Weekly Ethanol Update – 1/12/22

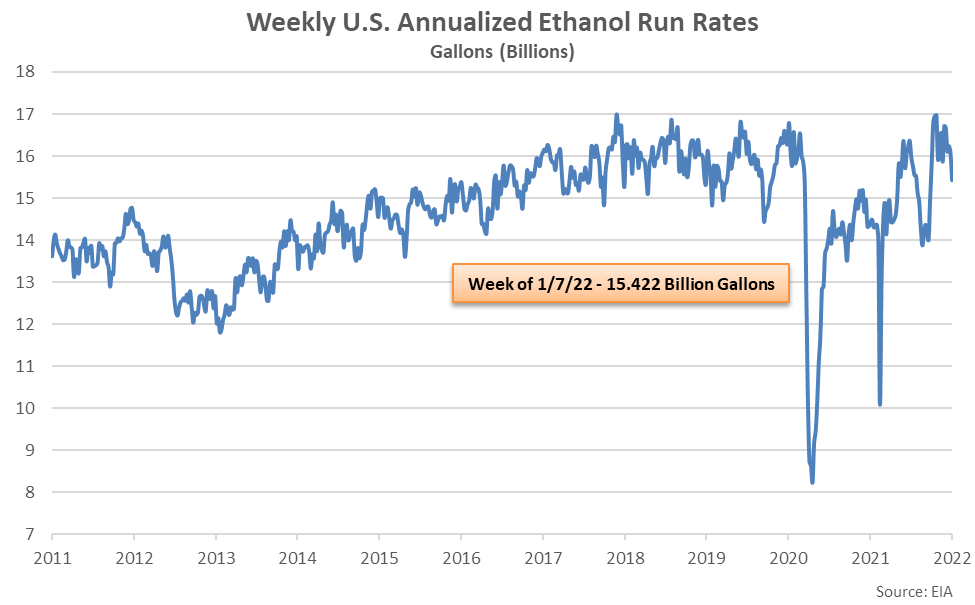

Jan 7th Ethanol Run Rates Declined 4.0% Week-Over-Week, Reaching a Three Month Low

