Grain & Oilseeds WASDE Update – Dec ’21

Corn – U.S. and Global Ending Stocks Slightly Above Private Estimates

- ’21-’22 U.S. ending stocks of 1.493 billion bushels slightly above expectations

- ’21-’22 global ending stocks of 305.5 million MT slightly above expectations

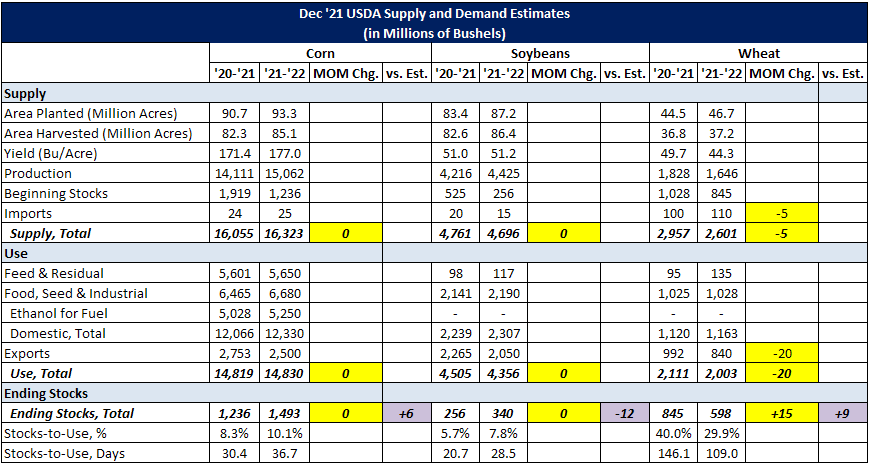

The ’21-’22 U.S. corn supply and demand projections were each unchanged from the previous month. ’21-’22 projected U.S. corn ending stocks of 1.493 billion bushels, or 36.7 days of use, finished 0.4% above expectations.

The ’21-’22 global corn ending stock projection finished 0.4% above the previous month and 0.4% above expectations, largely on an increase in Ukrainian production.

Soybeans – U.S. and Global Ending Stocks Below Private Estimates

- ’21-’22 U.S. ending stocks of 340 million bushels below expectations

- ’21-’22 global ending stocks of 102.0 million MT below expectations

The ’21-’22 U.S. soybean supply and demand projections were each unchanged from the previous month. ’21-’22 projected U.S. soybean ending stocks of 340 million bushels, or 28.5 days of use, finished 3.4% below expectations.

The ’21-’22 global soybean ending stock projection finished 1.7% below the previous month and 2.0% below expectations, largely on a decline in Chinese production.

Soybean Complex – U.S. Oil Stocks Raised Slightly, U.S. Meal Stocks Unchanged

The ’21-’22 U.S. soybean oil ending stock projection was raised slightly from the previous month as an increase in production is expected to more than offset higher food, feed & industrial usage. Globally, the ’21-’22 soybean oil ending stock projection was reduced slightly from the previous month, largely on a reduction in European Union beginning stocks.

The ’21-’22 U.S. soybean meal supply and demand projections were each unchanged from the previous month. Globally, the ’21-’22 global soybean meal ending stock projection was reduced slightly from the previous month, largely on a reduction in European Union beginning stocks.

Wheat – U.S. and Global Ending Stocks Above Private Estimates

- ’21-’22 U.S. ending stocks of 598 million bushels above expectations

- ’21-’22 global ending stocks of 278.2 million MT slightly above expectations

The ’21-’22 U.S. wheat supply projection was reduced slightly from the previous month on a reduction in imports while the U.S. wheat demand projection was reduced slightly from the previous month, largely on a reduction in export demand. ’21-’22 projected U.S. wheat ending stocks of 598 million bushels, or 109.0 days of use, finished 2.6% above the previous month and 1.5% above expectations.

The ’21-’22 global wheat ending stock projection finished 0.9% above the previous month and 0.7% above expectations, largely on increases in Australia, Russian and Canadian production.

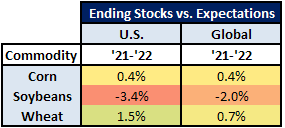

Ending Stocks vs. Expectations Summary

Overall, ’21-’22 projected domestic wheat ending stocks finished most significantly above expectations, followed by global wheat ending stocks, domestic corn ending stocks and global corn ending stocks. Domestic soybean ending stocks finished most significantly below expectations, followed by global soybean ending stocks.