U.S. Dairy Dry Product Stocks Update – Feb ’22

Executive Summary

U.S. dairy dry product stock figures provided by the USDA were recently updated with values spanning through Dec ’21. Highlights from the updated report include:

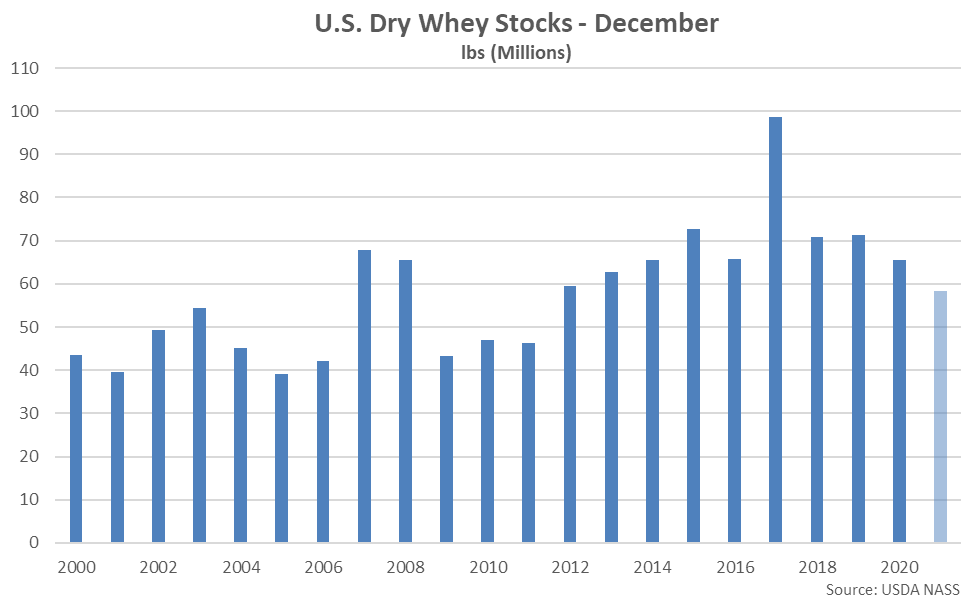

- U.S. dry whey stocks remained lower on a YOY basis for the 15th time in the past 16 months throughout Dec ’21, finishing 11.2% below previous year figures and reaching a ten year low seasonal level.

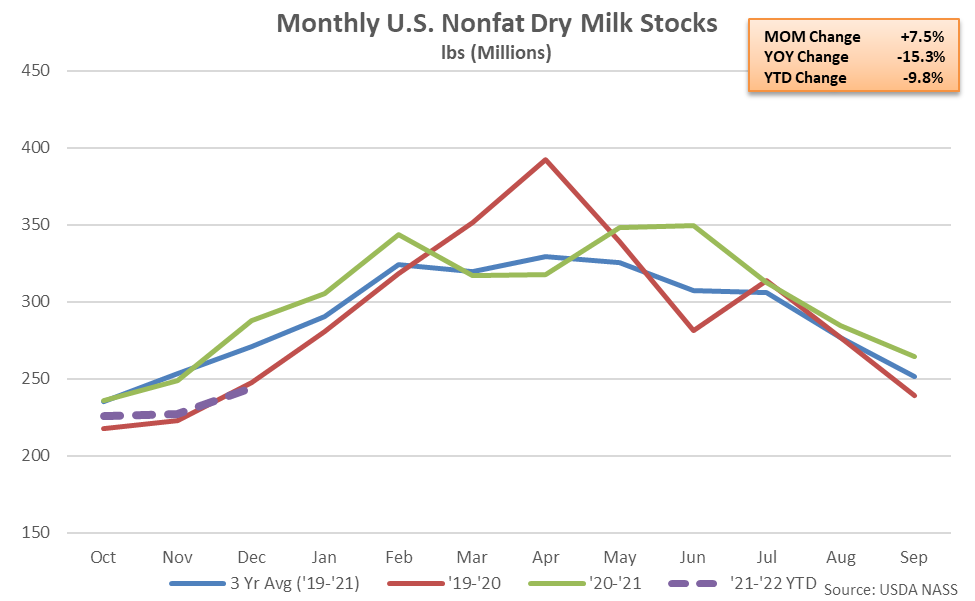

- Dec ’21 U.S. nonfat dry milk stocks increased seasonally to a three month high level but remained 15.3% below previous year levels, reaching a five year low seasonal level.

