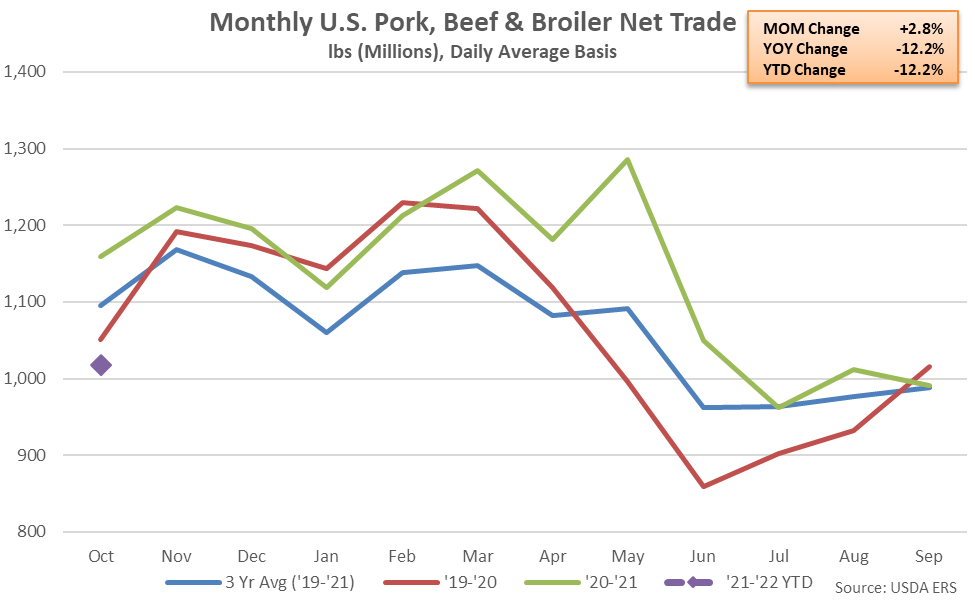

U.S. livestock and meat trade figures provided by the USDA were recently updated with values spanning through Oct ’21. Highlights from the updated report include:

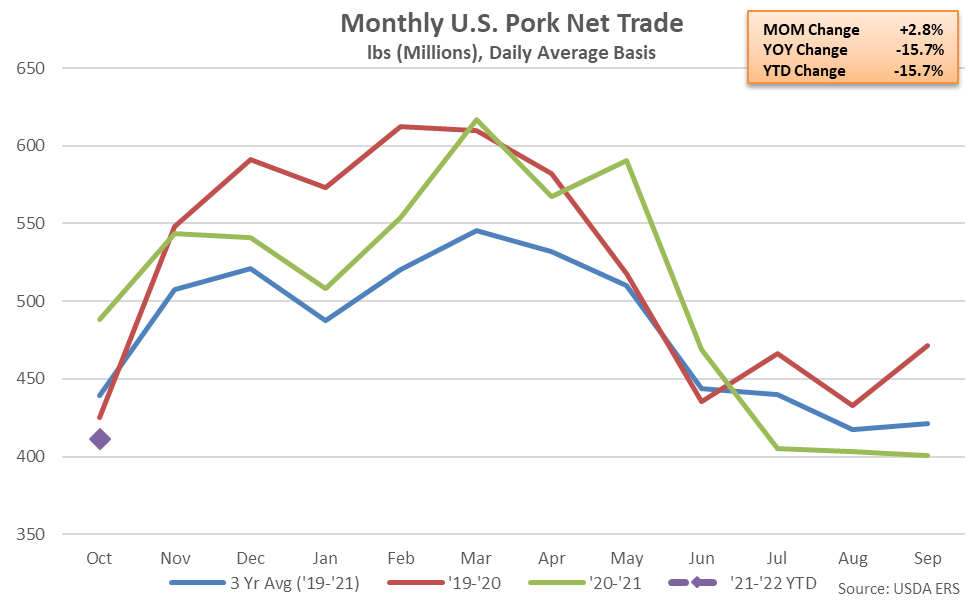

- U.S. pork export volumes remained below previous year levels for the fourth consecutive month throughout Oct ’21 while pork import volumes reached a new record high monthly level for the second consecutive month. Oct ’21 net pork trade reached a three year low seasonal level, finishing 15.7% below previous year levels.

