U.S. Dairy Cow Slaughter Update – Jan ’22

Executive Summary

U.S. dairy cow slaughter figures provided by the USDA were recently updated with values spanning through Dec ’21. Highlights from the updated report include:

- Dec ’21 U.S. dairy cow slaughter rates finished 4.1% below previous year levels when normalizing for slaughter days, reaching a five year low seasonal level.

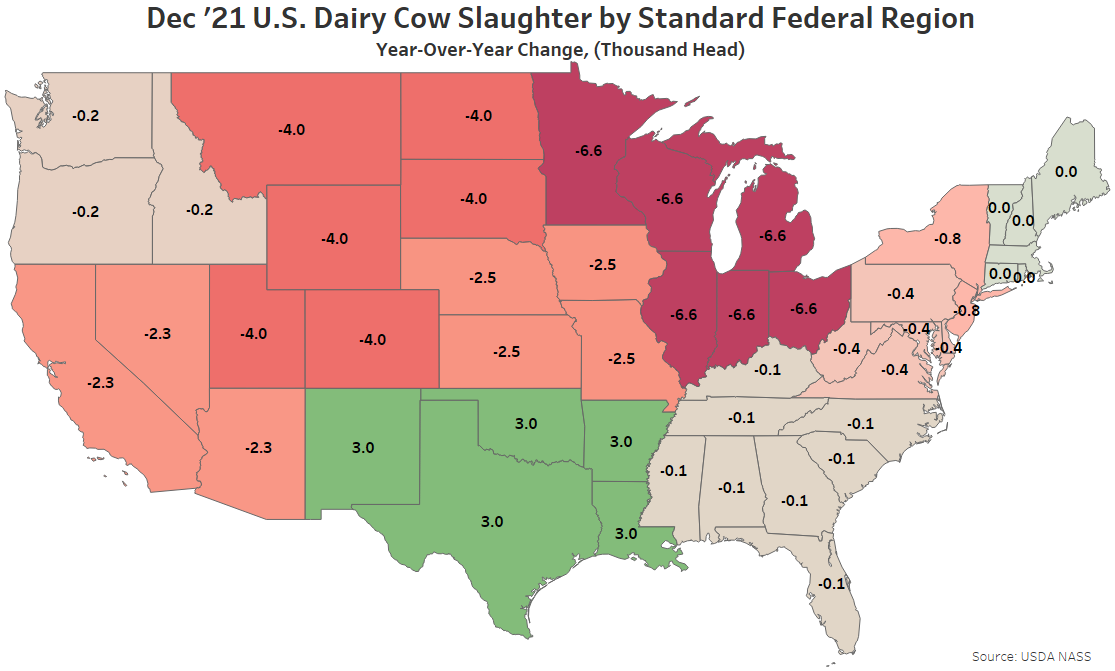

- Dec ’21 YOY declines in dairy cow slaughter rates were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin).

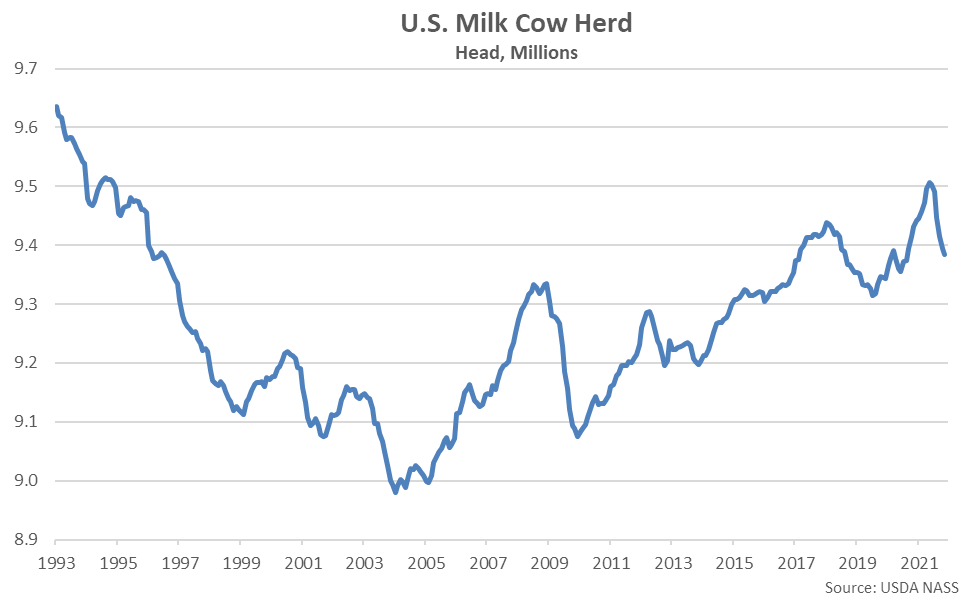

- Recent upticks in slaughter rates have contributed to the Nov ’21 U.S. milk cow herd finishing 122,000 head below recently experienced 26 year high levels, declining to a 15 month low level, overall.

