U.S. Oil Rig Count Update – 3/16/22

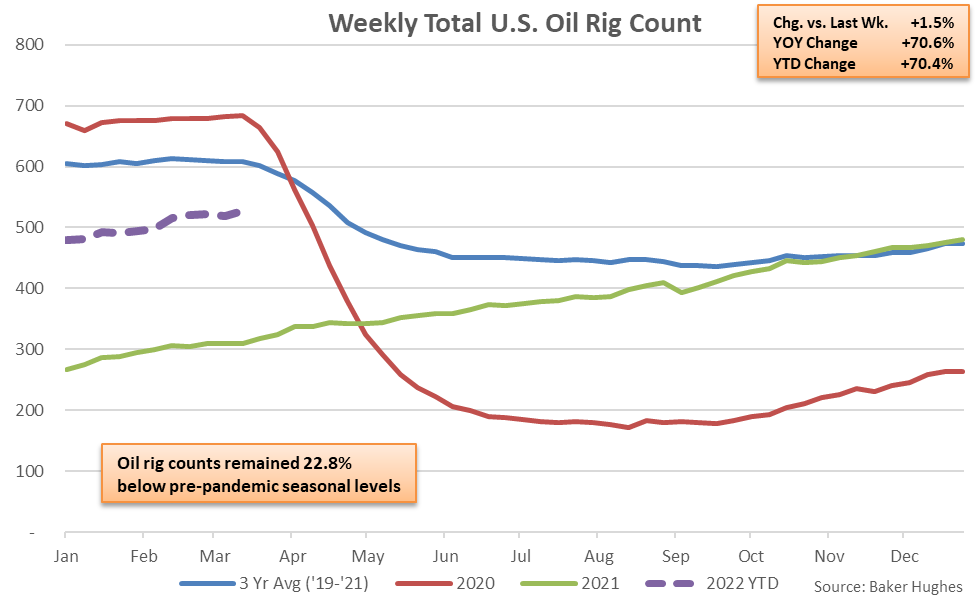

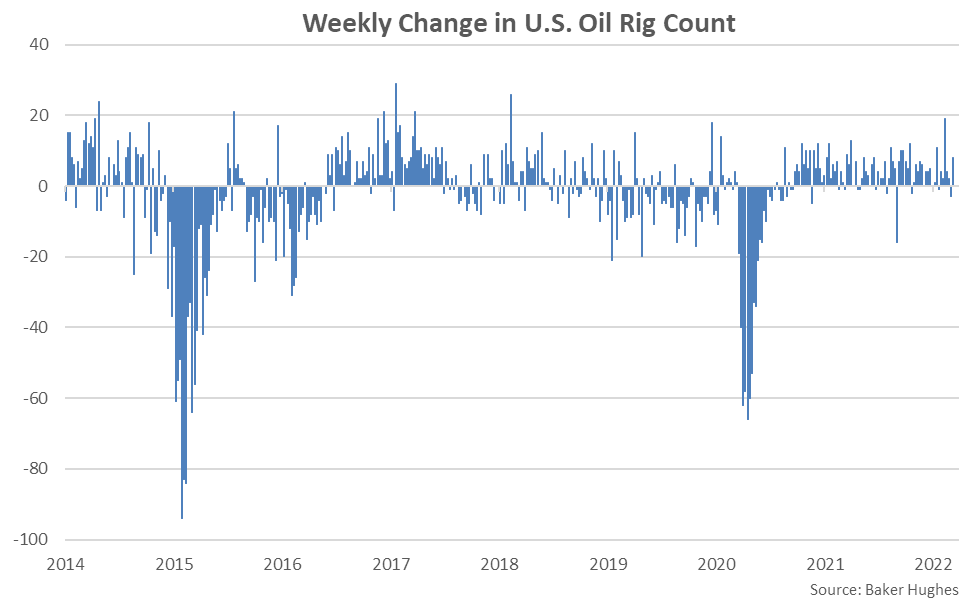

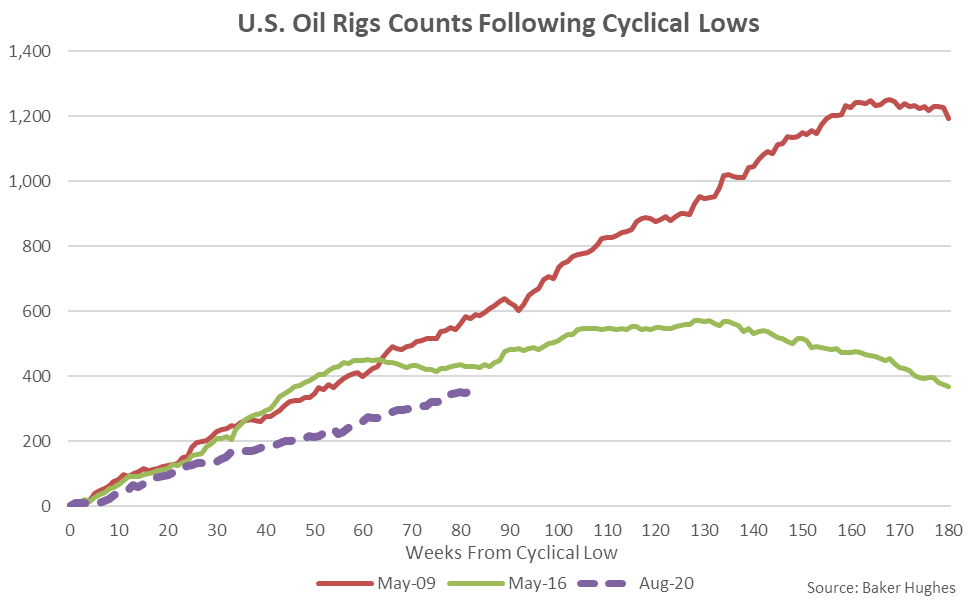

According to Baker Hughes, U.S. oil rig counts reached a 23 month high level during the week ending Mar 11th. Mar 11th week ending oil rig counts increased 1.5% from the previous week while finishing 70.6% above previous year levels. Oil rig counts remained 22.8% below pre-pandemic seasonal levels and 40.7% below the three and