Crop Progress Update – 6/13/22

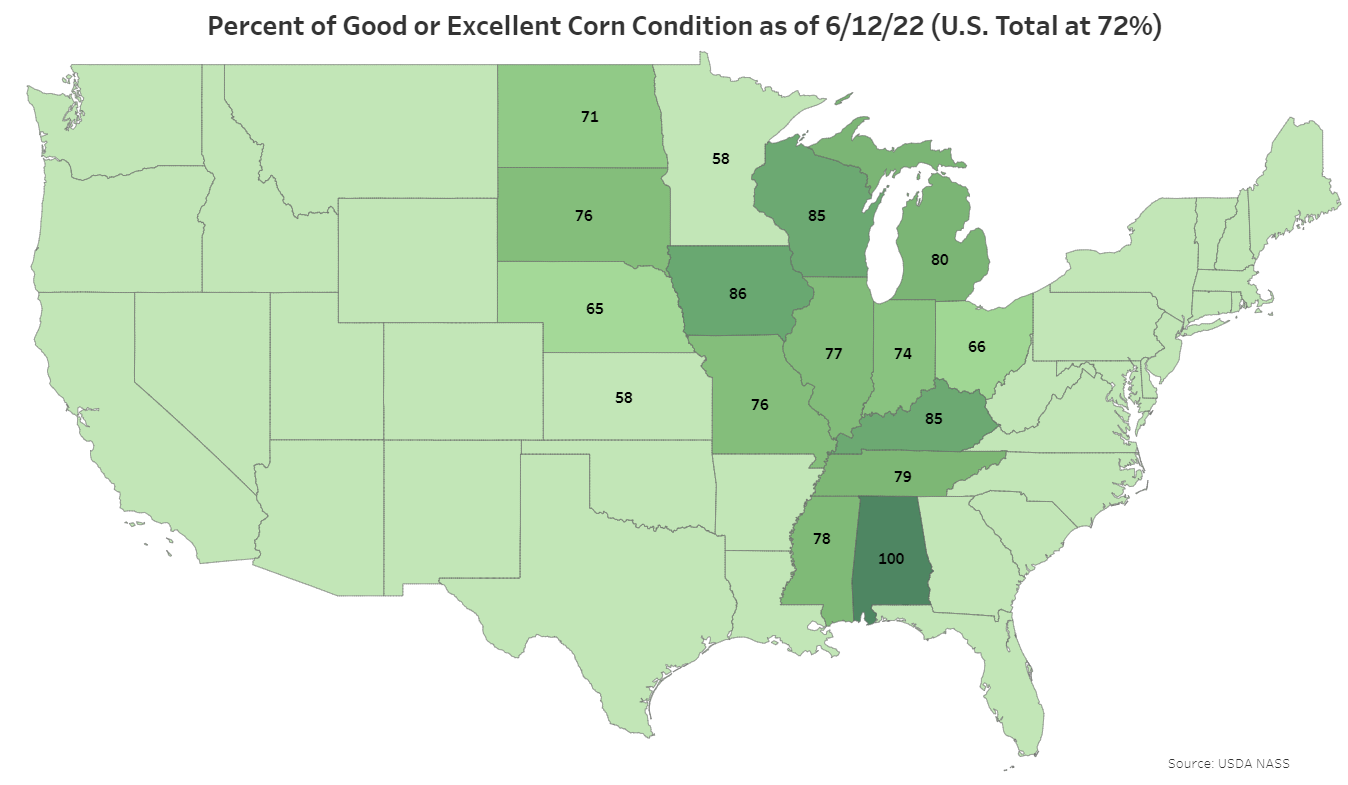

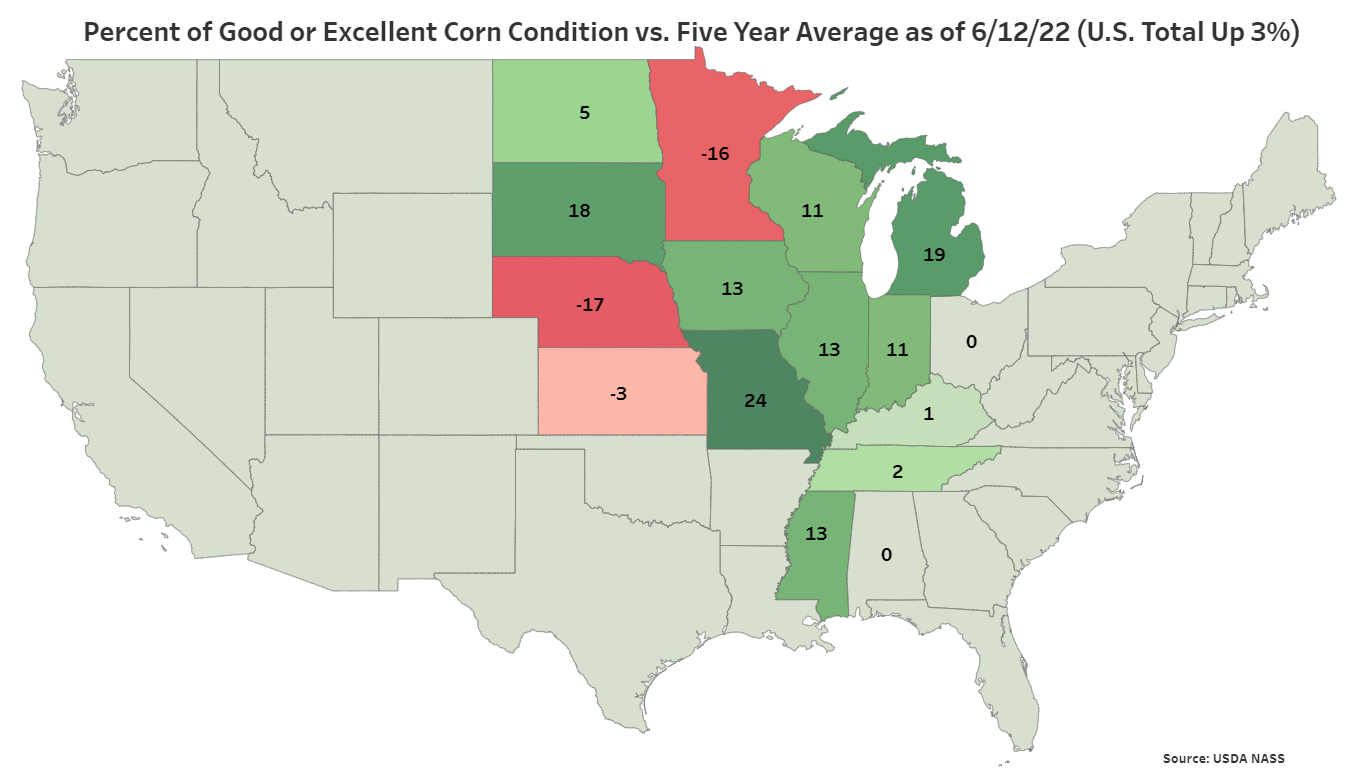

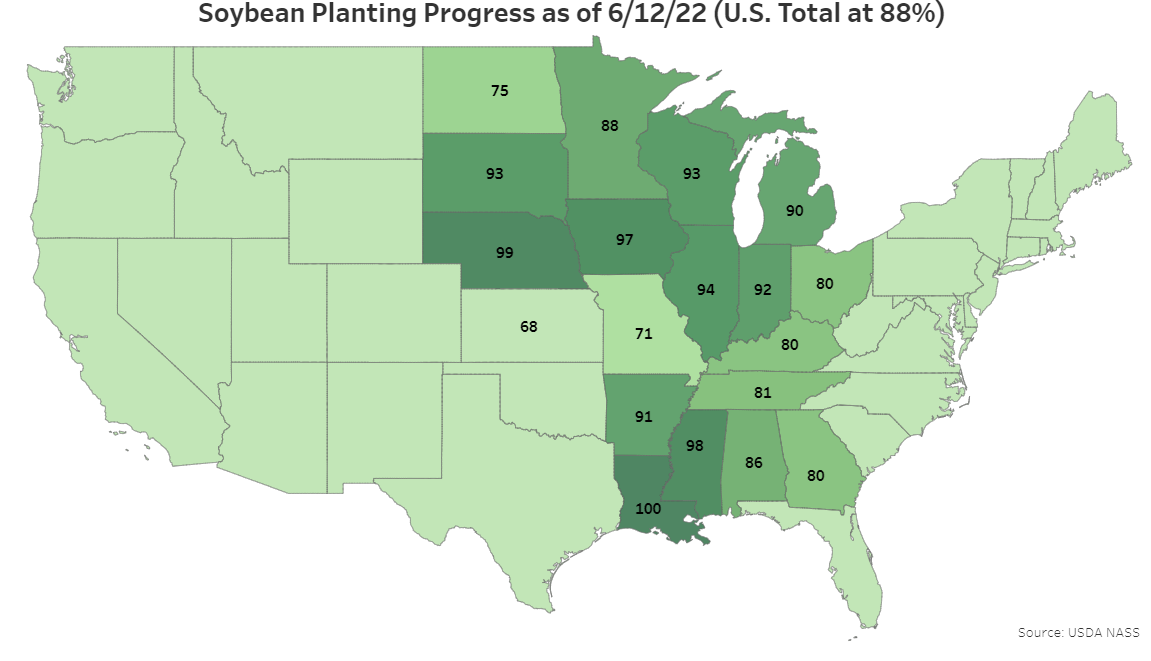

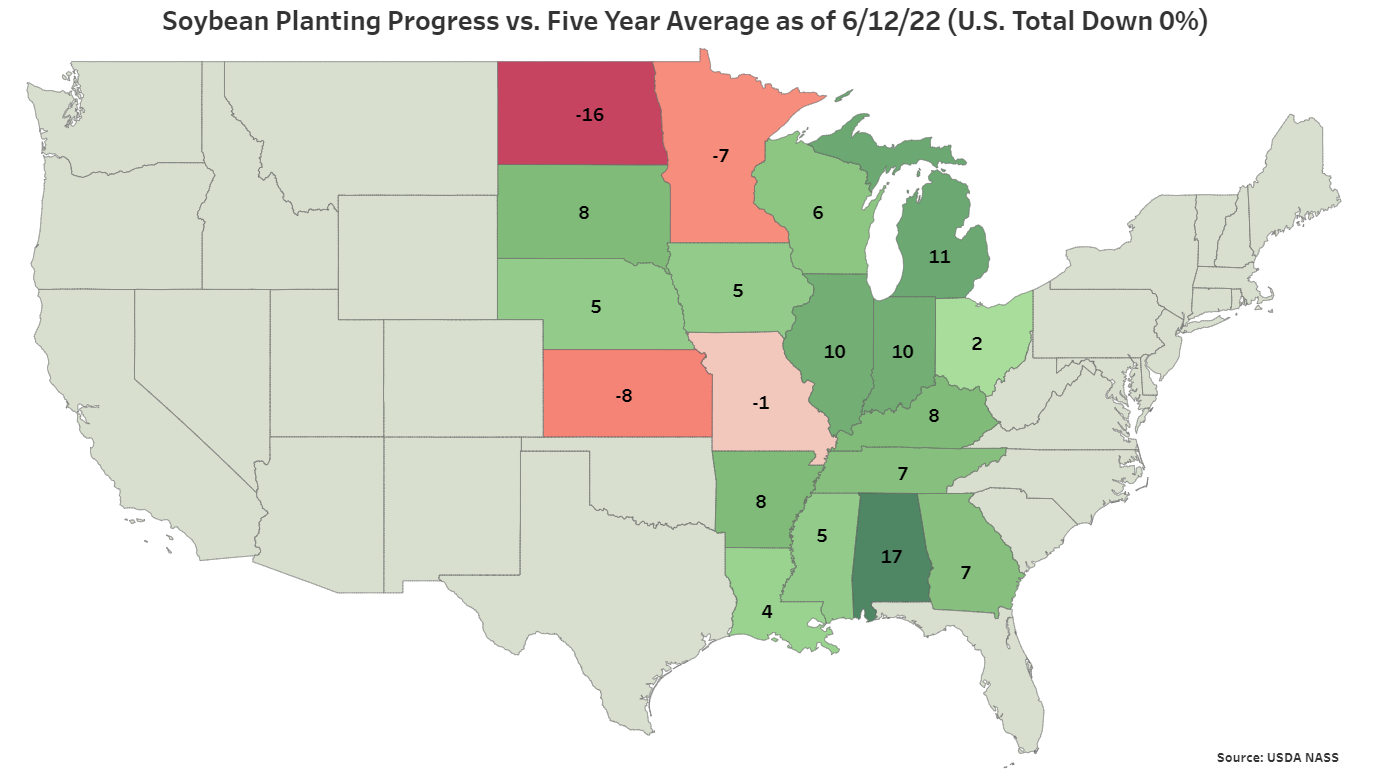