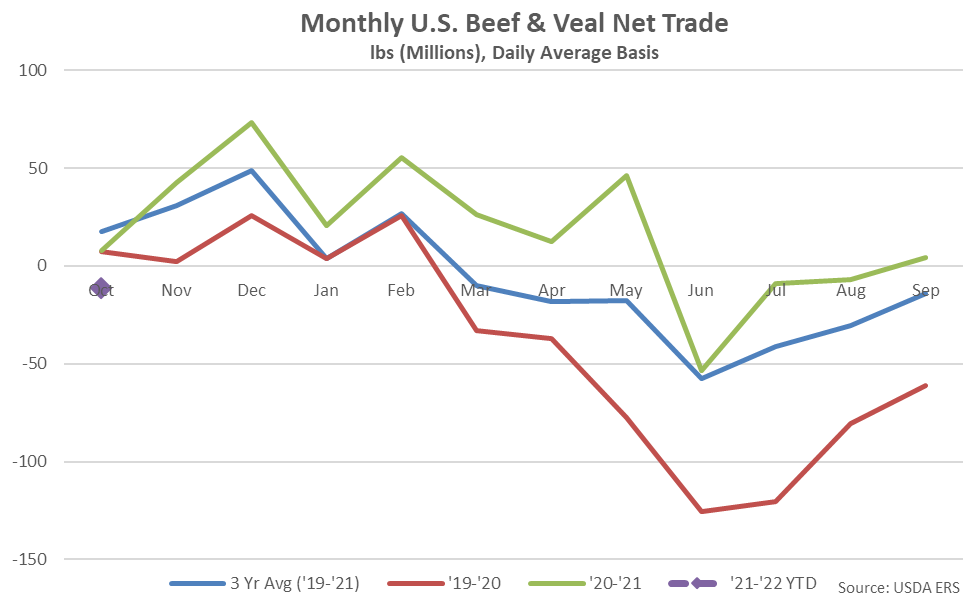

- U.S. beef & veal export volumes increased 8.9% on a YOY basis throughout Oct ’21, remaining at a record high seasonal level, however net beef & veal trade declined to a six year low seasonal level, remaining negative for the fourth time in the past five months.

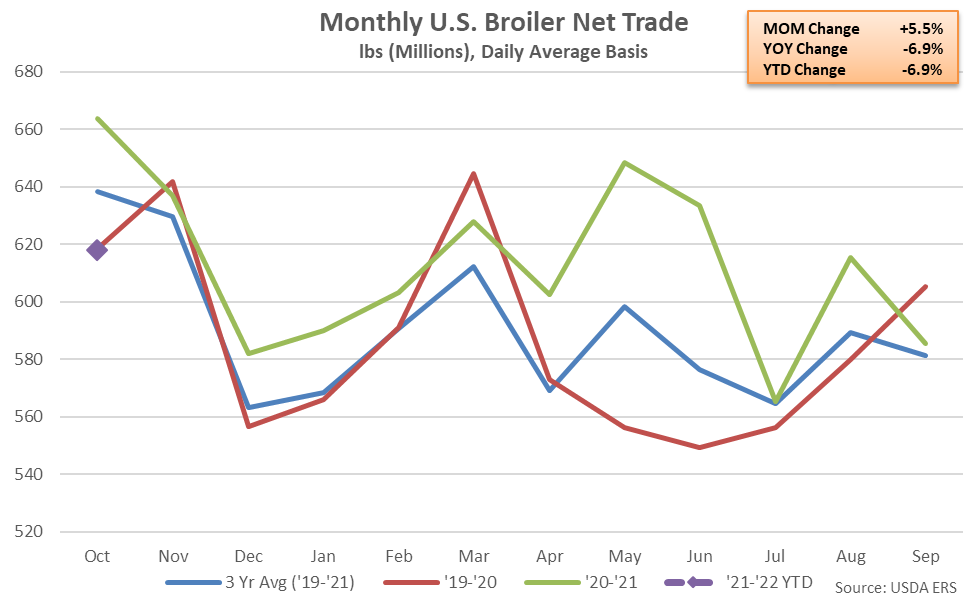

- U.S. net broiler trade finished below previous year levels for the second consecutive month, declining by 6.9% and reaching a four year low seasonal level.

