Global Milk Production Update – Dec ’21

Executive Summary

Milk production figures throughout the major dairy exporting regions of New Zealand, the EU-27+UK, the U.S., Australia and Argentina were recently updated with values spanning through Oct ’21. Highlights from the updated figures include:

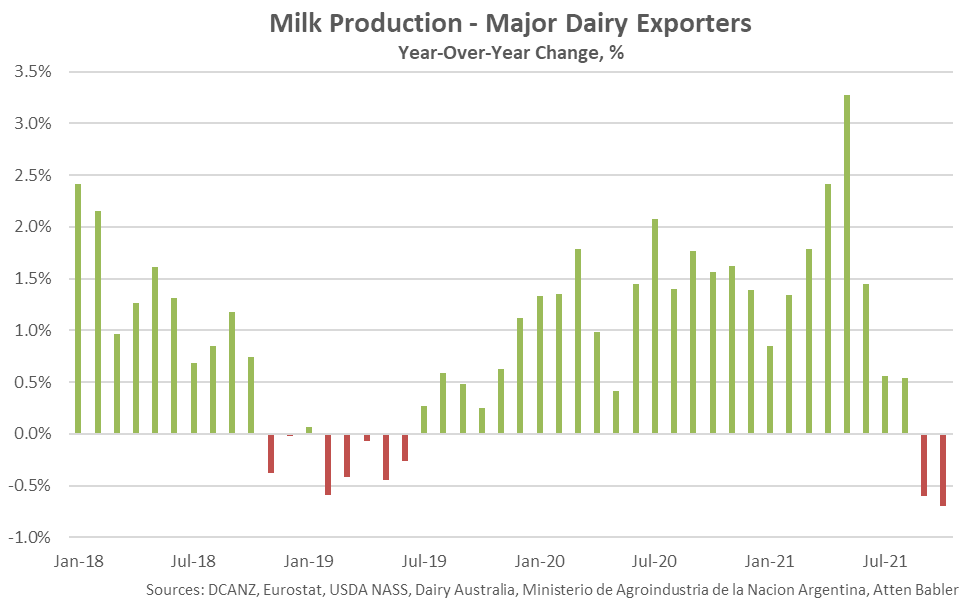

- Combined milk production within the major dairy exporting regions declined 0.7% on a YOY basis throughout Oct ’21, finishing below previous year levels for the second consecutive month. The YOY decline in combined milk production volumes was the largest experienced throughout the past four and a half years on a percentage basis.

