Quarterly Grain Stocks Update – Jan ’22

Corn – Dec 1st Stocks Rebound to a Three Year High Seasonal Level, Finish Slightly Above Expectations

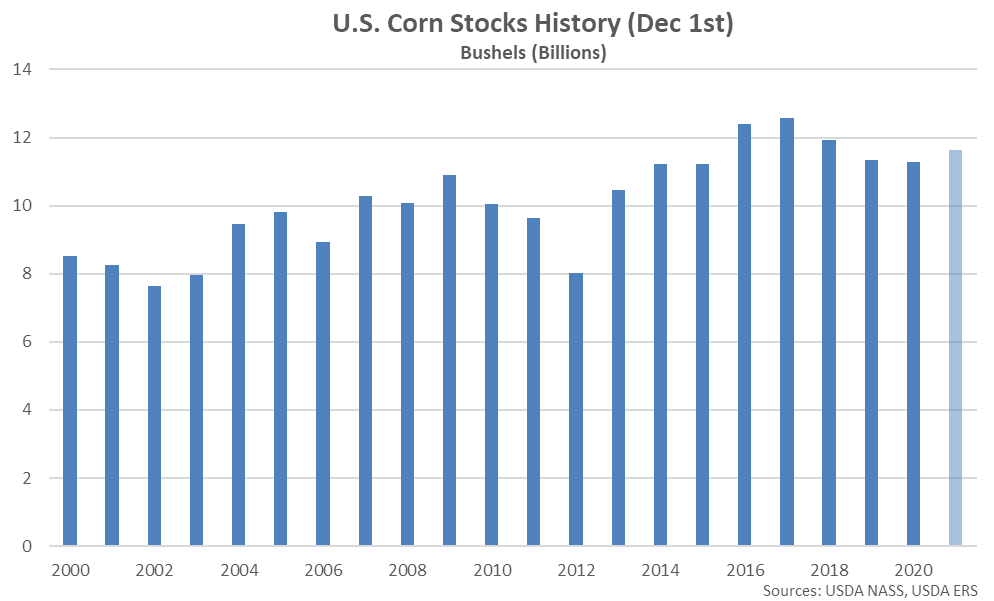

Corn stored in all positions as of December 1st, 2021 totaled 11.65 billion bushels, up 3.1% from the previous year and reaching a three year high seasonal level. Corn stocks finished 0.4% above average analyst estimates of 11.60 billion bushels. Stocks increased seasonally by 10.41 billion bushels from the previous quarter, 11.1% above the build experienced during the same period last year.