Additional Report Details

Dry Whey – Stocks Reach a Ten Year Low Seasonal Level, Down 11.2% YOY

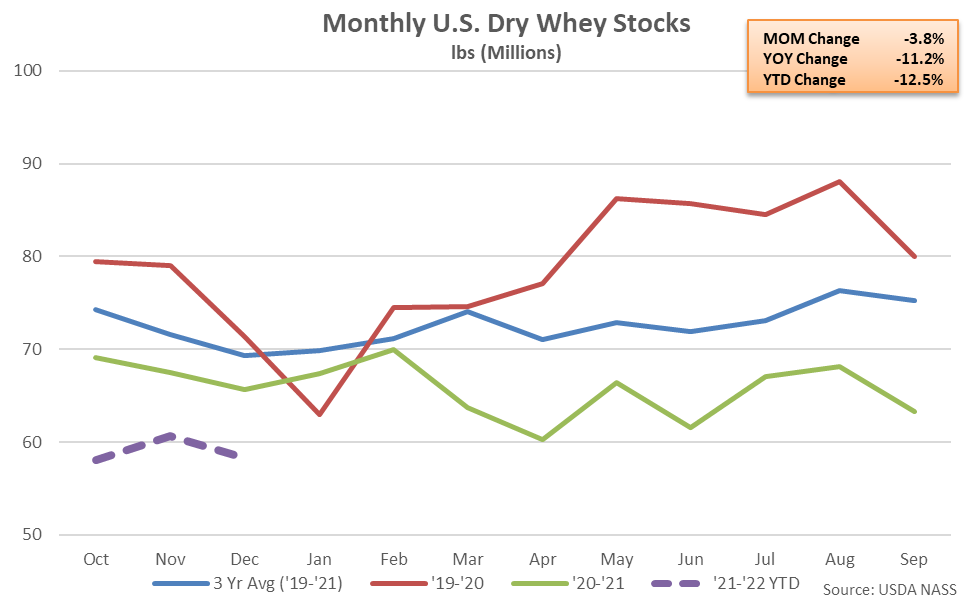

According to the USDA, Dec ’21 month-end dry whey stocks declined contraseasonally from the previous month while finishing 11.2% below previous year levels, reaching a ten year low seasonal level for the month of December. Dry whey stocks have remained below previous year levels over 15 of 16 months through Dec ’21.

The month-over-month decline in dry whey stocks of 2.3 million pounds, or 3.8%, was a contraseasonal move when compared to the ten year average November – December seasonal build in dry whey stocks of 3.1 million pounds, or 7.3%. Dry whey production declined 5.0% on a YOY basis throughout Dec ’21, finishing below previous year levels for the first time in the past three months.