Additional Report Details

Pork – Net Trade Declines to a Three Year Low Seasonal Level, Down 15.7%

According to the USDA, U.S. pork export volumes declined 8.4% on a YOY basis throughout Oct ’21, finishing below previous year levels for the fourth consecutive month. Pork export volumes had reached record high seasonal levels over four consecutive months through Jun ’21, prior to declining on a YOY basis throughout the four most recent months of available data. Despite declining on a YOY basis, Oct ’21 pork export volumes remained at the second highest seasonal level on record.

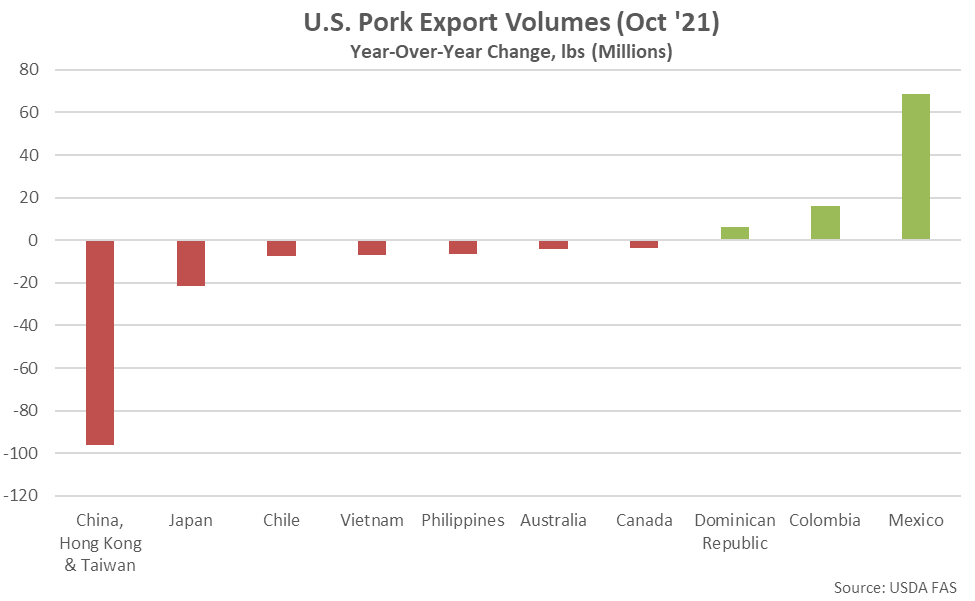

YOY declines in pork export volumes were led by volumes destined to China, Hong Kong & Taiwan, while pork export volumes destined to Mexico remained most significantly higher on a YOY basis throughout the month. A 64.6% YOY decline in pork export volumes destined to China, Hong Kong & Taiwan more than offset a 10.6% YOY increase in volumes destined to all other countries throughout Oct ’21.