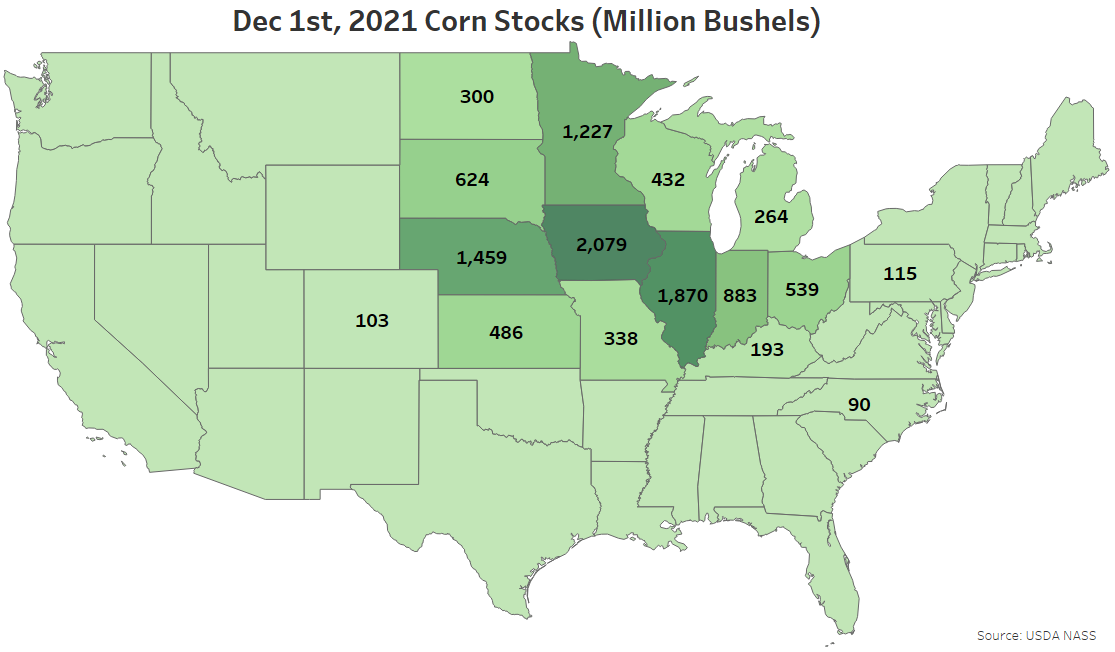

Dec 1st corn stocks were most significant within Iowa, followed by Illinois and Nebraska. The aforementioned states combined to account for nearly 45% of the total U.S. corn stocks.

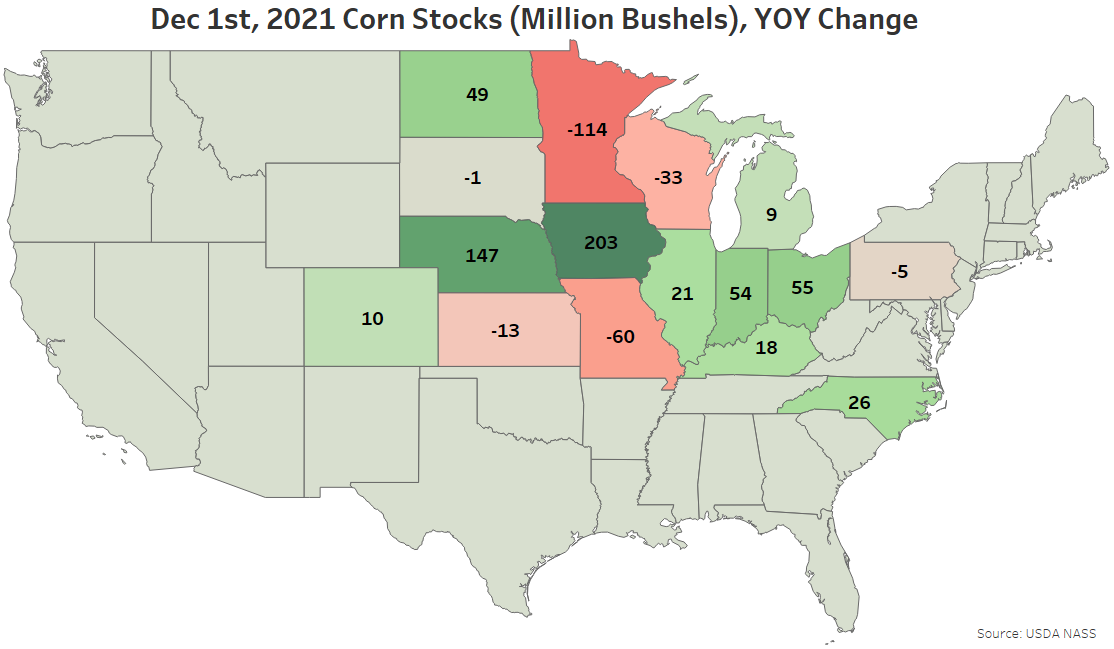

The most significant YOY increase in Dec 1st corn stocks was experienced throughout Iowa, followed by increases experienced throughout Nebraska and Ohio. Minnesota corn stocks declined most significantly from previous year levels. Iowa accounted for over half of the total YOY increase in corn stocks.