a half year high levels experienced during November of 2018, however. The current rebound in oil rig counts has been slower than rebounds from cyclical lows experienced throughout both 2009 and 2016.

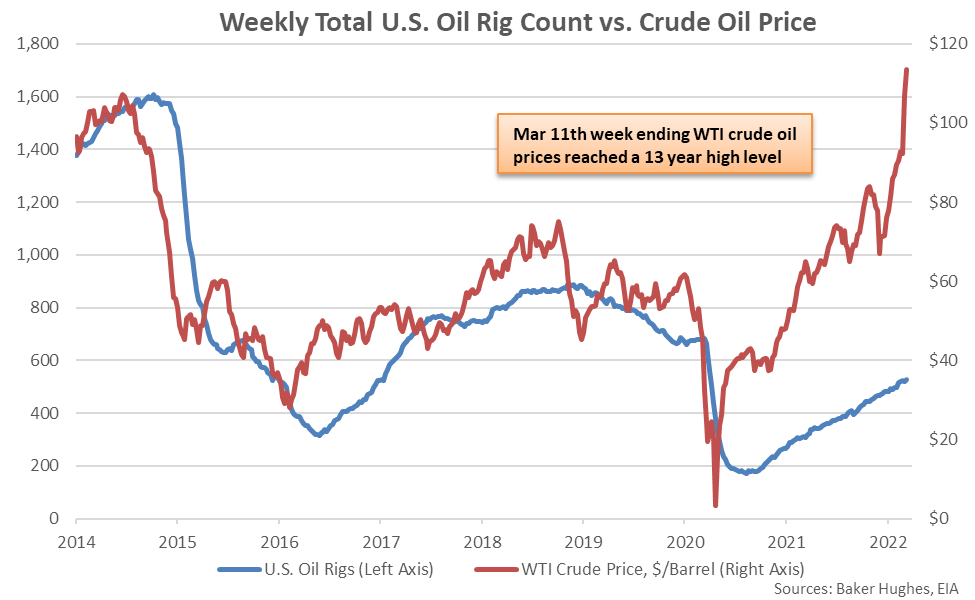

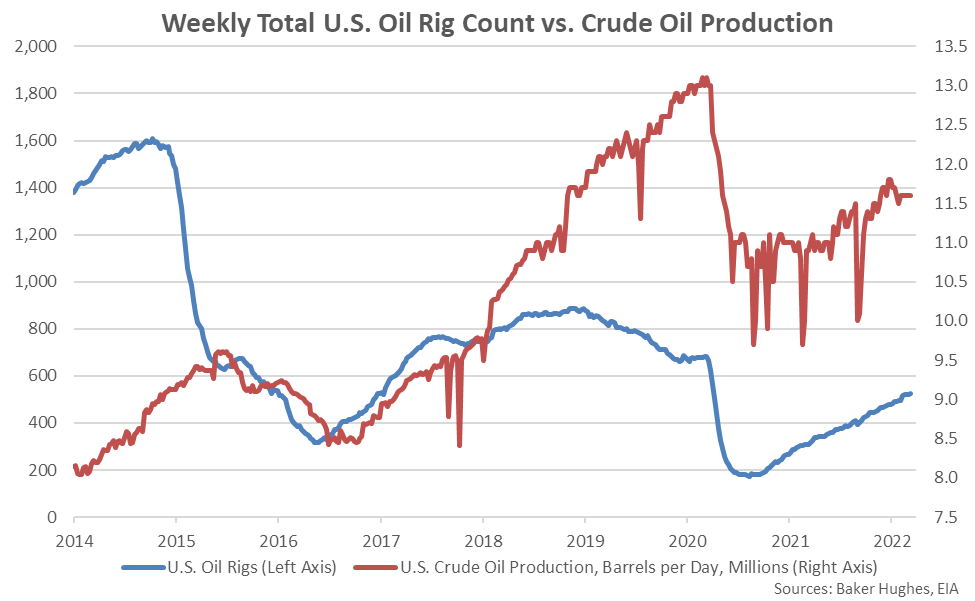

Oil rig counts declined sharply throughout the first half of 2020 in response to lower WTI crude oil prices. WTI crude oil prices rebounded to a 13 year level throughout the week ending Mar 11th, however.