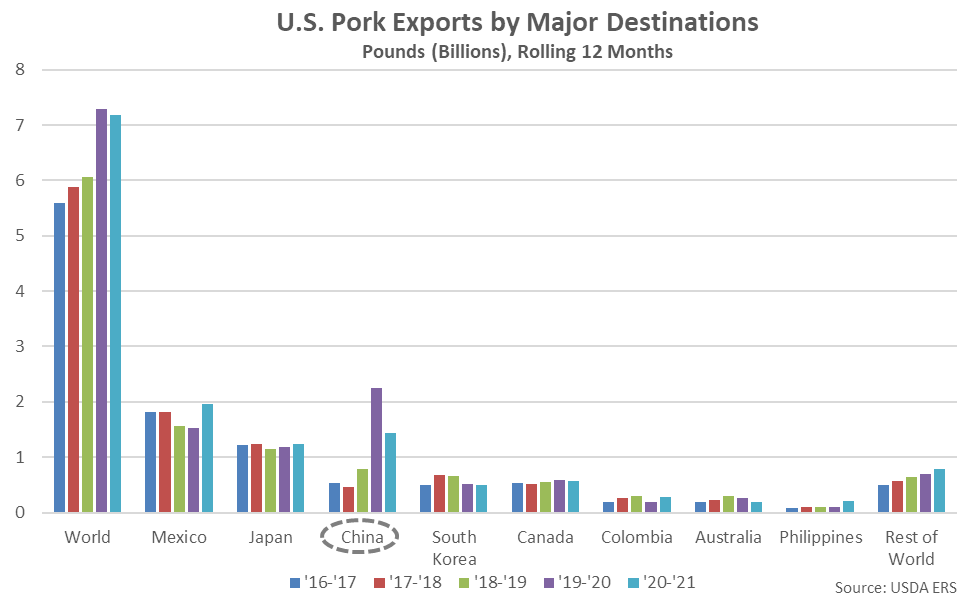

Mexico and Japan have historically been the largest importers of U.S. pork products, accounting for over 45% of the total U.S. pork export volumes throughout the past five years. Combined U.S. pork export volumes destined to Mexico and Japan have increased by 18.6% on a YOY basis throughout the past 12 months. Throughout the past 12 months, YOY increases in U.S. pork exports have been led by product destined to Mexico, while shipments destined to China, Hong Kong & Taiwan have declined most significantly on a YOY basis over the period. U.S. pork exports destined to China, Hong Kong & Taiwan remain elevated when compared to historical figures, however.

U.S. pork import volumes reached a new record high monthly level for the second consecutive month throughout Oct ’21, finishing 34.9% above previous year figures. The YOY increase in pork import volumes was the 12th experienced throughout the past 13 months. The increase in pork import volumes, coupled with the decline in export volumes, resulted in Oct ’21 U.S. net pork trade finishing 15.7% below previous year levels, reaching a three year low seasonal level. The YOY decline in net pork trade was the fourth experienced in a row and the largest experienced throughout the past six and a half years on a percentage basis.

’20-’21 annual net pork trade declined 2.9% YOY, finishing below previous year levels for the first time in the past six years.

Beef & Veal – Exports Remain at a Record High Seasonal Level, However Trade Finishes Negative