According to the USDA, corn and soybean crop planting has mostly wrapped up and areas that have been delayed significantly in Minnesota and North Dakota will result in prevent plant acres. Crop conditions in much of the rest of the corn-belt have been very good and early crop ratings are positive relative to historical averages.

Corn:

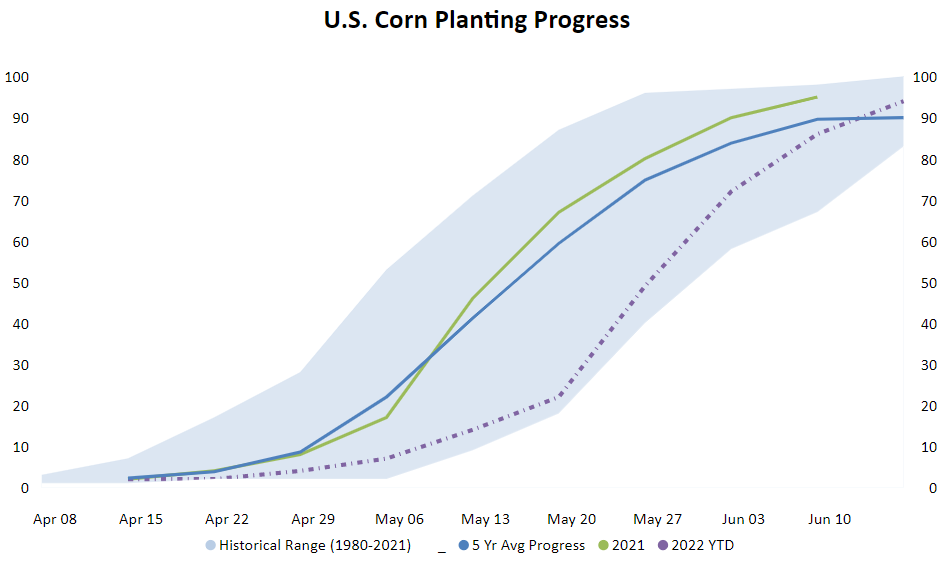

Corn plantings ended the week at 97% complete compared to last