U.S. Dairy Cow Inventory Update – Jan ’22

U.S. Dairy Cow Inventory Update – Jan ’22

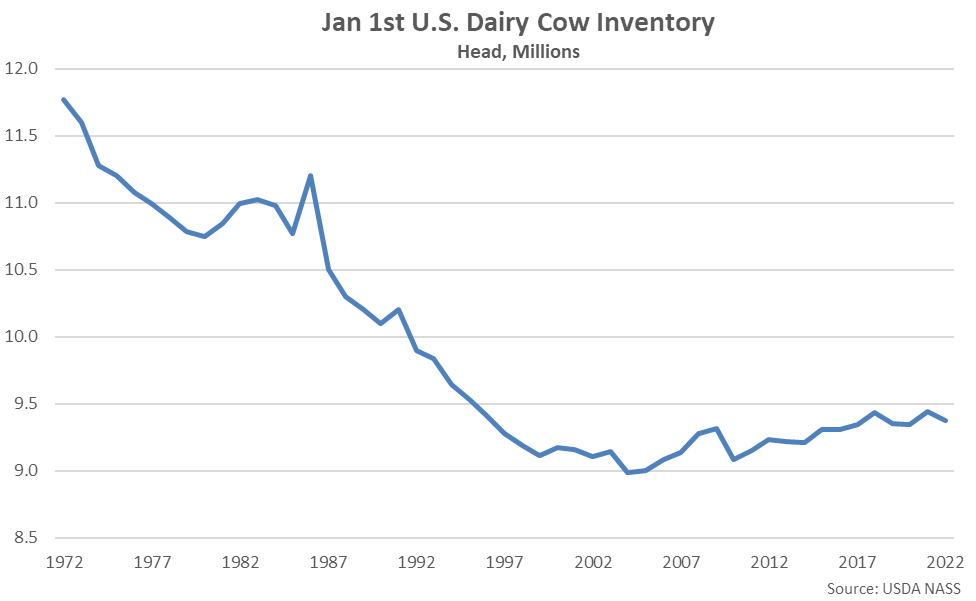

According to USDA’s semiannual cattle inventory report, the U.S. dairy cow herd declined from recently experienced 26 year high levels. The report showed that as of January 1st, 2022, the total U.S. dairy cow herd stood at 9.375 million head, down 67,400 head, or 0.7%, from the 26 year high level experienced throughout the previous year.

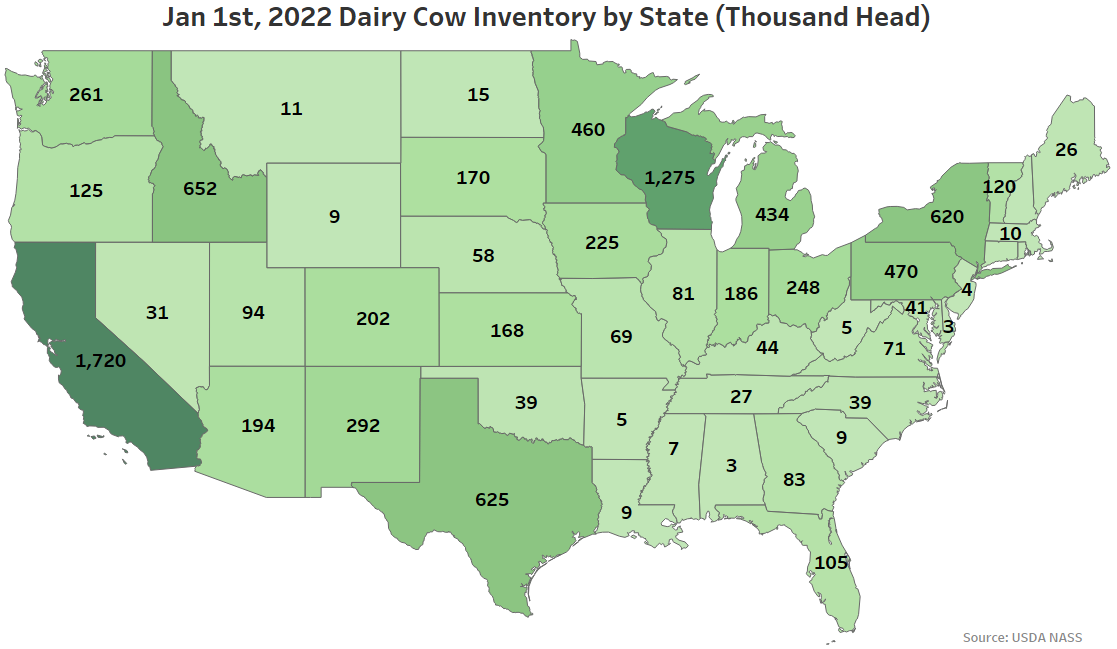

California had the largest dairy cow herd as of January 1st, 2022, followed by Wisconsin, Idaho, Texas and New York. The aforementioned states accounted for over half of the total national dairy cow herd.