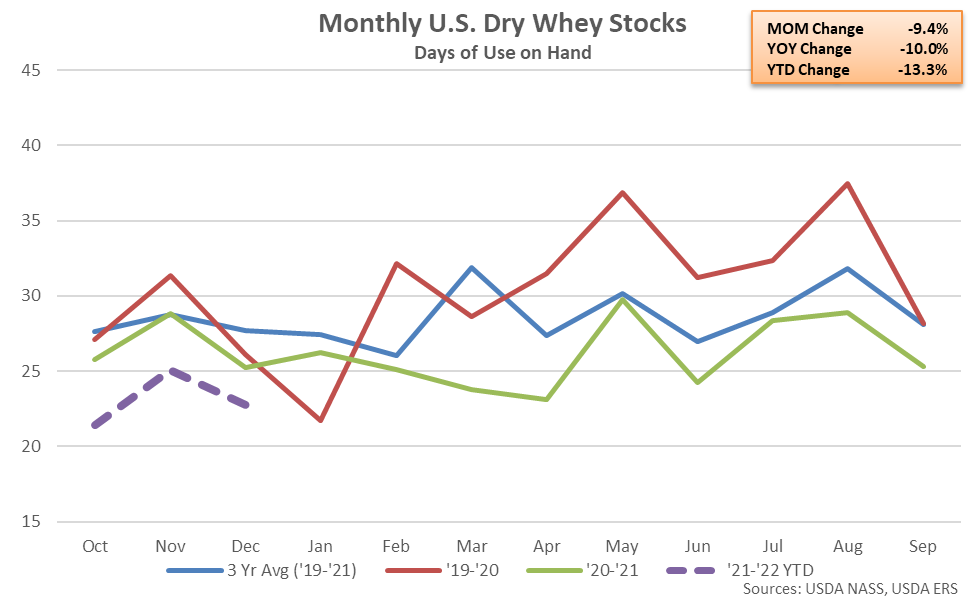

On a days of usage basis, Dec ’21 U.S. dry whey stocks also remained lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of December, dry whey stocks on a days of usage basis finished 10.0% below previous year levels, declining on a YOY basis for the 15th time in the past 16 months and reaching an eight year low seasonal level.

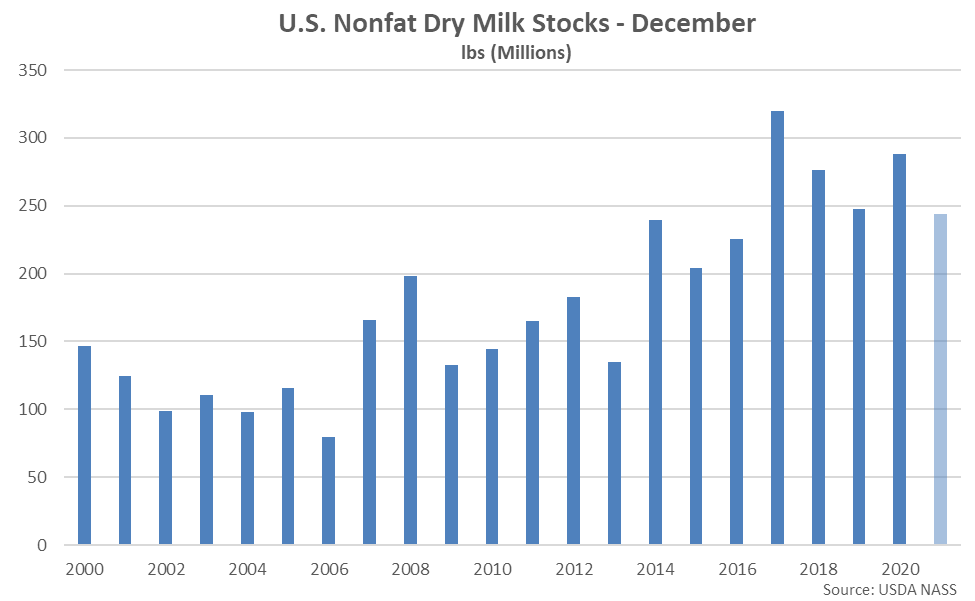

Nonfat Dry Milk – Stocks Reach a Five Year Low Seasonal Level, Down 15.3% YOY

Dec ’21 month-end nonfat dry milk (NFDM) stocks increased seasonally to a three month high level but remained 15.3% below previous year levels, reaching a five year low seasonal level. The YOY decline in NFDM stocks was the third experienced in a row and the largest experienced throughout the past eight months on a percentage basis.

The month-over-month increase in NFDM stocks of 17.1 million pounds, or 7.5%, was slightly smaller than the ten year average November – December seasonal build in stocks of 18.6 million pounds, or 11.5%. Previous month NFDM stock levels were revised 15.4% above previously stated levels. NFDM production declined 20.1% on a YOY basis throughout Dec ’21, finishing below previous year levels for the fifth time in the past six months.