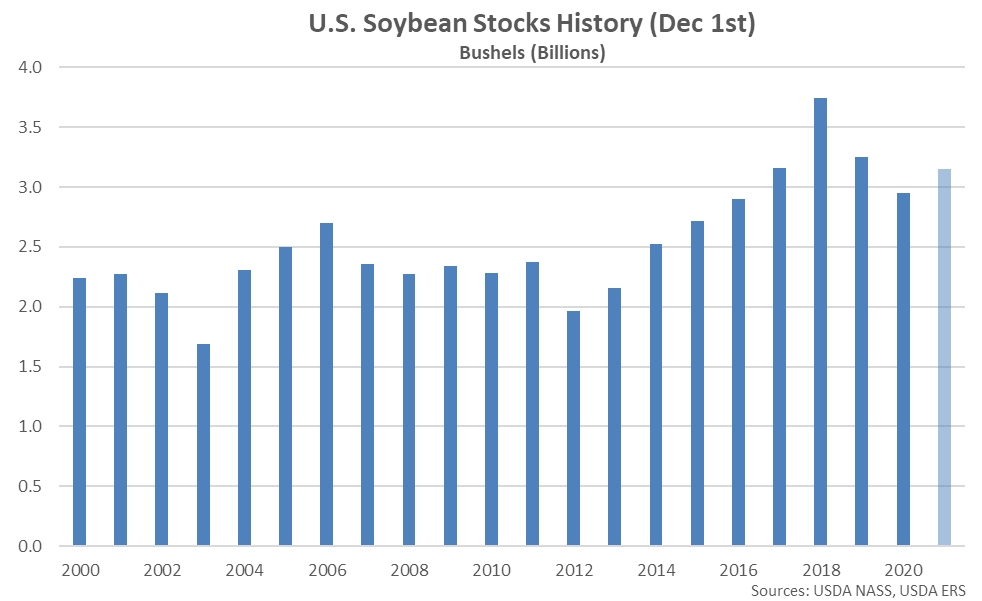

Soybeans – Dec 1st Stocks Rebound From the Previous Year, Finish Slightly Above Expectations

Soybeans stored in all positions as of December 1st, 2021 totaled 3.15 billion bushels, up 6.9% from the previous year. Soybean stocks finished 0.6% above average analyst estimates of 3.13 billion bushels. Stocks increased seasonally by 2.89 billion bushels from the previous quarter, 19.4% above the build experienced during the same period last year.