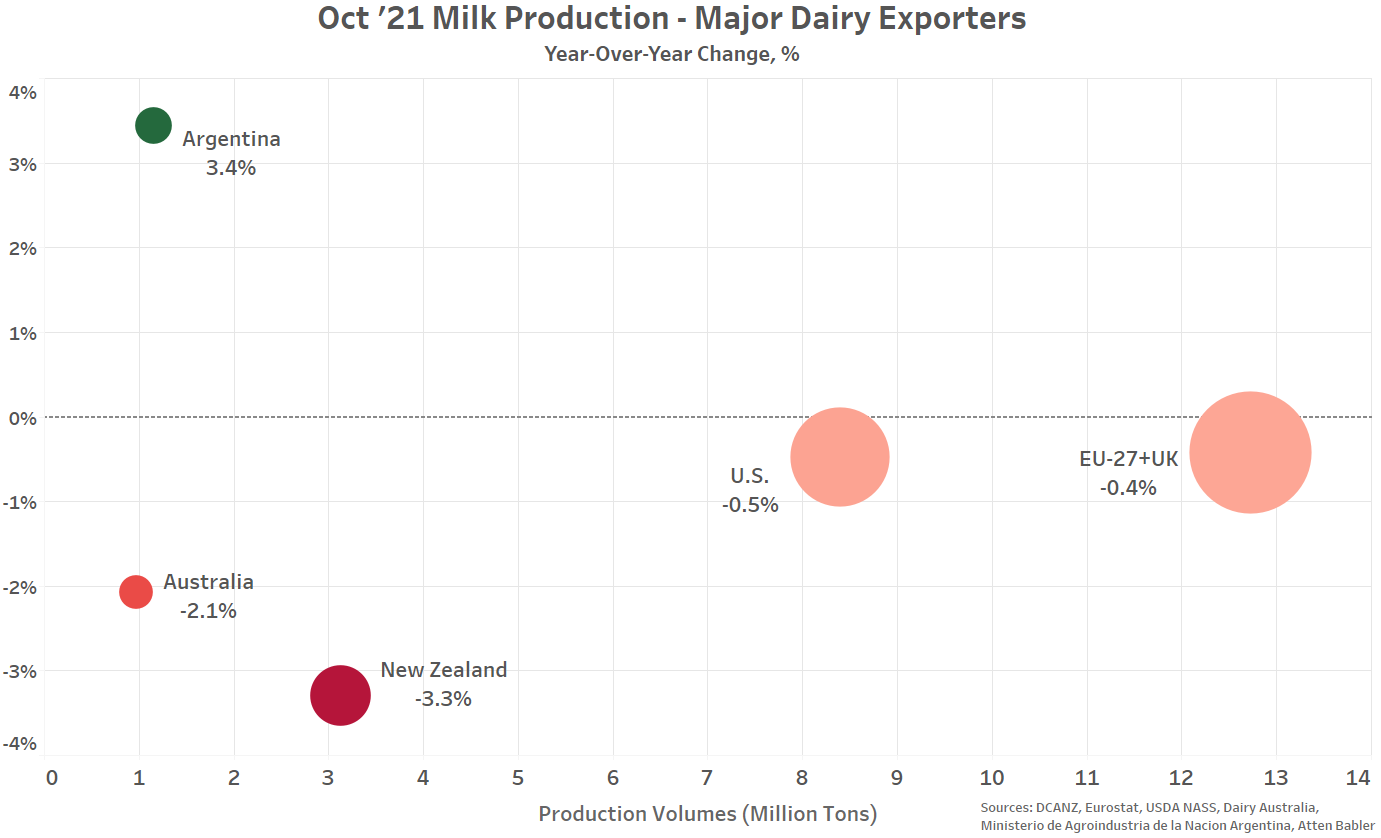

- Oct ’21 YOY declines in milk production on a percentage basis were led by New Zealand, followed by Australia, the U.S. and the EU-27+UK. Argentine milk production volumes remained above previous year levels throughout Oct ’21.

