Soybean Complex Price & Value Update – Jan ’22

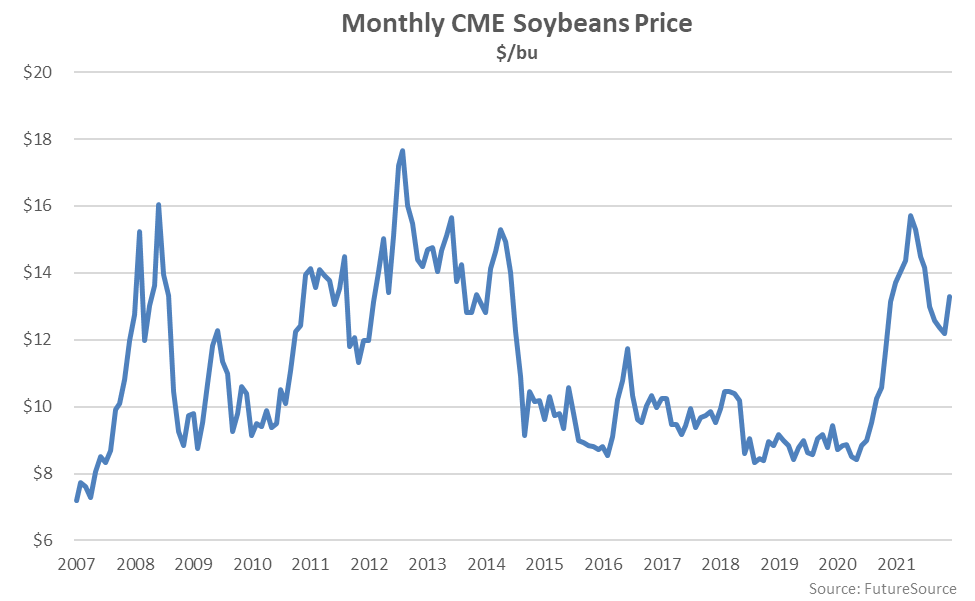

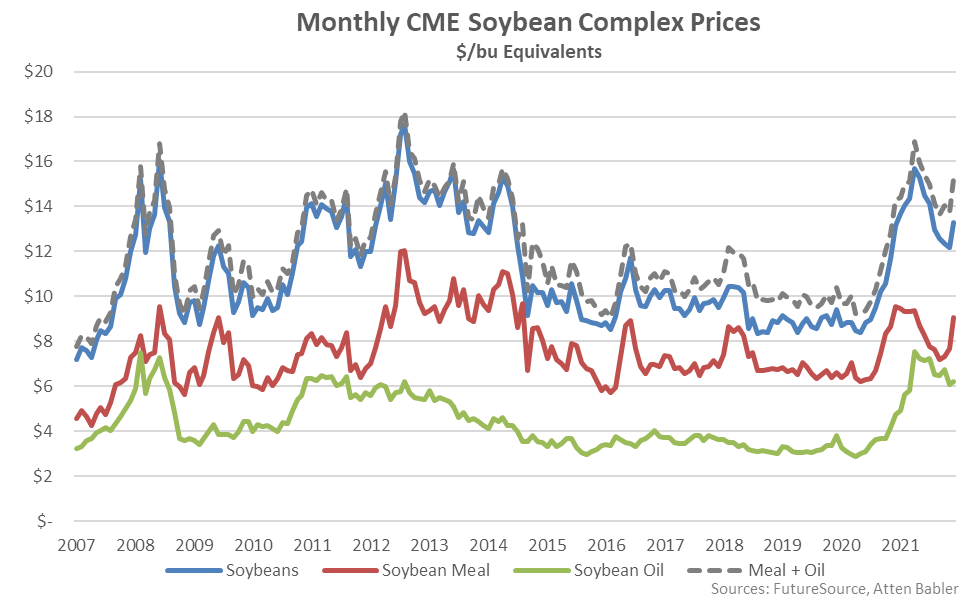

Dec ’21 CME Soybean Prices Rebounded to a Five Month High Level

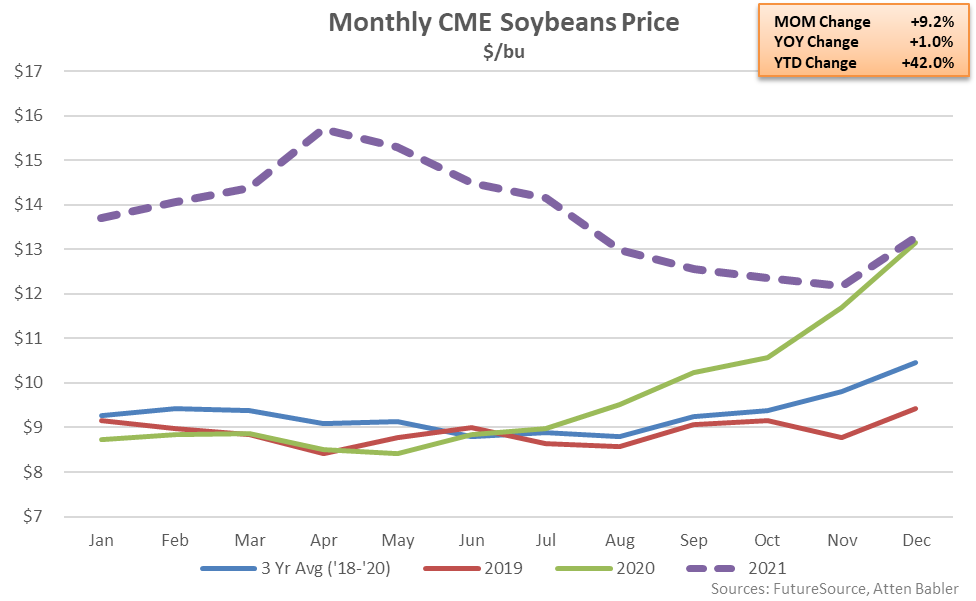