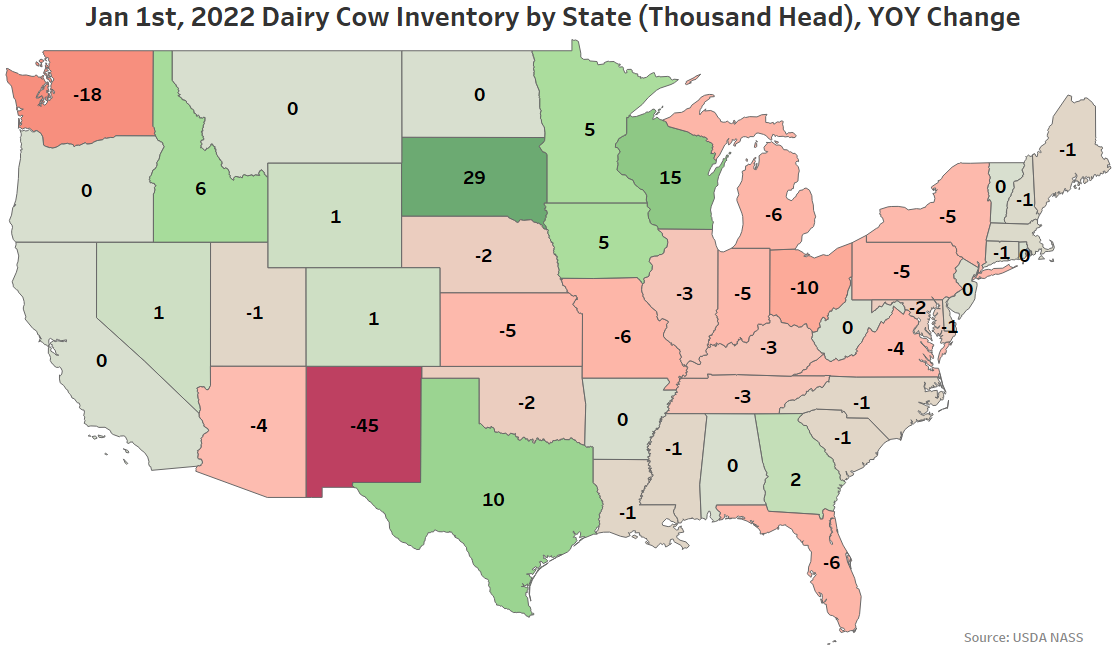

YOY declines in dairy cow herd figures were led by New Mexico (-45,000 head), followed by Washington (-18,000 head) and Ohio (-10,000 head). South Dakota (+29,000 head), Wisconsin (+15,000 head) and Texas (+10,000 head) experienced the largest increases in their dairy cow herds throughout the year.