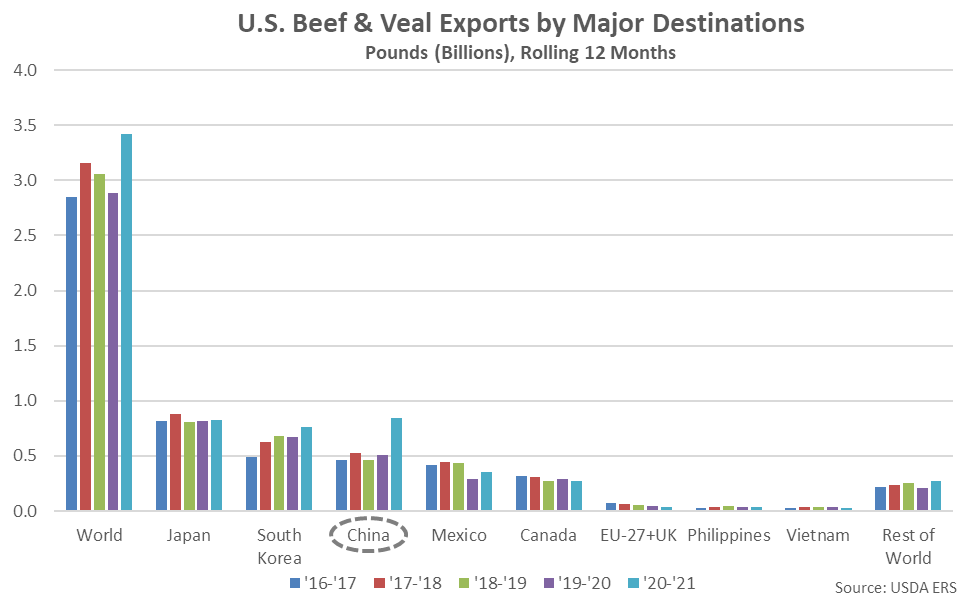

Oct ’21 U.S. beef & veal export volumes remained at a record high seasonal level for the 11th time in the past 12 months, finishing 8.9% above previous year levels. The YOY increase in beef & veal export volumes was the 13th experienced in a row but the smallest experienced throughout the past eight months on a percentage basis.

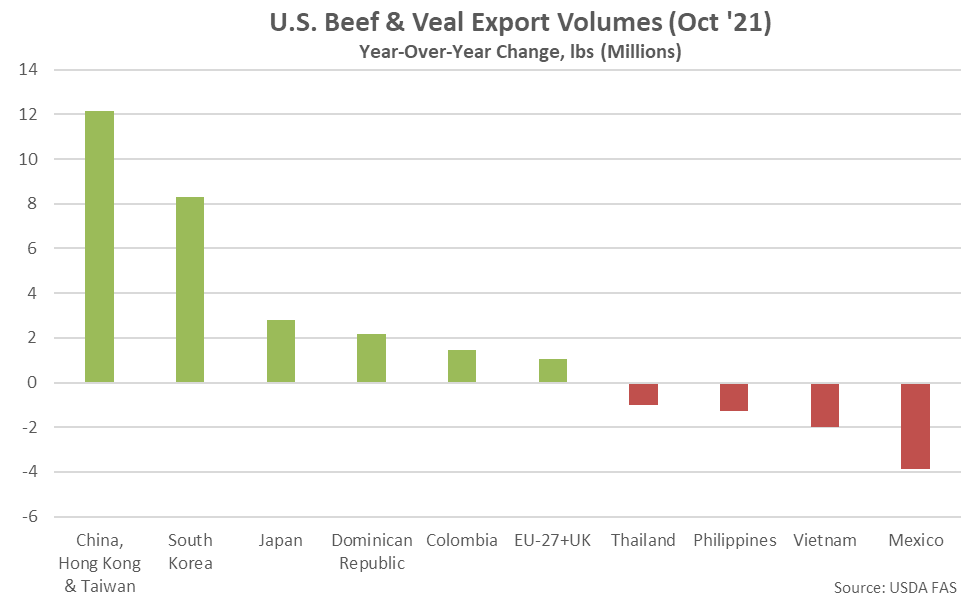

YOY increases in beef & veal export volumes were led by shipments destined to China, Hong Kong & Taiwan, followed by shipments destined to South Korea and Japan, while export volumes destined to Mexico finished most significantly lower on a YOY basis throughout the month.

Japan, South Korea, China, Hong Kong & Taiwan, Mexico and Canada have historically been the largest importers of U.S. beef & veal products, combining to account for nearly 90% of the total U.S. beef & veal export volumes throughout the past five years. Throughout the past 12 months, U.S. beef & veal export volumes destined to China, Hong Kong & Taiwan have increased most significantly on a YOY basis, while shipments destined to Canada and Vietnam have declined most significantly on a YOY basis over the period.

Oct ’21 U.S. beef & veal import volumes finished above previous year levels for the first time in the past four months, increasing by 17.0% and reaching a 17 year high seasonal level. Beef & veal import volumes exceeded export volumes for the fourth time in the past five months throughout Oct ’21, resulting in U.S. beef & veal net trade finishing at a negative level. Beef & veal net trade reached a six year low seasonal level for the month of October.