Dec ’21 CME Soybean Prices Increased 9.2% MOM While Finishing 1.0% Higher YOY

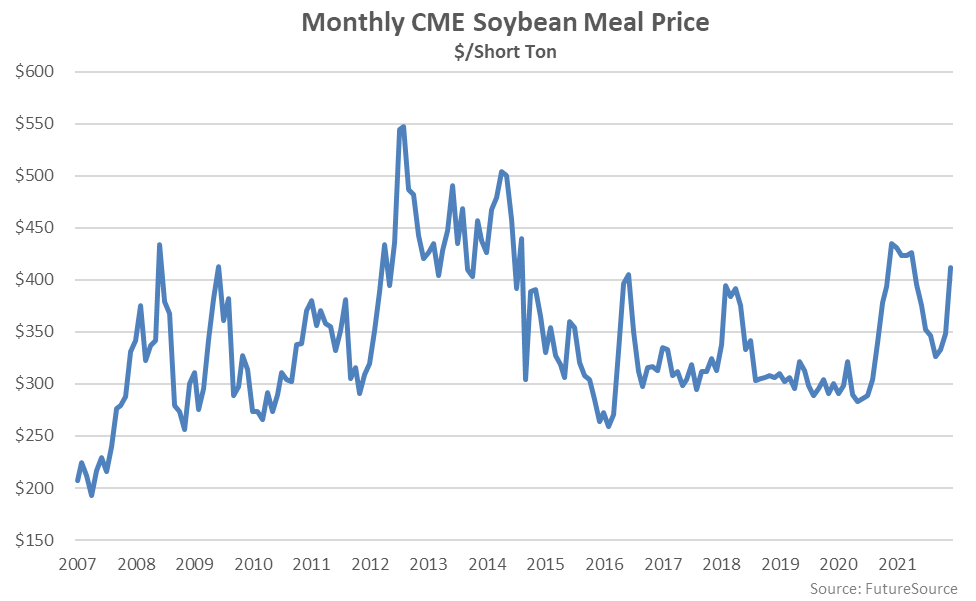

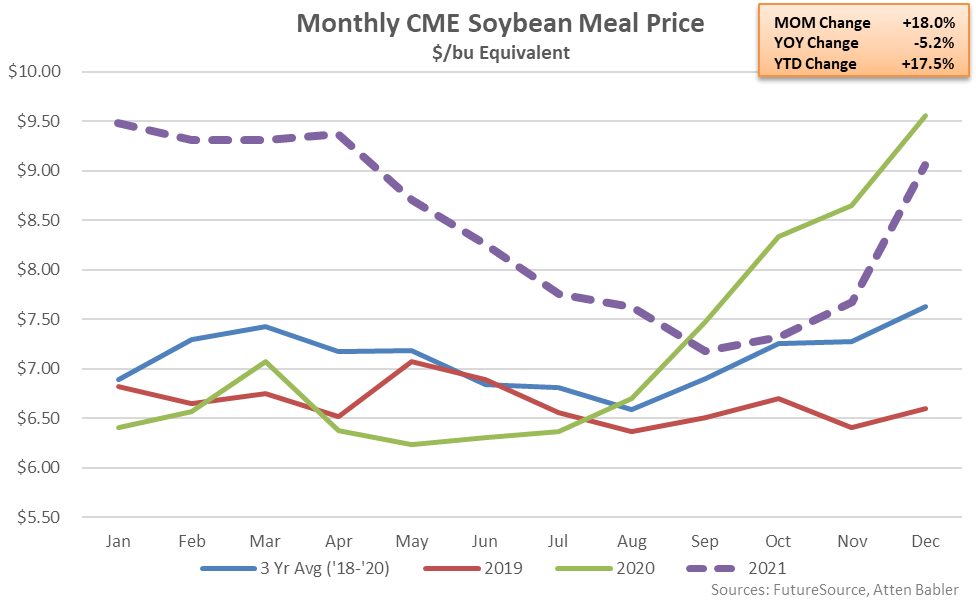

Dec ’21 CME Soybean Meal Prices Rebounded to an Eight Month High Level

Dec ’21 CME Soybean Meal Prices Increased 