Soybean Complex Price & Value Update – Mar ’22

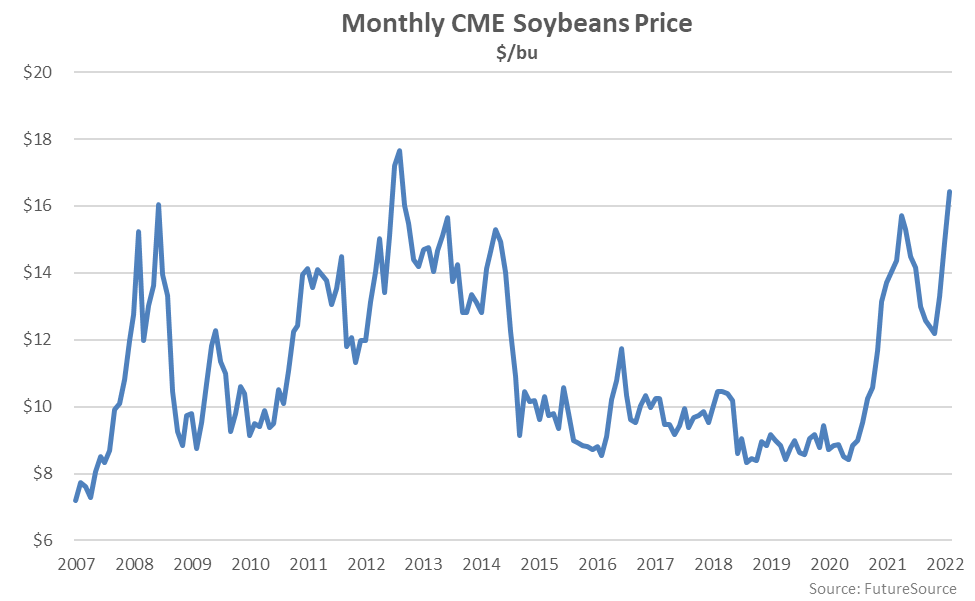

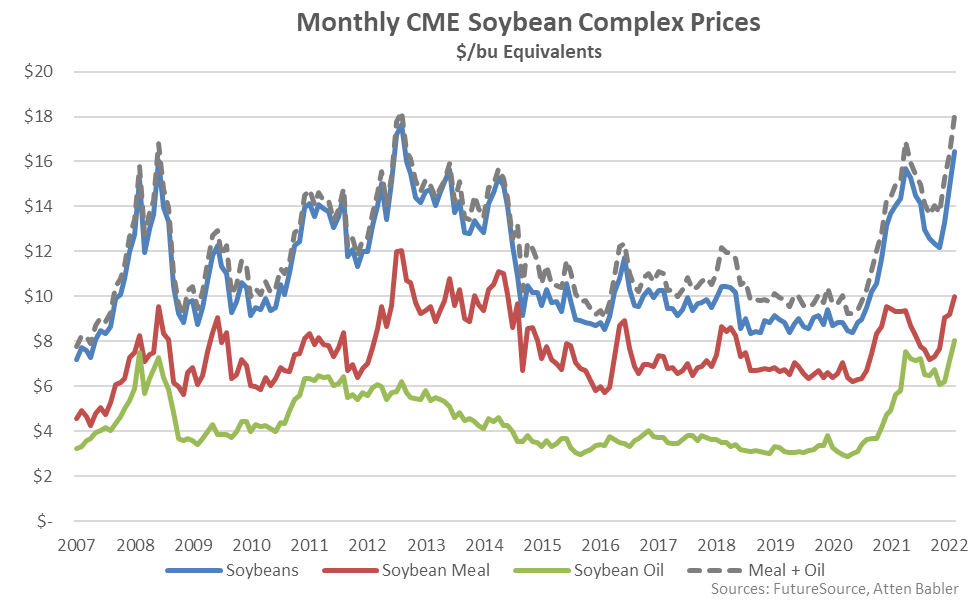

Feb ’22 CME Soybean Prices Reached a Nine and a Half Year High Level

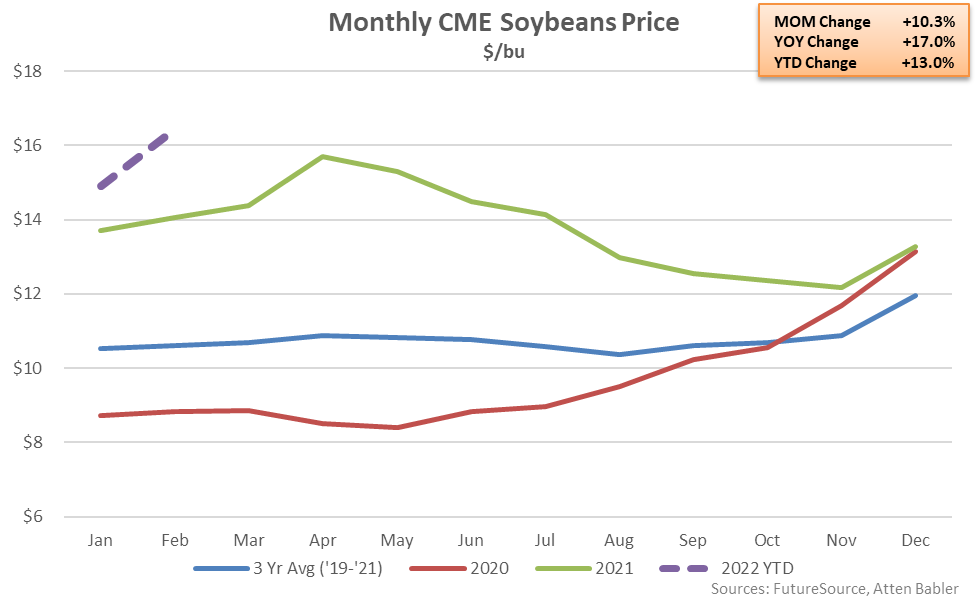

