U.S. Ethanol Exports Update – Jan ’22

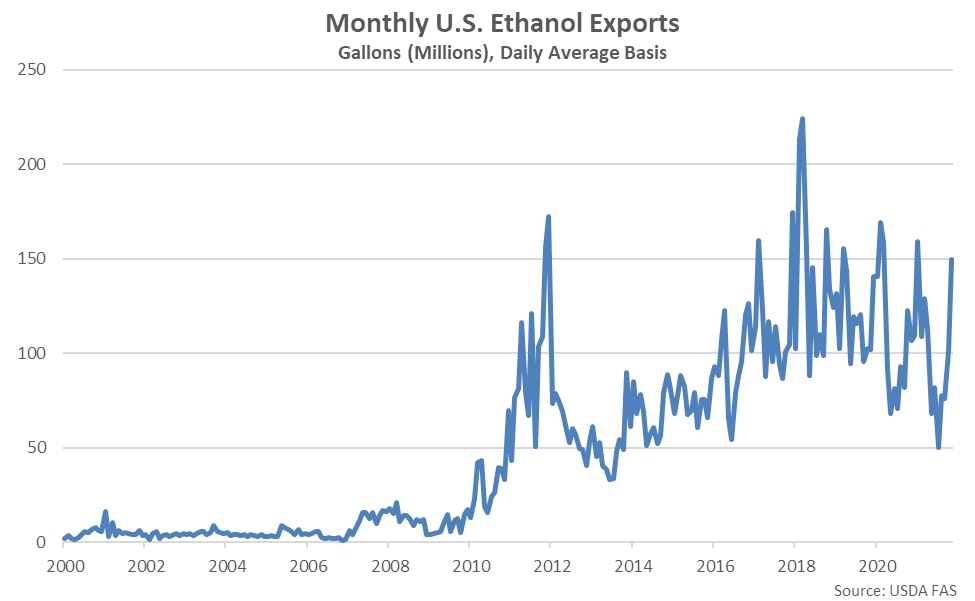

According to the USDA, Nov ’21 U.S. ethanol export volumes rebounded to a ten month high level and a ten year high seasonal level for the month of November. U.S. ethanol export volumes destined to Brazil rebounded to a 20 month high level however volumes destined to China remained minimal throughout the month.

Nov ’21 U.S. Ethanol Exports Rebounded to a Ten Month High Level

Nov ’21 U.S. Ethanol Exports Increased 47.4% MOM While Finishing 40.3% Higher YOY

Nov ’21 U.S. Ethanol Exports Reached a Ten Year High Seasonal Level

The Nov ’21 YOY Increase in U.S. Ethanol Exports was the First in the Past Five Months

Canada and Brazil Were the Top Destinations for U.S. Ethanol Exports During Nov ’21

Nov ’21 U.S. Ethanol Exports Destined to Brazil Increased Most Significantly YOY

U.S. Ethanol Exports Destined to Brazil Remain Down Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach an Eight Year Low Level

Nov ’21 U.S. Ethanol Exports to Brazil Rebounded to a 20 Month High Level

The Brazilian Tariff-Free Ethanol Import Quota Expired During Dec ’20

Nov ’21 U.S. Ethanol Exports to China Remained Minimal

2021 YTD U.S. Ethanol Exports Destined to China Have Already Reached a Five Year High Level

Dec ’21 Ethanol Exports are Projected to Remain Higher YOY Based on Weekly Implied Figures