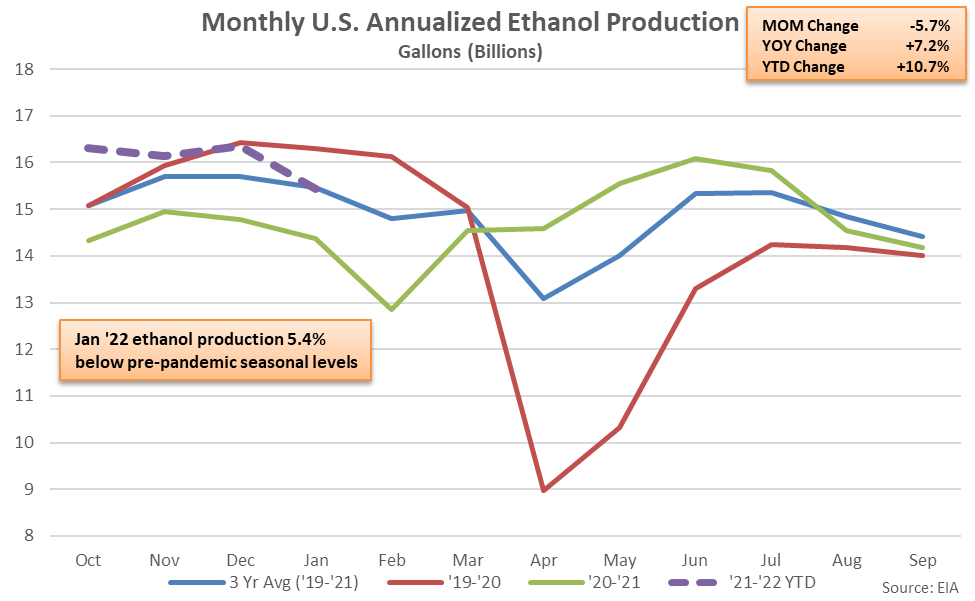

Jan ’22 Ethanol Production Down 5.7% MOM but up 7.2% YOY Through One Week

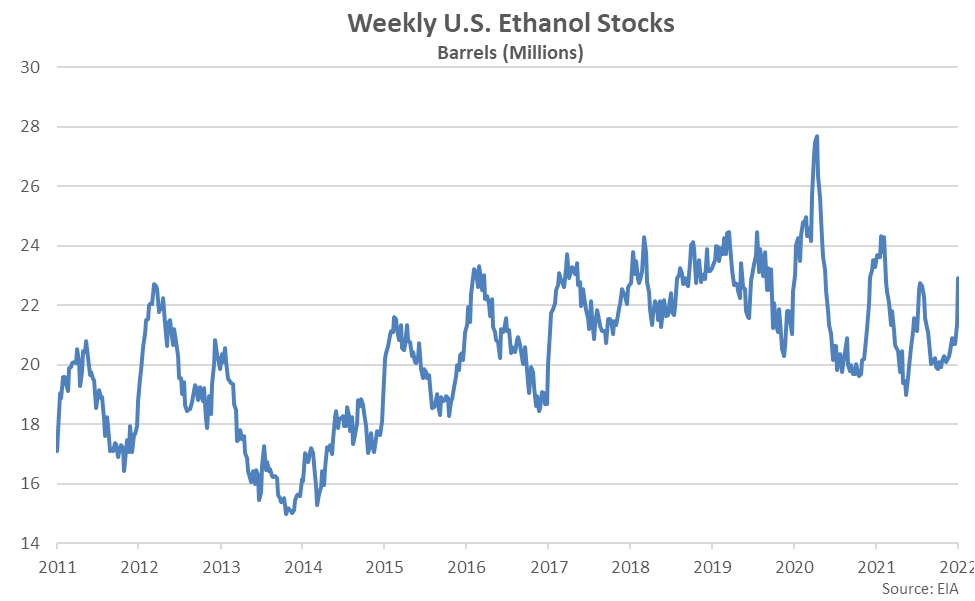