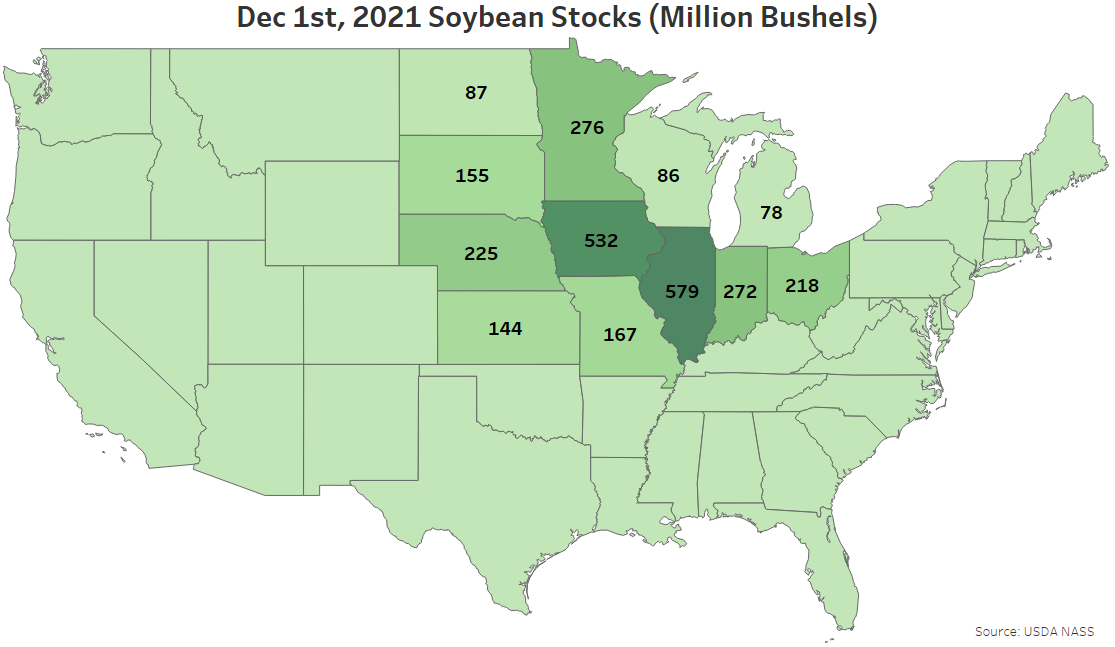

Dec 1st soybean stocks were most significant within Illinois, followed by Iowa and Minnesota. The aforementioned states combined to account for nearly 45% of the total U.S. soybean stocks.

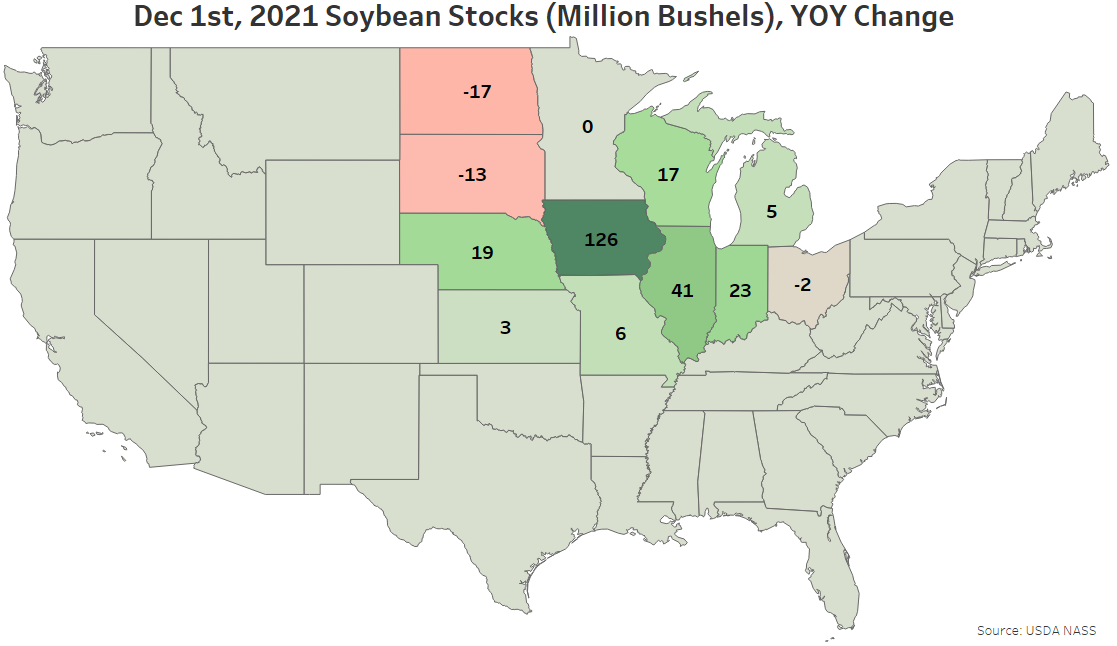

The most significant YOY increase in Dec 1st soybean stocks was experienced throughout Iowa, followed by increases experienced throughout Illinois and Indiana. North Dakota soybean stocks declined most significantly from previous year levels. Iowa accounted for over 60% of the total YOY increase in soybean stocks.