18.0% MOM but Remained 5.2% Lower YOY

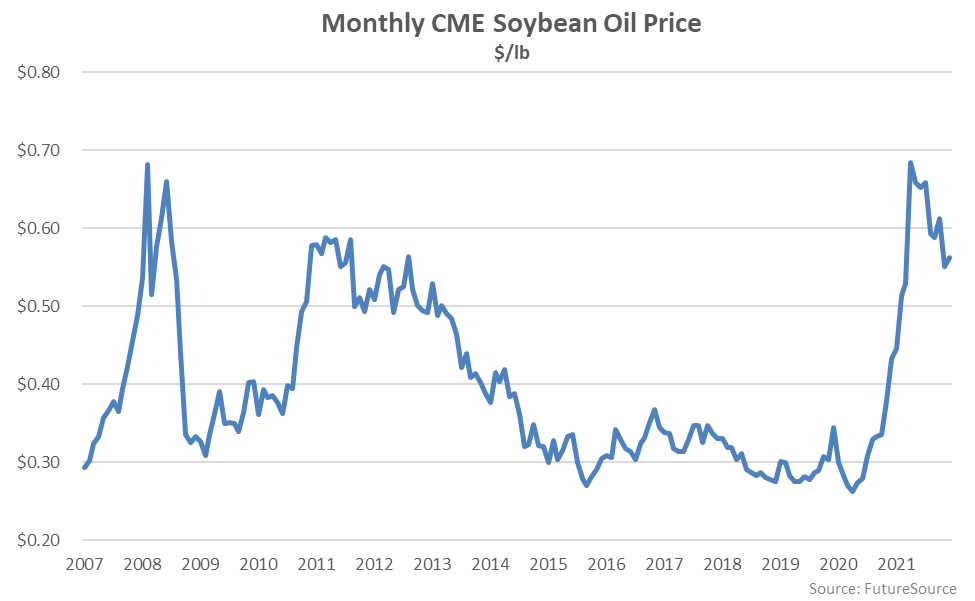

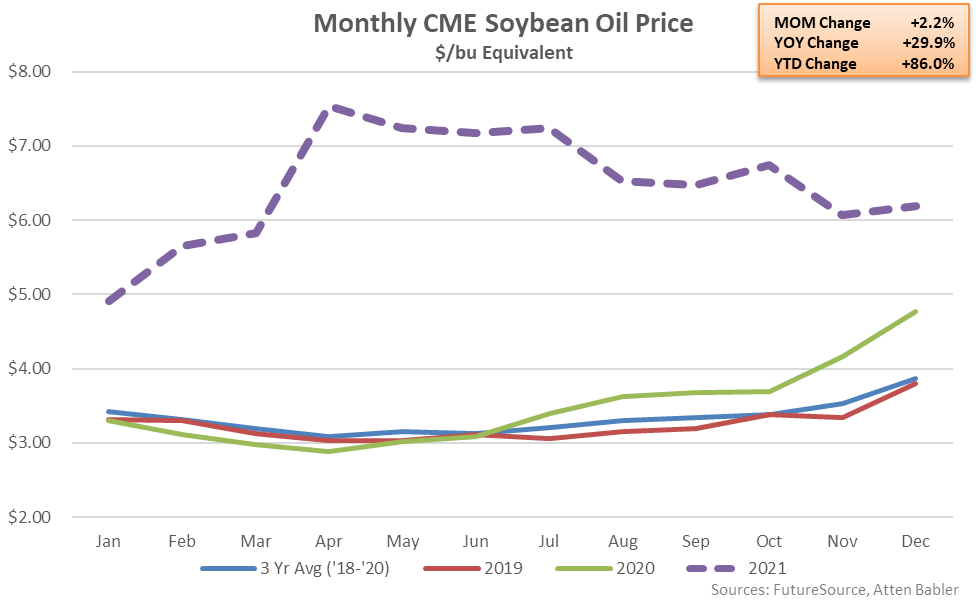

Dec ’21 CME Soybean Oil Prices Rebounded From the Previous Month’s Eight Month Low

Dec ’21 CME Soybean Oil Prices Increased 2.2% MOM While Finishing 29.9% Higher YOY