year’s pace of 100% and the five-year average pace of 97%.

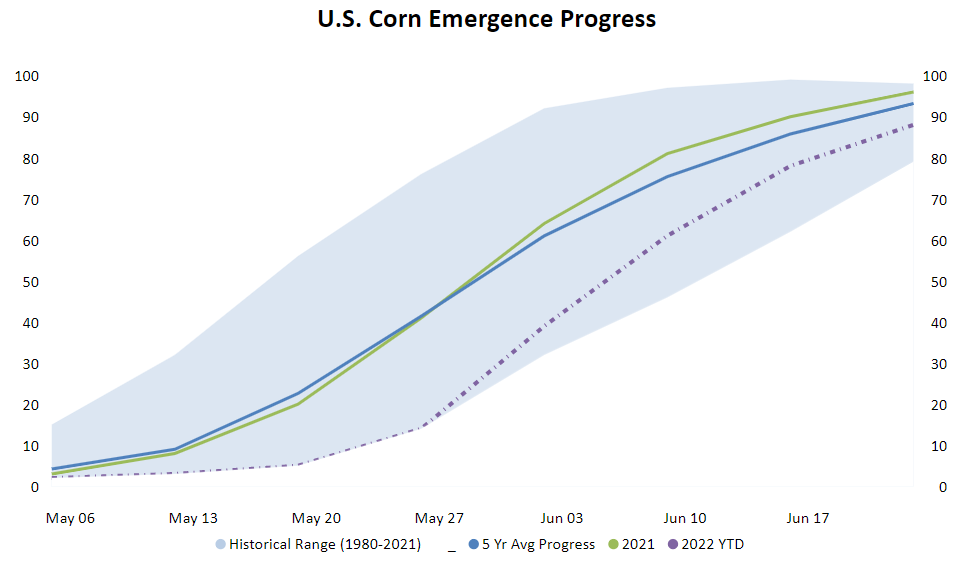

Corn emergence ended the week at 88% compared to last year’s pace of 95% and the five-year average pace of 89%.