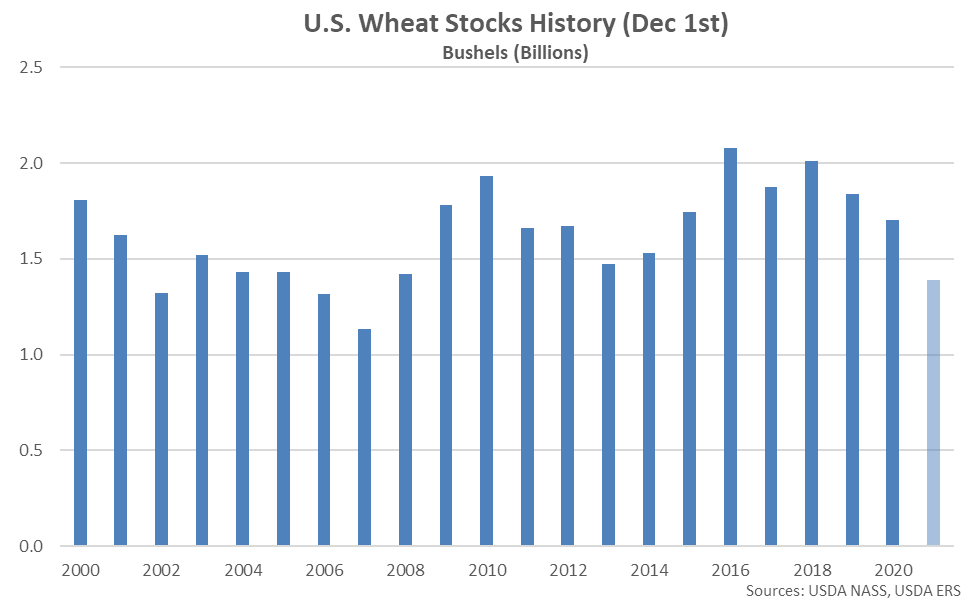

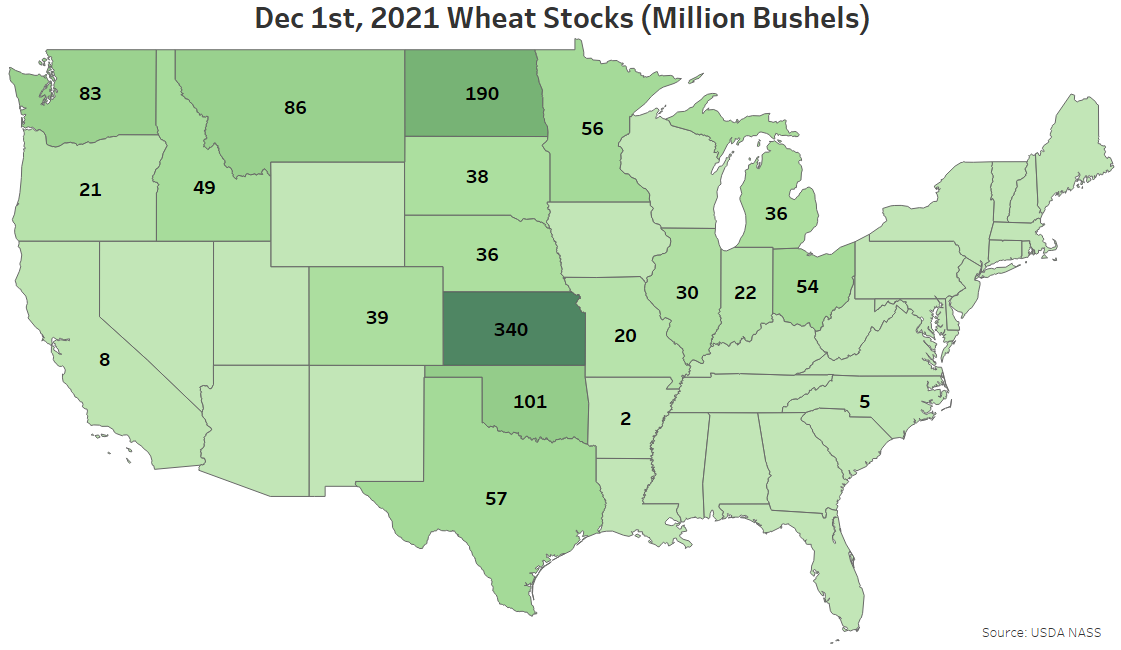

Wheat – Dec 1st Stocks Reach a 14 Year Low Seasonal Level, Finish Below Expectations

Wheat stored in all positions as of December 1st, 2021 totaled 1.39 billion bushels, finishing 18.4% below the previous year and reaching a 14 year low seasonal level. Wheat stocks finished 2.2% below average analyst estimates of 1.42 billion bushels. Stocks indicated disappearance of 390 million bushels from the previous quarter, 14.3% below the drawdown experienced during the same period last year.