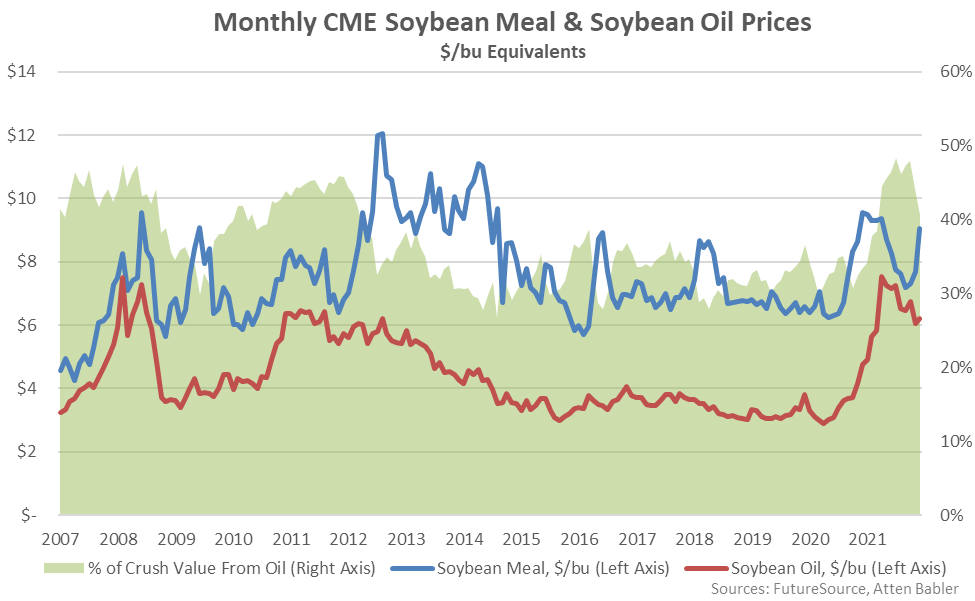

The Dec ’21 Oil Percentage of Crush Value of 40.6% Declined to a Nine Month Low Level

Dec ’21 Meal + Oil Prices Finished at a $15.25/bu Eq, Compared to a Bean Price of $13.29