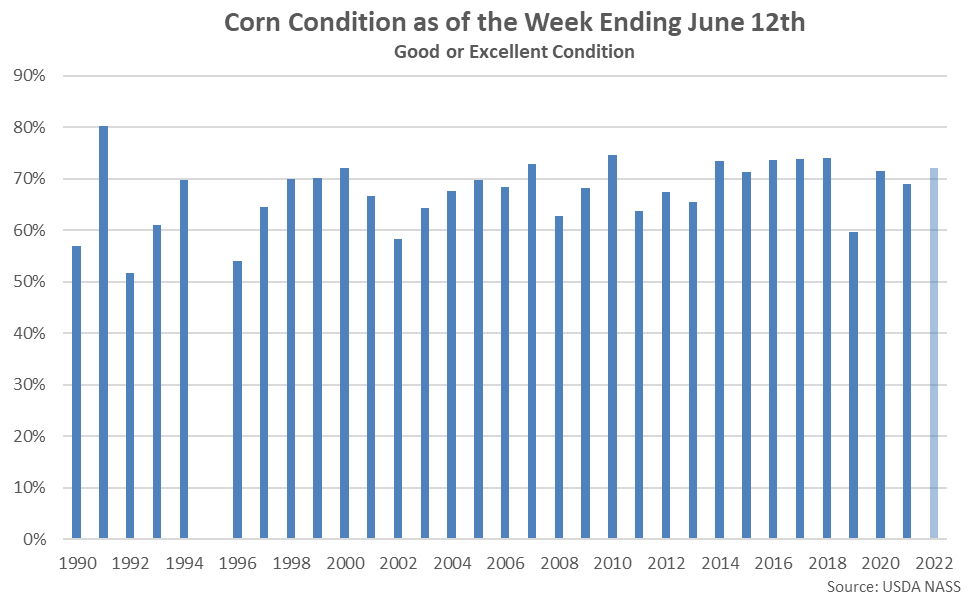

Corn good plus excellent condition ratings ended the week at 72% compared to last year’s at 68% and the five-year average pace of 69%.

Soybeans:

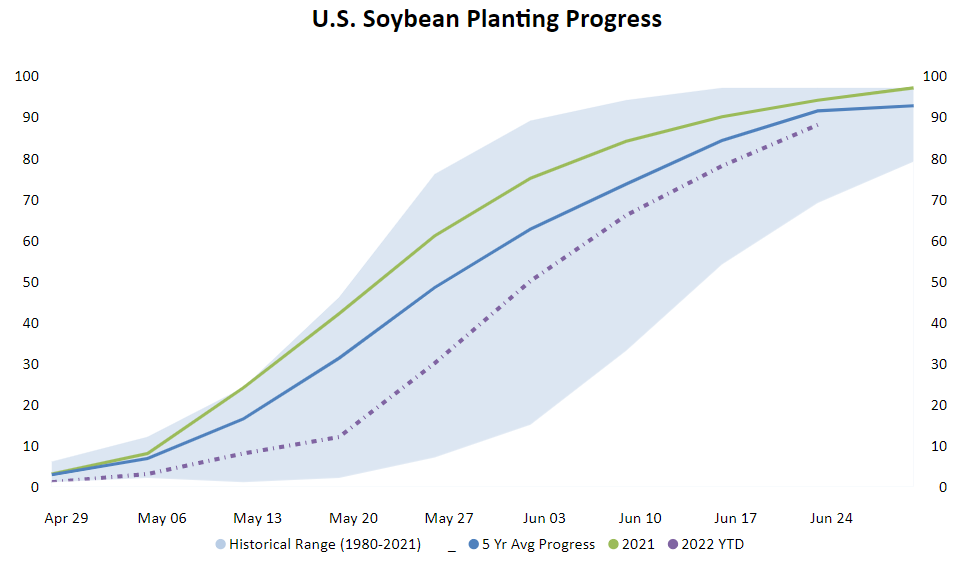

Soybean plantings ended the week at 88% complete compared to last year’s pace of 93% and the five-year average pace of 88%.