’20-’21 annual beef & veal net trade reached an eight year high annual level, rebounding from the negative level experienced throughout the previous production season.

Broilers – Exports & Net Trade Remain Lower YOY for the Second Consecutive Month

U.S. broiler export volumes declined 6.3% on a YOY basis throughout Oct ’21, finishing below previous year levels for the second consecutive month. The YOY decline in broiler export volumes was the largest experienced throughout the past two and a half years on a percentage basis.

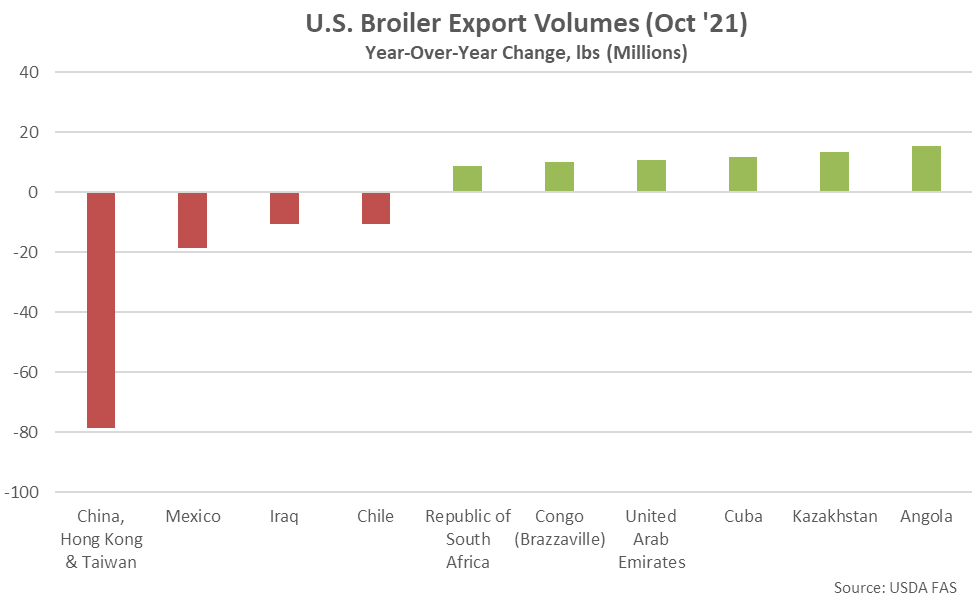

YOY declines in U.S. broiler export volumes were led by shipments destined to China, Hong Kong & Taiwan, followed by volumes destined to Mexico and Iraq, while volumes destined to Angola increased most significantly on a YOY basis throughout the month.