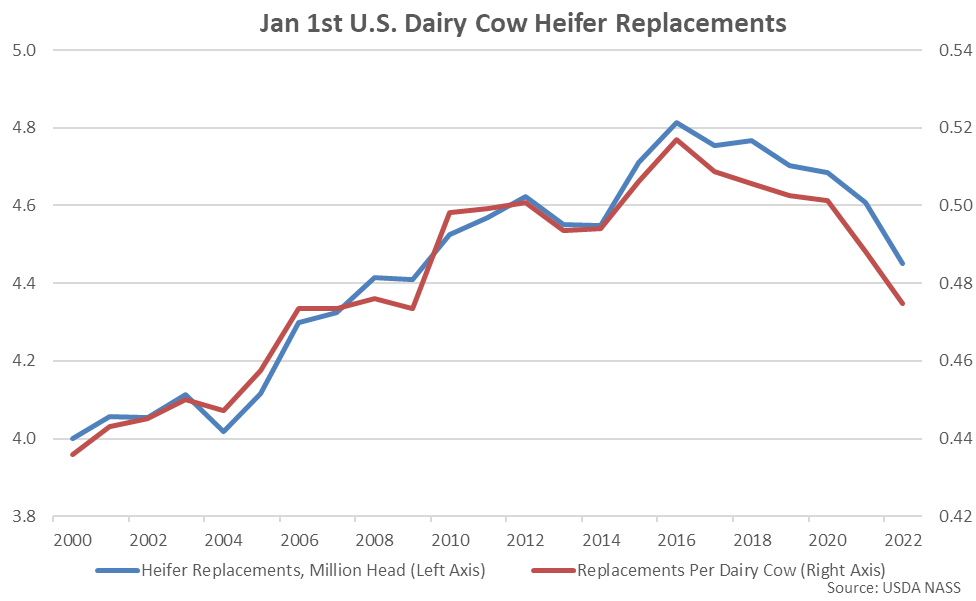

Dairy heifer replacements continued to decline, reaching a 13 year low level as of Jan ’22. Total dairy heifer replacements of 4.45 million head declined 157,900 head, of 3.4%, from the previous year. The YOY decline in dairy heifer replacements was the fourth experienced in a row. On a heifer replacement per dairy cow basis, the Jan ’22 figure of 0.475 also reached a 13 year low level.

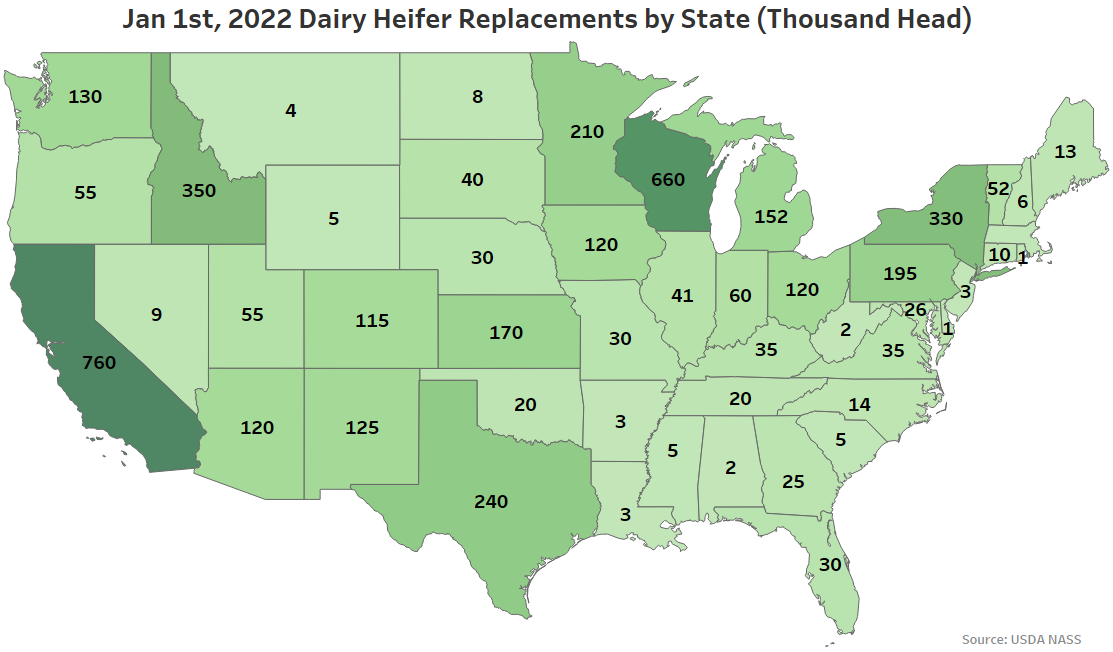

California had the largest number of dairy heifer replacements as of January 1st, 2022, followed by Wisconsin, Idaho, New York and Texas. The aforementioned states accounted for over half of the total national dairy heifer replacements.