Feb ’22 CME Soybean Prices Increased 10.3% MOM While Finishing 17.0% Higher YOY

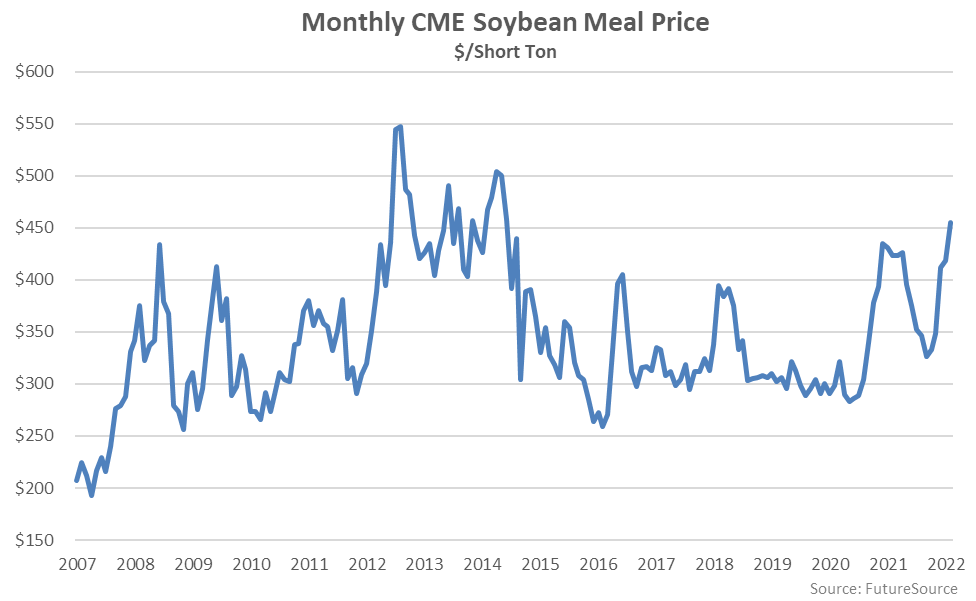

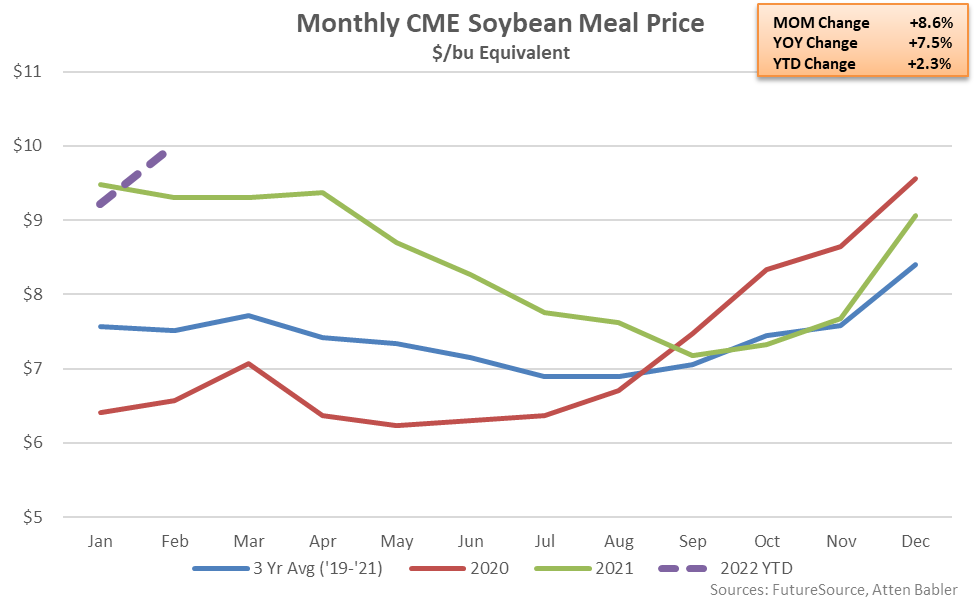

Feb ’22 CME Soybean Meal Prices Reached a Seven and a Half Year High Level

Feb ’22 CME Soybean Meal Prices Increased 8.6% MOM While Finishing 7.5% Higher YOY