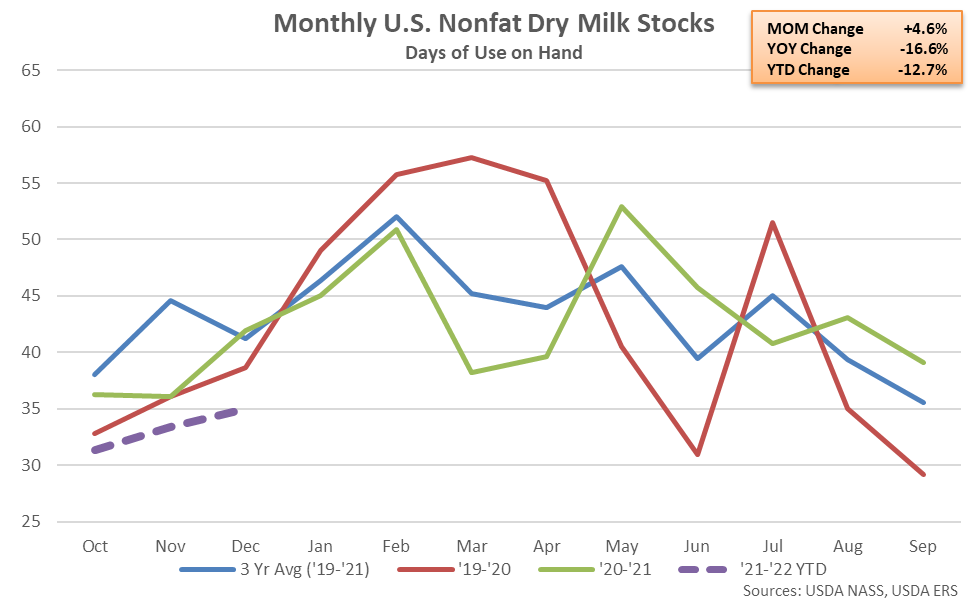

On a days of usage basis, Dec ’21 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of December, NFDM stocks on a days of usage basis finished 16.6% below previous year figures, declining on a YOY basis for the third consecutive month and reaching a six year low seasonal level.

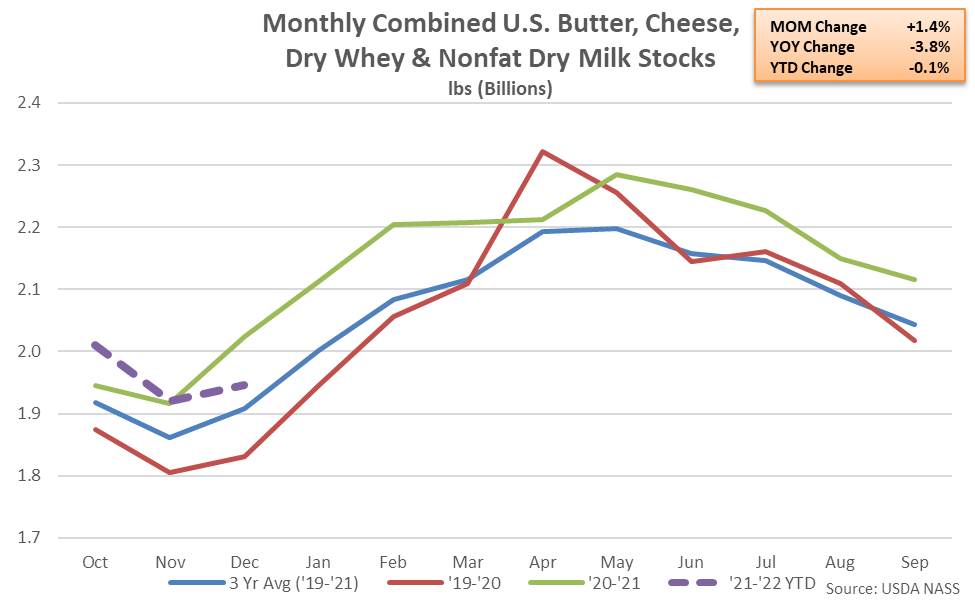

Combined Dairy Product Stocks – Stocks Finish Lower YOY for the First Time in Eight Months

Combined stocks of butter, cheese, dry whey and NFDM finished 3.8% below previous year levels throughout Dec ’21, declining on a YOY basis for the first time in the past eight months. A 21.1% YOY decline in Class IV milk product (butter and nonfat dry milk) stock volumes more than offset a 2.8% YOY increase in Class III milk product (cheese & dry whey) stock volumes throughout the month.