Dec 1st wheat stocks were most significant within Kansas, followed by North Dakota and Oklahoma. The aforementioned states combined to account for over 45% of the total U.S. wheat stocks.

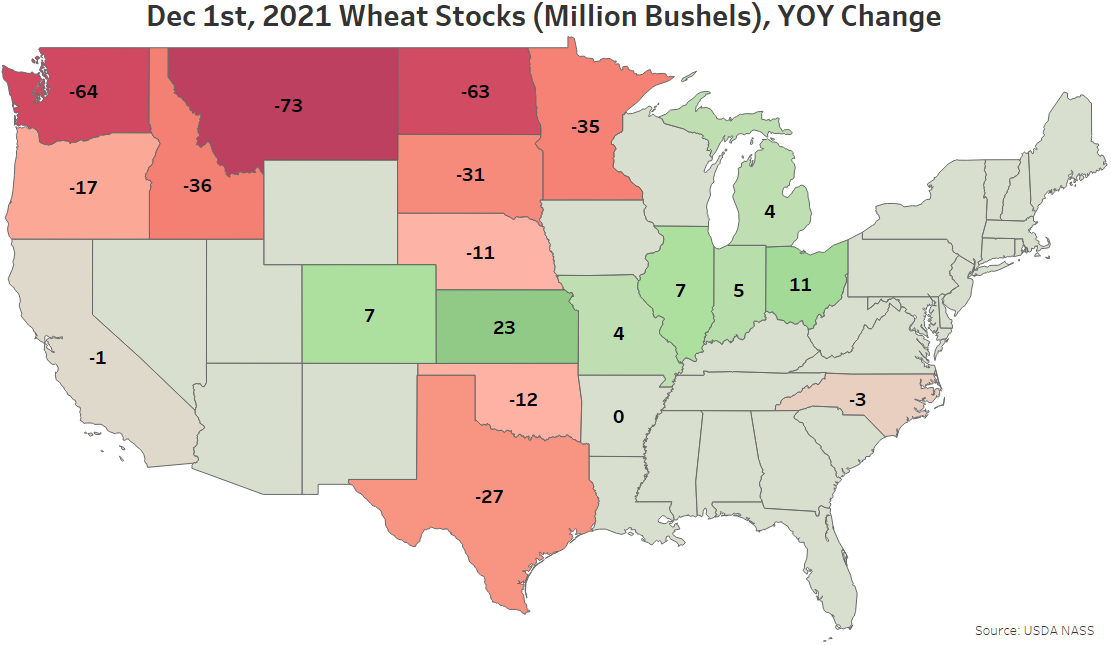

The most significant YOY decline in Dec 1st wheat stocks was experienced throughout Montana, followed by declines experienced throughout Washington and North Dakota. Kansas wheat stocks increased most significantly from previous year levels.