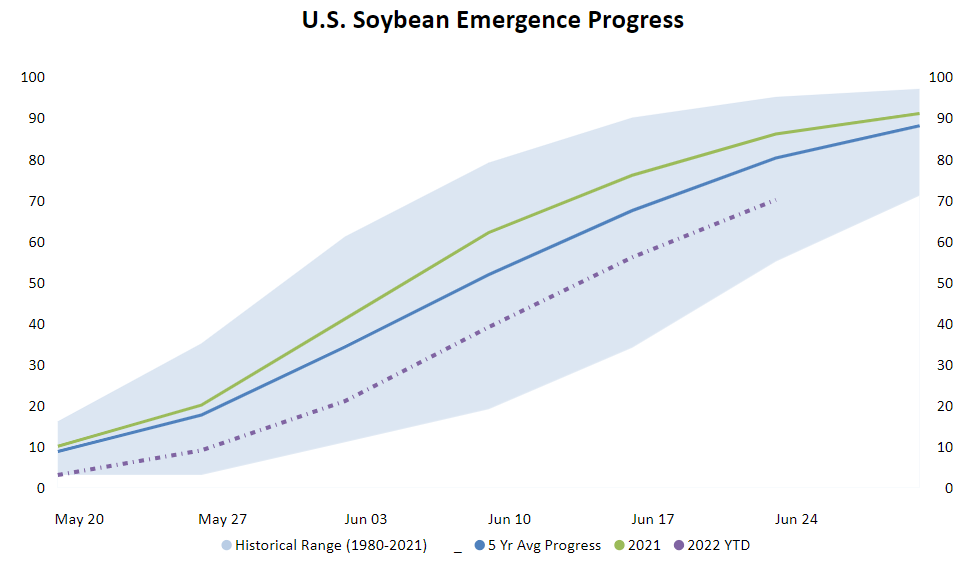

Soybean emergence ended the week at 70% compared to last year’s pace of 85% and the five-year average pace of 74%.

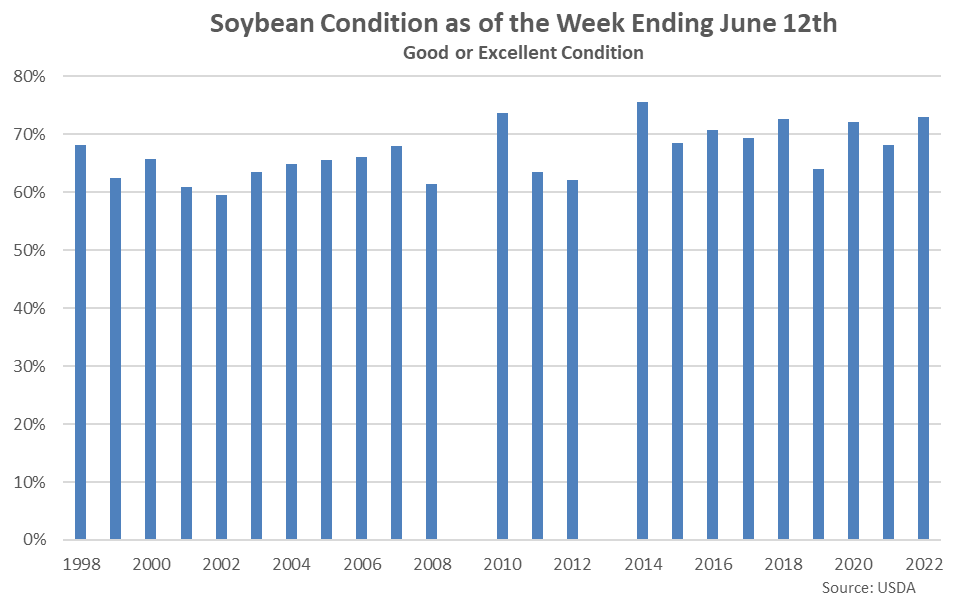

Soybean good plus excellent condition ratings ended the week at 70% compared to last year’s at 68% and the five-year average pace of 69%.