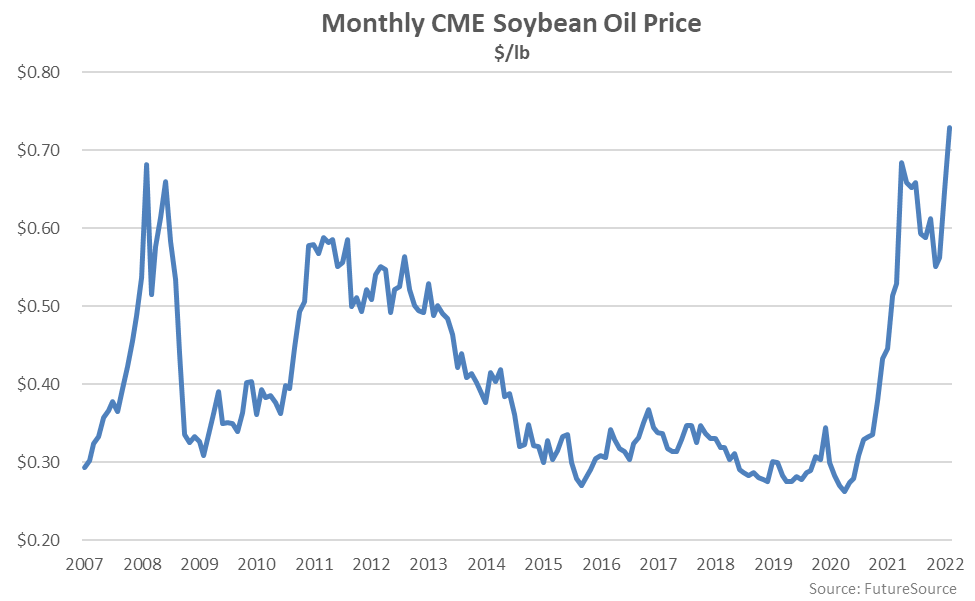

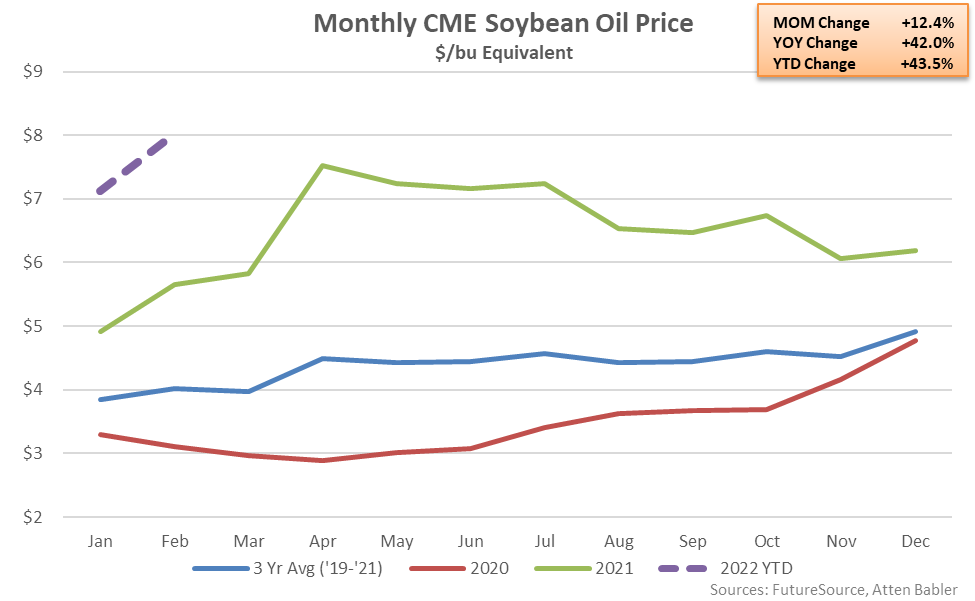

Feb ’22 CME Soybean Oil Prices Reached a Record High Level

Feb ’22 CME Soybean Oil Prices Increased 12.4% MOM While Finishing 42.0% Higher YOY