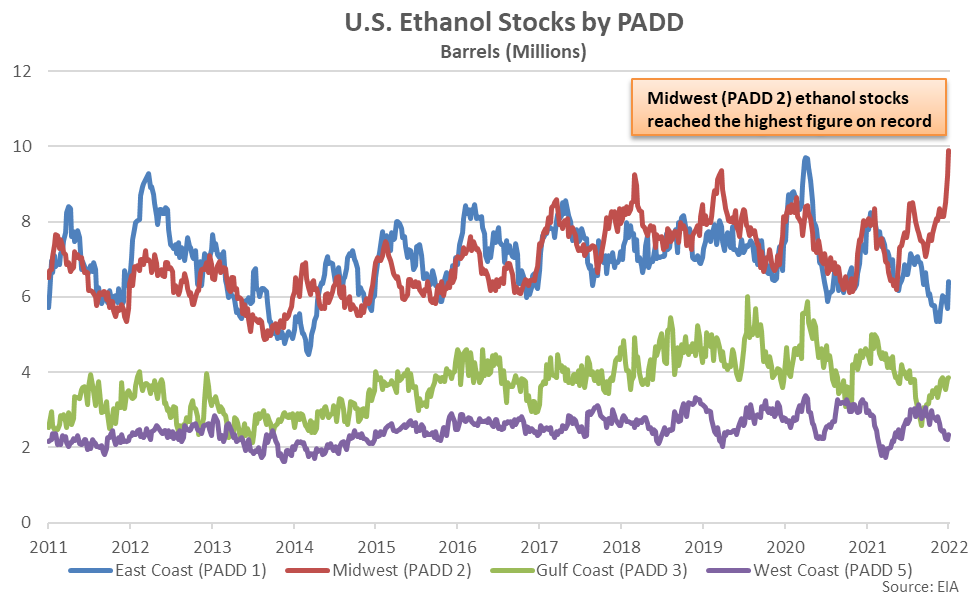

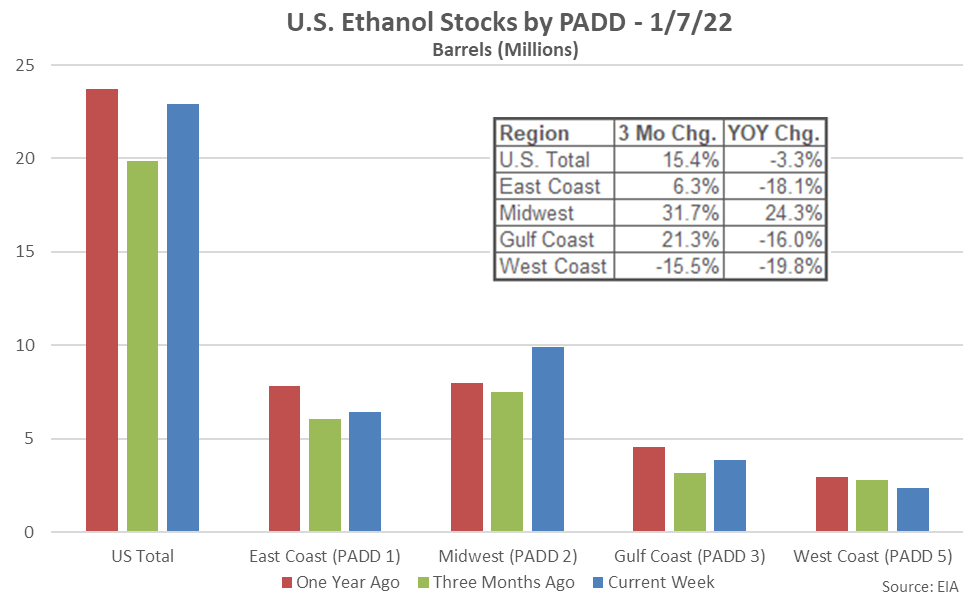

Jan 7th Ethanol Stocks Increased 7.3% Week-Over-Week, Reaching a Ten Month High Level