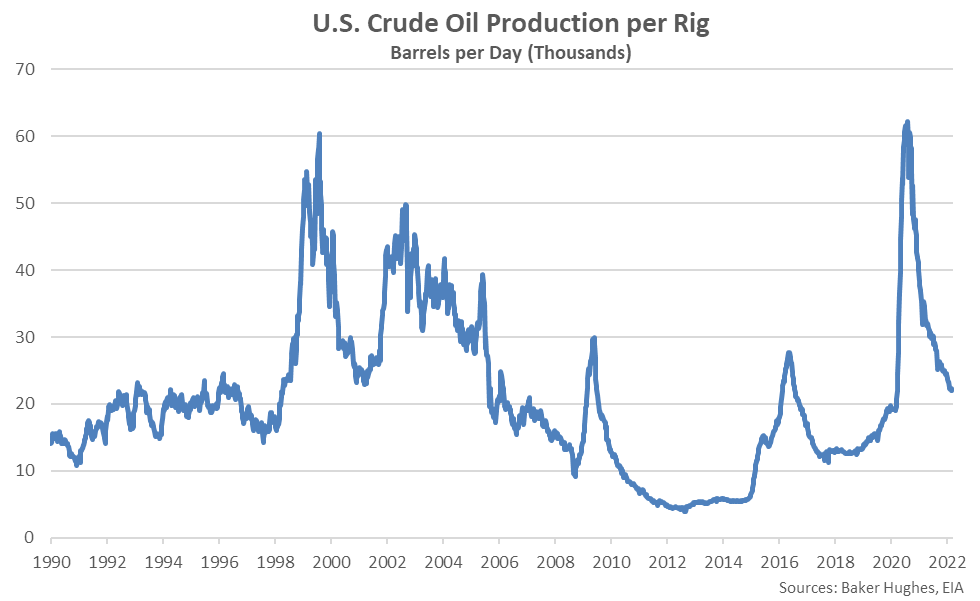

Crude oil production volumes reached a 15 month high level during the final week of Aug ’21, prior to returning to a six month low level during the first week of Sep ’21, a result of declines associated with Hurricane Ida. Crude oil production levels rebounded to 20 month high level throughout Dec ’21 prior to returning to a two month low level throughout the final week of Jan ’22. Mar 11th oil production remained near the recently experienced two month low levels while oil production per rig declined to a 23 month low.

Mar 11th Oil Rig Counts Increased 1.5% Week-Over-Week While Finishing 70.6% Higher YOY

Oil Rig Counts Have Finished Flat to Higher Over 39 of the Past 45 Weeks Through Mar 11th

Oil Rig Counts Followed Crude Oil Prices Lower Prior to Rebounding Throughout 2021

The Current Rebound in U.S. Oil Rig Counts Remains Slower Than Previous Cycles

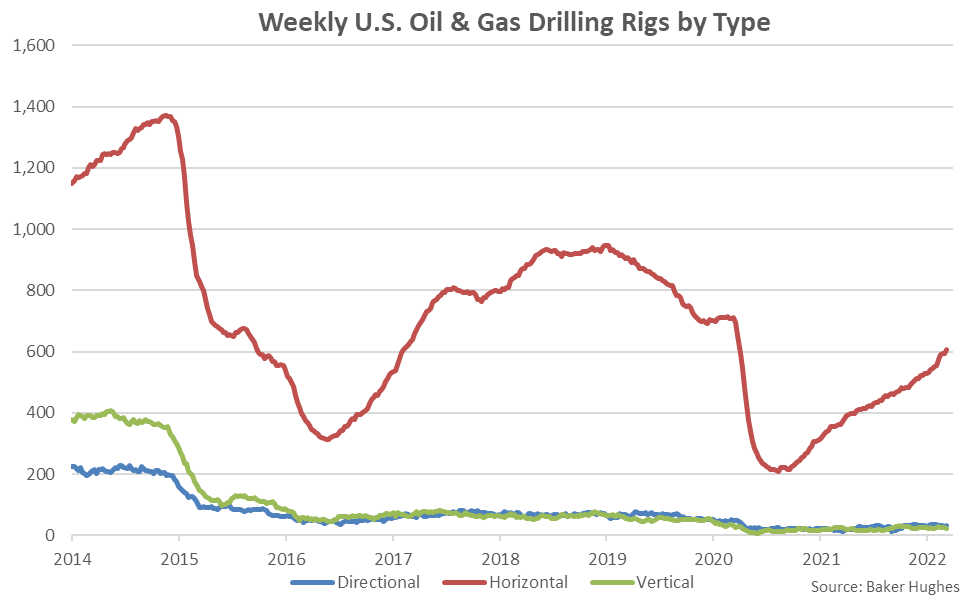

Horizontal Rigs Have Accounted for 95% of the Rebound in Total Rigs Since Aug ’20

Mar 11th Crude Oil Production Volumes Remained Near Recent Two Month Low Levels

Mar 11th Crude Oil Production per Rig Declined to a 23 Month Low Level