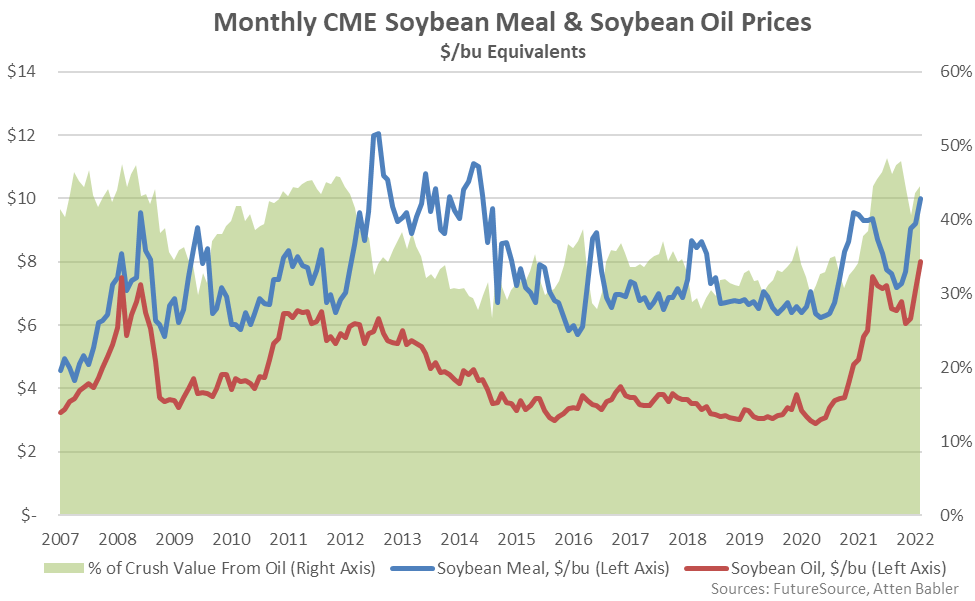

The Feb ’22 Oil Percentage of Crush Value of 44.5% Rebounded to a Four Month High Level

Feb ’22 Meal + Oil Prices Finished at a $18.03/bu Eq, Compared to a Bean Price of $16.44