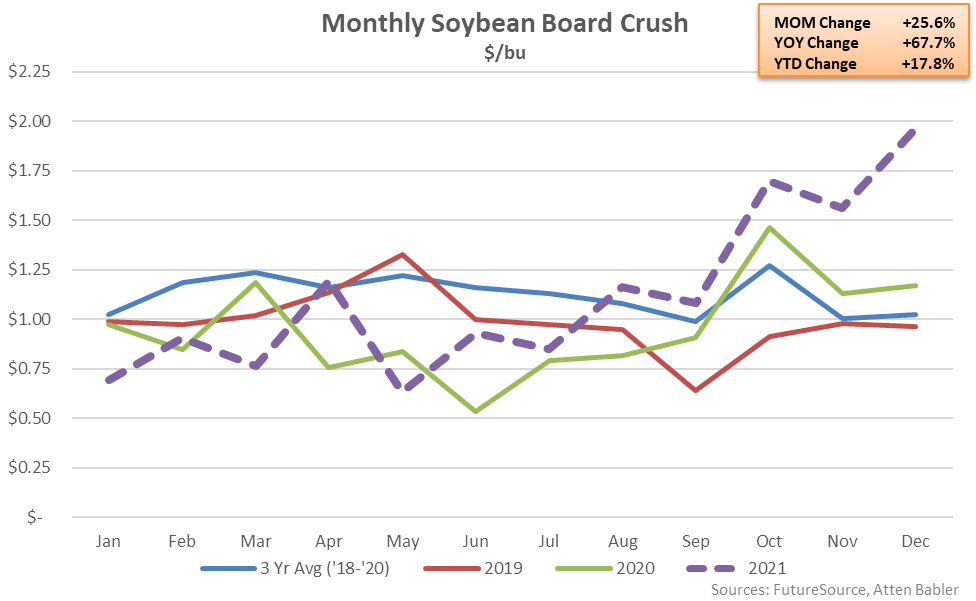

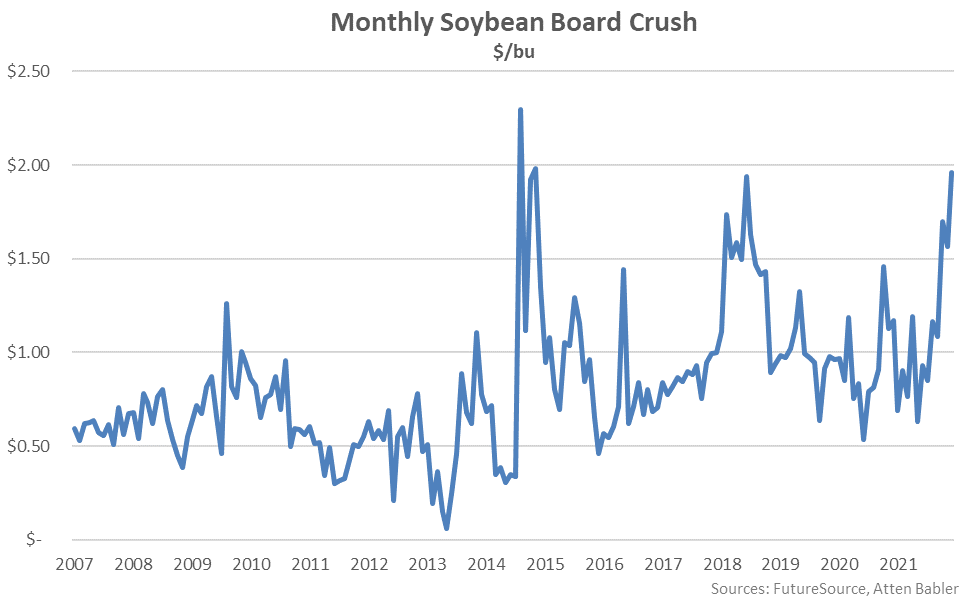

Dec ’21 Soybean Board Crush Reached a Seven Year High Level

Dec ’21 Soybean Board Crush Increased 25.6% MOM While Finishing 67.7% Higher YOY