Jan 7th Weekly Increase in Ethanol Stocks Greatest on the East Coast

Jan 7th Total Ethanol Stocks Remain Down 3.3% YOY, West Coast Stocks Down 19.8%

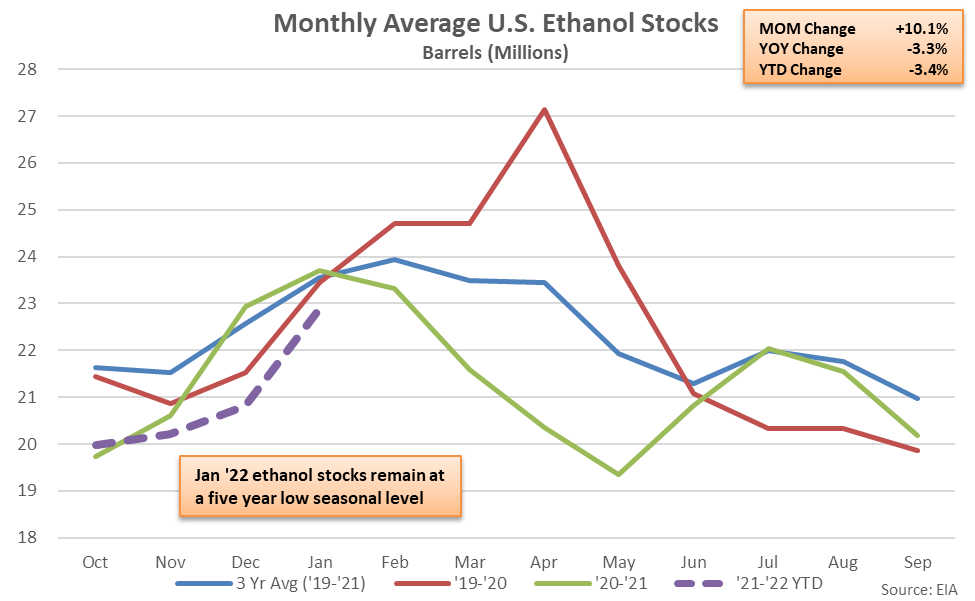

Jan ’22 Ethanol Stocks up 10.1% MOM but Down 3.3% YOY Through One Week

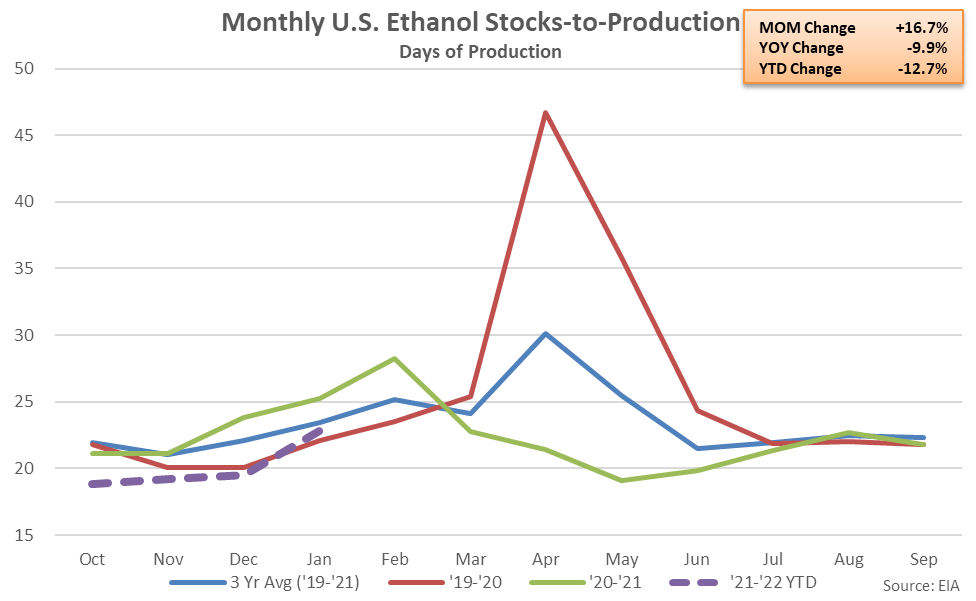

Jan ’22 Ethanol Stocks-to-Production up 16.7% MOM but Down 9.9% YOY Through One Week

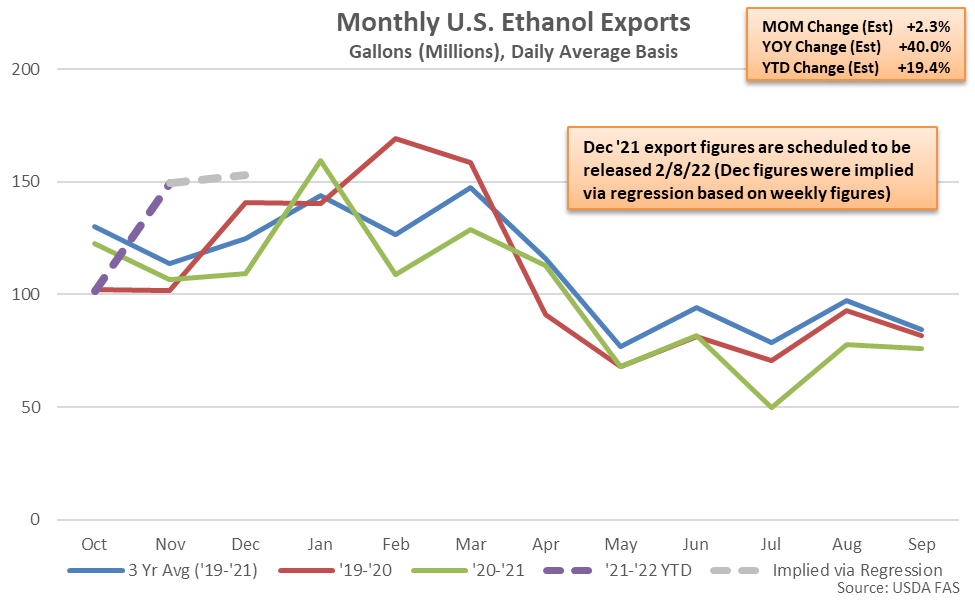

Nov ’21 Ethanol Exports Increased 40.3% YOY, Dec ’21 Volumes Projected to Remain Higher