Additional Report Details

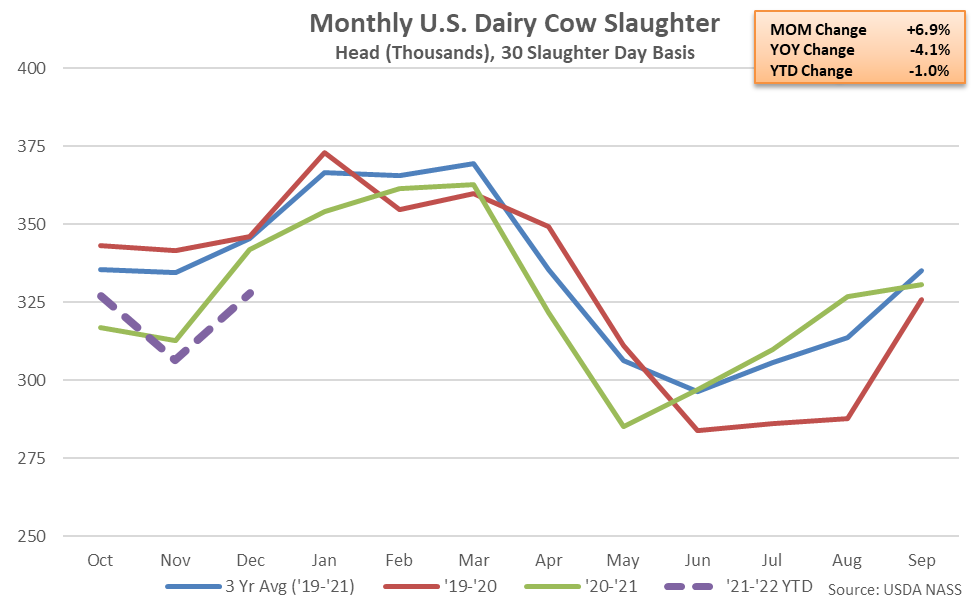

According to the USDA, Dec ’21 U.S. dairy cow slaughter rates increased seasonally from the previous month but remained 4.1% below previous year levels when normalizing for slaughter days, reaching a five year low seasonal level. The month-over-month increase in slaughter rates of 6.9% was larger than the ten year average November – December seasonal build of 1.9%.

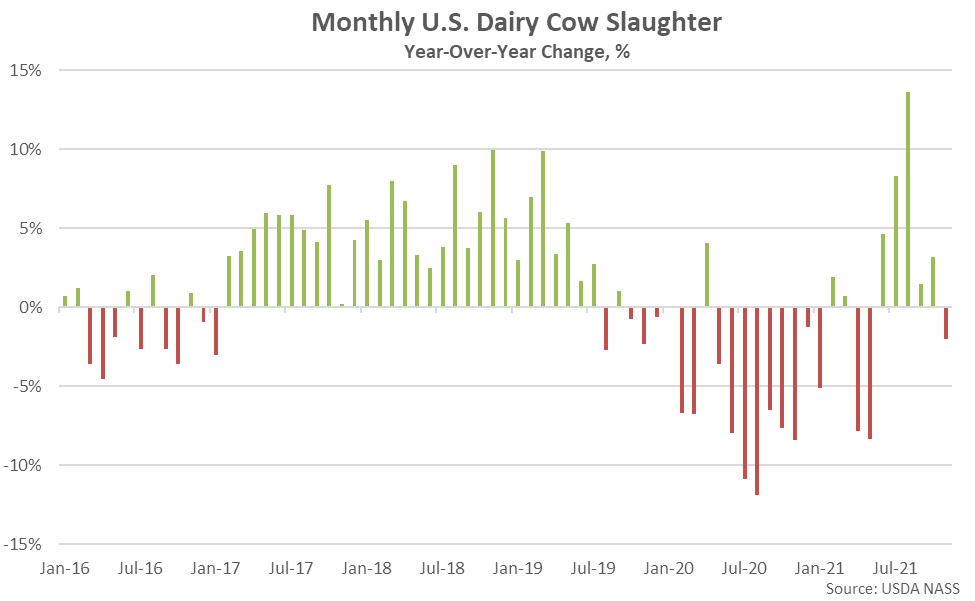

Dairy cow slaughter rates had finished higher on a YOY basis over 30 consecutive months through Jul ’19 prior to finishing flat or lower throughout 18 of 22 months through May ’21. More recently, dairy cow slaughter rates had finished higher on a YOY basis over five consecutive months through Oct ’21, prior to finishing below previous year levels throughout the two most recent months of available data.

’20-’21 annual U.S. dairy cow slaughter rates finished 1.0% below previous year levels, reaching a four year low annual level. ’21-’22 YTD slaughter rates have declined by an additional 1.0% on a YOY basis throughout the first quarter of the production season.