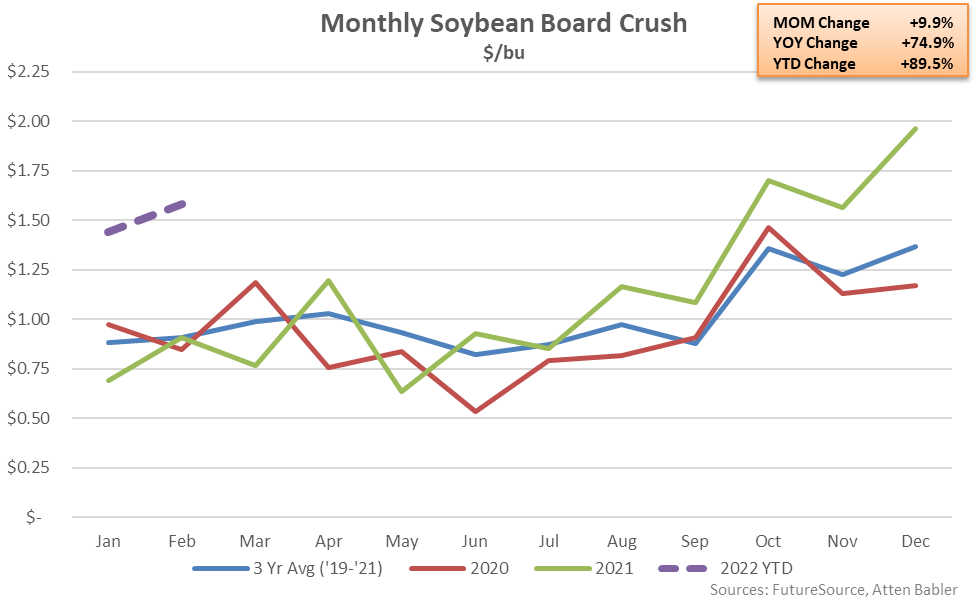

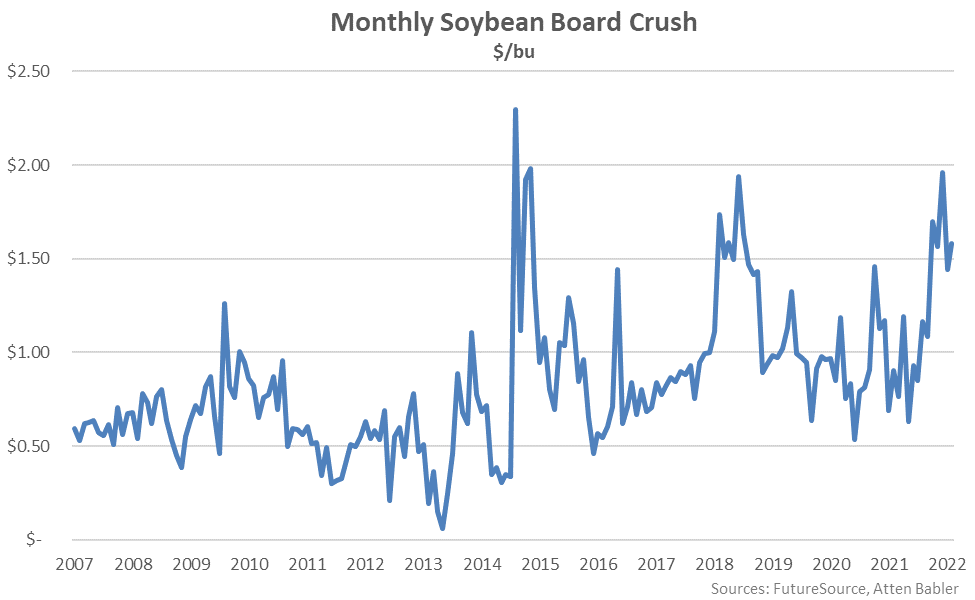

Feb ’22 Soybean Board Crush Rebounded From the Previous Month

Feb ’22 Soybean Board Crush Increased 9.9% MOM While Finishing 74.9% Higher YOY