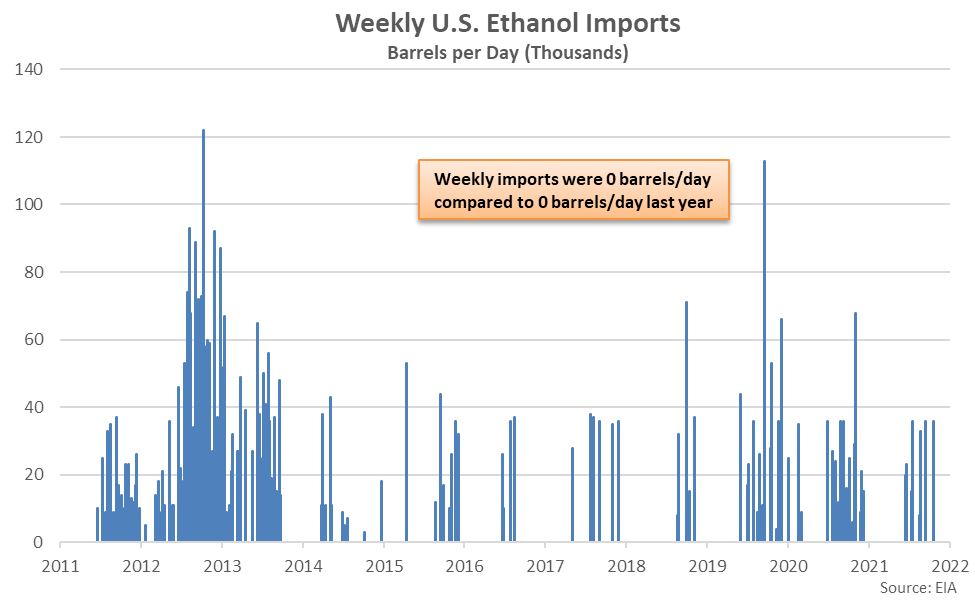

Jan 7th Ethanol Imports Remained at Minimal Levels for the 11th Consecutive Week

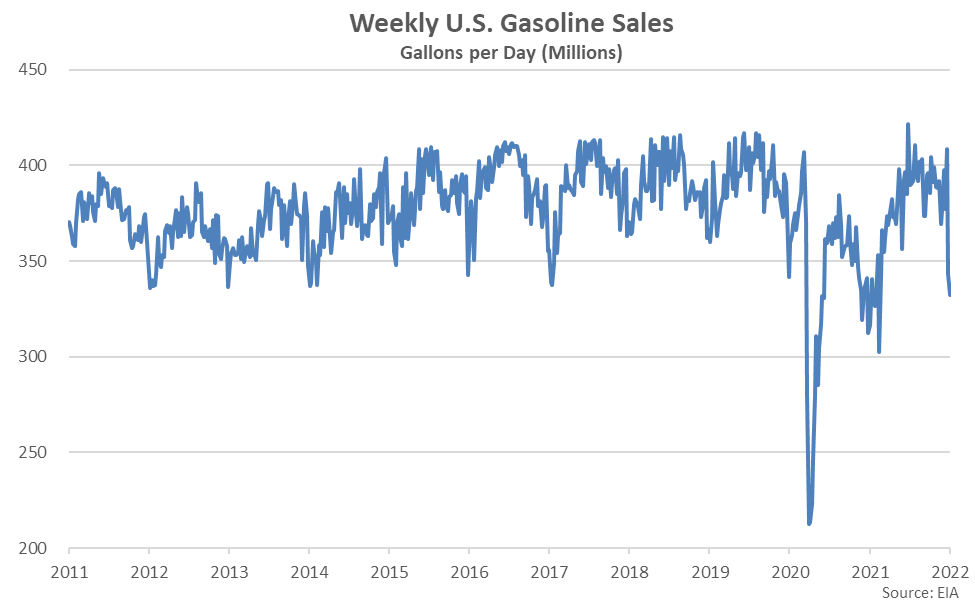

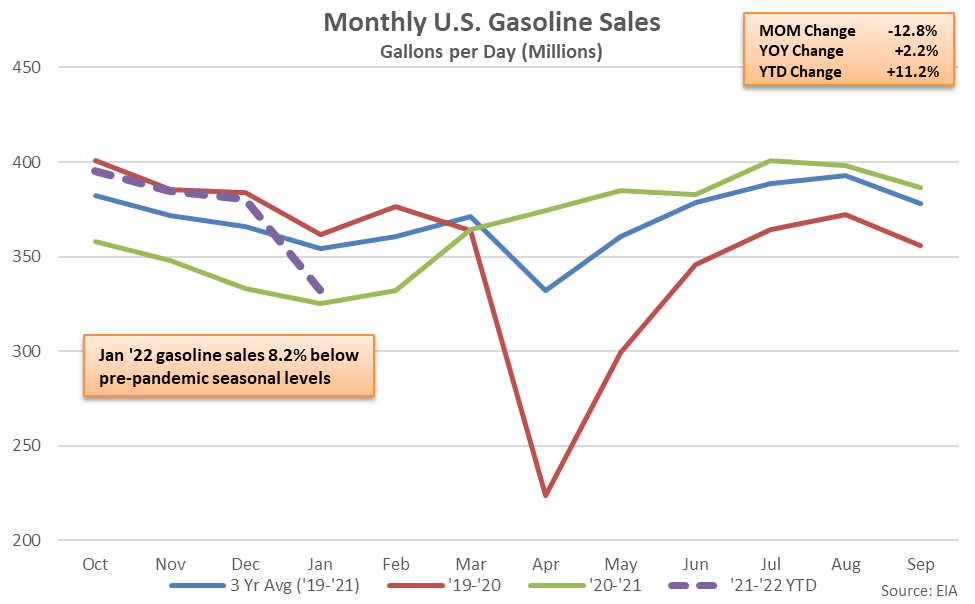

Jan 7th Gasoline Sales Declined 3.3% Week-Over-Week, Reaching an 11 Month Low Level