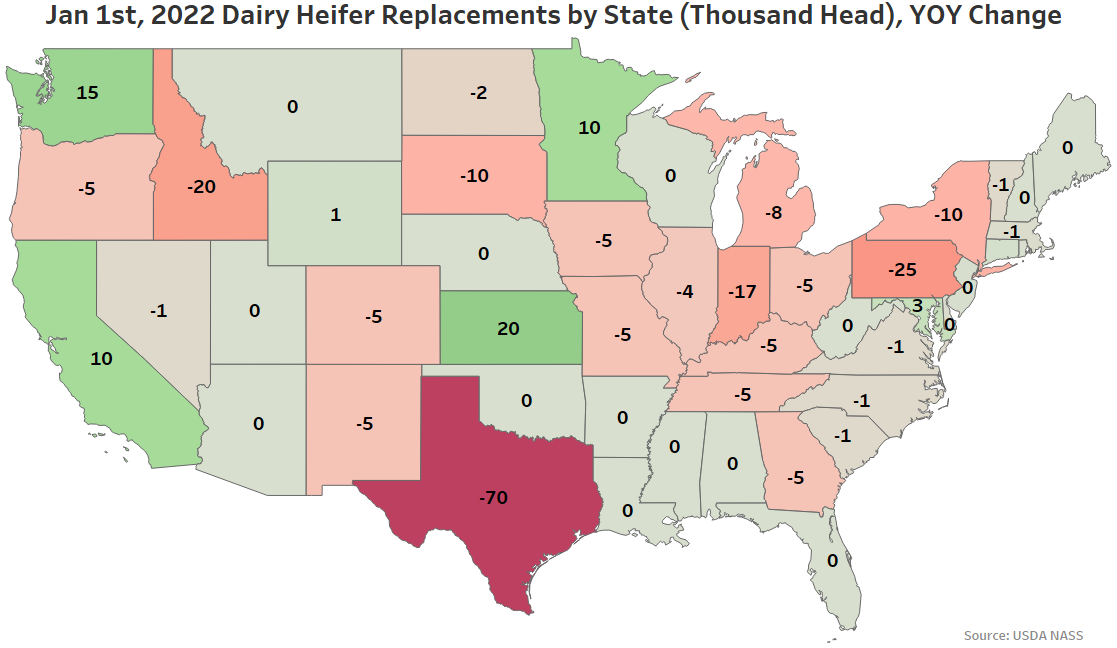

YOY declines in dairy heifer replacements were most significant within Texas (-70,000 head), followed by Pennsylvania (-25,000 head) and Idaho (-20,000 head). Kansas (+20,000 head) and Washington (+15,000 head) experienced the largest increases in dairy heifer replacements throughout the year.

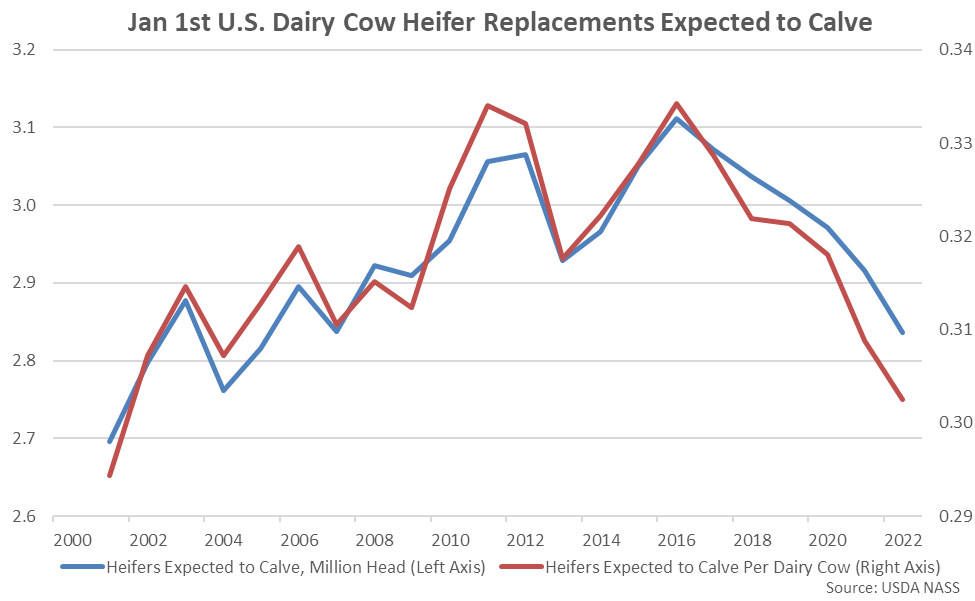

Dairy heifer replacements expected to calve declined to a 17 year low level as of Jan ’22. Total dairy heifer replacements expected to calve of 2.84 million head declined 79,700 head, or 2.7%, from the previous year. The YOY decline in dairy heifer replacements expected to calve was the sixth experienced in a row and the largest experienced throughout the past nine years on a percentage basis. On a heifer replacement expected to calve per dairy cow basis, the Jan ’22 figure of 0.303 declined to a 21 year low level.