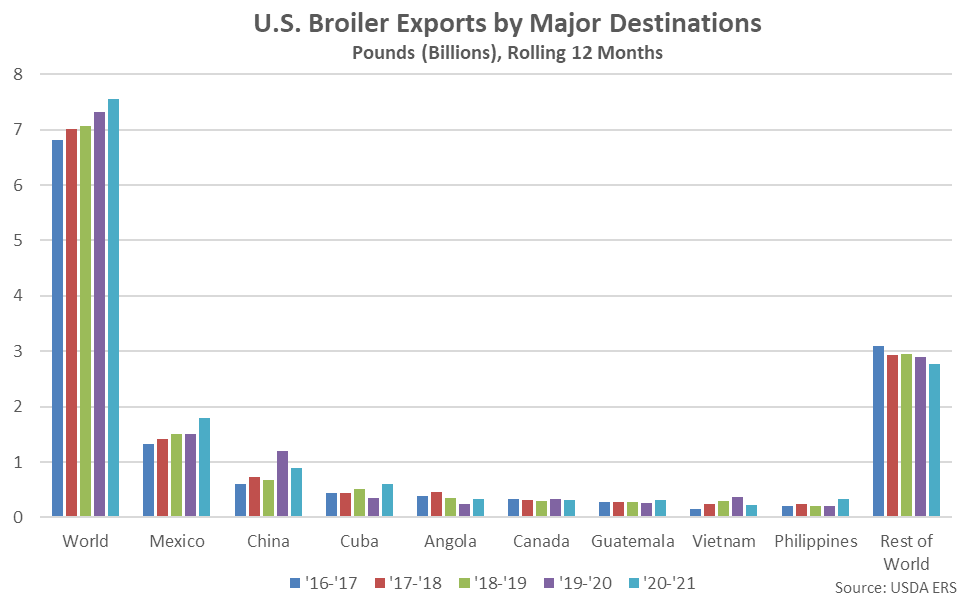

Mexico has historically been the largest importer of U.S. broilers, accounting for over one fifth of the total U.S. broiler export volumes throughout the past five years. Throughout the past 12 months, U.S. broiler export volumes destined to Mexico have increased most significantly on a YOY basis, followed by volumes destined to Cuba, while shipments destined to China, Hong Kong & Taiwan have declined most significantly on a YOY basis over the period.

U.S. broiler import volumes finished above previous year levels for the first time in the past four months during Oct ’21, increasing by 29.5% and reaching a record high seasonal level. Broiler import volumes remained at insignificant levels relative to export volumes, however, as Oct ’21 imports amounted to just 2.3% of export volumes. The YOY decline in broiler export volumes, coupled with the increase in import volumes, resulted in U.S. broiler net trade finishing 6.9% lower on a YOY basis during Oct ’21, reaching a four year low seasonal level. The YOY decline in broiler net trade was the second experienced in a row and the largest experienced throughout the past two and a half years on a percentage basis.

’20-’21 annual net broiler trade finished up 4.5% YOY, reaching a record high annual level for the first time in the past seven years.

Combined Net Trade

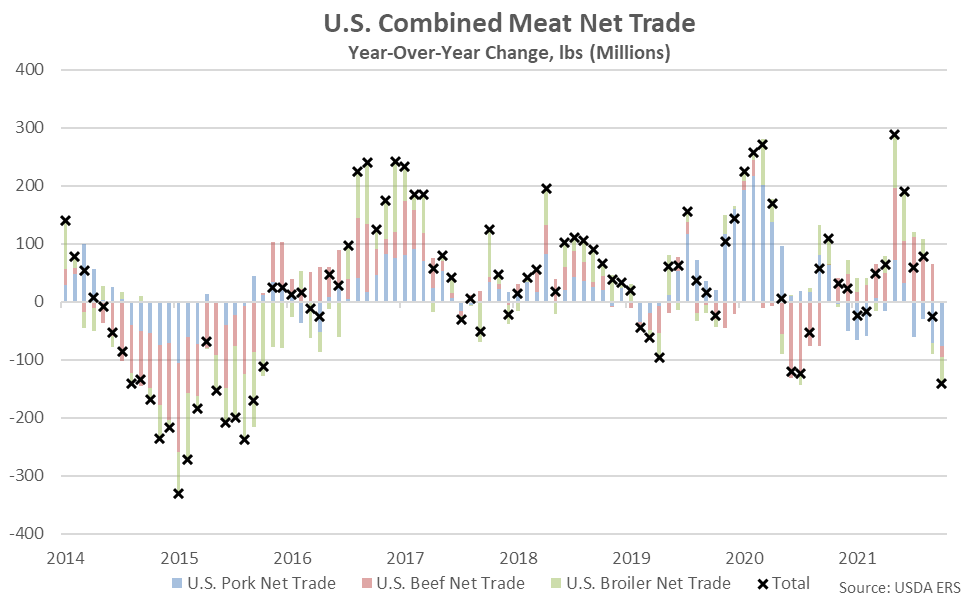

Overall, combined net trade of U.S. pork, beef and broilers declined on a YOY basis for the second consecutive month during Oct ’21, finishing down 141.3 million pounds, or 12.2%, and reaching a four year low seasonal level. The YOY decline in combined net trade of U.S. pork, beef and broilers was the largest experienced throughout the past six years on an absolute basis.