Jan ’22 Gasoline Sales Down 12.8% MOM but up 2.2% YOY Through One Week

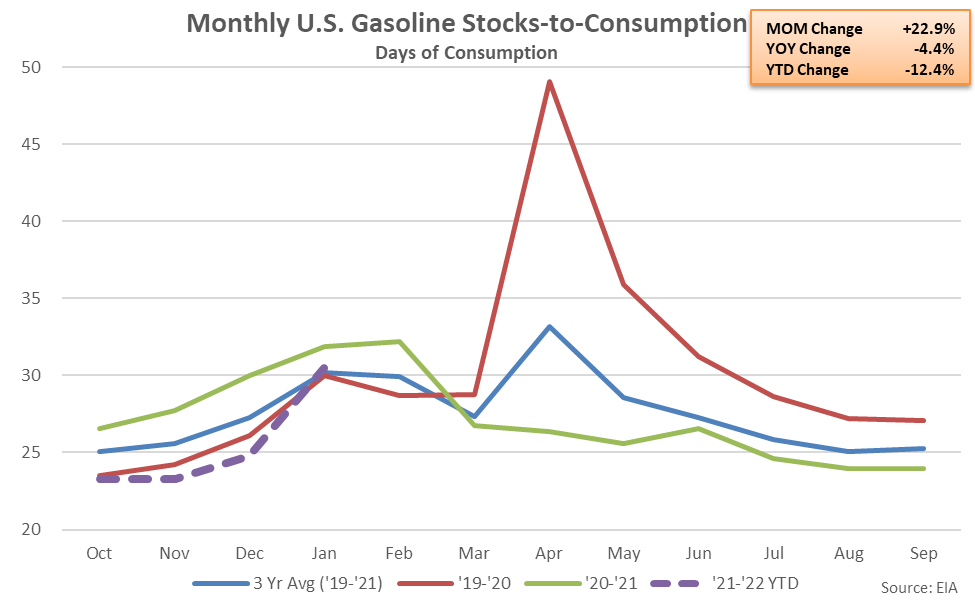

Jan ’22 Gasoline Stocks-to-Consumption up 22.9% MOM, Down 4.4% YOY Through One Week

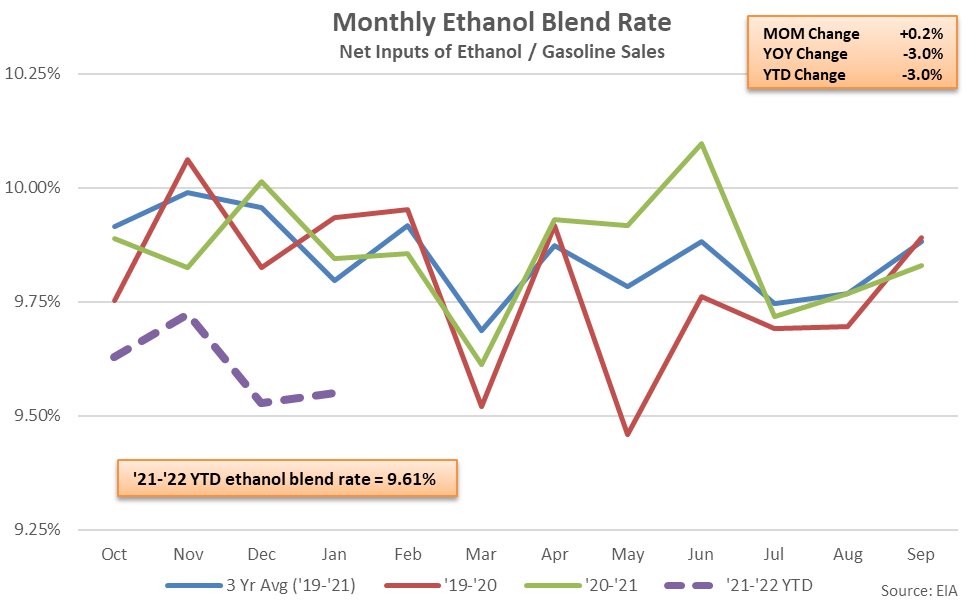

Jan ’22 Ethanol Blend Rate up 0.2% MOM but Down 3.0% YOY Through One Week