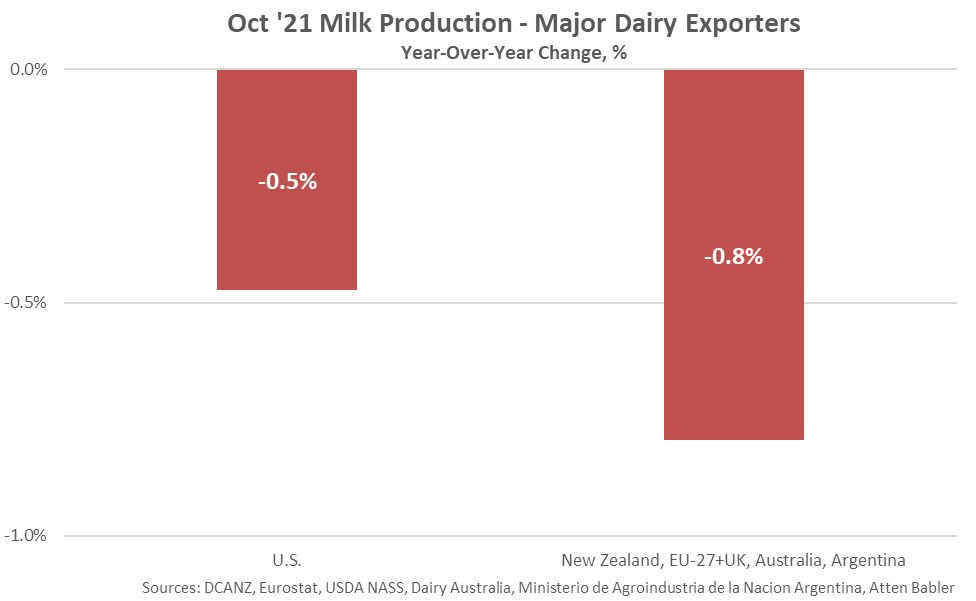

- Milk production growth throughout the U.S. finished below previous year levels throughout Oct ’21 but remained above growth experienced throughout the other major dairy exporting regions for the 15th consecutive month.

Additional Report Details

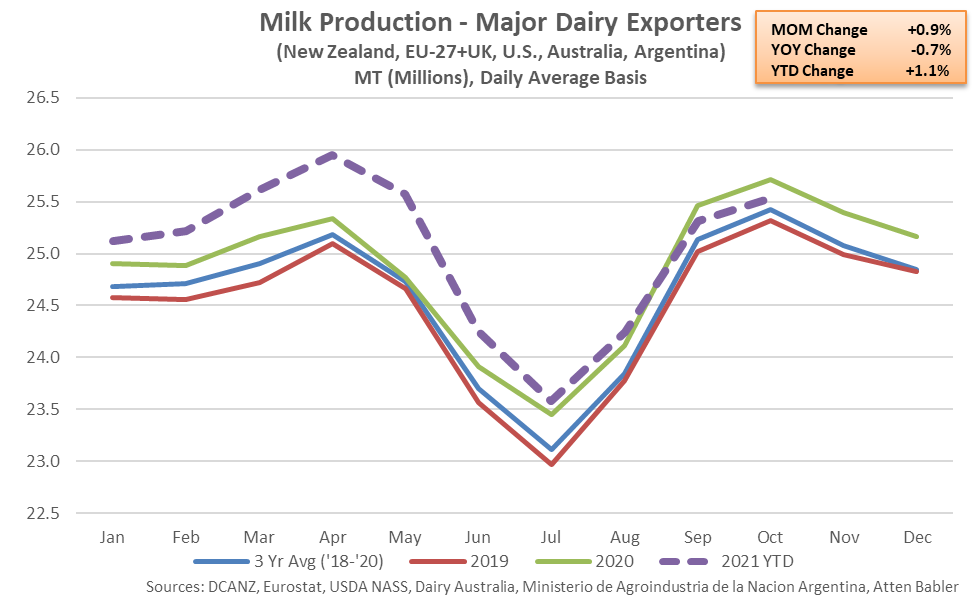

Combined milk production within the major dairy exporting regions of New Zealand, the EU-27+UK, the U.S., Australia and Argentina rebounded seasonally to a five month high level but finished 0.7% below previous year levels throughout Oct ’21. The aforementioned regions combined to account for 90% of global butter, cheese, whole milk powder and nonfat dry milk export volumes throughout 2020.

Combined milk production volumes finished largely flat or lower on a YOY basis over eight consecutive months through Jun ’19, prior to finishing higher throughout each of the past 26 months through Aug ’21. The Oct ’21 YOY decline in combined milk production volumes was the second experienced in a row and the largest experienced throughout the past four and a half years on a percentage basis.

Oct ’21 YOY declines in milk production on a percentage basis were led by New Zealand (-3.3%), followed by Australia (-2.1%), the U.S. (-0.5%) and the EU-27+UK (-0.4%). Oct ’21 milk production volumes remained higher on a YOY basis throughout Argentina (+3.4%). The EU-27+UK produces significantly more milk than the other dairy exporting regions, accounting for nearly half of the combined production within the five exporting regions throughout Oct ’21.

Excluding the U.S., milk production within the major dairy exporting regions declined by 0.8% on a YOY basis throughout the month of October, remaining below the growth rate exhibited within the U.S. for the 15th consecutive month.