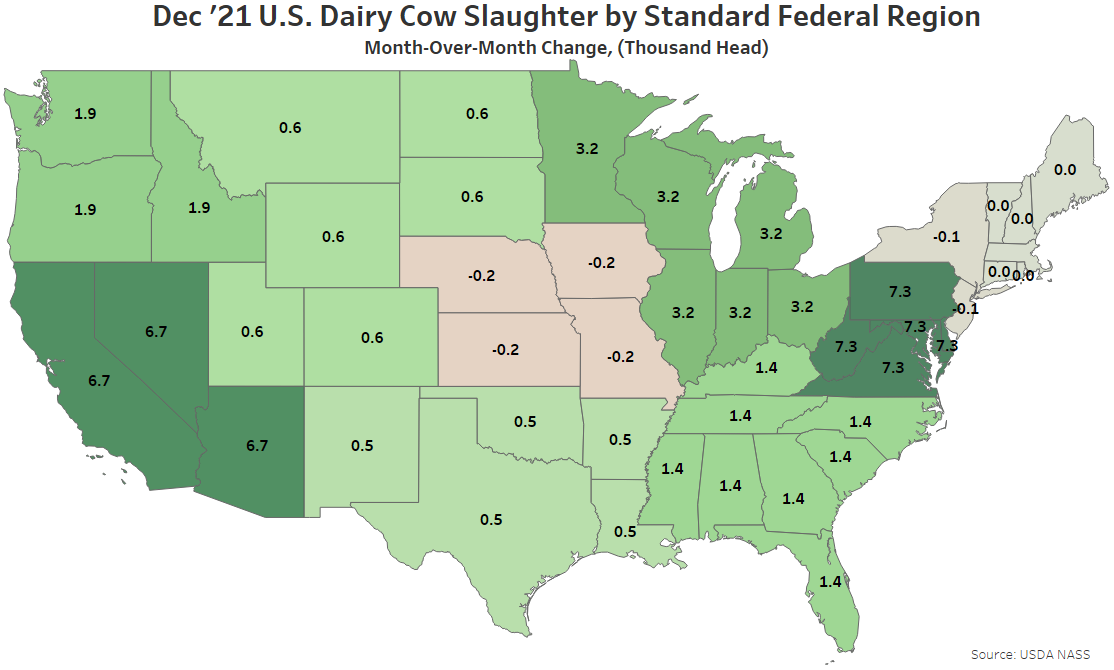

Month-over-month increases in dairy cow slaughter rates were most significant throughout Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia), followed by Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

YOY declines in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), while increases were largest throughout Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas).

The U.S. milk cow herd expanded significantly throughout the first half of 2021, aided by reduced slaughter rates. More recently, the U.S. milk cow herd has declined 122,000 head from the 26 year high level experienced throughout the month of May, reaching a 15 month low level during Nov ’21.

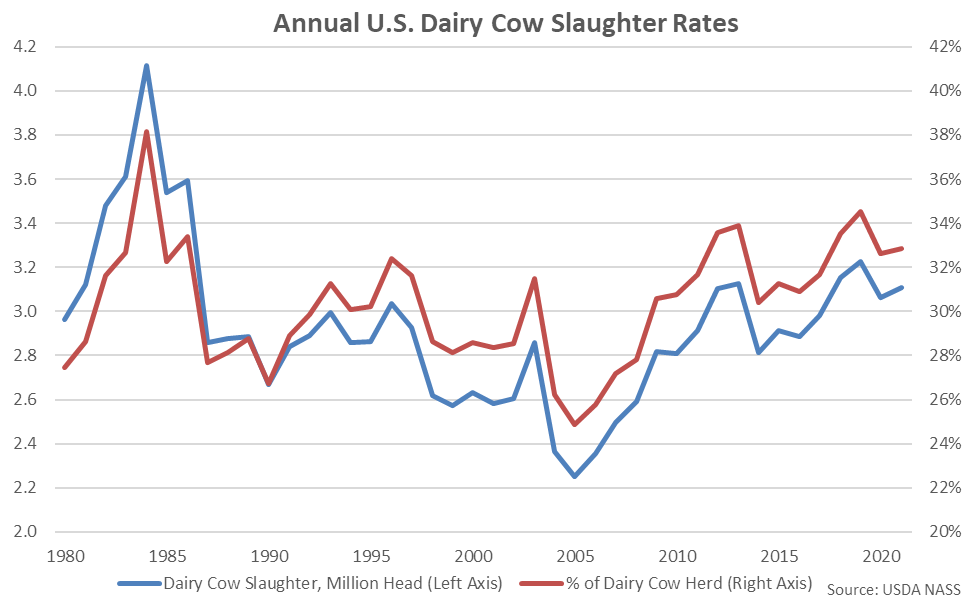

2019 annual dairy cow slaughter rates increased 2.3% on a YOY basis, reaching a 33 year high level and a 35 year high level on a percentage of the total dairy cow herd basis. Dairy cow slaughter rates declined 5.6% on a YOY basis throughout 2020 prior to rebounding by 0.2% throughout 2021.